Table of Contents

Introduction

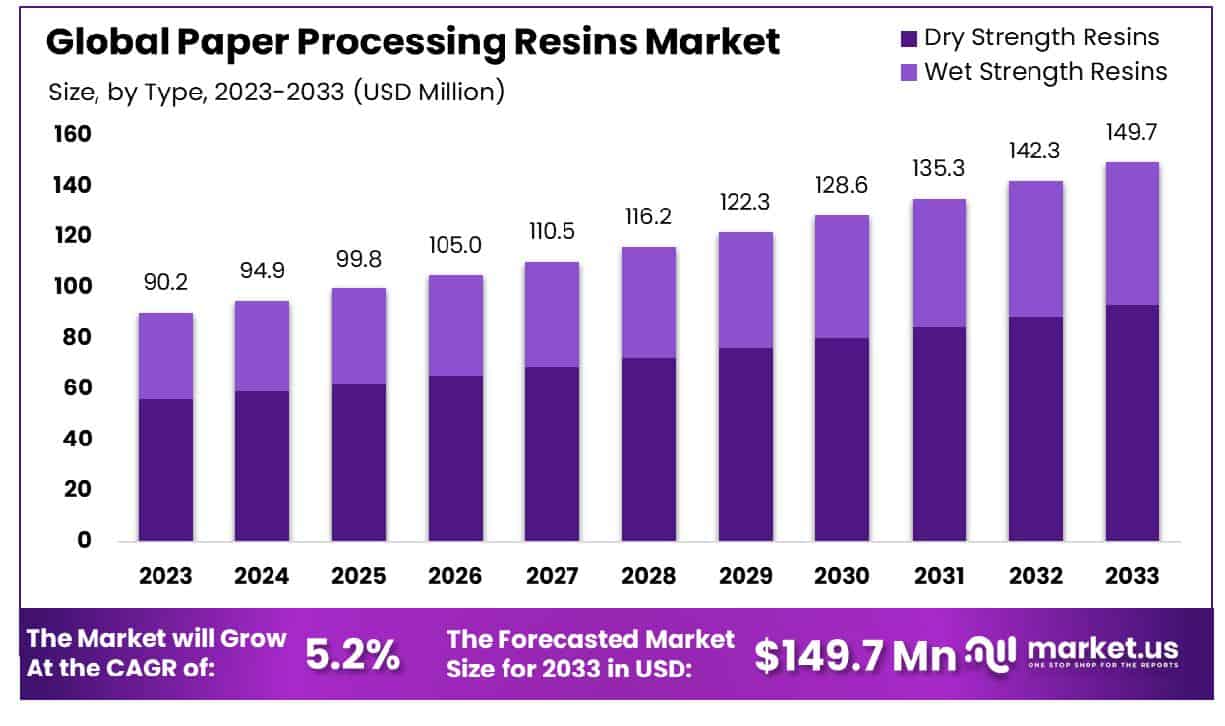

The Global Paper Processing Resins Market is projected to expand from USD 90.2 million in 2023 to approximately USD 149.7 million by 2033, demonstrating a compound annual growth rate (CAGR) of 5.2% over the forecast period from 2024 to 2033. This growth can primarily be attributed to the increasing demand for sustainable packaging solutions and advancements in paper processing technologies. Paper processing resins are critical in enhancing paper products’ strength, durability, and printability, catering to a broad spectrum of industrial, commercial, and retail applications.

However, the market faces significant challenges, including stringent environmental regulations and the volatility of raw material prices, which could impede growth. Recent developments in the sector include the introduction of bio-based resins, which offer a more environmentally friendly alternative to traditional synthetic resins. These innovations align with global sustainability trends and are expected to provide new opportunities for market expansion in the coming years.

BASF SE has made significant strides by launching a new range of eco-friendly paper processing resins, specifically designed to reduce environmental impact. This initiative not only supports sustainability but also meets the increasing regulatory demands across various regions. Additionally, BASF SE has recently expanded its production capacity by 30% at its facility in Germany to meet the growing demand for specialized paper resins.

Kemira Oyj has focused on strategic partnerships to bolster its supply chain capabilities. In 2022, the company entered into a collaboration with a leading paper manufacturing company to develop custom solutions that improve the recycling rate of paper products. This partnership is expected to enhance Kemira Oyj’s product offerings and strengthen its market presence.

