Table of Contents

Introduction

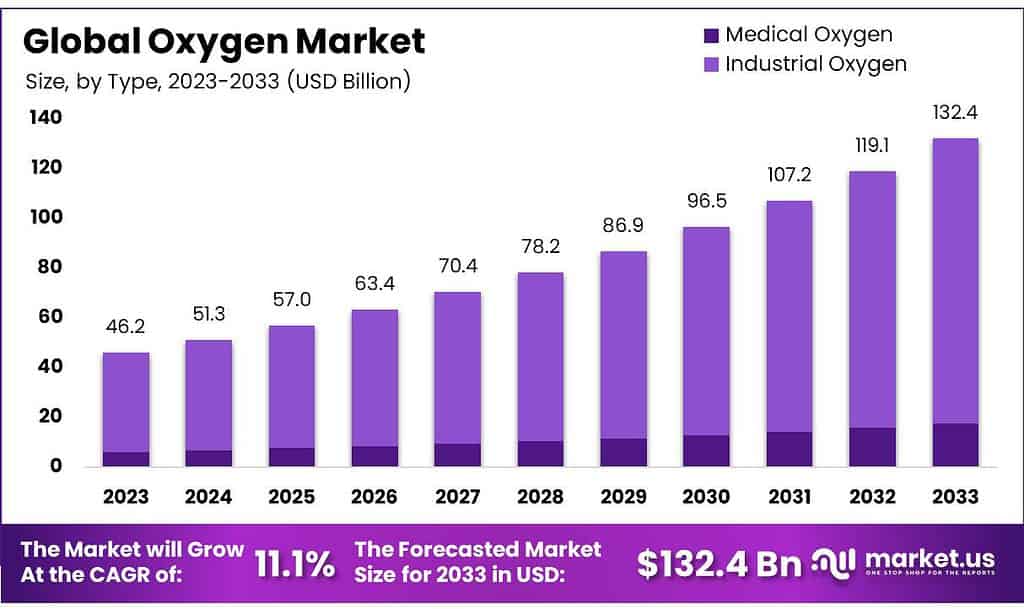

The global oxygen market is poised for significant growth, with its size expected to expand from USD 46.2 Billion in 2023 to around USD 132.4 Billion by 2033, reflecting a Compound Annual Growth Rate (CAGR) of 11.1% during the forecast period from 2024 to 2033. This growth is primarily driven by the increasing demand for medical oxygen due to rising respiratory illnesses and an aging population. Additionally, the industrial sector contributes to the demand, especially in areas like manufacturing, where oxygen is crucial for processes such as metal cutting and welding.

However, the market faces challenges such as the high cost of oxygen production and delivery infrastructure, and stringent safety regulations that govern its storage and transport. Recently, there have been significant developments in production technologies aimed at reducing costs and improving supply efficiency, such as the expansion of onsite and modular oxygen production facilities. These advancements are crucial in meeting the growing global demand and overcoming logistical challenges in oxygen supply.

The oxygen market is currently witnessing several dynamic movements among key players, reflecting broader industry trends focused on expansion and technological advancements.

INOX-Air Products Inc. is aggressively expanding its capacity to meet growing demands. Recently, they announced a significant investment of INR 2,000 crore to establish eight new air separation units across India. These units are expected to enhance their production capabilities significantly, catering to diverse sectors such as electronics, pharmaceuticals, and heavy industries, and are set to be operational between 2022 and 2024.

Messer North America, Inc. has not featured prominently in recent news updates specific to new developments in the oxygen sector. However, Messer continues to play a critical role in the North American market as a major provider of industrial gases, including oxygen, which is crucial for a wide range of industrial applications.

Bhuruka Gases Limited has not been highlighted in the latest available detailed public disclosures or news releases regarding specific recent developments in the oxygen market. The company continues to serve as a significant player in the Indian industrial gases market, providing a variety of gases, including oxygen, for industrial use.

Air Products Inc. has been part of several significant contracts and development projects. Notably, they secured over $130 million in contracts from NASA to supply liquid hydrogen and have been involved in numerous initiatives aimed at supporting the transition to cleaner energy and enhancing their sustainability practices.

These activities highlight the vibrant and evolving nature of the oxygen market, driven by technological advancements, increased capacity, and strategic investments to meet the rising global demand across various sectors.

Key Takeaways

- Market Growth Projection: The Oxygen Market is expected to reach USD 132.4 billion by 2033, with a robust 11.1% CAGR from the 2023 value of USD 46.2 billion.

- Comprehensive Industrial Role: Oxygen is a vital industrial gas, dominating sectors like manufacturing (86.7%) and healthcare, showcasing its diverse applications.

