Table of Contents

Introduction

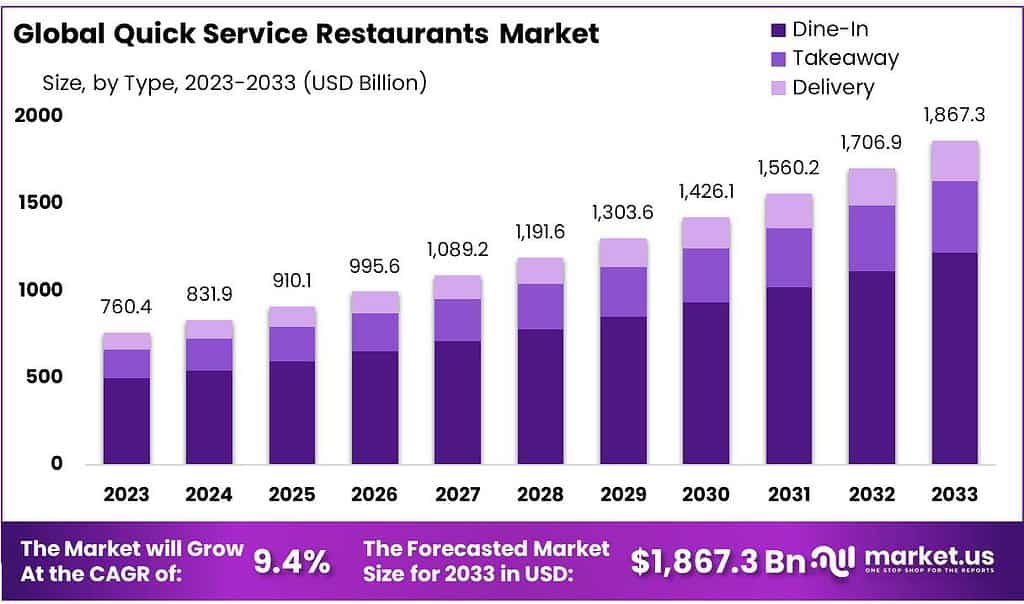

The global Quick Service Restaurants market is projected to reach a value of USD 1867.3 billion by 2033, expanding from USD 760.4 billion in 2023, at a (CAGR) of 9.4% during the forecast period from 2023 to 2033. This growth is driven by several key factors, alongside notable challenges and recent developments in the industry.

One of the primary growth drivers is the increasing pace of life and the consequent demand for quick meal solutions. Urbanization and the growth of the middle class, which possesses more disposable income for dining out, have significantly contributed to the expansion of the Quick Service Restaurants Market. The convenience and competitive pricing offered by QSRs, along with the rapid service, make them an attractive option for busy consumers. The market has also benefited from technological advancements, such as digital ordering and delivery services, which have enhanced customer convenience and service efficiency.

Consumer preferences have also shifted towards healthier eating options, pushing QSRs to diversify their menus to include more nutritious choices. This trend aligns with the increasing wellness lifestyle, where consumers prefer foods that are not overly processed and contain natural ingredients. Plant-based products, in particular, have seen a surge in popularity, driven largely by younger generations like Gen Z.

However, the Quick Service Restaurants Market faces several challenges. High storage expenses and labor shortages are significant hurdles. Managing large inventories of perishable items increases operational costs, which can squeeze profit margins. Additionally, labor scarcity affects service efficiency and overall customer experience, posing a threat to operational sustainability.

Recent developments in the market highlight the industry’s dynamic nature. Major QSR chains are continually expanding their global footprint. For instance, Jollibee Foods Corp planned to open 600 new stores by the end of 2023, and McDonald’s entered into a strategic partnership with Glovo to enhance its delivery services. These expansions are crucial for maintaining competitive advantage and market share.

Key Takeaways

- Projected Growth: Quick Service Restaurants Market to reach USD 1867.3 billion by 2033, with a 9.4% CAGR from 2023, indicating substantial expansion.

- Segment Preference: Dine-In dominates with 65.4% market share in 2023, showcasing consumer inclination towards traditional dining experiences.

- Service Trend: Self-service leads with 55.4% market share, reflecting consumer preference for convenience and efficiency.

- Regional Focus: North America, especially the US, holds a 42.5% market share, driven by strong demand and innovation.

- McDonald’s is the world’s largest QSR chain, with over 38,000 locations across more than 100 countries as of 2022.

- Burger chains account for the largest segment of the Quick Service Restaurants Market, with a market share of around 30% globally.

- Drive-thru accounts for around 70% of sales at major QSR chains in the United States.

Fast Food Consumption Statistics

- Annual Spending: Americans spend 10% of their annual income on fast food.

- Global Increase: Fast food consumption increased by 2.2% year over year worldwide.

- Daily Consumption: 37% of Americans consume fast food daily, equating to 84 million people.

- Typical Meal Cost: The typical fast food meal costs $5 to $7, with a 6% price increase during the pandemic.

- Global Revenue: The global fast-food industry generated $797.7 billion in revenue in 2021.

Growth and Trends Statistics

- U.S. QSR Market: The U.S. quick-service sector will grow at a rate of 5.6% annually, adding over 2,000 restaurants each year.

