Table of Contents

Introduction

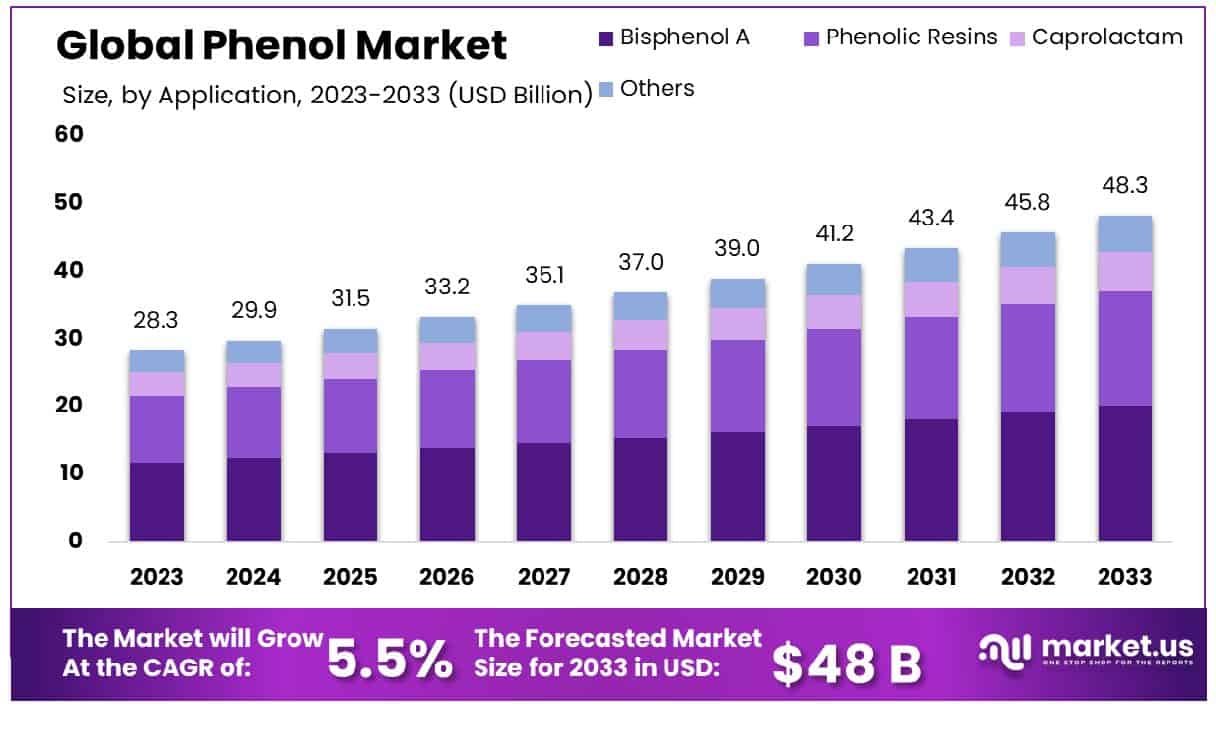

The Global Phenol Market is poised for substantial growth, anticipated to expand from USD 28.3 billion in 2023 to approximately USD 48.3 billion by 2033, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period from 2024 to 2033. This growth can primarily be attributed to the escalating demand for phenol-derived products like Bisphenol-A, which is extensively used in the manufacturing of polycarbonate plastics and epoxy resins.

These materials are integral in various industries, including automotive, electronics, and construction, due to their durability and versatility. However, the market faces significant challenges, such as stringent environmental regulations concerning phenol production and the volatility in raw material prices, which could impede growth. Despite these hurdles, recent developments indicate a robust adaptation by the industry.

Notably, key players have increased their production capacities and invested in technological advancements to enhance efficiency and environmental compliance. For instance, in 2022, a leading manufacturer announced the expansion of its phenol production facility, aiming to increase output by 20% to meet growing global demand. These strategic initiatives underline the market’s dynamic nature and its ability to navigate through potential constraints toward sustained growth.

