Table of Contents

- Introduction

- Editor’s Choice

- Personal Protective Equipment Market Overview

- Personal Protective Equipment Export Statistics

- Personal Protective Equipment Import Statistics

- Global Distribution of PPE Production

- Personal Protective Equipment Products Demanded by Businesses

- PPE Manufacturing, Distribution, and Sourcing by Businesses

- Concerns About PPE Shortages Among Businesses

- Personal Protective Equipment and COVID-19

- Personal Protective Equipment Shortages

- Regulations for Personal Protective Equipment

Introduction

According to Personal Protective Equipment Statistics, Personal Protective Equipment (PPE) is essential in various industries, safeguarding workers from occupational hazards.

It includes gear like helmets, safety glasses, gloves, and respirators. Proper selection depends on hazard assessment and regulatory compliance, with factors such as fit, comfort, and durability considered.

Training on usage, maintenance, and recognizing when PPE is needed is crucial. Compliance with regulatory standards, like those set by OSHA, is mandatory.

PPE should complement other hazard control measures, and regular assessments ensure effectiveness. Overall, understanding PPE basics is vital for workplace safety and regulatory adherence.

Editor’s Choice

- The global Personal Protective Equipment (PPE) market revenue is projected to reach USD 147.1 billion by 2033.

- Hand protection products consistently held the largest share in the U.S., starting at 25% in 2016, experiencing slight fluctuations, and reaching 24.08% by 2026.

- In 2019, the global market for personal protective products was dominated by several key exporters. China led the market with a substantial 17.20% share of world exports.

- In January 2020, the monthly export value was USD 155.1 million, experiencing a 17.9% increase by February to USD 182.8 million.

- In 2022, Denmark led the imports of personal protective equipment (PPE) per capita, with a value of USD 56.78.

- In August 2021, the demand for personal protective equipment (PPE) among businesses showed that hand sanitizer was the most sought-after product, with 90.1% of businesses requiring it.

- In January 2022, nearly 1 in 10 (8.6%) businesses in the manufacturing, retail, and wholesale sectors were involved in the manufacturing or distribution of personal protective equipment (PPE), marking a 3.2% point increase compared to August 2021.

Personal Protective Equipment Market Overview

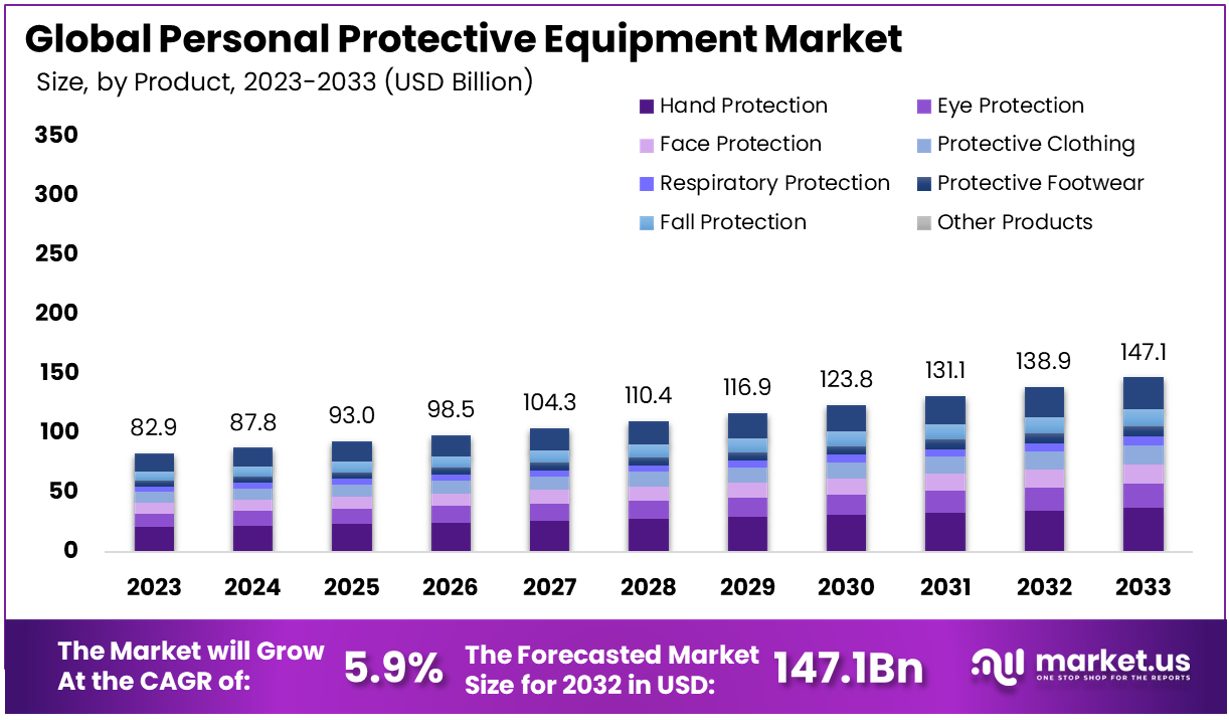

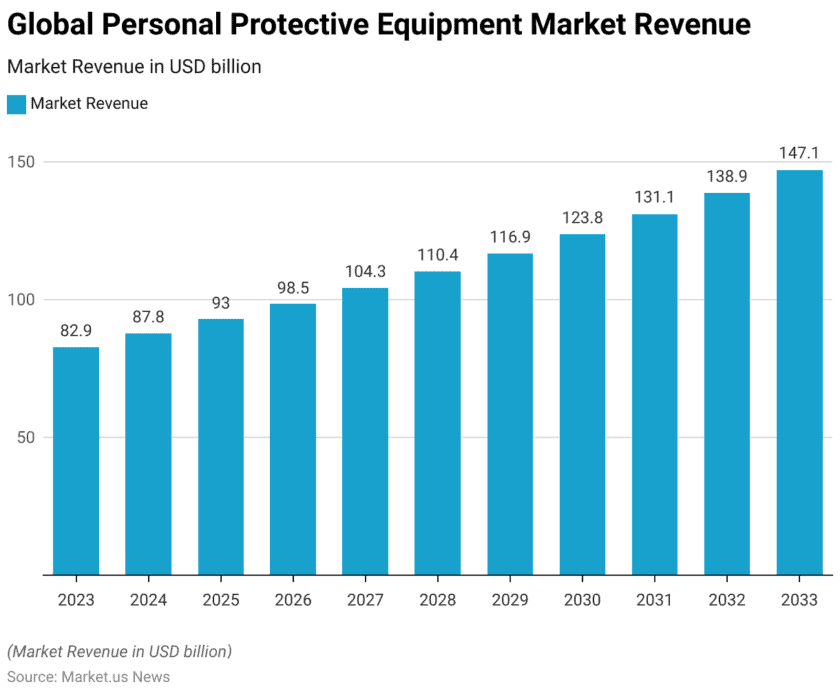

Global Personal Protective Equipment Market Size

- The global Personal Protective Equipment (PPE) market has shown consistent growth from 2023 to 2033 at a CAGR of 5.9%.

- In 2023, the market revenue was USD 82.9 billion, and it is projected to increase to USD 87.8 billion in 2024.

- The growth trajectory continues, with the market projected to achieve USD 138.9 billion in 2032 and reach USD 147.1 billion by 2033.

