Table of Contents

Introduction

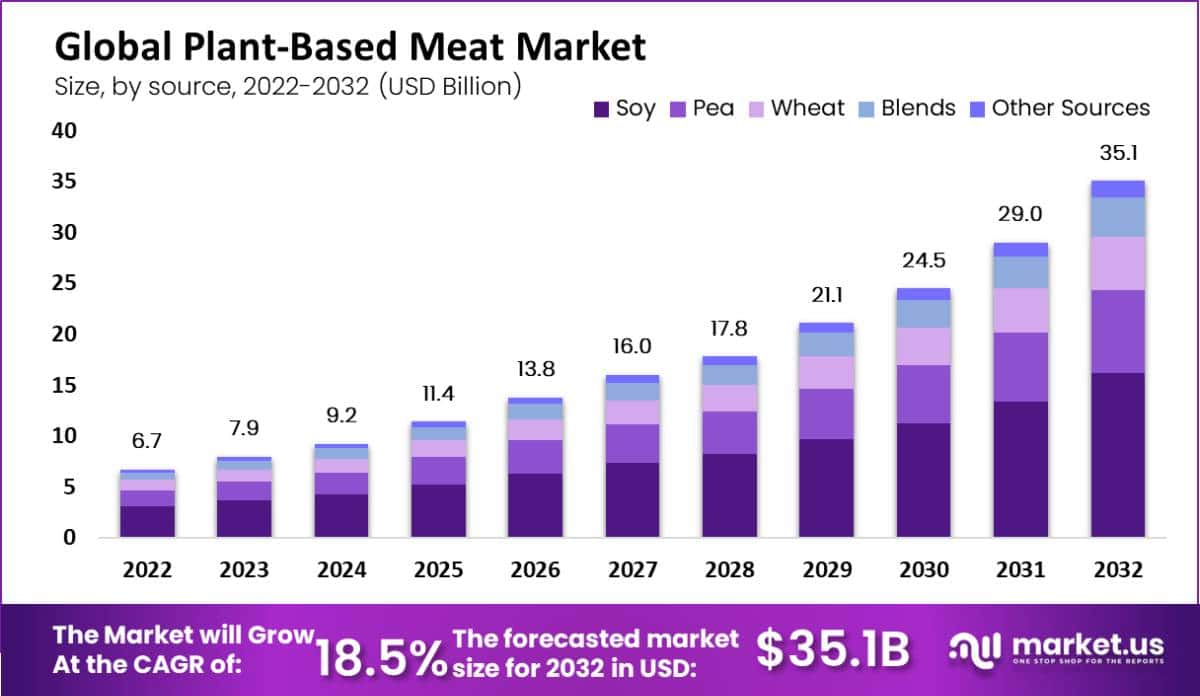

The global plant-based meat market is poised for substantial growth, expected to surge from USD 6.7 billion in 2022 to USD 35.1 billion by 2032, with a CAGR of 18.5% during the forecast period from 2024 to 2033. This rapid expansion is driven by increasing consumer awareness of health and environmental benefits associated with plant-based diets, alongside advancements in food technologies that improve taste and texture.

However, the sector faces several challenges. Key among them is the need for ongoing innovation to enhance product quality and overcome consumer skepticism regarding taste and price. Despite these challenges, the market continues to evolve dynamically with significant investments in new product development and marketing strategies to increase consumer acceptance and expand market reach.

Recent developments in the industry include introducing a variety of new products that mimic traditional meat in flavor and texture, broadening the range of options available to consumers. Companies also focus on strategic partnerships to expand their distribution networks and increase market penetration.

Beyond Meat Inc. has been focusing on expanding its product range and distribution. The company has launched several new products and partnered with major brands and food service outlets to make its products more accessible globally.

Impossible Foods Inc. has made significant strides in expanding its retail presence and launching new products. Notably, Starbucks introduced the Impossible Breakfast Sandwich as part of its sustainability initiative, which has been well-received in the U.S. market.

Overall, the plant-based meat market is characterized by its rapid growth and the continuous evolution of products that are increasingly aligned with consumer preferences for healthier and more sustainable dietary choices.

Key Takeaways

- The global plant-based meat market soared to USD 6.7 billion by 2032, showcasing a robust CAGR of 18.5% from 2023.

- Market segmentation reveals soy-based meats dominated revenue, contributing 46% as of 2022.

- Plant-based chicken led the product types with a 35% market share in 2022, underscoring its popularity.

- Beyond Burgers are highlighted for containing 35% less fat than traditional meat burgers, with reduced cholesterol levels.

- Storage options for plant-based meats include refrigerated, frozen, and shelf-stable, with frozen options leading with a 55% revenue share in 2022.

- North America led the market with 38.5% revenue share by revenue generation in 2022.

Plant-Based Meat Statistics

- Over 15-20% of global methane gas emissions are from animal farming.

