Table of Contents

Introduction

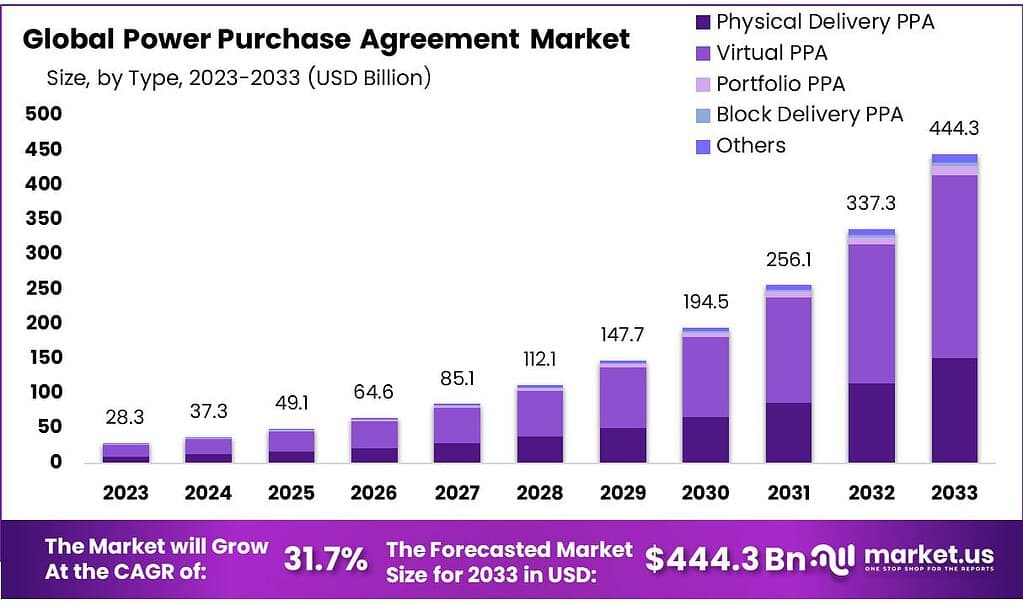

The Global Power Purchase Agreement (PPA) Market is projected to expand from USD 28.3 billion in 2023 to approximately USD 444.3 billion by 2033, achieving a (CAGR) of 31.7%. This growth is largely fueled by the rising demand from corporations for renewable energy solutions.

In 2022, major industry leaders such as Microsoft, Apple, and Walmart signed substantial clean energy agreements, underscoring the increasing role of PPAs in supporting sustainability goals and securing long-term energy supply. These agreements are particularly important as companies seek to reduce carbon footprints and align with global environmental initiatives.

Despite the promising growth prospects, the market faces a number of challenges. Geopolitical instability and fluctuations in global energy markets, particularly due to tensions in key fossil fuel-producing regions, have led to volatile energy prices, creating uncertainty for renewable energy project financing.

This volatility can make long-term PPAs harder to negotiate, as the financial risks become harder to predict. Additionally, evolving regulatory environments and the need for managing exchange rate risks remain significant hurdles, making it more complex for international players to enter the market and finalize deals with confidence.

General Electric has been significantly expanding its footprint in the Power Purchase Agreement (PPA) market through a series of strategic initiatives, although specific developments for 2023 were not detailed in the available sources.

Siemens AG, in partnership with BP, signed a Memorandum of Understanding (MoU) to jointly explore and develop next-generation low-carbon technologies, with a strong focus on offshore wind energy projects. This collaboration is expected to speed up the transition towards cleaner energy sources and support the decarbonization goals of various industries.

Shell Plc has also made noteworthy advancements in its energy strategy. In March 2023, Shell signed a long-term PPA with a major solar developer to purchase renewable energy from new solar farms being developed in Texas.

The agreement, valued at over USD 250 million, is part of Shell’s broader efforts to secure clean energy sources for its global operations and reduce its carbon emissions. Additionally, Shell made a strategic move into the hydrogen market, investing USD 200 million in a green hydrogen production plant in the Netherlands, reinforcing its commitment to sustainable energy solutions.

Despite the ongoing challenges, the Power Purchase Agreement (PPA) market has witnessed significant growth and development in recent years. In 2023, North America experienced a remarkable surge, securing over 18.5 GW of contracted renewable power, reflecting the region’s strong commitment to clean energy adoption.

