Table of Contents

Introduction

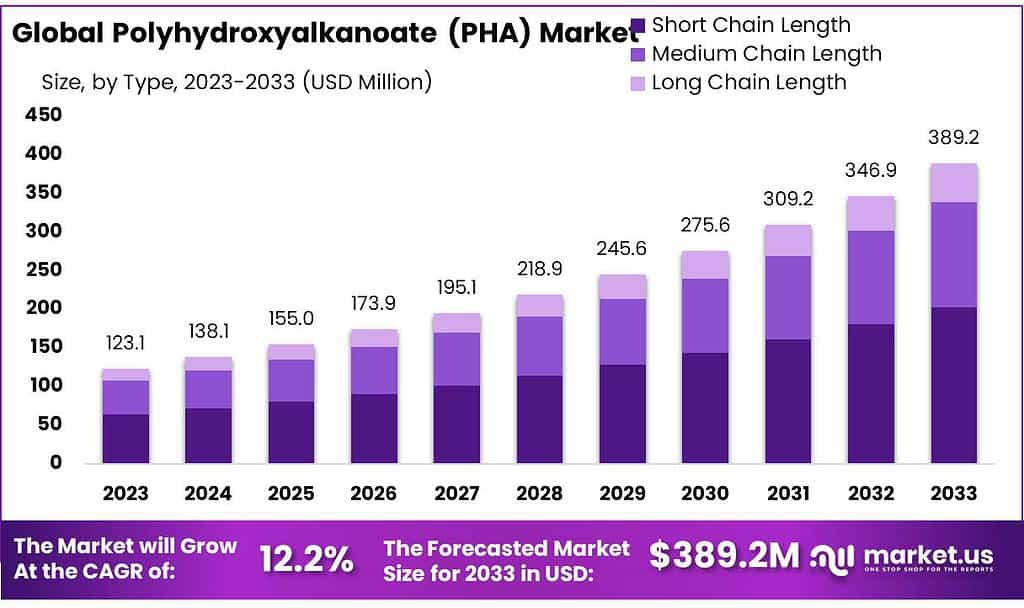

The global Polyhydroxyalkanoate (PHA) market, poised for substantial growth, is forecasted to expand from a valuation of USD 123.1 million in 2023 to approximately USD 389.2 million by 2033, achieving a compound annual growth rate (CAGR) of 12.2% over the decade. PHAs, biodegradable polymers synthesized through bacterial fermentation of sugars or lipids, are recognized for their potential as eco-friendly substitutes for conventional plastics. The escalating environmental concerns, stringent governmental policies against plastic pollution, and the rising demand for sustainable materials are key drivers propelling the growth of the PHA market. These polymers are extensively used across various industries including packaging, agriculture, and biomedical applications due to their environmentally benign nature.

Despite the optimistic outlook, the PHA market faces challenges such as high production costs and the complexity of manufacturing processes compared to traditional plastics. However, ongoing advancements in biotechnological methods are enhancing the cost-efficiency and scalability of PHA production. For instance, recent developments in genetic engineering and microbial fermentation processes have significantly reduced production costs, thereby facilitating broader commercial adoption.

In the realm of innovation, the biomedical sector remains a prominent area of development for PHAs, where their application in producing sutures, drug delivery devices, and biocompatible implants continues to evolve. The inherent biodegradability and non-toxic degradation products of PHAs make them highly suitable for medical applications, adding another layer of demand within the market.

Danimer Scientific has announced a major investment of $700 million to construct a new facility aimed at increasing PHA production. This expansion is driven by the rising demand for sustainable materials, particularly in packaging and single-use products. The facility is expected to significantly enhance the company’s production capacity, reinforcing its position as a leader in the PHA market. The company has also launched a new line of Eco-choice compostable dental flossers, utilizing their proprietary Nodax PHA technology. This move underscores their commitment to expanding the use of PHA in everyday consumer products, offering sustainable alternatives to conventional plastics.

Bio-on S.p.A. has been focusing on strengthening its partnerships to expand its application portfolio, particularly in the cosmetics and packaging sectors. The company is also investing in research and development to improve the efficiency and cost-effectiveness of its PHA production processes. Bio-on has been working on enhancing the mechanical properties of its PHA through innovative biotechnological processes, aiming to make PHA more competitive with traditional plastics in a wider range of applications.

