Table of Contents

Introduction

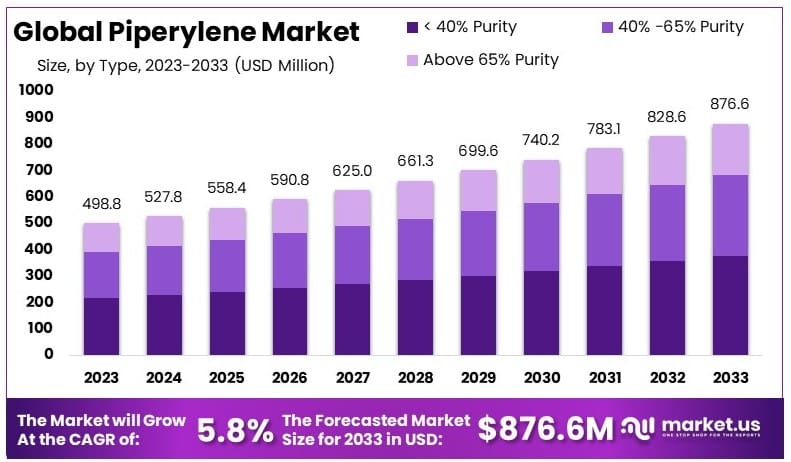

The Global Piperylene Market is poised for notable growth, projected to expand from USD 498.8 Million in 2023 to USD 876.6 Million by 2033, at a Compound Annual Growth Rate (CAGR) of 5.8% during the forecast period from 2024 to 2033. Piperylene, a valuable petrochemical used predominantly in the production of adhesives, paints, and rubber, is experiencing an upswing in demand driven by the burgeoning manufacturing and automotive industries.

However, the market faces challenges including stringent environmental regulations and the volatility of raw material prices, which could impede growth. Recent developments have seen advancements in production technologies and strategies to mitigate environmental impact, reflecting an industry adapting to regulatory pressures and market demands. These dynamics underscore the potential for robust market expansion tempered by significant operational challenges.

The piperylene market is currently experiencing significant activities involving key players such as Sinopec, Formosa Chemical, Zeon, and LOTTE Chemical. Each company is actively pursuing strategies to strengthen its market position through various initiatives.

Sinopec is expanding its operational capacity with a major investment in the Luoyang ethylene project, which is part of their strategy to reduce dependency on imported refined products. This expansion is a clear indicator of Sinopec’s commitment to enhancing its production capabilities and market reach.

Formosa Chemicals is not specifically mentioned in the recent developments, but being a major player, it continues to influence the market dynamics significantly, likely focusing on technological advancements and expanding its product portfolio to meet the global demand.

Zeon Corporation has made strides in optimizing production processes and focusing on specialty products to cater to diverse industrial applications. This approach helps in maintaining a competitive edge in the highly volatile chemical market.

LOTTE Chemical has been focusing on increasing its production efficiency and capacity. The company is also expanding its global footprint by investing in new markets and enhancing its technological capabilities to support sustainable growth.

These key players are navigating the complex market landscape by investing in new technologies, expanding into new territories, and enhancing their production capabilities to meet the growing global demand and regulatory requirements.

Key Takeaways

- Market Value: The Piperylene Market was valued at USD 498.8 million in 2023, and is expected to reach USD 876.6 million by 2033, with a CAGR of 5.8%.

- By Purity Analysis: The < 40% Purity category led with 43.9%, widely used due to its cost-effectiveness in bulk applications.

- By Application Analysis: Adhesives were the most significant application at 45.9%, essential for their role in diverse industrial processes.

- Dominant Region: North America dominated with 37.9% of the market, supported by robust industrial and manufacturing sectors.

- Analyst Viewpoint: The market is witnessing dynamic growth driven by advancements in chemical processing and increasing demand from the adhesives sector.

Piperylene Statistics

- Piperylene is also known as 1,3 Pentadiene and has the chemical formula C5H8.