This growth was further supported by the increasing popularity of innovative PPA structures, such as “green hybrid PPAs,” which integrate renewable energy generation with energy storage solutions. These hybrid agreements are designed to improve grid reliability, ensure consistent power supply, and increase the financial viability of renewable energy projects, particularly in regions with variable weather patterns and high energy demand.

Key Takeaways

- In 2023, the global Power Purchase Agreement Market was valued at USD 28.3 Billion.

- The global Power Purchase Agreement market is projected to grow at a CAGR (Compound Annual Growth Rate) of 31.7% between 2024 and 2033.

- By type, the Virtual PPAs held a major market share of 59.2% in 2023.

- By Location, the off-site segment dominated the global market with an 83.1% market share in 2023.

- By Category, the Corporate segment accounted for 86.3% of the global market.

- Based on the deal type, the wholesale segment led the market with a 62.5% market share in 2023.

- By Capacity, the 50-100 MW segment dominated the market in 2023, accounting for over 49.6% market share.

- By application, the wind segment accounted for the fastest growth, accounting for 51% CAGR during the forecasted period.

- Based on the end-user, the Commercial segment dominated the market with more than 50% market share in 2023.

- In 2023, North America dominated the market with the highest revenue share of 40.7%.

- In 2022, According to the American Public Power Association, 7 gigawatts (GW) of offsite projects were supported by power purchase agreements signed by more than 167 companies.

- Australia’s Renewable Energy Target (RET) influences PPAs by setting targets for electricity generation from renewable sources. For instance, the country has set a national renewable electricity target of 82% by 2030.

Power Purchase Agreement Statistics

- Market Growth:

- BNEF Data: The global PPA market saw strong growth in recent years, with a 21% increase in 2021, 32% in 2022, and 12% in 2023. This indicates a solid trend, though the pace of growth slightly slowed in 2023 compared to the prior year.

- Pexapark Data for Europe: In 2023, Europe experienced significant growth in PPAs, with 16.2 GW of contracts signed—a 41% increase compared to 2022. This suggests that Europe is a key player in the global PPA market, likely due to its commitment to renewable energy goals and sustainability.

- Technology Breakdown:

- Solar Power: The majority of PPA contracts are tied to solar plants, making up 65% of the contracts in Europe. This reflects the decreasing cost of solar energy and its increasing adoption in corporate sustainability strategies.

- Wind Power: Onshore wind accounts for 14%, while offshore wind accounts for 12% of PPA contracts. This balance shows the ongoing shift toward diverse renewable energy sources in the European market.

- Contract Details:

- A total of 272 contracts were signed in 2023 in Europe, with an average volume of 60 MW per contract. The trend indicates larger-scale renewable energy projects being financed through PPAs, which are attractive due to the long-term, stable pricing structures they offer. Many of these contracts are likely in line with corporate or institutional sustainability goals, where companies are looking for long-term, reliable sources of green energy.

- Regulatory Impact:

- Electricity Consumption Limitations: If the plant operator consumes less than 50% of the generated electricity, there are motivations to stay below 300 kWp for rooftop solar systems. This regulatory threshold ensures that the energy produced is primarily for off-site consumption or sale rather than self-consumption, a common feature of PPA contracts.

- Financeability of Larger Systems: PPAs allow for financing of large rooftop systems above the 300 kWp limit, which would otherwise be difficult due to regulatory restrictions. This opens the door to financing larger renewable energy projects, even for corporate or industrial rooftops.

- Greenfield PPAs:

- Greenfield PPAs are increasingly seen as an ideal solution for financing new green energy facilities, especially those with capacities of 20 MW or more. These agreements are crucial for new projects that would not otherwise be viable without guaranteed off-take agreements like PPAs.

- Market Knowledge:

- According to surveys, only 3% of respondents have a high level of knowledge about PPAs, while 51% have medium to advanced knowledge, and the remaining are beginners. This suggests a gap in understanding about PPAs, pointing to an opportunity for education and information dissemination within the industry.

Emerging Trends

Hybrid PPAs: These combine traditional PPA models with battery storage solutions to offer greater energy reliability. By storing excess energy generated from renewable sources like solar or wind, hybrid PPAs mitigate the intermittent nature of these sources, improving grid stability. This makes them a more attractive option for corporate buyers who require consistent, predictable energy supply.

Shorter-term Agreements: In response to volatile energy prices and rapid technological advancements, there’s a marked shift towards shorter-term PPAs. This flexibility allows buyers to adjust more quickly to market changes, take advantage of emerging technologies, and better manage energy costs in an unpredictable market.

