Table of Contents

Introduction

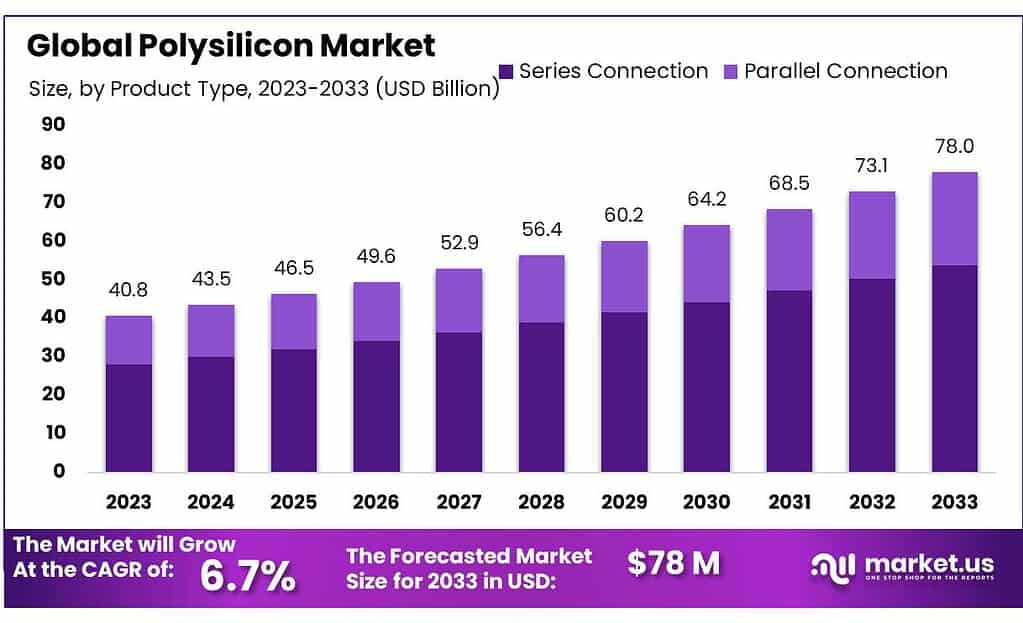

The global Polysilicon Market, with a projected expansion from USD 40.8 billion in 2023 to USD 78.0 billion by 2033, is poised to achieve a robust CAGR of 6.7% during this period. This growth is primarily fueled by the escalating demand for solar photovoltaics (PV) and semiconductors, reflecting the increasing shift towards renewable energy and advanced electronics.

A significant driver of this market is the technological advancements in solar panel technologies and the production enhancements in polysilicon that increase its purity and efficiency. The burgeoning solar energy industry, supported by government policies promoting clean energy adoption, has significantly contributed to the demand for high-quality polysilicon, especially in solar applications.

However, the polysilicon market also faces challenges, including the high cost of production and price volatility, which can hinder market growth. Environmental concerns associated with polysilicon production processes, which require high energy consumption and involve significant emissions, add another layer of complexity to market expansion efforts.

Recent developments in the market include strategic expansions and partnerships aimed at increasing production capacity and improving supply chain sustainability. Notable among these is the expansion by Wacker Chemie AG, which plans to increase its capacity for semiconductor-grade polysilicon by over 50% by early 2025, a move expected to entail significant capital expenditure.

High-Purity Silicon America Corporation (HSA), a leader in ultra-pure polycrystalline silicon for the semiconductor industry, has been focusing on quality and technological advancement to meet the stringent requirements of the semiconductor and fiber optics industries. HSA manufactures a range of silicon forms including chips, chunks, and rods, and also produces high-purity Chlorosilane gases essential for the semiconductor industry.

OCI Company Ltd., renowned for its high-purity polysilicon products, supplies 11-Nines grade (99.999999999% purity) polysilicon, which is a core material for semiconductor wafers and ultra-high efficiency solar wafers. OCI’s commitment to maintaining the highest quality standards is evident in their integrated quality management systems and extensive certifications.

Qatar Solar Technologies has not featured prominently in recent specific updates but continues to play a significant role in the market as part of the global supply chain for polysilicon, particularly in leveraging the region’s rich energy resources to boost the supply of key materials for the solar industry.

REC Silicon ASA has been particularly active, partnering with Mississippi Silicon to establish a sustainable and transparent U.S.-based solar supply chain. This collaboration is focused on enhancing the U.S. capacity for solar module production from raw silicon to assembled units, emphasizing carbon footprint reduction and traceability. Furthermore, REC Silicon has been expanding its production capacity significantly, leveraging both traditional Siemens manufacturing practices and efficient Fluidized Bed Reactor (FBR) technology, which enhances production efficiency and reduces environmental impact.