- In some regions, animal excrement exceeds human waste by 130 times.

- Sales of plant-based meat products in the US surpassed $900 million in 2019, doubling in 2020, driven by health, environmental, and ethical concerns.

- Volume sales of refrigerated plant-based meats down 11.6% over the past year.

- Beyond Meat laid off 200 people, accounting for 19% of its workforce.

- Plant-based meat category saw volumes decline for 22 consecutive months.

- Plant-based meat uses 47% less land than conventional meat.

- Plant-based meat emits up to 90% fewer greenhouse gases than conventional meat.

- Plant-based meat uses up to 99% less water than conventional meat.

- Plant-based meat causes up to 91% less aquatic nutrient pollution than conventional meat.

- Beyond Meat shares fell by 30.5% in Q2 2023, with revenue dropping by USD 44.9 million in the US.

- Plant-based meats are 20% pricier than conventional meat, impacting consumer choice.

- 25% of US consumers on SNAP benefits resort to cheaper food options.

- Plant-based milk market surged in 2023, reaching 44% US household penetration, up by 10%.

- Predictions indicate the plant milk market will surpass $17 billion by 2026, from $12 billion in 2019.

- North American dairy-free milk market alone valued over $6 billion.

- Calories: Plant-based meat (250 kcal) vs. Animal meat (220 kcal).

- Cholesterol: Plant-based meat (0 mg) vs. Animal meat (60 mg).

- Sodium: Plant-based meat (370 mg) vs. Animal meat (70 mg).

- Protein: Animal meat (23 g) vs. Plant-based meat (19 g).

Emerging Trends

- Whole Foods and Simple Ingredients: The trend towards whole foods and less processed options is growing. Consumers are increasingly seeking plant-based foods that use simple, recognizable ingredients. This shift is partly driven by a consumer preference for foods perceived as more natural and wholesome.

- Taste and Texture Innovations: There’s a significant push to improve the taste and texture of plant-based meats to mimic their animal-based counterparts better. This includes using advanced technology and new ingredients to enhance flavor profiles and mouthfeel, making these products more appealing to a broader audience.

- Expansion in Food Service and Institutional Settings: Plant-based meats are expanding beyond retail, growing their presence in food service sectors such as schools, corporate cafeterias, and healthcare facilities. This expansion is supported by the nutritional benefits and the dietary diversity these products offer, catering to varied eating preferences in these settings.

- Sustainable and Ethical Production: Sustainability continues to be a major driving force in the industry. There is a growing emphasis on products that are plant-based and produced in ways that minimize environmental impact. This includes the use of regenerative agriculture practices and sustainable packaging solutions.

- Diversified Protein Sources: The market is seeing an introduction of diverse protein sources in plant-based meats, moving beyond soy and pea protein to include ingredients like mushrooms, legumes, and novel plant proteins. These cater to consumer desires for variety and help address nutritional profiles and sustainability concerns.

Use Cases

- Food Service and Retail: Plant-based meats are increasingly prominent in food service sectors, including restaurants, schools, and hospitals. This is due to their nutritional benefits and ability to cater to diverse dietary preferences. For example, schools are incorporating plant-based options to provide more dietary choices and align with healthier meal programs.

- Consumer Products: There’s a significant trend towards incorporating plant-based meats into everyday consumer products. Supermarkets and online retailers are expanding their plant-based offerings to include a wide range of products like burgers, sausages, and ready-to-eat meals. This expansion is supported by the consumer’s growing preference for products that are perceived as healthier and more sustainable.

- Innovative Dining Experiences: In the culinary world, chefs and food innovators are using plant-based meats to create sophisticated and novel dining experiences. This includes high-end restaurants offering gourmet plant-based dishes that cater to both vegetarians and flexitarians looking for sustainable dining options without compromising on taste or texture.

- Sustainability Initiatives: Companies are also leveraging plant-based meats in sustainability initiatives, aiming to reduce the environmental impact of food production. This aligns with global efforts to decrease greenhouse gas emissions and land use compared to traditional animal farming methods.

Key Players Analysis

Beyond Meat Inc. has firmly positioned itself as a leader in the plant-based meat sector by offering a wide range of products designed to mimic the taste and texture of animal meat. Known for its partnerships with major brands like McDonald’s and PepsiCo, Beyond Meat focuses on innovation and sustainability. Their products, such as the Beyond Burger and Beyond Sausage, are crafted to appeal to both vegetarians and meat-eaters looking for healthier and more sustainable food options. Beyond Meat’s products are available in numerous countries, reflecting their global reach and influence in the plant-based food industry.