- Preferred Oxygen Form: Liquid Oxygen led in 2023, securing a 61.5% market share, emphasizing its versatility and convenience in various industrial applications.

- Top Production Method: Cryogenic production claimed dominance in 2023, indicating efficiency in meeting diverse industrial oxygen demands at extremely low temperatures.

- End-Use Dominance: Metal & Mining held a significant 49.7% market share in 2023, highlighting oxygen’s pivotal role in critical processes within the industry.

Oxygen Statistics

Global Trade and Export Data

- In 2022, the global trade value of oxygen was $262M.

- Between 2021 and 2022, the exports of oxygen decreased by 7.39%, from $283M to $262M.

- The trade in oxygen represented 0.0011% of the total world trade in 2022.

- Oxygen ranked 3481st in the Product Complexity Index (PCI) in 2022.

Top Exporters and Importers

- Belgium was the top exporter of oxygen in 2022, with exports valued at $63.6M.

- France exported $30.1M worth of oxygen in 2022.

- The United States exported $12.4M worth of oxygen in 2022.

- The Netherlands was the top importer of oxygen in 2022, with imports valued at $45.3M.

- Germany was the second-largest importer of oxygen in 2022, with imports totaling $28.2M.

Fastest Growing Exports and Imports

- Fastest growing exports between 2021 and 2022 were Belgium ($18.8M), France ($8.43M), and Kuwait ($5.78M).

- Fastest growing imports were the Netherlands ($11.8M), Luxembourg ($8.04M), and France ($7.86M).

Net Exporters and Importers

- Belgium was the top net exporter of oxygen in 2022, with a net export value of $59.6M.

- The Netherlands was the top net importer of oxygen in 2022, with a net import value of $39.9M.

- Largest trade value in exports over imports were Belgium ($59.6M), Kuwait ($17.3M), and the United States ($10.2M).

- Largest trade value in imports over exports were the Netherlands ($39.9M), Germany ($18.5M), and Luxembourg ($11.4M).

Medical Oxygen Production and Supply

- In 2019, top exporters of medical oxygen were Belgium ($31,856.56K), France ($24,658.77K), and the European Union ($9,146.10K).

- Reliance Industries Ltd (RIL) produces over 1,000 MT of medical-grade liquid oxygen per day at its Jamnagar complex.

- Since March 2020, Reliance has supplied over 55,000 MT of medical-grade liquid oxygen across India.

Portable Oxygen Cylinders Market

- Portable oxygen cylinder export shipments totaled 821, exported by 204 exporters to 185 buyers as of March 28, 2024.

- The top three exporters of portable oxygen cylinders are the United States (199 shipments), Ecuador (195 shipments), and India (97 shipments).

- India is the top importing country with 133 shipments, followed by Chile (115 shipments), and Ecuador (86 shipments).

Emerging Trends

- Increased Medical Use: The demand for medical oxygen has surged, particularly in response to respiratory illnesses and aging populations. This trend is accelerating innovations in oxygen delivery systems and the expansion of production facilities to meet healthcare needs.

- Advancements in Oxygen Therapy Technology: New technologies in oxygen therapy, including portable and more efficient oxygen concentrators, are becoming popular. These advancements improve the quality of life for patients requiring long-term oxygen therapy.

- Growth in Home Healthcare: There is a rising trend towards home healthcare services, which includes at-home oxygen therapy. This shift is driven by the cost-effectiveness and comfort of receiving treatment at home, especially for chronic conditions.

- Use in Water Treatment: Oxygen is increasingly used in water treatment processes to improve the efficiency of removing impurities and pathogens. This application is crucial for environmental protection and public health.

- Industrial Applications: In industries such as mining, glassmaking, and steel production, the use of oxygen is critical for enhancing combustion processes. This application is driving the development of more robust and efficient industrial oxygen supply systems.

- Development of Portable Oxygen Systems: There is significant growth in the development and use of portable oxygen systems in various sectors, including emergency medical services, military operations, and personal use for altitude sickness prevention.

- Sustainability Initiatives: The oxygen industry is seeing an increase in sustainability initiatives, focusing on reducing energy consumption in oxygen production and exploring renewable energy sources to power production plants.

Use Cases

- Medical Oxygen for Healthcare: Oxygen is crucial in healthcare for treating respiratory ailments and during surgery to maintain adequate oxygen levels in patients’ blood. Hospitals worldwide rely heavily on medical-grade oxygen, especially during health crises like the COVID-19 pandemic, where the demand can increase dramatically.

- Industrial Manufacturing: In industries such as steel, glass, and paper, oxygen is used to enhance combustion in furnaces, increasing efficiency and reducing emissions. For example, in steel production, oxygen is blasted into furnaces to purify the metal and significantly speed up the process.

