Table of Contents

Introduction

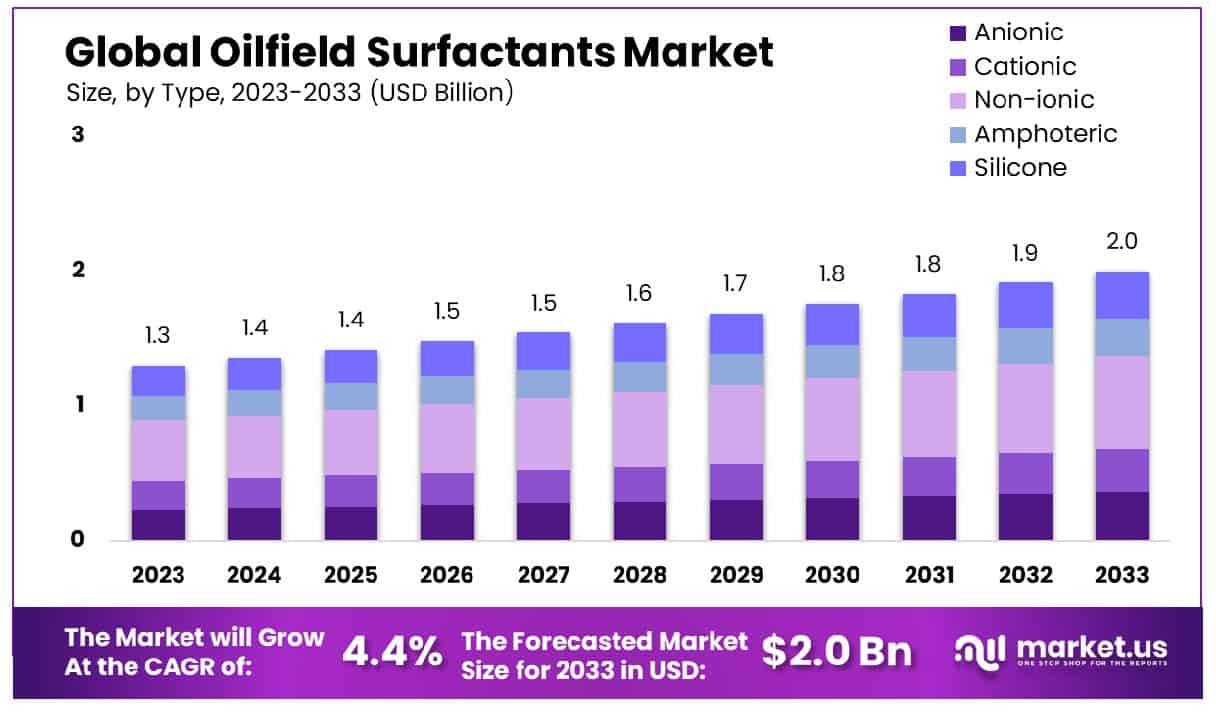

The Global Oilfield Surfactants Market is anticipated to witness significant growth, expanding from USD 1.3 billion in 2023 to an estimated USD 2.0 billion by 2033, with a compound annual growth rate (CAGR) of 4.4% over the forecast period from 2024 to 2033. This growth is primarily driven by the increasing demand for enhanced oil recovery techniques and the need for more efficient drilling and production processes. Surfactants are crucial in reducing surface tension and improving oil mobility, facilitating easier extraction and processing.

However, the market faces challenges such as stringent environmental regulations and the volatility of oil prices, which could impede market progress. Recent developments in the sector include advancements in bio-based surfactants, which are gaining traction due to their lower environmental impact compared to synthetic alternatives. These innovations are poised to address some regulatory challenges and open new avenues for market expansion.

Schlumberger Limited has enhanced its portfolio through strategic partnerships aimed at developing advanced surfactant solutions that improve oil recovery rates. This aligns with the industry’s push towards more efficient and environmentally friendly extraction methods.

Halliburton recently launched a new range of specialized surfactants designed for high-stress oilfield environments, which are proving crucial in maintaining productivity in challenging geological formations. This launch not only expands their product line but also reinforces their position in providing cutting-edge solutions to the industry.

BASF SE has been active in both R&D and strategic mergers. Recently, they acquired a smaller chemical manufacturer, expanding their capabilities in producing bio-based surfactants. This move not only broadens their sustainable product range but also strengthens their supply chain, ensuring greater market reach and reliability.

