Table of Contents

Overview

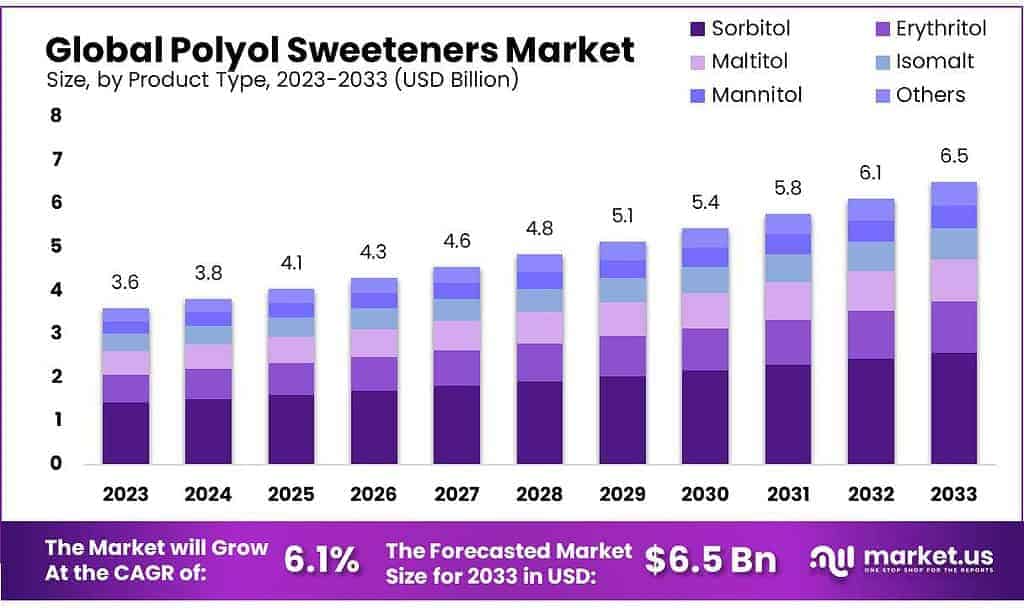

The Polyol Sweeteners Market is projected to reach approximately USD 6.5 billion by 2033, up from USD 3.6 billion in 2023, reflecting a compound annual growth rate (CAGR) of 6.1% over the forecast period from 2023 to 2033.

The market is anticipated to expand due to the rising demand for sugar alternatives in food and beverage products, along with increasing consumer awareness around health and wellness. Polyol sweeteners derived from carbohydrates through processes like hydrogenation or fermentation are produced using sources such as corn cobs, birch bark, and pulp or paper waste.

Key Takeaways

- Market Outlook: The Polyol Sweeteners Market is set to grow from USD 3.6 billion in 2023 to approximately USD 6.5 billion by 2033, registering a consistent CAGR of 6.1% over the forecast period.

- Top Product: Sorbitol leads the market with a 39.7% share, favored for its low calorie count and oral health benefits, making it popular in food and beverage formulations.

- Widespread Applications: Polyol sweeteners are used across multiple sectors, including personal care, pharmaceuticals, and industrial segments like paints, coatings, and textiles.

- Form Factor: The powder or crystalline format dominates with over 72.3% market share due to its convenience, extended shelf life, and compatibility with diverse manufacturing needs.

- Primary Function: With a 52.6% share, the main role of polyol sweeteners is flavor enhancement and sugar substitution, helping deliver sweetness without the downsides of traditional sugar.

- Key Barriers: Higher costs, potential for mild digestive side effects, and differences in taste compared to regular sugar remain key adoption challenges.

- Growth Opportunities: Increasing demand for healthier sugar alternatives and innovations aimed at improving flavor and texture are expected to drive future market growth.

- Regional Trends: North America currently leads with a 44.6% revenue share, but Asia Pacific is projected to grow the fastest due to rising incomes and greater interest in sugar-free products.

