Table of Contents

Introduction

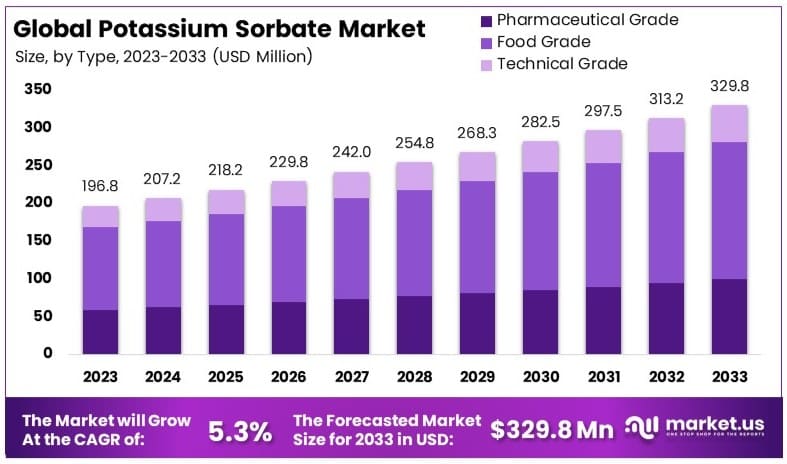

The global potassium sorbate market, valued at USD 196.8 million in 2023, is projected to reach approximately USD 329.8 million by 2033, expanding at a CAGR of 5.3% during the forecast period from 2024 to 2033. Potassium sorbate, widely used as a preservative in the food and beverage industry, plays a crucial role in extending shelf life and preventing spoilage by inhibiting the growth of mold, yeast, and bacteria.

This market growth can be attributed to several factors, including the increasing demand for convenience foods and beverages, the rising trend of ready-to-eat meals, and the growing awareness of food safety and preservation. Additionally, the expansion of the cosmetics and personal care industry, where potassium sorbate is used to prevent spoilage and extend product life, contributes to the market’s upward trajectory.

However, the market faces challenges such as the rising preference for natural preservatives and stringent regulatory standards that may impact production and usage. Recent developments in the market include advancements in production technology and the introduction of more cost-effective manufacturing processes, which are expected to enhance market growth. The increasing application of potassium sorbate in various industries, including pharmaceuticals and animal feed, further supports market expansion. Despite challenges, the continuous demand for effective preservation solutions across multiple sectors ensures a positive outlook for the potassium sorbate market.

Recent developments in the potassium sorbate market reveal significant activities among key players such as Celanese Corporation, Archer Daniels Midland Company (ADM), FBC Industries, Inc., and Hawkins, Inc. These developments are indicative of the dynamic nature of the market and highlight various strategic moves including acquisitions, new product launches, and infrastructural investments.

Celanese Corporation continues to innovate within the potassium sorbate market, enhancing its product offerings to cater to diverse industrial needs. The company has introduced Nutrinova® Potassium Sorbate BFX Granules, which are particularly suitable for aqueous-based detergent formulations with a pH of 7 or lower. This product is designed to be non-sensitizing to the skin, making it a preferred choice for liquid detergents and hand dishwashing products.

Archer Daniels Midland Company (ADM) has been actively expanding its production capabilities and geographical footprint. Recently, ADM announced the construction of a new biodiesel plant in Lloydminster, Alberta, Canada, which will significantly increase its biodiesel production capacity by 50%. This new facility, adjacent to their existing canola crushing plant, is expected to enhance the company’s ability to produce renewable biodiesel efficiently. This strategic move not only supports Canada’s renewable diesel mandate but also aligns with ADM’s commitment to sustainable and environmentally friendly operations.

FBC Industries, Inc. and Hawkins, Inc. have also been making strides in the market. Specific recent developments for these companies, it is known that they play crucial roles in supplying high-quality potassium sorbate to various sectors including food and beverages, pharmaceuticals, and personal care products. These companies focus on maintaining stringent quality standards and meeting the growing demand for effective preservatives.

