Table of Contents

Introduction

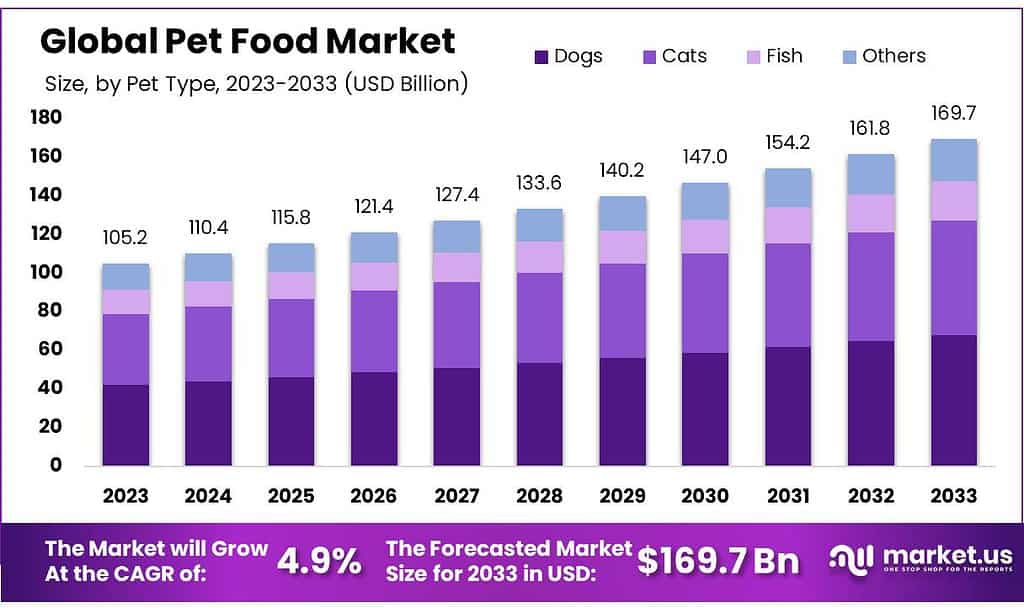

The global pet food market is poised for significant growth, projected to expand from USD 105.2 billion in 2023 to USD 169.7 billion by 2033, with a compound annual growth rate (CAGR) of 4.9% during this period. This growth is underpinned by increasing pet ownership, the humanization of pets, and a rising demand for premium pet food products.

One of the key drivers of this market is the growing consumer preference for healthier and higher-quality pet food. This includes natural and organic ingredients that cater to the health and well-being of pets, a trend that aligns with the humanization of pets, where pet owners treat their animals as family members and seek the best dietary options for them.

However, the market faces challenges such as the threat of home-cooked and alternative diets. Pet owners are increasingly opting for home-prepared meals for their pets, utilizing ingredients like chicken, salmon, and vegetables, which can impact commercial pet food sales. Furthermore, the industry is experiencing competitive pressures, with major players like Mars Inc., Nestlé Purina, and Hill’s Pet Nutrition dominating the market, striving to innovate and capture consumer interest through specialized products and extensive marketing campaigns.

Recent developments in the market highlight the dynamic nature of the industry. For instance, Mars Petcare’s recent investments in expanding its wet cat food production facilities in Australia and the acquisition of Champion Petfoods are indicative of strategic moves to bolster its market position and address growing global demand. Additionally, Nestlé’s significant investment in enhancing its wet cat food production capabilities further underscores the emphasis on expanding product lines and improving supply chain efficiencies to meet consumer expectations.

Mars Petcare, recognized as the world’s largest pet food manufacturer, has been actively innovating its product lines. Recent expansions include investing in new production facilities and launching new products like grain-free dog food and Regal Cat food. This initiative is part of Mars’s broader strategy to meet diverse consumer needs and maintain its market leadership. Hill’s Pet Nutrition focuses on science-led pet nutrition, which has strengthened its market position. The company leverages scientific research to formulate foods that meet specific health needs of pets, catering to a niche but growing segment of pet owners looking for specialized dietary options.

