Table of Contents

- Introduction

- Editor’s Choice

- Personal Protective Equipment Market Overview

- Personal Protective Equipment Export Statistics

- Personal Protective Equipment Import Statistics

- Global Distribution of PPE Production

- Personal Protective Equipment Products Demanded by Businesses

- PPE Manufacturing, Distribution, and Sourcing by Businesses

- PPE Demand and Supply Trends Among Businesses

- Concerns About PPE Shortages Among Businesses

- Personal Protective Equipment and COVID-19

- Personal Protective Equipment Shortages

- Regulations for Personal Protective Equipment

- Recent Developments

- Conclusion

- FAQs

Introduction

Personal Protective Equipment Statistics: Personal Protective Equipment (PPE) is essential in various industries, safeguarding workers from occupational hazards. It includes gear like helmets, safety glasses, gloves, and respirators.

Proper selection depends on hazard assessment and regulatory compliance, with factors such as fit, comfort, and durability considered.

Training on usage, maintenance, and recognizing when PPE is needed is crucial. Compliance with regulatory standards, like those set by OSHA, is mandatory.

PPE should complement other hazard control measures, and regular assessments ensure effectiveness. Overall, understanding PPE basics is vital for workplace safety and regulatory adherence.

Editor’s Choice

- The global Personal Protective Equipment (PPE) market revenue is projected to reach USD 147.1 billion by 2033.

- Hand protection products consistently held the largest share in the U.S., starting at 25% in 2016, experiencing slight fluctuations, and reaching 24.08% by 2026.

- In 2019, the global market for personal protective products was dominated by several key exporters. China led the market with a substantial 17.20% share of world exports.

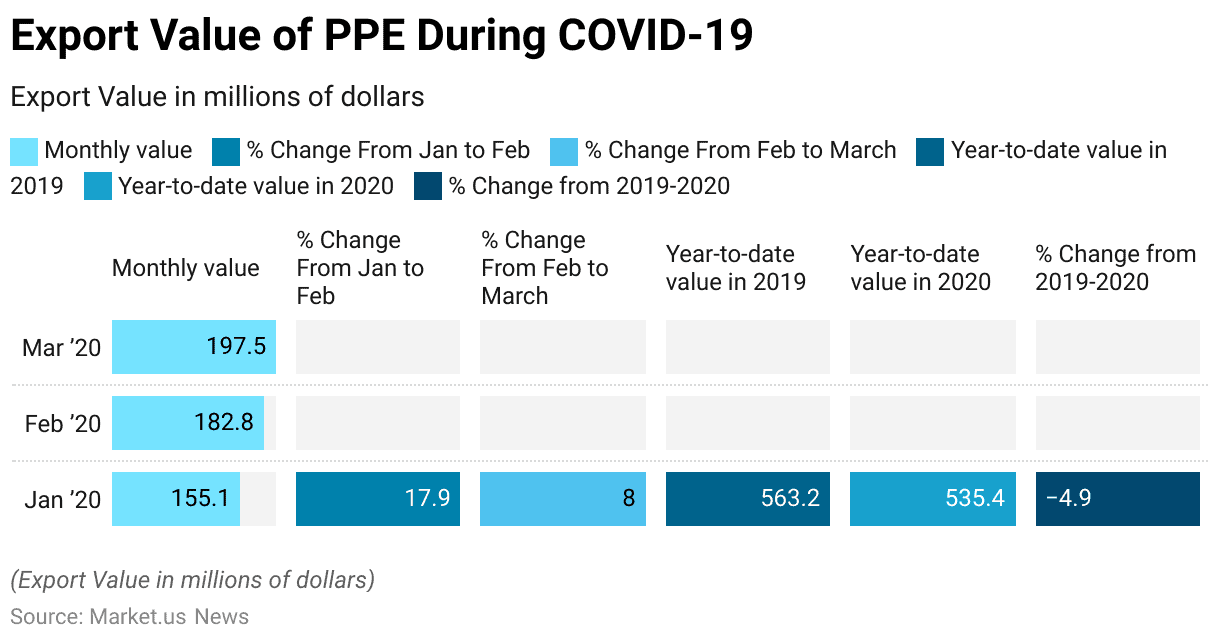

- In January 2020, the monthly export value was USD 155.1 million, experiencing a 17.9% increase by February to USD 182.8 million.

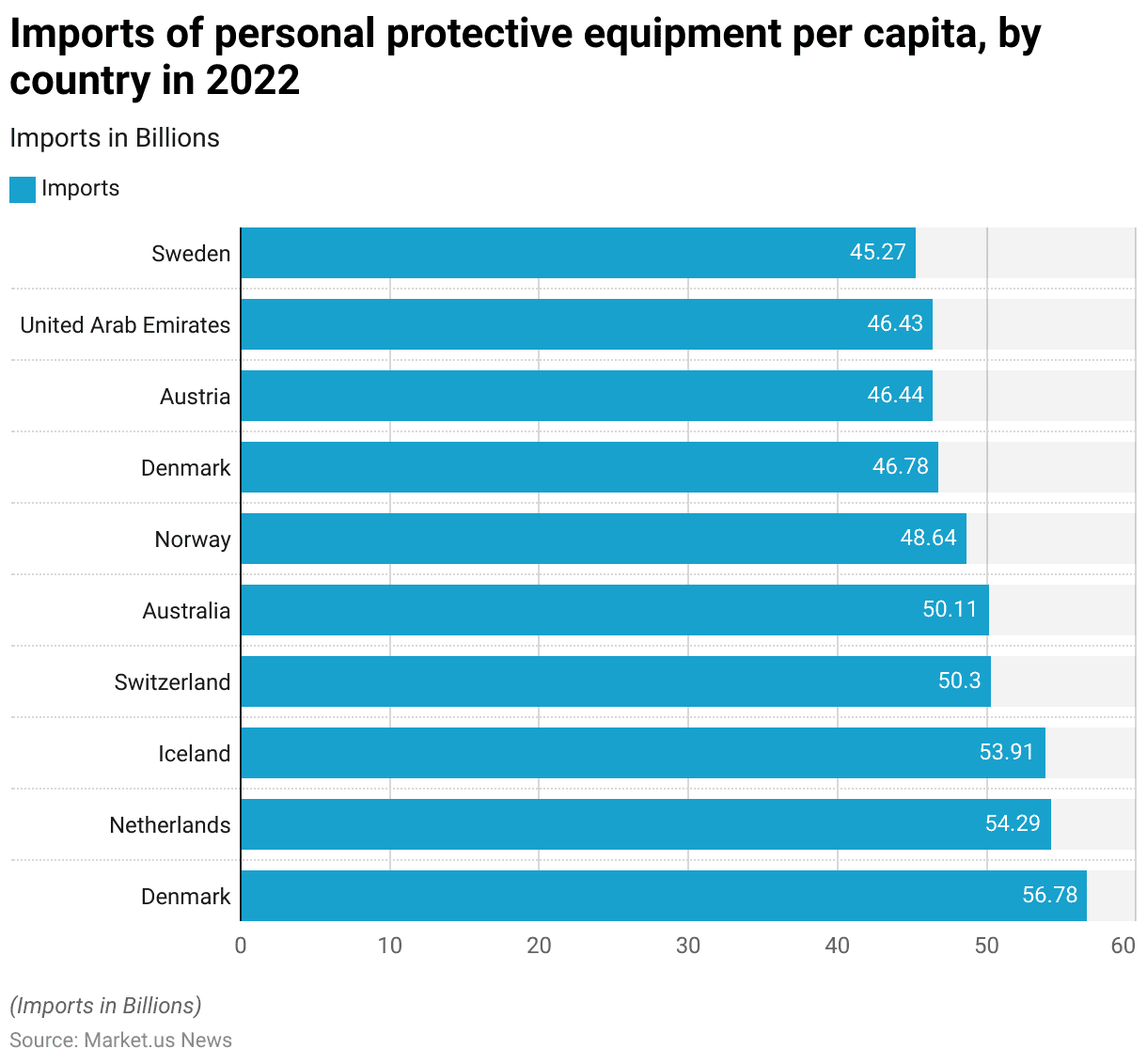

- In 2022, Denmark led the imports of personal protective equipment (PPE) per capita, with a value of USD 56.78.

- In August 2021, the demand for personal protective equipment (PPE) among businesses showed that hand sanitizer was the most sought-after product, with 90.1% of businesses requiring it.

- In January 2022, nearly 1 in 10 (8.6%) businesses in the manufacturing, retail, and wholesale sectors were involved in the manufacturing or distribution of personal protective equipment (PPE), marking a 3.2 percentage point increase compared to August 2021.

