Table of Contents

Introduction

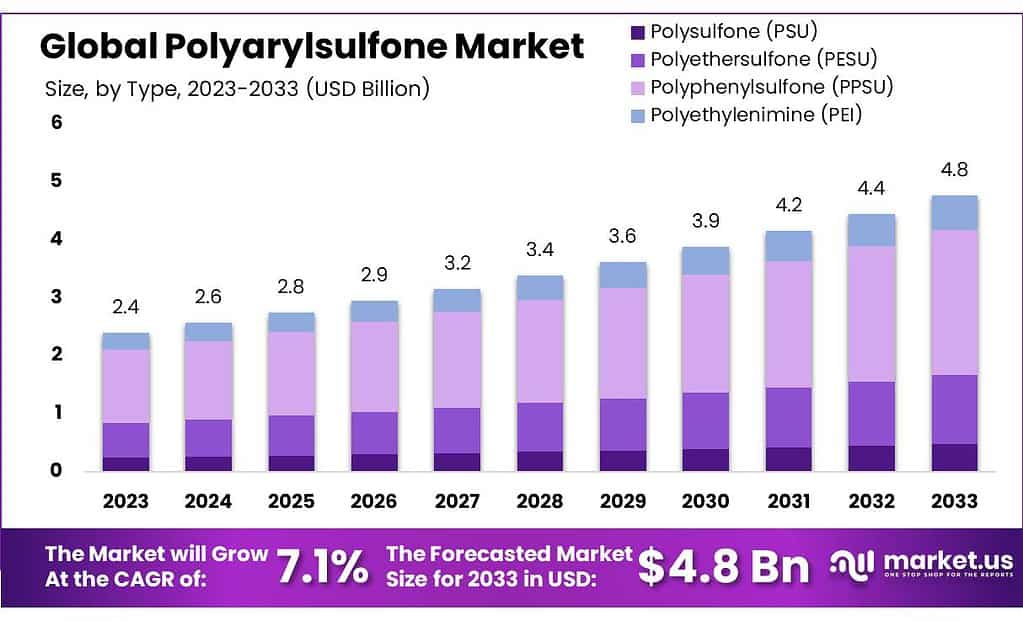

The Polyarylsulfone (PAS) market, with a valuation poised to grow from USD 2.4 billion in 2023 to USD 4.8 billion by 2033, is expected to witness a robust Compound Annual Growth Rate (CAGR) of 7.1% over the next decade. This growth trajectory can be primarily attributed to the escalating demand for high-performance thermoplastics across various industries, including automotive, aerospace, and healthcare, due to their exceptional resistance to heat and chemicals.

Despite these promising aspects, the market faces significant challenges, such as the high cost of raw materials and stringent regulatory standards that could potentially impede growth. Recent developments have indicated a trend toward research and innovation aimed at enhancing the application scope of polyarylsulfones, which could open new avenues for market expansion. Additionally, strategic collaborations and advancements in material science are being pursued to overcome existing barriers and enhance market penetration in emerging regions.

BASF has recently enhanced its polyarylsulfone production capacity by launching a new facility in Germany. This expansion, completed in 2022, is expected to increase the company’s output by 25%, thereby meeting the growing demand for high-performance thermoplastics. This development aligns with BASF’s strategy to solidify its market leadership and cater to the burgeoning sectors of aerospace and automotive, which are increasingly adopting PAS due to its thermal and chemical resistance.

Sabic, In a strategic move to diversify its high-performance materials portfolio, Sabic acquired a smaller competitor in 2021, specializing in advanced thermoplastics. This acquisition has not only expanded Sabic’s production capabilities by 30% but also broadened its technological horizons, particularly in the medical devices sector, where PAS materials are crucial due to their robustness and safety standards.

Solvay launched a new series of polyarylsulfone compounds in late 2022, designed specifically for the electronics industry. These new products are engineered to withstand higher temperatures and offer better electrical insulation. The launch is part of Solvay’s strategy to penetrate deeper into the electronics market, where PAS demand is on the rise due to the miniaturization of electronic components.

Quadrant AG has focused on enhancing its research and development capabilities. In 2023, the company invested USD 20 million into a new R&D center in Switzerland dedicated solely to advanced thermoplastics like PAS. This center aims to pioneer innovations in PAS applications, particularly focusing on sustainability and recycling processes, a growing demand among environmentally conscious consumers and regulatory bodies.

