Table of Contents

Introduction

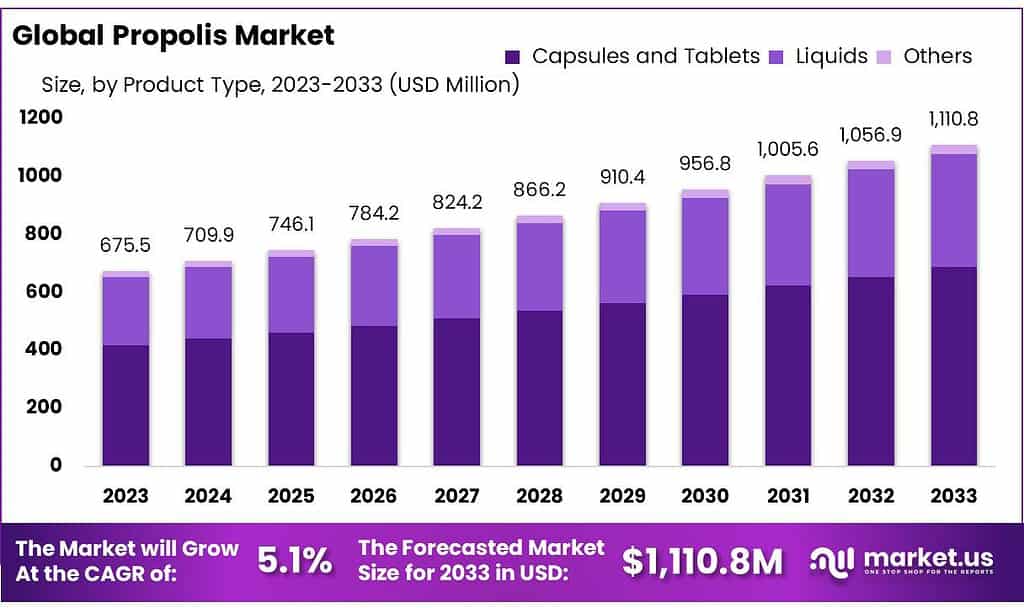

The global Propolis Market is expected to reach USD 1,110.8 million by 2033, growing from USD 675.46 million in 2023 at a CAGR of 5.1% during the forecast period (2023-2033). This growth is primarily driven by the increasing demand for propolis in the healthcare and pharmaceutical sectors, where it is used for its anti-inflammatory, antimicrobial, and immunomodulatory properties. Propolis, a resinous mixture produced by bees, is widely recognized for its benefits in treating conditions like cold sores, and skin infections, and even as a supplementary treatment in cancer care, where it can reduce tumor growth.

Healthcare applications dominate the market, supported by research into propolis’s efficacy in managing conditions like genital herpes and diabetes, as well as its immune-boosting properties. The rising prevalence of these conditions is driving significant interest in propolis-based products, particularly in regions like North America, where propolis is integrated into therapeutic products for immune support and wound care. The COVID-19 pandemic further accelerated demand as consumers sought natural remedies with immunity-boosting properties.

Recent developments in the market include innovations in product formulations and distribution. Companies like Comvita and Bee Health are leading with new partnerships and product launches that expand the availability and awareness of propolis-based supplements and topical treatments. For instance, Comvita’s collaboration with Caravan in 2021 aimed to leverage celebrity endorsements to promote natural health products, enhancing brand visibility. Additionally, the rise of e-commerce platforms has significantly expanded market reach, allowing consumers easier access to a wider range of products at competitive prices.

Apis Flora: New Product Launches: Apis Flora has expanded its product portfolio by introducing new propolis-based supplements aimed at boosting immunity and skin health. Their innovation in extraction techniques has enhanced the bioavailability of propolis, making their products more effective.

Strategic Partnerships: Apis Flora continues to collaborate with pharmaceutical companies to integrate propolis into over-the-counter (OTC) healthcare products, particularly targeting cold sores and wound healing.