Personal Protective Equipment Market Overview

Global Personal Protective Equipment Market Size Statistics

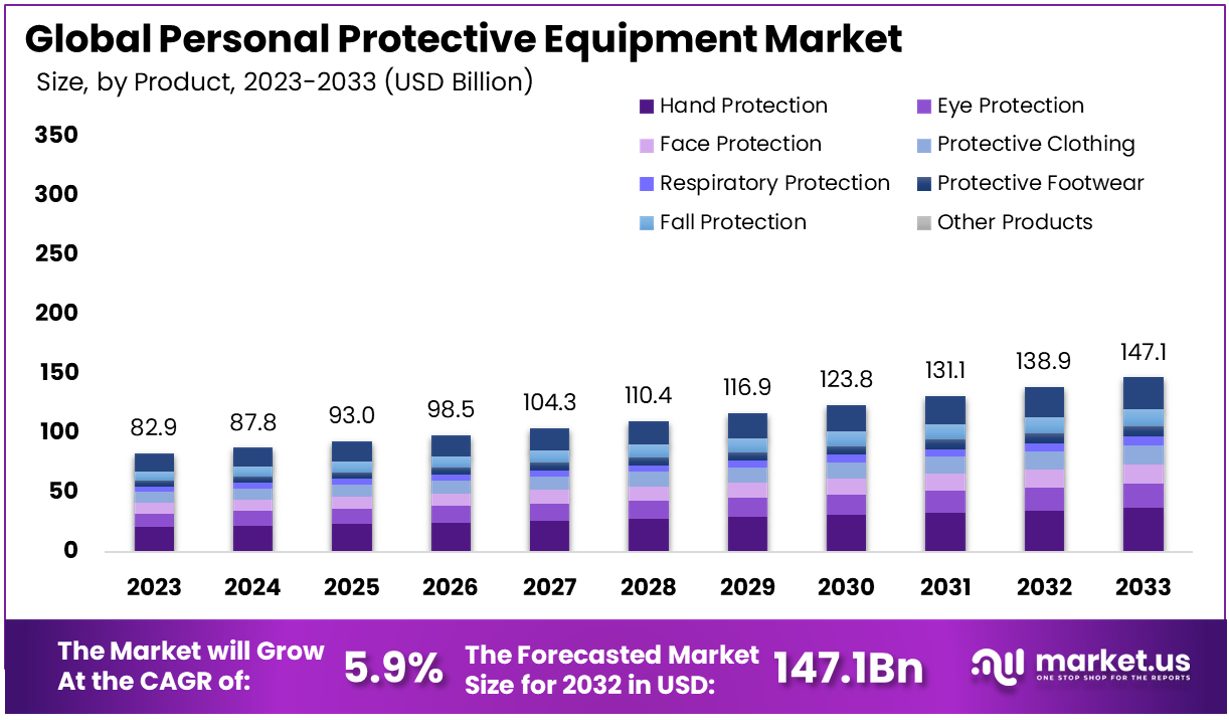

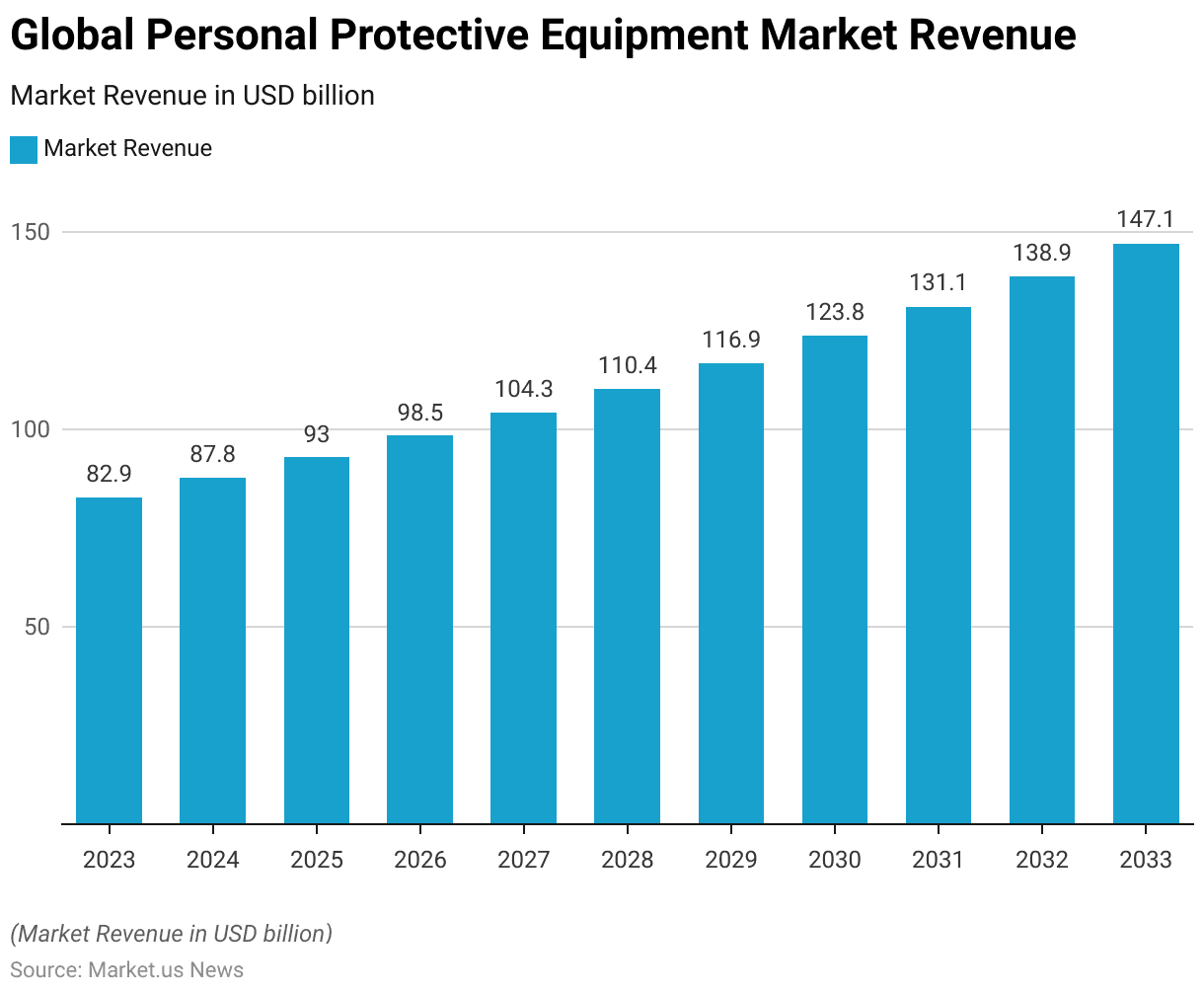

- The global Personal Protective Equipment (PPE) market has shown consistent growth from 2023 to 2033 at a CAGR of 5.9%.

- In 2023, the market revenue was USD 82.9 billion, and it is projected to increase to USD 87.8 billion in 2024.

- This upward trend continues, with the market expected to reach USD 93.0 billion in 2025 and USD 98.5 billion in 2026.

- By 2027, the market is anticipated to grow to USD 104.3 billion, further increasing to USD 110.4 billion in 2028.

- The revenue is forecasted to rise to USD 116.9 billion in 2029, USD 123.8 billion in 2030, and USD 131.1 billion in 2031.

- The growth trajectory continues, with the market projected to achieve USD 138.9 billion in 2032 and reach USD 147.1 billion by 2033.

- This consistent growth reflects the increasing demand and investment in PPE globally.

(Source: market.us)

Global Personal Protective Equipment Market Share – By Product Category Statistics

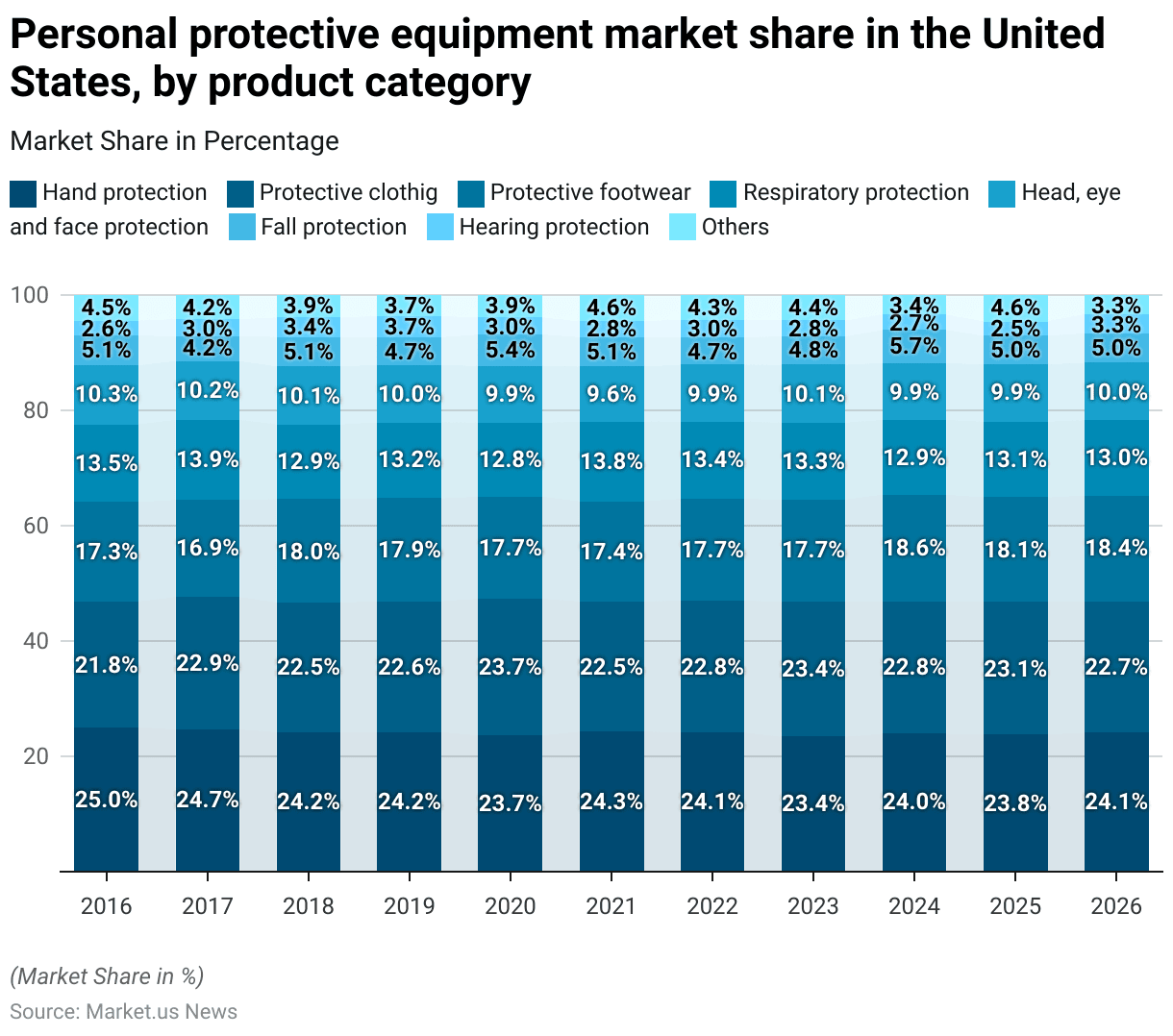

- The market shares of personal protective equipment (PPE) in the United States by product category have shown various trends from 2016 to 2026.