- Commercial piperylene has a purity of about 75%.

- Piperylene (75%) is classified as hazardous to health under the Globally Harmonized System as a potential carcinogen and mutagen.

- Piperylene Sulfone undergoes a reversible retrocheletropic reaction at 110°C, allowing for facile solvent removal and recycling.

- Piperylene concentrate is a complex mixture of 5-carbon unsaturated hydrocarbons obtained as a by-product when naphtha or gas oils are cracked.

- The maximum amount of trans-1,3-pentadiene obtained through iodine catalysis was 70%, compared to 51% in the original piperylene concentrate.

- The recovery rate of the product using iodine catalysis was 90%, with the remainder being diiodo compounds and polymer.

- Large quantities of PS (200-500 mL) were synthesized from piperylene (cis-and trans-mixture) and sulfur dioxide using 8-anilino-1-naphthalenesulfonic acid hemi-magnesium salt as a polymerization inhibitor.

- Asia, particularly China, Japan, and South Korea, produces over 50% of the world’s piperylene.

Emerging Trends

- Increased Demand in Adhesives Production: Piperylene, a key component in manufacturing adhesives, is seeing a surge in demand due to the expanding global packaging and automotive industries. Manufacturers are leveraging piperylene’s properties to develop stronger, more reliable adhesives, which are crucial for various applications, including packaging tapes and automotive assembly.

- Growth in the Paints and Coatings Industry: The paints and coatings industry is increasingly incorporating piperylene to enhance the properties of alkyd resins. Piperylene-based resins offer improved adhesion, flexibility, and resistance to harsh weather conditions, driving their popularity in both residential and industrial applications.

- Bio-based Piperylene Development: There is a notable shift towards sustainable production processes, with significant investments directed towards developing bio-based piperylene. This trend is fueled by growing environmental concerns and stringent regulations regarding petrochemical derivatives, pushing the market towards greener alternatives.

- Expansion in Asian Markets: Asia is emerging as a central hub for piperylene production due to rapid industrial growth, especially in countries like China and India. The region’s robust expansion in chemical manufacturing and automotive sectors is propelling the demand for piperylene, positioning Asia as a key player in the global market.

- Technological Advancements in Production: Technological innovations are enabling more efficient and cost-effective piperylene production processes. These advancements are not only enhancing the yield and purity of piperylene but are also minimizing the environmental impact associated with its production.

- Fluctuations in Raw Material Supply: The piperylene market is experiencing volatility in raw material supply, particularly from the petroleum industry. This fluctuation affects piperylene price and availability, prompting companies to explore alternative sources and hedging strategies to manage risks associated with raw material procurement.

- Integration of Piperylene in High-performance Polymers: The demand for high-performance polymers is driving the integration of piperylene in their production. Piperylene is being used to modify properties of polymers, making them more suitable for advanced applications in aerospace, electronics, and automotive industries, where material performance is critical.

Use Cases

- Adhesive Production: Piperylene is extensively used in manufacturing various adhesives due to its excellent tackifying properties. These adhesives are employed in numerous industries, including packaging, woodworking, and automotive, where strong, durable bonds are essential for product integrity and performance.

- Paints and Coatings: In the paints and coatings sector, piperylene enhances the performance of alkyd resins, which are key components in producing high-quality paints. This application ensures better adhesion, weather resistance, and durability of the coatings, making them ideal for both indoor and outdoor use.

- Rubber Manufacturing: Piperylene serves as a co-monomer in the production of synthetic rubbers. It is particularly valued in the automotive industry for manufacturing tires and other rubber components, which require materials that withstand various temperatures and mechanical stress.

- Plastic Modifiers: Piperylene is utilized to modify plastics, improving their flexibility and impact resistance. This is crucial in industries that require durable plastic materials, such as consumer electronics, automotive, and construction.