Sumitomo Chemical Co., Ltd., has been aggressively pursuing market expansion through collaborative efforts. In 2023, it formed a joint venture with a South Korean firm to develop and market new PAS grades tailored for the automotive industry. This collaboration aims to leverage Sumitomo’s chemical expertise with local market insights, projecting a 15% increase in their PAS sales in the Asian market by 2025.

Key Takeaways

- Market Growth: The Polyarylsulfone Market is anticipated to reach around USD 4.8 billion in 2033, soaring from USD 2.4 billion in 2023, At a CAGR of 7.1%.

- By Type: In 2023, polyphenylsulfone led the market, 52.6% share due to its outstanding properties.

- By End-Uses: Healthcare emerged as the primary end-user, holding over 31.2% share in 2023.

- Asia-Pacific Dominance led the market in 2023, accounting for over 42.3% share

Polyarylsulfone Thermal and Mechanical Properties

- Polysulfones are used in the temperature range from -100 to +200 °C and are used for electrical equipment, vehicle construction, and medical technology.

- Polysulfones are rigid, high-strength, and transparent, retaining properties between −100 °C and 150 °C. Glass transition temperature is between 190 and 230 °C.

- High dimensional stability in polysulfones, size change under boiling water or 150 °C air or steam falls below 0.1%.

- Exceptional thermal stability in polyarylsulfones, with service temperatures up to 180°C.

- BASF’s production capacity for polyarylsulfones is 12,000 tons per annum.

Polyarylsulfone Production and Application Impact

- The melt Flow (g/10 min) of PPSU ranges from 8.0 to 45.2.

- 57 MeV 56Fe ions and 9 MeV protons can induce significant effects in polymers used for space applications.

- The Ultimate Tensile Strength of PPSU varies between 1.90 and 121 MPa.

- Yield Tensile Strength of PPSU ranges from 71.3 to 121 MPa.

- Nitrogen ion implantation can alter the optical and structural characteristics of CR-39 polymer.

Emerging Trends

- Increased Adoption in Medical Applications: PAS is increasingly being utilized in the medical sector due to its ability to withstand sterilization processes and its resistance to high temperatures and aggressive chemicals. Its application ranges from medical devices like surgical instruments to components used in medical imaging equipment. This trend is driven by the growing need for more durable and safe materials in healthcare environments.

- Expansion into Automotive and Aerospace Industries: There is a growing trend of using PAS in the automotive and aerospace industries for parts that require high thermal stability and mechanical strength. Components such as connectors, insulators, and other structural parts in airplanes and vehicles benefit from PAS’s lightweight and durable nature, contributing to fuel efficiency and overall performance enhancements.

- Focus on Sustainability: The PAS market is witnessing a trend towards sustainability, with increased efforts in recycling and developing bio-based alternatives. Companies are investing in research to produce eco-friendly grades of PAS, which are derived from renewable sources and offer the same performance characteristics as their fossil-based counterparts. This shift is driven by stricter environmental regulations and a growing consumer preference for sustainable products.

- Technological Innovations: Continuous advancements in material science are leading to the development of new PAS compounds that offer enhanced properties such as improved impact resistance and transparency. These innovations are expanding the applications of PAS into new areas such as consumer electronics, where durable and high-performance materials are required.

- Global Expansion in Emerging Markets: As markets in Asia, Africa, and South America develop, there is an increasing demand for high-performance materials like PAS. Companies are strategically entering these regions, either by setting up production facilities or through partnerships and acquisitions, to tap into the local demand and gain a competitive edge.

Use Cases

- Water Treatment Facilities: PAS is increasingly being utilized in water treatment applications due to its superior chemical and thermal stability. For instance, PAS components are used in filtration membranes and fittings due to their ability to withstand corrosive environments and high temperatures often encountered in water purification processes. The global water treatment market, which is expected to reach USD 250 billion by 2025, sees approximately 5% of its materials needs being met by high-performance thermoplastics like PAS.