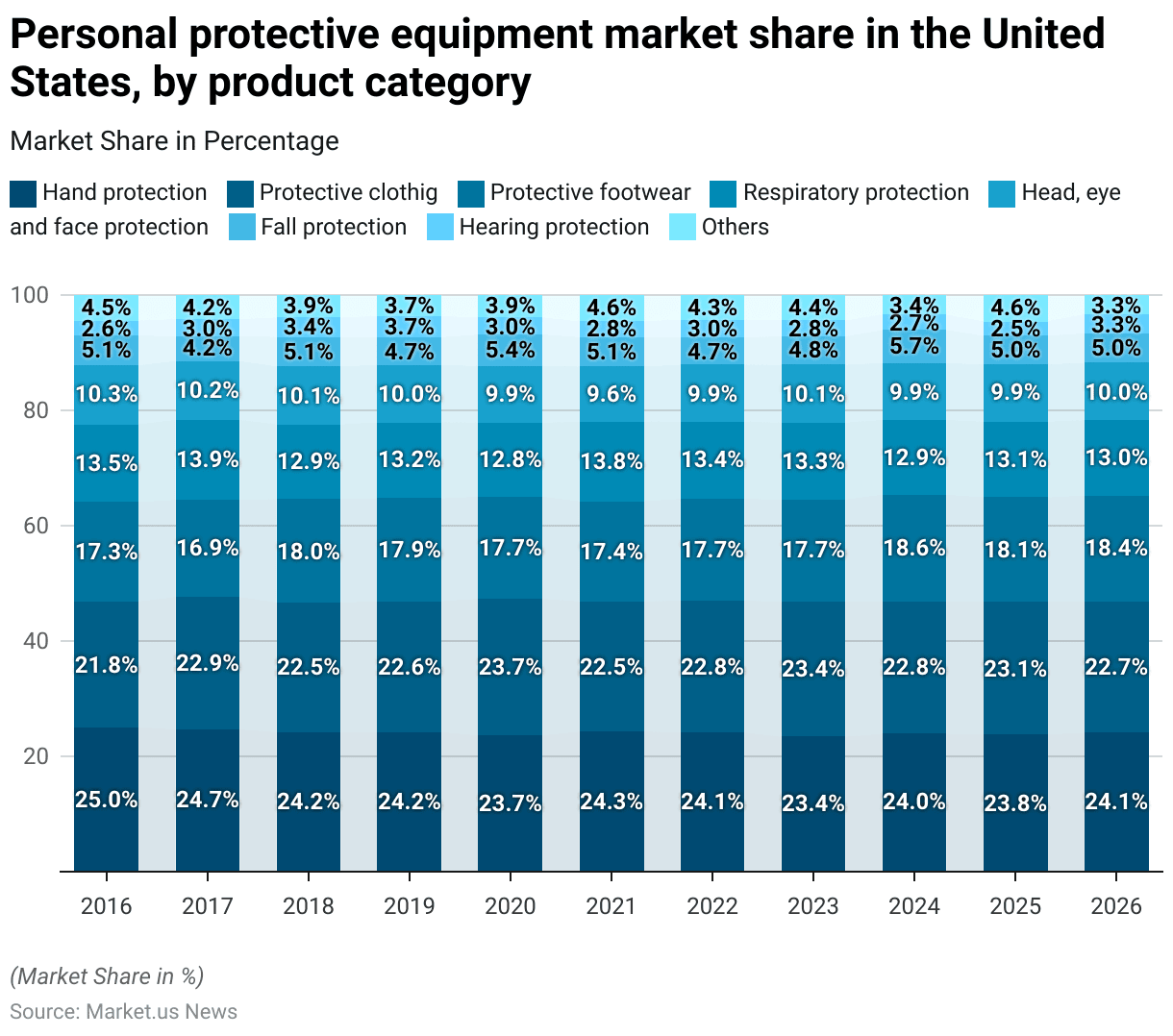

Global Personal Protective Equipment Market Share – By Product Category

- The market shares of personal protective equipment (PPE) in the United States by product category have shown various trends from 2016 to 2026.

- Hand protection consistently held the largest share, starting at 25% in 2016, experiencing slight fluctuations, and reaching 24.08% by 2026.

- Protective clothing followed closely, beginning at 21.79% in 2016, peaking at 23.65% in 2020, and stabilizing around 22.74% in 2026.

- Protective footwear maintained a significant share, starting at 17.31% in 2016 and slightly increasing to 18.39% in 2026.

- Respiratory protection saw variations, starting at 13.46% in 2016, peaking at 13.86% in 2017, and reaching 13.04% in 2026.

- The share of head, eye, and face protection slightly decreased from 10.26% in 2016 to 10.03% in 2026.

- Fall protection remained relatively stable, starting at 5.13% in 2016, with minor fluctuations, and reaching 5.02% in 2026.

- Hearing protection showed variability, starting at 2.56% in 2016, peaking at 3.37% in 2018, and ending at 3.34% in 2026.

- The ‘Others’ category also showed fluctuations, starting at 4.49% in 2016 and varying through the years to 3.34% in 2026.

Personal Protective Equipment Export Statistics

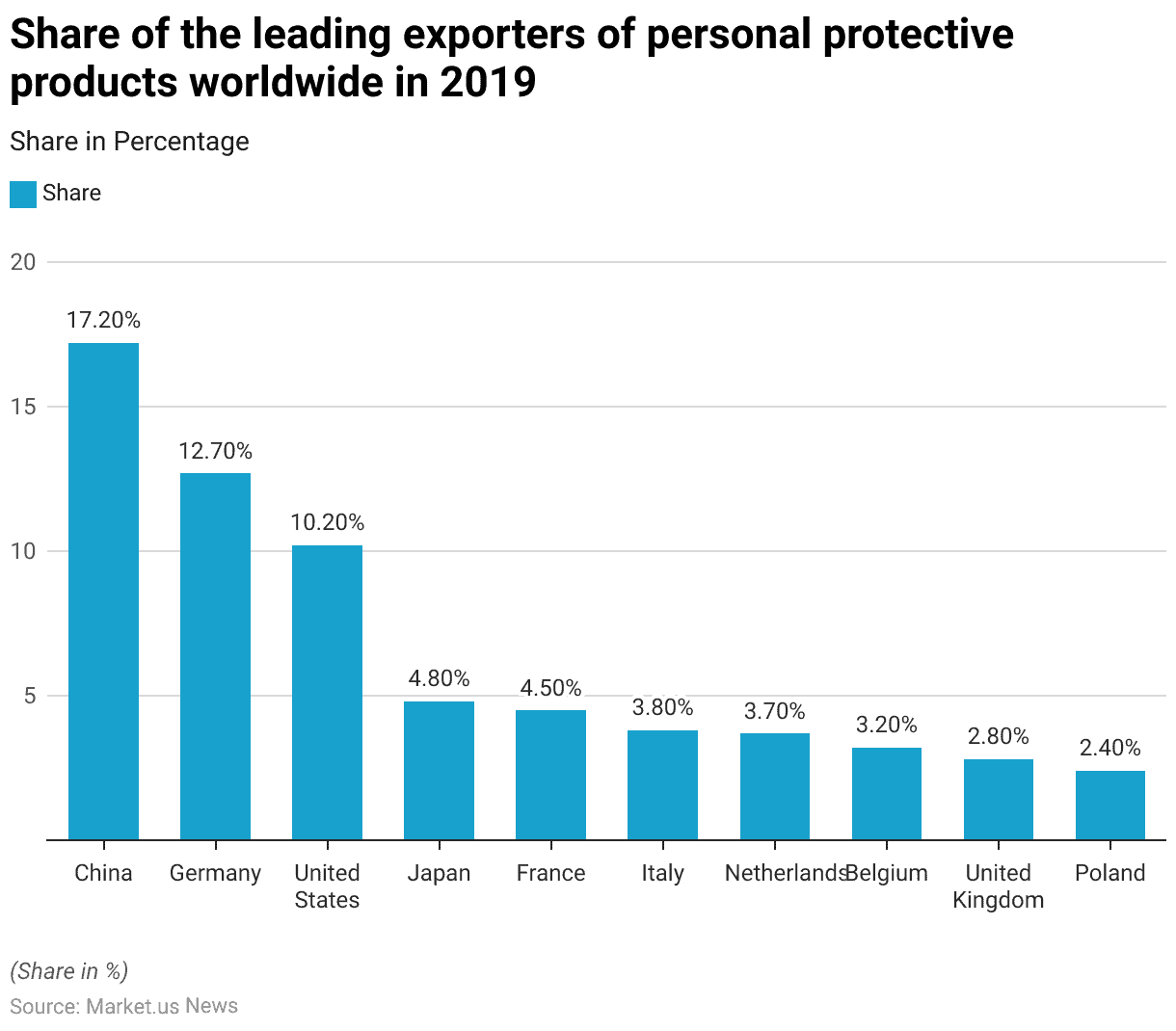

Share of The Leading Exporters of Personal Protective Products Worldwide

- In 2019, the global market for personal protective products was dominated by several key exporters. China led the market with a substantial 17.20% share of world exports.