- Water Treatment: Oxygen is used in wastewater treatment plants to accelerate the breakdown of organic materials by aerobic bacteria. This process, known as aerobic digestion, is more environmentally friendly compared to chemical treatments and helps in maintaining clean water supplies.

- Oxygen Therapy: For individuals with chronic obstructive pulmonary disease (COPD) or other lung conditions, portable oxygen concentrators are essential for daily therapy, enhancing mobility and quality of life by providing supplemental oxygen during activities.

- Aquaculture: Oxygen is vital in aquaculture to sustain healthy fish populations, especially in densely stocked systems. By increasing dissolved oxygen levels, fish health and growth rates improve, supporting more sustainable and productive aquaculture practices.

- Mining Operations: Oxygen is used in various mining processes, including gold and uranium leaching. Adding oxygen into these processes increases the efficiency of extracting metals from ores, thus optimizing production rates and reducing overall operational costs.

- Emergency Medical Services (EMS): Oxygen is a standard treatment in EMS for various conditions, including trauma, heart failure, and respiratory distress. Ambulances are equipped with oxygen cylinders to provide immediate care during medical emergencies, crucial for patient survival before hospital treatment.

Major Challenges

- Supply Chain Constraints: The logistics of transporting and storing oxygen, especially medical-grade oxygen, are complex and costly. Oxygen needs to be kept at specific temperatures and pressures, requiring specialized equipment and handling. Disruptions in the supply chain, as seen during health crises like the COVID-19 pandemic, can lead to severe shortages.

- High Production Costs: Producing oxygen, particularly through processes like cryogenic distillation, is energy-intensive and expensive. These high costs can limit the ability to expand production quickly in response to sudden increases in demand.

- Regulatory Compliance: Oxygen production and distribution are heavily regulated due to safety concerns. Complying with these regulations, which can vary significantly by country and region, adds additional operational complexities and costs.

- Market Volatility: Demand for oxygen can fluctuate widely, influenced by factors such as public health crises or changes in industrial demand. This volatility makes it challenging to maintain a balanced supply, impacting pricing and investment strategies.

- Technological Challenges: While advancements in technology offer opportunities for more efficient production and use of oxygen, they also present challenges. Staying ahead in technological innovation requires continuous investment and adaptation, which can be a significant hurdle for smaller players or those in developing markets.

Growth Opportunities

- Technological Innovations in Production: Advances in production technology could reduce costs and increase the efficiency of oxygen production. Innovations such as membrane technology or improved cryogenic separation processes offer potential for market growth by making oxygen supply more reliable and affordable.

- Expansion into Emerging Markets: Many developing countries are experiencing rapid industrialization and improvements in healthcare infrastructure. This expansion represents a substantial opportunity for the oxygen market to grow as the demand for industrial and medical oxygen increases in these regions.

- Integration with Home Healthcare Services: As home healthcare gains popularity, especially for chronic conditions requiring oxygen therapy, there is an opportunity to develop and market portable oxygen concentrators and other home-use oxygen delivery systems tailored to patient needs.

- Use in Water Treatment Applications: Increasing environmental regulations and the need for cleaner water supply systems can drive the demand for oxygen in wastewater treatment and other water purification processes. Oxygen is used to enhance the effectiveness of these systems, representing a growth area as global water management concerns increase.

- Partnerships with Healthcare Providers: Collaborating with hospitals and other healthcare facilities to supply medical-grade oxygen can open new channels for growth. As health systems continue to expand and modernize, especially in developing regions, these partnerships could ensure steady demand and strengthen market presence.

Key Players Analysis

INOX Air Products Inc., a leading player in the oxygen sector, recently inaugurated a new ultra-high purity cryogenic oxygen plant in Pradesh, India. This facility, with a capacity of 200 tonnes per day, will significantly enhance the production of liquid oxygen, nitrogen, and argon, supporting both medical and industrial demands. The plant’s addition boosts the region’s liquid oxygen production capacity from 115 to 265 tonnes per day, reflecting the company’s commitment to meeting increased demand and supporting regional industrial growth.

Messer North America Inc., a major entity in the oxygen sector, reported a 7.1% increase in total sales to €4.39 billion for 2023, showcasing resilience amidst economic challenges. Recently, Messer completed the acquisition of the Federal Helium System from the U.S. Department of the Interior’s Bureau of Land Management, further expanding its capabilities in the industrial gases market. This acquisition aligns with Messer’s strategic growth plans, leveraging its extensive production and distribution network across the Americas.