Key Takeaways

- Potassium Sorbate Market was valued at USD 196.8 million in 2023, and is expected to reach USD 329.8 million by 2033, with a CAGR of 5.3%.

- Food Grade dominates the type segment with 55.4% due to its extensive use in preserving food products.

- Food and Beverages lead the application segment with 48.3% owing to high demand for food preservation solutions.

- North America holds the largest market share at 38.6%, attributed to the region’s strong food and beverage industry.

Potassium Sorbate Statistics

- Potassium sorbate is used primarily as a preservative, releasing 74% sorbic acid, which exhibits anti-fungal properties that inhibit the spread of yeast. The centesimal composition of potassium sorbate consists of 74.64% sorbic acid and 26.03% potassium.

- Sorbic acid was first isolated from rowanberry in 1859 by German chemist Wilhelm von Hofmann. In the 1980s, sorbic acid replaced nitrites as a meat preservative due to the carcinogenic nature of nitrites.

- In the EU and UK, potassium sorbate is listed as E202; sorbic acid is listed as E200. Potassium sorbate is highly soluble in water at 20°C, moderately soluble in alcohol (95% by volume) at approximately 14 g/l, and insoluble in ethyl ether.

- Potassium sorbate is generally recognized as safe (GRAS) by the U.S. Food and Drug Administration (FDA). The acceptable daily intake (ADI) for potassium sorbate is 25 mg/kg body weight, as established by the Joint FAO/WHO Expert Committee on Food Additives (JECFA).

- Health Canada has updated the permitted level of potassium sorbate as a Class 3 preservative in cakes, croissants, Danish pastries, and muffins from 1,000 parts per million (p.p.m.) to 3,500 p.p.m., following a safety assessment which found no concerns.

- China is the primary exporter of potassium sorbate due to favorable climate conditions, with Germany also exporting but in lesser quantities.

- Potassium sorbate can significantly prolong the shelf life of foods. For example, dipping poultry in a 5,000 ppm solution extended its shelf life from 7.5 to 11 days.

- Extending the shelf life of poultry meat by 10 days can reduce waste by 57 kg per day per 1,000 kg of production, equating to a 6% reduction in food waste. Similar benefits are seen with bread, where extending shelf life by one day can reduce waste by 5%.

- In food products, potassium sorbate is used in concentrations ranging from 0.025% to 0.10%. It is used in cheeses, dips, yogurt, sour cream, bread, cakes, pies, baking mixes, icings, fudges, etc.

- For animal feed, potassium sorbate is used in concentrations between 0.4% and 1.5%. As a mold inhibitor, potassium sorbate is effective up to a pH of 6.5, with increasing effectiveness as pH decreases.

Emerging Trends

- Growth Driven by Organic and Natural Products: The demand for potassium sorbate is significantly influenced by the increasing consumer preference for organic and natural food products. As consumers become more health-conscious, they are seeking natural alternatives to synthetic preservatives. Potassium sorbate, being a naturally occurring compound, meets this demand and is widely used in products like organic wines and other natural food items.

- Extended Shelf Life Requirements: The globalization of food markets necessitates longer shelf lives for food and beverage products, particularly those that are exported. Potassium sorbate plays a crucial role in extending the shelf life by preventing microbial growth and maintaining product freshness during long transportation and storage periods. This trend is especially prominent in the export-oriented sectors of fruit juices and soft drinks.

- Regulatory Challenges and Consumer Perceptions: Despite its widespread use, potassium sorbate faces regulatory challenges and consumer perception issues. Various regions have strict regulations regarding its use and labeling, which can increase operational costs and complexity for manufacturers. In some regions, consumers are wary of preservatives, which can impact the market growth negatively.

- Market Segmentation and Key Applications: Potassium sorbate is used in several application sectors, with the food and beverage industry being the largest. It is essential for preserving dairy products, bakery items, and beverages, ensuring they remain fresh and safe for consumption. The pharmaceutical industry also utilizes potassium sorbate to preserve medications, while the personal care sector uses it in cosmetics and hair care products.