- Restaurant Count: The U.S. has 201,865 quick-service restaurants, up nearly 1% in Q1 2023.

- Revenue Growth: The U.S. fast food industry revenue was $331.41 billion in 2022.

- Historical Growth: The industry has grown at a rate of 1.1% for decades, from $239.2 billion in 2000.

- Franchise Owners: In 2020, there were 785,316 franchise owners operating fast-food restaurants in the U.S.

Consumer Behavior Statistics

- Online Orders: Mobile app and online orders increased by 12% on weekdays.

- Taste Importance: 94% of U.S. consumers prioritize taste in restaurant experiences.

- Weekly Dining: 83% of U.S. consumers dine at quick-service restaurants at least once a week.

- Subway Locations: Subway is the largest franchised store in the U.S., with 20,622 locations.

- California Leads: California hosts 2,014 Subway locations, about 10% of all Subway stores.

Emerging Trends

Digital-Only Restaurants: The QSR sector is increasingly adopting digital-only formats, where the front-of-house is minimized in favor of a technologically advanced back-of-house. This trend includes self-service kiosks, automated food prep, and digital ordering systems. Notable examples include McDonald’s digital-only restaurant in Texas and similar concepts tested by Wingstop and Chipotle. This shift aims to streamline operations and improve efficiency, especially in a time of persistent labor shortages.

Integration of AI and Automation: Artificial Intelligence (AI) and automation are revolutionizing the QSR industry. AI is being used to enhance customer interactions and food preparation processes, helping to reduce human error and increase efficiency. For instance, Sweetgreen’s acquisition of the robotic food prep company Spyce is a testament to this trend. The integration of voice and vision AI in drive-thrus and kitchens is also gaining traction, offering potential solutions to labor shortages and operational inefficiencies.

Emphasis on Data Analytics: Data analytics has become crucial for QSRs to understand customer behavior and optimize operations. By leveraging data, restaurants can tailor their offerings to meet customer preferences, improve menu pricing, and enhance the overall dining experience. Chains like The Cheesecake Factory and Darden Restaurants have successfully utilized data analytics to achieve significant operational savings and better customer satisfaction.

Rise of Contactless and Mobile Ordering: The adoption of contactless payment and mobile ordering is expected to continue growing. Customers can use their smartphones to access digital menus, place orders, and make payments, which enhances convenience and reduces wait times. This trend not only improves customer satisfaction but also boosts order accuracy and operational efficiency. Major QSR chains are investing heavily in these technologies to stay competitive.

Health and Wellness Focus: Consumers are increasingly demanding healthier food options, pushing QSRs to diversify their menus to include more nutritious choices. This includes the introduction of plant-based products and the removal of artificial ingredients. This trend is driven by the wellness wave, where consumers are more health-conscious and prefer foods that align with their wellness goals.

Snacking and Smaller Portions: There is a noticeable shift towards snacking and smaller portion sizes, with consumers opting for snacks over full meals during off-peak hours. This trend is driven by changing eating habits and the desire for convenience. QSRs are responding by offering a wider variety of snack options and promoting them through dynamic digital displays and interactive ordering kiosks.

Sustainable Practices: Sustainability is becoming a key focus for QSRs, driven by consumer demand for environmentally friendly practices. Restaurants are adopting sustainable sourcing, reducing waste, and using eco-friendly packaging. These efforts not only cater to environmentally conscious consumers but also help QSRs differentiate themselves in a competitive market.

Use Cases

Enhancing Customer Experience with AI and Automation: Quick-service restaurants are leveraging artificial intelligence (AI) and automation to improve customer service and operational efficiency. For instance, Wendy’s has integrated AI into their drive-thru operations to speed up service and ensure order accuracy. AI-powered kiosks and mobile apps allow customers to place orders quickly and customize their meals, reducing wait times and enhancing the overall dining experience. According to a report, implementing AI in QSRs can reduce service time by up to 30% and increase order accuracy by up to 20%.

Digital-Only Restaurant Concepts: The rise of digital-only QSRs is another significant use case. McDonald’s has experimented with a digital-only restaurant in Texas, where customers can place orders through kiosks or mobile apps, and the food is prepared with minimal human intervention. This model reduces overhead costs and streamlines operations. It is estimated that digital-only concepts can cut labor costs by up to 20% and improve service speed by 25%.

Personalized Marketing and Promotions: Quick Service Restaurants Market is using data analytics to personalize marketing efforts and promotions. For example, Taco Bell uses customer data to run targeted promotions during major events like the Super Bowl. They offer specific discounts or free items based on game scenarios, which boosts customer engagement and sales. Personalization in marketing can increase customer loyalty by 15% and boost sales by 10-15%.

Mobile and Contactless Ordering: Mobile and contactless ordering systems are increasingly popular in QSRs. Brands like Starbucks and Chipotle allow customers to order via mobile apps and pick up their food without direct human interaction. This system enhances convenience, especially during peak hours, and reduces the risk of errors in order-taking. In 2023, mobile orders accounted for 60% of total QSR sales, demonstrating their significant impact on the industry.