Aditya Birla Group continues to strengthen its position in the phenol market through strategic expansions and by leveraging its vast network in the Asia-Pacific region. Their recent facility inauguration highlights their commitment to meeting regional demands and their ambition to enhance their supply capabilities globally.

AdvanSix’s recent technological advancements demonstrate their focus on innovation and efficiency. By reducing production costs and improving yield, AdvanSix is well-positioned to offer competitive pricing and maintain profitability in a market where cost management is crucial for success.

Altivia’s acquisition strategy has proven effective for rapid growth and expansion. By integrating acquired assets, they have not only increased their production capacity but also their influence in the North American market, setting a robust foundation for future growth and stability.

Bayer AG’s introduction of sustainable phenol products represents a strategic response to the growing demand for eco-friendly chemicals. This move is likely to enhance their brand reputation and align with global sustainability trends, providing them with a competitive advantage in new market segments.

Cepsa’s joint venture in China exemplifies its strategic approach to international cooperation and market penetration. By partnering with local firms, Cepsa aims to harness regional growth opportunities and cater more effectively to the dynamic Asian markets.

Key Takeaways

- Market Growth: The Global Phenol Market is projected to reach USD 48.3 billion by 2033, up from USD 28.3 billion in 2023, with a 5.5% CAGR.

- Asia-Pacific phenol market holds 46.2%, valued at USD 13.1 billion.

- By Manufacturing Process: The cumene process dominates phenol production, accounting for 45.3%.

- By Application: Bisphenol A major application, represents 41.3% of phenol use.

- By End-use: Chemicals lead in phenol end-use, comprising 36% of the market.

- By Distribution Sales: Indirect sales prevail, constituting 54.3% of phenol distribution.

Phenol Market Statistics

- phenol, C6H5OH, a colorless, crystalline solid that melts at about 41℃, boils at 182℃ and is soluble in ethanol and ether and somewhat soluble in water.

- In 2022, the world imports of “Phenols; phenol-alcohols” exceeded $7.48 billion (according to external trade statistics of 134 countries). It was $8.32 billion in the previous year.

- The value of exports of commodity group 2907 “Phenols; phenol-alcohols” from India totaled $ 227 million in 2023.

- Sales of commodity group 2907 from India decreased by 29% in value terms compared to 2022.

- exports of commodity group 2907 “Phenols; phenol-alcohols” decreased by $ 95 million.

- In January 2022, the output of phenol was 266,700 tons, 150,000 tons more than that in December 2021, 0.57% more than that in December 2021, and 5,300 tons more than that in the same period last year, 2.03% more than that in the same period last year.

- The degradation percentage of phenol was found to be 77.15 %, and the degradation percentage of TOC was 59.87%.

- Phenol spreads have improved sharply by ~32% to US$558/MT

- Acetone and Phenol prices are up 13%/8% respectively

- 60% of its overall EBIT from the phenolic business. DN earnings are sensitive to phenol spreads as Rs1/kg increase in spreads positively impacts earnings by 1.8%.

- The MAC (maximum admissible concentration) in the EEC countries for phenols in drinking water is 0.5 μg/L. In the 70’s the US environmental protection agency (EPA).

- The phenol conversion could be kept at ca. 90% and the cyclohexanone selectivity maintains ca. 90%.

- The price of Phenol (United States) increased during April 2019 to 1,030 USD per metric ton, which represents a considerable rise of 7% compared to the previous month’s value.

- On a year-over-year basis, the prices of Phenol (United States) decreased significantly by 13%.

- Meanwhile, the average price of Phenol (China) amounted to 1,160 USD per metric ton, from 1,680 USD per metric ton one year earlier.

- On a month-over-month basis, the price of Phenol (China) is 11% lower than the price one month before.

- In a study on using 88% phenol to treat idiopathic guttate hypomelanosis (IGH), 64% of the 139 IGH macules showed repigmentation after 3 months of treatment.

- Of the pigmented lesions, 45% showed over 75% improvement, 41.5% showed 50-75% improvement, and 13.4% showed 25-50% improvement.

- Phenol has a molecular weight of 94.11 g/mol and a density of 1.07 g/cm³.

- Phenol has a melting point of 40.5°C and a boiling point of 181.7°C.

