Table of Contents

Introduction

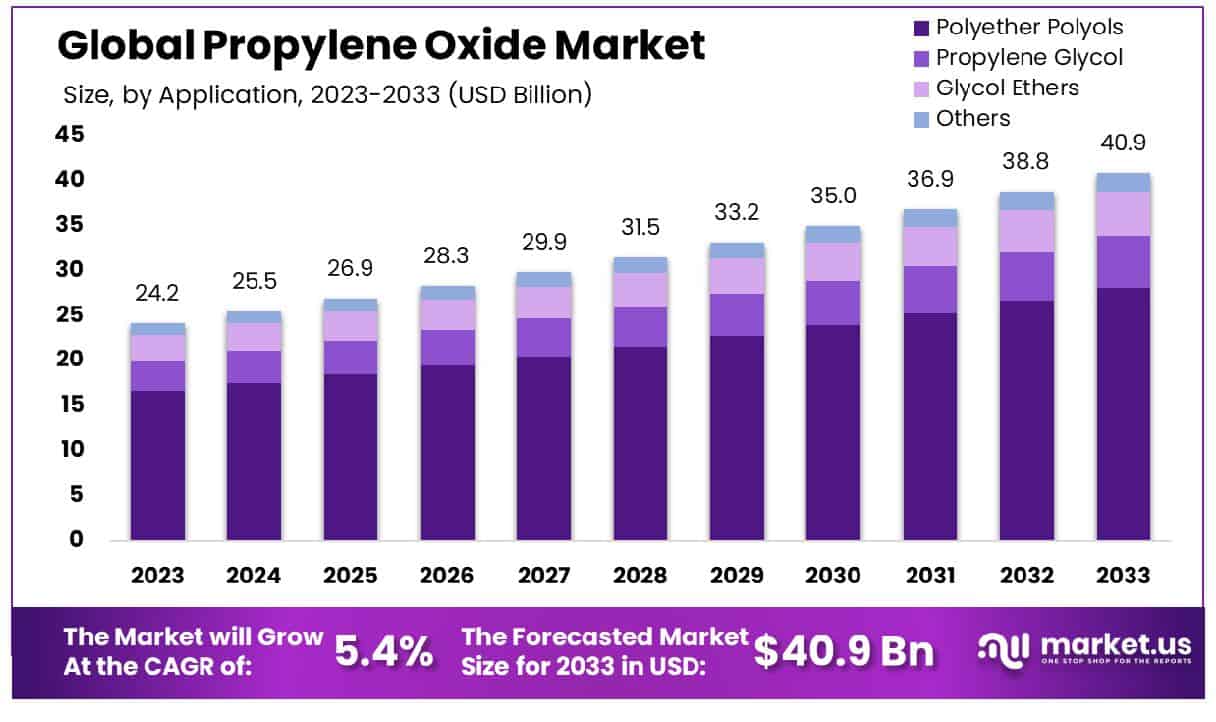

The Propylene Oxide Market is poised for significant growth over the next decade, with projections estimating the market size to increase from USD 24.2 billion in 2023 to USD 40.9 billion by 2033, achieving a Compound Annual Growth Rate (CAGR) of 5.4% between 2024 and 2033. This expansion can be attributed to the escalating demand for polyurethane products, which are extensively used in automotive, construction, and furniture applications due to their flexibility, durability, and insulation properties. However, the market faces challenges such as stringent environmental regulations concerning the production of propylene oxide, which involves hazardous chemicals posing health risks and environmental concerns.

Recent developments in the market include advancements in production technologies that aim to reduce waste and improve efficiency. For instance, in 2021, a major chemical company announced the development of a new catalytic process that significantly minimizes the production of byproducts, thereby addressing some of the environmental challenges associated with propylene oxide synthesis. These advancements are crucial for sustaining market growth while complying with global environmental standards.

China Petrochemical Corporation, also known as Sinopec, has recently intensified its focus on the propylene oxide market by expanding its production capacity. In 2022, the company completed the construction of a new propylene oxide plant in Eastern China with an annual production capacity of 300,000 tons. This expansion aims to meet the growing demand for polyurethane products in the Asian market and strengthen Sinopec’s position as a leading chemical producer.