Impossible Foods Inc. has made significant inroads in the plant-based meat market with its famous Impossible Burger, which closely resembles traditional beef. The company’s offerings are part of a broader strategy to replace animal-based foods with plant-based alternatives across various food categories. Impossible Foods targets not only vegetarians and vegans but also meat-eaters by creating products that mimic the sensory qualities of meat, aiming to reduce the environmental impact of food production. Their products have been adopted by several major food chains, indicating their strong presence and acceptance in the mainstream market.

Maple Leaf Foods Inc. has strategically expanded into the plant-based meat sector, owning brands like Field Roast and Lightlife. Although they initially witnessed rapid growth, recent years have seen a leveling off in sales, leading to a strategic pivot towards seeking profitability within this market segment. The company’s focus is on adjusting its product mix and enhancing distribution channels to stabilize and grow its market share within the plant-based category, despite facing challenges in consumer retention and market saturation.

Vegetarian Butcher is renowned for its innovative approach to plant-based meats, offering a wide range of products that mimic the taste and texture of animal meats. As a part of Unilever, Vegetarian Butcher has benefited from substantial distribution networks and marketing prowess, helping it expand rapidly across various markets. The brand focuses on using non-GMO ingredients to create products that appeal not only to vegetarians and vegans but also to meat-eaters looking to reduce their meat consumption, aligning with current trends towards healthier and more sustainable diets.

Conagra Inc. has significantly expanded its presence in the plant-based meat sector through its Gardein brand, which it acquired in 2018. Gardein has successfully captured a diverse consumer base by not just appealing to vegans and vegetarians but also attracting flexitarians with products that closely mimic meat. This strategy reflects in their innovative product range that includes everything from plant-based chicken and beef alternatives to sausages and meatballs. Conagra has been focusing on integrating these plant-based options into broader food categories like soups and frozen meals, underscoring their commitment to making plant-based eating accessible and enjoyable across various meal types. This approach has helped them tap into a growing market, positioning them to capitalize on a projected significant growth in the plant-based foods sector over the next decade.

Kellogg NA Co., through its MorningStar Farms and Incogmeato brands, has been actively expanding its footprint in the plant-based meat sector. The company has introduced a range of products including plant-based Chik’n Tenders and various other meat alternatives designed to cater to both the retail and foodservice markets. These products aim to replicate the taste and texture of meat, appealing to a broad consumer base including flexitarians. Despite a general slowdown in the category growth, Kellogg continues to innovate and push forward in the plant-based space, seeing it as a significant long-term opportunity.

Marlow Foods Ltd., trading as Quorn Foods, is a prominent player in the plant-based meat sector, known for its innovative use of mycoprotein derived from fungi. As a pioneer in meat alternatives, Quorn offers a variety of products designed to meet the growing demand for sustainable and nutritious food options. The company focuses on expanding its R&D capabilities and production capacity to meet global demands, particularly in the U.S. and Europe. Recent strategic moves include supplying mycoprotein to other manufacturers, like Tempty Foods, to create diverse plant-based products that emphasize taste and nutrition over meat imitation. This approach not only enhances Marlow Foods’ market presence but also aligns with broader environmental goals by offering products that use significantly less land, water, and carbon emissions compared to traditional meat.

Amy’s Kitchen Inc. has made a significant mark in the plant-based meat sector by focusing on producing a wide variety of plant-based meals that cater to the increasing consumer demand for healthier and sustainable food options. Their range includes plant-based burgers and sausages designed to replicate the sensory experience of meat, leveraging their commitment to organic and non-GMO ingredients. The company’s strategy includes expanding product offerings to meet diverse consumer needs, emphasizing the health benefits associated with plant-based diets. Amy’s Kitchen continues to grow its presence in the market by innovating and providing high-quality, convenient, and tasty food solutions for vegetarians, vegans, and flexitarians alike.

Tofurky, a well-established brand in the plant-based meat sector, has continued to make strides with innovative product offerings and strategic business moves. Following its acquisition by Morinaga Nutritional Foods, Tofurky has leveraged the partnership to enhance its operational efficiencies and broaden its product range. This includes exploring new flavor profiles and formulations in traditional strongholds like deli slices and introducing new products like plant-based cheeses and desserts under the Moocho brand. Despite challenges such as market saturation and competitive pressures from larger corporations, Tofurky has maintained a growth trajectory, emphasizing its quirky brand identity and diversified product lineup, which ranges from plant-based deli slices to tempeh and sausages.

Gold&Green Foods Ltd., founded in Helsinki in 2015, has become a notable player in the plant-based meat sector. The company is distinguished by its innovative use of Nordic oats and legumes to create unique plant-based products like their signature Pulled Oats®. Gold&Green focuses on clean, sustainable food production, leveraging their expertise to develop versatile plant-based protein granules and flakes that can be used in a variety of food products. These ingredients are designed to enhance the nutritional value and flavor of everything from burgers and balls to bakery and dairy alternative products. The company’s commitment to healthy, environmentally friendly ingredients resonates well with the increasing consumer demand for sustainable and nutritious food solutions.