Emerging Trends

- Increased Demand in the Asia-Pacific Region: The Asia-Pacific region is seeing a surge in demand for phenol, primarily driven by its expanding automotive and electronics industries. Countries like China and India are leading this growth, with their large manufacturing bases and increasing consumer markets.

- Development of Bio-based Phenol: Environmental concerns and stringent regulations regarding petrochemical-derived products are pushing the development of bio-based phenol. This trend is gaining momentum as companies seek sustainable alternatives that reduce environmental impact. Bio-based phenol is made from renewable resources, making it more eco-friendly compared to traditional methods.

- Advancements in Recycling Technologies: With increasing awareness of sustainability, recycling technologies for phenol are becoming more sophisticated. These advancements make it possible to recover and reuse phenol from industrial waste, reducing both costs and environmental footprint.

- Expansion in End-Use Applications: Phenol’s applications are expanding beyond its traditional uses in plastics and fibers. It is increasingly used in pharmaceuticals, herbicides, and as a critical raw material in the production of bisphenol A, which is used in making polycarbonate plastics and epoxy resins.

- Volatility in Raw Material Prices: The price of benzene, a key raw material for phenol production, is highly volatile. This volatility affects the pricing of phenol, impacting manufacturers’ margins and pricing strategies in downstream applications.

Use Cases

- Production of Polycarbonates: Phenol is a key component in manufacturing polycarbonates, a type of plastic used extensively in the production of electronic and automotive components. Polycarbonates account for approximately 40% of the global phenol consumption.

- Epoxy Resins: About 20% of all phenol produced is used to make epoxy resins. These resins are crucial in the coatings industry for their excellent adhesive properties and resistance to environmental degradation, making them ideal for use in automotive paints, can coatings, and electronics.

- Phenolic Resins: Phenolic resins, derived from phenol, are used in a wide range of applications including insulation, laminates, and molding compounds. They are valued for their high thermal stability and flame resistance.

- Bisphenol A (BPA) Production: Phenol is also used to produce bisphenol A, a chemical compound that is a building block for producing polycarbonate plastics and epoxy resins. BPA-based products are extensively used in the manufacture of water bottles, food containers, and other consumer goods.

- Nylon Industry: About 10% of the global phenol is used in the production of caprolactam, the precursor to Nylon 6, which is a material used in textiles, carpets, and automotive parts due to its strength and elasticity.

- Pharmaceutical Applications: Phenol is employed in pharmaceuticals for its antiseptic properties. It is used in low concentrations in various throat lozenges and mouthwashes to help alleviate throat pain and oral conditions.

- Herbicides and Other Chemicals: Phenol is an intermediate in the synthesis of a variety of herbicides, helping to control weed growth across agricultural industries. This application underscores its importance in supporting agricultural productivity.

Key Players Analysis

Aditya Birla Group has made significant strides in the phenol sector through its chemicals division, specifically focusing on the production of phenolic resins. These resins are crucial for creating composites with high mechanical strength and durability, utilized across various industries including automotive and electronics. The group’s innovative approach in this sector emphasizes not only the production of phenolic compounds but also aligns with sustainability goals, highlighting their commitment to eco-friendly manufacturing processes.

AdvanSix is a prominent player in the phenol sector, recognized for its high-purity phenol production primarily used in various applications requiring exceptional quality. This includes the manufacturing of herbicides, pharmaceuticals, and dyes, as well as components in automotive glazing and electronic insulators. The company ensures a consistent supply of phenol from its Frankford facility, which is among North America’s largest producers, serving global markets.

Altivia operates as a prominent merchant producer of phenol in North America, maintaining a significant production facility in Haverhill, Ohio. This facility specializes in the production of phenol, acetone, and alpha-methylstyrene (AMS), crucial for manufacturing various chemical intermediates used in products like phenolic resins, bisphenol A, and caprolactam. These chemicals find applications in industries such as automotive, construction, and adhesives, highlighting Altivia’s integral role in the chemical supply chain across multiple sectors.