Herb Pharm LLC: Herb Pharm has strategically acquired smaller herbal product companies to diversify its range of propolis products, including tinctures and liquid extracts. The company recently launched a new organic propolis extract product, catering to the growing demand for natural remedies. Their propolis products are now certified organic, which has attracted a new segment of health-conscious consumers. Herb Pharm has increased its presence in European and Asian markets, leveraging growing awareness of the health benefits of propolis in these regions.

Bee Health Limited: Bee Health Limited was acquired by Innovations in Nutrition + Wellness (INW) in 2021. This acquisition has expanded Bee Health’s global footprint and enhanced its product development capabilities, allowing for the launch of new propolis-based nutritional supplements. Bee Health has recently introduced several new products targeting immune health, including a propolis-based gummy supplement designed for younger consumers. This product capitalizes on the growing trend for functional foods. The company has invested heavily in R&D to improve extraction methods, resulting in more potent and pure propolis products.

Key Takeaways

- Market Growth Projection: The Propolis Market is estimated to reach approximately USD 1110.8 billion by 2033, showing a substantial increase from USD 675.46 million in 2023, with a projected CAGR of 5.1%.

- Product Types and Preferences: Capsules and tablets currently dominate the market with over 61% share due to ease of consumption and dosage control. Liquid propolis is gaining traction, expected to grow by 3% owing to increased demand, changing lifestyles, and digestive benefits.

- Distribution Channels: Retail stores hold a significant share (72%) as a primary channel for Propolis products, offering direct access and consultation. However, online sales are predicted to witness the fastest growth due to discounts, a variety of brands, and convenience.

Statistics

- More than 300 compounds have been identified in propolis, such as phenolic compounds, aromatic acids, essential oils, waxes, and amino acids.

- Resins and balsams (45–55%), waxes (8–35%), essential oils and aromatics (5–10%), fatty acids (5%), pollen (5%) and organic and mineral substances (5%) are the main compounds found in this product.

- The propolis extracts were characterized by moderate DPPH free radical scavenging activity (29.22–35.14%), and relatively low ferrous iron chelating activity (9.33–32.32%).

- The total phenolic contents in propolis extracts from Poland determined by Socha et al. were in a range from 150.05 to 190.79 mg GAE/g of raw propolis and differed depending on the part of the country where propolis samples were collected.

- The sum of quantified polyphenolics extracted varied between 1.5 and 91.2 mg/g propolis.

- Water and ethanolic solutions (25%, 50%, 70% w/w) were used for extraction.

- Most of the organic compounds consist of polyphenolics (58%) and flavonoids (28%), which contribute to the antioxidant properties of propolis.

- Ten grams of propolis were extracted with 100 mL ethanol (1:10 w/v) to perform the propolis ethanol extract.

- It is used for beehive construction, repair, and disinfection (Pasupuleti et al., 2017). Propolis contains 50% resin and vegetable balms, 30% beeswax, 10% essential oils, 10% terpenes, 10% pollen, and other organic substances (Burdock, 1998).

- Extraction of propolis was carried out using 70% ethanol, propolis to ethanol ratios of 1:10 and 1:5, extraction times of 1 or 7 days, and shaking extraction

- Propolis is a bee product with various biological properties. C57BL/6 mice were fed a high-fat diet and treated with propolis for 14 weeks. Body weight in mice treated with 2% propolis was less than that in control mice from 3 weeks after the start of treatment until 14 weeks except for the 7th week.

- In the experimental diet, propolis was added to the control diet at a dose of 2.0% (w/w) instead of dextrin. All experimental procedures were approved by the Animal Research Committee of the University of Tokushima.

Emerging Trends

Growing Popularity of Natural and Organic Products: As consumers become more health-conscious, the demand for natural remedies is rising, with propolis increasingly recognized for its antimicrobial and immune-boosting properties. This trend is particularly strong in the cosmetic and healthcare sectors, where consumers seek organic alternatives to chemical-laden products. Propolis is being integrated into skincare products, such as creams and serums, due to its ability to heal wounds and reduce inflammation.