Stable Pricing Windows: The recent market shift towards lower natural gas prices, coupled with an abundant supply of solar panels, has led to more stable PPA prices. This has created a window of opportunity for buyers, allowing them to lock in favorable terms and reduce the risks that come with price volatility.

Corporate Clean Energy Procurement: There has been a significant uptick in corporate demand for clean energy, driven by sustainability goals. Companies, particularly in the tech sector, are increasingly procuring renewable energy via PPAs to meet ambitious targets, with many striving for 100% renewable energy in their operations. This demand is pushing the PPA market towards greater innovation and flexibility.

Geopolitical and Economic Influences: Geopolitical factors, such as trade policies and material costs, continue to influence PPA pricing. For example, changes in tariffs or restrictions on solar panel imports could impact the overall cost of renewable energy procurement, affecting future PPA negotiations and availability.

Use Cases

The global corporate sector is increasingly turning to power purchase agreements (PPAs) as a strategic tool to meet sustainability objectives and control energy expenses. In 2023, corporations announced a record-breaking 46 gigawatts (GW) of solar and wind PPAs, fueled by favorable market conditions and ambitious corporate clean energy targets. This growth has been particularly pronounced in Europe, where corporate PPA volumes saw a significant increase. Corporations are adopting PPAs not only to align with sustainability goals but also to lock in long-term, stable energy prices, offering them a cost-effective solution in an evolving energy landscape.

PPAs are also proving to be an essential enabler for community energy projects, allowing local groups to directly purchase renewable energy. This not only promotes energy self-sufficiency within communities but also helps reduce carbon footprints, fostering the development of local renewable energy initiatives. Moreover, such projects contribute to regional economic growth by supporting clean energy infrastructure.

Governments and municipalities are leveraging PPAs to green public infrastructure, a growing trend aimed at reducing public sector carbon emissions and bolstering local renewable energy industries. By sourcing clean energy through PPAs for public services and infrastructure, governments can lead by example in the transition to renewable energy, while promoting economic growth and energy sustainability within their regions.

For non-profit organizations, PPAs offer a mechanism to stabilize energy costs, particularly since these organizations are often unable to capitalize on tax incentives for renewable energy investments. By entering into PPAs, non-profits can secure lower, predictable energy prices, providing them with a long-term financial advantage in managing operating expenses.

In deregulated markets, where the physical delivery of electricity is not required, virtual PPAs have become increasingly popular. These financial agreements allow off-takers to claim the environmental benefits of renewable energy generated elsewhere. This structure offers flexibility and risk mitigation, enabling companies and organizations to support renewable energy generation without needing direct access to the physical infrastructure, further expanding the reach of clean energy solutions.

Major Challenges

Price Volatility

One of the most significant challenges in PPAs is the potential for price volatility, especially in markets where energy prices fluctuate widely. For example, in the wake of the global energy crisis exacerbated by geopolitical tensions (e.g., the Russia-Ukraine conflict), energy prices spiked in 2022. This volatility can make it difficult for corporations to lock in predictable energy costs for the long term. According to data from the International Energy Agency (IEA), global natural gas prices in Europe surged by more than 400% in 2022, leading to a reevaluation of energy pricing models.

Complex Negotiations

PPAs can be complex, particularly when structuring terms around issues like pricing, delivery schedules, and the allocation of risk between the parties. The need to align various stakeholders—including energy producers, off-takers (corporations, governments, utilities), and financial institutions—can make the process time-consuming and difficult. In fact, studies show that negotiating a PPA can take anywhere from 6 to 18 months, depending on the complexity of the agreement and the maturity of the renewable energy market in the region.

Creditworthiness and Financing

In many cases, energy developers and buyers must prove their creditworthiness to secure financing for renewable energy projects. For instance, developers often need long-term PPAs to secure the financing required to build wind or solar farms. However, if an off-taker’s credit rating is low, securing favorable financing terms can be challenging. According to the BloombergNEF (BNEF) report, projects with corporate PPAs have seen a rise in their financing costs, especially where off-taker creditworthiness is in question, increasing the overall cost of projects by as much as 10-15% in certain regions.

Regulatory and Policy Risks

The regulatory landscape surrounding PPAs can be unpredictable, especially in regions with changing policies related to renewable energy and climate goals. Shifts in government policies, such as changes to subsidies, tariffs, or energy tariffs, can impact the financial viability of a PPA. For instance, in 2023, India introduced new curbs on foreign funding for renewable energy projects, which created uncertainty for international investors and developers relying on PPAs for financing.

