Table of Contents

Introduction

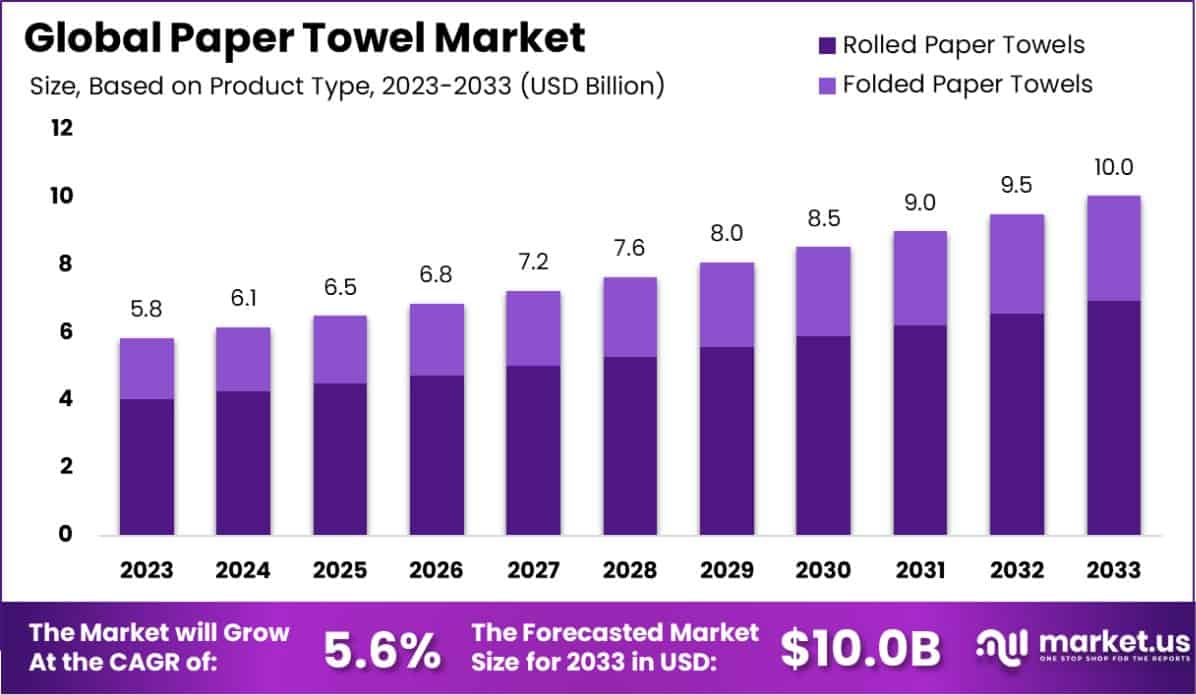

The Global Paper Towel Market is projected to reach approximately USD 10.0 billion by 2033, rising from USD 5.8 billion in 2023, with an expected compound annual growth rate (CAGR) of 5.6% during the forecast period from 2024 to 2033.

A paper towel is a disposable, absorbent sheet made from paper that is primarily used for cleaning, drying hands, and various hygiene applications. Unlike cloth towels, paper towels are single-use and designed to be discarded after use, making them a convenient and sanitary choice in households, commercial spaces, and public facilities.

The Paper Towel Market encompasses the global industry focused on the production, distribution, and sale of these products, including various segments like kitchen rolls, folded paper towels, and recycled or eco-friendly variants.

The market for paper towels has demonstrated robust growth, largely driven by rising awareness around hygiene, an increase in disposable income, and the convenience associated with these products. The surge in demand for hygiene products, especially post-pandemic, has accelerated market growth, as consumers and businesses place greater emphasis on sanitation.

Additionally, there is a notable demand shift towards eco-friendly paper towel options, with consumers increasingly seeking products made from recycled materials and sustainable sources.

Opportunities within the Paper Towel Market lie in the development of innovative and environmentally friendly products. Brands that focus on sustainable practices and highlight their eco-friendly credentials are well-positioned to capture market share, particularly as environmental consciousness grows globally.

Enhanced distribution channels and expanding usage across various sectors, including hospitality, healthcare, and offices, present further growth potential for market players. The paper towel industry, therefore, remains a vital component of the broader hygiene products market, with substantial room for innovation and market penetration.

Key Takeaways

- The global Paper Towel Market is anticipated to reach approximately USD 10.0 billion by 2033, growing from USD 5.8 billion in 2023, with a compound annual growth rate (CAGR) of 5.6% from 2024 to 2033.

- In 2023, rolled paper towels led the market in the Product Type segment, securing a dominant position.

- Virgin material dominated the Material segment in 2023, holding the largest share within the Paper Towel Market.

- The Commercial segment was the leading End-User category in 2023, accounting for 60.3% of the market share.