Key Takeaways

- Polysilicon market size is expected to be worth around USD 78.0 billion by 2033, from USD 40.8 billion in 2023, growing at a CAGR of 6.7%.

- Series Connection segment held a dominant market position, capturing more than a 65% share.

- Siemens Process held a dominant market position in the polysilicon market, capturing more than a 41.2% share.

- Chips held a dominant market position in the polysilicon market, capturing more than a 34.2% share.

- Photovoltaic held a dominant market position in the polysilicon market, capturing more than a 78% share.

- Asia Pacific held the largest share of 63.2% in 2023 total market share due to its rapid growth in the solar energy sector

Statistics

- Chinese polysilicon prices have tumbled 85% since mid-2022 due to a major build-out of factories that was far more than the market actually needed.

- Bernreuter Research says the volume of polysilicon shipments into China dropped 28.5% year on year in 2023 to the lowest level since 2011. It predicts that imports could fall by another 40% this year.

- The three companies increased their polysilicon exports to Vietnam from 18,672 MT in 2022 to 33,265 MT in 2023, up 78.2% year on year.

- Customs statistics show that polysilicon exports from China to Vietnam rose from 639 MT in 2022 to 4,970 MT in 2023 – an increase of more than 700%.

- In the fourth quarter of 2023, the combined share of Wacker and OCI of total Chinese polysilicon imports rose to 97.8%.

- Bernreuter Research said it that it expected polysilicon prices to soon dip below the historical low of $6.75/kg, which was reached in June 2020.

- Polysilicon prices edged up again this week. Among them, the transaction price range of n-type rod silicon was 39,000-44,000 yuan/ton, up 0.73% month-on-month.

- According to statistics, the domestic supply of polysilicon in August was about 129,700 tons, a decrease of 6.01% month-on-month, and the supply of polysilicon in

- September is expected to remain at about 135,000 tons.

- CVD process, as well as other production processes, requires solutions bearing high temperature conditions up to 1500°C. Mersen has developed dedicated solutions adapted to customer’s requirements.

- The statistics of grain boundaries described here reveals a relation between nanoscopic location and the arrangement of grain boundaries, which implies fluctuation in transistor characteristics of 45-nm and beyond MOSFETs.

- The average transaction price for n-type polysilicon fell to CNY 41.8/kg, and granular silicon dropped to CNY 35.3/kg, dropping 5.4% week-on-week.

- Solarbe’s statistics indicate that the average bid price for p-type modules in May was CNY 0.82/W, down 2.3% MoM.

- Similarly, the average bid price for n-type modules dropped to CNY 0.874/W, down 1.2%.

Emerging Trends

- Emerging trends in the polysilicon market highlight several pivotal developments poised to influence its trajectory. The industry is experiencing a significant surge in demand driven by advancements in solar panel technologies and the semiconductor industry’s expansion. This is coupled with a growing focus on renewable energy sources and high-performance electronic devices which require high-quality polysilicon.

- One major trend is the increasing efficiency of solar panels, which decreases the amount of polysilicon required per unit of power generated. This efficiency gain is crucial in reducing costs and improving the accessibility of solar power technologies, especially in burgeoning solar markets around the world.

- The market is also seeing a push towards sustainability, with polysilicon manufacturers striving to enhance their production processes. This includes adopting cleaner production methods and improving energy efficiency to align with global environmental standards. Such initiatives are crucial as the industry faces scrutiny for the environmental impact of polysilicon production processes.

- Technological advancements in manufacturing techniques such as Chemical Vapor Deposition (CVD) continue to dominate the production landscape, offering high-purity polysilicon essential for sophisticated electronics and solar applications.

- Despite these positive shifts, the polysilicon industry is navigating challenges such as price volatility and supply chain disruptions, which have been particularly impactful in emerging markets. The costs of polysilicon have seen dramatic fluctuations, impacting the broader solar energy sector’s growth and posing challenges for the deployment of new solar capacities.

Use Cases

- Polysilicon, a highly purified form of silicon, is primarily used in two major sectors: solar energy and electronics. In the solar industry, polysilicon is essential for manufacturing photovoltaic (PV) cells, which are critical components in solar panels. The surge in global solar energy adoption, driven by governmental incentives and the declining cost of solar technologies, has significantly boosted the demand for high-quality polysilicon. The solar PV segment dominated the polysilicon market, accounting for a substantial share of its usage due to the widespread installation of solar panels and the ongoing shift towards renewable energy sources.