- Industry Efforts: Major players such as Cargill, ADM, and DuPont are investing in R&D and process innovation to diversify their polyol sweetener offerings and meet evolving market demands.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/polyol-sweeteners-market/free-sample/

Report Scope

| Market Value (2024) | US$ 5.4 Bn |

| Forecast Revenue (2034) | US$ 9 Bn |

| CAGR (2025-2034) | 5.8% |

| Segments Covered | By Process(Wet Chemical, Direct, Indirect, Others), By Form(Powder, Pellets, Liquid), By Grade(Standard, Treated, USP, FCC , Others), By Application(Chemicals, Rubber, Pharmaceuticals, Ceramics, Paints & Coatings, Cosmetics and Personal Care, Agriculture, Others) |

| Competitive Landscape | EverZinc, Ace Chemie Zynk Energy Limited, AG CHEMI GROUP s.r.o., CCL, EverZinc, Zinc Nacional, HAKUSUI TECH, LANXESS, IEQSA, Neo Zinc Oxide, Pan-Continental Chemical Co., Ltd., Rubamin, Tata Chemicals Ltd., TOHO ZINC CO., LTD., TP Polymer Private Limited, Upper India, Weifang Longda Zinc Industry Co., Ltd., Yongchang zinc industry Co., Ltd., Zinc Oxide Australia, Zochem, Inc |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=26546

Key Market Segments

Product Analysis:

Sorbitol leads the Polyol Sweeteners market with a 39.7% share, thanks to its popularity as a sugar substitute in many food and drink products. Consumers prefer it for its fewer calories and dental benefits. It’s widely used in foods like surimi (a refined fish paste), beverages, and dietary supplements. Sorbitol also finds applications in cosmetics like lotions and face masks, as well as in paints, textiles, and surfactants.

Mannitol, another sweetener, is gaining demand in pharmaceuticals because it helps reduce brain pressure and is used for kidney-related treatments.

Form Analysis:

In 2023, Powder/Crystal form held over 72.3% of the market, as it’s easy to handle, store, and mix in food, beverages, and personal care products. It also lasts longer on the shelf, making it a preferred choice in industrial use.

Products like sugar-free seafood snacks, mint tablets, and frozen meals in countries like South Korea and China are driving this demand.

Meanwhile, liquid or syrup-based sweeteners are favored for their water solubility, especially in pharmaceuticals and nutraceuticals.

Function Analysis:

Flavoring and sweetening is the largest function in the market, holding around 52.6% share in 2023. Polyol sweeteners mimic the taste of sugar but with fewer calories, making them perfect for candies, desserts, and drinks.

They’re often mixed with other sweeteners for sugar-free treats. Some types, like erythritol and xylitol, also have a cooling effect in the mouth, making them ideal for menthol-based products. These sweeteners are also used to add bulk and improve the texture of baked goods and confectionery, and are used in cosmetics as moisturizing agents.

Application Analysis:

The Food & Beverage sector led the market in 2023, contributing over 40.6% of total usage. Polyol sweeteners are found in candies, soft drinks, dairy items, and more helping manufacturers reduce sugar while maintaining sweetness.

They’re recognized as safe by the U.S. FDA under the GRAS (Generally Recognized As Safe) status. Products like erythritol, isomalt, lactitol, and xylitol fall into this category.

Additionally, these sweeteners are used as coatings for chewing gums and candies and are gaining popularity in personal care and dental health products, which will likely fuel future growth.

Regional Analysis

North America led the Polyol Sweeteners Market in 2023, accounting for more than 44.6% of the total revenue. This dominance is expected to continue due to rising interest in natural ingredients and the rapid growth of the personal care sector, particularly in countries like the United States and Canada.

In Europe, future growth is likely supported by sustainability initiatives such as the Horizon 2020 Strategy, approved in April 2019. This strategy promotes the use of naturally sourced ingredients, which is expected to boost demand for polyol sweeteners in the region’s food industry over the coming years.

Polyol sweeteners also serve as functional ingredients in products like emulsifiers, wetting agents, detergents, and dispersants. Europe’s increasing interest in bio-based alternatives is anticipated to support demand for ingredients like sorbitol and rhamnolipids, especially under new regulations aimed at reducing greenhouse gas emissions.

Meanwhile, the Asia Pacific region is projected to see the fastest growth between 2023 and 2032. Factors such as rising disposable incomes, increased consumption of sugar-free and reduced-sugar nutritional products, and expanding pharmaceutical usage are key drivers in countries like China, India, and Japan.