High Transaction Costs

The transaction costs associated with PPAs, especially in emerging markets, can be prohibitively high. These costs cover legal, financial, and advisory fees required to structure and negotiate an agreement. According to the World Bank, these transaction costs can sometimes account for as much as 5-10% of the total project cost, making PPAs less attractive for smaller projects or off-takers with limited budgets.

Top Opportunities

Growing Corporate Demand for Renewable Energy

Corporations are increasingly adopting PPAs to meet their sustainability targets and reduce their carbon footprints. According to the BloombergNEF report, global corporate PPA activity reached a record 46.2 GW in 2023, with tech giants like Google, Microsoft, and Amazon leading the charge. This growth is largely driven by the corporate push for 100% renewable energy, which has gained momentum with initiatives such as the RE100 campaign, where companies pledge to source all of their energy from renewable sources. The strong corporate appetite for clean energy continues to fuel the demand for PPAs.

Expansion of Community and Distributed Energy Projects

As communities and local governments seek to enhance energy resilience and reduce reliance on traditional power grids, there is an increasing focus on community-based PPAs. These agreements enable local energy projects to sell power directly to consumers or communities, reducing costs and promoting energy self-sufficiency. According to the U.S. Department of Energy, community solar projects alone added over 3.3 GW of capacity in 2022. PPAs play a critical role in facilitating these projects by providing a reliable revenue stream for developers and energy producers.

Government Support and Policy Initiatives

Governments worldwide are providing strong support for renewable energy projects through policy frameworks, tax incentives, and regulations that make PPAs more attractive. In the U.S., the Inflation Reduction Act (IRA) passed in 2022, includes provisions for expanding clean energy projects and incentivizing the use of PPAs. These policies are expected to accelerate the adoption of PPAs, especially as countries aim to meet ambitious carbon reduction targets. The European Union’s Green Deal and similar regulations in Asia further open up new markets for PPA-driven investments in renewable energy.

Technological Advancements in Energy Storage

With advancements in energy storage technology, particularly in battery storage systems, PPAs are becoming more flexible and reliable. Storage solutions help address the intermittency of renewable energy sources like solar and wind by storing excess power for later use. According to a report by BloombergNEF, global investment in energy storage reached $17.8 billion in 2022, marking a 26% increase from the previous year. This growth in energy storage technology is expected to unlock new PPA opportunities by making renewable energy more reliable and viable for both buyers and sellers.

Cost Reductions in Renewable Energy Technologies

The declining costs of renewable energy technologies, particularly solar and wind power, are opening up significant opportunities for PPAs. For instance, the cost of solar photovoltaic (PV) systems has decreased by over 80% since 2010, according to the International Renewable Energy Agency (IRENA).

This trend makes it easier for energy producers to offer competitively priced PPAs to buyers, further driving the adoption of clean energy through these agreements. As the cost of renewable energy continues to fall, PPAs are becoming an increasingly attractive option for businesses seeking to reduce energy costs while supporting sustainability.

Future Outlook of the Power Purchase Agreement (PPA) Industry

Growth in Renewable Energy: As countries and corporations increasingly commit to reducing carbon emissions, the demand for renewable energy sources continues to grow. PPAs are pivotal in facilitating the finance and development of renewable energy projects, such as solar and wind farms. This trend is likely to persist as more entities aim to achieve carbon neutrality.

Corporate Demand: There’s a significant increase in corporate PPAs where private businesses agree to purchase electricity directly from renewable energy producers. This shift is motivated by the desire to lock in energy costs and reduce carbon footprints. Companies like Google, Amazon, and Microsoft have been leading this trend, and it’s expected that more companies will follow suit.

Technological Advancements: Innovations in energy storage and smart grid technologies enhance the viability of PPAs by making renewable energy sources more reliable and efficient. As these technologies continue to evolve, they can solve intermittent issues related to wind and solar energy, making PPAs more attractive.

Regulatory Support: Many governments are implementing policies that encourage the adoption of renewable energy, such as subsidies, tax incentives, and mandates. These policies are crucial for the growth of the PPA market as they provide a more stable and predictable environment for long-term investments in renewable energy.