- Hand protection consistently held the largest share, starting at 25% in 2016, experiencing slight fluctuations, and reaching 24.08% by 2026.

- Protective clothing followed closely, beginning at 21.79% in 2016, peaking at 23.65% in 2020, and stabilizing around 22.74% in 2026.

- Protective footwear maintained a significant share, starting at 17.31% in 2016 and slightly increasing to 18.39% in 2026.

- Respiratory protection saw variations, starting at 13.46% in 2016, peaking at 13.86% in 2017, and reaching 13.04% in 2026.

- The share of head, eye, and face protection slightly decreased from 10.26% in 2016 to 10.03% in 2026.

- Fall protection remained relatively stable, starting at 5.13% in 2016, with minor fluctuations, and reaching 5.02% in 2026.

- Hearing protection showed variability, starting at 2.56% in 2016, peaking at 3.37% in 2018, and ending at 3.34% in 2026.

- The ‘Others’ category also showed fluctuations, starting at 4.49% in 2016 and varying through the years to 3.34% in 2026.

- These trends highlight the dynamic nature of the PPE market in the United States, which is influenced by changes in demand and regulatory requirements.

(Source: market.us)

Personal Protective Equipment Export Statistics

Share of The Leading Exporters of Personal Protective Products Worldwide

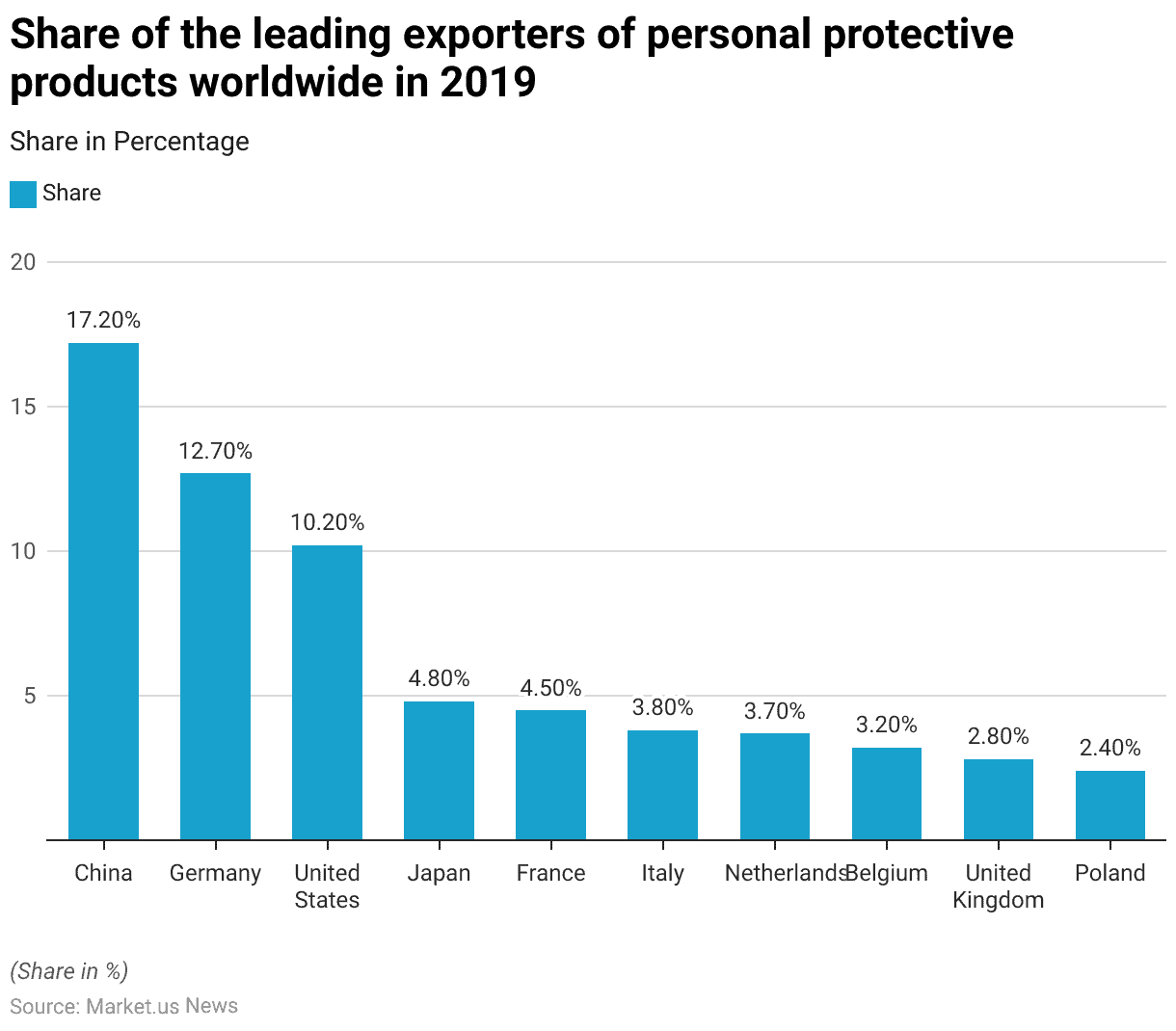

- In 2019, the global market for personal protective products was dominated by several key exporters. China led the market with a substantial 17.20% share of world exports.

- Germany followed, accounting for 12.70% of exports, while the United States held a 10.20% share.

- Japan and France contributed 4.80% and 4.50%, respectively.

- Italy exported 3.80% of the world’s protective products, closely followed by the Netherlands at 3.70%.

- Belgium held a 3.20% share, with the United Kingdom and Poland accounting for 2.80% and 2.40%, respectively.

- This distribution highlights the significant role of these countries in supplying personal protective equipment globally.

(Source: Statista)

Export of Personal Protective Equipment During COVID-19 Statistics

- In 2020, the export of personal protective equipment showed significant monthly changes.

- In January 2020, the monthly export value was USD 155.1 million, experiencing a 17.9% increase by February to USD 182.8 million.

- The upward trend continued into March, with the export value rising by 8% to USD 197.5 million.

- When comparing year-to-date values, the total export value in 2019 was USD 563.2 million, while in 2020, it was slightly lower at USD 535.4 million, representing a 4.9% decrease.

- These figures highlight the dynamic nature of the personal protective equipment export market during this period.

(Source: Statistics Canada)

Personal Protective Equipment Import Statistics

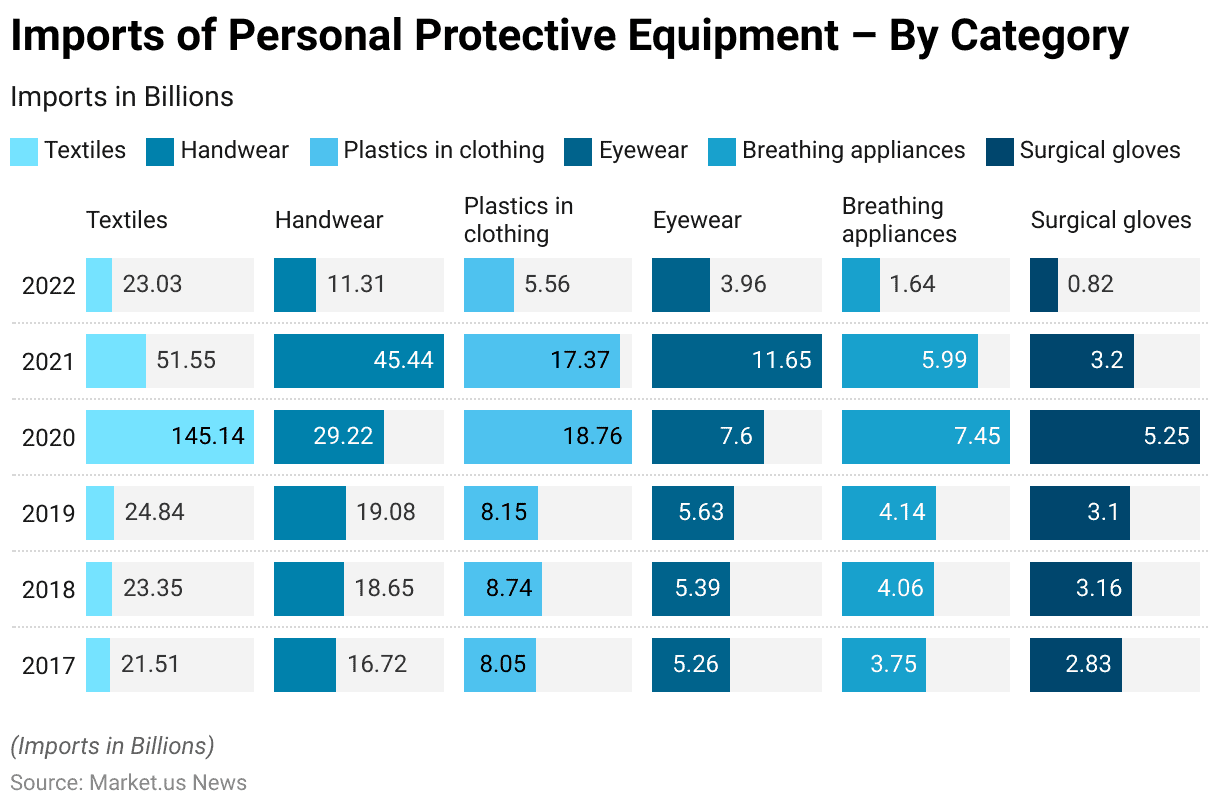

Imports of Personal Protective Equipment – By Category Statistics

- The import of personal protective equipment (PPE) across various categories has demonstrated significant fluctuations from 2017 to 2022.