Expanding Use in Dietary Supplements: Propolis is gaining popularity in the dietary supplements market as a natural solution for boosting immunity, supporting respiratory health, and promoting overall wellness. With a growing focus on preventive healthcare, especially post-pandemic, consumers are turning to propolis supplements in the form of capsules, tinctures, and gummies.

Increased Research and Development in Therapeutic Applications: Ongoing research into the medicinal properties of propolis has highlighted its potential in treating skin infections, cancer, and even managing diabetes. Studies show that propolis can help inhibit tumor growth and reduce inflammation, making it a valuable natural component in future pharmaceutical products. This interest from the medical community is spurring new product developments and clinical trials.

Rise of E-commerce and Online Sales: The shift towards e-commerce has significantly boosted the sale of propolis-based products. Consumers are increasingly purchasing propolis products online due to the convenience and wider availability of product choices. Online retail platforms also offer competitive pricing, making propolis more accessible to a broader audience globally.

Increasing Interest in Propolis for Skincare: Propolis is being used more frequently in cosmetic formulations due to its antioxidant and anti-inflammatory properties. It is found in products targeting acne, aging skin, and sensitive skin conditions. As consumers become more aware of the benefits of natural skincare products, propolis is emerging as a favored ingredient for its soothing and healing capabilities.

Focus on Sustainability and Ethical Sourcing: With growing concerns over environmental impact, companies producing propolis are focusing on sustainable sourcing and ethical beekeeping practices. This trend aligns with the increasing demand for eco-friendly and sustainable products, especially among younger, environmentally conscious consumers.

Regional Growth in Asia-Pacific: Countries in the Asia-Pacific region, such as China and Japan, are seeing increased demand for propolis due to rising disposable incomes and a growing interest in traditional remedies. The use of propolis in traditional medicine in these regions is driving its demand in both health supplements and beauty products.

Use Cases

- Immune System Support: Propolis is widely used in dietary supplements for its immune-boosting properties. It contains compounds like flavonoids and antioxidants that support the body’s defense mechanisms. Many studies show that regular consumption of propolis can help reduce the incidence of common colds and respiratory infections. For example, propolis supplements are sold in the form of capsules, tablets, and liquid extracts, with demand growing in regions like North America, where the immune health market is projected to reach over USD 20 billion by 2027.

- Wound Healing and Skin Care: Propolis is increasingly used in dermatological treatments due to its antimicrobial and healing properties. It is found in products that treat acne, burns, wounds, and skin infections. In skincare, propolis is added to creams, serums, and balms to promote faster healing of damaged skin. The global wound care market, where propolis-based products are gaining traction, is expected to grow at 6.3% CAGR by 2030.

- Oral Health: Propolis is used in oral care products due to its antibacterial properties. It is found in toothpaste, mouthwashes, and gums, where it helps in reducing plaque formation, preventing cavities, and treating oral infections like gingivitis. A study has shown that propolis can reduce gingival inflammation by 17%, making it an effective natural ingredient in maintaining oral hygiene.

- Treatment for Cold Sores and Herpes: One of the most popular medicinal uses of propolis is in the treatment of cold sores caused by the herpes simplex virus. Clinical trials have demonstrated that topical propolis ointments can reduce healing time for cold sores by 50% compared to conventional treatments. With over 500 million people globally affected by herpes, the demand for propolis-based ointments is on the rise.

- Anti-Cancer Applications: Research has shown that propolis may have potential anti-cancer effects by inhibiting the growth of tumor cells. Studies suggest that compounds in propolis can induce apoptosis (cell death) in cancerous cells without affecting healthy cells. This has opened up possibilities for using propolis in cancer therapy, especially in integrative oncology.

- Diabetes Management: Propolis is being explored for its benefits in managing diabetes. It has been found to improve glycemic control and enhance insulin sensitivity in patients with type 2 diabetes. Some studies report that propolis can reduce fasting blood sugar levels by 5-7% in diabetic patients, making it a promising complementary therapy for diabetes management.

- Cosmetic Applications: Due to its antioxidant and anti-inflammatory properties, propolis is increasingly found in beauty products like creams, lotions, and face masks. It helps in hydrating and rejuvenating the skin, making it an ideal ingredient in anti-aging formulations. The global demand for natural ingredients in cosmetics is growing, with propolis-based products becoming more prevalent in Asia-Pacific and European beauty markets.

