Table of Contents

Introduction

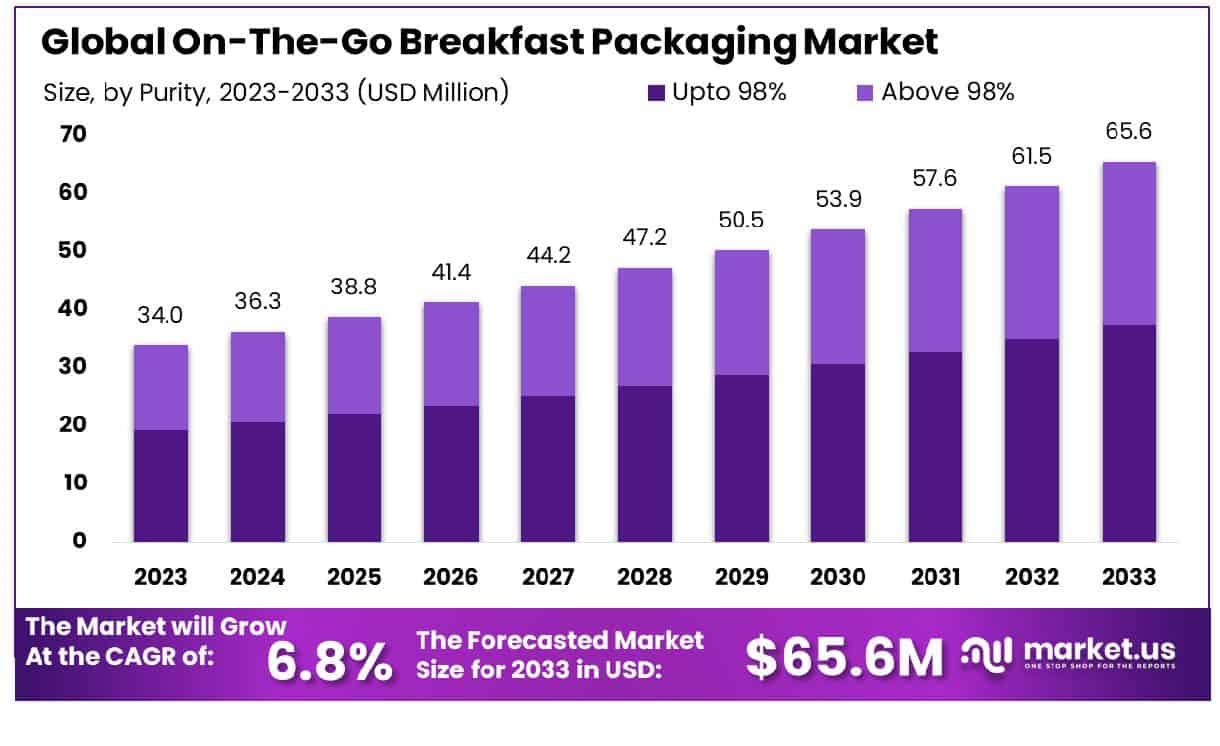

The Global On-The-Go Breakfast Packaging Market is poised for significant expansion, anticipated to escalate from USD 34.0 million in 2023 to approximately USD 65.6 million by 2033, progressing at a compound annual growth rate (CAGR) of 6.8% over the forecast period from 2024 to 2033. This growth trajectory is primarily driven by increasing consumer demand for convenient and quick meal solutions amid busy lifestyles, particularly in urban areas. Additionally, advancements in packaging technology that enhance product freshness and extend shelf life contribute to market expansion.

However, the market faces challenges such as the rising concern over the environmental impact of disposable packaging materials, prompting the need for more sustainable solutions. Recent developments in the industry include the introduction of biodegradable and recyclable packaging options, which are gaining traction among environmentally conscious consumers. These innovations are expected to address some of the ecological challenges associated with the market while catering to the growing consumer preference for sustainability.

Thermo Fisher Scientific has expanded its capabilities in the market through strategic acquisitions aimed at enhancing its packaging solutions for temperature-sensitive on-the-go breakfast products. Their recent acquisition of a smaller packaging firm specializing in insulated products has enabled Thermo Fisher to offer advanced, sustainable packaging options that maintain food safety and extend shelf life, thereby strengthening their market position.

Hefei Home Sunshine Pharmaceuticals has ventured into the breakfast packaging sector by launching a new line of bio-based packaging solutions tailored for on-the-go breakfast items. These products are designed to be compostable and have received positive preliminary feedback from consumers looking for environmentally responsible options. This move is part of Hefei’s broader strategy to penetrate the health-conscious consumer segment.

