Table of Contents

Introduction

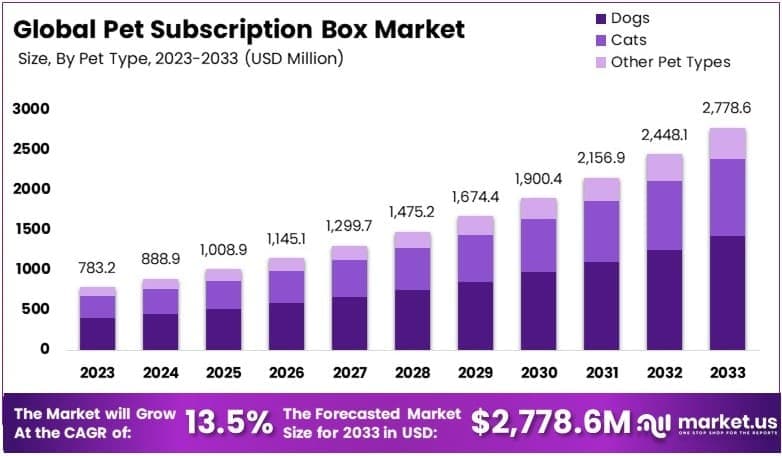

The Global Pet Subscription Box Market is projected to reach a value of USD 2,778.6 million by 2033, up from USD 783.2 million in 2023. This growth represents a compound annual growth rate (CAGR) of 13.5% during the forecast period spanning 2024 to 2033.

A pet subscription box is a recurring delivery service that provides curated products for pets and their owners, including toys, treats, grooming supplies, and accessories. These boxes are often personalized based on the pet’s breed, size, preferences, or specific needs. Subscription boxes offer convenience and the opportunity to discover unique or premium pet-related items, appealing to pet owners who seek variety and quality without frequent trips to the store.

The pet subscription box market refers to the global industry surrounding the production, marketing, and distribution of these recurring pet product packages. This market encompasses a variety of subscription models, including monthly, quarterly, and customizable deliveries. The industry serves pet owners across multiple demographics, driven by a combination of e-commerce trends, the growing humanization of pets, and the increasing willingness of consumers to spend on premium pet products. It is part of the broader pet care market, which has been experiencing robust growth.

The growth of the pet subscription box market is fueled by several interrelated factors. The surge in pet ownership, particularly following the COVID-19 pandemic, has increased the demand for pet-related services and products. Additionally, e-commerce adoption has made it easier for consumers to access subscription-based services. The increasing trend of pet humanization, where pets are treated as family members, has driven owners to seek personalized, high-quality products that cater to their pets’ specific needs. Innovations in subscription box customization and digital marketing strategies, such as social media promotions, have also contributed significantly to market expansion.

The demand for pet subscription boxes is underpinned by convenience and the ability to access curated, premium products at competitive prices. With busy lifestyles, many pet owners value the automated, hassle-free nature of subscription services. The rising awareness of pet health and wellness has also encouraged consumers to opt for subscription boxes that include organic, natural, or specialized products for dietary and grooming needs. Seasonal and themed boxes, offering unique experiences, are further driving interest among pet enthusiasts.

The pet subscription box market presents several promising opportunities for growth and innovation. Regional market expansion in developing countries with growing e-commerce infrastructure represents untapped potential. Diversifying product offerings to cater to niche segments, such as pets with specific dietary requirements or exotic pets, can open new revenue streams. Additionally, leveraging data analytics and AI for enhanced personalization can strengthen customer loyalty and retention. Collaborations with established pet brands or influencers can also boost visibility and market penetration. Finally, incorporating eco-friendly packaging and sustainable product options aligns with increasing consumer preferences for environmentally conscious practices, providing a competitive edge.

Key Takeaways

- The Pet Subscription Box Market was valued at USD 783.2 million in 2023 and is projected to grow at a CAGR of 13.5%, reaching USD 2,778.6 million by 2033.

- In 2023, the Dogs segment led the market, accounting for 51.2% of the pet type category, fueled by increasing demand for dog-focused subscription services.

- The Pet Food Products segment dominated the product category in 2023, driven by a rising preference for premium and customized pet nutrition solutions.

- The Replenishment Subscription model emerged as the leading subscription type in 2023, offering convenience and reliable supply for pet owners.

- North America held the largest market share at 35.0% in 2023, supported by a high rate of pet ownership and growing adoption of pet subscription services.

Pet Subscription Box Statistics

- U.S. pet industry spending rose to $147 billion in 2023, a 7.5% increase from 2022.

- Pet insurance in the U.S. generated $3.9 billion in premiums in 2023.

- By the end of 2023, nearly 5.7 million pets in the U.S. were insured.

- The average pet insurance cost for dogs was $676 annually in 2023.

- Sixty-six percent of U.S. households owned pets in 2024.

- 86.9 million U.S. families reported owning pets.

- Dog ownership accounts for 65.1 million households in 2024.

- Cats are owned by 25.4% of U.S. households.