- Food Preservation: Propolis is also used as a natural preservative in the food industry. Its antimicrobial properties allow it to extend the shelf life of foods by preventing the growth of bacteria and fungi. It is used in coatings for fresh fruits and as an additive in health drinks and other consumables. The natural food preservatives market is expected to grow by 7.1% CAGR, with propolis gaining popularity in organic and clean-label products.

Major Challenges

- Lack of Standardization: One of the most significant challenges is the lack of uniform standards in the quality and composition of propolis products. Propolis varies widely depending on factors like the source of the bees and the type of trees or plants the bees collect resin from. This variation makes it difficult for consumers to know the potency or efficacy of the propolis products they purchase. Inconsistent labeling and quality can lead to mistrust among consumers and hinder market growth.

- Allergic Reactions and Sensitivities: Propolis, being a bee product, can trigger allergic reactions in some individuals, particularly those allergic to bee stings, honey, or pollen. Common reactions include skin irritations, swelling, or more severe symptoms in rare cases. This risk limits the product’s appeal to a broader audience, as many people might avoid using propolis-based products due to concerns about possible allergic responses.

- Regulatory Challenges: Regulatory frameworks for propolis vary across regions, which creates complexity for companies trying to market propolis products globally. In some regions, propolis is classified as a dietary supplement, while in others, it may fall under pharmaceutical or cosmetic regulations. These variations make it difficult for companies to ensure compliance across all markets, slowing down product launches and limiting global reach.

- Sustainability Concerns: Propolis production depends heavily on bee populations, which are under threat due to factors like climate change, pesticides, and habitat loss. Declining bee populations pose a significant risk to the supply of propolis, which could lead to higher prices and supply chain disruptions.

Market Growth Opportunities

- Rising Demand for Natural Products: As consumers increasingly prioritize natural and organic products for their health and wellness, propolis is becoming more popular due to its antimicrobial, anti-inflammatory, and immune-boosting properties. This trend is particularly strong in sectors like skincare and dietary supplements, where consumers are shifting away from synthetic ingredients. The global natural products market is expected to grow, providing a significant boost to the demand for propolis-based products.

- Expanding Applications in Healthcare: Propolis has shown potential in healthcare for treating conditions like cold sores, oral infections, and even as a complementary therapy in cancer treatment. As research continues to support its therapeutic benefits, the demand for propolis in pharmaceutical products is expected to rise. This creates opportunities for companies to develop new propolis-based medications and treatments that address a broader range of health issues.

- Growth in the Cosmetics Industry: The cosmetics and personal care industry presents a lucrative opportunity for propolis, particularly in products aimed at acne treatment, anti-aging, and skin repair. With consumers seeking out natural beauty products, propolis-infused creams, serums, and balms are becoming more popular. The global beauty industry is projected to grow by 5% annually, which bodes well for the incorporation of propolis in high-demand skincare lines.

- Expansion into Emerging Markets: There is a growing interest in Asia-Pacific and Latin American regions, driven by rising disposable incomes and increased awareness of propolis’s health benefits. These regions are seeing a surge in demand for natural health supplements and cosmetics, offering a new market for propolis-based products. Companies can tap into these markets through e-commerce and local partnerships.

Key Player Analysis

Apis Flora has been actively working in the propolis sector, with significant developments in 2023 and 2024. The company is renowned for its Green Propolis 70 Extract, a high-quality product made exclusively from Brazilian green propolis. This extract is 2.5 times more concentrated than conventional propolis extracts, with 70% of green propolis in natura. Throughout 2023, Apis Flora has focused on standardizing their propolis extracts through the EPP-AF® process, ensuring high bioactive content like Artepelin C, a compound known for its antimicrobial, anti-inflammatory, and antioxidant properties. This standardized process involves over 100 quality control analyses, highlighting their commitment to delivering contaminant-free, highly effective products. In addition, Apis Flora expanded their product line with innovations like Propodry® Plus, a dry propolis extract with high concentration and stability, designed for use in capsules and tablets. These advancements, coupled with increasing global demand, position Apis Flora as a leader in the propolis industry.