- In 2017, textiles were the leading category with imports valued at USD 21.51 billion, followed by handwear at USD 16.72 billion, plastics in clothing at USD 8.05 billion, eyewear at USD 5.26 billion, breathing appliances at USD 3.75 billion, and surgical gloves at USD 2.83 billion.

- The following year saw an increase across most categories, with textiles reaching USD 23.35 billion and handwear at USD 18.65 billion. By 2019, imports of textiles rose to USD 24.84 billion, while handwear slightly increased to USD 19.08 billion.

- The year 2020 marked a dramatic surge in PPE imports due to the COVID-19 pandemic, with textiles skyrocketing to USD 145.14 billion, handwear to USD 29.22 billion, and plastics in clothing to USD 18.76 billion. Eyewear and breathing appliances also saw significant increases, reaching USD 7.6 billion and USD 7.45 billion, respectively, with surgical gloves rising to USD 5.25 billion.

- In 2021, the import values adjusted, with textiles dropping to USD 51.55 billion and handwear rising sharply to USD 45.44 billion. Plastics in clothing remained relatively stable at USD 17.37 billion, while eyewear imports increased to USD 11.65 billion. Breathing appliances saw a slight decrease to USD 5.99 billion, and surgical gloves remained stable at USD 3.2 billion.

- By 2022, import values returned closer to pre-pandemic levels, with textiles at USD 23.03 billion, handwear at USD 11.31 billion, and plastics in clothing at USD 5.56 billion. Eyewear imports were USD 3.96 billion, breathing appliances were USD 1.64 billion, and surgical gloves dropped to USD 0.82 billion.

- This data highlights the significant impact of the pandemic on PPE imports and the subsequent stabilization in the following years.

(Source: Our World in Data)

Imports of Personal Protective Equipment Per Capita – By Country Statistics

- In 2022, Denmark led the imports of personal protective equipment (PPE) per capita, with a value of USD 56.78.

- The Netherlands followed closely with imports amounting to USD 54.29 per capita.

- Iceland and Switzerland also reported high per capita imports, at USD 53.91 and USD 50.30, respectively.

- Australia imported USD 50.11 worth of PPE per capita, while Norway recorded imports of USD 48.64 per capita.

- Another notable importer was Austria, with per capita imports of USD 46.44, closely matched by the United Arab Emirates at USD 46.43.

- Sweden also featured prominently, with PPE imports per capita reaching USD 45.27.

- This data underscores the significant investments made by these countries in PPE to ensure public health and safety.

(Source: Our World in Data)

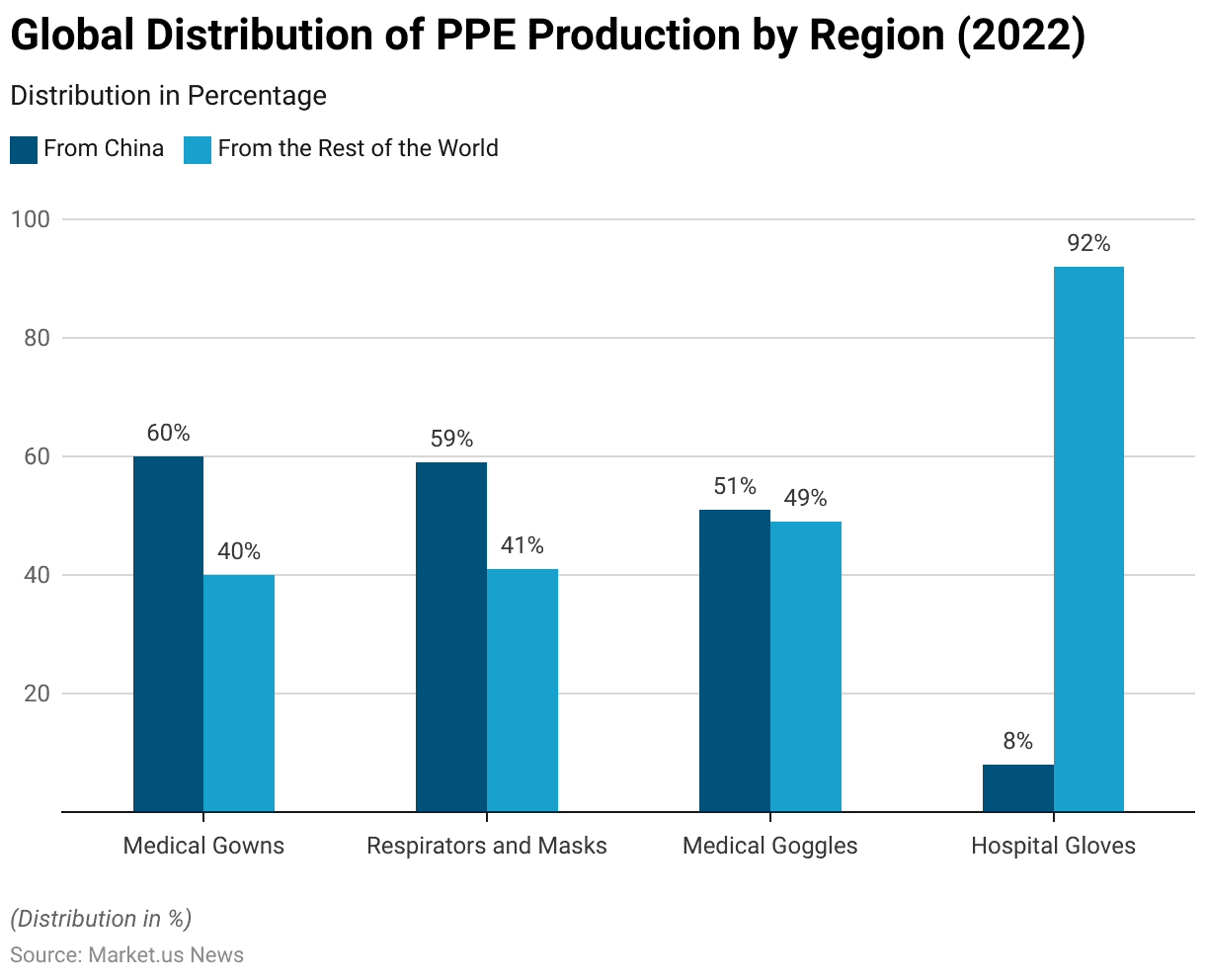

Global Distribution of PPE Production

- The global production of personal protective equipment (PPE) reveals significant regional contributions.

- For medical gowns, 60% are produced in China, while the remaining 40% come from the rest of the world.

- Similarly, 59% of respirators and masks are manufactured in China, with 41% produced elsewhere.

- Medical goggles see a slight shift, with 51% coming from China and 49% from other regions.

- In contrast, hospital gloves are predominantly produced outside China, with only 8% originating from China and a substantial 92% from the rest of the world.

- This distribution highlights China’s dominant role in certain PPE categories, while other regions contribute significantly to others.

(Source: Trade Risk Guaranty Brokerage Services LLC)

Personal Protective Equipment Products Demanded by Businesses

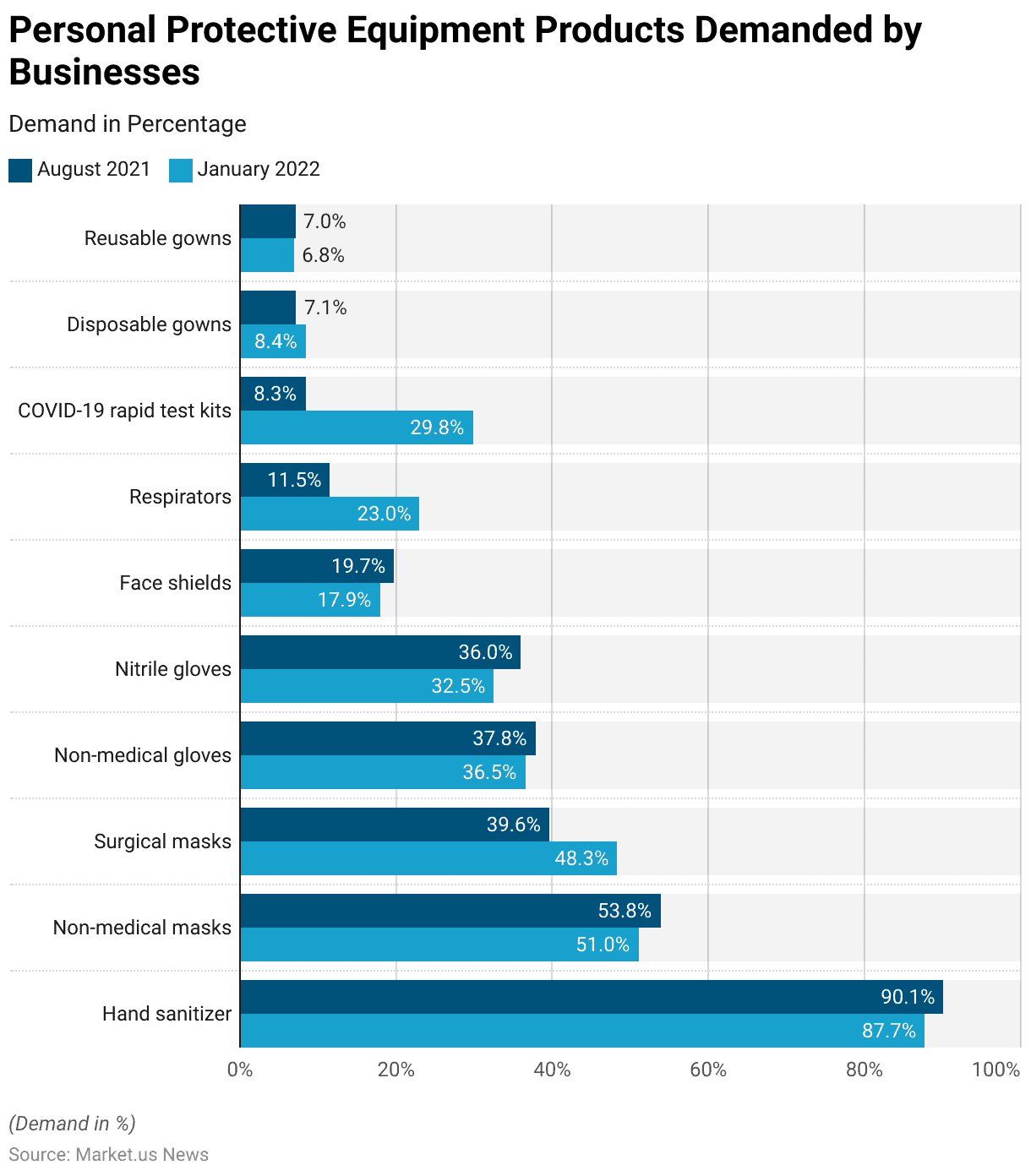

- In August 2021, the demand for personal protective equipment (PPE) among businesses showed that hand sanitizer was the most sought-after product, with 90.1% of businesses requiring it.

