Table of Contents

Introduction

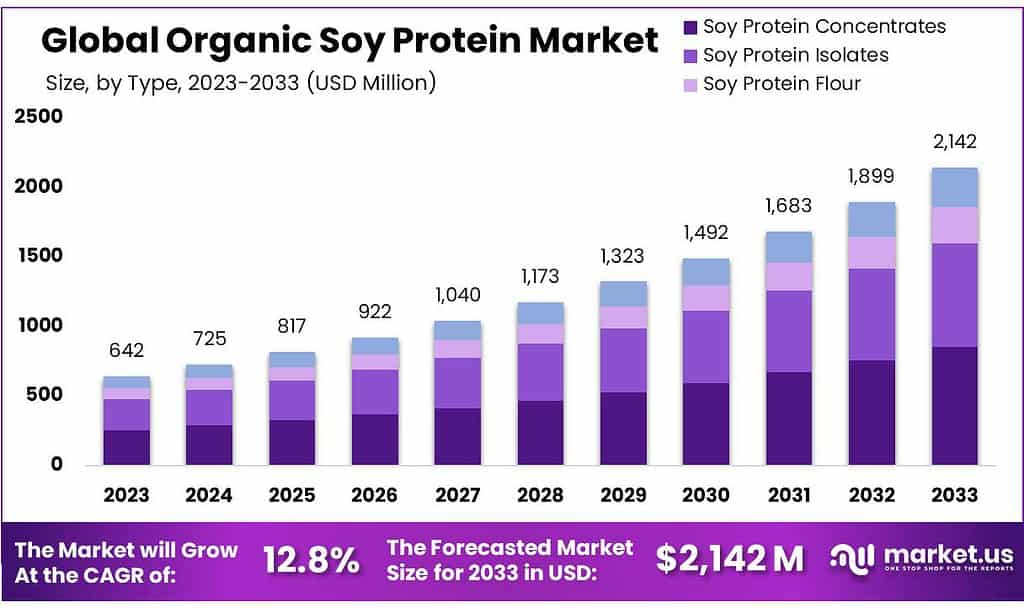

The global organic soy protein market is poised for substantial growth, projected to escalate from USD 642 million in 2023 to around USD 2142 million by 2033, with a compound annual growth rate (CAGR) of 12.8% during this period. This market expansion is underpinned by the rising consumer demand for plant-based proteins, reflecting a significant shift towards healthier and more sustainable food options.

Notably, organic soy protein is increasingly incorporated into a variety of food products like functional foods, infant formulas, and meat alternatives due to its high protein content and essential amino acids which are crucial for muscle building and overall health maintenance.

However, the market faces significant challenges, including high production costs due to the strict requirements of organic farming and the limited availability of organic soybeans, which can hinder supply chain efficiency and escalate product prices.

Despite these challenges, recent developments in the market, such as the integration of organic soy protein in sports nutrition products and its growing acceptance in regions like North America and Asia-Pacific, are expected to drive further growth. This trend is supported by a broader consumer shift towards clean, plant-based nutrition and increased health consciousness, particularly post the COVID-19 pandemic where there is a heightened focus on dietary health and sustainability.

Recent developments in the organic soy protein market, particularly involving Harvest Innovations and World Food Processing, reflect the dynamic nature of this industry. Harvest Innovations, a key player, has been actively expanding its market reach and enhancing its product portfolio to cater to the rising demand for plant-based proteins. This strategic focus is aimed at strengthening its market position in the increasingly competitive organic soy protein market.

World Food Processing, known for its innovation in plant-based ingredients, continues to develop new processing techniques to enhance the quality and nutritional profile of its organic soy protein products. These advancements are not only crucial for meeting consumer demand for healthier and sustainable food options but also for maintaining a competitive edge in the global market.

Organic Soy Protein Statistics

- 2 tbsp of organic whole food soya protein (PVL) contains 110 Calories. The macronutrient breakdown is 25% carbs, 39% fat, and 36% protein. This is a good source of protein (18% of your Daily Value), fiber (18% of your Daily Value), and potassium (12% of your Daily Value).

- The protein content of soybeans is 36–56% of the dry weight

- The fat content is approximately 18% of the dry weight — mainly polyunsaturated and monounsaturated fatty acids, with small amounts of saturated fat.

- Nutrela Soya chunks has 52% Dhaakad Protein – which is the highest source of protein. This is equal to having 16 bowls of cooked daal, 17 boiled eggs, and 18 glasses of cow’s milk!

- Nutrela Soya Chunks is available in packs of 50g, 80g, 220g and 1 kg. You can buy the pack that best suits your family’s needs. The price of Nutrela Soya Chunks is pretty reasonable as well.

- Nutrela Soya has 52% Dhaakad Protein, which is the highest source of protein.

- The majority of soybeans are crushed into oil and soybean meal, and approximately 75% of the soybean meal that is produced in the world is fed to pigs or poultry.