Baker Hughes has secured multiple contracts to supply advanced surfactants for major oilfield projects, indicating strong demand for their products. These contracts, often valued in the tens of millions of dollars, underscore the company’s significant role in the market and its ability to meet large-scale industrial demands.

Clariant has focused on innovation by investing in new production facilities specifically designed for the manufacture of oilfield surfactants. These facilities are intended to boost production capacity and reduce lead times, enhancing Clariant’s ability to respond to market demands swiftly.

Key Takeaways

- Market Growth: The Global Oilfield Surfactants Market size is expected to be worth around USD 2.0 Billion by 2033, From USD 1.3 Billion by 2023, growing at a CAGR of 4.4% during the forecast period from 2024 to 2033.

- In North America, the Oilfield Surfactants Market accounted for 31.5% share, amounting to USD 410 million.

- By Type: Non-ionic surfactants comprise 34.5%, a significant share in formulations.

- By Source: Synthetic sources dominate at 68.7%, indicating widespread industrial use.

- By Application: Drilling fluids applications constitute 28.4%, serving essential oil extraction processes.

- By End-Use: Upstream sectors utilize 56.7%, driving demand for drilling fluid solutions.

Global Production and CEOR Potential

- Current global production of petroleum is about 85 million barrels/day (bbl/d), or more than 30 billion bbl/year. OPEC (the Organization of the Petroleum Exporting Countries) expects demand by developing countries to increase global production to 107 million bbl/d by 2030.

- Only about 30% of available oil and gas has been extracted from most existing wells. That leaves chemically enhanced oil recovery (CEOR) on the short list of methods available to boost oil production in the secondary and tertiary phases of oil recovery.

- Wells treated with Locus biosurfactants have achieved a 40% or more increase in baseline production—at only 3% of the cost of drilling and completing a new well.

- Locus’ biosurfactants can be applied mid-life using only one pump truck, less than 100 gallons of diesel, and less than 200,000 gallons of water—compared to 100,000 gallons of diesel and 13.8 million gallons of water needed for completion.

- It had good injectivity in low-permeability reservoirs, and its oil recovery efficiency increased by over 10% in the laboratory experiment.

Advanced Recovery Techniques and Laboratory Insights

- The mobility reduction factor of three formulations was performed with CO2 by using Berea sandstone cores at 96 °C and 1400 psi.

- The polymer–surfactant binary system was synthesized. It had good injectivity in low-permeability reservoirs, and its oil recovery efficiency increased by over 10% in the laboratory experiment.

- The matching technologies of production engineering and surface facilities were formed. Through the implementation of chemical flooding, the Daqing Oilfield achieved outstanding performances with an enhanced recovery rate of 12% in polymer flooding and an enhanced recovery rate of 18% in ASP flooding.

- Surfactant drag reduction is applied in single-building and district heating and cooling systems, where pumping energy costs have been reduced by 50% or more, as well as in several oilfield applications, including hydraulic fracturing, gravel packing, matrix acidizing, wellbore cleanout, and drilling.

- The oil-displacement efficiencies of SDBS-1 to SDBS-4 were obviously higher than that of SDBS, and the oil-displacement efficiency of SDBS-2 was the best, with an efficiency of 25%.

Synergies and Field Applications

- Nano-silica was selected as the NPs used in this study. It was found that the synergistic effect is more prominent between SDS and nano-silica with a decrease in emulsion phase height percentage (measure of emulsion stability) going down to 22% compared with 43% for the combination of CTAB and nano-silica, and 51% in the case of using only surfactants.

- Labile ester bonds enhance surfactant biodegradability by more than 25%.

- The research revealed synergistic effects of up to 99.6% in reducing interfacial tension (IFT), achieving a low IFT value of 0.04 mN m–1 corresponding to an optimal GSAIL mole fraction of 0.2 for the mixture of surfactants.

- Additionally, significant synergies of 53.4 and 74% were observed in oil–water emulsification and in surface wettability when using a GSAIL mole fraction of 0.2.

- The list is incomplete; there are more than 25,000 oil and gas fields of all sizes in the world. However, 94% of known oil is concentrated in fewer than 1500 giant and major fields.

