Table of Contents

Introduction

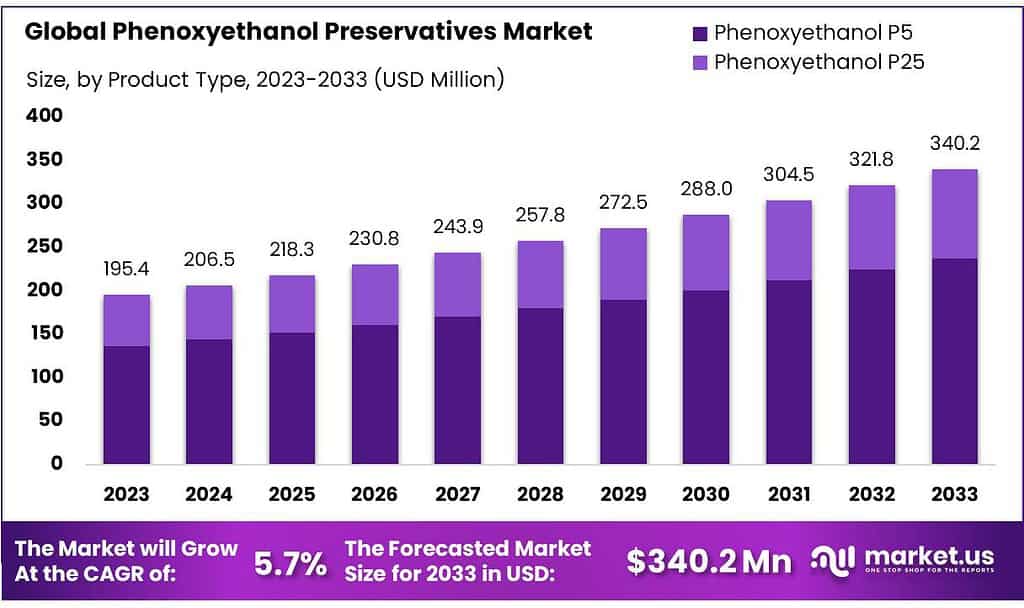

The Global Phenoxyethanol Preservatives Market, valued at USD 195.4 million in 2023, is anticipated to expand significantly, reaching approximately USD 340.2 million by 2033, with a Compound Annual Growth Rate (CAGR) of 5.7%. This growth is propelled by several factors, including increasing demand in the cosmetics industry due to phenoxyethanol’s efficacy as a preservative and its reputation for safety compared to parabens.

However, the market faces challenges such as stringent regulatory policies concerning the use of synthetic preservatives and growing consumer preference for natural alternatives. Recent developments have seen innovations in product formulation to enhance effectiveness and safety, aiming to comply with regulatory standards and consumer preferences. These dynamics are shaping the trajectory of the phenoxyethanol preservatives market, reflecting both its potential and the obstacles it must navigate.

BASF SE, a leading chemical company, has intensified its focus on sustainable solutions by launching a new range of phenoxyethanol preservatives that comply with global regulatory standards while maintaining high performance. This launch is a strategic move to capture a larger share of the market, especially in regions with strict environmental regulations.

Lanxess AG has expanded its operations through strategic acquisitions, most notably its recent purchase of a specialty chemicals plant in 2022 for $250 million. This acquisition is aimed at boosting its production capacity of phenoxyethanol and other biocidal products, thereby strengthening its global supply chain and market reach.

N.V. Organics Pvt. Ltd. has received significant investment, amounting to $50 million in 2023, to enhance its manufacturing capabilities and increase its export potential. This infusion of capital is expected to enable N.V. Organics to innovate further and tailor its offerings to meet the specific demands of various international markets.

Akema Fine Chemicals has been proactive in developing a new formulation of phenoxyethanol that boasts a lower environmental impact. Launched in early 2024, this product has been well-received in markets increasingly driven by eco-conscious consumers, demonstrating Akema’s commitment to innovation and sustainability.

Lonza Group, known for its rigorous research and development, has recently entered into a collaboration with a technology startup to develop a biodegradable variant of phenoxyethanol. This collaborative effort is part of Lonza’s strategy to lead in the eco-friendly segment of the market, appealing to a broader range of consumers seeking greener alternatives.

Key Takeaways

- Market Growth: The phenoxyethanol preservatives market to grow from USD 195.4 million in 2023 to USD 340.2 Million by 2033, at 5.7% CAGR.