- About 3.2 million cats enter shelters yearly due to abandonment or surrender.

- Roughly 920,000 animals are euthanized in shelters annually in the U.S.

- Wyoming has the highest U.S. pet ownership rate at 72% of households.

- Online pet product purchases increased significantly, with 70% of owners buying online in 2024.

- The most purchased online pet products in 2024 were food (79%), treats (76%), and toys (69%).

- Exotic pets in the U.S. include approximately 7,000 large animals like tigers.

- Only 20 states in the U.S. have laws banning the private ownership of exotic pets.

- There are 13,500 animal shelters and rescue organizations across the U.S.

- 6.3 million pets enter U.S. animal shelters each year.

- Over 4 million pets are adopted from U.S. shelters annually.

- Globally, there are 900 million pet dogs.

- Worldwide, 370 million cats are kept as pets.

- Russia has the highest percentage of cat ownership globally, at 59%.

- Globally, 33% of households own at least one pet.

- U.S. households own a total of 6.1 million pet birds in 2024.

- Around 326,000 U.S. households keep ferrets as pets.

- Approximately 1.5 million households in the U.S. own rabbits.

- Americans spent an estimated $136 billion annually on pet products.

- 79% of pet owners say their pets help reduce stress.

- Owning a dog is associated with a 36% lower risk of heart disease-related deaths.

- Food and beverage subscription boxes represent the largest market share at 34%.

- 55% of subscription box customers are aged between 25 and 44.

- 28% of subscription box users have two or more active subscriptions.

- On average, subscription box users maintain 2.6 active subscriptions.

- 13% of subscription box users started their subscription due to receiving it as a gift.

- The average retention rate for subscription boxes after one year is 40%.

- 32% of active subscription users plan to increase their subscriptions.

- Pet spending growth is expected to reach 7% annually by 2030.

- U.S. pet spending growth is projected to slow to 2.5% in 2024 and 3.9% in 2025.

- Approximately 1 in 10 people globally report pet allergies.

- Globally, pet birds number 249,651,000 across households.

- About 81% of UK dog owners buy birthday or holiday presents for their pets.

- Lost pets have a 90% recovery rate within 12 hours if actively searched for.

Emerging Trends

- Personalization and Customization: Consumers increasingly seek subscription boxes tailored to their pets’ specific needs, such as dietary restrictions, size, and activity level. This demand for personalized offerings enhances customer satisfaction and loyalty.

- Emphasis on Health and Wellness: There’s a growing focus on including health-oriented products in subscription boxes, such as organic treats, supplements, and grooming items. This trend aligns with pet owners’ desire to ensure their pets’ well-being.

- Sustainability and Eco-Friendly Products: Environmental consciousness is influencing product selection, with a preference for eco-friendly toys, biodegradable packaging, and sustainably sourced treats. This shift reflects broader consumer trends towards sustainability.

- Technological Integration: Companies are leveraging technology to enhance user experience, offering mobile apps for subscription management, personalized recommendations, and tracking deliveries. This integration simplifies the customer journey and adds value.

- Expansion into Niche Markets: Beyond traditional dog and cat offerings, subscription boxes are diversifying to cater to other pets like birds, reptiles, and small mammals. This expansion taps into underserved segments, broadening market reach.

Top Use Cases

- Convenient Delivery of Essential Supplies: Subscription boxes provide a hassle-free method for pet owners to receive regular deliveries of necessities such as food, treats, and grooming products. This service ensures pets’ needs are consistently met without frequent trips to retail stores.

- Access to Premium and Specialized Products: These subscriptions often include high-quality or niche items not readily available in local markets, such as organic treats or breed-specific accessories, enhancing the pet’s care experience.

- Cost-Effective Bundling: By consolidating multiple products into a single package, subscription boxes can offer cost savings compared to purchasing items individually, providing economic benefits to pet owners.

- Personalized Pet Care Solutions: Many services customize box contents based on the pet’s profile, including factors like age, size, and dietary restrictions, ensuring the products align with the pet’s specific needs.

- Support for Pet Health and Wellness: Some subscription boxes focus on health-oriented products, such as dental chews or supplements, contributing to the overall well-being of pets.

Major Challenges

- Market Saturation and Differentiation: The proliferation of pet subscription services has led to a crowded marketplace. Companies must distinguish themselves through unique offerings, such as exclusive products or personalized selections, to attract and retain customers. For instance, BarkBox, a leading provider, offers themed boxes and a Super Chewer option to cater to different pet needs.

- Customer Retention and Churn Rates: Subscription services often struggle with maintaining long-term customer engagement. High churn rates can be costly, as acquiring new customers is typically more expensive than retaining existing ones. Implementing loyalty programs and consistently delivering high-quality products are essential strategies to enhance customer retention.

- Supply Chain and Logistics Management: Ensuring timely and cost-effective delivery of subscription boxes is a complex task. Challenges include managing inventory, coordinating with multiple suppliers, and handling shipping logistics. Delays or inconsistencies in delivery can negatively impact customer satisfaction and brand reputation.