Shenzhen Ecomann Biotechnology is continuing to diversify its product offerings, particularly in biodegradable plastics. The company recently introduced new PHA-based compounds designed for injection molding and film applications. These products are tailored to meet stringent environmental standards, including food contact regulations in both the US and EU. The company is actively expanding its market reach in Asia and Europe, focusing on sustainable agriculture and packaging solutions that leverage its PHA technology.

Newlight Technologies has entered into a 15-year agreement with CNX Resources Corporation to capture and utilize methane emissions for producing Aircarbon, their proprietary PHA-based material. This partnership not only provides a sustainable source of raw materials but also aligns with global efforts to reduce greenhouse gas emissions. The company is scaling up its production capabilities to meet growing demand, particularly in the automotive and consumer goods sectors. Newlight’s focus on leveraging greenhouse gas byproducts for PHA production sets it apart in the sustainability landscape, making its products increasingly attractive to environmentally-conscious consumers and businesses.

Polyhydroxyalkanoate (PHA) Statistics

- PHA can accumulate to high levels by bacterial fermentation, typically between 50–80% cell dry weight, depending on the type of PHA, with some reports of up to 90% cell dry weight.

- Downstream processing contributes about 50% of the overall production expenses thus it is a crucial aspect to define the PHA’s biomanufacturing costs (Li and Wilkins, 2020).

- PHB accumulation in the range of 1–2% dry weight using acetyl-CoA produced in the peroxisomes has been reported in both corn suspension cells and sugarcane leaves (Hahn et al, 1999; Tilbrook et al., 2011).

- Approximately 1 g of each sample was dispersed in 99 ml of sterile distilled water and agitated gently for 2 min.

- For this purpose, nutrient agar plates containing 1% glucose and an ethanolic solution of 0.3% Sudan Black B dye were inoculated with bacterial isolates and incubated for 24 hr at 37°C

- Synthesis of PHB in the plastid led to the highest level of accumulation, reaching 40% dry weight in Arabidopsis leaves.

- Interestingly, the accumulation of 8% PHB in the leucoplasts of seeds of oilseed rape was not associated with any growth retardation or defect in germination.

- Estimates of global emissions of plastic waste to fresh and sea water range from 9 to 23 million metric tons annually, the same order of magnitude as calculated for plastic waste emitted into the land.

- Microbial polyhydroxyalkanoate (PHA) biopolyesters, have a current share of not even 2% of the entire bioplastic market, reaching an annual production of not more than approximately 40,000 to 50,000 tons in 2021 estimated.

- Commercialized as “bioplastic” will already be among the top 5 “bioplastics”, with an expected share of 6.4% on the “bioplastics” market, which will correspond to about 0.5 million annual tons; hence, the tenfold production quantity of today is expected to be reached in just five years.

- A polymer purity of 70% was obtained using SBW as the sole PHA recovery agent; it was possible to increase purity to 80% by adding minor quantities of sodium hypochlorite solution for better solubilization of non-PHA biomass.

- With an expected 12 billion metric tons of plastic to accumulate within landfills and ecosystems by 2050.

- Slow crystallization rate and low nucleation density — This promotes the formation of large spherulites. This makes PHB more prone to cracking and fracturing. It is reflected in its low elongation at a break of 5-7%.

- PHA yields of LAFB decreased with the increase of LA concentrations 2421-23,013 mg/L.

- The reactor was mixed by a mechanical stirrer at 100 rpm. In the enrichment of PHA bacteria consortia (second stage), the glass reactors were employed for acclimating the PHA inoculum.

- A high PHA yield of 0.48 g PHA-COD/g CODini and 55.4% PHA content were obtained.

- The pH was adjusted to 7.5 for microbial enrichment and PHA production.

- In acidogenic fermentation, swine manure, and apple waste mixture were added with distilled water in the reactor to make a 4% volatile solid of feedstock.