- Germany followed, accounting for 12.70% of exports, while the United States held a 10.20% share.

- Japan and France contributed 4.80% and 4.50%, respectively.

- Italy exported 3.80% of the world’s protective products, closely followed by the Netherlands at 3.70%.

- Belgium held a 3.20% share, with the United Kingdom and Poland accounting for 2.80% and 2.40%, respectively.

Personal Protective Equipment Import Statistics

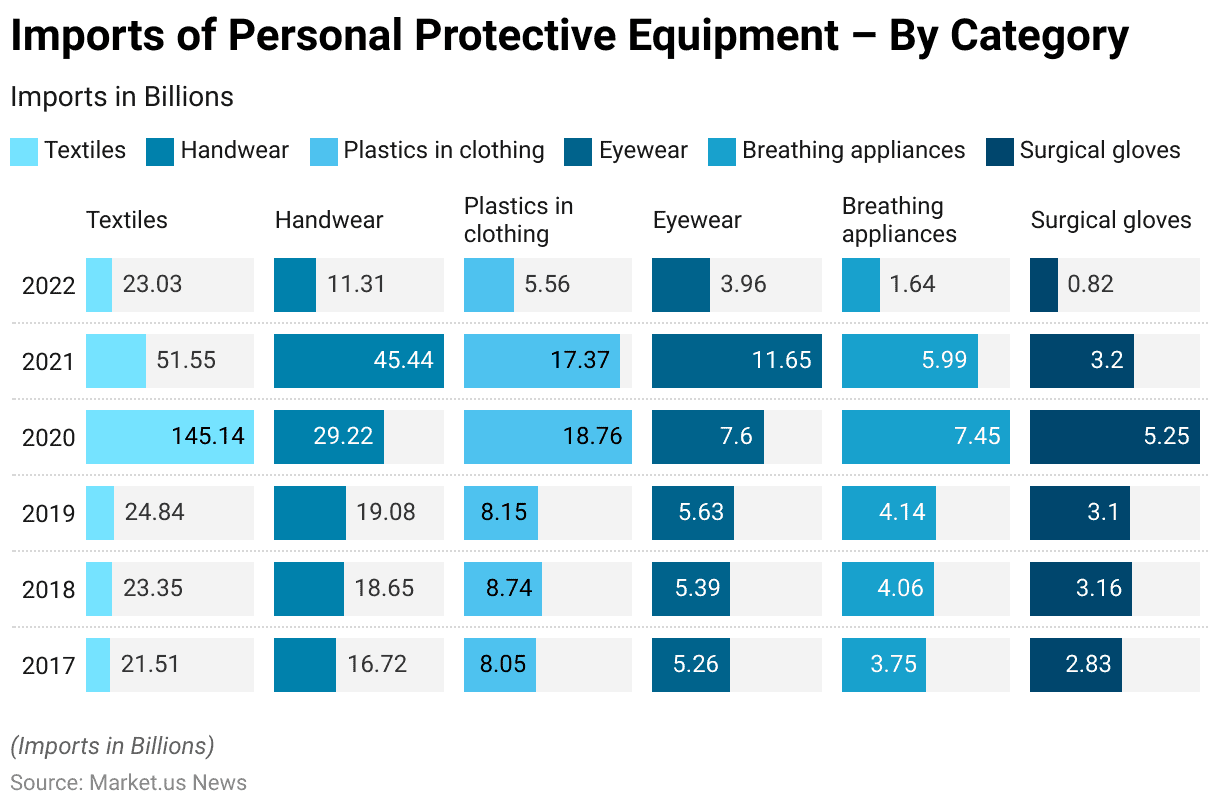

Imports of Personal Protective Equipment – By Category

- The import of personal protective equipment (PPE) across various categories has demonstrated significant fluctuations from 2017 to 2022.

- In 2017, textiles were the leading category with imports valued at USD 21.51 billion, followed by handwear at USD 16.72 billion, plastics in clothing at USD 8.05 billion, eyewear at USD 5.26 billion, breathing appliances at USD 3.75 billion, and surgical gloves at USD 2.83 billion.

- By 2022, import values returned closer to pre-pandemic levels, with textiles at USD 23.03 billion, handwear at USD 11.31 billion, and plastics in clothing at USD 5.56 billion. Eyewear imports were USD 3.96 billion, breathing appliances were USD 1.64 billion, and surgical gloves dropped to USD 0.82 billion.