- Non-medical masks followed with 53.8%, while surgical masks were demanded by 39.6% of businesses.

- Non-medical gloves and nitrile gloves were also in demand, at 37.8% and 36.0% respectively.

- Face shields were required by 19.7% of businesses, and respirators by 11.5%.

- COVID-19 rapid test kits had a lower demand at 8.3%, along with disposable gowns at 7.1% and reusable gowns at 7.0%.

- By January 2022, the demand for hand sanitizer slightly decreased to 87.7%. Non-medical masks and non-medical gloves also saw a slight decrease, with 51.0% and 36.5% respectively.

- However, the demand for surgical masks increased to 48.3%, and respirators saw a significant rise to 23.0%. The demand for COVID-19 rapid test kits also surged to 29.8%.

- Meanwhile, nitrile gloves, face shields, disposable gowns, and reusable gowns saw slight decreases in demand at 32.5%, 17.9%, 8.4%, and 6.8%, respectively.

- These changes reflect shifting priorities and needs in PPE among businesses over this period.

(Source: Statistics Canada)

PPE Manufacturing, Distribution, and Sourcing by Businesses

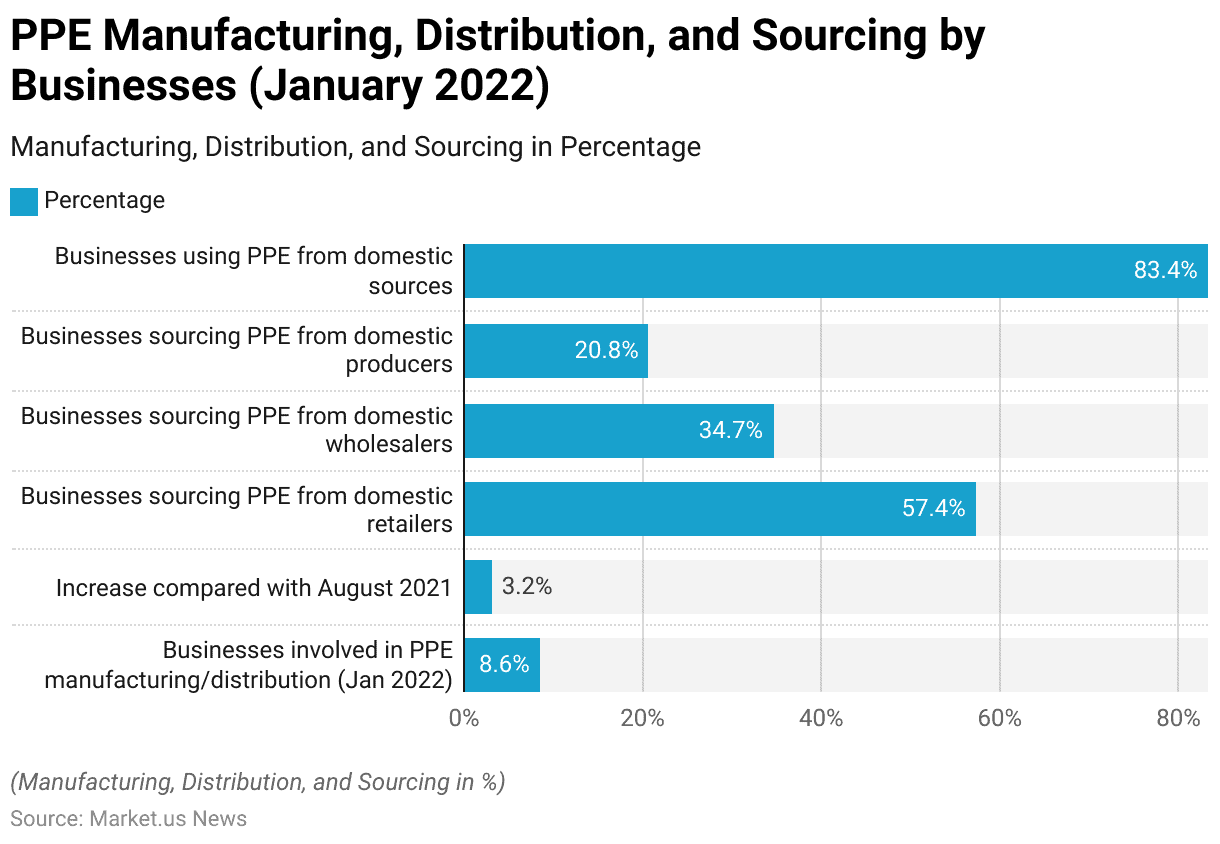

- In January 2022, nearly 1 in 10 (8.6%) businesses in the manufacturing, retail, and wholesale sectors were involved in the manufacturing or distribution of personal protective equipment (PPE), marking a 3.2 percentage point increase compared to August 2021.

- Nearly three-fifths (57.4%) of businesses reported sourcing PPE from domestic retailers, while just over one-third (34.7%) obtained PPE from domestic wholesalers.

- Additionally, 20.8% sourced PPE from domestic producers.

- Collectively, more than four-fifths (83.4%) of businesses indicated they were using PPE from domestic sources. Including domestic retailers, wholesalers, and producers.

(Source: Statistics Canada)

PPE Demand and Supply Trends Among Businesses

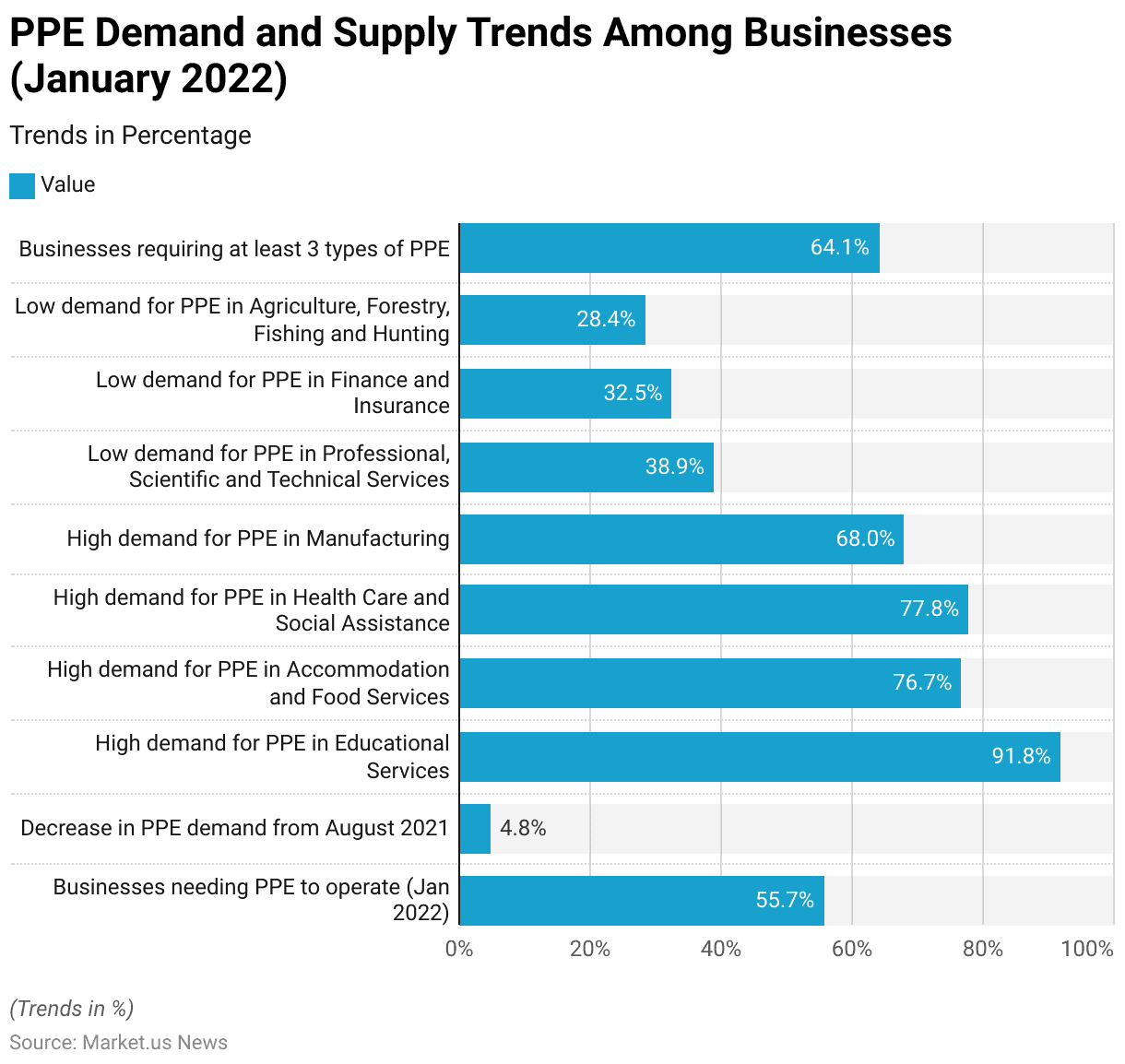

- In January 2022, over half (55.7%) of the businesses responding to the Personal Protective Equipment Survey reported needing or expecting to need PPE to operate by COVID-19-related public health guidance, marking a 4.8% decrease in demand from August 2021.

