Table of Contents

Introduction

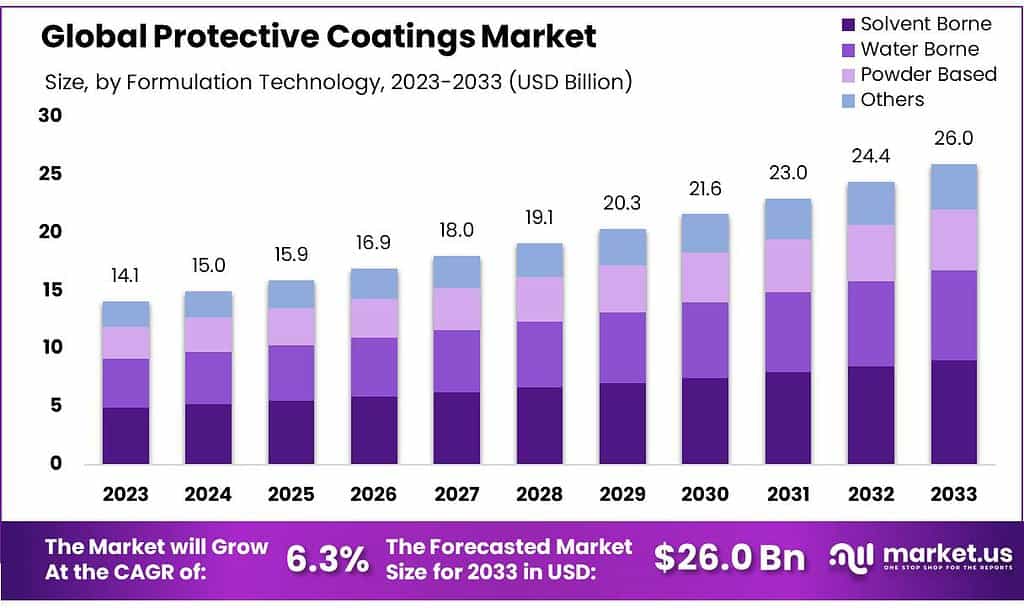

The global protective coatings market is on a robust growth trajectory, projected to escalate from USD 14.1 billion in 2023 to approximately USD 26.0 billion by 2033, marking a compound annual growth rate (CAGR) of 6.3% over the forecast period. This growth is driven by several key factors, including the increasing demands from the infrastructure and industrial sectors, particularly in regions like Asia-Pacific which is witnessing significant industrialization and infrastructure development. For instance, extensive construction projects in China and substantial investments in infrastructure in India are boosting demand for protective coatings that ensure the longevity and durability of structures and materials under severe environmental conditions.

However, the market faces challenges, notably from stringent environmental regulations concerning volatile organic compounds (VOCs) emissions. Countries across Europe and North America are tightening rules, pushing the market towards more environmentally friendly water-based solutions as opposed to traditional solvent-based options. This shift is echoed globally as developing nations adopt similar regulatory frameworks.

Recent developments in the market reflect a response to these environmental challenges and market demands. Innovations such as the introduction of new protective coatings with enhanced performance characteristics—like high resistance to extreme weather conditions and better environmental sustainability—are becoming more prevalent. For example, companies are developing coatings with reduced VOC emissions and improved durability to align with global sustainability goals and regulatory standards.

PPG Industries, Inc. has been at the forefront of introducing advanced protective coatings, focusing heavily on sustainability and high-performance solutions. For example, PPG launched the PPG ENVIROCRON® Primeron series, which is designed to provide high corrosion resistance. This innovation is part of PPG’s broader initiative to meet industry demands for durability and environmental compliance. Additionally, PPG’s recent acquisition of Tikkurila enhances their market reach and product portfolio in Europe, demonstrating their commitment to expanding its global footprint.

Kansai Paint Co., Ltd. has strengthened its position through strategic acquisitions, such as the purchase of WEILBURGER, which marks a significant investment in business-to-business growth sectors like the railroad industry. This acquisition aligns with Kansai’s broader strategy to diversify its offerings and enhance its technological capabilities in various industrial applications.

Key Takeaways

- Market Growth: Protective Coatings Market to reach USD 26.0 billion by 2033, growing at 6.3% CAGR from USD 14.1 billion in 2023.

- Resin Dominance: Epoxy coatings led with 38.6% market share in 2023, valued for corrosion resistance in heavy industries.

- Formulation Preference: Solvent-borne coatings held a 34.7% market share in 2023, prized for durability in industrial applications.

- Regional Leadership: APAC dominated with 47.6% market share, worth USD 6.7 billion in 2023, driven by industrialization and infrastructure projects.

