Table of Contents

Introduction

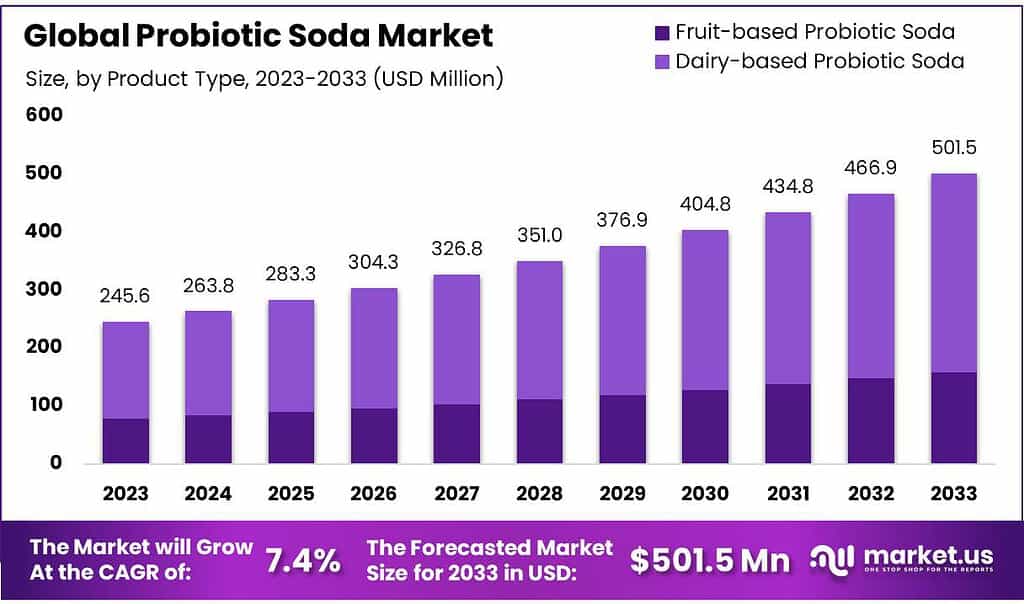

The global prebiotic soda market is poised for substantial growth, projected to increase from USD 245.6 million in 2023 to around USD 501.5 billion by 2033, with a compound annual growth rate (CAGR) of 7.4%. This surge is driven by a growing consumer emphasis on gut health and the rising popularity of functional beverages. Prebiotic sodas, enriched with fibers that aid digestive health, cater to an increasing demand for wellness-oriented products.

However, the market faces challenges such as stringent regulatory frameworks regarding health claims and fierce competition from other functional drinks like probiotic beverages and flavored waters. Recent developments have seen key players innovate with new flavors and sustainable packaging to distinguish themselves in this competitive landscape. For instance, brands have introduced organic and premium variants that align with consumer preferences for natural and health-forward options.

Bio-K Plus International Inc. and Fonterra Co-operative Group are part of a competitive landscape where companies are increasingly investing in research and development to introduce new products and enhance their market share. This approach is reflected in the overall growth strategies observed in the probiotic drinks market, which shares similarities in terms of consumer base and product characteristics with the prebiotic soda market.

Chobani LLC has been innovative in its offerings, particularly with the launch of new plant-based beverages that cater to a growing segment of health-conscious consumers. This aligns with the trend towards plant-based diets and reflects the company’s commitment to diversity in product offerings to meet changing consumer preferences.

Moreover, the industry has witnessed a shift towards plant-based alternatives, reflecting broader dietary trends towards vegan and environmentally conscious choices. This dynamic market scenario underscores a robust industry response to evolving consumer demands, focusing on health benefits and sustainability to drive future growth.

Key Takeaways

- Market Growth: Prebiotic Soda Market is expected to reach USD 501.5 billion by 2033, growing at 7.4% CAGR from 2023’s USD 245.6 million.

- Type: Dairy-based prebiotic sodas hold a dominant market share of over 59.3%, while plant-based variants are rapidly gaining traction.

- Packaging: Bottles are the preferred packaging type, capturing over 38.5% of the market share, followed by Tetra Packs and cans.

- Flavors: Fruit flavors dominate the market, with a share of over 45.3%, while cola flavors also hold a significant position.