- Offline Stores held the top position in the Distribution Channel segment of the Paper Towel Market in 2023.

- North America led the regional market in 2023, capturing a 33.4% share and generating USD 1.9 billion in revenue from the Paper Towel Market.

Paper Towel Statistics

- The U.S. consumes 13 billion pounds of paper towels annually, leading global usage per capita.

- Each ton of paper towels requires 17 trees and 20,000 gallons of water to produce.

- Annual U.S. paper towel production uses approximately 130 billion gallons of water.

- Paper towels are the largest contributor to household paper waste in the U.S.

- American families use 1.5 to 2 rolls of paper towels every two weeks, spending $120–$180 annually.

- Switching to 100% recycled paper towels could save 54,000 trees in the U.S. each year.

- Average office workers use around 3,000 paper towels per year.

- Recycled paper towels reduce water use in production by up to 50%.

- Decomposition time for paper towels is typically 2–4 weeks.

- Advanced embossing techniques have increased absorbency by 50%.

- Bamboo paper towels are growing at 25% annually due to sustainability demand.

- Smart dispensers that reduce waste by 20–30% are increasingly popular in businesses.

- Paper towels decrease bacteria spread by 77% compared to air dryers.

- 90% of health organizations recommend single-use paper towels for hygiene.

- The market for antimicrobial paper towels is growing by 15% annually.

- Antibacterial paper towels can eliminate up to 99.9% of common bacteria.

- Europeans use 50% fewer paper towels per capita than Americans.

- Paper towel consumption in Asia is rising by 15% annually.

- During holiday seasons, U.S. paper towel use increases by about 25%.

- Raw material costs for paper towels rose by 12% in 2023.

- Premium paper towel brands cost 40–60% more than store brands.

- American businesses spend $800–$1,200 on paper towels per location annually.

- Buying in bulk can reduce paper towel costs by 15–30%.

- About 50% of U.S. consumers prefer select-a-size rolls over standard ones.

- Modern production lines manufacture up to 1,000 paper towel rolls per minute.

- Smart dispenser adoption is projected to grow by 200% by 2025

Emerging Trends

- Rising Demand for Eco-Friendly Products: With heightened consumer awareness around environmental issues, there is a strong trend towards sustainable and recycled paper towels. Brands are responding by increasing the use of recycled fibers and ensuring certifications like FSC (Forest Stewardship Council) for eco-responsibility, which has gained traction in both retail and commercial segments. This trend not only helps reduce deforestation but also appeals to environmentally conscious consumers who seek greener alternatives.

- Increased Use in Commercial Settings : The use of paper towels in commercial spaces like offices, restaurants, and hospitals is growing as businesses prioritize hygiene and single-use options to minimize contamination risks. Particularly post-pandemic, paper towels have gained popularity as a more sanitary alternative to air dryers in public restrooms, fostering steady demand in sectors that value hygiene and health standards.

- Innovative Product Designs and Functionality: Companies are diversifying product offerings with innovative designs, including colored, patterned, and thicker, highly absorbent paper towels. This differentiation appeals to residential consumers looking for both aesthetic and practical benefits in household items. Brands are leveraging design and functionality to stand out in a competitive market, especially as consumers shift from plain white towels to more customizable options.

- Shift to Online Retail Channels : The convenience of online shopping has transformed the distribution landscape for paper towels. Consumers increasingly prefer e-commerce platforms, where they can buy in bulk and access a variety of options that may not be available in local stores. Retailers and manufacturers are adapting by strengthening their digital presence, making this a crucial distribution channel, especially as digital shopping becomes routine in urban and suburban markets.

- Focus on Cost-Effective, High-Performance Products for Emerging Markets : Paper towel usage is expanding in emerging markets, driven by urbanization and the product’s affordability and versatility. In regions with rising disposable incomes, households are adopting paper towels for everyday use, which has fueled demand for cost-effective, high-performance options. Manufacturers are tapping into these regions with products tailored to offer value and accessibility, thus contributing to global market growth

Top Use Cases

- Absorbent Surface for Kitchen Cleanup: Paper towels are essential for quickly absorbing spills and splashes, especially in kitchens. On average, high-quality brands like Bounty and Brawny can absorb up to 0.5 ounces of water per 4×4-inch piece, making them an effective solution for cleaning kitchen surfaces, countertops, and stovetops. This level of absorbency is preferred in over 80% of U.S. households for dealing with spills immediately and maintaining kitchen hygiene.

- Food Preparation Aid: Paper towels are widely used in food preparation to absorb excess moisture from meats, fish, and vegetables, helping ingredients retain better texture and flavor during cooking. For example, patting down meat can help it sear properly. Approximately 75% of households report using paper towels specifically in food prep, as they offer convenience and reduce cross-contamination by being disposable, unlike cloth towels.