Solenis has been proactive in acquisitions to expand its product portfolio and geographic reach. In a recent move, Solenis acquired a smaller resin manufacturer, which has allowed the company to integrate innovative technologies and tap into new markets in Asia-Pacific, where demand for processed paper products is on the rise.

Ashland Global Holdings Inc. has introduced a breakthrough product that promises to revolutionize the paper processing industry. This new resin enhances the water resistance of paper products, making them more durable for packaging applications. Launched in early 2023, this product has already seen a positive reception from major packaging companies.

The Dow Chemical Company has secured additional funding to invest in research and development focused on bio-based resins. In 2022, the company announced a project funded with USD 20 million aimed at developing resins that can provide superior performance while being fully compostable. This development is part of Dow’s commitment to sustainability and its strategy to lead the market in innovative, eco-friendly solutions.

Key Takeaways

- Market Growth: The Global Paper Processing Resins Market size is expected to be worth around USD 149.7 Million by 2033, From USD 90.2 Million by 2023, growing at a CAGR of 5.2% during the forecast period from 2024 to 2033.

- The Asia Pacific Paper Processing Resins Market holds 36.7%, valued at USD 33.1034 million.

- By Type: Dry Strength Resins dominate, holding a 62.4% market share.

- By Resin Type: Acrylic Resin represents 28.4% of the resin type market.

- By Application: Coatings lead applications with a 33.1% market presence.

Wet Strength Enhancement

- Wet strength resins which allow the end product paper to retain more than 15% and up to 50% of its dry strength when wet are well known in the papermaking art.

Using modern commercial resins, wet strength of 20- 50% of dry strength can be obtained. The addition of 1% resin can cause a three to six-fold increase in wet strength. - The use of chemicals can retain as much as 10% to 30% of the original dry strength of the paper.

- The residual strength of a wetted paper can be less than 10% of the original strength.

- It is determined that 0.6–0.8 % of absolutely dry fiber is an effective resin content in the

- paper composition. It allows for achieving the necessary paper strength of 9.3–9.6 % for the developed fiber composition, which provides basic operational properties of finished products.

Resin Utilization in Industry

- Epoxy resins account for about 8% of the thermosetting resins that are used in resin production.

- Globally, 41% of liquid epoxy resins that are produced are used for coatings and 31% are for adhesives with the remaining 28% used in a variety of other applications.

- In 2014, U.S. production of epoxy resins was at 254,465 metric tons making it a formidable and highly valued market.

- Green epoxy resin coatings modified with recycled fine aggregate in a replacement ratio of natural fine aggregate ranged from 20 to 100%.

- Thermosetting resins are expected to contribute 13.6% of the total revenue of the plastics and resins industry or $14 billion in 2016.

Environmental Impact and Sustainability

- The paper industry is the fifth most energy-intensive industry in the industrial sector in Germany. It is responsible for 1.9 % of total energy consumption and 1.75 % of total emissions in Germany.

- The “Forschungscluster Modellfabrik Papier“ (FOMOP) is an association of institutes, industry, and politics to reduce the energy consumption of paper production by 80 % up to 2045.

- South Africa’s wood and paper products exports demonstrated similar trends, declining 9% a year from 2016 to 2018, or from 3% of total exports to just under 2%.

- An estimated 318 million tonnes of plastic resin is produced every year, contributing to the 218 million tonnes of total annual solid plastic waste generation as part of Municipal Solid Waste (MSW).

- Global plastic production has been growing exponentially, with an annual growth rate of 8.4% since 1950, equating to approximately 380 million tonnes per annum.

Resin Effects on Product Performance

- Depending on the specific choice of resin, the maximum improvement over the rolling resistance temperature range is about 15%.

- VLEUGELS conducted a study on silica-reinforced SBR-BR tire treads from the perspective of using different terpene resins and found that the maximum improvement rate in the wet zone (0°C–30°C) was about 35%.

- The earliest method for developing wet strength was to fuse the cellulose fibers to one another, either by heating the paper to a very high temperature or by partially solubilizing the paper with 75% sulfuric acid.

- This procedure is usually less cumbersome than the addition to the paper stock. The saturation of paper with water reduces its strength to about 3-10% of its dry strength.

- The drawback to chemical pulping is that only 45% of the raw wood put in is returned as pulp.

