Table of Contents

Introduction

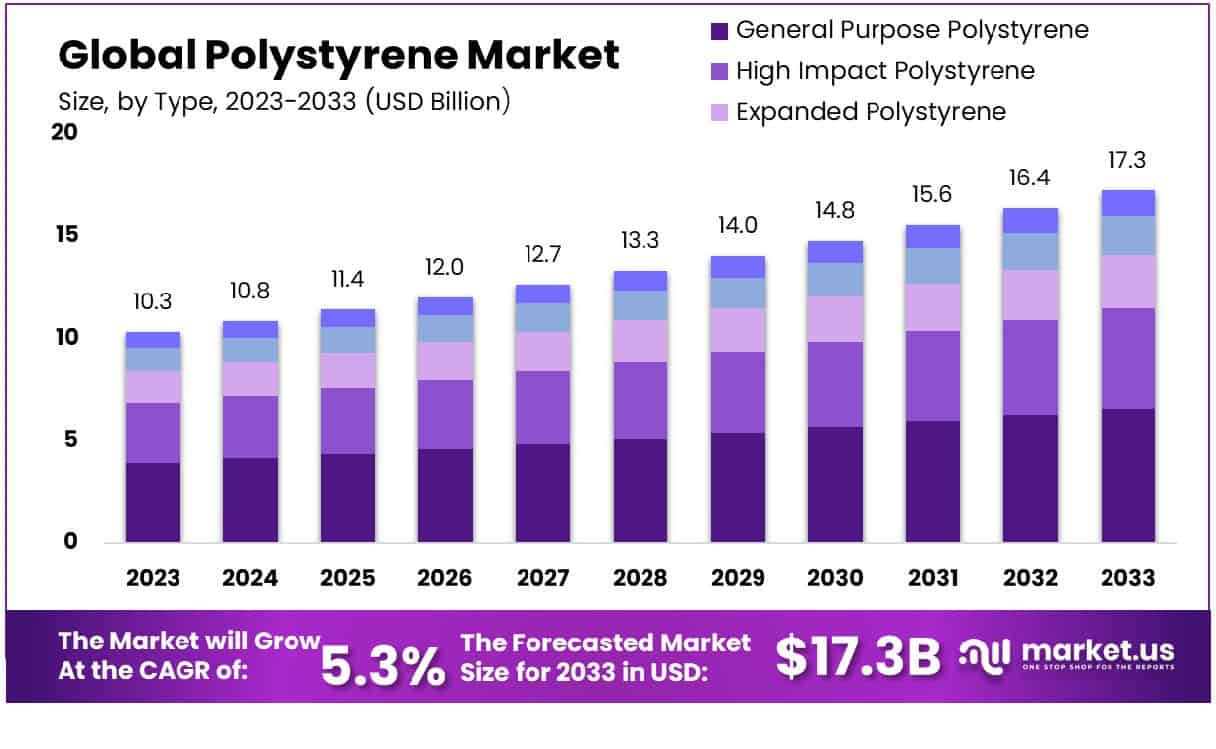

The Global Polystyrene Market is anticipated to expand from USD 10.3 billion in 2023 to approximately USD 17.3 billion by 2033, exhibiting a compound annual growth rate (CAGR) of 5.3% over the forecast period from 2024 to 2033. This growth can primarily be attributed to the increasing demand for polystyrene in various applications including packaging, appliances, and construction, where its lightweight and insulating properties are highly valued.

However, the market faces significant challenges such as environmental concerns related to polystyrene waste and the shifting regulatory landscape aiming to reduce the use of non-biodegradable plastics. Recent developments have seen a push towards improving recycling processes and innovations in bio-based polystyrenes, which are expected to offer new opportunities for market growth. These advancements are crucial as they address environmental issues while meeting the material needs of diverse industries.

Atlas Molded Products recently expanded its production capacity by acquiring a new manufacturing facility in Texas. This strategic move aims to cater to the increasing demand in the southern United States and improve supply chain efficiencies.