- Electrical and Electronics: In the electronics industry, PAS’s excellent electrical insulation properties and resistance to high temperatures make it ideal for use in electrical connectors, switches, and insulators. As the electronics market grows, projected at a CAGR of 7% through 2025, the demand for durable materials like PAS that can withstand the harsh operating conditions of electronic devices is also increasing.

- Food Industry: PAS is used in the food industry for applications requiring repeated sterilization and where direct contact with food occurs. Components like trays and containers made from PAS are valued for their ability to resist high temperatures during cleaning and processing, ensuring compliance with stringent food safety regulations. The food processing equipment market, where PAS plays a role, is anticipated to grow to USD 75 billion by 2027, with PAS contributing to advancements in materials used for direct food contact.

- Oil and Gas Industry: The resilience of PAS to harsh chemicals and extreme temperatures makes it suitable for use in oil and gas exploration and production. Components such as seals, gaskets, and pipes benefit from PAS’s properties, providing reliability in the corrosive and high-pressure environments typical of this industry. With the oil and gas sector investing significantly in durable materials, PAS is expected to see an increase in its application, supporting the industry’s need for materials that can reduce maintenance downtime and enhance operational efficiency.

Major Challenges

- High Production Costs: PAS materials are complex to manufacture, involving costly raw materials and energy-intensive processes. This results in higher production costs compared to other thermoplastics, which can limit its usage to high-end applications where cost considerations are secondary to material performance. The price of PAS is approximately 20-30% higher than that of more commonly used engineering plastics, which can be a deterrent for industries looking to minimize material costs.

- Recycling and Environmental Concerns: The recycling of PAS is challenging due to its chemical resistance and high melting points, making it difficult to process using standard recycling methods. As environmental regulations become stricter and the demand for sustainable materials increases, the inability to efficiently recycle PAS could hinder its market growth. Currently, less than 10% of PAS materials are recycled effectively, with most ending up in landfills or incineration facilities.

- Competition from Alternative Materials: PAS competes with other high-performance polymers like PEEK (Polyether Ether Ketone) and PAI (Polyamide-imide), which can offer similar or better performance characteristics in some applications. For instance, PEEK is preferred in certain high-temperature applications due to its superior thermal stability. This competition puts pressure on PAS manufacturers to continually innovate and differentiate their products to maintain market share.

- Supply Chain Vulnerabilities: The production of PAS relies on specific chemical precursors that are often sourced from a limited number of suppliers. Disruptions in the supply chain, whether due to geopolitical tensions, trade restrictions, or raw material shortages, can significantly affect the availability and cost of PAS. These vulnerabilities were highlighted during global disruptions like the COVID-19 pandemic, which caused temporary shutdowns of production facilities and increased the lead time for raw materials.

- Regulatory and Compliance Issues: The use of PAS in sensitive applications such as medical devices and food contact materials requires compliance with stringent regulatory standards across different regions. Navigating these regulations can be costly and time-consuming, potentially delaying product launches and limiting market entry in certain jurisdictions. The regulatory landscape is also evolving, with new standards often requiring additional testing and certification.

Market Growth Opportunities

- Expansion in Healthcare Applications: The healthcare industry continues to demand materials that can withstand harsh sterilization processes while maintaining performance. PAS, known for its high thermal and chemical resistance, is increasingly used in medical devices such as surgical instruments, dental instruments, and fluid handling systems. With the global medical device market expected to grow at a CAGR of 5% and reach USD 800 billion by 2030, PAS stands to benefit significantly from increased usage in this sector.

- Growth in Automotive and Aerospace Sectors: As industries push for lighter and more durable materials to enhance fuel efficiency and performance, PAS is well-positioned to replace traditional materials in automotive and aerospace components. The use of PAS in these sectors can lead to weight reductions of up to 30%, contributing to better fuel efficiency and lower emissions. The global automotive parts market is projected to grow to USD 1.2 trillion by 2027, with aerospace components following a similar trajectory, offering substantial opportunities for PAS adoption.

- Development of High-Performance Filtration Systems: With increasing environmental concerns and regulatory pressures, there is a growing need for high-performance filtration systems in both industrial and residential settings. PAS’s ability to resist high temperatures and corrosive chemicals makes it ideal for water and air filtration systems. The global filtration market is expected to reach USD 110 billion by 2025, with a significant portion of growth driven by advanced materials like PAS.