- The highest demand for PPE was observed in the educational services sector (91.8%), followed by health care and social assistance (77.8%), accommodation and food services (76.7%), and manufacturing (68.0%).

- In contrast, the lowest demand was seen in the professional, scientific, and technical services sectors (38.9%), finance and insurance (32.5%), and agriculture, forestry, fishing, and hunting (28.4%).

- Nearly two-thirds (64.1%) of the businesses that required PPE to operate safely needed at least three of the ten types of PPE covered in the survey.

- While the distribution of most PPE items demanded by businesses remained stable from August 2021. There was an increase in demand for surgical masks, respirators, and COVID-19 rapid test kits in January 2022.

(Source: Statistics Canada)

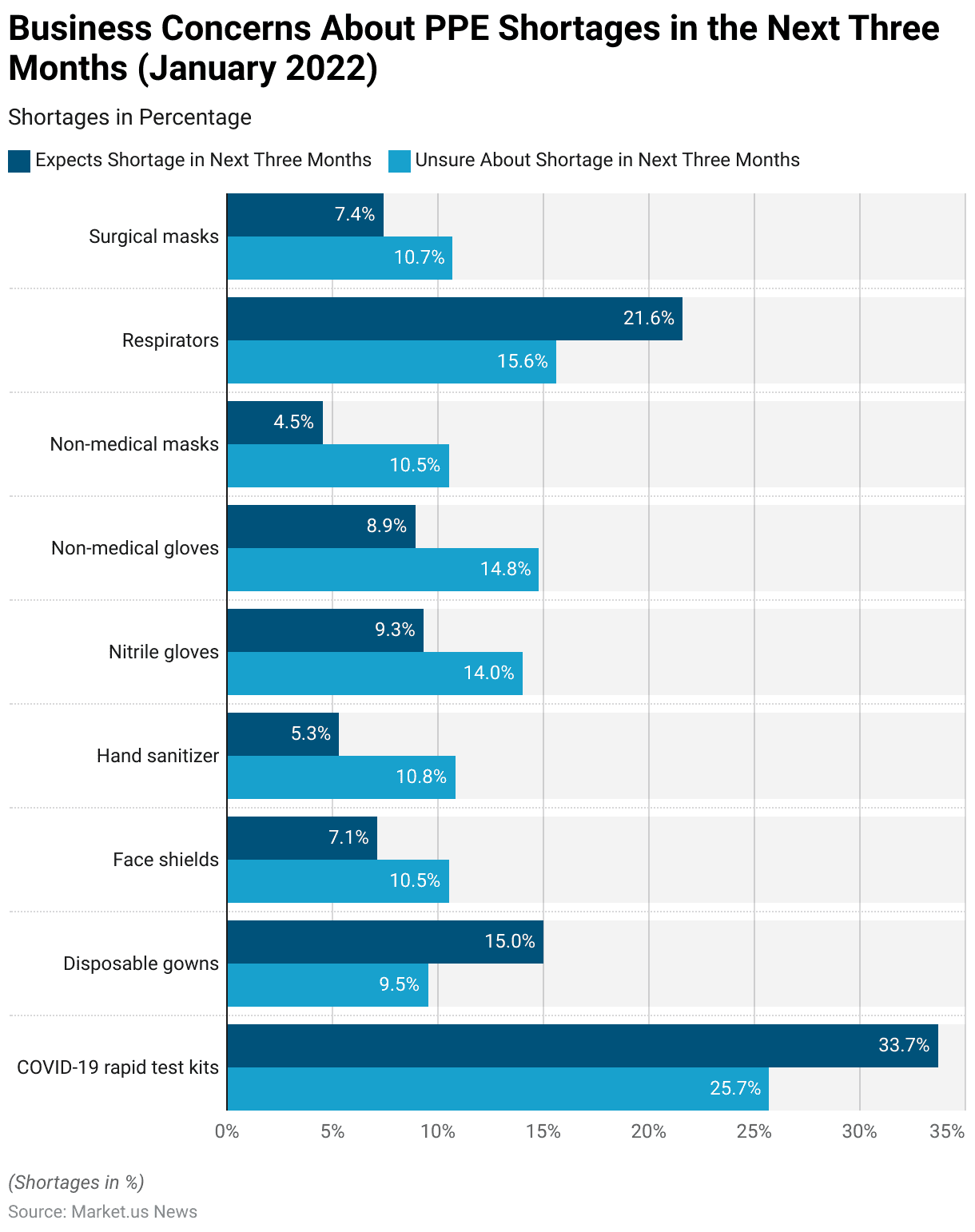

Concerns About PPE Shortages Among Businesses

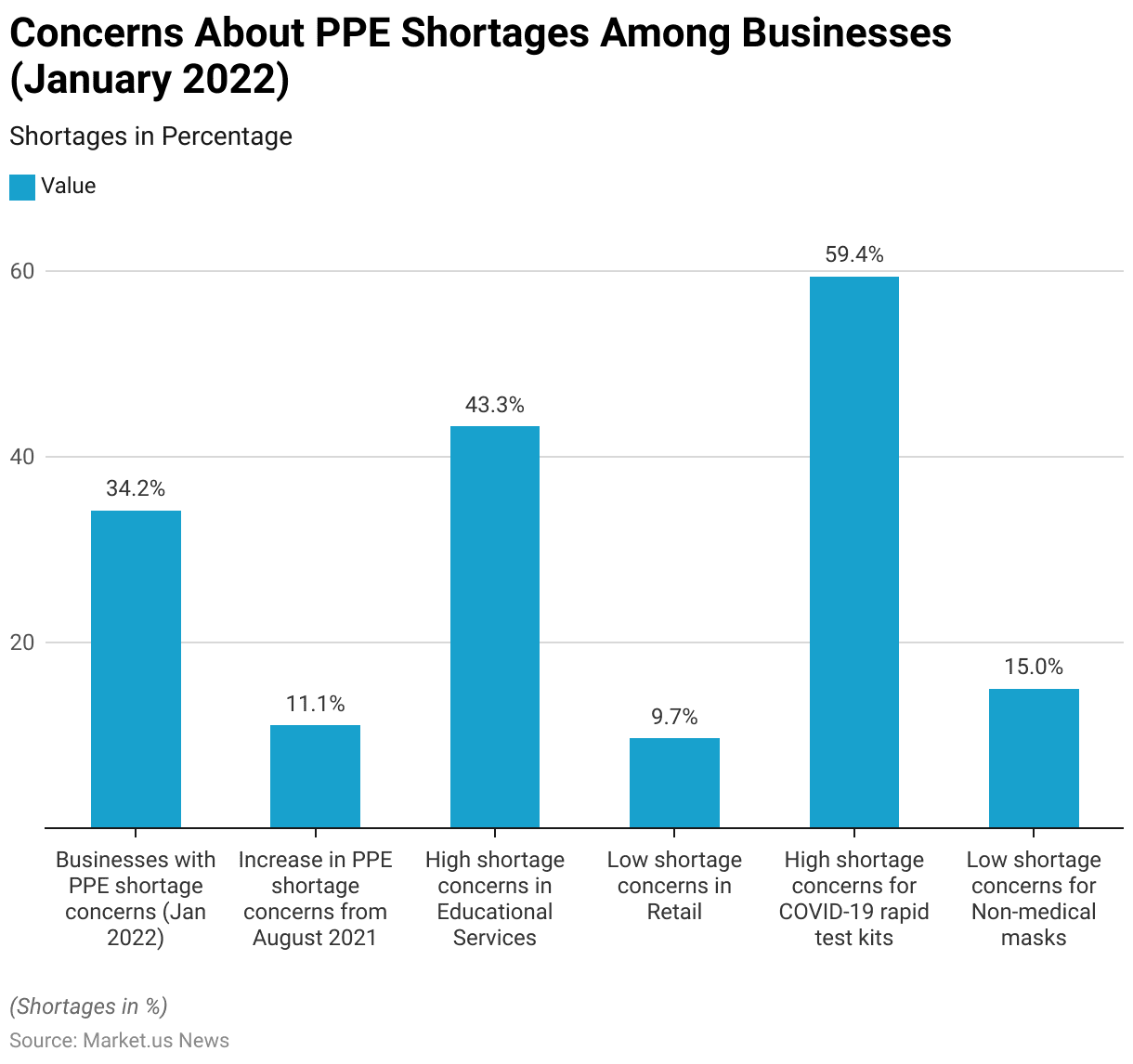

- In January 2022, over one-third (34.2%) of businesses that required at least one type of personal protective equipment (PPE) to operate by public health guidelines expressed concerns about PPE shortages within the next three months, marking an 11.1 percentage point increase from August 2021.

- Businesses in the educational services sector were the most concerned, with 43.3% reporting shortage concerns for at least one type of required PPE, while the retail sector had the lowest concern at 9.7%.

- The highest expected shortages were for COVID-19 rapid test kits, with 59.4% of businesses expressing concerns, whereas non-medical masks had the lowest reported shortage concerns at 15.0%.

- These figures highlight the growing anxiety among businesses about the availability of essential PPE.