Pulp Production Techniques

- The kraft process alone accounts for over 80% of the chemical pulp produced in the USA.

Chemical pulps tend to cost more than their mechanical pulp counterparts, which is largely due to the lower yield, often 40–50% of the original wood depending upon the source of fiber. - Generally, most wood sources contain 40–50% cellulose, 15–25% lignin, and 20–35% hemicelluloses.

- The proposed method detects resin ducts with a sensitivity of 0.85 and precision of 0.76.

- The corresponding scores for tree-ring boundary detection are 0.92 and 0.99, respectively.

- The annual production of plastics is 300 million metric tonnes worldwide.

Emerging Trends

- Bio-based Resins: There is a significant shift towards bio-based resins, driven by the global push for environmental sustainability. These resins are derived from natural sources and are designed to reduce the carbon footprint associated with paper production. As companies and consumers alike prioritize green products, the demand for bio-based resins is expected to rise sharply.

- Enhanced Recyclability: The trend towards improving the recyclability of paper products is gaining momentum. Paper processing resins are being developed to enhance the strength and quality of recycled paper, making it more competitive with virgin paper. This is crucial as industries and governments intensify efforts to reduce waste and promote circular economies.

- Performance Optimization: Technological advancements are enabling the development of resins that enhance the performance characteristics of paper. These include improvements in water resistance, durability, and printability. The aim is to broaden the applications of paper products into areas traditionally dominated by plastics and other materials.

- Customization for Specific Applications: There is an increasing trend towards the customization of resins to meet specific industry needs. Whether for food packaging, industrial applications, or consumer goods, resins are being tailored to provide specific functional benefits like moisture barrier properties or enhanced thermal stability.

- Regulatory Compliance: As regulatory frameworks for environmental protection tighten globally, the paper processing resins market is adapting with products that comply with new regulations. This includes reducing volatile organic compounds (VOCs) and ensuring that resins are safe and sustainable for use in consumer packaging.

Use Cases

- Packaging Solutions: Resins are crucial in the production of packaging materials, particularly in food and beverage industries, where durability and resistance to moisture are essential. The global packaging market, valued at approximately USD 900 billion in 2022, relies heavily on these resins to improve the structural integrity and protective qualities of paper packaging.

- Printing and Writing Papers: Resins enhance the printability of paper by improving ink absorption and the smoothness of the paper surface, critical for high-quality printing outcomes. In 2023, the global market for printing and writing papers was estimated at around USD 80 billion, with resins playing a pivotal role in maintaining paper quality amid rising demand for premium printing materials.

- Specialty Papers: Used in applications ranging from decorative papers to industrial filters, resins impart specific characteristics such as fire resistance, strength, and thermal stability. The specialty paper market, projected to grow at a CAGR of 4.7% from 2024 to 2030, extensively utilizes resins to meet stringent performance criteria across diverse sectors.

- Consumer Products: Everyday items like napkins, tissues, and disposable towels benefit from resins that improve softness, absorbency, and tear resistance. The global tissue paper market alone, which is expected to reach USD 98 billion by 2025, depends on resins to enhance product qualities that are critical to consumer satisfaction.

- Construction and Insulation: Paper processing resins are used in building materials for insulation purposes, contributing to energy efficiency and structural durability in the construction sector. As the construction industry continues to grow, with expected expenditures of over USD 11 trillion by 2024, the demand for resin-enhanced insulation materials is also increasing.

Major Challenges

- Environmental Regulations: Stricter environmental regulations are increasingly impacting the production and disposal of paper processing resins. For example, regulations aimed at reducing emissions and waste require manufacturers to invest in cleaner technologies and processes, which can be costly. Compliance with these evolving standards can lead to increased operational costs, potentially reducing profitability if not managed effectively.

- Volatility of Raw Material Costs: The prices of raw materials necessary for manufacturing paper processing resins, such as petroleum-based products, are highly volatile and subject to global economic fluctuations. This volatility can lead to unpredictable production costs. For instance, a sudden 15% increase in crude oil prices can directly inflate resin production costs, affecting pricing strategies and profit margins.

- Technological Advancements and Innovation Pressure: Keeping up with technological advancements is a major challenge. The industry demands constant innovation to develop more efficient and environmentally friendly resins. Companies that fail to innovate risk losing a competitive edge, which is vital in a market projected to grow steadily. Investing in R&D is essential but requires significant financial resources and strategic foresight.