Dr. Praeger’s Sensible Foods has established itself as a leader in the plant-based meat sector by focusing on nutritious, veggie-forward frozen foods. Founded by cardiologists, the company emphasizes health and convenience in its product offerings, which include a wide range of veggie burgers and other plant-based alternatives. Their products, such as the Perfect Turk’y Burger and various veggie littles, cater to both health-conscious individuals and those seeking meat alternatives that closely mimic traditional meat flavors and textures. Recently, Dr. Praeger’s has expanded its product line at Whole Foods, introducing innovative items like the Cauliflower Veggie Burger and Perfect Burger, both of which are designed to offer delicious and nutritious options to consumers looking for plant-based foods.

VBites Foods Ltd. has positioned itself as a trailblazer in the plant-based meat sector, focusing on a wide range of vegan alternatives to traditional meats, including products like faux fish, chicken, and beef. They aim to cater to a global audience with their diverse offerings, providing plant-based solutions that maintain the flavors consumers expect from their meaty counterparts. VBites emphasizes sustainable practices and the ethical benefits of vegan food, striving to appeal to both vegetarians and meat-eaters looking to reduce their meat consumption.

LikeMeat GmbH, a part of the LIVEKINDLY collective, has been expanding its reach in the plant-based meat industry, especially in Europe. The company focuses on creating plant-based products that mimic the taste and texture of meat, catering to a growing demographic that values both the ethical and health aspects of their diet. LikeMeat offers a variety of products, including plant-based chicken and sausages, designed to meet consumer demands for food that is both delicious and sustainable. Their approach combines taste satisfaction with environmental consciousness, aiming to lead in the plant-based meat market across Europe.

Lightlife Foods Inc. has been a pioneer in the plant-based meat sector for over 40 years, consistently evolving to meet consumer demands for healthier and more sustainable food choices. Lightlife offers a broad range of products, including burgers, sausages, and tempeh, focusing on simple, clean ingredients. They have recently revamped their product line, enhancing flavor and nutritional content to appeal to both longtime vegetarians and the growing flexitarian market. Their offerings are widely available in major retail outlets across North America, underscoring their market presence and commitment to expanding plant-based food options.

Trader Joe’s does not specifically produce its own plant-based meats but is well-regarded for its diverse and frequently updated selection of plant-based products sourced from various suppliers. The store offers a range of affordable and accessible options, including exclusive Trader Joe’s branded items. This makes Trader Joe’s a popular destination for consumers looking to explore plant-based diets without committing to more expensive specialty items. Their approach to stocking innovative and culturally diverse food products caters well to the dietary preferences and curiosities of their customer base, particularly those interested in vegetarian and vegan lifestyles.

The Hain-Celestial Canada ULC is actively engaging in the plant-based meat sector, leveraging its well-known brands such as Yves Veggie Cuisine to cater to the growing demand for vegetarian and vegan meat alternatives. The company’s products are known for their quality and variety, offering everything from veggie dogs to meatless deli slices, which appeal to both health-conscious consumers and those seeking sustainable food options. The Hain-Celestial’s commitment to expanding its plant-based offerings aligns with current market trends that prioritize health, sustainability, and ethical considerations in food production.

Marlow Foods Ltd., trading under the name Quorn Foods, continues to be a significant player in the plant-based meat industry. The company specializes in mycoprotein-based products, which are used to create a variety of meat alternatives such as burgers, sausages, and more. Marlow Foods focuses on sustainability and health, promoting products that are not only meat-free but also have a lower environmental impact compared to traditional meat. Their approach includes using innovative techniques to enhance the flavor and texture of their products, making them appealing to a broad consumer base looking for healthier dietary options.

No Evil Foods is a pioneering brand in the plant-based meat industry, known for its commitment to sustainability and ethical food production. Starting from a farmers’ market, No Evil Foods now offers a range of meat alternatives that are notable for their minimal, clean ingredients. Their products, including plant-based chicken and sausages, cater to consumers looking for health-conscious food options that don’t compromise on taste. The company is also recognized for its environmental efforts, being the first Plastic Negative Certified plant-based meat company, demonstrating its commitment to reducing plastic waste and promoting a more sustainable food system .

Conclusion

The plant-based meat sector is rapidly transforming the food industry landscape, reflecting a significant shift towards more sustainable and health-conscious dietary choices. Driven by increasing consumer awareness of environmental issues, health benefits, and animal welfare, the market has experienced robust growth, with a diverse range of products now available that cater to varying consumer preferences. Innovations in taste and texture, alongside expanding availability across retail and food service sectors, are key factors fueling this growth. As technology advances and consumer demand for environmentally friendly and healthy alternatives rises, plant-based meats are poised to continue their trajectory towards becoming a mainstream food option, offering a viable and sustainable alternative to traditional animal meats.