Table of Contents

Introduction

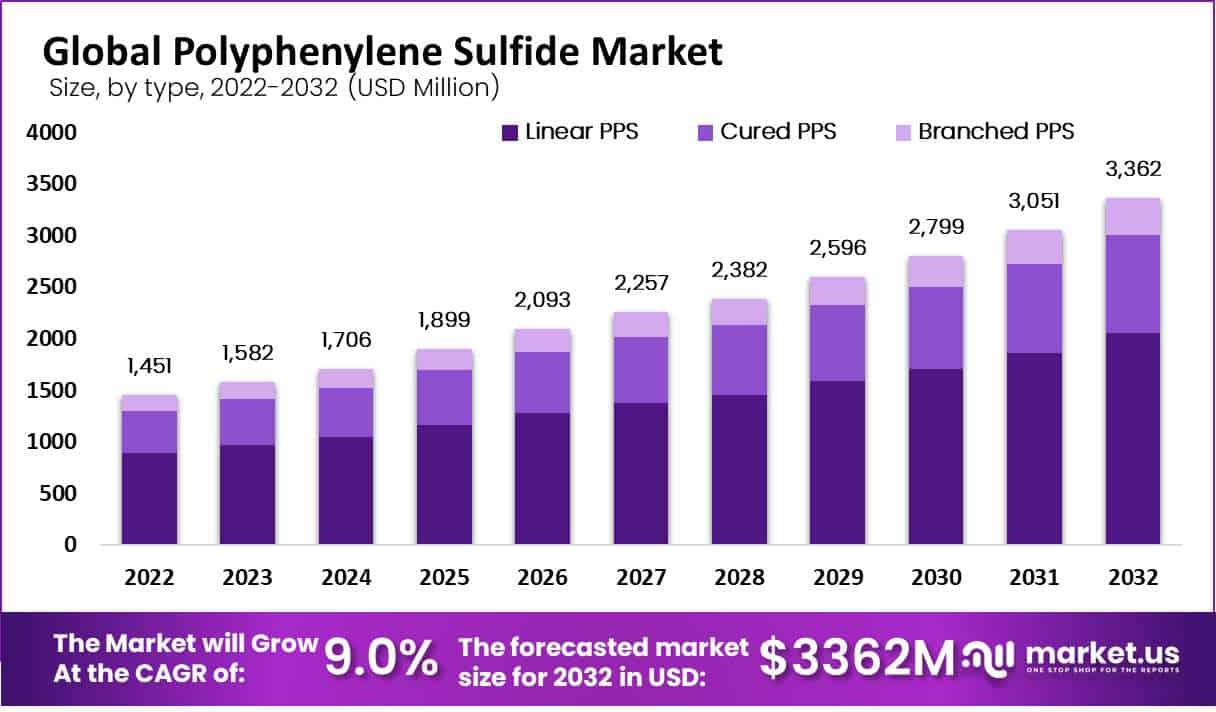

The global polyphenylene sulfide (PPS) market, a crucial segment in the field of high-performance engineering plastics, was valued at approximately USD 1,451 million in 2022. It is projected to expand significantly, reaching an estimated USD 3,362 million by 2032, with a compound annual growth rate (CAGR) of 9.0% during the forecast period from 2023 to 2032. This growth is primarily driven by the increasing demand for PPS across various end-use industries due to its exceptional properties, including high resistance to heat, and chemicals, and its ability to maintain dimensional stability under challenging conditions.

The automotive sector remains the largest consumer of PPS, accounting for a significant share of the market. The rising emphasis on lightweight and fuel-efficient vehicles has spurred the adoption of PPS in the production of automotive components such as fuel systems, electrical components, and under-the-hood applications. This trend is expected to continue as the automotive industry increasingly focuses on electric vehicles (EVs), which require materials that offer both durability and performance under high temperatures.

In addition to automotive applications, the electrical and electronics industry is anticipated to be the fastest-growing segment for PPS. The increasing global demand for electronic devices and components, particularly in the Asia-Pacific region, is contributing to this growth. Countries like China, Japan, and South Korea are at the forefront, benefiting from robust manufacturing sectors and the availability of low-cost raw materials and labor.

Technological advancements in PPS production have also played a critical role in market expansion. Innovations such as new catalysts and modified monomers have resulted in PPS formulations with enhanced heat resistance, better processability, and improved electrical properties. These developments not only improve the performance of PPS but also reduce production costs, making it more accessible for various industrial applications.

