Table of Contents

Introduction

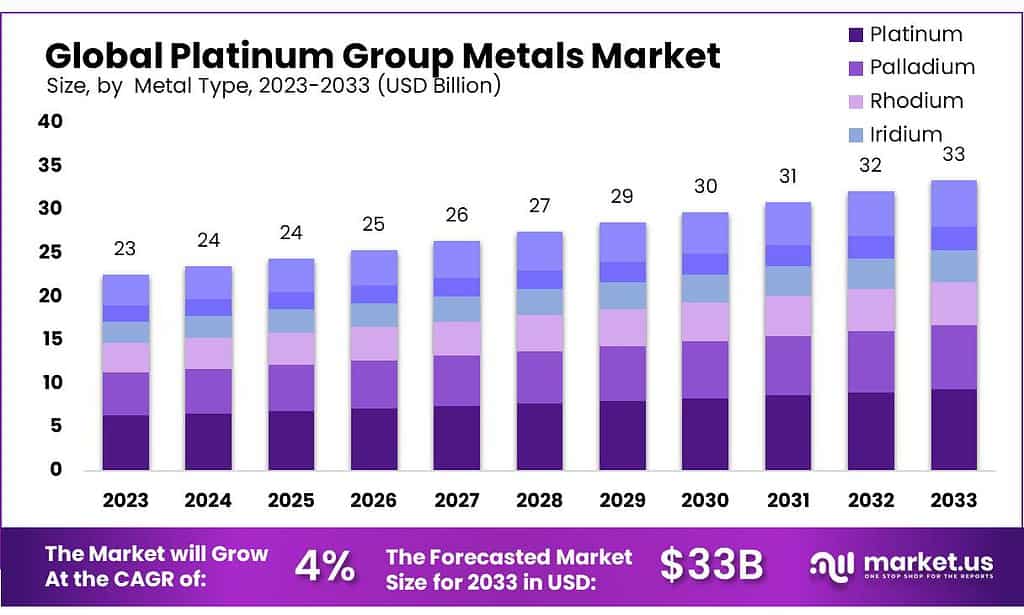

The Global Platinum Group Metals Market is poised for steady growth over the next decade, anticipated to increase from USD 23 billion in 2023 to USD 33 billion by 2033, at a CAGR of 4.0%. This sector, crucial for its diverse industrial applications, faces dynamic shifts driven by several growth factors, challenges, and recent developments.

Significant growth drivers include the escalating demand from the automotive industry for autocatalysts, vital for reducing emissions, and increasing utilization in the electronics sector for components like electrodes in devices. Additionally, the jewelry market, particularly in Asia-Pacific regions, continues to consume a considerable volume of these metals, supporting market expansion.

However, the market faces challenges such as the high costs of production and maintenance, which can hinder growth. The sustainability of supply chains and the high volatility in prices also pose substantial risks to steady market growth.

Recent developments highlight the market’s adaptability and potential for innovation. For instance, key players like Sibanye-Stillwater are expanding their recycling capabilities to include green precious metals, while Anglo-American collaborations aim to boost the use of these metals in green hydrogen and fuel-cell electric vehicles. Such initiatives not only enhance operational capabilities but also align with global pushes toward decarbonization and sustainable practices.

African Rainbow Minerals recently expanded its footprint in the platinum sector by acquiring the Bokoni platinum mine in South Africa for $221 million, gaining majority control and enhancing its resource base. ANGLO AMERICAN PLATINUM LIMITED has been active in forming strategic partnerships aimed at broadening the application of PGMs in emerging technologies such as fuel cell electric vehicles (FCEVs). These initiatives are part of their broader strategy to leverage their extensive PGM resources.

Key Takeaways

- Market Growth Projection: The PGMs market to reach USD 33 billion by 2033, with a 4.0% CAGR from 2023, reflecting steady expansion.

- Platinum Dominance: Platinum holds a 31.3% market share in 2023, favored for automotive and jewelry applications.

- Palladium Significance: Palladium’s demand for catalytic converters drives market share, particularly in gasoline vehicles.

- Auto Catalysts Demand: Auto catalysts claim over 26.2% market share in 2023, crucial for emissions control.

- Russia is the world’s largest producer of palladium, accounting for approximately 40% of global production.

- South Africa and Russia together account for over 90% of the world’s rhodium production.

Platinum Group Metals Statistics

- Separation techniques isolate the platinum-group elements from base metals, yielding a concentrate with around 60% platinum-group elements.