- Market Saturation in Developed Economies: In mature markets like North America and Europe, where paper consumption is either declining or stabilizing, companies face intense competition and limited growth opportunities. This saturation forces companies to either innovate or capture market share from competitors, both of which require substantial market strategy adjustments.

- Shifts in Consumer Preferences: The global shift towards digital communication and away from traditional paper products poses a long-term demand challenge. As more businesses and consumers opt for digital alternatives, the demand for paper products, and consequently for paper processing resins, may decline. This trend urges companies to explore new applications and markets for their products.

Market Growth Opportunities

- Expansion into Emerging Markets: Developing regions, such as Asia-Pacific, Latin America, and parts of Africa, are witnessing rapid industrial growth and an increase in consumer demand for paper-based packaging and products. For instance, the Asia-Pacific region is projected to see a compound annual growth rate (CAGR) of over 6% in paper consumption due to growing economies like China and India. This presents a lucrative opportunity for paper-processing resin manufacturers to expand their market presence and capitalize on new consumer bases.

- Innovations in Bio-based Resins: There is a growing demand for sustainable and eco-friendly products across global markets. Developing bio-based resins that can replace traditional petroleum-based products offers a significant growth avenue. The market for bio-based polymers is expected to grow at a CAGR of approximately 10% over the next five years, reflecting increasing consumer and regulatory pressures for sustainable products. Tapping into this trend can open new segments and customer bases for manufacturers.

- Enhanced Recycling Technologies: With the global push towards sustainability, improving the recyclability of paper products using advanced resins can be a game-changer. Investing in technologies that enhance the recycling process and the quality of recycled paper can meet both environmental goals and consumer demand for high-quality recycled products. The global recycled paper market is expected to grow steadily, and innovations in this space can provide a competitive edge.

- Specialty and High-Performance Resins: There is a growing need for specialty resins that offer unique properties such as high durability, moisture resistance, and improved printability for specialty papers. These high-performance resins cater to niche markets, including luxury packaging and industrial applications, where performance criteria are stringent. The specialty resins market is poised for growth, with predictions of a 7% CAGR over the next decade, driven by diverse industrial applications.

- Regulatory Compliance and Green Certifications: By aligning products with international environmental standards and obtaining green certifications, companies can not only comply with regulations but also attract customers looking for sustainably certified products. This alignment can be particularly advantageous in regions with strict environmental governance, providing a pathway to premium pricing and brand differentiation.

Key Players Analysis

- BASF SE plays a prominent role in the paper processing resins sector, utilizing its Dispersions & Resins division to supply key materials like binders and additives that enhance the quality and performance of paper products. These materials are crucial for producing a range of paper coatings that improve the durability, printability, and appearance of finished paper. Notably, BASF’s commitment to innovation in this sector is highlighted by its development of VINOFAN™, a vinyl acrylic latex binder that aids manufacturers in optimizing their coating formulations to achieve cost efficiencies.

- Kemira Oyj, a leader in sustainable chemical solutions for water-intensive industries, notably enhances the paper processing sector with its innovative products. Focusing on sustainability, the company has launched new ISCC PLUS-certified biomass balanced wet strength resins, demonstrating a significant step towards reducing fossil-based raw materials usage. These developments align with broader industry trends towards renewable resources and circular economy practices.

- Solenis enhances paper processing with its broad array of wet and dry strength additives, focusing on compliance and environmental sustainability. The company’s products, including Kymene wet-strength additives, are integral in improving the quality and efficiency of paper products while adhering to rigorous environmental standards.

- Ashland Global Holdings Inc. is a key player in the paper processing resins sector, where it leverages its expertise in specialty chemicals to provide innovative solutions. The company is committed to sustainability, focusing on enhancing the performance and environmental footprint of its paper resins. These efforts are part of Ashland’s broader strategy to deliver high-quality, reliable products across various industries, reinforcing its position in the market through strategic partnerships and a strong focus on research and development.

- Dow Chemical Company is a leader in the paper processing resins sector, providing advanced solutions that enhance paper strength, opacity, and barrier properties. The company’s innovations in polymer technology help improve the functionality and environmental profile of paper products, aligning with sustainability goals in the industry.