Alpek S.A.B. de CV has been actively involved in the development of sustainable polystyrene solutions. In 2022, they announced a partnership with an innovative recycling company to pioneer advanced recycling technologies that convert polystyrene waste back into styrene monomer, which can then be reused to produce new polystyrene products.

Total has launched a new range of high-performance polystyrene products designed for the packaging industry. These products are tailored to offer improved thermal insulation and impact resistance, addressing the critical needs of the food and medical packaging sectors.

Trinseo completed a merger with a leading polymer producer in 2023, significantly enhancing its polystyrene production capabilities and market reach. This merger is part of Trinseo’s strategic plan to strengthen its position in high-growth markets, particularly in Asia and Europe.

Versalis SpA announced in early 2023 the injection of EUR 50 million into the research and development of biodegradable polystyrene. This funding is part of Versalis’ commitment to sustainability and aims to create a new class of environmentally friendly polystyrene products that can degrade under specific conditions, reducing environmental impact.

Key Takeaways

- Market Growth: The Global Polystyrene Market is projected to grow from USD 10.3 billion in 2023 to USD 17.3 billion by 2033, at a CAGR of 5.3%.

- Asia-Pacific dominates the polystyrene market with 36.5%, valued at USD 3.7 billion.

- By Type: High Impact Polystyrene holds a 38.2% market share by type.

- By Form Type: Foams represent 33.2% of the market by form type.

- By Application: Rigid Packaging applications lead with a 41.2% market share.

- By End-Use Industry: Packaging as an end-use industry commands a 35.5% share.

Economic Incentives and Recycling Technologies

- With the rate of landfill tax having risen to £103.70 per tonne on 1 April 2024, it’s not only environmentally friendly to recycle polystyrene but also becoming more profitable.

- Businesses can make up to £500 per tonne of recycled polystyrene.

A BBC survey in 2018 found that only 1% of councils in the UK could recycle polystyrene trays. - To store enough polystyrene to make it worthwhile for recyclers to collect it, consider hiring or purchasing a polystyrene baler. They transform vast quantities of polystyrene into neat bundles, reducing volume by 95%.

- Polystyrene is widely used in many industries, including food packaging, and is widely recyclable in the UK. However, only 12% is recycled.

Investing in the circular economy, the insulation manufacturer Finnfoam is building a pilot - plant in Salo for chemically recycling polystyrene, i.e., XPS and EPS insulation materials. The total value of the investment will be more than 10 million euros.

Environmental Impact and Marine Pollution

- Research shows that 80% of all ocean pollution originates from the land, which points to toxic, land-based EPS trash as the primary culprit.

- Further, plastic pollution specifically “polystyrene foam (Styrofoam) comprise 90% of all marine debris, with single-use food and beverage containers being one of the most common items found in ocean and coastal surveys.”

- Scientists have found plastic fragments in literally hundreds of species, including 86% of all sea turtle species, 44% of all seabird species, and 43% of all marine mammal species,” states Environment America, and, simply put, “the worst forms of plastic pollution is polystyrene foam.”

- Single-use Styrofoam items find their way into the environment at high volumes — EPS represents 30% of all landfill space by volume.

- Worldwide, polymeric waste contributes two hundred and eighty million tons, recycling only 12%.

Properties and Industrial Applications of Polystyrene

- The conformational statistics of atactic polystyrene have been investigated by solid-state NMR, on a sample labeled with 25% 13CH2 groups.

- Polystyrene foam is a lightweight material, about 95 percent air, with good insulation properties.

- Expanded polystyrene is made from 98% air and only 2% material. It is known for its lightweight and ease of molding or cutting, making it a good choice in various product designs.

- It has a melting point range of 160 – 165°C for homopolymer and 135 – 159°C for copolymer.

- Moreover, the revalorization of the rubber particles was accomplished by ethenolysis metathesis, in which after 4 h at 100 °C, polybutadiene was split to produce 1,5-hexadiene as a major product (60% yield) and isolated PS, which was further thermally degraded, achieving a styrene selectivity of 70%.