- Refining this concentrate achieves individual platinum-group metals with purities exceeding 99.9%.

- Total world production of platinum-group metals (PGMs) in 2022: 224 metric tons.

- Leading producer of PGMs in 2022: South Africa, accounting for 75% of global output.

- U.S. production of PGMs in 2022: 3 metric tons, mainly from recycling of spent autocatalysts.

- Recycling rate of PGMs in the United States: Approximately 30%.

- Platinum Group Metals Ltd (PLG) stock price closed at $1.670 on May 22, 2024.

- After hours trading saw a slight increase to $1.689, marking a 1.132% rise.

- PLG’s stock experienced a day’s range between $1.660 and $1.840.

- Its 52-week range spans from $0.942 to $2.070.

- Average volume over the past three months stands at 388,393 shares.

- PLG’s market capitalization is $172.91 million.

- The company reported a 11.33% increase in stock value over the past year.

- PLG holds 50.02% interest in the Waterberg project in South Africa.

- Platinum Group Metals Ltd was founded in 2000 and is headquartered in Vancouver, Canada.

Emerging Trends

- Increased Use in Automotive Catalysts: PGMs, particularly palladium and rhodium, are increasingly used in autocatalysts to meet stringent global emission standards. This is particularly significant in gasoline-powered vehicles where these metals help reduce harmful emissions.

- Adoption in Fuel Cell Technology: Platinum plays a crucial role as a catalyst in hydrogen fuel cells, which are gaining traction as clean energy alternatives for vehicles and other applications. This technology is vital for the transition towards more sustainable energy solutions.

- Growth in Electronics and Medical Applications: The demand for PGMs is also rising in the electronics and medical sectors due to their excellent conductivity and corrosion resistance. These metals are essential in manufacturing electronic components and medical devices.

- Recycling and Sustainability Efforts: With the high cost of extracting PGMs, there is a growing trend towards recycling these metals from end-of-life products. This not only addresses supply constraints but also aligns with global sustainability goals.

- Investment in Green Technologies: The push towards decarbonization is driving investments in technologies that utilize PGMs, such as green hydrogen and fuel cells. This aligns with global efforts to reduce carbon footprints and promote clean energy.

Use Cases

- Automotive Industry: PGMs, especially platinum, palladium, and rhodium, are crucial in the production of autocatalysts used in vehicle exhaust systems. These metals help reduce harmful emissions from both gasoline and diesel engines, playing a vital role in adhering to global emissions standards.

- Electronics and Electrical Industry: These metals are used in various electronic components due to their excellent conductivity and durability. For instance, palladium and platinum are used in the manufacturing of computer hard disks and multilayer ceramic capacitors.

- Glass Manufacturing: Platinum is used in the production of fiberglass and high-quality liquid-crystal display (LCD) screens. The metal is part of an alloy used in the bushings that form the glass fibers, which are crucial for products like wind turbine blades and other composite materials.

- Jewelry and Investment: Due to their lustrous appearance and resistance to tarnish platinum and palladium are popular in jewelry making. Additionally, these metals are considered valuable investment commodities.

- Medical Devices: PGMs are used in the medical sector for their biocompatibility, making them ideal for dental and other medical implants.

- Fuel Cells and Green Technology: Platinum is essential in the manufacturing of proton exchange membrane electrolyzers and fuel cells, which are used for producing and utilizing green hydrogen. These technologies are crucial for clean energy solutions.

Key Players Analysis

African Rainbow Minerals (ARM) recently expanded its role in the Platinum Group Metals sector by acquiring the Bokoni platinum mine in South Africa. This strategic purchase for $221 million highlights ARM’s commitment to strengthening its position in the platinum market. The acquisition allows ARM to control significant resources and capitalize on the growing demand for platinum, used extensively in the automotive, electronic, and jewelry industries.

ANGLO AMERICAN PLATINUM LIMITED is a major player in the global Platinum Group Metals market, leveraging its extensive resource base to meet growing industrial demands. The company has been involved in innovative collaborations, such as with BMW and Sasol, to promote the use of platinum in hydrogen fuel-cell electric vehicles (FCEVs). This initiative is part of their broader strategy to support sustainable technologies and strengthen their market leadership in platinum production.

Glencore plays a significant role in the Platinum Group Metals sector, leveraging its extensive mining and metallurgical operations. As a leading diversified natural resource company, Glencore is involved in the extraction and processing of these valuable metals, contributing to the global supply chain. Their operations are integral to meeting the high demand for PGMs, used in various applications such as automotive catalytic converters and electronics, showcasing their strategic position in the market.