Merck KGaA has focused on enhancing its chemical treatment solutions for packaging materials that prevent food spoilage. Their latest innovation involves a new food-grade chemical layer that can be applied to paper-based packaging, significantly enhancing the freshness of packaged breakfast items. This development is expected to set new standards in the market, particularly among consumers prioritizing food quality and safety.

Clearsynth has taken a unique approach by developing a clear, synthetic packaging material that is both recyclable and resilient to temperature fluctuations. This new product launch aims to meet the increasing demand for durable and sustainable packaging options in the on-the-go breakfast market. The introduction of Clearsynth’s innovative material is likely to capture the attention of major food brands seeking advanced packaging technologies.

ANNEXE CHEM PVT LTD has secured significant funding to expand its research and development division, focusing on the creation of chemical compounds that enhance the tactile and protective properties of breakfast packaging materials. This investment is indicative of ANNEXE CHEM’s commitment to becoming a leader in the specialty chemicals market for food packaging, with a particular emphasis on improving consumer experience and product safety.

Key Takeaways

- Market Growth: The global on-the-go breakfast packaging market is projected to grow from USD 34.0 million in 2023 to USD 65.6 million by 2033, with a CAGR of 6.8%.

- Asia-Pacific holds 37.8% market share, valued at USD 12.1 million.

- By Purity: Up to 98% purity dominates with a 65.5% market share.

- By Application: Pesticides lead, capturing 45.2% of application segments.

- By End-use: The Fertilizer and Pesticide Industry holds a 33% market share.

- By Distribution Channel: Direct sales are predominant at 54.3% distribution share.

Impact and Preferences of On-The-Go Breakfast Solutions

- On average, schools that implement Grab and Go Breakfast see 65% breakfast participation.

- 80% of customers are more likely to choose a business that provides measures of safe serving and grab-and-go options.

- Foods are 51% more likely to get bought when marked with a “ready to eat” label.

- More than 40% of global consumers drink on the go at least once a week, with fortified milk, yogurt, and energy drinks among their favorite choices.

- A 75% increase in sales of healthy on-the-go products in a few years; and 65% of millennials are willing to try new and unusual flavors.

Environmental Impact and Consumer Habits

- In the UK, we generate millions of tonnes of packaging waste. Takeaway lunches account for 11 billion tonnes of waste a year, much of which isn’t recycled, recyclable, or biodegradable.

- The UK drinks about 95 million cups of coffee daily. Our nation consumes about 100 million cups of tea a day too.

- Online meal delivery revenues are expected to reach $220 billion by the end of 2023. This segment generates approximately 40% of all restaurant sales.

- It’s not surprising, then, to learn that celery snack packs and ready-to-eat salads are experiencing over 50% weekly dollar sales increases compared to previous years.

- Around 11 billion pieces of packaging waste are produced every year from food on the go; the delicious takeaways we loved came with a hefty price tag for the environment.

Dietary Changes and Government Interventions

- In 1960, Adelle Davis stressed the status of breakfast as the most important meal of the day and later studies detailed that ideally between 15% and 25% of our daily energy intake should be consumed at breakfast.

- Breakfast cereals such as porridge and muesli are also reported to contribute to more than 50% of the breakfast energy intake for the UK population.

- Nutritionists recommend that breakfast should provide around 20% of your daily energy and contribute significantly to your daily nutrient intake.

- Between 2016 and 2020, the government ran a sugar reduction program, which challenged all sectors of the food industry to reduce sugar in foods children consume by 20%.

- Action on Sugar says breakfast cereal and yogurt brands “celebrated” their reductions in sugar between 2015 and 2020. However, with reductions at 14.9% and 13.5% respectively, this is still shy of the 20% target given.

Emerging Trends

- Sustainability Initiatives: There is a significant move towards eco-friendly packaging solutions as consumers increasingly prioritize environmental impact in their purchasing decisions. Trends include the use of biodegradable, recyclable, and compostable materials. Manufacturers are also innovating with plant-based plastics and papers that significantly reduce the carbon footprint associated with traditional packaging materials.

- Smart Packaging: Technological advancements are being integrated into packaging solutions, leading to the rise of smart packaging. This includes the use of QR codes, NFC chips, and sensors that consumers can interact with via smartphones to check product freshness, origin, and nutritional information. This trend not only enhances consumer engagement but also aids in the management of inventory and product quality throughout the supply chain.

- Customization and Personalization: Packaging designs are becoming more tailored to specific demographics and lifestyle needs, featuring modular designs and resealable closures that enhance portability and convenience. Personalized packaging that caters to individual dietary requirements or preferences is also becoming more prevalent, enhancing consumer experience and brand loyalty.