Royal Dutch Shell has pursued strategic partnerships to enhance its propylene oxide business. In 2023, Shell formed a joint venture with a local chemical company in Belgium to develop a state-of-the-art propylene oxide facility, which is expected to commence operations by 2025. This facility will incorporate innovative technology that reduces waste and energy consumption, aligning with Shell’s broader sustainability goals.

BASF SE has launched a new line of eco-friendly propylene oxide products aimed at reducing the environmental impact of polyurethane production. Announced in 2024, these products use a proprietary catalyst that minimizes harmful byproducts. This development not only addresses regulatory pressures but also caters to the increasing consumer preference for sustainable materials.

LyondellBasell Industries completed a major acquisition in 2023, purchasing a competitor’s propylene oxide production assets in the United States for USD 800 million. This acquisition has significantly increased LyondellBasell’s production capabilities and market share in North America, positioning the company to better serve the increasing demand for insulation and sealing solutions in the construction and automotive industries.

Mitsui Chemicals, Inc. secured funding in 2024 to advance its research and development in the propylene oxide sector. With an investment of USD 200 million, Mitsui is focusing on developing advanced catalyst technologies that can improve the efficiency and environmental footprint of propylene oxide production. These innovations are expected to enhance Mitsui Chemicals’ competitiveness in the global market.

Key Takeaways

- Market Growth: The global propylene oxide market is projected to expand from USD 24.2 billion in 2023 to USD 40.9 billion by 2033, growing at a CAGR of 5.4%.

- Asia-Pacific dominates Propylene Oxide market at 48.9%, reaching USD 11.8 billion.

- By Production Process: Chlorohydrin process accounts for 45.6% of propylene oxide production.

- By Application: Polyether polyols dominate applications, representing 68.7% of market usage.

- By End-Use: The automotive industry leads end-use with 35.6% of consumption.

Propylene Oxide Production and Applications

- The term “oxide” is used for high-molar-mass polymers when end groups no longer affect polymer properties. Between 60 and 70% of propylene oxide is converted to polyether polyols by a process called alkoxylation.

- In 2020, the world’s propylene oxide (PO) production capacity was approximately 11.2 million tons per year, of which Asian production capacity accounts for approximately 45% of the world’s total production capacity, which is the region with the largest production capacity in the world; Western Europe accounts for approximately 24%; North America accounts for approximately 22%.

- In 2015, PCC Rokita SA completed the capacity expansion of its propylene oxide (PO) plant in the Chlorine segment from 36,000 tons to 48,000 tons per year. In 2020, the capacity is further expanded to a total of 57,000 tons per year.

- Dipropylene glycol appears to act as an active intermediate in the dehydration of propylene glycol to propylene oxide over a Cs-ETS-10 catalyst, which would limit PO selectivity to 50%.

- When V was introduced into TS-1, the propylene conversion decreased under the condition of 10% H2 concentration (C3H6/H2=1/1) in the reaction atmosphere, but the PO selectivity was maintained.

Propylene Oxide Industry Analysis

- The initial concentration of propylene oxide is tested in the range from 2 to 3% and the thermal conductivity of the mixture is tested in the range 0.599-0.799. It was found that the amount deactivated of the compound decreases with an increase in Reynolds number.

- The agency first proposed limits on the gas in April 2023, to reduce emissions by 80%. Now, the agency is predicting an emissions reduction of 90%.

- Propylene glycol is a key product in the Pharma & Healthcare industry, with a global network of 324 shippers and 412 consignees. This commodity is traded across 229 shipping lanes, facilitated by 264 freight forwarders.

- Propylene glycol (PG) is a basic petrochemical used primarily in polyurethane polyols and unsaturated polyester resins, and as an anti-freeze agent in aircraft de-icing applications, as well as an automotive coolant. Total annual global consumption is 1.5 million metric tonnes.

- The solutions of the poloxamers with a polyoxyethylene content of greater than 10% of the overall molecular weight are optically transparent over the temperature of the phase transition and the solutions of the polypropylene samples are optically transparent below the phase transition and turbid at elevated temperatures.