Bhuruka Gases Limited, a notable player in the oxygen sector, recently entered into a strategic partnership with Italy’s SOL Group to enhance its position in the specialty gases market. This collaboration aims to leverage SOL’s technological expertise with Bhuruka’s market presence in India, supporting initiatives like Make-in-India. Bhuruka’s diverse product range includes liquid oxygen, nitrogen, and argon, serving industries such as automotive and aeronautical. This partnership is expected to bolster the company’s growth and expand its market reach.

Air Products Inc., a major entity in the oxygen sector, reported a strong fiscal performance for 2023 with a GAAP net income of $2.3 billion, up 3% from the previous year. The company’s adjusted EPS increased by 12% to $11.51. Notably, Air Products continues to execute its clean hydrogen projects aimed at decarbonizing transportation and industrial sectors. Their strategic investments, including a forecasted $5.0 to $5.5 billion in capital expenditures for 2024, underscore their commitment to growth and sustainability.

Gulf Cryo recently signed a 20-year agreement with Ma’aden to build a large-scale CO2 capturing plant in Saudi Arabia. This facility will capture up to 300,000 metric tons per annum of CO2 emissions from Ma’aden’s operations, marking one of the region’s largest carbon capture projects. The CO2 will be repurposed for industrial applications such as enhanced oil recovery and water desalination, reflecting Gulf Cryo’s commitment to decarbonization and sustainable industrial gas solutions.

Matheson Tri-Gas, Inc. has entered into an agreement to supply oxygen for 1PointFive’s first Direct Air Capture (DAC) plant in Texas, named “Stratos”. This plant, expected to be operational by mid-2025, will capture up to 500,000 tons of CO2 annually. Matheson will invest in and establish an Air Separation Unit to provide the necessary oxygen, showcasing its commitment to supporting carbon capture and sequestration technologies.

TAIYO NIPPON SANSO CORPORATION operates through its U.S. subsidiary Matheson Tri-Gas, providing industrial, electronic, and medical gases globally. Matheson’s recent agreement to supply oxygen for a large DAC plant in Texas underlines its strategic focus on growth and sustainability within the industrial gas sector.

Airgas, Inc., a subsidiary of Air Liquide, is a leading supplier of industrial, medical, and specialty gases in the U.S. The company, founded in 1982, has grown through over 500 acquisitions and reported revenue of $7.1 billion in 2022. Airgas continues to innovate and expand, recently presenting advanced fabrication solutions at FABTECH 2022 and enhancing its dry ice production systems.

AIR WATER INC. is a significant player in the industrial gases sector, focusing on a diverse range of applications from healthcare to manufacturing. Recently, AIR WATER INC. has been expanding its capabilities and market reach through strategic acquisitions and partnerships, continuously driving growth and innovation in the gas industry.

Gasworld provides comprehensive news and analysis on the industrial gases sector, covering developments from companies like Airgas and AIR WATER INC. It serves as a crucial resource for industry professionals to stay updated on market trends, technological advancements, and business strategies within the gases industry.

Air Liquide reported a robust financial performance in 2023, with a revenue of €27.61 billion, reflecting a 3.7% increase on a comparable basis. The net profit rose by 11.6% to €3.08 billion. The company made significant investments in decarbonization projects, including a large-scale CO2 capture unit in Rotterdam and a new air separation unit in Quebec to support the electric vehicle battery sector. These initiatives underscore Air Liquide’s commitment to sustainability and innovation in the industrial gases sector.

Yingde Gases Group Co. Ltd. focuses on the production and distribution of industrial gases, serving various sectors such as steel, chemicals, and electronics. In recent years, Yingde Gases has expanded its capabilities and market presence through strategic investments and partnerships. The company continues to play a crucial role in China’s industrial gas market, leveraging its extensive network and technological advancements to meet growing demand.

Gulf Cryo recently signed a 20-year agreement with Ma’aden to build a large-scale CO2 capturing plant in Saudi Arabia. This facility will capture up to 300,000 metric tons per annum of CO2 emissions from Ma’aden’s operations, marking one of the region’s largest carbon capture projects. The CO2 will be repurposed for industrial applications such as enhanced oil recovery and water desalination, reflecting Gulf Cryo’s commitment to decarbonization and sustainable industrial gas solutions.

Conclusion

The oxygen market is poised for significant growth, fueled by advancements in technology, increasing industrial demands, and the expanding healthcare sector. As industries and healthcare providers continue to recognize the critical role of oxygen in enhancing operational efficiency and patient care, the market is likely to see a surge in demand.

However, challenges such as supply chain complexities and regulatory compliance must be addressed to fully capitalize on these opportunities. By innovating production techniques and expanding into emerging markets, companies in the oxygen industry can overcome these hurdles and continue to thrive. The future of the oxygen market looks promising, with ample opportunities for growth and development across various sectors.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)