Table of Contents

Introduction

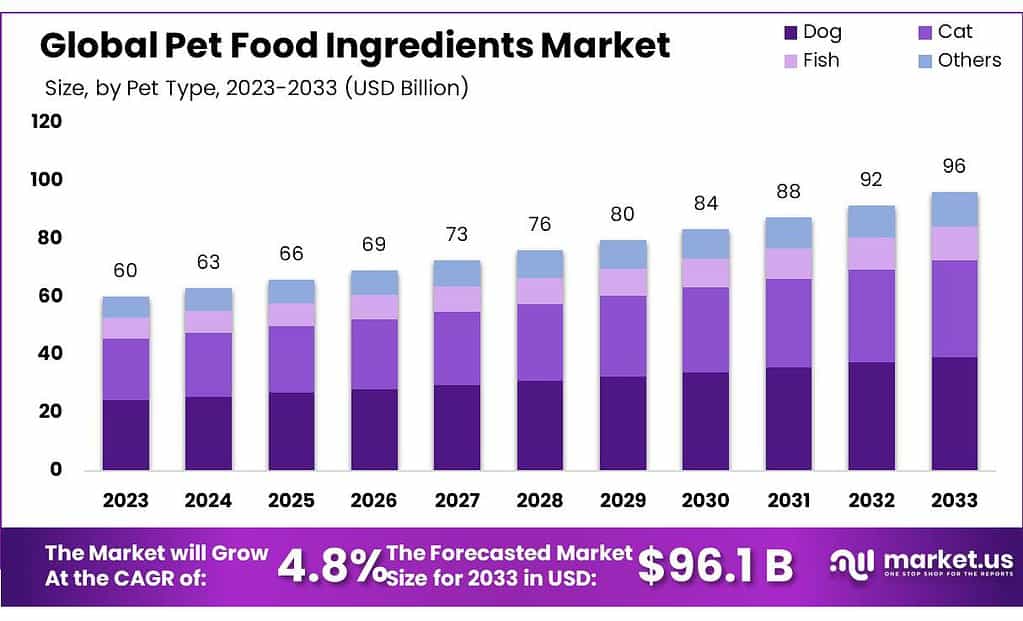

The global Pet Food Ingredients Market is poised for substantial growth, projected to escalate from USD 60.15 billion in 2023 to USD 96.1 billion by 2033, achieving a compound annual growth rate (CAGR) of 4.8%. This growth is fueled by the increasing trend of pet humanization and a greater emphasis on pet health and wellness, driving demand for high-quality pet food ingredients. Key developments include the expansion of production facilities and the introduction of innovative products tailored to meet specific nutritional needs of pets. For instance, new high-performance ingredients for pet nutrition have been developed to enhance the health benefits of pet foods.

Challenges in the market include navigating the complex regulatory environment and managing the rising costs of premium ingredients. Moreover, the shift towards sustainable and ethically sourced ingredients continues to shape the industry’s dynamics, reflecting a growing consumer preference for environmentally friendly pet food options. Companies are increasingly investing in research and development to diversify their product offerings and adapt to changing consumer preferences, such as the rising demand for plant-based and alternative protein sources for pets.

Recent strategic moves by major players in the market include acquisitions and expansion into new regions, aimed at consolidating market presence and enhancing the scalability of operations. For example, significant investments have been made in North America, which remains a leading market due to its high pet ownership rates and consumer willingness to spend on premium pet food products

FoodSafe Technologies has not released specific recent updates about their activities in the pet food ingredients market. For the latest developments, accessing their direct communications or industry-specific reports would be recommended.

Symrise, on the other hand, has been particularly active. In 2023, they inaugurated a new dry pet food pilot production line in Elven, France. This facility is aimed at bolstering their R&D capabilities, allowing Symrise to explore new recipes and enhance the nutritional value of their products. They also transformed their pet nutrition brand into “Nuvin,” repositioning their product offerings to focus more on health solutions like egg, chicken, and hydrolyzed proteins.