Bayer AG is primarily recognized as a global leader in pharmaceuticals and agrochemicals, rather than being prominently active in the phenol sector specifically. While Bayer’s business includes the production of a wide range of chemicals, the focus remains on healthcare and agricultural solutions rather than on phenol as a standalone product. Bayer’s extensive product portfolio addresses various needs in health care and crop science, with innovative products that contribute to the company’s substantial global presence.

Cepsa is a major player in the phenol sector, producing phenol and acetone at their integrated plant in Palos de la Frontera, Spain. This facility is one of Europe’s most modern and technologically advanced industrial centers, focusing on the sustainable production of phenol. Cepsa utilizes cutting-edge technology and a commitment to renewable energy, making it a key supplier of phenol used in various applications, including the production of polycarbonate, epoxy resins, and nylon. Their operations emphasize environmental sustainability, with significant use of renewable electricity sources.

China National Bluestar (Group) Co., Ltd. is actively involved in the phenol sector, particularly through its subsidiary’s joint venture with Asahi Kasei. This collaboration focuses on the integrated production and sale of modified polyphenylene ether (PPE), which utilizes phenol and methanol as primary raw materials. The partnership aims to establish manufacturing and sales operations in Nantong, Jiangsu, China, leveraging both companies’ technologies to meet the growing demand for mPPE in the Chinese market, particularly in applications requiring materials with superior heat resistance and mechanical properties.

Domo Investment Group NV, through its subsidiary DOMO Chemicals, plays a significant role in the phenol sector. They produce caprolactam, a derivative of phenol, which is a key component in manufacturing nylon 6 fiber and resins. This operation is part of their broader chemical production activities, highlighting their integrated approach in the chemical industry, with significant operations based in Leuna, Germany.

Formosa Plastics Corporation is a significant player in the phenol sector, especially noted for its comprehensive production capabilities in the petrochemical industry. The company operates advanced manufacturing facilities, such as its extensive site in Texas, which is equipped to produce a wide range of petrochemical products including phenol. This capacity supports Formosa Plastics’ role as a key supplier in various chemical markets, underlining their critical position in global supply chains.

Honeywell International Inc. is engaged in the production of phenol through its Honeywell UOP technologies, which are utilized by other companies like Lotte GS Chemical for large-scale production. Honeywell UOP’s technologies support the manufacturing of phenol and acetone by optimizing the use of raw materials and enhancing production efficiency. This capability is integral to producing key chemical derivatives used in various high-demand industrial applications.

INEOS Phenol is a dominant player in the global phenol market, operating as the largest producer of phenol and acetone worldwide. The company has notably enhanced its production capabilities with the startup of Europe’s largest cumene facility in Marl, Germany, which significantly reduces CO2 emissions by up to 50% per tonne of product. This facility is part of INEOS’s commitment to sustainable production processes and reinforces its strong market position by ensuring efficient and environmentally friendly production of essential chemicals like phenol and acetone, used across various industries including healthcare and cleaning products.

KUMHO P&B CHEMICALS, INC., part of the Kumho Petrochemical Group, specializes in the production and distribution of phenol, along with acetone, MIBK, BPA, and epoxy resins. These chemicals are essential for a variety of industrial applications including electronics, pharmaceuticals, and paints. The company is notable for its role in localizing the production of these critical petrochemicals within South Korea, significantly contributing to the nation’s trade balance and industrial advancement. KUMHO P&B continues to expand its global footprint, embracing new technologies and enhancing its production capabilities to meet both local and international demands.

LG Chem, a key player in the global chemicals market, has recently adjusted operations in its Daesan plant due to mechanical issues, affecting its phenol production capacity of 300,000 tons annually. The company is recognized for its diversified product range and strategic expansion, enhancing its competitive edge in the petrochemical sector.

Merck KGaA is engaged in the phenol sector primarily through its Life Science division, providing high-grade phenol for scientific and analytical purposes. The company supplies phenol products suitable for various laboratory applications, including chemical synthesis and analytical reagents, ensuring compliance with stringent industry standards like ACS and Ph Eur.