- Nalco Water, a division of Ecolab, plays a significant role in the paper processing resins sector by offering a range of specialized wet-strength additives crucial for enhancing the durability of paper products. These additives are integral for producing various grades of paper, such as tissue and packaging, ensuring they maintain integrity when wet. Nalco Water’s approach combines innovation with sustainability, focusing on reducing operational costs and environmental impact, which aligns with the broader industry shift towards sustainable production practices.

- SNF Floerger is a prominent player in the paper processing resins sector, focusing on the production of water-soluble polymers such as polyacrylamides, which are used as processing aids in paper manufacturing. Their products improve paper machine productivity, retention, and drainage, while also serving as fixatives for dyes and sizing agents. SNF Floerger’s approach emphasizes sustainability, aiming to reduce environmental impacts across its global operations, which span over 70 countries.

- Mitsubishi Chemical Corporation is a prominent player in the paper processing resins sector, known for its innovative approach to polymer and resin technologies. The company specializes in producing a variety of resins, including polycarbonate and polyvinyl alcohol (PVOH) resins, which are used across multiple industries for their durability and performance enhancements. Mitsubishi Chemical’s focus extends to developing environmentally friendly resin products, such as GOHSENOL™, which is biodegradable and meets diverse application needs from adhesives to paper processing. Their commitment to sustainability is evident in their development of high-value, specialty PVOH products that cater to a growing demand for eco-friendly materials.

- Arkema has a robust presence in the paper processing resins sector, particularly focusing on sustainability and innovation. The company’s portfolio includes bio-sourced resins like the Synaqua® range, derived significantly from paper byproducts. Arkema is also pioneering waterborne resin technologies that facilitate lower VOC emissions and offer enhanced performance characteristics suitable for various applications, aligning with environmental sustainability goals.

- Momentive Performance Materials Inc. is significantly involved in the paper processing resins sector, focusing on the development and production of specialized resin formulations. These resins are utilized for various functional and aesthetic enhancements in paper products, providing properties such as improved durability, resistance, and finish quality. Momentive leverages advanced silicone and other specialty resins to meet diverse industry needs, positioning itself as a leader in innovative resin solutions for the paper industry.

- Harima Chemicals Group, Inc. specializes in the production of paper chemicals leveraging water-based resin synthesis technologies. They develop polyacrylamide-based paper strengthening agents, rosin-based sizing agents, and surface treatment additives to enhance printability and water repellency. Harima focuses on innovation to support sustainable practices, aiming to replace single-use plastics with bio-based and water-resistant paper products suitable for global regulatory standards.

- Indulor Chemie GmbH specializes in the development and production of chemical binders, dispersants, and antistatic agents for the paper processing sector. These products enhance paper quality by improving properties such as strength, flexibility, and printability. With over 40 years of expertise in macromolecular chemistry, Indulor has established a strong presence in this industry by focusing on innovative resin solutions that cater to specific client needs.

- OMNOVA Solutions Inc. specializes in the production of attractive and functional paper laminates used in light-duty, low-wear applications. These laminates, suitable for various surfaces like cabinetry and furniture, offer a wide selection of patterns and colors, ensuring design flexibility and customization. OMNOVA focuses on combining aesthetic appeal with practical functionality in its product offerings, catering to diverse industry needs.

- Buckman Laboratories International, Inc. excels in the paper processing resins sector by offering a comprehensive suite of chemical products aimed at improving the strength and durability of paper products. Their offerings include wet and dry strength resins, which are critical for enhancing the mechanical properties of paper used in a variety of applications, from everyday printing to specialized packaging. Buckman’s focus on smart technologies and customer-centric solutions enables them to support sustainable paper production processes effectively.

Conclusion

The market for paper processing resins is poised for progressive growth, primarily driven by the increasing demand for enhanced paper quality and the rising adoption of sustainable practices in the paper industry. Innovations in resin formulations aimed at improving paper strength, durability, and printability, alongside environmental regulations pushing for reduced emissions, play a pivotal role in shaping market trends.

Market participants are encouraged to focus on eco-friendly resins to align with global sustainability goals, which will likely open up new avenues for growth and investment. Overall, stakeholders in the paper processing resin market can expect a favorable market environment, provided they continue to innovate and adapt to regulatory standards and environmental demands.