Emerging Trends

- Expansion of Bio-Based Propylene Oxide Production: There is a growing shift towards sustainable production methods in the chemical industry. Companies are investing in bio-based technologies to produce propylene oxide using plant-derived materials, reducing reliance on petroleum sources. This trend is driven by increasing environmental regulations and a global push for greener chemical processes.

- Increased Demand from Polyurethane Producers: Propylene oxide is a key raw material in the production of polyurethane, used extensively in the automotive, construction, and furniture industries. As these sectors expand due to urbanization and economic growth, particularly in Asia-Pacific regions, the demand for propylene oxide is expected to rise significantly.

- Advancements in Production Technologies: Technological advancements in production methods, such as the hydrogen peroxide to propylene oxide (HPPO) process, are becoming more prevalent. These methods offer higher efficiency and lower environmental impact compared to traditional processes, leading to their increased adoption by major chemical producers.

- Strategic Global Expansions and Investments: Major players in the propylene oxide market are strategically expanding their presence globally by setting up new production facilities and forming alliances with local firms in emerging markets. This is aimed at tapping into local demand and improving supply chain efficiencies.

- Increasing Use in Niche Applications: Propylene oxide is finding new applications in niche markets such as food additives, where it is used for sterilization, and in the pharmaceutical sector for producing specialized medicines. This diversification of applications is opening new revenue streams for producers.

Use Cases

- Polyurethane Production: Propylene oxide is primarily used to produce polyether polyols, which are a key component in manufacturing polyurethanes. These polyurethanes are used in a variety of products such as flexible foams for furniture and bedding, rigid foams for insulation in buildings and refrigerators, and elastomers for footwear and automotive parts. Approximately 60% of global propylene oxide is used in this sector.

- Propylene Glycol: Around 25% of propylene oxide produced is converted into propylene glycol. Propylene glycol is versatile and non-toxic, making it ideal for use in food, pharmaceutical, and cosmetic products. It acts as a solvent, preservative, and moisture-preserving agent. For example, it is used in food processing as a solvent for food colors and flavors, and in pharmaceuticals, it is used to create ointments and cough syrups.

- Glycol Ethers: Propylene oxide is also used to manufacture glycol ethers, which account for about 10% of its market usage. Glycol ethers are solvents commonly used in paints, inks, and cleaners. They help improve the performance of these products by enhancing their spreadability, evaporation rate, and stability.

- Flame Retardants: The remaining 5% of propylene oxide is utilized in the production of flame retardants. These are chemicals added to materials like plastics and textiles to prevent or slow the spread of fire. Propylene oxide-based flame retardants are especially used in products that must meet stringent safety standards, such as children’s clothing and furnishings.

Major Challenges

- Environmental Regulations: Strict environmental regulations pose a significant challenge for propylene oxide manufacturers. The production of propylene oxide involves processes that can emit hazardous pollutants. Compliance with these regulations often requires substantial investments in cleaner technologies or waste management systems, potentially increasing production costs by up to 30%. This can affect profitability and operational efficiency.

- Volatility of Raw Material Prices: The price of raw materials, such as propylene, which is a primary feedstock for propylene oxide, frequently fluctuates due to market supply and demand dynamics. Annual price variations can range from 20% to 25%, impacting production planning and cost stability. This volatility makes it challenging for producers to maintain consistent profit margins.

- Health and Safety Concerns: Propylene oxide is classified as a carcinogen, which raises significant health and safety concerns. Ensuring the safety of workers and compliance with health regulations often leads to additional operational costs, estimated to increase total compliance expenses by around 15%. The industry must invest in protective measures and training, adding to the financial burden.

- Competition from Alternatives: There is growing competition from alternative materials that are less toxic and more environmentally friendly. Bio-based chemicals and advanced polymers are increasingly favored by industries looking to enhance their sustainability profiles. These alternatives threaten to capture 5-10% of the market share from traditional propylene oxide applications, particularly in sensitive areas such as food and pharmaceuticals.

- Global Economic Instability: Economic instability across key markets, such as the United States, Europe, and China, can lead to fluctuations in demand for propylene oxide. Economic downturns reduce demand for consumer goods and construction materials, directly affecting the propylene oxide market. Predicting these trends and managing supply accordingly remains a challenge for industry players.