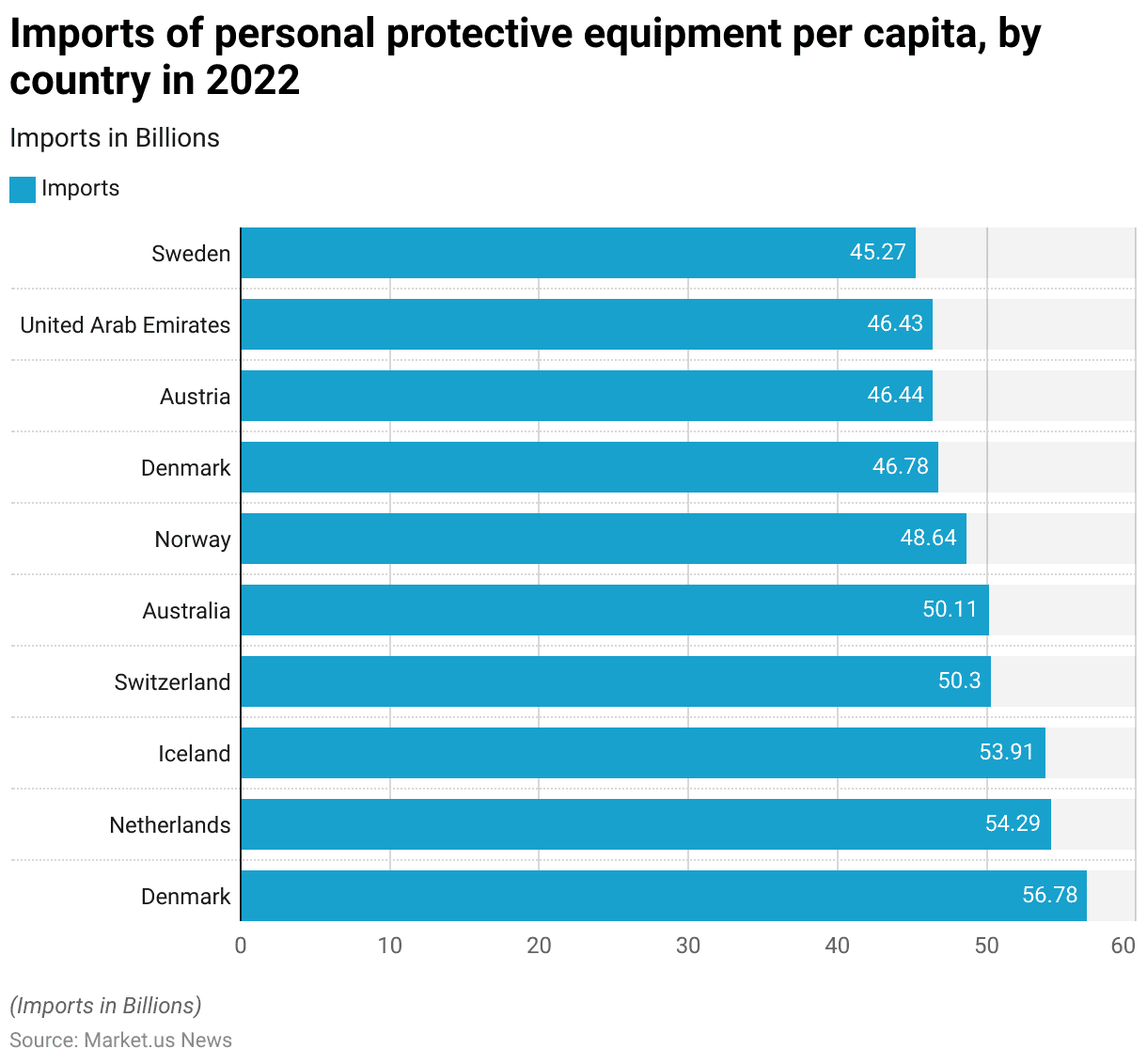

Imports of Personal Protective Equipment Per Capita – By Country

- In 2022, Denmark led the imports of personal protective equipment (PPE) per capita, with a value of USD 56.78.

- The Netherlands followed closely with imports amounting to USD 54.29 per capita.

- Iceland and Switzerland also reported high per capita imports, at USD 53.91 and USD 50.30, respectively.

- Australia imported USD 50.11 worth of PPE per capita, while Norway recorded imports of USD 48.64 per capita.

- Another notable importer was Austria, with per capita imports of USD 46.44, closely matched by the United Arab Emirates at USD 46.43.

- Sweden also featured prominently, with PPE imports per capita reaching USD 45.27.

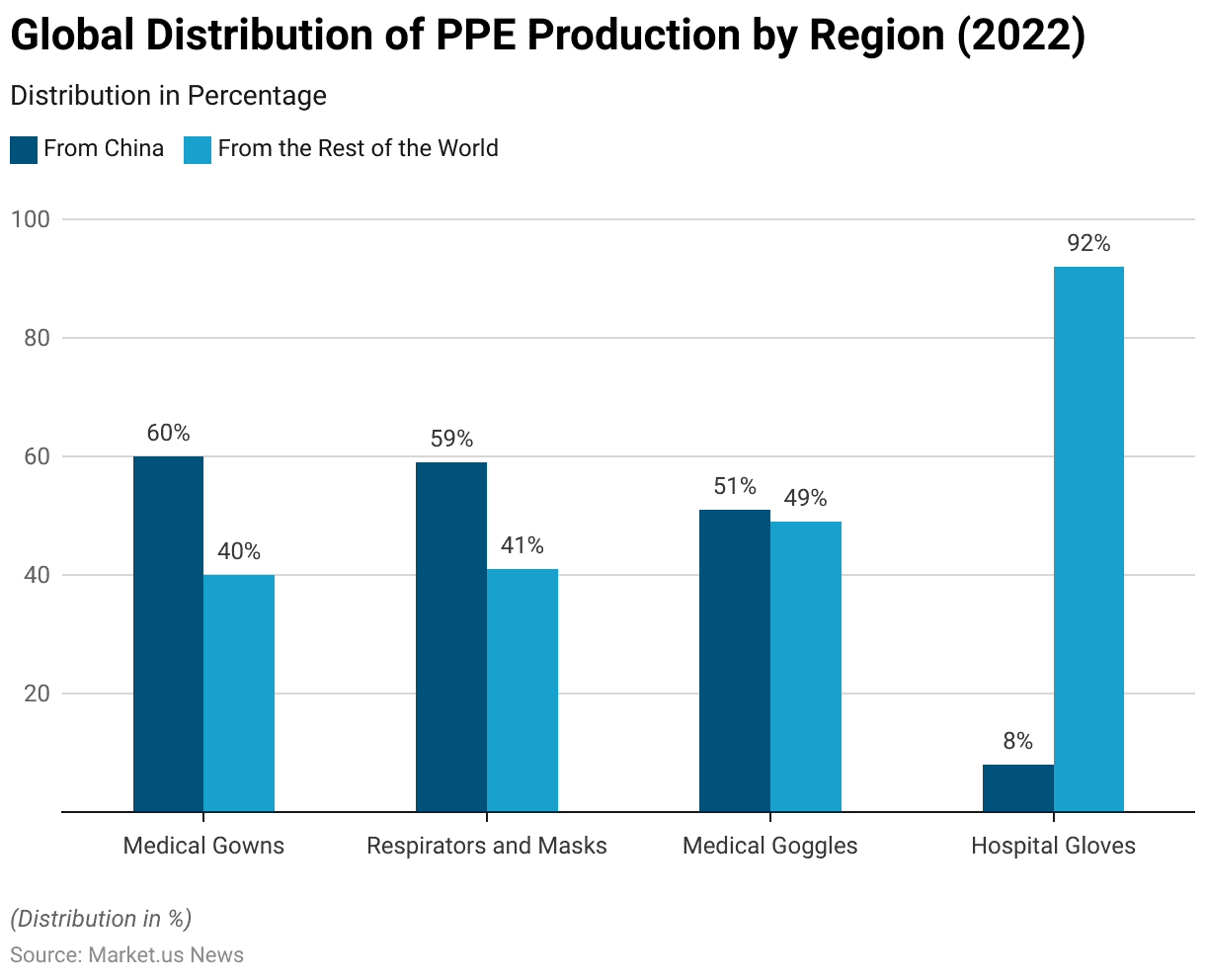

Global Distribution of PPE Production

- The global production of personal protective equipment (PPE) reveals significant regional contributions.

- For medical gowns, 60% are produced in China, while the remaining 40% come from the rest of the world.

- Similarly, 59% of respirators and masks are manufactured in China, with 41% produced elsewhere.

- Medical goggles see a slight shift, with 51% coming from China and 49% from other regions.

- In contrast, hospital gloves are predominantly produced outside China, with only 8% originating from China and a substantial 92% from the rest of the world.