Nestlé Purina PetCare has continued to show robust growth, with sales reaching US$21.47 billion in 2023, up from US$20.56 billion in 2022. This growth is propelled by successful product lines such as Purina ONE, Purina Pro Plan, and Felix, which have seen double-digit growth rates. The brand’s strong performance has been crucial to Nestlé’s overall growth, especially in North America where Purina contributes significantly to the group’s revenue.

Key Takeaways

- By 2033, the global pet food market is expected to reach USD 169.7 billion, growing from USD 105.2 billion in 2023 with a CAGR of 4.9%.

- Dry food, accounting for 43.3% of the market in 2023, is popular for its benefits like maintaining healthy teeth in dogs.

- Dogs made up 40% of the pet food market revenue in 2023, with rising consumer focus on dog health and care.

- Animal-source products dominate the pet food market, while plant-based options cater to specific dietary needs.

- In 2023, supermarkets/hypermarkets were the leading distribution channel, holding 42.8% of the pet food market share.

- North America led the regional market in 2023 with 39.3% of global revenues, driven by trends in pet humanization.

Pet Food Facts And Statistics

- There are between 700 million and 1 billion pet dogs in the world.

- The global pet food market is worth around $150 billion.

- More than 35 million metric tons of pet food is produced every year.

- Dog food accounts for approximately 60% of the global market.

- 58% of pet food produced is dry food.

- The US is the largest individual pet food market in the world, worth $60 billion annually.

- Chewy and Amazon account for 70% of online pet food sales in the US.

- In North America, it is estimated that over 60% of pets are overweight and 30% are obese.

- According to a 2019-2020 APPA National Pet Owners Survey, over 67% of American households now have at least one pet.

- Global pet product sales are expected to total $341 billion in 2024; projections show a market value of up to $500 billion in 2030.

- The average American pet owner spent $2,001 on their pet(s) in 2023.

- The average pet dog costs $137 per month in 2024; cat ownership costs $83.50 per month, per cat.

- In 2023, Americans spent $64.4 billion on pet food and treats.

- Projections indicate that in 2024, spending on pet food and treats in the U.S. will grow 3.88%.

- Revenue from snacks and treats represents $40.7 billion (42.9%) of the global pet food market.

- Projections indicate that in 2030, the pet food market will be worth $135 billion.

- We’re excited about it so far; it looks like it will be in the top 20% of our products.

- Most dried pet foods contain less than 50% meat because higher quantities of meat gum up the machinery that mixes and extrudes the kibble.

- According to Bloomberg Intelligence, the global pet industry is currently worth US$320 billion and is expected to reach US$493 billion by 2030, a meteoric 54% increase.

- 94% of pet parents consider their pets to be valuable members of the family.’

- 64% of pet parents read ingredient lists when making a food or treat purchase decision.

Emerging Trends

- Personalization and Health-Focused Products: There’s a growing trend towards personalized pet food products tailored to the specific health needs of pets, such as age, breed, or potential allergies. This shift is partly due to pet owners’ increasing focus on the health and wellness of their pets, leading them to seek out diets that can improve palatability and overall health.

- Natural and Organic Ingredients: The demand for pet foods that are free from artificial additives and are made with natural ingredients is rising. This trend is not only prevalent in the U.S. but also globally, as more pet owners are looking for cleaner, simpler ingredient lists that promote better health for their pets.

- Sustainable and Ethical Practices: Consumers are increasingly interested in sustainability and ethical sourcing in their purchases, including pet food. This includes preferences for products that are made with environmentally friendly practices and that ensure animal welfare.

- Growth of E-commerce: The convenience of online shopping continues to influence pet food sales, with a significant portion of pet owners opting to purchase pet supplies online. This trend is facilitated by a wider availability of products and the ability to easily compare prices and read reviews before purchasing.