- The results showed that when the C/N ratio was 10, the PHA/CDM ratios were 16.3 and 23.6 at 48 and 72 h, respectively.

Emerging Trends

- Use of Extremophilic Bacteria: A notable trend in PHA production is the growing interest in extremophilic bacteria, which can thrive under harsh environmental conditions such as high salinity and extreme temperatures. These bacteria offer advantages such as contamination resistance and high cell density growth, making them promising candidates for more cost-effective and sustainable PHA production. This approach aligns with the broader movement towards utilizing renewable feedstocks and reducing production costs, a significant barrier in large-scale PHA manufacturing.

- Integration with Circular Economy Principles: The concept of a circular economy is gaining traction in the PHA industry. This involves the use of waste streams and renewable feedstocks, such as lignocellulosic biomass and agro-industrial residues, as substrates for PHA production. By integrating biorefinery concepts, companies can not only produce PHAs but also reduce waste, making the entire process more sustainable and environmentally friendly. This trend is crucial as the world increasingly shifts towards greener and more sustainable production methods.

- Advancements in Microbial Synthesis: Recent developments in the microbial synthesis of PHAs have focused on optimizing bioprocesses to enhance productivity and reduce costs. For instance, innovative biotechnological techniques are being employed to modify microbial strains, allowing for more efficient PHA production. This includes the development of new expression systems that improve the solubility and yield of PHA synthase enzymes, making the production process more efficient and scalable.

- Customization of PHA Properties: Researchers are exploring ways to customize the properties of PHAs by incorporating different monomers into the polymer chains. For example, the inclusion of glycolate units into PHA chains has shown potential in controlling the bioabsorption rate of the material, which is particularly useful in biomedical applications. This ability to tailor the physical and chemical properties of PHAs opens up new avenues for their application in various industries.

- Expansion of Application Areas: The application of PHAs is expanding beyond traditional uses in packaging and agriculture. There is growing interest in their use in the biomedical field, particularly for drug delivery systems, sutures, and tissue engineering. The biocompatibility and biodegradability of PHAs make them ideal for these applications, which is driving further research and development in this area.

Use Cases

- Biodegradable Packaging: One of the most prominent use cases for PHAs is in the packaging industry. PHAs are being used to produce biodegradable films, containers, and disposable cutlery. This application is particularly important as global plastic pollution concerns grow, and regulations against single-use plastics tighten. The global demand for sustainable packaging solutions has led to an increased adoption of PHAs in products like shopping bags, food packaging, and agricultural films.

Agriculture: - Mulch Films and Plant Pots: In agriculture, PHAs are used to create biodegradable mulch films and plant pots. These materials help in reducing plastic waste in the environment since they decompose naturally without harming the soil. The use of PHA-based mulch films allows farmers to plow them directly into the soil after use, where they break down and enrich the soil without leaving harmful residues.

Controlled-Release Fertilizers: PHAs are also being explored as carriers for controlled-release fertilizers. These fertilizers release nutrients gradually, reducing the need for frequent application and minimizing environmental impact. - Sutures and Implants: Due to their biocompatibility and biodegradability, PHAs are increasingly being used in the biomedical field. They are used to make surgical sutures, which gradually dissolve in the body, eliminating the need for removal. Additionally, PHAs are utilized in making biodegradable implants and drug delivery systems, where they can deliver drugs over time and then safely degrade in the body.

- Tissue Engineering: PHAs are being investigated for their potential in tissue engineering. They can be used to create scaffolds that support the growth of new tissues. These scaffolds gradually break down as the tissue regenerates, making them ideal for use in regenerative medicine.

- Biodegradable Products: In the consumer goods sector, PHAs are used to produce biodegradable products such as toothbrushes, razors, and even disposable diapers. These products are designed to break down after disposal, helping to reduce landfill waste and environmental pollution.

- 3D Printing: PHAs are also gaining attention in the 3D printing industry. They are used to create biodegradable filaments that can be used in 3D printers to produce environmentally friendly prototypes and products.