- In the electronics sector, polysilicon is used to produce semiconductor wafers, which are fundamental in manufacturing various electronic devices like smartphones, computers, and other digital equipment. The demand in this segment is propelled by the continuous advancements in technology and the increasing need for more efficient and compact electronic devices. The growing markets for electric vehicles and green energy technologies, which rely on advanced electronic components for better energy management and efficiency, also contribute to the rising demand for semiconductor-grade polysilicon.

- Technological innovations in polysilicon production, such as the development of granular polysilicon, have improved the efficiency and reduced the costs of production processes. These advancements make polysilicon more accessible and preferable for various applications, aligning with global efforts towards sustainability and reduced carbon footprints.

Major Challenges

- The polysilicon market faces several major challenges that impact its stability and growth prospects. One of the primary concerns is the severe market oversupply, which pressures prices downwards and strains profitability across the industry. This issue is compounded by fluctuations in demand, particularly from the solar energy sector, which consumes a significant portion of global polysilicon output.

- Another significant challenge is the geopolitical and regulatory landscape, particularly in the United States where trade investigations and potential tariffs on imported solar cells and modules introduce considerable uncertainty and disrupt supply chains. This regulatory uncertainty can delay investments and complicate long-term planning for manufacturers.

- Environmental regulations also pose a challenge, as they require manufacturers to invest in cleaner production technologies and manage waste more effectively. These requirements can increase operational costs and necessitate significant capital investments.

- Furthermore, the dominance of Chinese manufacturers in the polysilicon market, controlling a significant portion of the market share, presents a competitive challenge for non-Chinese producers. These manufacturers must navigate not only competitive pricing but also geopolitical tensions and the risk of additional tariffs or trade barriers.

- Addressing these challenges requires strategic planning, investment in technology to improve efficiency and reduce costs, and agility to respond to regulatory changes and market dynamics. As the market evolves, companies must also focus on sustainable practices and compliance with global environmental standards to remain competitive and viable in the long term.

Market Growth Opportunities

- The polysilicon market is poised for significant growth, presenting various opportunities across different regions and applications. The Asia Pacific region, particularly China, dominates the market due to its extensive production capabilities and robust government support for the semiconductor and solar photovoltaic (PV) industries. This region is expected to maintain its lead due to ongoing investments in production technology and the rapid expansion of renewable energy projects.

- In North America, especially the United States, the polysilicon market is driven by the growing solar PV industry, which benefits from government incentives, a focus on reducing carbon emissions, and increasing solar installations. The U.S. solar industry’s capacity is projected to expand substantially, which in turn fuels the demand for high-quality polysilicon used in solar panels.

- Europe also presents considerable growth opportunities, attributed to strong governmental commitments to reduce carbon emissions and increase the use of renewable energy. Initiatives like the European Green Deal aim to significantly boost the percentage of renewable energy in the EU’s total consumption by 2030, promoting further adoption of solar energy technologies and increasing the demand for polysilicon.

- The global market is also witnessing a trend toward the production of high-purity polysilicon, which is essential for manufacturing high-efficiency solar cells and advanced electronic components. Technological advancements in production processes are enhancing the purity and efficiency of polysilicon, making it more desirable for cutting-edge applications in both the solar and semiconductor industries.

- Moreover, the increasing focus on sustainable and eco-friendly manufacturing practices is expected to spur the demand for polysilicon as industries seek to reduce their carbon footprint and enhance energy efficiency in production.

Key Player Analysis

Qatar Solar Technologies (QSTec) plays a significant role in the polysilicon sector by manufacturing high-grade polysilicon, which is the primary raw material used in the majority of the world’s solar modules. Operating from Ras Laffan Industrial City, QSTec has a production capacity of 8,000 metric tonnes per annum with plans to expand to over 50,000 metric tonnes. This expansion aims to establish a comprehensive solar manufacturing base within the region, showcasing sustainability through its 1.1 megawatt solar installation that includes various solar technologies like ground-mounted solar farms and rooftop installations.

REC Silicon ASA is a key player in the polysilicon industry, known for its production of solar grade polysilicon primarily used in photovoltaic cells. It utilizes advanced production technologies, including the Fluidized Bed Reactor (FBR) process, to enhance the efficiency and reduce the energy consumption of polysilicon production. REC Silicon’s commitment to sustainability is evident in its strategic partnerships aimed at establishing a secure and environmentally responsible supply chain for the solar industry.