- Form: Liquid prebiotic sodas are the most preferred, accounting for over 62.4% of the market share, followed by powdered variants.

- Distribution Channel: Supermarkets/hypermarkets lead in distribution, capturing over 45.9% of the market, followed by retail sales and online channels.

- Asia Pacific region emerges as a significant player, capturing a dominant market share of 46.9%.

Prebiotic Soda Statistics

- Health Benefits: May help gut bacteria growth, and lower sugar content than regular sodas (average 4-5g vs 35-40g).

- Nutritional Comparison: Lower in calories (e.g., Olipop has 35 calories vs Coke’s 150), no high fructose corn syrup.

- Sales of probiotic-containing soft drinks surged by 210% from April 2022 to April 2023.

- Water products with prebiotics and probiotics also saw an 18% increase year-over-year.

- Refrigerated yogurt sales, including drinkable yogurts, rose by 10% to $5 billion and 17% to $570 million respectively.

- Kombucha sales slightly declined by 1.7% to $650 million.

- Nutrition Facts (per serving): Less than 25 calories, 0g total fat, <7g total carbohydrates, <5g total sugars, <2g dietary fiber, 0mg sodium.

- Calories per can: Poppi has 25 calories; Olipop ranges between 35 calories.

- Sugar content per can: Poppi contains 5 grams; Olipop varies between 2 to 5 grams.

- Fiber per can: Poppi provides 2 grams of organic agave inulin; Olipop offers 9 grams from a blend including cassava root fiber and Jerusalem artichoke inulin.

- Calories per can: Poppi has 25 calories; Olipop ranges between 35 calories.

- Sugar content per can: Poppi contains 5 grams; Olipop varies between 2 to 5 grams.

- Fiber per can: Poppi provides 2 grams of organic agave inulin; Olipop offers 9 grams from a blend including cassava root fiber and Jerusalem artichoke inulin.

- Each can contain less than 1.7g of naturally occurring sugar and only 13kcal per 100 ml, with no added sweeteners.

- Low Calorie and Sugar: Poppi’s prebiotic soda contains only 25 calories and less than 5g of sugar per can.

Emerging Trends

Emerging trends in the prebiotic soda market reflect the industry’s adaptation to consumer preferences for healthier and functional beverages. A significant trend is the growing demand for plant-based options. Plant-based prebiotic sodas are gaining popularity due to increasing health consciousness and dietary preferences for vegan and lactose-free alternatives. This segment, which includes sodas made from non-dairy bases like almond, soy, oat, or coconut, is set to expand as consumers continue to prioritize health, environmental sustainability, and ethical considerations.

Another notable trend is the diversification in flavor offerings to meet varied consumer tastes. There is a particular increase in demand for fruit-flavored prebiotic sodas, which are sought after for their refreshing taste and perceived natural health benefits. These flavors, ranging from citrus to berry, are becoming staples within the prebiotic soda market.

Moreover, there’s a noticeable shift towards functional beverages that support digestive health, with prebiotic sodas being enriched with dietary fibers that aid in enhancing gut microbiome activity. This shift is driven by heightened consumer awareness of the links between gut health and overall wellness, including immune function and mental health.

Packaging innovations also play a crucial role, with a focus on sustainability and convenience. The use of recyclable materials like glass and aluminum cans is on the rise, appealing to environmentally conscious consumers. Additionally, the convenience offered by portable packaging forms like cans and Tetra Packs aligns well with the lifestyles of health-conscious, on-the-go consumers.

In summary, the prebiotic soda market is evolving rapidly with a strong emphasis on health benefits, plant-based ingredients, innovative flavors, and eco-friendly packaging, reflecting broader consumer trends toward health and sustainability.

Use Cases

Prebiotic sodas, emerging as a popular choice in the functional beverage market, present several use cases centered around their health benefits, primarily for gut health improvement. These carbonated drinks are often enhanced with fibers like inulin from chicory root or other plant-based sources, which serve as food for beneficial gut bacteria. This can aid in digestion, enhance immune function, and even improve nutrient absorption, like calcium, which is vital for bone health.

However, despite the health-oriented marketing, prebiotic sodas should not be viewed as a complete solution for dietary fiber needs. They contain less variety and quantity of fibers compared to whole foods. The typical fiber content in these sodas ranges from 2 to 9 grams per can, which can help contribute to the recommended daily intake, but they should ideally complement a diet rich in various fiber sources from whole plant foods.