- Minimalist Designs: In response to consumer demand for transparency and simplicity, there is a trend towards minimalist packaging designs. These designs use fewer materials and simpler graphics, which not only reduce production costs and environmental impact but also appeal to the consumer’s desire for authenticity and straightforwardness in product presentation.

- Enhanced Portability: As the name “on-the-go” suggests, portability remains a crucial aspect. Recent innovations include compact and lightweight packaging, as well as multipurpose designs that facilitate easier consumption while commuting, such as collapsible bowls or integrated utensil solutions.

Use Cases

- Commuter Convenience: For the 85% of urban workers who commute daily and seek quick breakfast options, on-the-go packaging offers portable solutions that are easy to consume in transit. Packaging is often designed to fit car cup holders or be easily handled with one hand, enhancing the convenience for consumers who are on the move.

- Eco-Friendly Solutions: With over 60% of consumers expressing a preference for environmentally-friendly packaging, the market has seen a rise in compostable and biodegradable options. These products cater to environmentally conscious consumers by providing packaging that they can dispose of guilt-free, supporting a reduction in plastic waste.

- Health-Conscious Individuals: For health-conscious consumers, clear labeling and portion-controlled packaging are crucial. Packaging that transparently displays nutritional information and ingredients caters to this demographic by making it easier for them to maintain their diet and manage caloric intake effectively.

- Outdoor Activities: Lightweight and durable packaging solutions are particularly useful for consumers engaging in outdoor activities like hiking or camping. Approximately 20% of millennials participate in outdoor activities and require products that are easy to carry and consume on-the-go, without the risk of leakage or spoilage.

- School Breakfast Programs: On-the-go breakfast packaging is instrumental in facilitating school breakfast programs, where ease of distribution and consumption is key. Packaging that is safe, easy to open, and disposed of by children is crucial, supporting the 30 million children participating in national school breakfast programs.

- Event Catering: With the rise in corporate events and conferences, on-the-go packaging solutions are increasingly used to serve large groups efficiently. Individual packaging allows for quick distribution, minimal cleanup, and the ability to cater to a wide range of dietary preferences and restrictions.

Major Challenges

- Regulatory Compliance: The packaging industry is heavily regulated, with stringent standards that vary by region. Compliance with food safety regulations, which ensure that materials are safe for food contact, presents a continual challenge. Approximately 40% of packaging manufacturers report difficulties in adapting to new regulations each year, which can delay product launches and increase costs.

- Supply Chain Volatility: Fluctuations in the availability and cost of raw materials are a constant concern. For instance, the price of biodegradable plastics can be up to 20-30% higher than conventional plastics, influenced by the availability of raw materials like corn or sugarcane. Supply chain disruptions, as seen during the COVID-19 pandemic, can lead to significant delays and cost overruns, affecting nearly 50% of food packaging companies.

- Consumer Perception and Behavior: Changing consumer behaviors and perceptions can pose a challenge. While there is a shift towards sustainable packaging, only about 30% of consumers are willing to pay a premium for it. This discrepancy between consumer preferences for sustainability and their purchasing behavior can impact the profitability of more sustainable packaging solutions.

- Technological Integration: Incorporating new technologies such as smart packaging elements involves high initial investment and technical expertise. The adoption rate for advanced technologies in packaging is still below 25% among small to medium enterprises, mainly due to the cost and complexity of integration.

- Waste Management: Despite the push for recyclable and compostable packaging options, the infrastructure for managing waste is not uniformly available. Only about 60% of urban areas have facilities that can process and recycle complex packaging materials, which poses a significant challenge in reducing the environmental impact of packaging waste.

Market Growth Opportunities

- Expansion into Emerging Markets: With urbanization rates increasing, especially in Asia and Africa, there is a growing demand for convenient meal solutions. Emerging markets present a substantial opportunity, with urban populations expected to double in the next two decades. This demographic shift is likely to drive a surge in demand for on-the-go breakfast options, offering a robust growth avenue for manufacturers.

- Innovation in Packaging Materials: As consumers become more environmentally conscious, there is a rising demand for innovative, sustainable packaging solutions. The market for sustainable packaging is projected to grow by 5% annually. Developing materials that are both eco-friendly and cost-effective can capture a significant share of the market, particularly among younger consumers who prioritize sustainability.

- Customization and Premiumization: There is a growing trend towards premium packaging that offers added value such as enhanced functionality, aesthetics, or reusability. Customizable and premium packaging options can attract a higher-paying customer segment, with the premium packaging sector expected to see a 7% growth rate over the next five years.

- Health and Wellness Focus: Packaging that promotes health and wellness, including clear labeling of nutritional content and portion control features, can attract health-conscious consumers. With over 70% of consumers indicating that packaging influences their purchase decisions, especially related to health attributes, there is a significant opportunity to innovate in how products are presented and marketed.