Tongwei Group Co., Ltd has solidified its position as a world leader in the polysilicon industry, especially noted for its massive production scale. As of 2022, Tongwei produced significantly more polysilicon than its closest competitors, highlighting its dominance in the market. The company has been aggressively expanding its production capacity, with plans to reach between 220,000 to 290,000 metric tons by the end of 2023. These expansions include new plants in Leshan and Baoshan, emphasizing their commitment to supporting the growing demand for solar energy technology.

Tokuyama Corporation is a well-established chemical and polysilicon manufacturer in Japan, known for producing high-quality materials for the semiconductor and solar industries. Their commitment to innovation and quality has positioned them as a key player in the global market for semiconductor-grade polysilicon. Tokuyama’s strategic focus on specialized products, such as high-purity polysilicon used in advanced electronics and solar applications, underlines their role in supporting critical industries in a rapidly evolving technological landscape.

Wacker Chemie AG is a key player in the global polysilicon market, known for its high-purity polysilicon primarily used in the semiconductor industry. The company, based in Germany, has strategically focused on maintaining a strong position in the electronics-grade polysilicon sector while its presence in the solar-grade polysilicon market has been reducing. This shift reflects Wacker Chemie’s adaptation to market dynamics, where it sees greater value and less competition compared to the rapidly growing but fiercely competitive solar-grade market segment.

Xinte Energy Co., Ltd. is a significant force in the polysilicon industry, primarily serving the solar power sector. It is part of the TBEA group and operates out of China, where it has recently embarked on an ambitious expansion to boost its production capacity significantly. Xinte Energy has invested heavily in new facilities to increase its annual polysilicon output, aiming to support the growing demand for high-purity polysilicon used in solar panels and semiconductors. The company’s expansion efforts include building a new polysilicon plant in Xinjiang with plans for future growth dependent on market conditions, emphasizing its commitment to scaling up production in line with global solar energy needs.

Daqo New Energy Co., Ltd. has significantly strengthened its position as a major supplier of high-purity polysilicon, primarily catering to the global solar PV industry. With a strategic focus on increasing production capacity, Daqo expanded its facilities in Inner Mongolia, enhancing its output from 105,000MT to 205,000MT to meet the growing demand from the solar industry. Their proactive approach includes securing long-term supply contracts, such as a three-year deal to provide high-purity polysilicon to Gaojing Solar, supporting large-scale solar wafer projects. Daqo’s developments demonstrate a robust commitment to maintaining a leadership role in the polysilicon market while adapting to dynamic market needs.

GCL Technology (formerly GCL-Poly Energy), has rebranded and continues to be a significant player in the polysilicon industry, focusing on the manufacture and sale of polysilicon and silicon wafers. The company is known for its substantial production capacity and has been instrumental in supplying materials for the solar power industry. GCL Technology’s emphasis on enhancing production efficiency and expanding its product offerings remains critical to its strategy, aimed at reinforcing its market position amidst the rapidly evolving solar sector demands.

Hemlock Semiconductor Operations LLC, based in Michigan, USA, stands out as a pivotal manufacturer of high-purity polysilicon, a crucial material used in the production of semiconductor devices and solar panels. Hemlock is distinctive as one of the few vertically integrated polysilicon producers, controlling every stage from raw material to finished product, which helps streamline costs and enhance supply chain efficiency. This integration was further solidified by their acquisition of DuPont’s trichlorosilane business, ensuring more control over the essential inputs for polysilicon production. Hemlock’s commitment to sustainability is evident in their production processes, designed to have a low carbon footprint, thereby supporting the creation of eco-friendly solar panels and high-tech electronics.

Conclusion

The polysilicon market is poised for robust growth, driven by escalating global demands for renewable energy and advancements in high-tech electronics. With significant contributions from regions such as Asia Pacific, North America, and Europe, the industry benefits from a strong production base and supportive governmental policies that encourage the adoption of solar and semiconductor technologies.

The continuous evolution of production techniques, aimed at enhancing the efficiency and purity of polysilicon, further underpins its critical role in the solar PV and semiconductor sectors. Despite facing challenges such as market oversupply and regulatory uncertainties, the future of the polysilicon market appears promising, bolstered by technological innovations and a global shift towards sustainable energy solutions. As the market continues to expand, the strategic focus on high-purity products and environmentally friendly practices will be crucial in sustaining its growth and meeting the demands of an increasingly energy-conscious world.