Diversification of Energy Sources: The diversification in renewable energy sources, including geothermal, biomass, and offshore wind, provides new opportunities for PPAs. Each of these sectors can have specific characteristics advantageous for different regions or energy needs, broadening the potential market for PPAs.

Decentralization of Energy Production: The move towards smaller, more distributed energy production facilities, including community and rooftop solar projects, could expand the role of PPAs in the residential and community sectors. This decentralization supports energy resilience and independence, appealing to a broader base of consumers.

North America Power Purchase Agreement (PPA) Market

In 2023, North America maintained its leadership in the Power Purchase Agreement (PPA) market, capturing a 40.7% share. This region’s dominance is underpinned by robust governmental support in the U.S. and Canada, where incentives and policy frameworks are aligned to promote renewable energy adoption. The attraction of PPAs for both producers and consumers in this region is heightened by these supportive measures.

Data from the American Clean Power Association reveals that in 2022, commercial and industrial entities in the U.S. committed to nearly 20 GW of clean PPAs, marking an unprecedented peak in corporate power procurement. The advanced state of North America’s renewable energy sector not only supports substantial project scales but also aligns with the rising corporate demand for sustainable energy solutions, driven by societal pressure for environmental responsibility.

On the other hand, Europe has demonstrated the highest growth velocity in the PPA market, with a Compound Annual Growth Rate (CAGR) of 36.6% during the forecast period. Analysts predict that Europe may soon surpass North America in market share due to stringent environmental regulations and ambitious renewable energy goals set by the European Union. These directives have significantly accelerated the uptake of renewable sources, positioning PPAs as a key mechanism for companies seeking reliable, long-term energy solutions.

The year 2023 marked a milestone for the European PPA market, which saw over 16.2 GW of renewable power contracted, and expectations are set for this figure to rise above 20 GW by 2024. The surge in demand within Europe is also fueled by an increased corporate focus on sustainability, with numerous companies committing to PPAs as a strategy to minimize their carbon footprint and secure a sustainable energy future.

Recent Developments

In 2023, General Electric (GE) expanded its role in the Power Purchase Agreements (PPAs) sector by securing multiple contracts to supply renewable energy. GE signed PPAs totaling over 3.5 GW of wind and solar energy capacity, helping corporations meet sustainability targets. GE’s renewable energy division, focused on onshore wind and energy storage, continues to drive large-scale green energy projects. These efforts contribute to the global shift toward cleaner energy, with GE’s technology playing a pivotal role in scaling renewable energy production.

Siemens AG has made significant strides in the Power Purchase Agreements (PPAs) market. In 2023, Siemens facilitated the signing of PPAs worth over 2.2 GW of renewable energy, focusing primarily on wind and solar projects. Siemens also supports clients with energy management solutions, integrating digital technologies to optimize energy consumption and meet corporate sustainability goals. Their involvement in PPAs helps organizations secure stable, long-term clean energy contracts while driving the transition to renewable energy.

In 2023, Shell Plc significantly expanded its footprint in the Power Purchase Agreements (PPAs) sector, securing contracts for over 4 GW of renewable energy, including solar and wind projects. The company focuses on providing long-term, stable energy solutions to corporate buyers, helping them meet their sustainability targets. Shell’s strategy includes offering flexible PPA models that integrate their expertise in energy trading and renewables, contributing to the global transition to clean energy.

Statkraft has been a major player in the PPA market, with a focus on renewable energy projects. In 2023, Statkraft signed PPAs totaling over 3.8 GW, primarily in wind and solar power. The company works closely with large corporations to secure long-term energy supply contracts, contributing to their sustainability goals. Statkraft’s strong presence in Europe and expanding global operations position it as a leader in providing clean energy solutions through PPAs.

Fairdeal Greentech India Pvt. Ltd. has been actively involved in the Power Purchase Agreements (PPAs) sector, focusing on solar energy projects. In 2023, the company signed multiple PPAs for over 150 MW of solar energy capacity, providing clean energy solutions to commercial and industrial clients across India. Their expertise in solar energy installation and management has made them a key player in the Indian renewable energy market, helping clients meet their sustainability goals.

Ameresco, a leading energy services company, has been deeply involved in the PPA market, particularly in renewable energy and energy efficiency projects. In 2023, Ameresco signed PPAs for more than 200 MW of solar and wind capacity, mainly in the U.S. The company focuses on long-term energy supply agreements that help businesses and municipalities reduce energy costs and meet environmental targets. Their role in providing integrated energy solutions has positioned them as a trusted partner for renewable energy procurement.