Emerging Trends

- Bio-based Surfactants: One of the most notable trends is the shift towards bio-based surfactants. These environmentally friendly alternatives are gaining popularity due to their biodegradability and reduced ecological footprint. Companies are increasingly investing in research and development to replace traditional synthetic surfactants with bio-based ones, aiming to meet stricter environmental regulations and corporate sustainability goals.

- Enhanced Oil Recovery (EOR) Techniques: The application of surfactants in enhanced oil recovery techniques is expanding. Surfactants are used to increase the efficiency of oil extraction from reservoirs, particularly in mature or declining oil fields. This application is crucial as it improves the extraction rate without the need for new explorations, thus maximizing the output from existing assets.

- Customization and Tailored Solutions: There is a growing demand for customized surfactant solutions tailored to specific geological conditions and oilfield environments. Companies are developing specialized formulations that can withstand extreme temperatures and pressures, catering to the unique challenges of different extraction sites. This trend is driven by the need for higher efficiency and lower production costs in the oil and gas industry.

- Nanotechnology Integration: The integration of nanotechnology in surfactant formulations is an emerging trend aimed at enhancing the performance of surfactants in oil recovery processes. Nano-enhanced surfactants can improve the dispersion and interaction of oil molecules at the nanoscale, leading to more effective and efficient oil recovery.

- Regulatory Compliance and Sustainability: As global regulatory bodies tighten environmental standards, the oilfield industry is adapting by adopting surfactants that comply with new regulations. This trend is increasingly influencing the development and marketing strategies of surfactant products, with a greater emphasis on sustainability and environmental responsibility.

Use Cases

- Drilling Fluid Additives: Oilfield surfactants are essential in the formulation of drilling fluids, where they help to reduce surface tension and stabilize the mud properties. These additives facilitate easier drilling by lubricating the drill bit, reducing friction, and preventing the sticking of particles. The market sees extensive use of surfactants in water-based drilling fluids, which hold about 80% share of the drilling fluid market due to their cost-effectiveness and lower environmental impact compared to oil-based fluids.

- Enhanced Oil Recovery (EOR): Surfactants play a critical role in enhanced oil recovery techniques by improving the efficiency of oil extraction from reservoirs. They are used to lower the interfacial tension between oil and water, allowing for increased oil mobility and recovery. EOR methods using surfactants can enhance oil recovery by up to 20%, significantly impacting production, especially in mature or declining oil fields.

- Stimulation Fluids: In hydraulic fracturing, surfactants are used as part of the stimulation fluids to increase the permeability of rock formations, thus facilitating the flow of oil or gas. These surfactants help to reduce the capillary forces that trap oil, effectively increasing the extraction rates. Market data suggests that the use of surfactants can improve hydrocarbon recovery by 15-25% in fracturing operations.

- Corrosion Inhibitors: Surfactants are incorporated into corrosion inhibitors to protect oilfield equipment and pipelines from corrosion, especially in environments where there is a high presence of corrosive substances like hydrogen sulfide and carbon dioxide. These inhibitors, enhanced with surfactants, can reduce corrosion rates by over 50%, extending the life of oilfield infrastructure and reducing maintenance costs.

- Emulsion Breakers: Oilfield surfactants are used to formulate emulsion breakers, which are crucial for separating oil from water in production processes. Effective separation enhances the quality of the oil and reduces processing costs. The application of surfactants in emulsion-breaking technologies can improve separation efficiency by up to 30%, ensuring more effective processing and handling of oil-water mixtures.

Major Challenges

- Environmental Regulations: Strict environmental regulations pose a significant challenge for the oilfield surfactants market. These regulations mandate the reduction of toxic chemicals in drilling and extraction processes to minimize environmental impact. For instance, certain surfactants that are effective in oil recovery are under scrutiny for potential ecological harm, prompting a need for reformulation. Adhering to these regulations can increase production costs by 10-15%, impacting the profitability of oilfield operations.

- Fluctuating Oil Prices: The volatility of global oil prices directly affects the demand for oilfield surfactants. When oil prices drop, oil and gas companies may reduce exploration and production activities, leading to decreased demand for surfactants. For example, a 20% drop in oil prices can lead to a 5-10% reduction in surfactant usage, as projects become less economically viable and are either slowed or halted.