- Asia Pacific leads with a 36.7% market share, valued at USD 71.7118 million, driven by robust manufacturing.

- By Product Type: Phenoxyethanol P5 held a dominant market position, capturing more than a 69.7% share.

- By Application: The Home & Personal Care sector held a dominant position in the Phenoxyethanol Preservatives Market, capturing more than a 41.2% share.

Phenoxyethanol Preservatives Market Statistics

- Commonly available pharmaceutical Octenisept, which is a mixture of 0.1% octenidine and 2% phenoxyethanol, was the cause of extensive peritonitis resulting from the rinsing with this antiseptic solution.

- For DMDM hydantoin it’s 0.6%, and this is the same for imidazolidinyl urea as well (0.6%).

- These ingredients are limited to 0.5% for leave-on products, 1.7% for oral products, and 2.5% for rinse-off products, and this is a combo of the two, in other words, the combined concentration cannot exceed those limits.

- According to the Cosmetic Ingredient Review (CIR), a limit of up to 0.4% (single paraben) or up to 0.8% (mixtures of parabens) can be added to cosmetic products.

- It is often combined with other preservatives to enhance its effectiveness and is generally used in concentrations below 1% in cosmetic formulations, as higher concentrations may pose health risks.

- This is particularly vital for products with a higher water content, which encompasses approximately 75-80% of cosmetic products.

- It is often used in concentrations of 0.5% to 2% as a preservative in a variety of products, including shampoos, lotions, creams, and makeup. However, its use is limited to products that have a pH below 5.5, as it is not effective at higher pH levels.

- Sustainable and eco-friendly cosmetics are on the rise, with an estimated 75% of consumers showing interest in products that use sustainable packaging.

- In 1970, the approximate percentage of naturally derived material (excluding water) in a typical cosmetic product was probably 50%, which included some animal-derived feedstock.

- In 2020, it was more likely to be 75% and this was wholly plant-based. There are several drivers for this trend.

- Regarding their potential to sensitize your skin, the statistics are as follows—between 0.5 and 1% in Europe, and 0.6 and 1.4% in the US.

- If you have 100 ml of tonic containing 0.1% phenoxyethanol and 250 ml serum containing 0.15% phenoxyethanol this is not 0.35% phenoxyethanol.

- The calculation shows that the total concentration is 0.13%, which means that the concentration increase is minimal.

- On average, American women use 12 beauty products a day that contain around 168 chemicals.

- American men use an average of 6 cosmetics that contain 85 different chemicals.

- 1 in 3 consumers don’t check the ingredients in their cosmetics before buying or using them.

- 46% of consumers who regularly wear makeup check the ingredients before purchasing.

- 55% of American women believe that the FDA regulates ingredients in cosmetics.

- 60% of consumers believe it is very important to tighten controls on chemicals used in cosmetics.

- 90% of consumers believe that cosmetic companies should have to alert the FDA if their product has been shown to cause harm.

- Some existing cosmetic brands are evolving in line with concerns, while newly emerging cosmetic brands are developing products with 100% naturally derived ingredients.

Emerging Trends

- Increased Use in Cosmetic Products: There’s a noticeable rise in using phenoxyethanol as a preservative in cosmetics. This trend is driven by its effectiveness and a general preference for parabens, which have faced scrutiny over potential health risks. Phenoxyethanol is valued for its stability and low irritation levels, making it a favorable choice for formulators.

- Regulatory Acceptance: Globally, phenoxyethanol is recognized and approved by major regulatory bodies like the U.S. Food and Drug Administration (FDA) and the European Union. Its acceptance in key markets helps maintain its demand, particularly in regions with strict cosmetic regulations.

- Natural and Clean Label Products: There is a growing demand for “clean label” beauty products, which are perceived as natural and free from harmful chemicals. This trend is influencing manufacturers to disclose more about their ingredients, including preservatives like phenoxyethanol. Although not a natural ingredient, phenoxyethanol is often considered safer and less harsh compared to traditional preservatives, aligning with the clean label movement.

- Innovation in Product Formulations: Manufacturers are innovating their formulations by combining phenoxyethanol with other preservatives to enhance efficacy and meet preservative standards without exceeding regulatory limits. Such combinations are tailored to prevent a wide range of microbial growth, thus broadening the applicability of phenoxyethanol in more product types.