Recent developments in the polyphenylene sulfide (PPS) market, particularly involving key companies such as Toray Industries Inc., DIC Corporation, Solvay S.A., and Lion Idemitsu Composites Co. Ltd., have been marked by significant advancements and strategic initiatives aimed at strengthening their market positions and expanding their product offerings.

Toray Industries developed a new PPS resin that combines high flexibility with superior chemical and heat resistance properties. This innovation is particularly targeted at automotive applications, where materials must withstand high temperatures while maintaining structural integrity.

Toray also announced a significant investment of USD 89.3 million in September 2018 to increase its PPS production capacity at its Gunsan plant in South Korea over three years. This expansion aims to meet the growing global demand for PPS, particularly in the automotive and electronics sectors.

DIC Corporation announced in March 2019 the construction of a new PPS production line at its Wisconsin, U.S., plant, with an annual capacity of 3,000 metric tons. This expansion is part of DIC’s strategy to enhance its production capabilities in response to increasing demand from the automotive and industrial sectors.

Solvay introduced two new grades of Ryton® PPS, named Ryton® Supreme HV and HF. These new products are designed for high-voltage and high-flow applications, particularly in the electric vehicle (EV) sector, where they contribute to better electrical performance and heat resistance. This development is aligned with the growing electrification trend in the automotive industry, aiming to improve safety and efficiency in EV components.

Key Takeaways

- Market Size: It is anticipated that the global polyphenylene sulfide market will experience a compound annual growth rate (CAGR) of 9.0% between 2023-2032.

- Type Analysis: In 2022, the linear PPS type dominated the polyphenylene sulfide market, holding an impressive total revenue share of 61%. This can be attributed to its high crystallinity, superior dimensional stability, and excellent mechanical and thermal properties.

- Application Analysis: Of these categories, the automotive segment stands out as the most profitable in the global polyphenylene sulfide market, contributing to a substantial total revenue share of 34% in 2022.

Polyphenylene Sulfide Statistics

- In its pure solid form, it may be opaque white to light tan. Maximum service temperature is 218 °C (424 °F).

- PPS has not been found to dissolve in any solvent at temperatures below approximately 200 °C (392 °F).

- The Federal Trade Commission’s definition of sulfur fiber is “A manufactured fiber in which the fiber-forming substance is a long chain synthetic polysulfide in which at least 85% of the sulfide (–S–) linkages are attached directly to two (2) aromatic rings.”

- The first commercial process for PPS was developed by Edmonds and Hill (US patent 3 354 129, Yr. 1967) while working at Philips Petroleum under the brand name Ryton.

- PPS can be resistant to 260°C for a short time and used below 200°C for a long time.

- The World Health Organization estimated the burden of disease from exposure to selected chemicals at 1.6 million lives in 2016.

- The Asia-Pacific Polyphenylene Sulfide Composites Market size is estimated at USD606.90 million in 2024 and is expected to reach USD 972.05 million by 2029.

- PPS has a melting point of about 285 ° C and retains its properties when used continuously up to 190 ° C.

- The top five players hold a share of over 80%. China is the largest market and has a share of about 40%. In terms of product type, Injection-grade PPS is the largest segment, occupying a share of about 50%, and in terms of application, Automobile Industry has a share of about 30 percent.

- The results show that the PPS composite composed of 80 wt% CFFs has optimal mechanical properties, where the tensile strength, fracture elongation, elastic modulus, flexural strength, flexural modulus, interlaminar shear strength, and impact strength reach 1200.3 MPa, 20.3%, 25.7 GPa, 1305.6 MPa, 230.6 GPa, 110.3 MPa, and 348.6 KJ/m2, respectively.

- Set temp to 80°C and allow to stabilize for 1 hour.

- PPS (polyphenylene sulfide) products offer the broadest resistance to chemicals of any advanced engineering plastic. They have no known solvents below 392°F (200°C) and offer inertness to steam, strong bases, fuels, and acids.

Emerging Trends

- Increased Focus on Electric Vehicles (EVs): With the rapid growth of the electric vehicle market, there is a rising demand for materials that can withstand high temperatures and provide excellent electrical insulation. PPS is increasingly being used in EV components such as battery housings, connectors, and insulation materials due to its ability to maintain performance under extreme conditions. This trend is driven by the need for lightweight, durable materials that contribute to the overall efficiency and safety of electric vehicles.