- Competitive Landscape and Innovations: The potassium sorbate market is competitive, with several key players like Seidler Chemical Company, Celanese Inc., and Ningbo Wanglong Group Co., Ltd. continuously innovating to maintain market share. These companies are focusing on new product developments, mergers, and acquisitions to enhance their market position and meet the evolving consumer demands.

- Price Trends and Economic Factors: The price of potassium sorbate is influenced by global supply-demand balances, trade policies, and economic factors. Recently, the market has seen fluctuations due to changes in raw material costs and varying demand levels across different regions. Understanding these price trends is crucial for stakeholders to make informed strategic decisions.

Use Cases

- Food Preservation

- Baked Goods and Dairy: It is commonly added to bread, pastries, cheese, yogurt, and other dairy products to prevent spoilage and extend shelf life. The typical concentration in food ranges from 0.025% to 0.1% by weight

- Beverages: In beverages like soft drinks, fruit juices, and wines, potassium sorbate is used to prevent microbial growth and unwanted fermentation. This is crucial for maintaining the flavor and quality of these drinks.

- Processed Foods: Potassium sorbate is also used in various processed foods, including jams, jellies, sauces, dried fruits, and processed meats. It helps prevent spoilage and extend the shelf life of these products, ensuring they remain safe and high-quality for longer periods.

- Cosmetics and Personal Care: Potassium sorbate is used in lotions, creams, shampoos, and other personal care products to inhibit the growth of harmful microorganisms, thereby extending the shelf life and ensuring product safety. The typical concentration in these products ranges from 0.1% to 0.3%

- Wine Making: Potassium sorbate is essential in winemaking, added after fermentation to prevent further yeast activity and re-fermentation. This stabilization process is crucial for sweet wines, helping them retain their desired taste and clarity without becoming carbonated or cloudy.

- Animal Feed: Potassium sorbate is used in animal feed to inhibit the growth of molds, yeasts, and bacteria, thereby extending shelf life and maintaining nutritional quality. This preservation ensures that animals receive safe, uncontaminated food, which is essential for their health and productivity.

- Medical Applications: In medical applications, potassium sorbate is used in topical ointments to prevent bacterial growth, ensuring the product remains effective and safe for treating skin conditions. This reduces infection risk and enhances the therapeutic benefits of the ointments.

Key Players Analysis

Celanese Corporation recently formed a joint venture named Nutrinova with Mitsui, focusing on food ingredients, including potassium sorbate. The venture aims to strengthen its market position in the food preservatives sector. In 2023, Celanese reported a full-year revenue of $9.4 billion, reflecting a strategic focus on high-growth markets. Additionally, they announced price increases for their Nutrinova® Potassium Sorbate products to offset rising production costs and sustain profitability.

Archer Daniels Midland Company (ADM) reported a full-year revenue of $93.9 billion for 2023. ADM continues to invest in its Carbohydrate Solutions segment, which includes potassium sorbate. Despite a 6% decline in adjusted segment operating profit, the company improved its profit margins through better pricing strategies and efficient operations. ADM also enhanced its market position by acquiring Fuerst Day Lawson Limited, expanding its specialty ingredients portfolio.

FBC Industries, Inc. is actively expanding its production capacity to meet the growing demand for potassium sorbate in the food and beverage industry. This strategic move is aimed at solidifying its market position and catering to the increasing preference for clean-label and natural preservatives. FBC Industries has focused on innovation and sustainability, ensuring its products align with current consumer trends. The company’s efforts are part of a broader industry shift towards more natural food preservation solutions.

Hawkins, Inc. reported a revenue of $935 million for fiscal 2023 and continues to strengthen its market presence through strategic acquisitions. Recently, Hawkins expanded its water treatment operations by acquiring Water Solutions Unlimited and Miami Products, enhancing its distribution network. These acquisitions are part of Hawkins’ broader strategy to diversify its product offerings, including potassium sorbate, and ensure sustained growth in the specialty chemical sector.