- Supply Chain Disruptions: The oilfield surfactants market is vulnerable to supply chain disruptions, which can be caused by geopolitical issues, trade disputes, or natural disasters. These disruptions can lead to shortages of raw materials, such as ethylene oxide, a key ingredient in many surfactants, potentially increasing the costs by up to 25%. Such disruptions can delay production schedules and increase operational costs, impacting market stability.

- Technological Challenges: Developing surfactants that are effective in extreme conditions, such as high temperature and high salinity environments, presents a technological challenge. Current surfactant formulations may not perform optimally in these harsh conditions, leading to inefficient oil recovery. Enhancing surfactant performance under such extreme conditions could require an additional 15-20% investment in research and development.

- Competition from Alternative Technologies: As the industry shifts towards more sustainable and environmentally friendly practices, there is increasing competition from alternative technologies that do not require surfactants. Techniques such as gas injection or thermal recovery are being explored as less chemically intensive options for oil recovery. This shift could potentially reduce the market share for oilfield surfactants by up to 10-15% in regions with stringent environmental policies.

Market Growth Opportunities

- Development of Bio-Based Surfactants: The growing environmental concerns and stringent regulatory frameworks are steering the oilfield industry towards sustainable solutions. Bio-based surfactants, derived from renewable resources, offer a significant opportunity. These surfactants not only meet regulatory standards but also provide competitive performance in various applications. The market for bio-based surfactants is expected to grow at a compound annual growth rate (CAGR) of approximately 5-7% over the next five years, driven by the industry’s shift towards sustainability.

- Expansion in Emerging Markets: Emerging markets present lucrative opportunities for the oilfield surfactants market. Countries like Brazil, China, and India are increasing their oil and gas production activities, which boosts the demand for enhanced oil recovery methods that incorporate surfactants. The market in these regions is projected to grow at a CAGR of around 6-8%, attributed to new explorations and the development of existing oilfields.

- Technological Advancements for Harsh Conditions: There is a continuous demand for surfactants that can perform under extreme conditions, such as high salinity and temperature. Investing in research and development to create surfactants that are more stable and efficient in these environments can open new segments and increase market share. Companies focusing on these innovations could see an increase in sales by 10-15% in markets with challenging extraction conditions.

- Partnerships and Collaborations: Forming strategic partnerships and collaborations with oil and gas companies can provide surfactant manufacturers with direct access to the end-users and tailor-made solutions. These partnerships are crucial for understanding specific needs and developing products that meet these requirements, potentially increasing market penetration by 20-25% in targeted regions.

- Enhanced Oil Recovery (EOR) Techniques: As mature oilfields continue to dominate the global oil landscape, the need for effective EOR techniques rises. Surfactants play a vital role in these techniques by improving oil recovery rates. The increasing number of mature fields and the need to maximize output from these assets are expected to drive the demand for surfactants in EOR applications, with potential market growth of 12-15% annually.

Key Players Analysis

BASF SE actively enhances oil extraction through its diverse array of surfactants, which are formulated to cope with various field conditions, including high temperatures and varying salinity levels. These surfactants are part of their broader strategy to increase efficiency in oilfield operations by offering solutions that are tailored to the dynamic needs of the industry.

Schlumberger Limited is a significant player in the oilfield services industry, recognized for its robust growth and technological advancements. The company focuses on developing surfactants critical for enhancing oil recovery, marked by a consistent expansion of its international operations, notably in the Middle East and Asia. Schlumberger leverages technology to increase efficiency in extraction processes, demonstrating strong financial management and strategic market positioning.

Baker Hughes actively engages in the oilfield surfactants sector, particularly enhancing hydraulic fracturing operations with specialized surfactants designed to prevent cement contamination and improve bonding in cement spacer systems. These surfactants ensure more effective operations by water-wetting the casing and formation, crucial for the energy sector’s evolving demands.

Halliburton is actively engaged in the oilfield surfactants sector, providing specialized chemicals that enhance oil recovery and operational efficiency in the oilfield. Their Multi-Chem division offers a range of specialty chemicals tailored for oilfield operations, focusing on service excellence through innovative chemistries and digital-enabled workflows. This approach supports performance optimization in the competitive oilfield surfactants market.

Clariant is a key player in the oilfield surfactants sector, innovating in the production of specialty chemicals for oil and gas. Their offerings enhance operational efficiency across conventional and unconventional oil sectors, focusing on the development of demulsifiers, corrosion inhibitors, and surfactant technologies for improved production and environmental compliance.