Key Takeaways

- Market Growth and Size Projected Growth: Expected market size to reach around USD 96.1 billion by 2033, growing from USD 60.15 billion in 2023 at a CAGR of 4.8%.

- Pet Segmentation: Dogs lead the market with over 40% share, followed closely by cats. Fish and other pets constitute smaller segments.

- Ingredient Analysis: Amino acids dominate the market, contributing over 33%, followed by phosphates and gut health ingredients.

- Asia Pacific, which had a market share greater than 36.9% in revenue, emerged as the largest regional market in 2023.

Pet Food Ingredients Statistics

- Composed of excreta that has been artificially dehydrated to moisture content not in excess of 15%. It shall contain not less than 20% crude protein, not more than 35% crude fibre, including other material such as straw, wood shavings, or acceptable bedding materials, and not more than 20% ash.

- About 50% of an animal is used in the human food industry with the remaining parts, heads, bones, intestines, organs, even unborn foetuses entering the pet food industry.

Cooked processed dry dog food contains very little moisture, about 10%, and is dehydrating to dogs - Indeed, marketing firm Vericast surveyed more than 700 pet owners and found more than three-quarters viewed their pet as their child, and roughly 78% of respondents were willing to spend more on pet food and treats in 2023 than in 2022.

- Dry food typically contains < 20% moisture, except in Europe (< 14%) and Brazil (< 12%).

Water content of semi-moist pet food can range from 20% up to 65%, except in Europe (14% to 60%). - Wet foods contain ≥ 65% moisture, except in Europe (≥ 60% moisture).

- Certified organic foods will display a USDA organic seal and must be made of at least 95% organic ingredients.

- In the U.S., 23% of pet owners look for products with limited ingredient lists,” said Dornblaser.

- She did note that only about 1% of product launches in any given year globally are frozen or refrigerated.

- Amed ingredients must account for at least 70% of the total product by weight, and at least 95% of the product by weight, not counting added water.

Emerging Trends

- Health and Wellness: There is a growing emphasis on the health and wellness of pets, similar to trends in human food. This includes a demand for pet food ingredients that support overall health, immunity, and longevity. Pet food brands are increasingly focusing on ingredients that offer these health benefits, driven by pet owner demand for high-quality, nutritious options.

- Plant-Based Ingredients: The market is witnessing a rise in plant-based ingredients. These ingredients cater to pet owners looking for allergy-friendly, sustainable, and perceived healthier options for their pets. The shift also includes a focus on ethical sourcing and reducing the carbon footprint of pet foods.

- Premiumization and Specialized Diets: There is an increasing trend towards premium pet foods that incorporate specialized diets, catering to various health needs and preferences of pets, such as grain-free, gluten-free, and high-protein diets. This trend is coupled with a willingness among pet owners to spend more on premium products.

- Technological Advancements and Personalization: Advances in technology are influencing pet food formulations and shopping experiences. E-commerce growth is notable, providing pet owners with convenient access to a wide range of pet food options. Additionally, there is a trend towards personalized pet foods, tailored to the specific dietary needs and preferences of individual pets.

- Sustainability: The industry is also seeing a significant push towards sustainability in pet food production. This includes the use of sustainably sourced ingredients and improvements in packaging to reduce environmental impact. There is a growing consumer preference for brands that demonstrate a commitment to environmental stewardship.

Use Cases

- Aquaculture Feed: The ingredients used in pet food are essential not only for traditional pet foods but also for aquaculture. The global aquaculture industry has seen fluctuations in feed tonnage, but continues to require high-quality feed composed of specialized pet food ingredients to ensure the health and growth of aquatic life.

- Specialized Pet Diets: There’s a growing trend towards tailor-made diets that cater to the specific health needs of pets. These diets include functional treats, meal-enhancing toppers, and targeted supplements, which are formulated to address specific health concerns such as joint health, digestion, or skin and coat improvement.