- Sustainable Packaging: The cosmetics industry is beginning to use PHA-based packaging materials. These materials offer a sustainable alternative to traditional plastic packaging, helping companies meet the increasing consumer demand for eco-friendly products. Microbeads in Personal Care Products: PHAs are being explored as a replacement for plastic microbeads in personal care products such as exfoliants and toothpaste. Unlike traditional microbeads, PHA microbeads are biodegradable and do not contribute to marine pollution.

Major Challenges

- High Production Costs: One of the most significant challenges facing the PHA market is the high cost of production. PHAs are produced through microbial fermentation, which involves expensive substrates and complex downstream processing. This makes PHAs less competitive compared to conventional petroleum-based plastics, which are cheaper to produce on a large scale. The cost of PHA production can be 3-5 times higher than that of traditional plastics.

- Limited Feedstock Availability: The production of PHAs depends heavily on the availability of suitable and cost-effective feedstocks. While efforts are being made to use renewable and waste materials, the scalability of these feedstocks remains a challenge. The reliance on agricultural products like corn and sugar cane also raises concerns about food security and the environmental impact of large-scale cultivation.

- Technical Barriers in Large-Scale Production: Scaling up PHA production from laboratory to industrial levels presents technical challenges. The fermentation processes must be optimized to ensure consistent quality and yield, which can be difficult to achieve on a large scale. Additionally, the recovery and purification of PHAs from bacterial cells are complex and costly, further hindering large-scale adoption.

- Competition with Other Bioplastics: PHAs face competition from other bioplastics like polylactic acid (PLA), which are also biodegradable but are currently less expensive to produce. This competition makes it difficult for PHAs to capture a larger share of the bioplastics market, especially in cost-sensitive applications.

- Market Awareness and Demand: There is still a lack of widespread market awareness and demand for PHAs. Many industries and consumers are not fully informed about the benefits of PHAs, and the higher costs can be a deterrent. Building awareness and educating the market about the environmental benefits of PHAs is crucial for driving demand and encouraging investment in this biopolymer.

Market Growth Opportunities

- Increased Demand for Sustainable Packaging: As global awareness of plastic pollution continues to rise, there is a growing demand for sustainable packaging solutions. PHAs, being biodegradable and derived from renewable sources, are well-positioned to capitalize on this trend. The packaging industry, particularly in food services and retail, presents a significant growth opportunity for PHAs as companies seek to meet consumer demand for environmentally friendly alternatives. The push for legislation banning single-use plastics in many countries is also expected to drive the adoption of PHA-based packaging.

- Advancements in Biotechnology: Recent advancements in biotechnology, such as the development of more efficient microbial strains and fermentation processes, are expected to lower production costs and improve the scalability of PHA production. These innovations could make PHAs more competitive with conventional plastics and other bioplastics like PLA, opening up new market opportunities across various industries, including automotive, electronics, and textiles.

- Expansion in Biomedical Applications: The biomedical sector offers significant growth potential for PHAs due to their biocompatibility and biodegradability. PHAs are increasingly being used in medical applications such as sutures, drug delivery systems, and tissue engineering. As research in this area progresses, PHAs could become a standard material in medical devices, further expanding their market presence.

- Circular Economy and Waste Valorization: The concept of a circular economy, where waste materials are repurposed into valuable products, aligns well with PHA production. Using agricultural residues, food waste, and other renewable feedstocks for PHA production not only reduces waste but also lowers production costs. This sustainable approach could attract more industries to adopt PHAs, particularly as global industries move toward greener practices.

Key Players Analysis

Danimer Scientific is a leading player in the Polyhydroxyalkanoate (PHA) sector, focusing on the development and commercialization of biodegradable plastics. The company’s flagship product, Nodax™ PHA, is produced using renewable resources like plant oils and is used in a wide range of applications, including packaging and single-use items. Danimer has been expanding its production capabilities, with significant investments aimed at scaling up PHA production to meet the growing global demand for sustainable materials.

TianAn Biologic Materials Co., Ltd. is a key player in the PHA sector, specializing in the production of biodegradable polymers through microbial fermentation. The company focuses on producing high-quality PHAs for various applications, including packaging, agriculture, and medical devices. TianAn is known for its robust research and development efforts, which have enabled the company to improve the efficiency and scalability of PHA production, making it more competitive in the global market.