(Source: Statistics Canada)

Personal Protective Equipment and COVID-19

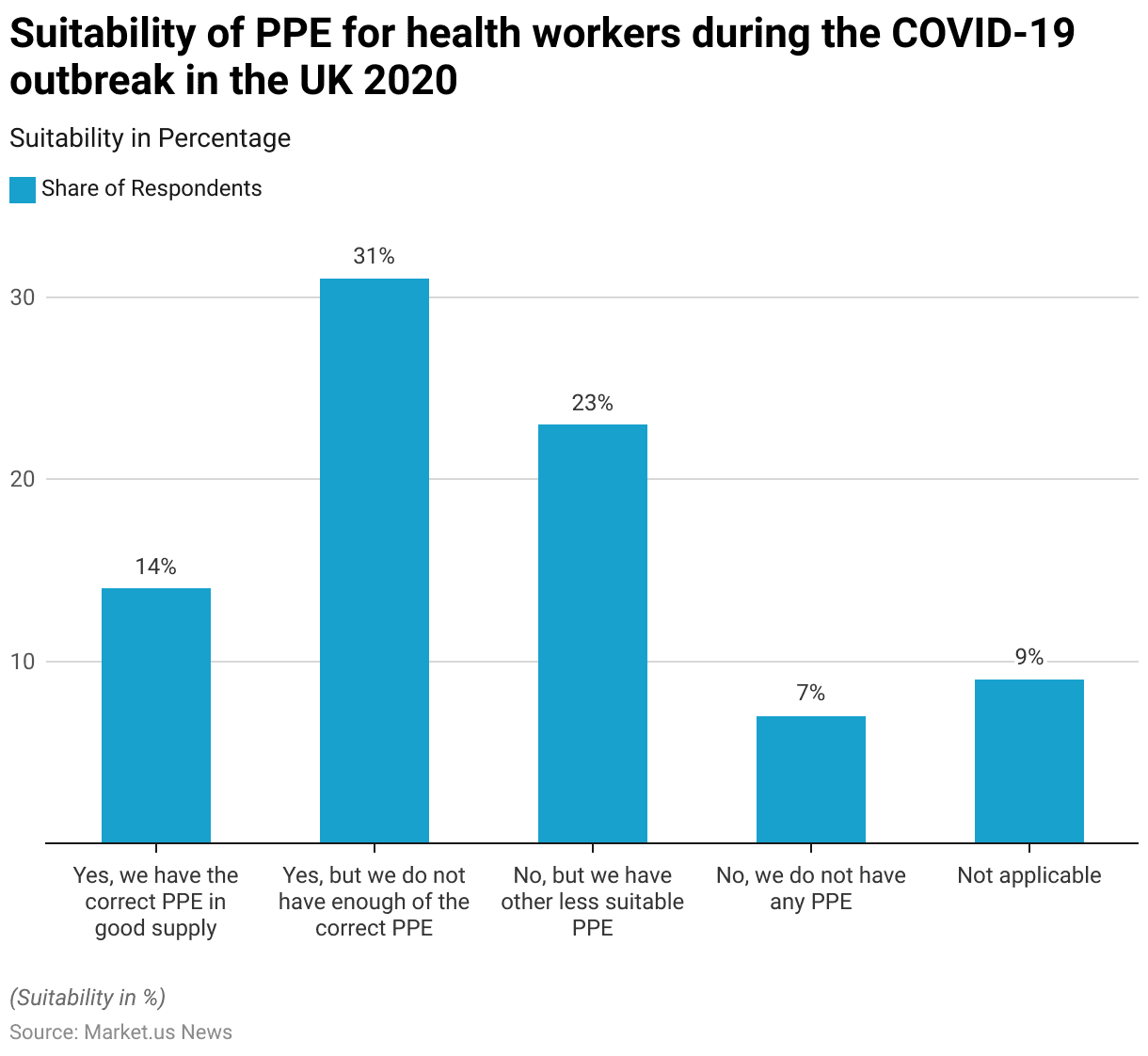

Suitability of PPE for Health Workers During the COVID-19 Outbreak

- During the COVID-19 outbreak in the UK in 2020, the suitability of personal protective equipment (PPE) for health workers was a critical concern.

- A survey revealed that only 14% of respondents confirmed having the correct PPE in good supply at their workplace.

- Meanwhile, 31% reported having the correct PPE but not in sufficient quantities.

- An additional 23% indicated that they had other, less suitable PPE instead of the required types.

- Alarmingly, 7% of respondents stated that they did not have any PPE available.

- Additionally, 9% of respondents marked the question as not applicable to their situation.

- These findings highlight significant challenges in ensuring adequate protection for health workers during the pandemic.

(Source: Statista)

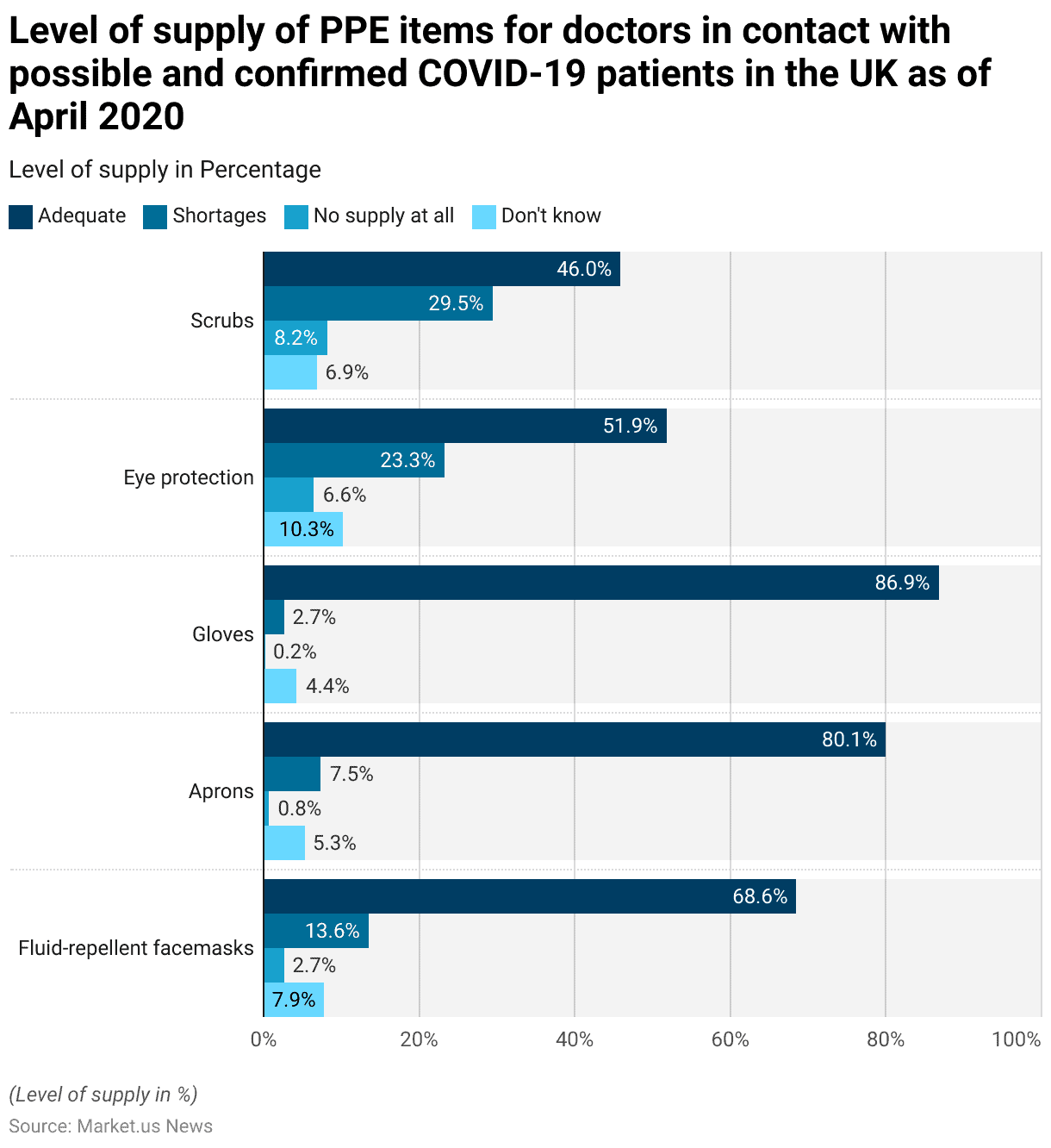

Level of Supply of PPE Items for Doctors in Contact with Possible and Confirmed COVID-19 Patients

- As of April 2020, the level of supply of personal protective equipment (PPE) for doctors in contact with possible and confirmed COVID-19 patients in the UK varied significantly across different items.

- Fluid-repellent facemasks were reported to be adequately supplied by 68.6% of respondents, though 13.6% experienced shortages and 2.7% had no supply at all; 7.9% were unsure of the supply status.

- Aprons had the highest level of adequate supply at 80.1%, with 7.5% reporting shortages and 0.8% indicating no supply, while 5.3% did not know.

- Gloves were adequately supplied for 86.9% of respondents, with minimal shortages at 2.7% and almost no instances of no supply at 0.2%; 4.4% were unsure.

- Eye protection had a lower adequacy, with only 51.9% reporting sufficient supply, 23.3% experiencing shortages, and 6.6% having no supply at all; 10.3% did not know the supply status.

- Scrubs were the least adequately supplied, with only 46% reporting sufficient supply, 29.5% facing shortages, and 8.2% with no supply; 6.9% were uncertain about the supply status.

- These statistics highlight the disparities in PPE availability for healthcare professionals during the pandemic.