- Key Industry: Infrastructure & Construction held a 23.5% market share in 2023, reliant on coatings for structural longevity.

Protective Coatings Facts And Statistics

- Solventborne one-component (1K) and two-component (2K) polyurethane systems are used across a broad array of industrial applications

- Those based on blocked NCO prepolymers will require baking at temperatures up to 180°C.

- The weathering properties of 1K coatings also largely depend on the isocyanate basis used.

- 2K PU systems dry relatively quickly without exposure to heat due to their reactive NCO groups.

- In some applications, these systems are force-dried at up to 80°C or baked at temperatures above 120°C to yield even shorter curing times.

- Temperatures between 120° and 200°C are required to release the blocking agents, which usually volatilize from the coating.

- These air-drying 1K coatings based on PUDs offer several good physical properties, including abrasion resistance.

- According to the statistics, rusted metal accounts for about 20 % to 40 % of the world’s annual output every year, which means huge economic losses.

- Compared to standard powder coatings, these reclaimable formulations can reduce power consumption by 20-30%

- But advancements in application, curing, resin, and binder chemistries have produced low-cure, fast-bake formulations that eliminate these traditional barriers with baking temperatures as low as 250-350°F (121-177°C) and cure times as quick as five minutes.

- Realize next-layer brilliance with customizable powder coatings in a spectrum of over 200 shades.

- This wavelength is in the range of electromagnetic waves as it has shorter wavelengths and more energy than visible light that is present in sunlight and encompasses about 10% of entire waves released from the sun.

Emerging Trends

Emerging trends in the protective coatings market are significantly shaped by technological innovations and shifting regulatory standards aimed at reducing environmental impacts. A notable shift is the increasing adoption of water-borne coatings, driven by stringent regulations on volatile organic compounds (VOCs) emissions. These coatings are gaining traction due to their lower environmental impact and are now comparable in performance to solvent-based counterparts.

Another significant trend is the rise of nanocoatings and UV-curable coatings. These products offer superior durability and efficiency, allowing for their application in various industries, including automotive and aerospace, where performance requirements are stringent. The innovation in nanocoatings, for example, provides cost-effective solutions with enhanced durability, appealing to a broad range of sectors.

Additionally, there’s a growing emphasis on the development of coatings that cater to specific industrial needs, such as those resistant to extreme temperatures and corrosive environments, seen particularly in the oil and gas and marine sectors. The market sees continual advancements in material science, leading to the creation of next-generation coatings that offer self-healing properties, extended lifespan, and improved performance.

Use Cases

- Industrial and Manufacturing: Protective coatings are extensively used in industrial settings to prevent corrosion and wear on machinery and structures exposed to harsh environments. For example, zinc-based coatings are applied through metallization, galvanization, and electroplating to provide a durable barrier against atmospheric corrosion.

- Infrastructure: In the construction and infrastructure sectors, protective coatings are crucial for safeguarding buildings and structures from environmental stressors like moisture, UV radiation, and corrosive chemicals. These coatings are applied to steel structures, bridges, and concrete surfaces to prevent degradation and extend service life.

- Oil and Gas: The oil and gas industry relies heavily on protective coatings to prevent corrosion in pipelines, storage tanks, and offshore platforms. These coatings ensure the integrity and efficiency of equipment operating in highly corrosive environments and under extreme temperatures.

- Automotive: In the automotive industry, protective coatings are used to enhance the durability and appearance of vehicles. They protect against chips, abrasions, and environmental elements, thus maintaining the vehicle’s aesthetic and structural integrity over time.

- Marine: Ships and marine structures benefit significantly from protective coatings that prevent fouling and corrosion due to saltwater exposure. These coatings are vital for maintaining the structural health of the vessel and optimizing performance by reducing drag and fuel consumption.

- Aerospace: High-performance protective coatings are critical in the aerospace industry, where they are used on aircraft surfaces to resist extreme environmental conditions and mechanical stress at high altitudes and speeds. These coatings protect against oxidation and thermal degradation, which are common in high-altitude environments.

- Nuclear Energy: In nuclear power plants, protective coatings are applied to control or prevent corrosion on critical components that are exposed to high levels of radiation and thermal stress. These coatings play a crucial role in ensuring the safety and longevity of nuclear facilities.

Key Players Analysis

PPG Industries, Inc. is a leader in the protective coatings sector, renowned for its comprehensive range of solutions that enhance durability and aesthetics while protecting against environmental and industrial challenges. PPG’s coatings are used across various industries including automotive, aerospace, and marine, where they provide resistance to corrosion, abrasion, and UV light. The company continues to innovate, developing new products that meet stringent environmental regulations and cater to the evolving needs of its global clientele.