Nantong Acetic Acid Chemical Co., Ltd. is a leading manufacturer of potassium sorbate, boasting an annual production capacity of over 30,000 metric tons. The company focuses on providing high-quality food preservatives, which include potassium sorbate used extensively in the food and beverage industry. Recently, they have strengthened their market position by enhancing production efficiency and meeting global standards, including ISO certifications. Their revenue for 2023 was reported at $420.64 million, reflecting steady growth and market demand.

ID Chemical Co., Ltd. is actively engaged in the production of potassium sorbate, focusing on expanding its product portfolio to meet diverse market needs. The company is known for its innovative approaches in food preservation, ensuring the safety and longevity of food products. Their strategic initiatives include enhancing production capabilities and maintaining strict quality standards to cater to both domestic and international markets.

Nantong Alchemy Biotech Development Co., Ltd. focuses on producing high-quality potassium sorbate for the food industry, ensuring safety and extending product shelf life. Recently, the company opened a new manufacturing base in Nantong Economic Development Zone, enhancing production efficiency with advanced technology. Their revenue for 2023 ranged between $10 million and $50 million, showcasing steady growth and robust market presence through over 900 sales channels in China and strategic international partnerships.

Sorbent Technologies is actively involved in the potassium sorbate market, focusing on innovation and quality. The company has enhanced its market presence by expanding its product line and improving manufacturing processes to ensure high purity and effectiveness of its products. Their recent financial performance shows steady growth, with significant contributions from their food preservatives sector. Sorbent Technologies continues to invest in R&D to meet evolving market needs and maintain a competitive edge.

Lubrizol is actively involved in the specialty chemicals market, including potassium sorbate, with a focus on sustainability and technological innovation. In 2023, the company reported revenues of $6.4 billion, a slight decline from the previous year. Lubrizol has been enhancing its product offerings, including the recent introduction of the PTFE-free PowderAdd™ 9780 Texturing Agent for powder coatings. The company’s global operations and strategic acquisitions, such as Advonex and Diamond Dispersions, underscore its commitment to growth and sustainability.

McCormick & Company, Inc. is a prominent player in the potassium sorbate sector, leveraging its extensive experience in the food industry to maintain high standards of food preservation. Recently, McCormick reported a revenue increase of 5% in its second quarter of 2023, driven by strong demand for its seasoning products. The company continues to innovate, launching new products and expanding its market reach, which highlights its ongoing commitment to providing high-quality food ingredients.

Tengzhou Aolong Fine Chemical Co., Ltd. is a leading Chinese producer of food and feed additives, including potassium sorbate. Established in 1999, the company annually produces 2,000 metric tons of potassium sorbate. In 2023, they emphasized expanding their market reach and maintaining high-quality standards with ISO9000:2000 certification and Kosher and Halal certifications. Tengzhou Aolong exports 90% of its products globally, ensuring a strong international presence and continuous innovation to meet diverse market demands.

Ningbo Wanglong Technology is a significant player in the potassium sorbate market, specializing in the production and distribution of food preservatives. The company reported a notable revenue growth in 2023, driven by increased demand for its high-quality preservatives. Wanglong continues to invest in research and development, enhancing its product portfolio to meet stringent global food safety standards and expanding its market presence both domestically and internationally.

Conclusion

The potassium sorbate market is poised for significant growth in the coming years. This growth can be attributed to the increasing demand for effective and safe preservatives in the food and beverage industry. With the rising health consciousness among consumers and the expanding applications of potassium sorbate in pharmaceuticals and personal care products, the market is expected to continue its upward trajectory.

Additionally, technological advancements and improved production processes are likely to enhance the quality and availability of potassium sorbate, further boosting its market presence. Overall, the potassium sorbate market holds promising opportunities for stakeholders, driven by evolving consumer preferences and the growing emphasis on food safety and quality.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)