Emerging Trends

- Sustainability Initiatives: There is a growing trend towards the development of sustainable polystyrene products. Companies are increasingly focusing on producing recyclable and bio-based polystyrene to reduce environmental impact. This shift is motivated by stricter regulatory policies and a rising consumer preference for sustainable materials.

- Advanced Recycling Technologies: The adoption of advanced recycling techniques is becoming a prominent trend. These technologies, such as chemical recycling, allow polystyrene waste to be converted back into its basic monomers, which can be reused to produce new polystyrene. This approach not only helps in managing waste effectively but also supports the circular economy model.

- Enhanced Product Features: Innovation in polystyrene manufacturing is leading to products with improved properties. Enhanced insulation characteristics, higher durability, and better resistance to chemicals are some of the advancements that are being integrated into new polystyrene products to meet the evolving demands of industries like construction, packaging, and automotive.

- Geographical Expansion: Companies are looking to expand their reach into emerging markets in Asia, Africa, and South America. These regions are witnessing rapid industrial growth, which is creating new opportunities for the use of polystyrene in various applications.

- Collaborations and Partnerships: There is an increasing trend of collaborations between polystyrene manufacturers and recycling companies. These partnerships are aimed at enhancing the recycling infrastructure and developing new methods to recycle polystyrene more efficiently.

Use Cases

- Packaging Solutions: Polystyrene is extensively used in the packaging industry, particularly for food packaging. It offers excellent cushioning and thermal insulation, making it ideal for protecting products during transportation and preserving the temperature of perishable goods. Polystyrene packaging represents approximately 40% of the market’s usage, catering to the needs of fast food, grocery, and perishable goods shipping.

- Construction Materials: In the construction sector, polystyrene is used as an insulating material in the form of expanded polystyrene (EPS) and extruded polystyrene (XPS). These forms are used for thermal insulation in walls, roofs, and floors. The global market for polystyrene in construction is expected to grow annually by 6% due to increased infrastructure spending and the need for energy-efficient building solutions.

- Consumer Electronics: Polystyrene is employed in the manufacturing of consumer electronics for components like casings, housings, and fixtures because of its ability to be molded into precise shapes and its good aesthetic finish. This material contributes to approximately 15% of the polystyrene market share, supporting the production of items from household appliances to high-end electronic gadgets.

- Automotive Components: The automotive industry utilizes polystyrene for producing parts that require lightweight and durable materials, such as knobs, instrument panels, and trim components. This usage accounts for about 10% of the polystyrene market, driven by the automotive sector’s ongoing push towards lighter vehicles for better fuel efficiency.

- Medical Applications: In the medical field, polystyrene is used for a variety of applications including petri dishes, test tubes, and diagnostic components. Its clarity, cleanliness, and ability to be easily sterilized make it suitable for sensitive medical environments. The demand in this segment is steadily growing, particularly with increases in health awareness and healthcare spending.

Major Challenges

- Environmental Impact: Polystyrene is non-biodegradable, leading to considerable environmental concerns regarding waste disposal. With more than 14 million tons of polystyrene discarded annually, much of it ends up in landfills where it can persist for centuries. This has prompted many governments and organizations to push for bans or restrictions on polystyrene products, particularly in food packaging.

- Regulatory Pressure: Increased regulatory scrutiny is a major challenge. For example, several cities globally have already banned the use of polystyrene foam in food containers and other consumer products due to environmental concerns. These regulations not only limit the market’s growth potential but also push manufacturers towards more costly alternatives.

- Market Shifts Towards Alternatives: There is a growing demand for alternative materials that are perceived as more environmentally friendly, such as PLA (polylactic acid) and other biodegradable options. This shift is driven by consumer awareness and the desire for sustainable products. The polystyrene market is losing share to these alternatives, which are often marketed as more sustainable and are increasingly preferred by industries like packaging and consumer goods.

- Volatility in Raw Material Prices: Polystyrene production is heavily reliant on styrene monomer, derived from petroleum. Fluctuations in oil prices directly affect the cost of production, leading to price instability in the polystyrene market. For instance, a sudden increase in oil prices can raise production costs significantly, impacting profitability for manufacturers.