Key Players Analysis

Thermo Fisher Scientific actively innovates in the On-The-Go Breakfast Packaging sector by developing sustainable packaging solutions aimed at reducing environmental impact. Their focus includes designing packaging to minimize waste and enhance recyclability, notably through the use of bio-based materials and optimizing transport efficiency to decrease emissions. These initiatives are part of their broader environmental strategy to align with global sustainability goals.

Hefei Home Sunshine Pharmaceutical Technology Co., Ltd. is not directly involved in the On-The-Go Breakfast Packaging sector. Instead, the company specializes in the production and supply of active pharmaceutical ingredients (APIs), intermediates, and fine chemicals. Established in 2013 and located in Hefei City, China, Hefei Home Sunshine Pharmaceutical emphasizes quality and credibility, with ISO 9001:2015 certification and a focus on continuous improvement in product and service offerings.

Merck KGaA does not specifically engage in the On-The-Go Breakfast Packaging sector. Instead, their core activities focus on pharmaceutical and life science products, materials for electronics, and more recently, advancements in mRNA technology through their acquisition of Exelead. This highlights their strategic expansion in biopharmaceutical production rather than food packaging.

Clearsynth does not appear to be involved in the On-The-Go Breakfast Packaging sector. The company specializes in the production of deuterated chemicals and other specialized reagents, primarily serving industries such as pharmaceuticals, biotech, and electronics, rather than food packaging.

Annexe Chem Pvt Ltd does not appear to be involved in the On-The-Go Breakfast Packaging sector. Instead, the company focuses on manufacturing pharmaceutical chemicals and food industry chemicals with capabilities to produce a wide range of substances like ammonium phosphate, monoammonium phosphate, and potassium phosphate, among others. They emphasize high-quality standards in their FDA-GMP-certified facilities.

Ami Organics does not appear to have any involvement in the On-The-Go Breakfast Packaging sector. The company is primarily engaged in the manufacture and development of pharmaceutical intermediates and specialty chemicals, with a focus on advanced pharmaceutical intermediates for various therapeutic areas and specialty chemicals for diverse industries.

Central Drug House does not appear to be involved in the On-The-Go Breakfast Packaging sector. Instead, the company specializes as an importer and distributor of pharmaceutical raw materials including active pharmaceutical ingredients, excipients, and fine chemicals, primarily serving the pharmaceutical industry.

Otto Chemie Pvt. Ltd. does not appear to be involved in the On-The-Go Breakfast Packaging sector. The company is primarily engaged in the manufacture and supply of laboratory chemicals, specialty chemicals, and nanotechnology products, with a focus on serving the chemistry and life science industries. They offer a range of products including organic and inorganic chemicals, enzymes, and nanotechnology products, along with custom synthesis services.

TNJ Chemical does not appear to have any direct involvement in the On-The-Go Breakfast Packaging sector. The company focuses on providing a wide range of chemical products and services across different industries, including pharmaceuticals, agrochemicals, and food additives, but there’s no specific mention of engagement in breakfast packaging.

NINGBO INNO PHARMCHEM CO., LTD. does not appear to be involved in the On-The-Go Breakfast Packaging sector. The company focuses on research and development, as well as the production and sales of pharmaceutical intermediates, fine chemicals, and specialty chemicals. Their operations primarily cater to sectors such as medicine, healthcare products, pesticides, textiles, and water treatment.

Shanghai Sunwise Chemical Co., Ltd. does not seem to be involved in the On-The-Go Breakfast Packaging sector. Instead, their focus is on providing global chemical sourcing solutions, working extensively in areas like intermediates, electronic materials, plastic additives, water treatment chemicals, and other industrial chemicals.

TCI Chemicals does not appear to be involved in the On-The-Go Breakfast Packaging sector. The company focuses on manufacturing specialty organic chemicals and providing containers for their products, which include glass and plastic bottles suitable for various applications. Their primary engagement is in the chemical industry, particularly in providing high-quality organic reagents for research and development across different scientific fields.

Conclusion

The market for on-the-go breakfast packaging is poised for substantial growth, driven by increasing consumer demand for convenience and portability in their morning routines. As lifestyles continue to accelerate, with more individuals seeking quick and easy meal solutions, the demand for innovative and sustainable packaging solutions is expected to rise.

Companies that invest in eco-friendly materials and user-friendly designs are likely to capture significant market share. Moreover, the integration of health-conscious options and attractive packaging can further enhance consumer engagement and brand loyalty. Stakeholders are encouraged to monitor evolving consumer preferences and technological advancements to effectively capitalize on this growing market segment.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)