- Innovation in Pet Nutrition: The pet food industry is continuously innovating with the introduction of new products that meet evolving consumer demands. These innovations include the development of new formulations that incorporate novel ingredients aimed at improving pet health and wellness.

- Export Market: The United States is a significant player in the global pet food market, exporting substantial amounts of dog and cat food worldwide. This international demand underscores the importance of high-quality, effective pet food ingredients in maintaining and expanding market reach.

Major Challenges

- Supply Chain Disruptions: The pet food industry is highly susceptible to global supply chain issues, which include delays at major ports and dependencies on imported ingredients such as vitamins from countries like China. These disruptions can lead to increased costs and delays in production. For instance, the U.S. pet food industry has faced particular challenges with supply chain disruptions at West Coast ports, affecting the timely import of critical ingredients and potentially leading to increased prices and shortages.

- Regulatory Challenges: Navigating the regulatory landscape presents another hurdle, as pet food ingredients must comply with stringent health and safety standards. Changes in regulations can impact the availability and use of certain ingredients, requiring companies to adapt quickly to remain compliant.

- Ingredient Costs and Availability: The cost and availability of high-quality ingredients are constantly fluctuating, influenced by factors like global demand, agricultural conditions, and geopolitical tensions. These fluctuations can significantly affect the pricing and formulation of pet foods.

- Consumer Preferences and Market Trends: The market is also challenged by changing consumer preferences, with a growing demand for natural and organic pet foods. This shift requires pet food manufacturers to source ingredients that meet these new standards, which can be more expensive and less readily available.

- Technological Adaptations: Lastly, the need for innovation in product development and manufacturing processes requires ongoing investment. Companies must continuously evolve and improve their offerings to meet consumer demands for premium, health-focused pet foods, adding financial and operational pressures.

Market Growth Opportunities

- Increased Pet Ownership: The rise in pet ownership globally, particularly in urban areas, boosts the demand for pet food and subsequently for high-quality ingredients.

- Premiumization Trend: There is a noticeable shift towards premium and specialty pet foods that include high-quality and innovative ingredients. Pet owners are willing to spend more on products that promise better health benefits for their pets.

- Health and Wellness Focus: The market is seeing a rise in health-conscious pet owners who prefer pet foods that support their pets’ health and wellbeing, further driving demand for nutritious ingredients.

- Regional Growth: North America continues to dominate the market due to high pet ownership and consumer spending on pet care. However, Asia-Pacific is also emerging as a significant market, with increased pet adoption and rising disposable incomes.

- Innovative Ingredients: The exploration of innovative ingredients like plant-based proteins, insect proteins, and cultured proteins presents new opportunities. These ingredients cater to sustainability concerns and dietary preferences and are poised for growth due to their minimal environmental impact and potential health benefits.

- Natural and Organic Products: There is a growing demand for natural and grain-free products, reflecting a broader consumer preference for healthier and more sustainable options for their pets.

Key Players Analysis

In 2023, FoodSafe Technologies primarily focused on enhancing its safety and quality solutions within the pet food ingredients sector. Although specific year-wise updates aren’t detailed in the latest data, the company is recognized for its specialized additives that ensure the safety and quality of pet food. FoodSafe Technologies continues to support pet food manufacturers by offering products that meet rigorous standards, ensuring the well-being of pets and peace of mind for pet owners.

Symrise made significant advancements in 2023 by inaugurating a new dry pet food pilot production line at its regional headquarters in Elven, France. This facility is part of Symrise’s strategy to enhance its research and development capabilities and refine its pet food production processes. Additionally, Symrise rebranded its pet nutrition ingredients under the new name “Nuvin,” focusing on egg, chicken, and hydrolyzed proteins to better meet the growing demands for high-quality, sustainable pet food solutions .

In 2023, AFB International continued to strengthen its presence in the pet food ingredients market by leveraging its expertise in palatability enhancement. Although specific details for 2023 are not mentioned in the available data, AFB International is known for its focus on research and development to innovate and improve the taste and acceptance of pet foods globally, enhancing the dining experience for pets across various regions.