- Printing Inks: Due to its solvent properties, piperylene is used in formulating printing inks. It helps in achieving the desired viscosity and drying characteristics, which are critical factors in printing processes, especially in high-speed printing operations.

- Perfume Fixatives: Piperylene derivatives are used as fixatives in perfumes to enhance the longevity of the scent. This application is significant in the cosmetics industry, where the lasting power of a fragrance can be a key factor in consumer satisfaction.

- Agricultural Chemicals: In agriculture, piperylene derivatives are used to produce pesticides and herbicides. These chemicals help in controlling pests and weeds, ensuring crop protection and yield enhancement, which is vital for meeting the growing global food demand.

Major Challenges

- Volatility of Raw Material Prices: Piperylene is primarily derived from crude oil, making its market susceptible to fluctuations in oil prices. This volatility can lead to unpredictable costs and challenges in budgeting and financial planning for manufacturers who rely on stable input costs to maintain profitability.

- Regulatory Compliance: The production and use of piperylene are subject to stringent environmental regulations aimed at reducing chemical emissions and promoting sustainability. Complying with these evolving standards can be costly and complex, requiring significant investment in cleaner production technologies and practices.

- Supply Chain Disruptions: Piperylene’s supply chain is vulnerable to disruptions caused by geopolitical tensions, trade disputes, or natural disasters. These disruptions can impede the availability of piperylene, affecting the entire production schedule and delivery of end products to consumers.

- Competition from Alternative Materials: The market is seeing a rise in the development and use of alternative materials that can perform similar functions as piperylene but with potentially lower environmental impacts or costs. This competition threatens piperylene’s market share and pressures producers to innovate and improve their offerings.

- Technological Advancements and Adoption: Keeping pace with technological advancements in chemical processing can be a challenge for piperylene producers. Investing in new technologies to enhance efficiency and reduce waste requires capital and expertise, which may not be readily available to all firms in the industry.

Growth Opportunities

- Expansion into Emerging Markets: With industrial growth in regions like Asia and Africa, piperylene producers have opportunities to tap into new markets. These regions are experiencing rapid development in automotive, construction, and packaging industries, all of which are significant consumers of piperylene-based products.

- Innovation in Bio-based Alternatives: As environmental concerns increase, there is a growing demand for sustainable chemical products. Piperylene producers can invest in developing bio-based piperylene to meet these eco-friendly standards, which not only aligns with global sustainability trends but also opens up new consumer bases.

- Enhanced Recycling Technologies: Investing in technologies that enhance the recyclability of piperylene-containing products could open new avenues for growth. Such technologies can make it easier to reclaim and reuse piperylene from end-products, reducing waste and production costs while appealing to environmentally conscious consumers.

- Collaborations and Partnerships: Forming strategic partnerships with downstream industries like adhesives, paints, and coatings can provide stable outlets for piperylene. These partnerships could involve collaborative product development, tailored to create innovative solutions that enhance the performance and appeal of end-products.

- Diversification into High-performance Applications: There is an opportunity for piperylene to be used in high-performance materials for sectors such as aerospace, electronics, and advanced automotive applications. Developing products that meet these high standards of durability and performance can lead to higher profit margins and strengthened market position.

Key Players Analysis

Sinopec has made notable strides in the piperylene sector, focusing on enhancing its production capabilities and market presence. In 2023, Sinopec completed the Kuqa green hydrogen project in Xinjiang, transmitting significant volumes of green hydrogen to its Tahe Refining & Chemical Company. The company’s total revenue for 2023 stood at $473.53 billion, reflecting its substantial market influence.

Formosa Chemicals & Fibre Corporation reported a consolidated operating revenue increase in November 2023, highlighting its robust performance in the piperylene market. The company’s strategic focus on expanding its product portfolio and market reach has reinforced its position in the global market.

Zeon Corporation has been actively expanding its piperylene business, leveraging its advanced chemical manufacturing capabilities. In 2023, Zeon reported significant revenue growth and emphasized innovations in piperylene-derived products, particularly in adhesives and synthetic rubber applications. The company’s financial results for FY2023 indicated a robust performance, driven by increased demand and strategic market expansions.