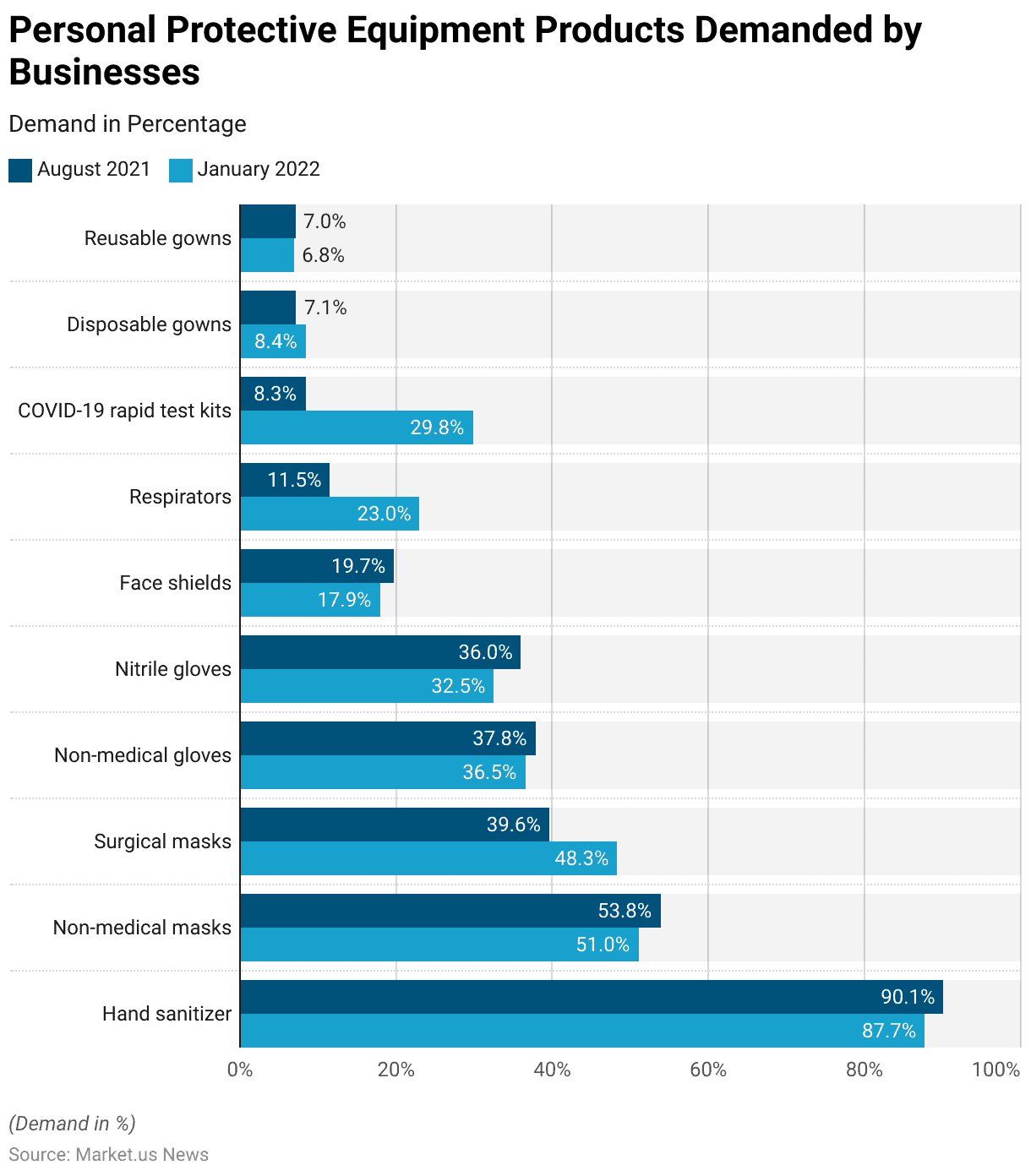

Personal Protective Equipment Products Demanded by Businesses

- In August 2021, the demand for personal protective equipment (PPE) among businesses showed that hand sanitizer was the most sought-after product, with 90.1% of businesses requiring it.

- Non-medical masks followed with 53.8%, while surgical masks were demanded by 39.6% of businesses.

- Non-medical gloves and nitrile gloves were also in demand, at 37.8% and 36.0% respectively.

- Face shields were required by 19.7% of businesses, and respirators by 11.5%.

- COVID-19 rapid test kits had a lower demand at 8.3%, along with disposable gowns at 7.1% and reusable gowns at 7.0%.

- By January 2022, the demand for hand sanitizer slightly decreased to 87.7%. Non-medical masks and non-medical gloves also saw a slight decrease, with 51.0% and 36.5% respectively.

- However, the demand for surgical masks increased to 48.3%, and respirators saw a significant rise to 23.0%. The demand for COVID-19 rapid test kits also surged to 29.8%.

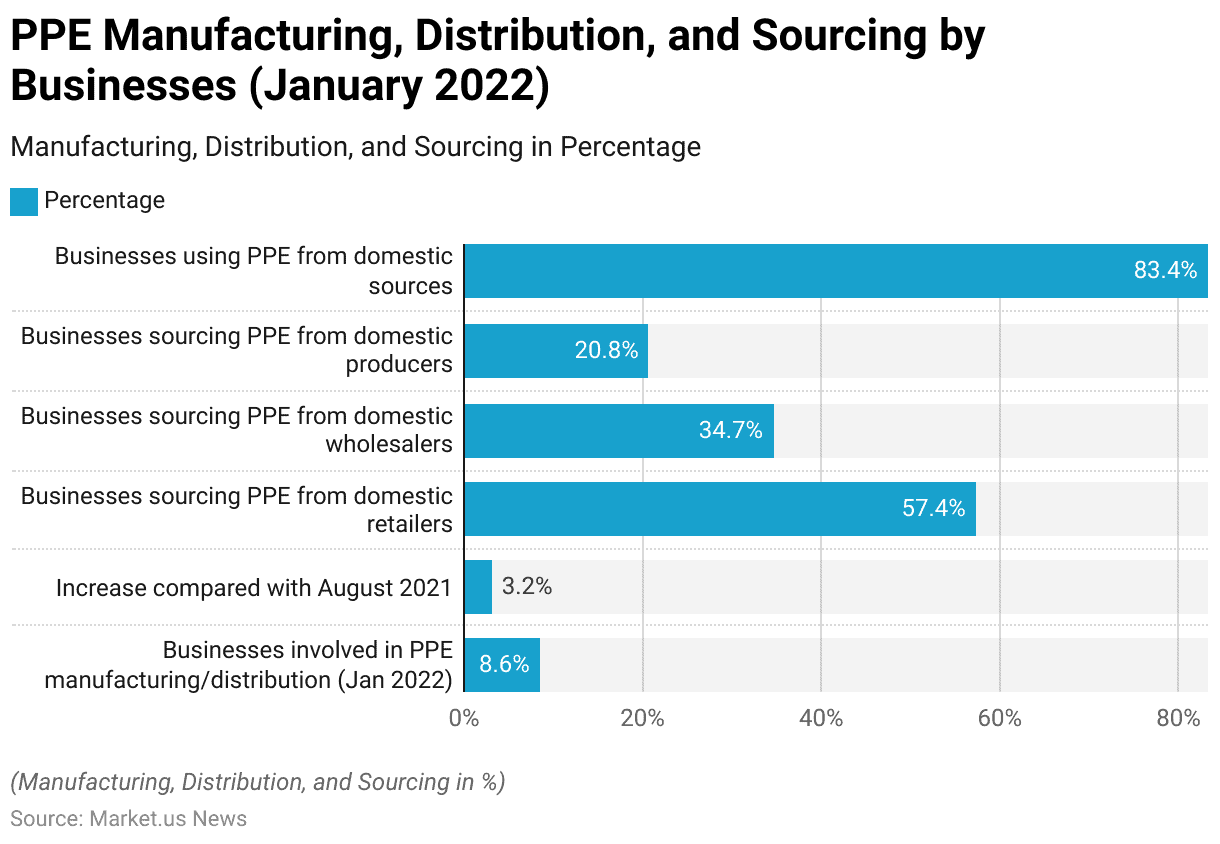

PPE Manufacturing, Distribution, and Sourcing by Businesses

- In January 2022, nearly 1 in 10 (8.6%) businesses in the manufacturing, retail, and wholesale sectors were involved in the manufacturing or distribution of personal protective equipment (PPE), marking a 3.2% point increase compared to August 2021.

- Nearly three-fifths (57.4%) of businesses reported sourcing PPE from domestic retailers, while just over one-third (34.7%) obtained PPE from domestic wholesalers.

- Additionally, 20.8% sourced PPE from domestic producers.

- Collectively, more than four-fifths (83.4%) of businesses indicated they were using PPE from domestic sources, including domestic retailers, wholesalers, and producers.