- DIY Wet Wipes and Surface Sanitizers: Paper towels can be transformed into homemade wet wipes by adding a cleaning solution or sanitizer, making them useful for disinfecting surfaces in a pinch. This use is popular in commercial settings as well, where hygiene is prioritized. For instance, restaurants and healthcare facilities increasingly opt for disposable paper towels for frequent cleaning, valuing the time efficiency and sanitary benefits they provide.

- Personal Care and Hygiene: In addition to drying hands, paper towels serve as an alternative to facial tissues or napkins when needed. Some brands even offer extra-soft options designed for personal care. With a substantial uptick in single-use products for hygiene in both homes and public spaces, the demand for paper towels has increased, contributing to the industry’s growth, which is projected to reach $22.4 billion by 2032, driven by heightened health awareness.

- Protection for Cookware and Kitchen Tools: Paper towels are also used as separators to protect non-stick and delicate cookware when stacking. Placing a paper towel between pans or dishes prevents scratching and prolongs the lifespan of these items. This simple yet effective use is common in households and commercial kitchens where maintaining cookware quality is a priority. With cookware costs in mind, many households use this technique to reduce wear on items that can cost $50 or more per piece.

Major Challenges

- Raw Material Sourcing and Costs: The high cost and limited availability of raw materials, particularly wood pulp, are ongoing challenges for the paper towel industry. This volatility is driven by increased demand and supply chain disruptions, especially in regions heavily reliant on imported wood fiber. For example, global pulp prices dropped by almost $350 per ton in 2023, affecting profit margins and pricing flexibility. With limited alternative sources, the industry faces pressure to diversify fiber sources or increase recycled fiber use, a shift that can help mitigate rising costs but requires significant investment in new technology.

- High Energy Consumption and Environmental Impact: Paper towel manufacturing is energy-intensive, and reducing energy consumption while maintaining product quality is challenging. The industry’s carbon footprint remains a significant concern, as the tissue and towel sector alone accounts for about 14% of global emissions from pulp and paper production. To address this, manufacturers are exploring renewable energy sources and energy-efficient technologies. However, the transition involves substantial upfront costs and infrastructure changes, which can strain smaller manufacturers.

- Waste Management and Sustainability Demands: Consumer expectations around sustainability have grown, putting pressure on companies to produce eco-friendly products. Paper towels contribute significantly to waste in landfills due to their single-use nature, and while recyclable options exist, they are often more costly to produce. Companies like Procter & Gamble and Kimberly-Clark are investing in biodegradable alternatives and post-consumer recycled products, but balancing environmental responsibility with affordability remains challenging in a market that prioritizes low-cost convenience.

- Increased Competition from Alternative Products: As consumers become more eco-conscious, there is growing competition from alternative products like reusable cloths, bamboo towels, and compostable wipes. These options appeal to consumers focused on reducing waste, particularly in regions like North America and Europe where environmental consciousness is high. This shift has led to an estimated 5-7% decline in traditional paper towel sales in these markets, as consumers seek sustainable replacements.

- Technological Adaptation and Innovation Costs: The paper towel industry is challenged by the need to modernize production with advanced technologies like automation and data analytics for efficiency and quality improvement. Many manufacturing facilities are still operating with outdated machinery, which reduces productivity and increases costs. Investing in new technologies requires substantial capital and skilled labor, creating a barrier for smaller companies that struggle to stay competitive with larger players who can afford these

Top Opportunities

- Expansion in Emerging Markets: Rising urbanization and increasing disposable incomes in emerging markets, particularly in Asia-Pacific and Latin America, are driving demand for paper towels. Currently, these regions have lower penetration rates compared to North America and Europe. As consumers in developing economies shift towards more disposable hygiene products, paper towels are projected to see strong growth. The Asia-Pacific market alone is expected to show substantial gains with regional growth rates estimated at over 6% annually due to increased purchasing power and a growing preference for Western-style convenience products.

- Product Innovation and Specialized Use Cases: There is growing demand for paper towels with enhanced properties such as higher absorbency, durability, and multi-purpose functionality. Innovations like antimicrobial paper towels, biodegradable options, and customizable “select-a-size” sheets cater to diverse customer needs. Product differentiation also presents opportunities in the commercial sector, where there is demand for specialized paper towels used in food service, healthcare, and hospitality for specific cleaning and hygiene tasks. By tailoring products for different end users, manufacturers can capitalize on niche, high-margin segments.

- Sustainability-Focused Products: With increasing environmental awareness, consumers are seeking eco-friendly paper towel options. Products made from recycled materials or sustainable fibers are becoming more popular, especially in regions with high environmental consciousness like North America and Europe. The development of biodegradable and compostable options is an opportunity for brands to attract eco-conscious consumers and comply with rising regulatory standards for green products. Offering sustainable paper towels can also align brands with corporate sustainability goals, appealing to both consumers and business clients in B2B markets.