DuPont Nutrition & Health has played a pivotal role in the pet food ingredients sector, particularly in 2023, by emphasizing the integration of natural and nutritional ingredients to support pet health. This year, they focused on expanding their range of probiotics and fibers, aiming to improve gut health and overall wellness in pets. DuPont’s continuous innovation in developing sustainable and high-quality ingredients underscores its commitment to meeting the evolving demands of the pet food industry.

In 2023, Biorigin celebrated its 20th anniversary, marking two decades of contributing high-quality, natural-origin ingredients to the pet food industry. The company has consistently focused on sustainability and innovation, developing solutions that enhance the taste and health benefits of pet food products. Biorigin’s dedication to quality and sustainability is demonstrated through their ongoing commitment to reducing environmental impact and improving the nutritional content of pet foods with ingredients that support gut and overall animal health.

Lallemand, Inc., another key player in the pet food ingredients sector, is known for its specialized work in the development and supply of yeast and bacteria products. Lallemand focuses on providing ingredients that enhance the health and nutrition of pets, supported by their strong commitment to research and innovation in the field of probiotics and other health-enhancing ingredients for animal nutrition. The company’s efforts are aimed at improving pet food quality and ensuring the well-being of pets through scientifically backed nutritional solutions

In 2023, Eurotec Nutrition has continued its work in the pet food ingredients market by focusing on innovative solutions for animal nutrition, particularly in the field of feed additives and functional ingredients. While specific details for 2023 were not found, the company is known for its commitment to quality and safety in the development of products that enhance the health and performance of pets.

Impextraco Ltda Brazil, in 2023, has made strides in the pet food ingredients market by emphasizing the sustainability and effectiveness of their feed solutions. This year, they continued to offer a broad range of feed ingredients, including vitamins, amino acids, and antioxidants, tailored to meet the nutritional needs of pets. Impextraco’s commitment to innovation is evident in their focus on developing products that contribute to the overall health and productivity of animals, ensuring high standards of quality and safety.

In 2023, Pancosma continued to innovate in the pet food ingredients market with a focus on enhancing palatability and nutritional content. While specific 2023 data is sparse, Pancosma is renowned for its advanced taste solutions and sensory performance additives that improve the appeal of pet foods without compromising on health benefits. Their work emphasizes the development of natural and sustainable ingredients that cater to the increasing demand for high-quality pet nutrition.

Alltech significantly contributed to the pet food ingredients sector in 2023 by expanding its portfolio and enhancing global feed production despite economic challenges. They increased their focus on sustainable and health-promoting ingredients, including advances in digestive aids and immune-supporting probiotics. Alltech’s initiatives in sustainability and nutritional science demonstrate their commitment to improving pet health through innovative feed solutions.

In 2023, Vitablend Nederland B.V. advanced its role in the pet food ingredients market by focusing on the production and distribution of fortified blend solutions and antioxidant systems tailored for pet foods. Specializing in enhancing the nutritional profile and stability of pet foods, Vitablend has emphasized innovation in custom nutrient premixes that cater to specific health needs of pets, ensuring products are both nutritious and appealing to a wide market.

Elanco, in 2023, expanded its impact in the pet food ingredients sector by enhancing its product offerings with advanced veterinary health solutions. Key developments include the FDA’s completion of a comprehensive review of Elanco’s new feed ingredient, Bovaer®, which is designed to reduce methane emissions in lactating dairy cattle, reflecting the company’s commitment to sustainability and innovative health solutions for animals. Elanco’s dedication to improving animal health through nutritional and medical advancements continues to position it as a leader in the pet care industry

Conclusion

The ongoing innovation in pet food products, including the use of alternative proteins and the development of specialized diets, is enhancing the overall quality and nutritional value of pet food. These efforts are supported by substantial investments in research and development across the globe, particularly in North America and the Asia-Pacific region, where pet ownership is rapidly increasing.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)