- Specialized Health Formulas: Alongside general trends towards health and wellness, there is an increasing availability of pet foods designed to address specific health concerns like obesity, kidney health, or food allergies. This includes products with added proteins, fibers, or formulations that support weight management.

- Innovative Product Formats: The market is also seeing innovation in the types of pet food offered, such as freeze-dried options, which cater to consumers looking for convenience without compromising on nutritional quality. These products often feature high-quality ingredients that appeal to health-conscious pet owners.

Use Cases

The pet food industry is experiencing diverse use cases that highlight the dynamic nature of this market. Notably, the adoption of private label brands is gaining momentum, especially in regions like Europe where such brands hold a significant market share due to their ability to offer high-quality, affordable alternatives to mainstream brands. This trend is reflected in the growing private-label market share in Europe, with substantial annual growth in private-label pet food sales.

Operational expansions are another critical use case, with companies like BioVeritas and TC Transcontinental Packaging significantly increasing their production capabilities. BioVeritas has recently expanded its facility footprint, focusing on developing food-grade samples, while TC Transcontinental Packaging is investing in new technologies to enhance packaging solutions, which are essential for pet food safety and shelf appeal.

Furthermore, the segmentation of products based on specific nutritional needs and life stages of pets is becoming increasingly prevalent. Companies are focusing on offering products that cater to the distinct dietary requirements of different pet life stages, with a strong emphasis on using high-quality, natural ingredients to improve overall pet health.

These use cases illustrate the pet food industry’s response to evolving consumer preferences, emphasizing sustainability, quality, and personalized pet nutrition. The ongoing developments suggest a robust market growth trajectory, influenced by innovation and strategic expansions aimed at meeting the diverse needs of pet owners globally.

Key Players Analysis

Mars Petcare Inc. is a dominant force in the global pet food market, leading with a comprehensive portfolio of nearly 50 renowned pet food brands. As the largest pet food manufacturer worldwide, Mars Petcare is dedicated to enhancing pet health through scientifically backed nutrition. Its flagship brands, such as Pedigree, Royal Canin, Iams, and Eukanuba, emphasize the company’s commitment to quality and innovation. In 2021, Mars Petcare’s contributions to the pet food sector generated significant revenue, emphasizing its pivotal role in shaping pet nutrition trends globally.

Nestlé Purina PetCare stands as a major player in the pet food industry, offering a wide array of products that cater to the nutritional needs of pets. Known for popular brands like Purina, Friskies, and Fancy Feast, Nestlé Purina is recognized for its commitment to quality and affordability. The company continuously innovates within the pet food market, focusing on crafting high-quality, nutritious products that support the health and wellness of pets worldwide.

Hill’s Pet Nutrition, a subsidiary of Colgate-Palmolive, is a prominent player in the pet food industry, known for its science-driven nutritional products. The company specializes in prescription diets and wellness foods under its Science Diet and Prescription Diet lines, addressing the specific health needs of pets. In 2023, Hill’s expanded its operations with a new manufacturing facility in Tonganoxie, Kansas, enhancing its capacity for wet pet food production and innovation. This expansion supports its ongoing efforts to cater to a diverse range of dietary needs for pets globally. Hill’s commitment to research and quality is evident in its extensive product range sold in over 80 countries, solidifying its position as a leader in pet nutrition.

J.M. Smucker’s involvement in the pet food sector is marked by its management of popular brands like Meow Mix, Milk-Bone, and Kibbles ‘n Bits. The company focuses on providing quality pet foods and treats to meet the various nutritional needs of pets. Smucker’s strategy includes leveraging its brand portfolio to innovate and expand its product offerings, ensuring it meets the evolving preferences of pet owners. This approach helps Smucker maintain a strong presence in the competitive pet food market, driven by a commitment to quality and consumer satisfaction.