Top Use Cases

1. Confectionery & Chewing Gum:

Polyol sweeteners like sorbitol, xylitol, and maltitol are widely used in sugar-free candies, gums, and chocolates. They offer sweetness with fewer calories, lower glycemic impact, and dental benefits making them ideal for diabetic-friendly and health-focused confectionery products.

2. Bakery & Snack Foods:

Baked goods and snack items use erythritol, isomalt, or maltitol to reduce sugar without compromising texture. Polyols act as bulking agents and help control sweetness and moisture, supporting clean-label and low-sugar formulations in cookies, cakes, energy bars, and pastries.

3. Functional & Beverages:

In low-calorie beverages, polyols like erythritol or maltitol help mimic sugar’s mouthfeel and sweetness. Used in flavored waters, diet sodas, and health drinks, they enable calorie reduction while maintaining taste and stability critical in beverages and dietary supplements.

4. Pharmaceutical & Nutraceuticals:

Polyols serve as excipients in chewable tablets, syrups, and lozenges. Products like sorbitol and mannitol mask taste, act as binders, improve solubility, and deliver gentle sweetness enhancing patient compliance, especially in pediatric and over-the-counter formulations.

5. Personal Care & Oral Hygiene:

As humectants and texture enhancers, polyols are used in toothpaste, mouthwash, and skincare. Xylitol and sorbitol help retain moisture and prevent drying. Their non-cariogenic and non-irritating properties support both dental health and cosmetic functionality.

6. Industrial & Animal Feed Applications:

Polyols appear in industrial uses as wetting agents, foaming agents, emulsifiers, and stabilizers in coatings, adhesives, and plastics. In animal feed, they improve taste and reduce sugar intake. These multifunctional applications extend the polyol market beyond food and personal care.

Recent Developments

Cargill Inc.: Cargill continues expanding its low- and no-calorie sweetener portfolio, offering polyols like erythritol (Zerose®), maltitol (Maltidex™), and mannitol across global markets. They showcased new sustainable sugar-reduction solutions at Food Ingredients Europe 2024, including clean-label reformulation systems combining polyols and stevia for better taste and functionality. This reinforces Cargill’s positioning as a versatile provider for sugar-reduced food and beverages.

Roquette Frères: Roquette invested €25 million (~USD 27.5M) at its Lestrem, France facility to boost production of liquid and powder polyols by 2024. This upgrade strengthens supply reliability and supports major growth in sugar-reduced confectionery and pharmaceutical excipients markets. Roquette remains the global leader in polyols, supplying ingredients like sorbitol, maltitol, mannitol, xylitol, and isosorbide for food, pharma, and industrial uses.

Archer Daniels Midland (ADM): ADM has continued to expand its carbohydrate and starch-based sweetener business, including polyol applications. Their investments in modified starch facilities support broader adoption of maltitol and sorbitol for clean-label, low-sugar snack and baked products. ADM’s focus on sustainable, plant-based ingredients positions it strategically in the evolving polyol market landscape.

Ingredion Inc.: Ingredion is reinforcing its modified starch and sweetener portfolio, with enhancements in clean-label and non-GMO polyol ingredients. Through acquisitions and plant upgrades, they’ve expanded production capacity across North America and globally. Ingredion focuses on polyols that support texture and sweetness in reduced-calorie applications, such as snacks, beverages, and bakery items.

Tereos Starch & Sweeteners / Südzucker AG: Tereos (part of Südzucker) is investing in enzyme-based starch modifications to enhance polyol production for clean-label food and beverage use. Reports highlight ongoing expansion of functional starch derivatives and sweetener applications across their European facilities, positioning Tereos as a competitive force in polyol innovation alongside ADM and Cargill.

Conclusion

This growth is driven by rising health awareness and the increasing demand for sugar-free and low-calorie products in food, beverages, and pharmaceuticals. North America leads in revenue share, while Asia Pacific shows strong future growth potential. Sorbitol remains the dominant product, and powder forms are preferred due to their versatility. Although higher costs and taste differences pose challenges, innovations and consumer demand for healthier options are expected to keep the market expanding steadily.