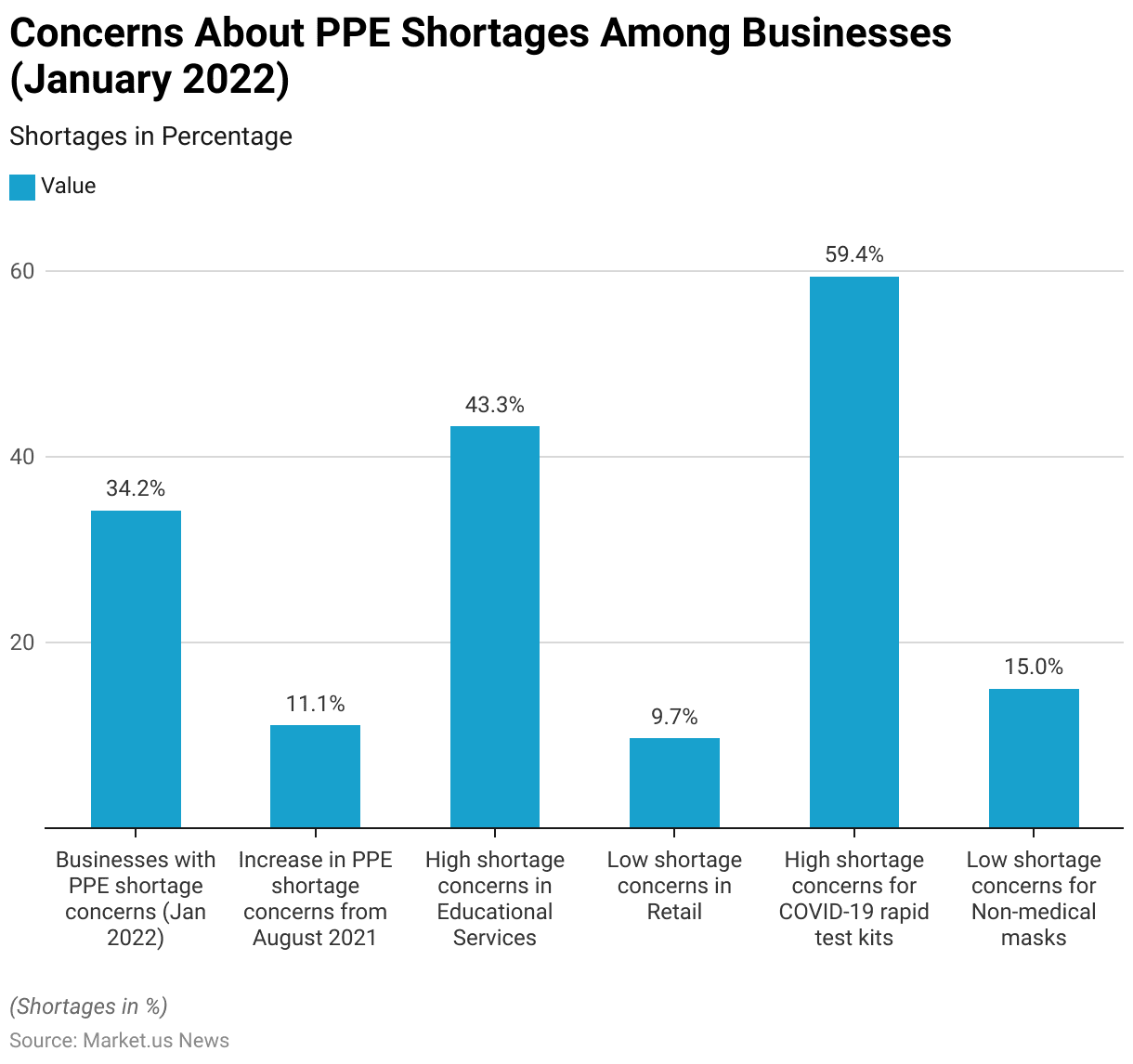

Concerns About PPE Shortages Among Businesses

- In January 2022, over one-third (34.2%) of businesses that required at least one type of personal protective equipment (PPE) to operate by public health guidelines expressed concerns about PPE shortages within the next three months, marking an 11.1% point increase from August 2021.

- Businesses in the educational services sector were the most concerned, with 43.3% reporting shortage concerns for at least one type of required PPE, while the retail sector had the lowest concern at 9.7%.

- The highest expected shortages were for COVID-19 rapid test kits, with 59.4% of businesses expressing concerns, whereas non-medical masks had the lowest reported shortage concerns at 15.0%.

Personal Protective Equipment and COVID-19

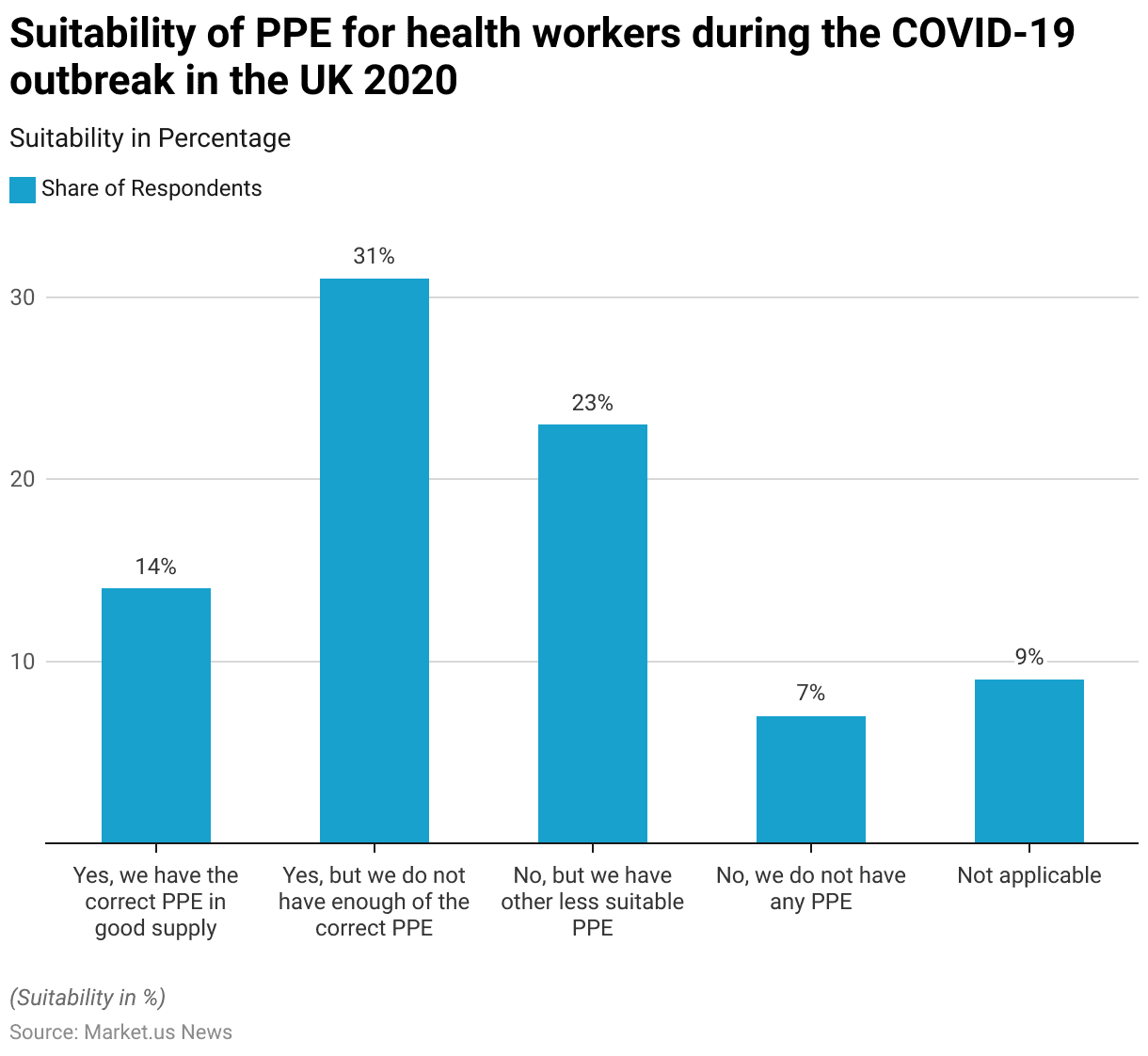

Suitability of PPE for Health Workers During the COVID-19 Outbreak

- During the COVID-19 outbreak in the UK in 2020, the suitability of personal protective equipment (PPE) for health workers was a critical concern.