- As much as 50% protein when dry, TVP can be rehydrated at a 2:1 ratio, which drops the percentage of protein to an approximation of ground meat at 16%.

- Measured levels of residual hexane in TVP are around 20 parts per million and studies in rodents suggest that 5 g/kg is the minimum dose at which undesirable effects may be observed.

- TVP can be made from soy flour or concentrate, containing 50% and 70% soy protein, respectively; they have a mild beany flavor.

- The soybean industry in the U.S. started in the first years of this century and was only 5,000,000 bushels just 50 years ago.

- This year it is expected to be over 1.5 billion bushels, reflecting a remarkable growth.

Only ca. 3% soy protein is used in human food today.

Emerging Trends

Emerging trends in the organic soy protein market are significantly shaped by the increasing consumer shift towards healthier and more sustainable dietary choices. A notable trend is the integration of organic soy protein into functional foods and sports nutrition products.

As health consciousness rises, there is a growing demand for food products that not only provide essential nutrients but also come with added health benefits like muscle recovery and improved heart health. This has led to organic soy protein being included in a variety of functional foods such as protein bars, meal replacements, and sports beverages.

Additionally, there is a rising trend in utilizing organic soy protein in meat alternatives and dairy substitutes, driven by the growing vegan and vegetarian populations. The versatility of soy protein makes it ideal for producing a range of plant-based products that cater to these dietary preferences, thereby supporting the sustainability of food production with reduced environmental impact.

The market is also witnessing innovations in product development, particularly in enhancing the sensory attributes and functionality of organic soy protein-based products, which are designed to meet specific consumer needs and preferences. This includes improving the texture and taste of soy protein isolates used in various food applications, making them more appealing to a broader consumer base.

Use Cases

- Functional Foods and Beverages: Organic soy protein is widely used to enhance the nutritional value of functional foods like protein bars, meal replacements, and beverages. Its high-quality amino acid profile and health benefits such as supporting muscle recovery make it a popular choice in the sports nutrition market, particularly among athletes and fitness enthusiasts.

- Meat Alternatives: The rise in vegetarian and vegan populations has boosted the demand for plant-based meat substitutes where organic soy protein serves as a crucial ingredient. It offers a sustainable and high-protein alternative to animal meat, catering to consumers looking for plant-based diet options.

- Dairy Alternatives: Organic soy protein is also a key component in dairy substitutes such as soy milk, yogurt, and cheese, where it replaces dairy protein to cater to lactose-intolerant consumers and those preferring vegan diets.

- Bakery and Confectionery: In the bakery sector, organic soy protein is incorporated into products such as breads, pastries, and snacks to enhance protein content and improve texture, meeting the growing consumer demand for healthier bakery options.

- Infant Formula: Organic soy protein is favored in infant formulas for its digestibility and nutritional profile, making it a preferred choice for parents seeking dairy-free, hypoallergenic feeding options for infants.

Major Challenges

- The organic soy protein market is confronting several challenges that could affect its growth trajectory. A major challenge is the allergenic properties of soy, which can deter consumers with soy allergies from using soy-based products. This necessitates clear labeling and allergen management by manufacturers to mitigate health concerns.

- Another significant challenge is the high production costs associated with organic farming practices, which can lead to higher retail prices for organic soy protein products. This price premium may limit consumer uptake, particularly among price-sensitive segments. Furthermore, the competition from other plant-based proteins like pea, rice, and hemp proteins is intensifying, requiring soy protein manufacturers to differentiate their products through marketing and innovation to stay competitive.

- There’s also the issue of consumer perception, where some consumers may have reservations about the taste and texture of soy-based products compared to animal-derived proteins. Overcoming these sensory barriers is crucial for broader market acceptance. Additionally, regulatory and geopolitical issues such as trade disruptions and fluctuating soybean prices can complicate the market dynamics, impacting supply chains and pricing

Market Growth Opportunities

- The organic soy protein market is poised for significant growth, presenting various opportunities across multiple sectors. One of the primary growth drivers is the expanding demand for plant-based proteins among health-conscious consumers, fueled by an increasing awareness of health, environmental sustainability, and ethical concerns. This trend is supported by a growing consumer preference for organic and non-GMO products, which are perceived as healthier and more environmentally friendly.

- The market is also benefiting from the rising popularity of functional foods and sports nutrition, where organic soy protein is valued for its high-quality amino acid profile and muscle recovery benefits. This has led to its increased incorporation into products like protein shakes, bars, and meal replacements. Additionally, the demand in the infant formula sector is climbing as parents seek safer, plant-based alternatives for their children, further broadening the market scope.

- Geographically, regions such as Europe and North America are currently leading in the organic soy protein market due to high consumer awareness and the presence of established industries. However, Asia-Pacific is emerging as a significant growth area, driven by increasing health consciousness and dietary shifts towards plant-based nutrition.