- Sustainability and Eco-Friendly Manufacturing: The push towards more sustainable manufacturing practices is influencing the PPS market. Companies are developing PPS grades that incorporate recycled materials and are produced using renewable energy sources. This trend is particularly evident in the automotive and electronics industries, where reducing the environmental impact of materials is becoming increasingly important.

- Expansion in 3D Printing Applications: PPS is gaining traction in the 3D printing sector due to its high-temperature resistance and dimensional stability. As industries such as aerospace, automotive, and healthcare adopt 3D printing for creating complex, high-performance parts, PPS is being recognized as a material that can meet the stringent requirements of these applications.

- Development of High-Performance PPS Grades: There is ongoing innovation in developing new PPS grades that offer enhanced properties, such as higher mechanical strength, improved processability, and better thermal stability. These advancements are aimed at meeting the specific needs of industries that require materials capable of performing under harsh conditions, such as the oil and gas, aerospace, and chemical processing sectors.

- Growing Use in Medical Devices: PPS is increasingly being used in medical devices due to its biocompatibility and resistance to sterilization processes. The material’s ability to withstand repeated exposure to high temperatures and chemicals makes it suitable for components in medical equipment that require durability and long-term reliability.

- Regional Shifts in Production and Consumption: The Asia-Pacific region continues to dominate the PPS market, driven by the rapid industrialization and growth of end-use industries such as automotive and electronics in countries like China, Japan, and South Korea. This region is expected to remain the largest market for PPS, with ongoing investments in expanding production capacity and innovation.

Use Cases

- Automotive Industry: Under-the-Hood Components: PPS is widely used in manufacturing components that are exposed to high temperatures and harsh chemicals, such as fuel system parts, coolant systems, and electrical connectors. For example, in fuel systems, PPS’s resistance to fuel and high temperatures makes it ideal for components like fuel injectors and throttle bodies. The automotive industry accounts for a significant portion of PPS consumption, with its use helping to reduce vehicle weight and improve fuel efficiency.

- Connectors and Switches: PPS’s excellent dielectric properties and resistance to high temperatures make it a preferred material for electrical connectors, switches, and sockets used in demanding environments, such as industrial automation and high-temperature electronic devices.

- PCB Substrates and Insulators: In printed circuit boards (PCBs), PPS is used as a substrate material due to its stability and ability to maintain dimensional accuracy at elevated temperatures, which is crucial for maintaining the integrity of electronic circuits.

- Lightweight Structural Components: The aerospace industry benefits from PPS’s high strength-to-weight ratio and resistance to chemicals, making it suitable for various structural components, including brackets, clips, and fasteners. These components need to withstand harsh operational environments while contributing to overall weight reduction, which is critical in aerospace applications.

- Insulation and Coatings: PPS is also used for insulation materials and coatings in aerospace applications, where thermal and chemical stability are essential for safety and performance.

- Chemical Processing Equipment: PPS is used in pumps, valves, seals, and other components in chemical processing industries due to its excellent chemical resistance. It can withstand exposure to aggressive chemicals and high temperatures, making it ideal for use in harsh industrial environments.

- Filter Bags: In the filtration industry, PPS is utilized in the production of filter bags for dust collection systems, particularly in high-temperature applications such as power plants and incinerators. The material’s stability and resistance to chemical degradation extend the lifespan of these filters.

Medical Devices: - Sterilizable Components: PPS is increasingly used in medical devices that require frequent sterilization. Its resistance to high temperatures and chemicals makes it suitable for surgical instruments, sterilization trays, and other medical equipment components that must withstand repeated exposure to steam and chemical disinfectants.

- High-Performance Prototypes: PPS is gaining popularity in 3D printing for producing high-performance parts that require excellent thermal and chemical resistance. It is particularly useful for printing components that need to endure rigorous operational conditions, such as parts for automotive, aerospace, and industrial applications.

Major Challenges

- Fluctuating Raw Material Prices: One of the significant challenges for PPS production is the volatility in the prices of raw materials, such as p-dichlorobenzene and sodium sulfide. These materials are essential for PPS manufacturing, and their price fluctuations, influenced by factors like supply chain disruptions, geopolitical tensions, and natural disasters, can lead to increased production costs. This, in turn, affects the pricing of PPS products, making them less competitive in the market.

- Limited Availability of Raw Materials: The production of PPS is highly dependent on specific raw materials that are not widely available globally. This limited availability can cause supply chain issues, leading to potential shortages and delays in production. As a result, manufacturers may struggle to meet the growing demand for PPS, particularly in rapidly expanding industries like automotive and electronics.