RWE AG has been a major player in the Power Purchase Agreements (PPAs) sector, focusing heavily on renewable energy projects. In 2023, RWE secured over 5 GW of PPAs for wind and solar power, helping large corporations meet their renewable energy targets. The company’s strong focus on clean energy sources and its ability to offer flexible PPA terms have made it a preferred partner for corporate and industrial clients globally. RWE’s expertise in offshore and onshore wind projects continues to drive its growth in the PPA market.

Enel Global Trading has significantly expanded its presence in the PPA market, securing long-term contracts for renewable energy across Europe, North America, and Latin America. In 2023, Enel signed PPAs totaling approximately 4 GW of solar and wind capacity. Enel’s strategy focuses on offering flexible and tailored energy solutions that align with the sustainability goals of its clients. Its expertise in energy trading and procurement allows Enel to offer competitive pricing, making it a key player in the renewable energy sector.

Ecohz has emerged as a key player in the Power Purchase Agreements (PPAs) sector, primarily focusing on facilitating renewable energy projects through long-term agreements. In 2023, Ecohz secured over 200 MW of solar and wind PPAs for its clients across Europe. The company is known for offering tailored PPA solutions that allow corporations to meet their sustainability goals by sourcing clean energy. Ecohz’s expertise in renewable energy procurement and its flexibility in contract structures have made it a trusted partner in the renewable energy transition.

Green Sphere Cleantech Services Private Limited has been actively involved in the Power Purchase Agreements (PPAs) market in India, focusing on providing solar energy solutions. In 2023, the company signed PPAs for over 50 MW of solar power capacity with various industrial clients. Green Sphere specializes in helping businesses reduce their energy costs and achieve sustainability targets by offering clean energy through long-term agreements. Their commitment to renewable energy projects has made them a significant player in India’s clean energy landscape.

Iberdrola, S.A. has made significant strides in the Power Purchase Agreements (PPAs) market, securing large-scale renewable energy contracts. In 2023, Iberdrola signed over 4.5 GW of PPAs, primarily in solar and wind energy, across Europe and the Americas. The company is focused on providing clean energy solutions to corporate clients and utilities, helping them meet their sustainability targets. Iberdrola’s leadership in offshore wind projects continues to drive its success in the renewable energy PPA sector.

Ørsted A/S has been a global leader in Power Purchase Agreements (PPAs), with a focus on offshore wind and solar energy projects. In 2023, Ørsted signed PPAs totaling 3.2 GW, helping companies achieve their renewable energy goals. Ørsted’s expertise in large-scale renewable energy generation and its ability to offer competitive pricing have made it a preferred partner for corporate buyers worldwide. The company continues to expand its PPA offerings, particularly in Europe and North America.

Renew Energy Global PLC has been expanding its presence in the Power Purchase Agreements (PPAs) sector, primarily focusing on renewable energy. In 2023, the company secured over 1.5 GW of PPAs, mainly for solar and wind projects across emerging markets in Asia and Africa. Their commitment to providing affordable and clean energy solutions has made them a strong partner for corporations and governments looking to meet sustainability targets. Renew Energy’s flexible PPA structures are contributing to their rapid growth in the renewable energy sector.

Drax Energy Solutions Limited has been actively involved in the PPA market, focusing on providing clean energy through biomass and renewables. In 2023, Drax signed PPAs totaling 1.2 GW, primarily in the UK and North America. The company’s expertise in biomass energy and its ability to offer flexible PPA contracts has made it a preferred partner for businesses looking to secure long-term, renewable energy supplies. Drax’s efforts contribute to decarbonizing the energy sector and helping organizations achieve their environmental goals.

Conclusion

Power Purchase Agreements (PPAs) have become a fundamental driver of the global transition to renewable energy, providing a reliable framework for businesses, governments, and communities to secure long-term, sustainable, and cost-effective energy sources. In 2023, the PPA market saw remarkable growth, with corporate participation reaching record levels. This surge highlights the increasing demand for renewable energy, fueled by both economic incentives and ambitious sustainability targets.

As the energy sector continues to evolve, PPAs have proven to be essential tools that not only enable the scaling of renewable energy projects but also help stabilize energy prices, making them an attractive option for various stakeholders. The flexibility of PPAs, which can adapt to diverse market conditions and regulatory environments, positions them as critical components in shaping the future of energy procurement and sustainability strategies on a global scale.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)