Mitsui Chemicals, Inc., responding to market pressures such as oversupply and declining domestic demand, particularly from new production capabilities in China, is set to close its Ichihara Works phenol plant by fiscal 2026. This strategic move is part of a broader restructuring to shift towards a specialty chemicals focus, emphasizing green, sustainable chemical production. Despite the closure, Mitsui will maintain phenol production in Osaka and Shanghai, ensuring continued supply chain robustness and efficiency.

Prasol Chemicals Pvt. Ltd. has established itself as a significant player in the phenol sector, primarily through its production and supply of acetone derivatives, which are key components for various industrial applications. The company leverages its extensive experience and advanced technology to produce high-quality specialty chemicals that cater to diverse industries, including pharmaceuticals, agrochemicals, and coatings, supporting global markets from its facilities in India.

PTT Phenol Company Limited, a subsidiary of PTT Global Chemical, is a major producer of Phenol and Acetone in Thailand, with a production capacity of 492,000 and 304,000 tonnes per year, respectively. The company also manufactures 157,500 tonnes per year of Bisphenol A (BPA), used across various industries such as automotive, construction, and pharmaceuticals. Recently, after a brief maintenance shutdown, PTTGC resumed phenol and acetone production, maintaining an operational capacity of 90% to optimize efficiency and ensure supply stability.

Sasol Ltd is a significant supplier in the phenol sector, known for its extensive range of phenolic or acrylic acids, which include pure phenol and various cresols. These products are vital for numerous applications across different industries, including the manufacture of resins, pesticides, and dyes. Sasol’s global operations ensure the provision of high-purity phenol and cresols to meet the needs of industries worldwide, demonstrating its strong position in the chemical market.

Shell plc is recognized as a major player in the phenol market, especially noted for its contribution to the production of essential derivatives like Bisphenol-A (BPA). Shell’s activities in the phenol sector are part of its broader chemical division, which plays a crucial role in producing materials that are fundamental to a variety of industries, including the manufacturing of polycarbonates and epoxy resins. These products are essential in applications ranging from automotive parts to construction materials, highlighting Shell’s impact on both the chemical industry and broader manufacturing sectors.

Shengquan Group is a leading manufacturer of phenolic resins, prominently recognized for its large-scale production capabilities. It operates one of the largest and most technologically advanced phenolic resin workshops in the world, capable of producing an impressive 650,000 tons annually. This positions Shengquan as a top global producer, heavily involved in the development and application of phenolic resins used across various industries, including refractories where their products are integral due to their high carbon residue and excellent binding strength. This extensive production and innovation in phenolic resins highlight Shengquan’s significant role in the sector.

Solvay is recognized as a major player in the global phenol market, which is projected to experience steady growth through 2034. Solvay’s involvement in the production of phenol underscores its strategic focus on supplying key industrial sectors including automotive, construction, and consumer goods. This strategic positioning allows Solvay to cater to a diverse range of applications from chemical intermediates to specialty coatings, leveraging its expertise to enhance market reach and technological advancement in the phenol sector.

Taiwan Prosperity Chemical Corporation (TPCC) is a significant entity in the Asian phenol and acetone market. As a major producer, TPCC operates a plant in Kaohsiung, Taiwan, with a substantial annual production capacity of 360,000 tonnes of phenol. The company has faced challenges, such as declaring force majeure on phenol and acetone supplies due to unforeseen circumstances, which impacted the regional supply chain and market prices. TPCC was acquired by Chang Chun Plastics Co., Ltd. from Taiwan Cement Corp. in 2021, marking a significant transition in its operational control.

Conclusion

Phenol continues to be a crucial chemical in various industrial sectors due to its diverse applications. As a market research analyst, it’s clear that the demand for phenol is particularly driven by its uses in the production of polycarbonates, epoxy resins, and phenolic resins, which are integral to the automotive, electronics, and construction industries. The shift towards more sustainable practices is also influencing the market, with increasing investments in bio-based phenol and advanced recycling technologies.

Additionally, the volatility in raw material prices, particularly benzene, presents ongoing challenges for phenol producers and consumers alike. Looking forward, the phenol market is expected to adapt and grow, influenced by both technological advancements and changing regulatory landscapes, underscoring its enduring importance in the global chemical industry.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)