- A survey revealed that only 14% of respondents confirmed having the correct PPE in good supply at their workplace.

- Meanwhile, 31% reported having the correct PPE but not in sufficient quantities.

- An additional 23% indicated that they had other, less suitable PPE instead of the required types.

- Alarmingly, 7% of respondents stated that they did not have any PPE available.

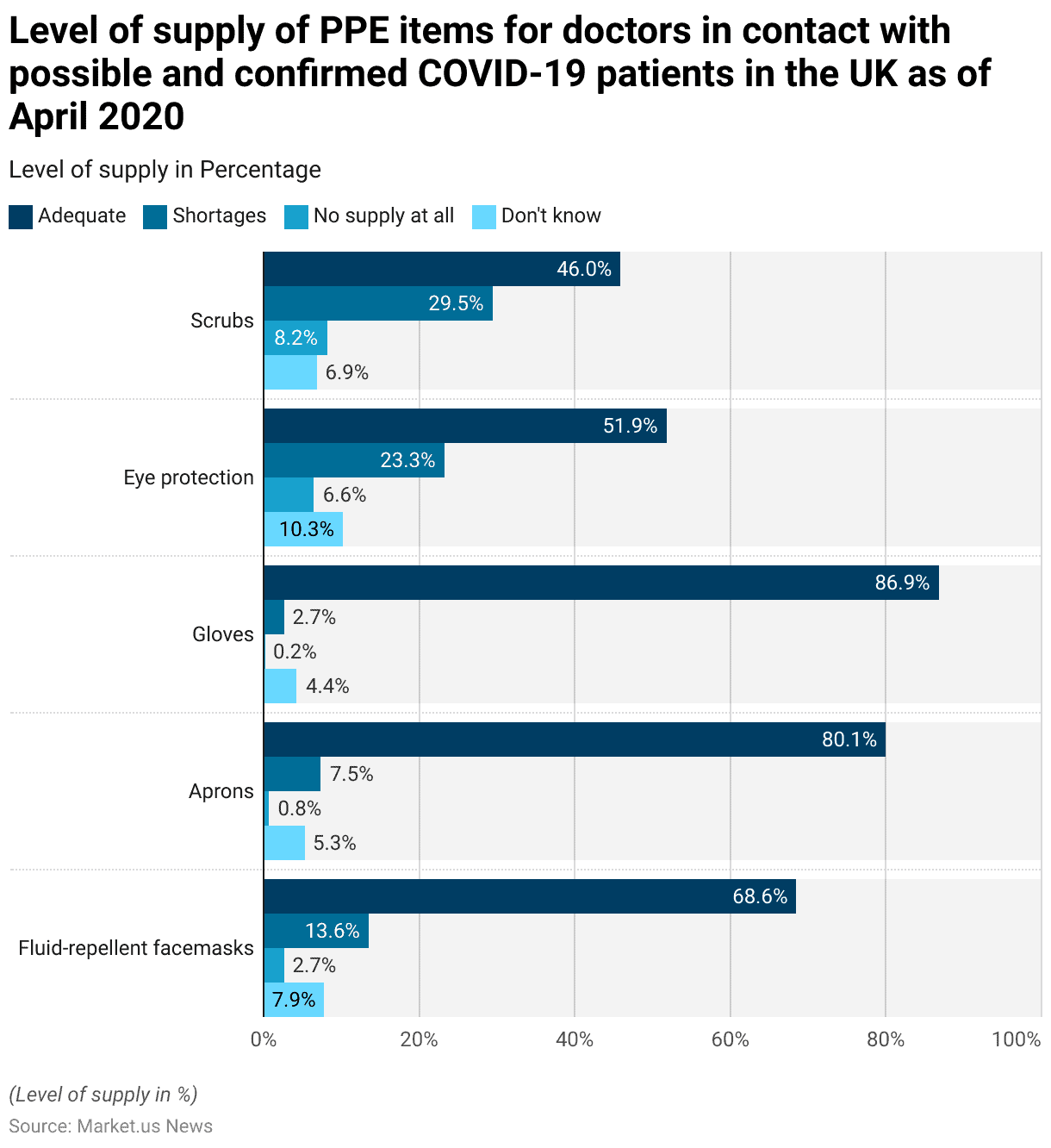

Level of Supply of PPE Items for Doctors in Contact with Possible and Confirmed COVID-19 Patients

- As of April 2020, the level of supply of personal protective equipment (PPE) for doctors in contact with possible and confirmed COVID-19 patients in the UK varied significantly across different items.

- Fluid-repellent facemasks were reported to be adequately supplied by 68.6% of respondents, though 13.6% experienced shortages and 2.7% had no supply at all; 7.9% were unsure of the supply status.

- Aprons had the highest level of adequate supply at 80.1%, with 7.5% reporting shortages and 0.8% indicating no supply, while 5.3% did not know.

- Gloves were adequately supplied for 86.9% of respondents, with minimal shortages at 2.7% and almost no instances of no supply at 0.2%; 4.4% were unsure.

- Eye protection had a lower adequacy, with only 51.9% reporting sufficient supply, 23.3% experiencing shortages, and 6.6% having no supply at all; 10.3% did not know the supply status.