LOTTE Chemical has strengthened its presence in the piperylene market through strategic investments and innovations. Recently, the company announced enhancements to its production facilities to meet growing demand for high-purity piperylene used in adhesives and sealants. LOTTE Chemical’s financial results for 2023 reflect substantial revenue growth, reinforcing its competitive position in the global chemical industry.

Eastman Chemical Company has focused on enhancing its piperylene production and sustainability efforts. In 2023, the company reported $9.21 billion in revenue and completed the divestiture of its Texas City Operations for $490 million. Eastman introduced plastic waste into its Kingsport methanolysis facility, aligning with its circular economy goals. The company expects significant contributions from this facility, reinforcing its strong market position.

LyondellBasell Industries reported a 2023 revenue of $41.11 billion, reflecting an 18.52% decrease from 2022. Despite this, the company continues to innovate, focusing on sustainable solutions and expanding its core businesses. Recent strategic moves include a 35% stake acquisition in Saudi Arabia’s NATPET, enhancing their polypropylene business. The company also expanded its Southeast European distribution hub, improving customer service.

Mitsui & Co. has been active in the piperylene market, emphasizing its commitment to sustainable and advanced materials. Recent developments include strategic investments and partnerships to bolster its production capabilities and market reach. The company’s focus on innovation and sustainability continues to drive its growth in the chemical sector.

Shell has focused on enhancing its energy transition strategy, investing $5.6 billion in low-carbon energy solutions in 2023. The company aims to invest between $10-15 billion by 2025 to support its net-zero emissions target by 2050. Shell’s revenue for 2023 was $316.62 billion, with significant investments in electric-vehicle charging, biofuels, renewable power, hydrogen, and carbon capture and storage.

Ningbo Jinhai Chenguang Chemical has been actively enhancing its piperylene production capabilities, focusing on expanding its market reach. The company reported notable improvements in its production efficiency and market share in 2023, reflecting a strategic emphasis on innovation and sustainable practices in the chemical industry.

Braskem has maintained a strong position in the piperylene market by focusing on sustainable development and expanding its product portfolio. The company’s recent financial performance indicates steady revenue growth, driven by strategic investments in advanced materials and sustainable technologies. Braskem continues to prioritize environmental sustainability, aligning with global market trends.

Shandong Yuhuang Chemical has significantly bolstered its position in the piperylene market by focusing on expanding production and improving efficiency. The company reported strong revenue growth in 2023, attributed to its innovative approaches and strategic investments in high-purity piperylene production. This focus has allowed Shandong Yuhuang Chemical to capture a substantial market share and enhance its competitive edge in the global market.

YNCC (Yeochun NCC) has been enhancing its piperylene production capabilities, reflecting robust financial performance in 2023. The company’s strategic initiatives in the chemical sector, including modernization of facilities and increased production capacity, have strengthened its market position. YNCC’s emphasis on high-purity piperylene has driven its revenue growth and market share expansion.

Nanjing Yuangang Chemical has maintained a strong presence in the piperylene market through continuous innovation and strategic investments. The company reported notable improvements in production efficiency and market reach in 2023. By focusing on sustainable practices and advanced chemical manufacturing technologies, Nanjing Yuangang has reinforced its competitive position in the industry.

Conclusion

In conclusion, the piperylene market presents a dynamic landscape marked by both challenges and substantial growth opportunities. While it faces obstacles such as raw material price volatility, stringent regulatory demands, and competitive pressures from alternative materials, the potential for expansion into emerging markets, development of sustainable bio-based products, and advancements in recycling technologies offer promising avenues for growth.

Strategic investments in technology and collaborations could further enhance the market position of piperylene producers. By navigating these complexities with innovation and adaptability, the industry can look forward to sustained growth and profitability.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)