- Competition from Alternative Materials: PPS faces stiff competition from other high-performance plastics, such as polyether ether ketone (PEEK) and polyimide (PI). These alternatives sometimes offer similar or superior properties, such as higher temperature resistance or better mechanical strength, which can make them more attractive for certain applications. The presence of these alternatives in the market can limit the adoption of PPS in industries where material selection is highly competitive.

- Environmental and Regulatory Challenges: As industries and governments worldwide push for more sustainable manufacturing practices, PPS producers face pressure to reduce the environmental impact of their production processes. This includes minimizing emissions and improving the recyclability of PPS products. Meeting these regulatory requirements can increase production costs and pose a challenge for manufacturers who must balance environmental concerns with maintaining product performance and cost-effectiveness.

Market Growth Opportunities

- Electric Vehicle (EV) Market Expansion: As the global shift towards electric vehicles accelerates, the demand for materials that can withstand high temperatures and provide electrical insulation is increasing. PPS is ideally suited for use in battery components, connectors, and insulation materials in EVs due to its thermal stability and chemical resistance. This growing EV market offers a significant opportunity for PPS manufacturers to expand their presence in the automotive industry, particularly as automakers prioritize lightweight and high-performance materials to enhance vehicle efficiency.

- Increased Adoption in Aerospace and Defense: The aerospace and defense industries are increasingly using PPS due to its high strength-to-weight ratio, chemical resistance, and stability at high temperatures. As these sectors continue to develop more advanced technologies and materials, the demand for PPS in applications such as structural components, insulation materials, and coatings is expected to grow. This presents a substantial growth opportunity, especially in regions investing heavily in aerospace technology.

- Growth in the Electronics Industry: With the rapid development of the electronics industry, particularly in Asia-Pacific, the demand for high-performance materials like PPS is on the rise. PPS is used in connectors, circuit boards, and other electronic components that require materials with excellent dielectric properties and thermal stability. The expansion of consumer electronics and the increasing complexity of electronic devices present a significant opportunity for PPS to be more widely adopted in this sector.

- Sustainability and Recyclability Initiatives: The push for more sustainable and eco-friendly materials is creating opportunities for PPS, particularly in industries where recyclability is becoming a key consideration. Companies that can develop and market recyclable PPS materials will likely benefit from the growing demand for sustainable solutions across industries such as automotive, electronics, and industrial applications.

Key Player Analysis

Toray Industries Inc. has been actively expanding its capabilities and product offerings in the polyphenylene sulfide (PPS) sector, focusing on innovations that cater to high-performance applications. In March 2023, Toray introduced a new PPS resin with enhanced flexibility while maintaining its chemical and heat resistance, aimed at automotive applications where durability and performance under extreme conditions are critical. Earlier, in September 2018, the company announced a significant investment of USD 89.3 million over three years to increase the production capacity of its PPS plant in Gunsan, South Korea.

Lion Idemitsu Composites Co. Ltd has been actively involved in the polyphenylene sulfide (PPS) sector, focusing on enhancing its product range to meet the evolving needs of high-performance applications, particularly in the automotive and electronics industries. In April 2023, the company launched an advanced PPS compound with improved mechanical and thermal properties, aimed at addressing the demands for lightweight and durable materials in electric vehicles and electronic devices.

This new compound is designed to offer better processability and higher resistance to heat and chemicals, making it suitable for critical components in these industries. Additionally, in September 2024, Lion Idemitsu is set to expand its PPS production capacity at its plant in Japan, reflecting its commitment to scaling up production to meet increasing global demand. The company’s ongoing efforts in research and development and strategic capacity expansion highlight its dedication to maintaining a competitive edge in the PPS market.

Polyplastics Co. Ltd. has been actively expanding its footprint in the polyphenylene sulfide (PPS) sector, focusing on increasing production capacity to meet the growing demand for high-performance materials in various industries. In January 2023, Polyplastics completed the expansion of its PPS compound production facility in Nantong, China, significantly boosting its capacity from 9,000 to 21,400 tons per year. This expansion is a strategic move to support the rising demand from automotive and electronics manufacturers who require materials with superior thermal stability and chemical resistance. The company’s commitment to increasing its production capacity underscores its ambition to solidify its position as a leading supplier of PPS in the global market, catering to the evolving needs of its customers across Asia and beyond.