In 2023, Herb Pharm LLC has continued to expand its propolis product line, emphasizing high-quality, wildcrafted propolis extracts. The company offers a Propolis Liquid Herbal Extract, which supports the immune system and helps improve its response to challenges. Herb Pharm uses propolis harvested from wild-growing trees, ensuring the resin is carefully collected and processed to maintain its potency. Their extraction methods involve certified organic cane alcohol, ensuring a clean, natural product. This product is part of their larger commitment to responsible wildcrafting and maintaining high standards for organic and non-GMO products.

In 2023, Bee Health Limited continued to solidify its position as the world’s leading supplier of propolis products, delivering to over 40 countries. The company utilizes a unique refining process to ensure its propolis products are of the highest purity and quality. Bee Health offers a wide range of propolis-based products including capsules, tablets, creams, liquids, and sprays, catering to both health and personal care markets. In 2024, Bee Health has further expanded its propolis product line, adding Propolis with Vitamin C & Zinc tablets, reflecting the growing demand for immune-boosting supplements. The company’s ongoing focus on innovation and quality ensures that it remains a leader in the propolis sector.

In 2023, YS Organic Bee Farms continued its work as a pioneer in organic beekeeping in the U.S., maintaining its leadership in producing high-quality certified organic honey. The company, based in Sheridan, Illinois, has a long history, spanning four generations of beekeeping expertise. YS Organic Bee Farms is best known for its 100% raw, unprocessed, unfiltered organic honey, which is harvested without chemicals to preserve its natural enzymes, vitamins, and antioxidants. Their product line also includes bee pollen, propolis, and royal jelly, all marketed for their health benefits, such as immune system support and antioxidant properties. In 2024, the company has expanded its product offerings to include honey varieties like Raw Manuka Honey and Cinna Honey, catering to the growing demand for natural, functional foods

In 2023 and 2024, Apiário Polenectar, a Brazilian company with over 30 years of experience, continues to lead in the production of premium propolis extracts and other bee products like honey, royal jelly, and bee pollen. Known for their high-quality Brazilian green propolis, Polenectar has invested heavily in technology to produce beewax-free propolis extracts, allowing for a higher concentration of active ingredients such as Flavonoids and Artepelin-C. These propolis extracts are recognized for their antimicrobial, anti-inflammatory, and immune-boosting properties. Throughout 2023, Polenectar expanded its product line to meet the growing demand for natural health supplements, launching new products like Wax-Free Propolis Extract 80 with a 36% dry extract, one of the highest concentrations available. Their commitment to quality control and innovation continues to drive their success in both domestic and international markets.

In 2023 and 2024, Uniflora Health and Food Products LLC, a subsidiary of Brazil’s Uniflora Nutraceutica Ltda, continues to be a leader in the production and distribution of Brazilian bee byproducts. The company specializes in green bee propolis, pure honey, royal jelly, and bee pollen, known for their health benefits. Uniflora’s propolis products, including Propolis Extracts and Propolis Capsules, are highly regarded for their antimicrobial and immune-boosting properties. In 2024, Uniflora expanded its product line to include alcohol-free propolis sprays and wax-free extracts, catering to consumers seeking natural remedies with minimal processing. The company’s commitment to using high-quality Brazilian raw materials continues to position it as a trusted name in the natural health industry.

Conclusion

In conclusion, the propolis market is poised for steady growth, driven by increasing consumer demand for natural health products. Propolis’s proven benefits, such as its antimicrobial, anti-inflammatory, and immune-boosting properties, make it a valuable ingredient in health supplements, skincare, and pharmaceutical products. As research continues to uncover more therapeutic applications, the demand for high-quality propolis, particularly from regions like Brazil, will rise. Companies investing in innovation, such as developing alcohol-free and wax-free propolis extracts, are well-positioned to capture growing market opportunities. The market’s future looks promising, supported by the expanding global focus on natural remedies and sustainable health solutions.