Blue Buffalo, part of General Mills since 2018, has become a key player in the pet food industry by offering natural and healthy pet food under various product lines like BLUE Life Protection Formula and BLUE Wilderness. Known for its rapid growth, Blue Buffalo has significantly expanded its distribution and household penetration in the U.S., leveraging both traditional and e-commerce channels. The brand’s focus on natural ingredients and its ability to cater to pet health trends have positioned it strongly in the market, with ongoing innovations aimed at enhancing its product offerings.

Diamond Pet Foods is recognized for producing a wide range of pet food products under different brand names, catering to the nutritional needs of pets at various life stages. Known for its commitment to quality and safety, Diamond Pet Foods focuses on manufacturing processes that ensure high standards are met across all its product lines. The brand’s approach combines the use of quality ingredients with comprehensive testing to deliver pet food that owners can trust.

WellPet LLC, known for its commitment to delivering high-quality, natural pet food, operates under brands like Wellness, WHIMZEES, Old Mother Hubbard, Eagle Pack, and Holistic Select. The company focuses on providing products that support the overall health and well-being of pets, utilizing wholesome ingredients without artificial additives. WellPet’s dedication to crafting nutritious pet foods is backed by continuous research and innovation aimed at meeting the evolving needs of pet owners and their pets, establishing the company as a significant player in the premium pet food segment.

Ainsworth Pet Nutrition, maker of the Rachael Ray Nutrish brand, focuses on offering super-premium pet food made from natural ingredients. The company, acquired by J.M. Smucker in 2018, emphasizes products that are both healthy and affordable, catering to the growing consumer demand for pet foods that support wellness without compromising on quality. Ainsworth’s approach to pet nutrition is tailored to enhance the lives of pets through recipes that provide optimal nutrition, combining the appeal of market trends with nutritional science.

Merrick Pet Care stands out in the pet food industry for its focus on high-quality, natural ingredients. Their commitment to safety and quality is evidenced by their facility in Hereford, Texas, achieving the SQF Level 3 certification, ensuring their products meet stringent food safety standards. Merrick’s approach includes a strong online presence and marketing strategies that not only aim to sell but also build an emotional connection with pet owners, emphasizing their pets’ health and well-being.

Big Heart Pet Brands, known for its array of pet food and snacks, focuses on delivering quality and value. As a subsidiary of the J.M. Smucker Company, it includes well-known brands like Milk-Bone, Meow Mix, and Natural Balance. Big Heart Pet Brands caters to a diverse market with products that span a range of price points and dietary needs, aiming to meet the preferences and requirements of pet owners across different segments.

Deuerer, a prominent private-label pet food manufacturer based in Germany, stands out in the European market for its extensive operations. The company owns several major European pet food brands, including Vitakraft and Pets Choice, allowing it to maintain a significant presence across Europe, with expansions reaching into Asia and North America. Deuerer is renowned for its expertise in developing, producing, and marketing pet food, catering to a diverse range of consumer needs and preferences.

Central Garden & Pet Company, based in the United States, plays a dual role in the pet and garden supply industries, providing a broad array of products that enhance the lives of pets and their owners. The company’s pet segment offers products ranging from consumables, like pet food and treats, to hard goods, such as aquariums and bedding, reflecting its comprehensive approach to the pet care market. Central Garden & Pet is recognized for its commitment to quality and innovation, supporting pet owners with products that promote the health and well-being of their pets.

Conclusion

The pet food industry is poised for continued growth, driven by several key factors that highlight the evolving demands and expectations of pet owners. The increasing trend towards the humanization of pets, where owners are looking for high-quality, nutritionally balanced diets for their pets, supports the expansion of premium pet food products. The surge in online shopping offers pet food brands new avenues to reach consumers directly, enhancing the potential for market growth.

Additionally, the operational expansions by key industry players indicate a strong commitment to meeting the growing demand for pet food, which is expected to fuel the industry’s upward trajectory. With innovations in product offerings and a focus on sustainability and ethical sourcing, the pet food market is well-positioned to adapt to the changing landscape and continue its growth in the coming years.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)