Dow Chemical Company innovates in the oilfield surfactants market with a focus on environmentally responsible solutions like ECOSURF™, which are utilized in oil recovery to enhance performance and efficiency. Their products, including TERGITOL™ and DOWFAX™, play crucial roles in various oilfield applications, providing key functionalities such as emulsification and foam control, which are essential for effective oil recovery and processing operations.

Nouryon in the oilfield surfactants sector focuses on delivering chemical solutions to enhance drilling, production, and stimulation processes through a global supply chain and expert chemistry knowledge. They emphasize sustainable and innovative chemical formulations, including non-ionic surfactants for diverse applications and cationic surfactants for enhanced performance in oilfield operations.

Solvay, in collaboration with the Russian petrochemical company SIBUR, has established a joint venture named Ruspav to produce surfactants and oilfield process chemicals. This venture aims to meet the growing regional demand for surfactants in the CIS, utilized extensively in oil & gas and home & personal care industries. Solvay brings its surfactant technology and formulation expertise, while SIBUR provides raw materials and market insight, enhancing its collective footprint in the CIS markets.

Stepan Company, in the oilfield surfactants sector, focuses on delivering innovative chemical solutions that improve efficiency in oil and gas applications. They offer specialized products like PETROSTEP FRB-5, which enhances the performance of freshwater friction reducers, making them effective even in high-salinity conditions typical of oilfield operations.

Huntsman Corporation, previously a significant player in the oilfield surfactants market, has shifted its focus from surfactants following the sale of its chemical intermediates and surfactants business to Indorama Ventures. This strategic move has allowed Huntsman to concentrate more on its downstream and specialty businesses, aiming to enhance long-term shareholder value and financial flexibility.

Evonik Industries AG has positioned itself as a pioneer in sustainable oilfield surfactants through the inauguration of the world’s first industrial-scale rhamnolipid biosurfactant plant in Slovakia. This facility underscores Evonik’s commitment to biobased, biodegradable surfactants which are manufactured using a fermentation process that utilizes European corn sugar. These rhamnolipids are designed for a variety of applications, including household cleaners and industrial uses like oil and gas, showcasing their eco-friendly profile and high functionality.

Sasol’s Olefins and Surfactants (O&S) division is engaged in producing key raw materials for detergents, including linear alkyl benzene and fatty alcohols. Positioned in Hamburg, Germany, this division supplies a wide array of surfactants and other specialty chemicals, underpinning Sasol’s reputation as a leading supplier in the global market. Their focus on sustainable and efficient chemical solutions reflects their broader commitment to environmental stewardship and innovation within the industry.

Chevron Phillips Chemical Company actively engages in the oilfield surfactants market, utilizing its expertise in chemical production to deliver solutions like drilling fluids and enhanced oil recovery systems. Their products are designed to optimize operational efficiency and reduce costs in oilfield operations, backed by a strong focus on sustainability and community safety.

Ashland Global Holdings Inc. plays a significant role in the oilfield surfactants market, focusing on innovative chemical solutions that improve the efficiency and effectiveness of oil recovery processes. Their products are designed to meet the rigorous demands of the oilfield industry, ensuring optimal performance in various applications.

Lubrizol Corporation is engaged in the oilfield surfactants sector, where it delivers innovative solutions such as Chembetaine™ C surfactant. This product is derived from coconut oil, known for its high foaming properties and stability across various pH levels. It is particularly effective in hydraulic fracturing and drilling applications, enhancing the performance of hand soaps and industrial cleaners. Lubrizol’s approach emphasizes both performance enhancement and environmental safety, as evidenced by its Safer Choice certification and listing on CleanGredients.

Conclusion

The oilfield surfactants market is poised for substantial growth, driven by the industry’s push towards more sustainable and efficient extraction methods. The development of bio-based surfactants, expansion into emerging markets, and technological advancements tailored for extreme extraction conditions represent key areas of opportunity. Additionally, strategic partnerships and the increasing necessity for enhanced oil recovery techniques further bolster market prospects.

By capitalizing on these opportunities and navigating challenges such as environmental regulations and market volatility, companies in the oilfield surfactants sector can achieve significant growth and maintain competitiveness in a dynamic market landscape. This strategic focus is essential for those looking to lead in the evolving energy sector.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)