- Expansion into Other Industries: Beyond cosmetics, phenoxyethanol is gaining traction in other sectors such as pharmaceuticals and home cleaning products. Its effectiveness and safety profile encourage its adoption across a diverse range of applications, potentially opening new market segments.

- Environmental and Safety Concerns: As with many chemicals, there is ongoing research and debate regarding the environmental impact and safety of phenoxyethanol. Some studies suggest potential adverse effects, which could lead to increased regulation or shifts in consumer preference. Market participants are closely monitoring these developments, as they could influence future trends and regulatory landscapes.

Use Cases

Personal Care and Cosmetics

- Market Share & Usage: Phenoxyethanol is widely used in the cosmetics industry due to its stability and efficacy as a preservative. It is found in approximately 20% of all cosmetic products globally.

- Applications: This preservative is commonly included in formulations for skin creams, sunscreens, and makeup products to prevent bacterial contamination and extend shelf life.

- Consumer Safety: Regulated by authorities like the FDA and the EU, the concentration of phenoxyethanol in cosmetic products is generally capped at 1%, ensuring safety for consumer use.

Pharmaceuticals

- Usage Statistics: In the pharmaceutical sector, phenoxyethanol is utilized in about 15% of topical medications.

- Role: It serves to maintain the sterility of medicinal creams, ointments, and various injectables, protecting them against microbial growth that could compromise their effectiveness and safety.

- Regulatory Compliance: Its use in pharmaceuticals is strictly monitored under pharmaceutical guidelines to prevent any adverse effects.

Home and Industrial Cleaning Products

- Market Penetration: Phenoxyethanol is found in around 10% of cleaning agents due to its antimicrobial properties.

- Functionality: It is used to inhibit the growth of microbes in detergents, sprays, and wipes, enhancing their shelf life and efficiency.

- Consumer Trends: There is a growing trend toward using safer and more sustainable chemicals, which has influenced the adoption rate of phenoxyethanol in this segment.

Food and Beverage Industry

- Limited Use: Its use in food products is less common, with an estimated inclusion in less than 5% of food preservatives.

- Specific Applications: Phenoxyethanol can be used in certain processed food items to prevent bacterial contamination during storage and transport.

- Regulations and Safety: The concentration levels and types of food products in which phenoxyethanol can be used are strictly regulated by food safety authorities globally.

Key Players Analysis

BASF SE has innovated in the windows sector by enhancing the properties of PVC-window profiles with their Ultradur® grade. This product allows for co-extrusion with PVC, yielding profiles that are lighter, cost-effective, and offer improved insulation compared to traditional steel-stiffened counterparts. This development not only supports better mechanical performance and energy efficiency but also contributes to sustainable building practices.

LANXESS AG, a prominent player in the specialty chemicals industry, has enhanced its position in the phenoxyethanol preservatives market, particularly within the cosmetics sector. The company offers a comprehensive portfolio, including Neolone PH 100, a high-quality phenoxyethanol product known for its excellent preservative properties across various personal care products. This product is part of a broader strategy to meet growing regulatory demands and customer needs for effective and stable preservative solutions.

N.V. Organics Pvt. Ltd., an Indian company with over two decades of experience, specializes in the distribution and technical support of cosmetic ingredients, including phenoxyethanol preservatives. They are recognized for their comprehensive application lab which supports the development of customized formulations for their clients, which enhances their product offerings in the preservatives market.

Akema Fine Chemicals, an Italian-based family-owned company since 1973, specializes in manufacturing phenoxyethanol-based preservatives, notably Kemaben 4, which is widely utilized in the cosmetics sector. This product offers broad-spectrum antimicrobial effectiveness, suitable for various cosmetic applications due to its stability across a broad pH range and high-temperature resistance. This preservative is renowned for its efficacy against both bacteria and fungi, making it a key component in global cosmetic preservation solutions.

Lonza Group has made a significant impact in the phenoxyethanol preservatives sector by focusing on innovative, sustainable preservation solutions, particularly for personal care products. Their approach includes a range of traditional and alternative preservative chemistries, catering to the evolving needs of global markets with a commitment to safety and environmental considerations.