- Customization and Personalization: Meeting diverse customer preferences requires advanced data analytics and flexible supply chains. Offering personalized products based on pet size, breed, or dietary needs can enhance customer satisfaction but adds complexity to operations. Companies like PupJoy provide customizable boxes to address this demand.

- Pricing Pressures and Consumer Expectations: Consumers expect value for money, especially in a competitive market. Balancing product quality with affordable pricing is challenging, particularly when managing costs associated with sourcing premium products and shipping. For example, Pet Treater offers budget-friendly options to appeal to cost-conscious pet owners.

Top Opportunities

- Expansion into Emerging Markets: With rising pet ownership in developing regions, there is a significant opportunity to introduce subscription services tailored to local preferences and economic conditions. Adapting product offerings to regional tastes can capture a new customer base.

- Integration of Technology for Enhanced Personalization: Utilizing data analytics and artificial intelligence can enable companies to offer more personalized product selections, improving customer satisfaction and loyalty. For example, analyzing pet behavior and preferences can lead to customized box contents that better meet individual needs.

- Incorporation of Sustainable and Eco-Friendly Products: As consumers become more environmentally conscious, offering eco-friendly and sustainable pet products can differentiate a brand and appeal to this growing demographic. This includes using recyclable packaging and sourcing products from sustainable materials.

- Development of Health and Wellness-Focused Offerings: With increasing awareness of pet health, subscription boxes that include health-oriented products, such as organic treats or supplements, can attract health-conscious pet owners. Providing educational content on pet wellness alongside products can add value to the subscription.

- Leveraging Social Media and Influencer Partnerships: Collaborating with pet influencers and utilizing social media platforms can enhance brand visibility and attract new customers. Engaging content and endorsements can drive subscriptions and foster a community around the brand.

Key Player Analysis

- BarkBox: Established in 2011, BarkBox offers monthly subscription boxes for dogs, featuring themed toys, treats, and chews. As of 2020, the company reported revenues of $365 million and served over 2 million dogs monthly.

- Meowbox: Specializing in feline products, Meowbox provides monthly boxes containing toys and treats for cats. While specific revenue figures are not publicly disclosed, the company has garnered a substantial customer base, emphasizing high-quality, unique items tailored for cats.

- PupBox: Targeting puppy owners, PupBox delivers monthly boxes with training materials, toys, and treats appropriate for a puppy’s developmental stage. The company gained increased visibility after appearing on the television show “Shark Tank,” leading to a significant boost in sales.

- KitNipBox: Focusing on cat owners, KitNipBox offers monthly subscriptions featuring toys, treats, and other cat-centric products. The company has been recognized for its charitable efforts, donating a portion of proceeds to animal welfare organizations.

- The Dapper Dog Box: Catering to dog owners seeking stylish accessories, The Dapper Dog Box includes monthly themed boxes with toys, treats, and a limited-edition bandana. The company emphasizes high-quality, USA-made products and has built a loyal customer base.

Recent Developments

- In 2023, Butternut Box, a UK-based fresh dog food company, secured £280 million in funding from General Atlantic and existing investor L Catterton. The investment aims to boost the brand’s European expansion and enhance its commitment to providing fresh, nutritious meals for dogs. The deal is expected to close in Q4 2023, pending regulatory approvals.

- In 2023, Nestlé Purina PetCare announced its plan to acquire Red Collar Pet Foods’ Miami, Oklahoma, facility from Arbor Investments. The acquisition, expected to close in March, will expand Purina’s North American production network to 22 facilities and strengthen its capacity for dog and cat treat innovation.

- In 2024, Rover Group, the world’s largest online pet care marketplace, was acquired by private equity funds under Blackstone in a deal valued at $2.3 billion. The transaction marks a significant milestone for Rover as it continues its global expansion under new ownership.

- In 2023, PAI Partners, a leading private equity firm, announced the acquisition of Alphia, one of North America’s largest pet food co-manufacturers, from J.H. Whitney Capital Partners. Financial terms of the deal were not disclosed.

- In 2023, VAFO Group finalized its acquisition of Pooch & Mutt, a rapidly growing UK pet food company. After initially taking a minority stake in 2020 and increasing it to 40% in 2022, VAFO acquired the remaining shares. This partnership has driven over 400% growth for Pooch & Mutt, with projected revenues of £18 million in 2023.

Conclusion

The pet subscription box market is poised for significant growth, driven by increasing pet ownership and the rising trend of pet humanization. Consumers are seeking convenient, personalized, and high-quality products for their pets, fueling demand for subscription services that offer curated selections tailored to individual needs. The integration of technology enhances customer experience through personalized recommendations and seamless subscription management. Additionally, a growing emphasis on sustainability and eco-friendly products aligns with broader consumer preferences, presenting opportunities for companies to differentiate themselves in a competitive landscape. To capitalize on these trends, businesses should focus on innovation, customer engagement, and strategic partnerships to drive growth and maintain relevance in the evolving pet care industry.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)