Boomer is a specialized company in the Polyhydroxyalkanoate (PHA) sector, focused on the production of high-purity PHAs for use in medical and industrial applications. Boomer has been pioneering the development of PHA-based materials since the 1990s, offering products that are biodegradable and biocompatible. Their PHAs are used in various fields, including medical implants, packaging, and agricultural films. Biomer’s expertise lies in customizing PHA formulations to meet specific industry needs, making them a significant player in the sustainable plastics market.

Kaneka Corporation is a prominent player in the PHA sector, known for its innovative approach to producing biodegradable plastics. Kaneka’s PHBH (Poly(3-hydroxybutyrate-co-3-hydroxyhexanoate)) is a unique PHA that offers flexibility and heat resistance, making it suitable for various applications such as packaging, agricultural films, and disposable items. The company has been actively expanding its production capacity to meet the growing demand for sustainable materials, particularly in Europe and Asia, where environmental regulations are driving the shift toward biodegradable plastics.

Bio-on S.p.A. was an innovative Italian company in the PHA sector, known for developing biodegradable plastics using agricultural waste as feedstock. Their flagship technology produced high-quality PHAs for use in cosmetics, packaging, and biomedical applications. Bio-on focused on sustainable production processes and sought to replace traditional plastics with eco-friendly alternatives. However, the company faced significant financial difficulties, leading to bankruptcy proceedings in 2019, which disrupted its operations and market presence.

Shenzhen Ecomann Biotechnology Co., Ltd. is a Chinese company specializing in the production of biodegradable PHAs through microbial fermentation. The company is focused on creating sustainable alternatives to conventional plastics, with applications in packaging, agriculture, and medical sectors. Shenzhen Ecomann has developed a range of PHA products tailored to meet environmental standards in Europe and the United States, positioning itself as a competitive player in the global bioplastics market.

Newlight Technologies LLC is an innovative company in the Polyhydroxyalkanoate (PHA) sector, known for its unique approach of using greenhouse gases like methane and carbon dioxide as raw materials for PHA production. Their proprietary product, AirCarbon, is a type of PHA that is biodegradable and used in various applications, including packaging and consumer goods. Newlight’s focus on sustainability and reducing carbon emissions has positioned it as a leader in the bioplastics market, particularly in producing environmentally friendly materials.

Metabolix Inc., now rebranded as Yield10 Bioscience was a pioneer in the PHA sector, known for its work in developing biodegradable plastics. The company focused on creating high-performance PHAs for various industrial applications, including packaging and agriculture. Despite significant technological advancements, Metabolix faced challenges in scaling production and profitability, leading to a strategic shift away from bioplastics. Their legacy in the PHA market remains significant, particularly in advancing the science and application of biodegradable polymers.

Tepha, Inc. is a biotechnology company specializing in the production of Polyhydroxyalkanoate (PHA) materials, particularly for medical applications. Tepha’s PHA-based biomaterials are used in a variety of medical devices, including sutures, meshes, and tissue engineering scaffolds. These materials are highly valued for their biocompatibility and biodegradability, which allow them to safely integrate into the body and gradually degrade over time. Tepha’s innovative PHA technology has made significant contributions to advancing the field of regenerative medicine and surgical devices.

Meredian Holdings Group Inc., now known as Danimer Scientific, is a prominent player in the PHA market, focused on producing biodegradable plastics through sustainable practices. The company’s PHA products are derived from renewable resources like plant oils and are used in a wide range of applications, including packaging and single-use items. Their commitment to sustainability and innovation has positioned them as a leader in the effort to replace traditional petroleum-based plastics with environmentally friendly alternatives.

Conclusion

In conclusion, Polyhydroxyalkanoates (PHAs) represent a promising and sustainable alternative to conventional plastics, offering significant environmental benefits due to their biodegradability and biocompatibility. Despite challenges such as high production costs and technical barriers in large-scale production, ongoing advancements in biotechnology and increased demand for eco-friendly materials are driving the growth of the PHA market. The adoption of PHAs is expanding across various industries, including packaging, agriculture, and biomedicine, positioning them as a critical component in the global shift towards more sustainable and circular economies.