Kansai Paint Co., Ltd. is a significant player in the protective coatings industry, offering advanced coating solutions that cater to a wide range of industrial and environmental needs. Their products are designed to provide long-term anti-corrosion performance under severe conditions, such as in marine and industrial environments. Kansai Paint’s commitment to technological innovation and quality has made it a trusted supplier for critical infrastructure projects globally, contributing to the company’s strong position in the market.

Dulux Protective Coatings has established itself as a prominent manufacturer and supplier of quality protective coatings, serving regions including Australia, New Zealand, Papua New Guinea, and Fiji for over 80 years. The company is recognized for its extensive product range designed to protect and enhance spaces and places in various environments. Dulux Protective Coatings focuses on delivering long-term and sustainable solutions for new and existing buildings, infrastructure, and facilities, providing detailed support from substrate preparation to application and maintenance. Their approach emphasizes practical, cost-effective maintenance systems that help reduce downtime, lower maintenance costs, and sustain the value of assets.

Wacker Chemie AG plays a pivotal role in the protective coatings sector, leveraging its expertise to offer a wide array of binders and additives that enhance the performance and durability of coatings. Their products are particularly notable for their resistance to UV radiation, chemicals, and environmental wear, making them ideal for applications in marine and industrial settings. Wacker’s innovations include SILRES® silicone resins and VINNOL® vinyl chloride copolymers, which provide crucial properties like improved adhesion, heat resistance, and environmental sustainability.

Henkel AG & Co. KGaA is renowned for its contributions to the protective coatings industry, focusing on solutions that enhance durability and resistance against harsh conditions. Henkel’s portfolio includes technologically advanced adhesives and functional coatings that cater to a wide range of industrial needs. Their products are designed to offer superior protection for metals and other materials, ensuring long-term performance even under challenging environmental conditions. Henkel’s emphasis on innovation and sustainability makes it a key player in the protective coatings market, addressing both performance needs and environmental concerns.

The Chemours Company is a prominent player in the protective coatings industry, recognized for its innovative solutions tailored to meet stringent environmental regulations. Their Ti-Pure™ TS-6700, a high-performance, environmentally friendly titanium dioxide grade, is designed specifically for waterborne architectural coatings. This product is noted for its sustainability, being produced with 100% renewable electricity and offering significant advantages in terms of pigment performance and paint processing. Chemours’ commitment to sustainability and innovative product development helps coatings producers achieve compliance with evolving environmental standards while maintaining high-quality performance.

Oasis Paints offers a robust selection of protective coatings suited for a range of industrial applications. Their products, such as the Oasis 8758 Epoxy Tank Lining and Oasis 8876 Coal Tar Epoxy, are designed for high-performance environments requiring durable and reliable coatings. The company provides coatings that offer protection against corrosion, wear, and environmental elements, making them suitable for heavy-duty industrial uses like pre-engineered buildings, oil and gas sectors, and more.

Hempel specializes in coatings that provide protection and aesthetic enhancement across various industries, including marine, infrastructure, and energy sectors. Their focus on innovation and sustainability is evident in their advanced protective coatings that safeguard surfaces from extreme conditions and environmental impacts. Hempel’s solutions are tailored to enhance durability and performance while supporting the global shift towards more sustainable industrial practices.

Berger Paints has made significant contributions to the protective coatings sector with its Protection range, which emphasizes sustainability and efficiency. Their products are designed to combat corrosion in both steel and concrete structures under harsh conditions, using innovations like high-volume solids paints, water-based paints, and solvent-less paints. This range includes various specialized coatings such as Epilux and high-performance anticorrosive systems, which are widely used in industrial infrastructures like oil rigs, pipelines, and tank farms due to their durability and resistance to severe environmental challenges.

The Sherwin-Williams Company is a major player in the protective coatings industry, offering a diverse portfolio that includes high-performance coatings and systems for industrial and marine environments. Their products are crafted to protect against corrosion, impact, and wear, making them suitable for heavy-duty applications. Sherwin-Williams combines innovative technology with a broad range of coating types to meet the specific needs of various industries, ensuring both performance and environmental compliance

Conclusion

In conclusion, protective coatings are an indispensable part of maintaining and extending the durability and efficiency of various industrial, infrastructural, and commercial assets. Across sectors—from automotive and aerospace to oil and gas, and marine industries—these coatings safeguard against corrosion, wear, and environmental damage, thereby reducing maintenance costs and increasing the longevity of critical equipment and structures. The market is evolving, driven by technological advancements and stringent environmental regulations, which are prompting the shift towards more sustainable solutions like water-based and high-performance coatings. As industries continue to expand and face harsher operational conditions, the demand for innovative protective coatings is expected to rise, underscoring their pivotal role in global industrial practices.