Galaxy Surfactants Limited is recognized for its production of Phenoxyethanol, a preservative used widely in the cosmetics industry. This chemical is essential in skincare and other personal care products due to its efficacy in preventing microbial growth and maintaining product integrity. Galaxy Surfactants’ expertise in chemical production underpins their capability to meet the high safety and quality standards required in the sector.

Triveni Interchem Pvt. Ltd., established in 2010 in Gujarat, India, is a prominent manufacturer and supplier in the chemicals industry, offering a wide range of organic and inorganic chemicals, including phenoxyethanol. They serve various industrial sectors, highlighting their expertise in producing and supplying high-quality chemicals recognized for their reliability and effectiveness.

Clariant International Ltd., a leader in the cosmetic preservatives market, has developed Phenoxetol SG, a sustainable phenoxyethanol preservative derived from bio-based ethanol. This product, boasting a renewable carbon index of 25%, aligns with growing market demands for greener cosmetic solutions. It offers robust antimicrobial effectiveness while maintaining the chemical integrity of traditional phenoxyethanol, ensuring easy integration into existing formulations without extensive reformulation efforts.

Ashland Global Holdings Inc. develops and markets Optiphen™ and euxyl™ PE 9010, two broad-spectrum preservatives incorporating phenoxyethanol. These products are designed for optimal protection against microbial growth in various personal care applications, including skincare and haircare products. Ashland’s offerings are known for their compatibility with different pH levels and temperatures, making them highly effective for preserving product integrity and enhancing stability across a wide range of formulations.

Haihang Industry Co. Ltd. is actively engaged in the phenoxyethanol preservatives market, noted for its role in manufacturing the chemical 2-phenoxyethanol. This compound, primarily used as a preservative in cosmetics and pharmaceuticals, contributes to the company’s offerings in the market. Phenoxyethanol is recognized for its antimicrobial properties and is employed to extend the shelf life of various consumer products, particularly in the personal care and home cleaning sectors. As the demand for non-toxic preservatives like phenoxyethanol increases, Haihang Industry Co. Ltd. continues to play a significant role in supplying this essential ingredient.

Du Pont de Nemours Inc., a recognized leader in the global market, contributes significantly to the Phenoxyethanol Preservatives sector. Leveraging its broad technology-based material expertise, DuPont supports various industries, including personal care, which benefits directly from its contributions to Phenoxyethanol production. DuPont is poised for growth, emphasizing sustainability and innovation, which aligns with the growing demand for effective yet less toxic preservatives like Phenoxyethanol.

Symrise has developed a robust portfolio of phenoxyethanol-based preservatives under the SymOcide® brand, focusing on skin-safe and effective solutions for cosmetic formulations. These products, including SymOcide® PH and SymOcide® PS, provide broad-spectrum antimicrobial protection and are suited for various applications in cosmetics, ranging from shampoos to lotions, emphasizing ease of use and compatibility with different cosmetic ingredients.

The Dow Chemical Company is actively engaged in the Phenoxyethanol Preservatives market, particularly noted for their launch of the Neolone PH 100 preservative. This product is recognized for its broad-spectrum efficacy against bacteria, fungi, and yeast, and is versatile across various pH levels, which makes it suitable for a wide range of personal care products. The preservative’s attributes include being effective at low use levels and maintaining stability under different temperature conditions, which are critical factors for its adoption in the market.

Schülke & Mayr GmbH specializes in the production of euxyl® PE 9010, a phenoxyethanol-based preservative effective in a variety of cosmetic applications including creams, lotions, and shampoos. This product is known for its broad-spectrum antimicrobial properties, which protect against bacteria, yeast, and mold. The preservative is particularly noted for its enhanced performance in products containing natural ingredients, which are more susceptible to microbial growth. euxyl® PE 9010 is also part of a recycling program in Europe, emphasizing the company’s commitment to sustainability.

Conclusion

The market for phenoxyethanol preservatives is positioned for steady growth, driven by increasing demand across various industries such as cosmetics, pharmaceuticals, and household products. The compound’s efficacy as a preservative, coupled with its relatively low toxicity compared to other preservatives, makes it a preferred choice among manufacturers seeking to extend product shelf life while adhering to regulatory standards.

However, market expansion may be tempered by rising consumer preferences for natural preservatives and stricter regulatory scrutiny in certain regions. Companies in the phenoxyethanol preservatives market can capitalize on these trends by investing in research and development to enhance product effectiveness and safety, potentially expanding their market share in a competitive environment.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)