Consumers should also consider the potential downsides. For some individuals, especially those with sensitive guts or conditions like IBS, the fibers in prebiotic sodas can cause bloating, gas, or other digestive discomforts. Additionally, these sodas often contain added sugars and sweeteners to enhance flavor, which could contribute to other health issues if consumed in excess.

Key Players Analysis

Bio-K Plus International Inc. is actively involved in the prebiotic soda market, leveraging its expertise in probiotics to innovate in this sector. The company has capitalized on its established reputation in probiotic beverages to introduce prebiotic soda options that cater to the growing demand for gut health-enhancing products.

Chobani LLC, traditionally known for its yogurt products, is also making strides in the prebiotic soda market. Chobani is harnessing its expertise in dairy and plant-based products to explore functional beverages that support digestive health, aligning with consumer trends towards healthier, functional drinks.

Danone S.A. is actively involved in the prebiotic soda market, focusing on incorporating prebiotics into its range of functional beverages. This approach aligns with the company’s broader health and wellness strategy, leveraging its expertise in dairy and plant-based products to offer beverages that support digestive health. Danone’s participation in the prebiotic soda sector underscores its commitment to meeting consumer demand for products that contribute positively to overall well-being, aligning with global trends towards healthier, functional beverages.

Fonterra Co-operative Group has entered the prebiotic soda market, capitalizing on its extensive dairy expertise to offer innovative beverage solutions that promote gut health. This move is part of Fonterra’s broader strategy to diversify its product offerings and tap into the growing demand for functional, health-oriented beverages. By leveraging its reputation and capabilities in dairy production, Fonterra is well-positioned to make a significant impact in the burgeoning market for prebiotic sodas, providing consumers with options that align with healthier lifestyle choices.

GCMMF (Amul) is expanding its presence in the prebiotic soda market, capitalizing on the rising consumer awareness of gut health benefits. Known for its dairy expertise, Amul is exploring innovative health-oriented beverage solutions, including prebiotic sodas, to meet the demand for functional drinks that offer benefits beyond traditional refreshments.

Harmless Harvest, originally renowned for its organic coconut water, has ventured into the prebiotic beverage sector with its line of organic probiotic and prebiotic-rich cultured coconut beverages. This product expansion aligns with the company’s sustainability goals and its commitment to health-conscious consumers, offering beverages that support digestive and immune health with all-natural ingredients.

Nestlé SA has expanded into the prebiotic soda market, focusing on enhancing its health and wellness portfolio. They are incorporating prebiotics into beverages to cater to the growing consumer demand for functional and health-oriented drinks. This move aligns with broader market trends emphasizing gut health and well-being.

NextFoods has recently innovated within the prebiotic sector by launching GoodBelly Organic Prebiotic Sparkling Water. This new product, enriched with prebiotics from Blue Agave, marks a significant step in their commitment to promoting gut health through functional beverages. This launch is part of NextFoods’ ongoing effort to combine health benefits with sustainable practices, targeting consumers interested in digestive health and natural ingredients.

Yakult Honsha Co., Ltd., primarily known for its probiotic beverages, has also ventured into the prebiotic soda market, leveraging its extensive expertise in gut health products. The company focuses on enhancing digestive health through its range of beverages by incorporating prebiotics, which are non-digestible fibers that fuel beneficial gut bacteria. This move aligns with Yakult’s long-standing commitment to improving health through scientifically-backed products and broadens its portfolio in the functional beverages sector, addressing the growing consumer interest in gut health and wellness.

Conclusion

In conclusion, the prebiotic soda market is positioned at the intersection of growing health consciousness and the increasing popularity of functional beverages. As consumers continue to prioritize gut health and overall wellness, prebiotic sodas are gaining traction due to their added dietary fibers that support the microbiome. However, while these sodas offer a convenient and tasty alternative to traditional sodas with potential health benefits, they should not replace the diverse fibers obtained from whole foods. Consumers should be mindful of the sugar content and choose options with minimal additives to maximize health benefits. Ultimately, prebiotic sodas can be a part of a balanced diet but are best when used to complement a lifestyle already rich in a variety of natural, fiber-rich foods.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)