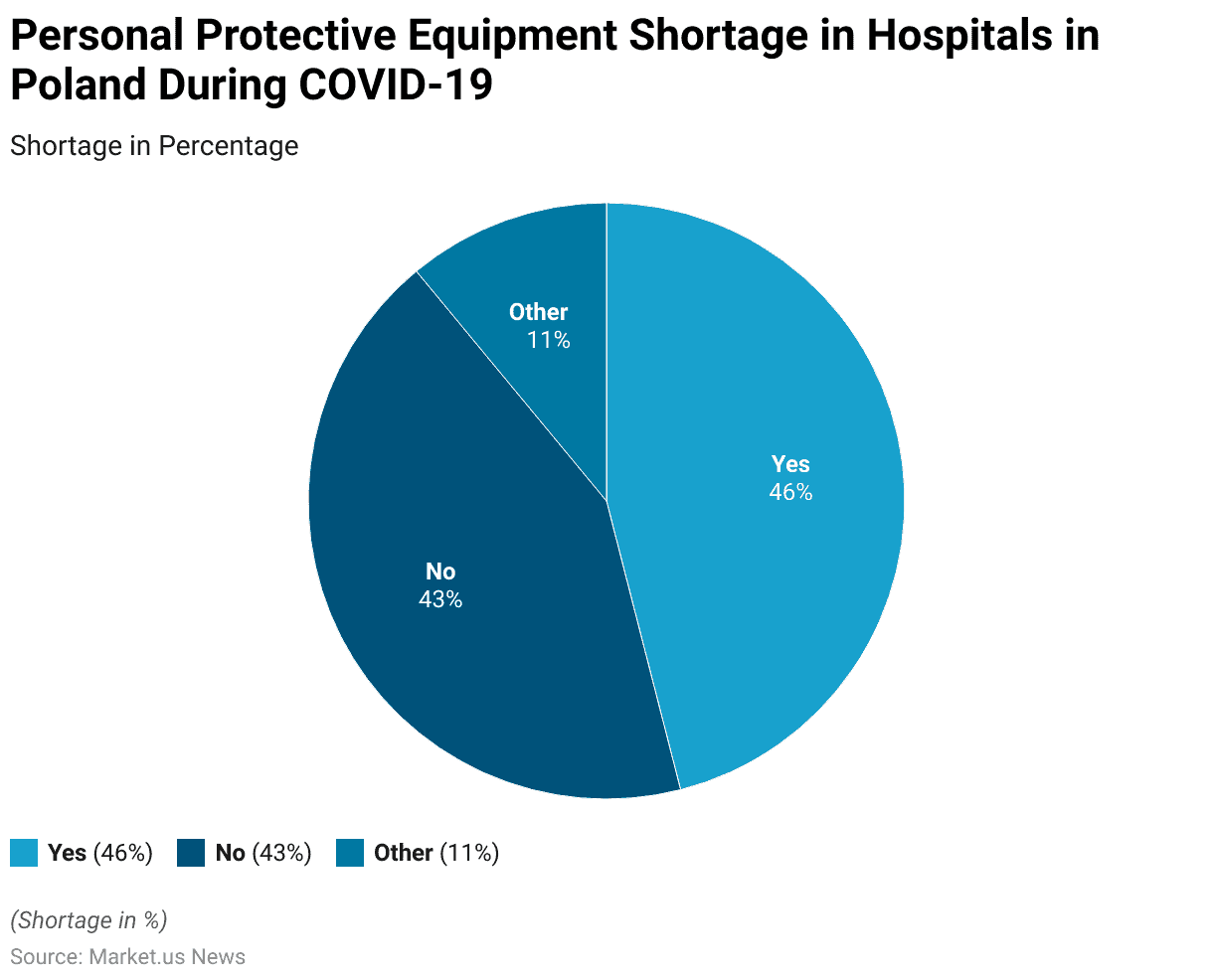

Personal Protective Equipment Shortage in Hospitals During COVID-19

- In 2020, during the COVID-19 pandemic, hospitals in Poland faced significant challenges regarding the availability of personal protective equipment (PPE).

- A survey revealed that 46% of respondents reported a shortage of PPE in their facilities or hospital wards.

- Conversely, 43% of respondents indicated that there was no shortage of PPE.

- An additional 11% provided responses that fell into the “Other” category, indicating varied or unspecified situations regarding PPE availability.

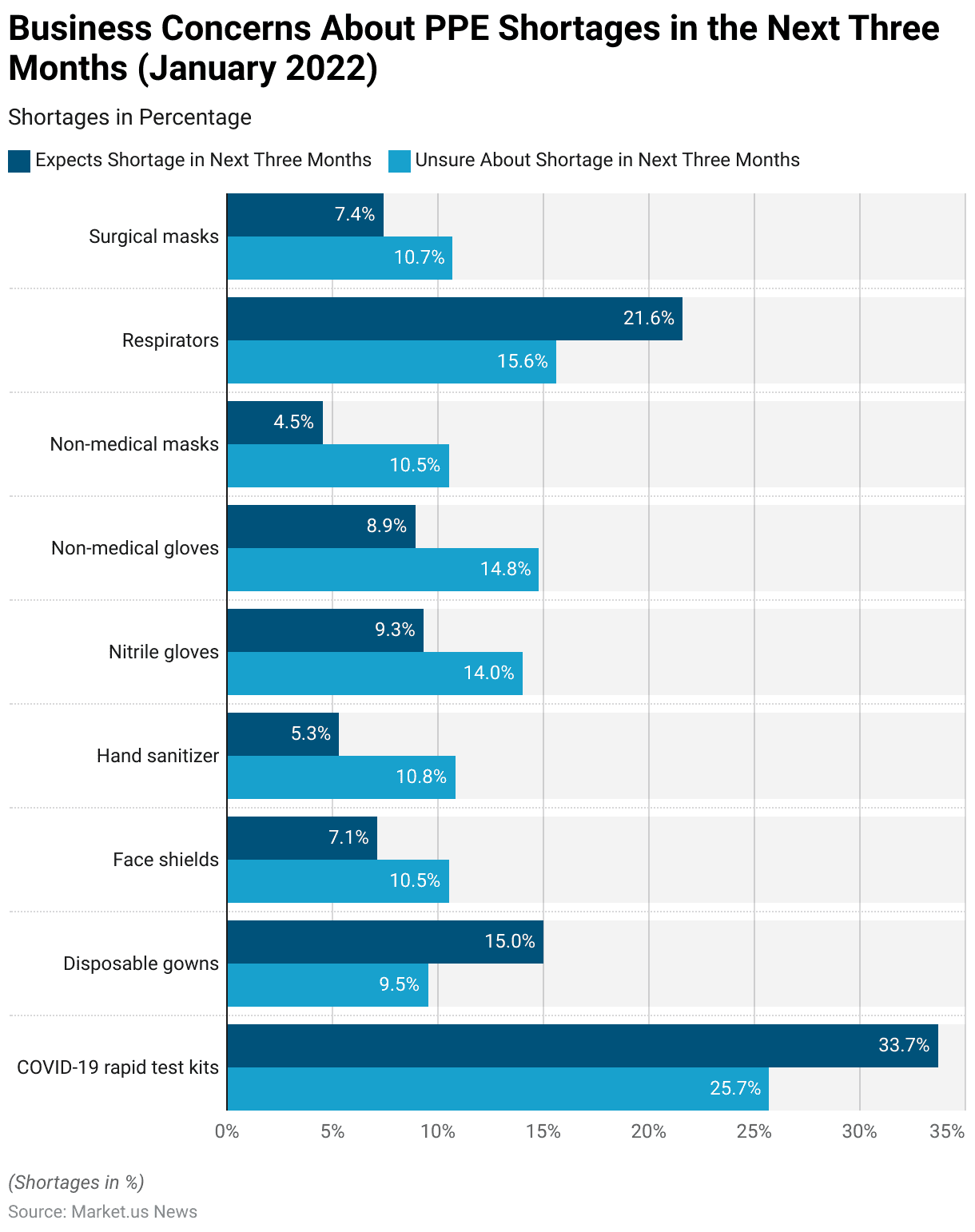

Personal Protective Equipment Shortages

Business Concerns About PPE Shortages

- In January 2022, businesses expressed concerns about potential shortages of personal protective equipment (PPE) over the next three months.

- The highest level of concern was for COVID-19 rapid test kits, with 33.7% of businesses expecting a shortage and 25.7% unsure.

- Disposable gowns were also a concern, with 15.0% anticipating a shortage and 9.5% uncertain.

- For face shields, 7.1% expected shortages, while 10.5% were unsure.

- Hand sanitizer: 5.3% of businesses are expecting a shortage, and 10.8% are uncertain.

- Nitrile gloves and non-medical gloves had similar levels of concern, with 9.3% and 8.9% expecting shortages and 14.0% and 14.8% unsure, respectively.

- Non-medical masks saw 4.5% expecting shortages and 10.5% unsure.

- Respirators were a significant concern, with 21.6% expecting shortages and 15.6% unsure.

Regulations for Personal Protective Equipment

- Regulations for personal protective equipment (PPE) vary by country to ensure safety and compliance in different environments.

- In the European Union, Regulation (EU) 2016/425 sets the standards for the design, manufacture, and marketing of PPE, requiring products to bear the CE marking, which indicates conformity with health and safety requirements.

- In the United States, the Occupational Safety and Health Administration (OSHA) mandates that PPE must meet standards developed by the American National Standards Institute (ANSI) and that employers provide proper training and maintenance for PPE.

- In the UK, the Personal Protective Equipment at Work Regulations 2022 extend the obligation of providing suitable PPE from employees to all workers, including casual and irregular workers.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)