Tosoh Corporation has been making significant strides in the polyphenylene sulfide (PPS) sector, focusing on enhancing its product offerings and expanding its production capabilities. In April 2023, Tosoh launched a new PPS compound designed with improved thermal shock resistance, specifically tailored for automotive applications that require high durability under extreme conditions. This new product also offers better weld strength and liquidity, contributing to the development of lightweight automotive components. Additionally, in September 2024, Tosoh plans to further expand its PPS production capacity at its plant in Japan, aiming to meet the increasing global demand for high-performance engineering plastics. These developments reflect Tosoh’s commitment to innovation and its strategic focus on maintaining a competitive edge in the PPS market.

SK Chemicals has been actively advancing its position in the polyphenylene sulfide (PPS) sector, with a focus on developing high-performance materials that cater to the demands of various industries, including automotive and electronics. In March 2023, SK Chemicals announced the launch of a new grade of PPS resin that offers enhanced chemical resistance and thermal stability, specifically designed for use in electric vehicles (EVs) and electronic components.

Chengdu Letian Plastics Co. Ltd. has been progressively enhancing its role in the polyphenylene sulfide (PPS) sector, focusing on the development and production of advanced PPS materials that cater to the needs of various high-performance applications. In February 2023, the company expanded its PPS product line to include new grades with improved thermal and mechanical properties, aimed at the automotive and electronics industries.

Celanese Corporation has been actively involved in the polyphenylene sulfide (PPS) sector, focusing on enhancing its product portfolio to cater to high-performance applications. In April 2023, Celanese introduced a new high-performance PPS grade designed specifically for use in the automotive and electronics industries. This new grade offers superior thermal stability and chemical resistance, making it ideal for components that need to withstand harsh conditions, such as those found in electric vehicles and electronic devices. Additionally, Celanese has been working on expanding its global supply chain and production capabilities to ensure a stable supply of PPS materials to meet increasing market demands. These efforts are part of Celanese’s broader strategy to strengthen its position in the advanced materials market by offering innovative and reliable solutions to its customers.

Teijin Limited has been actively expanding its presence in the polyphenylene sulfide (PPS) sector by focusing on innovative solutions and strategic collaborations. In May 2023, Teijin introduced a new PPS compound tailored for automotive applications that require high heat resistance and mechanical strength. This new material is specifically designed to meet the growing demands of electric vehicles and other advanced automotive technologies. Additionally, Teijin has been enhancing its production capabilities to ensure a reliable supply of high-quality PPS materials, aiming to support the rapidly evolving needs of the automotive and electronics industries. These efforts reflect Teijin’s commitment to leveraging its advanced materials expertise to deliver cutting-edge solutions in the PPS market.

SABIC, a global leader in diversified chemicals, has been actively expanding its presence in the polyphenylene sulfide (PPS) sector by developing advanced materials for high-performance applications. In April 2023, SABIC launched a new glass fiber-reinforced PPS compound, known as LNP THERMOCOMP OFC08V, specifically designed for use in 5G base station dipole antennas and other electronic applications. This new material is engineered to provide excellent mechanical strength and stability at high temperatures, making it ideal for the rapidly growing telecommunications and electronics sectors.

Zhejiang NHU Co. Ltd., a prominent player in the polyphenylene sulfide (PPS) sector, has been focusing on expanding its production capabilities and developing new PPS products to cater to the increasing demand from various industries. In March 2023, Zhejiang NHU announced the completion of an expansion project at their PPS production facility, which significantly increased their annual output capacity. This expansion is part of the company’s broader strategy to strengthen its market position by ensuring a reliable supply of high-quality PPS materials, particularly for the automotive, electronics, and industrial sectors. The new production line also incorporates advanced technologies aimed at improving the efficiency and sustainability of the manufacturing process. Zhejiang NHU’s ongoing efforts in innovation and capacity expansion demonstrate its commitment to meeting the evolving needs of its global customers in the PPS market.

Conclusion

Polyphenylene sulfide (PPS) stands out as a highly versatile and high-performance thermoplastic, finding increasing applications across various industries due to its exceptional thermal stability, chemical resistance, and mechanical strength. The growing demand from sectors such as automotive, electronics, aerospace, and industrial applications underscores its significance in modern manufacturing and engineering. As industries continue to prioritize materials that offer both performance and sustainability, PPS is well-positioned to experience sustained growth.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)