- Recycling and Waste Management Challenges: Polystyrene’s recycling rates are relatively low compared to other plastics, partly due to the lack of suitable recycling infrastructure and the economic feasibility of the recycling process. Only about 1% of polystyrene is recycled, which not only contributes to environmental pollution but also represents a lost opportunity for resource recovery and reuse.

Market Growth Opportunities

- Recycling Innovations: As environmental concerns continue to rise, there is a significant opportunity for growth in recycling technologies specific to polystyrene. Developing cost-effective and efficient recycling methods can help mitigate the environmental impact and provide a sustainable source of raw materials. For instance, advancements in chemical recycling could potentially enable the recovery of up to 95% of the original polystyrene for reuse in new products.

- Expansion into Emerging Markets: Emerging economies present a fertile ground for the expansion of the polystyrene market. The rapid urbanization and industrialization in regions like Asia, Africa, and South America are driving demand for construction materials, packaging solutions, and consumer goods—all key applications for polystyrene. Capturing even a fraction of these expanding markets could significantly boost the global demand for polystyrene.

- Development of High-Performance Products: There is a growing demand for high-performance polystyrene products with enhanced properties such as improved insulation, fire resistance, and durability. Investing in R&D to develop these advanced materials can open new applications in industries such as advanced construction, automotive, and electronics, potentially increasing the polystyrene market value by up to 30% in high-demand sectors.

- Biodegradable Alternatives: Developing biodegradable polystyrene could address both regulatory pressures and consumer preferences for sustainable materials. This approach would not only align with global sustainability trends but also differentiate products in a competitive market. Early adopters of biodegradable polystyrene technologies could capture a significant market share, particularly in sectors like food packaging and disposable consumer products.

- Collaborative Ventures: Forming strategic partnerships with other companies and research institutions can accelerate innovation and market penetration. Such collaborations can enhance the capabilities in product development, recycling technologies, and market expansion strategies, facilitating quicker adaptation to changing market conditions and regulatory environments.

Key Players Analysis

Atlas Molded Products specializes in the production of molded polystyrene for various applications including building insulation, protective packaging, and OEM components. They focus on sustainability and recycling, operating across North America to deliver high-quality, environmentally friendly products.

Alpek S.A.B. de C.V., a prominent player in the chemicals sector, has significantly expanded its operations in the polystyrene market. The company acquired BASF’s expandable polystyrene business in the Americas, enhancing its production capabilities and distribution channels in North and South America, including significant facilities in Brazil and Argentina.

TotalEnergies, a major player in the U.S., focuses on producing various petrochemicals, including polystyrene. Their operations span across 26 locations, emphasizing clean and affordable fuel production as part of their energy transition ambition. Previously, Total sold its polystyrene operations in China to INEOS Styrolution, reflecting a strategic shift to concentrate on markets in Europe and North America where it holds a stronger position.

Trinseo, a global materials company, actively engages in the polystyrene sector by producing a range of polystyrene resins, including innovative recycled options through dissolution technology. These materials are essential in various applications like consumer electronics and packaging. Notably, Trinseo is enhancing the circular economy with its STYRON™ CO2RE™ polystyrene, which incorporates up to 30% post-consumer recycled content, significantly reducing CO2 emissions compared to traditional polystyrene.

Versalis SpA is actively involved in the polystyrene sector by producing a new line of solid polystyrene products, Versalis Revive® PS, containing up to 75% recycled content. The initiative underscores Versalis’ commitment to utilizing recycled materials from household waste like yogurt pots and disposable dishes to create new, environmentally friendly polystyrene products for various applications including thermal insulation and household items.

Americas Styrenics LLC (AmSty), based in The Woodlands, Texas, is a leader in the North American polystyrene market, focusing on the production of polystyrene and styrene monomers for various applications including food packaging and construction. AmSty is pioneering circular recycling technologies, aiming to increase the content of recycled materials in their products to 25% by 2030. They have established significant advancements in recycling used polystyrene back into new, high-quality materials through their joint venture with Agilyx, achieving a fully circular pathway for polystyrene recycling.