- Growth of E-Commerce Channels: Online retail is an expanding distribution channel, especially as consumer habits have shifted post-COVID-19. By leveraging e-commerce, paper towel brands can reach a wider customer base and cater to the growing demand for bulk and subscription-based products for both residential and commercial buyers. Digital platforms allow brands to gather consumer insights and personalize product offerings, which is expected to drive sales significantly. E-commerce sales in the paper towel sector are anticipated to grow at a CAGR of approximately 8% as convenience remains a top priority.

- Increasing Health and Hygiene Awareness: Heightened awareness around hygiene continues to fuel demand for disposable paper products across both households and public facilities. The single-use nature of paper towels aligns with hygiene protocols, making them preferable in public places like restaurants, hospitals, and workplaces. This demand is particularly strong in sectors focused on high cleanliness standards, such as healthcare and hospitality, creating an opportunity to expand product use in commercial settings globally. With continued focus on hygiene, the market for paper towels in commercial applications is expected to grow at a steady 5% annually, supporting overall market expansion.

Key Player Analysis

- Procter & Gamble (P&G): Procter & Gamble leads with its well-known brand Bounty, which dominates the U.S. paper towel market, generating around $2.5 billion in revenue. Known for absorbency and durability, Bounty is positioned as a premium brand, appealing to consumers seeking high-performance products. P&G’s innovation efforts, like Select-A-Size sheets, cater to efficiency-minded consumers and have strengthened its market position globally.

- Kimberly-Clark Corporation: Kimberly-Clark, with brands like Scott and Viva, holds a strong market share, especially in North America. Generating roughly $1.1 billion annually, Kimberly-Clark focuses on both affordability (Scott) and premium quality (Viva). Their innovations, including plastic-free core plugs, align with growing environmental concerns and consumer demand for sustainable products, particularly in Europe.

- Georgia-Pacific LLC: As a leading player with brands like Brawny and Sparkle, Georgia-Pacific also earns around $1.1 billion in the paper towel segment. Known for high strength and thickness, their products are highly regarded for both household and commercial uses. Recent investments in technology have allowed Georgia-Pacific to improve absorbency, reducing the number of sheets needed per use and appealing to cost-conscious consumers.

- SCA Group (Essity): SCA, operating under the brand Essity, is a prominent European company known for sustainable practices and eco-friendly products. With an investment of approximately $9.7 million in sustainable manufacturing in Sweden, SCA is committed to eco-conscious production. Its product portfolio includes towels for both household and away-from-home markets, making it a preferred choice in sustainability-sensitive regions.

- Kruger Inc.: Based in Canada, Kruger focuses on customer-centric innovations in both retail and commercial segments. Known for high-quality, eco-friendly paper towels, Kruger has invested in upgrading production technology to meet growing demand, especially for recycled products. This emphasis on sustainability resonates well with North American consumers, supporting Kruger’s competitive standing in the eco-conscious market

Recent Developments

- In 2024, Kimberly-Clark Corporation (NYSE: KMB) revealed a significant shift in its operational approach. Under the leadership of Mike Hsu, Chairman and CEO, the company introduced a new operating model and pivotal commercial strategies aimed at accelerating the growth of its brands and businesses beyond the industry norm. This transformation is set to redefine the pace at which Kimberly-Clark competes in its sectors, signaling a dynamic phase in its corporate evolution.

- In 2024, Metsä Group’s tissue paper sector, including its greaseproof paper division, earned the prestigious Platinum rating from EcoVadis for the fifth year in a row, underscoring its commitment to sustainability and social responsibility. With this rating, Metsä Tissue stands in the top one percent of all companies evaluated by EcoVadis, particularly excelling in environmental stewardship with an impressive score of 90 out of 100.

- In 2024, Kruger Products Inc. (KPI), partially owned by KP Tissue Inc. (TSX: KPT), announced an upcoming price hike for its consumer and private label tissue products in Canada, effective September 2, 2024. The adjustment, described as a high single-digit increase, is a response to the substantial rise in commodity costs and ongoing inflation, highlighting the economic pressures facing the industry.

Conclusion

The global paper towel market is projected to see sustained growth, driven by heightened hygiene awareness, especially post-pandemic, and increasing demand for sustainable products. As consumers and businesses prioritize disposable hygiene solutions, eco-friendly options like recycled and bamboo paper towels are gaining traction, aligning with global environmental trends. Product innovation in areas such as absorbency, strength, and aesthetics, along with the expansion of e-commerce channels, is reshaping market dynamics, presenting new opportunities for industry players to meet diverse customer needs across residential and commercial sectors.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)