Implats Platinum Limited is a major producer in the Platinum Group Metals market, focusing on the extraction and processing of platinum and other PGMs. The company’s operations are centered in South Africa, one of the richest PGM-bearing regions globally. Implants is committed to sustainable mining practices and plays a crucial role in supplying platinum, used in various industrial applications including automotive, jewelry, and electronics. Their work not only supports global industries but also contributes significantly to technological advancements in green energy sectors like fuel cells.

Johnson Matthey is a key figure in the Platinum Group Metals (PGM) sector, primarily focusing on advanced materials technology that uses PGMs to catalyze chemical reactions in various industrial processes. Their work includes significant contributions to the automotive industry by producing catalytic converters that help reduce harmful emissions. Johnson Matthey is also involved in the recycling of PGMs, emphasizing sustainability in their operations. They are known for providing detailed market analyses and forecasts about the PGM sector through their annual market reports, which are highly regarded in the industry for their depth and insight.

Norilsk Nickel is another major player in the PGM market, known for its substantial mining operations. It is one of the world’s largest producers of nickel and palladium and a significant producer of platinum and copper. The company’s activities are crucial in supplying PGMs for global industries that produce everything from automotive catalytic converters to electronic devices and chemical manufacturing. Norilsk Nickel’s operations are particularly noted for their scale and efficiency, which allow them to meet large portions of the global demand for these essential metals.

Northam Platinum Holdings Limited has demonstrated strong performance in the Platinum Group Metals sector, particularly noted by a significant 19.9% increase in total production from its operations, reaching 518,084 ounces for the last half of 2023. This growth is attributed to strategic enhancements in mechanization and operational efficiency, which have been crucial in navigating the challenges of fluctuating PGM prices and economic conditions. Northam’s proactive management strategies have positioned it well within the industry, enabling it to maintain robust production levels and financial health, despite market volatilities.

Northam Platinum Limited, operating under Northam Platinum Holdings Limited, has also been active in the PGM sector, engaging in extensive mining and production of platinum group metals. The company’s efforts are focused on sustainable mining practices and increasing production capacities to meet the growing demand for PGMs, used across various high-tech and industrial applications. The company’s strategic initiatives, including increasing mechanization, have contributed to its strong production outputs and operational resilience.

Platinum Group Metals Ltd. is actively advancing its Waterberg Project in South Africa, focusing on creating a fully mechanized, shallow palladium, platinum, gold, and rhodium mine. The company aims to make this one of the lowest-cost underground PGM mines globally. Recent efforts include a comprehensive pre-construction work program and collaborations to integrate platinum and palladium in lithium battery technologies. These initiatives align with their strategic goal to move the Waterberg Project toward development and construction, ensuring sustainable advancement in the PGM sector.

Royal Bafokeng Platinum is well recognized in the platinum group metals market for its substantial contributions to mining and production. It strategically utilizes its position in the South African PGM-rich Bushveld Complex to optimize extraction and processing operations. Royal Bafokeng Platinum focuses on sustainable practices and community engagement to enhance its operational and corporate reputation, which supports its standing as a significant player in the global PGM market.

Sibanye-Stillwater is a key player in the Platinum Group Metals (PGM) sector, actively engaged in mining and production activities primarily in Southern Africa and the United States. The company is recognized for its significant contributions to the PGM market, especially through its autocatalyst manufacturing, which utilizes platinum and palladium to reduce vehicle emissions. Sibanye-Stillwater has recently faced challenges, such as revising its production guidance downwards in the U.S., but continues to push forward with strategic projects like the K4 mine in South Africa, aiming for long-term sustainability and efficiency in its operations. Their efforts are complemented by strong commitments to environmental sustainability and community engagement, which are integral to their corporate strategy.

Conclusion

In conclusion, the Platinum Group Metals (PGMs) market is poised for robust growth, driven by diverse applications across multiple industries. From their critical role in reducing automobile emissions through catalytic converters to their essential functions in electronics, medical devices, and green technologies, PGMs continue to be indispensable in modern technology and industry. The increasing demand for these metals, coupled with advancements in recycling and sustainability, underscores their ongoing relevance and potential for future growth. As the world moves towards more sustainable energy solutions and continues to innovate in high-tech manufacturing, the strategic importance of PGMs is only set to increase.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)