Market Growth Opportunities

- Increasing Demand in Developing Markets: Emerging economies in Asia, Latin America, and Africa are experiencing rapid industrialization and urbanization, leading to increased demand for construction and automotive products that require polyurethanes derived from propylene oxide. The compound annual growth rate (CAGR) in these regions is projected at approximately 8%, presenting significant opportunities for market expansion.

- Innovation in Bio-based Propylene Oxide: There is a growing trend towards sustainability in the chemical industry. Innovations in bio-based propylene oxide production, which utilize renewable resources instead of petroleum-based feedstocks, can not only meet regulatory standards but also potentially reduce production costs by up to 20%. This shift can appeal to environmentally conscious consumers and businesses, opening new markets.

- Expansion in Propylene Glycol Applications: Propylene glycol, derived from propylene oxide, has diverse applications in the food, pharmaceutical, and cosmetic industries. With the increasing global focus on health and wellness, the use of propylene glycol in these sectors is expected to grow by 7% annually. Capitalizing on this trend can drive substantial growth for propylene oxide producers.

- Strategic Alliances and Acquisitions: Forming strategic alliances or acquiring smaller companies can enable major players to quickly increase their market presence and tap into new technologies. Such strategic moves can potentially increase a company’s market share by 10-15% within a few years, enhancing competitive advantage and operational capabilities.

- Advances in Recycling and Green Chemistry: Advancements in recycling technologies and green chemistry practices present an opportunity to reduce waste and improve the environmental footprint of propylene oxide production. Implementing these technologies could lead to a 5% increase in profit margins through reduced raw material costs and compliance with environmental regulations.

Key Players Analysis

China Petrochemical Corporation (Sinopec), in collaboration with LyondellBasell, has established a joint venture to enhance propylene oxide (PO) production in China. This venture focuses on constructing a facility in Zhenhai Ningbo with an annual capacity of 275 kilotons of PO. The initiative aims to meet growing domestic demands within the Chinese market, leveraging advanced PO/SM technology to optimize production and market distribution.

Royal Dutch Shell is a significant player in the propylene oxide market, leveraging its proprietary SM/PO technology for production. This chemical is crucial in various industries, from construction materials like paints and adhesives to food product applications such as preservatives in drink mixes and baked goods. The market’s growth is driven by increasing demand in these sectors, though challenges like substitute products do pose constraints.

BASF SE has strategically positioned itself in the propylene oxide sector through innovative technology development and plant operations. In collaboration with Dow Chemical, BASF implemented the Hydrogen Peroxide to Propylene Oxide (HPPO) process, enhancing production efficiency while reducing environmental impact. This technology is highlighted by their operations in Antwerp, Belgium, and the joint venture in Thailand, showcasing BASF’s commitment to advancing sustainable chemical processes in the global market.

LyondellBasell has initiated operations at its newly established propylene oxide (PO) and tertiary butyl alcohol (TBA) unit in Texas, which is currently the largest of its kind globally. This facility, part of a $5 billion growth initiative along the U.S. Gulf Coast, aims to address rising market demands by producing an annual capacity of 470 thousand metric tons of PO and one million metric tons of TBA. The strategic expansion aligns with the company’s long-term objectives to innovate and enhance production efficiency, contributing significantly to both local economies and global markets.

Mitsui Chemicals, Inc. collaborates with Sanyo Chemical Industries through a partnership focused on the production of polypropylene glycols, utilizing propylene oxide. This joint effort aims to enhance productivity and stabilize supply, addressing competitive pressures in the global market for polyurethanes used in various applications like automotive and construction.

Dow Chemical is significantly engaged in the production of propylene oxide, an essential chemical used widely in industrial applications. They produce this chemical at several integrated sites across the United States. A recent highlight in their operations includes achieving ISCC PLUS certification for their manufacturing facilities in Freeport, Texas, reflecting a commitment to sustainable practices and the use of circular and bio-circular feedstocks.

Sumitomo Chemical Co., Ltd. is actively advancing its presence in the propylene oxide sector through its innovative cumene process technology (POC). This process is particularly noteworthy for its environmental benefits, including minimal waste and the absence of co-products, which reduces market fluctuation impacts. Sumitomo’s technology ensures high operational efficiency and has attracted global licensing interest due to its reduced environmental footprint and superior operability. The technology is designed for robust and stable production, offering a high-quality propylene oxide used in various applications, from hygiene products to industrial solutions.