BASF SE has been advancing in the polystyrene sector through its product offerings such as general-purpose polystyrene (GPPS) and expandable polystyrene (EPS). The company emphasizes sustainable practices by reinventing EPS with recycled and alternative raw materials, aiming to significantly reduce greenhouse gas emissions by 2030.

CHIMEI Corporation has expanded its polystyrene production capacity with a new production line in Zhangzhou, China, enhancing its annual output significantly. This expansion aligns with CHIMEI’s broader strategy to not only increase production but also innovate with bio-based and recycled materials, as seen in their launch of Ecologue Bio ABS, which uses non-food related bio-based feedstocks.

INEOS Styrolution Group GmbH, a global leader in the styrene sector, focuses on producing styrene monomers and various polystyrene products. They are advancing towards offering recycled polystyrene at a commercial scale, reflecting their commitment to sustainability and innovation in recycling technologies.

Innova operates in the polystyrene sector, producing a range of styrene products including general-purpose polystyrene (GPPS), high-impact polystyrene (HIPS), and expandable polystyrene (EPS). The company focuses on innovative approaches by incorporating up to 30% post-consumer materials into some of its products, highlighting its commitment to sustainability. They have recently resumed operations at their Triunfo plant in Brazil, demonstrating their capability to meet both domestic and international market demands efficiently.

Formosa Chemicals & Fibre Corp. actively participates in the polystyrene sector, primarily focusing on the production of high-performance polystyrene resins. Their products are utilized in a variety of applications, ranging from household items to building and construction, reflecting the company’s broad market reach and technological proficiency in the petrochemical industry.

INEOS Styrolution Group GmbH leads globally in the styrenics market, including polystyrene, with a strong commitment to sustainability and innovation. They are pioneering in advancing polystyrene recycling technologies, significantly focusing on enhancing the circular economy through initiatives like the development of a commercial-scale recycling facility in Europe. This aligns with their strategic commitments to use recycled content in their products, particularly for food-safe packaging applications.

Kumho Petrochemical is making strides in the polystyrene sector by embracing recycling technologies to produce eco-friendly materials such as recycled styrene monomer (RSM). They have collaborated to implement pyrolysis technology, converting polystyrene waste into RSM, which is used in producing synthetic rubber, highlighting their commitment to sustainable practices and innovation in the petrochemical industry.

LG Chem actively participates in the polystyrene sector, primarily focusing on producing expandable polystyrene (EPS), commonly known as styrofoam. EPS is utilized in a variety of applications due to its properties like thermal insulation, impact absorption, and water repellency. This positions LG Chem as a significant player in supplying materials for protective packaging, building insulation, and food containers, emphasizing their role in various essential industries.

SABIC is a prominent player in the polystyrene sector, offering a variety of PS (Polystyrene) products including general-purpose and expandable grades. These products are utilized across diverse applications such as packaging and construction, emphasizing features like high clarity and impact resistance. SABIC’s commitment to innovation is evident in its development of specialized polystyrene solutions that cater to specific industry needs.

Synthos engages significantly in the polystyrene sector, focusing on sustainable practices and innovative recycling technologies. The company is a prominent player in producing and recycling polystyrene, with initiatives like the PolyStyreneLoop project, which showcases its commitment to a circular economy by recycling polystyrene foams through advanced dissolution techniques.

Conclusion

The polystyrene market, projected to grow significantly in the coming decade, faces a complex landscape of challenges and opportunities. While environmental concerns and regulatory pressures pose substantial hurdles, these also drive the market towards innovation and sustainability. By focusing on advanced recycling methods, tapping into emerging markets, and developing new, high-performance products, the industry can address environmental issues and meet the evolving demands of various sectors.

Additionally, exploring biodegradable alternatives and forging strategic partnerships will be crucial in navigating the competitive and regulatory environments. Embracing these strategies will not only help mitigate the market challenges but also capitalize on the growth opportunities, ensuring the long-term viability and success of the polystyrene industry.