- Innovations and Material Advancements: Continued research and development into PAS could lead to new formulations and composites that enhance their properties or reduce their cost, making them more competitive against other high-performance polymers. Innovations that improve the manufacturability, recyclability, or performance of PAS can open new applications and markets, further driving its adoption.

- Geographic Expansion into Emerging Markets: Developing regions such as Asia-Pacific, Latin America, and parts of Africa are experiencing rapid industrialization and urbanization, leading to increased demand for advanced materials. Establishing production facilities, distribution networks, and strategic partnerships in these regions could allow PAS manufacturers to tap into new customer bases and capitalize on regional growth trends.

Key Players Analysis

BASF has expanded its capabilities in the polyarylsulfone sector by starting a new production line for high-temperature resistant plastics under the ultrasonic brand in Yeosu, Korea. This strategic move increases BASF’s global production capacity to 24,000 tonnes annually, reinforcing its market presence by catering to demands in water treatment, electronics, and automotive industries due to the material’s heat resistance and chemical stability.

SABIC actively participates in the global polyarylsulfone market, mainly through its specialty products sector. The company’s innovation hubs worldwide support its operations in the high-performance thermoplastics market, contributing to its growth in various regions including North America and Asia Pacific.

Solvay has demonstrated robust performance in the polyarylsulfone sector, capitalizing on the strength of its specialty polymers. In 2021, despite challenges, Solvay reported significant revenue growth in its Materials segment, driven by strong sales in specialty polymers including polyarylsulfones. This growth is supported by strategic production facilities in the United States and India, catering to diverse industries such as automotive and electronics.

Quadrant AG is a prominent player in the polyarylsulfone sector, recognized for its high-performance thermoplastics used across various industries, including automotive and aerospace due to their exceptional heat resistance and lightweight properties. The company forms part of a competitive landscape where innovations focus on replacing metal components to enhance functionality and cost-effectiveness in critical applications like medical devices and aircraft interiors.

Sumitomo Chemical Co., Ltd. is an influential player in the polyarylsulfone market, focusing on innovative solutions for various industrial applications. The company is noted for its commitment to research and development, contributing to the advancement of high-performance materials used in automotive, aerospace, and healthcare sectors

Ensinger is actively involved in the polyarylsulfone sector, primarily focusing on the manufacture and supply of high-performance plastics like polysulfone (PSU). The company produces semi-finished products and custom components, utilizing advanced manufacturing techniques such as 3D printing and injection molding. Ensinger’s participation in this market underscores its commitment to innovation in thermoplastics, meeting the demanding requirements of industries such as aerospace, automotive, and medical where durability and high-temperature resistance are crucial.

RTP Company enhances the polyarylsulfone sector by creating specialty-engineered thermoplastic compounds. They focus on producing and selling high-performance materials like Radel PPSU resins, which offer superior properties such as flame retardancy and structural integrity, tailored for various industries including aerospace and medical sectors.

Westlake Plastics Company, Inc. plays a significant role in the Polyarylsulfone sector by manufacturing and distributing semi-finished thermoplastic products used across various industries, including medical, aerospace, and semiconductor fields. Their expertise lies in advanced melt processing technologies that transform high-performance thermoplastics into useful formats like rods, sheets, and films, tailored with specific attributes such as heat resistance and chemical stability, meeting diverse industry requirements.

Techmer PM operates within the Polyarylsulfone sector by developing and producing advanced material solutions including masterbatches and compounds for plastics. They focus on high-performance applications that require significant technical support and innovation, specifically in areas like healthcare and consumer products. Their capabilities extend globally with production facilities across North America and partnerships that enhance their manufacturing reach.

Conclusion

The Polyarylsulfone (PAS) market is set to experience substantial growth, driven by its superior properties and expanding applications across critical industries like healthcare, automotive, and aerospace. Despite facing challenges related to high production costs, recycling complexities, and competitive pressures, PAS offers promising opportunities for growth.

These include its increasing use in medical devices, potential for material innovations, and expansion into emerging markets. As industries continue to demand more robust and versatile materials, PAS’s role is expected to become increasingly vital. By addressing existing challenges and capitalizing on these opportunities, the PAS market is well-positioned to thrive and expand its footprint globally, supporting a wide range of industrial advancements and innovations.