Ineos Group Limited, through its Ineos Oxide division, stands out as a leading producer in the propylene oxide market. This company, with significant production facilities in Europe and the USA, capitalizes on strategic locations and integrated supply chains to support robust propylene oxide and derivative production. This strategic positioning allows Ineos to effectively cater to diverse industrial demands, enhancing its market presence.

Huntsman International LLC, a global chemical producer, has been active in the propylene oxide market, notably increasing prices for products including propylene oxide due to rising raw material costs. This strategic move reflects the company’s adaptation to market dynamics in the Americas region. Furthermore, Huntsman’s propylene oxide activities were notably part of a larger acquisition by Indorama Ventures, emphasizing the importance of these operations within the global chemical industry landscape.

Lotte Chemical Corporation engages in propylene oxide production through strategic vertical integration, optimizing the supply chain from raw materials to finished products. The company focuses on enhancing its product offerings to meet diverse industrial requirements, emphasizing the development of eco-friendly and efficient chemical solutions.

PetroChina International Co., Ltd. has actively expanded its role in the global propylene oxide market, leveraging its substantial resources and extensive network to enhance production and distribution capacities. This strategic move aligns with the company’s broader initiatives to boost its petrochemical segment and foster growth in international markets, positioning itself as a significant player amid global leaders in the propylene oxide industry.

SK Chemicals, established in 1969 and headquartered in South Korea, is a prominent player in the propylene oxide industry. The company manufactures a diverse range of chemical products, including materials used in the production of copolyesters, 3D printing materials, coatings, adhesives, and engineering plastics. Their involvement in the propylene oxide sector is part of their broader chemical and life sciences operations, which also extend into the life science sector with pharmaceuticals and vaccines.

Air Products and Chemicals, Inc. is a key supplier in the propylene oxide market, providing vital gases such as oxygen, which is essential in the manufacture of products like propylene oxide. The company’s expertise in supplying oxygen enrichment aids in enhancing production capacity and reducing costs for various chemical processes, positioning it as a leader in industrial gas supply and associated technologies.

Eastman Chemical Company is actively involved in the propylene oxide market, recognized as a key player among global competitors. This involvement aligns with Eastman’s broader strategic focus on specialty chemicals, leveraging its technological capabilities to enhance product offerings and market reach.

Hanwha Group, through its subsidiary Hanwha TotalEnergies Petrochemical, is actively involved in the propylene oxide sector as part of its broader petrochemical operations. The company focuses on a range of chemical productions, including propylene, and has a significant presence in the integrated Daesan refining and petrochemical complex in South Korea. This facility is part of Hanwha’s strategy to expand its high-value-added polymer products and enhance its global market presence, particularly in the Asian markets.

Repsol, a Spanish oil and gas company, has a significant presence in the propylene oxide market. The company is involved in technology licensing agreements to expand its operations internationally, including agreements to construct chemical plants in China for propylene oxide and related chemicals production. This aligns with Repsol’s strategic initiatives to enhance its global market share and ensure operational integrity through rigorous safety and maintenance protocols, especially following disruptions such as the temporary shutdown of production lines due to a fire incident in Tarragona.

AGC Chemicals, a subsidiary of AGC Inc., produces propylene oxide at its Kashima Plant using the chlorohydrin process. This propylene oxide is utilized in the manufacture of several derivatives including propylene glycol and polypropylene glycol. These products find applications across diverse industries, such as in the creation of polyurethane foams used in the automotive and construction sectors. AGC’s production capabilities are complemented by its commitment to safety and environmental standards, evident in its detailed handling instructions and product specifications provided to ensure safe usage and transportation.

Conclusion

The propylene oxide market is positioned for robust growth, driven by increasing demand in developing regions, technological advancements, and a shift towards sustainable production methods. While challenges such as environmental regulations and raw material price volatility exist, the opportunities for expansion and innovation present compelling prospects for industry players.

Companies that leverage these opportunities through strategic investments, sustainable practices, and market expansion in emerging economies are likely to see significant gains in market share and profitability. Embracing these trends will be crucial for staying competitive in a dynamically evolving global market.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)