(Source: Statista)

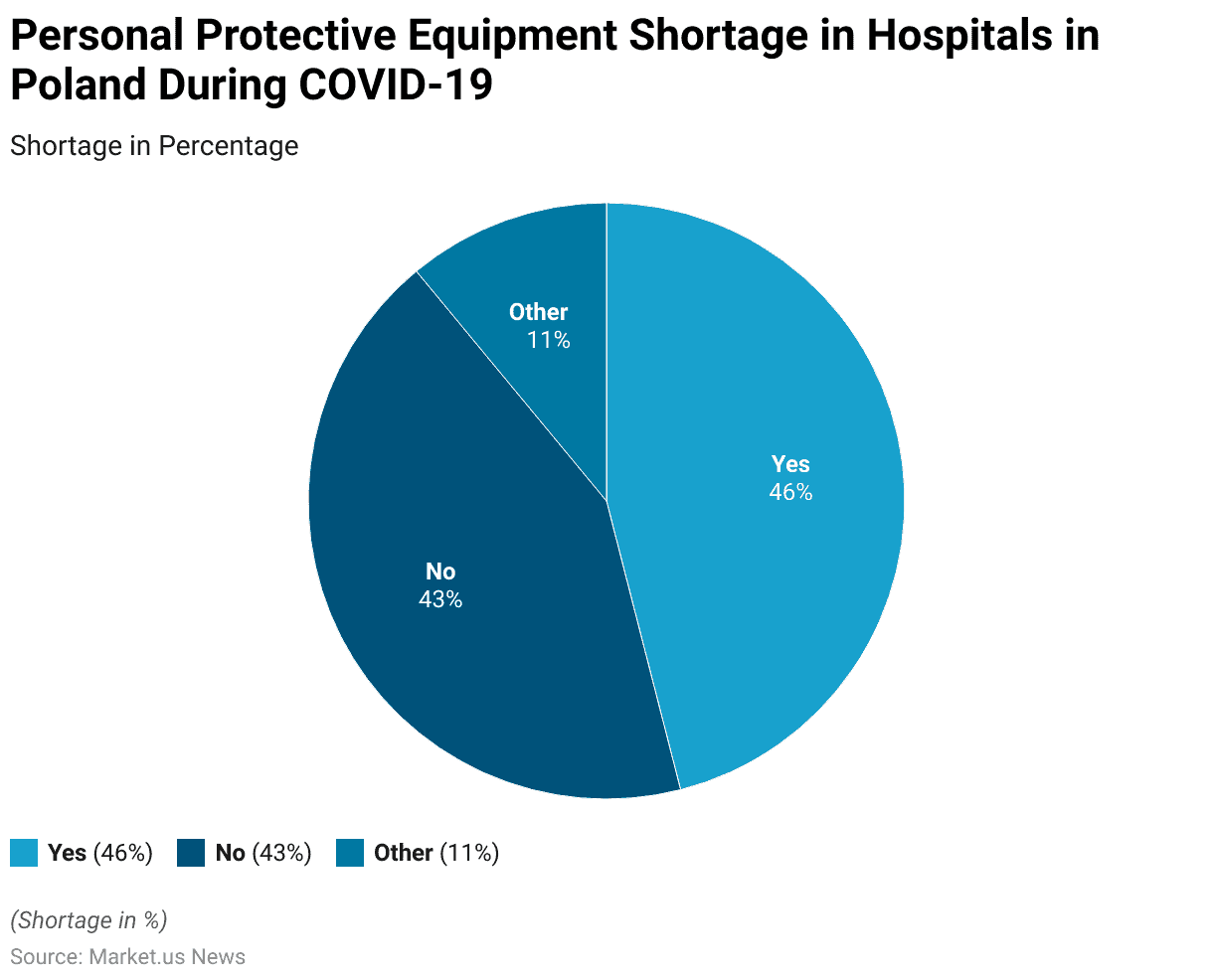

Personal Protective Equipment Shortage in Hospitals During COVID-19

- In 2020, during the COVID-19 pandemic, hospitals in Poland faced significant challenges regarding the availability of personal protective equipment (PPE).

- A survey revealed that 46% of respondents reported a shortage of PPE in their facilities or hospital wards.

- Conversely, 43% of respondents indicated that there was no shortage of PPE.

- An additional 11% provided responses that fell into the “Other” category, indicating varied or unspecified situations regarding PPE availability.

- These statistics underscore the mixed experiences of hospitals in Poland in securing adequate PPE during the pandemic.

(Source: Statista)

Personal Protective Equipment Shortages

Business Concerns About PPE Shortages

- In January 2022, businesses expressed concerns about potential shortages of personal protective equipment (PPE) over the next three months.

- The highest level of concern was for COVID-19 rapid test kits, with 33.7% of businesses expecting a shortage and 25.7% unsure.

- Disposable gowns were also a concern, with 15.0% anticipating a shortage and 9.5% uncertain.

- For face shields, 7.1% expected shortages, while 10.5% were unsure.

- Hand sanitizer: 5.3% of businesses are expecting a shortage, and 10.8% are uncertain.

- Nitrile gloves and non-medical gloves had similar levels of concern, with 9.3% and 8.9% expecting shortages and 14.0% and 14.8% unsure, respectively.

- Non-medical masks saw 4.5% expecting shortages and 10.5% unsure.

- Respirators were a significant concern, with 21.6% expecting shortages and 15.6% unsure.

- Lastly, 7.4% of businesses anticipated a shortage of surgical masks, with 10.7% uncertain.

- These concerns highlight the ongoing challenges businesses face in securing adequate PPE supplies.

(Source: Statistics Canada)

Regulations for Personal Protective Equipment

- Regulations for personal protective equipment (PPE) vary by country to ensure safety and compliance in different environments.

- In the European Union, Regulation (EU) 2016/425 sets the standards for the design, manufacture, and marketing of PPE, requiring products to bear the CE marking, which indicates conformity with health and safety requirements.

- In the United States, the Occupational Safety and Health Administration (OSHA) mandates that PPE must meet standards developed by the American National Standards Institute (ANSI) and that employers provide proper training and maintenance for PPE.

- In the UK, the Personal Protective Equipment at Work Regulations 2022 extend the obligation of providing suitable PPE from employees to all workers, including casual and irregular workers.

- These regulations ensure that PPE used in workplaces effectively protects against risks. Compliance is monitored through regular assessments and proper documentation.

(Sources: European Commission, Gov.UK, Health and Safety Executive UK)

Recent Developments

Acquisitions:

- Honeywell’s Acquisition of Norcross Safety Products: In April 2022, Honeywell acquired Norcross Safety Products for $1.2 billion. This acquisition enhances Honeywell’s PPE portfolio, especially in the North American market, providing substantial growth opportunities.

- MSA Safety’s Acquisition of Bristol Uniforms: In January 2022, MSA Safety acquired UK-based Bristol Uniforms for $60 million. This acquisition strengthened MSA Safety’s position in the fire service PPE sector and expanded its presence in European markets.

New Product Launches:

- Honeywell’s New Respiratory Protection Solutions: Honeywell launched two new NIOSH-certified respiratory protection products in 2022 to meet the needs of healthcare workers, expanding its PPE offerings in the healthcare sector.

- 3M’s Redesigned Reusable Industrial Face Masks: 3M introduced redesigned reusable industrial face masks that better protect healthcare workers and help prevent mask shortages. These masks gained NIOSH approval for their enhanced design to trap viruses inside.

Funding:

- Investment in Production Capacity: Companies are investing in expanding their production capacities to meet the rising demand for PPE. For instance, Ansell opened a new manufacturing plant in India with an $80 million investment to produce high-quality surgical gloves.

Market Growth:

- Global PPE Market Expansion: The growth is driven by increasing awareness of worker safety and stringent occupational safety regulations.

- Regional Insights: North America accounted for the largest market share in 2023 due to increased government expenditure in the healthcare sector and rising workplace safety awareness. The Asia-Pacific region is expected to witness significant growth due to rapid industrialization and infrastructure spending.

Innovation and Trends:

- Integration of Smart Technologies: Manufacturers are integrating smart sensors and data transmission modules into traditional PPE to enhance safety features. For example, advanced firefighting gear now includes navigation systems, sensors, and thermal cameras to improve safety and operational efficiency.

- Sustainable PPE Solutions: Companies are focusing on sustainability by developing eco-friendly PPE products. This includes the use of recycled materials and sustainable production practices to reduce the environmental impact of PPE manufacturing.

Conclusion

Personal Protective Equipment Statistics – In conclusion, the global personal protective equipment (PPE) market is critical for ensuring the safety of workers across various industries, including healthcare, manufacturing, and construction.

The demand for PPE has significantly increased due to heightened awareness of workplace safety and the ongoing impact of the COVID-19 pandemic.

Governments and private companies worldwide have invested heavily in PPE production and distribution to meet this demand.

Regulations, such as the EU’s Regulation (EU) 2016/425, OSHA standards in the U.S., and the UK’s PPE at Work Regulations 2022, ensure that PPE meets stringent safety requirements and is adequately supplied to protect workers.

These efforts are essential for maintaining health and safety standards, mitigating risks, and enhancing the overall well-being of employees.

FAQs

Personal Protective Equipment (PPE) refers to protective clothing, helmets, gloves, face shields, goggles, facemasks, respirators, and other equipment designed to protect the wearer from injury or the spread of infection or illness. PPE is commonly used in healthcare settings, industrial environments, construction sites, and other workplaces to ensure the safety and health of individuals.

PPE is crucial because it serves as a barrier between infectious materials and the wearer’s skin, mouth, nose, or eyes (mucous membranes). In industrial settings, it protects against hazards such as chemical spills, electrical hazards, sharp objects, and airborne particles. The use of PPE minimizes the risk of injury, infection, and long-term health issues.

PPE is selected based on the type of hazard present in the workplace and the level of protection required. Factors to consider include the nature of the hazard (biological, chemical, physical), the environment, the duration of exposure, and the specific activities being performed.

Proper maintenance of PPE includes regular inspection, cleaning, and storage according to the manufacturer’s instructions. Damaged or worn-out PPE should be replaced immediately. Ensuring that PPE is in good condition is essential for providing adequate protection.

Yes, various national and international standards regulate the use of PPE. In the United States, the Occupational Safety and Health Administration (OSHA) sets and enforces standards for workplace safety, including PPE requirements. Other organizations, such as the National Institute for Occupational Safety and Health (NIOSH) and the American National Standards Institute (ANSI), also provide guidelines.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)