Key Players Analysis

Harvest Innovations has maintained a strong position in the organic soy protein market into 2023, focusing on producing high-quality, non-GMO organic soy protein products that cater to a growing demand among health-conscious consumers. The company is leveraging its strengths in innovation and strategic market positioning to expand its reach and enhance its product offerings across various sectors.

World Food Processing is also a significant player in the organic soy protein market, recognized for its commitment to providing organic, non-GMO soy protein. The company has been actively expanding its production capabilities and enhancing its product range to meet the increasing consumer demand for plant-based proteins. Their efforts are directed towards strengthening their market position and addressing the needs of a diverse customer base looking for healthier dietary options.

Devansoy Inc has been proactive in enhancing its market presence in the organic soy protein sector. Throughout 2023, Devansoy has focused on leveraging its core capabilities to meet the increasing demand for non-GMO, organic soy products. Their commitment is highlighted by continuous improvements in product quality and customer satisfaction, positioning them well for anticipated growth into 2024 and beyond.

The Scoular Company has solidified its role in the organic soy protein market by offering a wide range of soy protein products that meet rigorous non-GMO and organic standards. In 2023, Scoular continued to advance its market position through strategic sourcing and an integrated supply chain that emphasizes sustainability and quality. Looking ahead to 2024, the company is well-prepared to address the growing consumer demand for plant-based proteins, maintaining its competitive edge in both North American and European markets.

SunOpta Inc. has solidified its reputation in the organic soy protein market, particularly highlighting a strong commitment to sustainable and plant-based products. In 2024, SunOpta is expected to continue seeing substantial growth, with revenue forecasts ranging between $670 million to $700 million and adjusted EBITDA projected to be between $87 million to $92 million. This outlook reflects their ongoing efforts to innovate within the plant-based foods sector and maintain sustainability at the core of their operations.

FRANK Food Products has also made its mark in the organic soy protein sector, primarily through offering a variety of plant-based food options that cater to health-conscious consumers. While specific financial figures for 2023 or 2024 were not detailed, the company is known for its commitment to high-quality organic ingredients and sustainable practices, contributing to its steady presence in the market.

Hodgson Mill continues to make its mark in the organic soy protein sector by focusing on providing high-quality, non-GMO, gluten-free soy products. As a well-established player, Hodgson Mill is recognized for its dedication to health-conscious manufacturing and marketing. Their products cater to the growing consumer demand for organic and plant-based protein options, helping to drive the overall growth of the soy protein market through 2023 and beyond.

Mill, as a general entity in the food industry, typically focuses on processing grains and similar products, which may include soybeans. Companies operating mills that handle soy generally contribute to the production of soy flour and possibly soy protein concentrates, though specific details about operations named “Mill” in the organic soy protein sector were not detailed in the latest market reports. These types of operations are crucial in providing foundational ingredients used in a variety of food products, supporting the broader market’s expansion by catering to the rising demand for plant-based proteins.

Agrawal Oil & Biocheam has established a noteworthy presence in the organic soy protein market. In 2023 and 2024, the company continues to innovate in the sector, focusing on creating high-quality, non-GMO soy protein products that cater to the health-conscious consumer. Agrawal Oil & Biocheam is recognized for its commitment to sustainable practices and its ability to meet the rising demand for plant-based proteins, a trend driven by increasing consumer preferences for healthier dietary options.

Biopress S.A.S. operates out of France and plays a significant role in the organic soy protein market by offering specialized soy protein products. The company has made strides in product innovation and sustainability, crucial for catering to the evolving market demands. In 2023 and heading into 2024, Biopress S.A.S. focuses on expanding its reach and enhancing its offerings, particularly in textured and isolated soy protein forms, to support the growing trend of plant-based diets and sustainable food solutions.

Natural Products, Inc. has been a proactive participant in the organic soy protein market, known for its commitment to producing high-quality, non-GMO soy products. This focus aligns well with increasing consumer preferences for health-conscious dietary options. Over 2023 and 2024, the company continues to innovate within its product lines to meet the growing demand for plant-based proteins, positioning itself strongly within the competitive landscape of the organic soy protein market.

Conclusion

The organic soy protein market is poised for substantial growth, underpinned by increasing health consciousness and a shift towards plant-based diets. This market is driven by a combination of consumer demand for healthier, environmentally sustainable, and ethical food options, which has significantly increased the popularity of organic and non-GMO soy products. With growing applications in functional foods, sports nutrition, and infant formulas, organic soy protein is expanding its presence across various sectors.

Additionally, regions like Europe, North America, and Asia-Pacific are seeing significant market activity, with the latter poised for rapid growth due to rising health awareness and changing dietary preferences. As the market continues to evolve, the versatility and health benefits of organic soy protein will likely make it a staple in the ongoing shift towards plant-based nutrition, presenting ongoing opportunities for industry participants.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)