Healthier Menu Options: Responding to consumer demand for healthier food choices, QSRs like Subway and Panera Bread have introduced more nutritious menu options, including salads, grain bowls, and plant-based dishes. These options cater to health-conscious consumers and attract a broader customer base. Health-focused menu items have been shown to increase customer satisfaction and can boost sales by 5-10%.

Sustainable Practices: Sustainability is a growing concern for QSRs. Chains like Starbucks and McDonald’s have committed to using sustainable packaging and reducing waste. McDonald’s aims to source all its packaging from renewable, recycled, or certified sources by 2025. These practices not only appeal to environmentally conscious consumers but also reduce operational costs in the long run. Sustainable initiatives can increase brand loyalty by 10-15%.

Advanced Drive-Thru Technology: Innovations in drive-thru technology are transforming the QSR landscape. Restaurants are incorporating digital menu boards, AI-powered order-taking, and real-time order tracking to enhance the drive-thru experience. Studies show that advanced drive-thru systems can reduce service times by up to 60 seconds per car, leading to higher customer throughput and increased sales during peak hours.

Major Challenges

Labor Shortages: One of the biggest challenges facing QSRs is labor shortages. With fewer workers available, restaurants struggle to maintain service standards and efficiency. This issue has been exacerbated by the pandemic, leading to increased competition for a shrinking pool of workers. Many QSRs have had to raise wages and offer better benefits to attract and retain staff. Despite these efforts, the labor shortage continues to impact operational efficiency and customer service.

Rising Costs: QSRs are facing rising costs across multiple areas, including ingredients, packaging, and wages. Inflation has driven up the cost of raw materials, making it more expensive to produce and serve food. Additionally, sustainability initiatives, while beneficial for the environment, often come with higher costs for eco-friendly packaging and waste management. These increased expenses put pressure on profit margins and can lead to higher prices for consumers, potentially reducing customer spending.

Supply Chain Disruptions: Global supply chain disruptions have significantly affected the QSR industry. Delays and shortages in the supply of ingredients and packaging materials have made it challenging for restaurants to maintain consistent menu offerings. These disruptions can lead to increased costs and force QSRs to find alternative suppliers, which may not always meet the same quality standards. Managing these supply chain issues requires careful planning and often results in additional operational costs.

Health and Safety Regulations: Navigating the complex landscape of health and safety regulations is another major challenge. QSRs must comply with various local, state, and federal guidelines, which can change frequently. This includes maintaining high standards of cleanliness, ensuring food safety, and implementing measures to protect both employees and customers from health risks, such as COVID-19. Compliance can be costly and requires ongoing training and monitoring.

Changing Consumer Preferences: Consumer preferences are constantly evolving, and QSRs must adapt to stay relevant. There is a growing demand for healthier menu options, sustainability, and transparency about ingredients. QSRs need to balance these demands with their traditional offerings to attract a broader customer base. Failing to adapt can result in losing customers to competitors who better meet these new preferences.

Market Growth Opportunities

Expansion of Digital Ordering and Delivery Services: The rapid growth of digital ordering and delivery services presents a significant opportunity for QSRs. Mobile apps and online platforms make it easier for customers to place orders, enhancing convenience and increasing sales. According to a study, digital orders accounted for over 60% of QSR sales in 2023 and are expected to continue growing. Investing in technology to streamline ordering and delivery processes can help QSRs reach more customers and boost revenue.

Adoption of Artificial Intelligence and Automation: Integrating AI and automation into QSR operations can improve efficiency and reduce labor costs. AI can be used for tasks such as taking orders, customizing menus, and managing inventory. For example, AI-driven kiosks and robotic kitchen assistants can speed up service and ensure order accuracy. Implementing these technologies can help QSRs address labor shortages and enhance the customer experience, potentially increasing profitability by up to 20%.

Focus on Healthier Menu Options: There is a growing demand for healthier food options among consumers, particularly younger demographics. QSRs can capitalize on this trend by offering more nutritious menu items, such as salads, whole grain products, and plant-based alternatives. Introducing these options can attract health-conscious customers and differentiate QSRs from competitors. Studies show that including healthier options can increase customer satisfaction and sales by up to 15%.

Expansion into Emerging Markets: Emerging markets, particularly in Asia and Latin America, offer substantial growth opportunities for QSRs. These regions have rising middle-class populations with increasing disposable incomes and a growing appetite for fast food. Expanding into these markets can help QSRs tap into new customer bases and achieve significant growth. For instance, the Quick Service Restaurants Market in Asia is expected to grow at a CAGR of 12% over the next decade.

Sustainability Initiatives: Adopting sustainable practices can enhance Quick Service Restaurants Market brand image and attract environmentally conscious consumers. This includes using eco-friendly packaging, sourcing sustainable ingredients, and implementing waste reduction strategies. Customers are increasingly favoring brands that align with their values, and sustainability can be a key differentiator. Sustainable practices can also lead to cost savings in the long term, improving overall profitability.

Recent Developments

In 2023, McDonald’s Corporation showcased robust performance within the quick-service restaurant sector. Monthly data indicates consistent growth, driven by strategic initiatives and market adaptations.

In January 2023, McDonald’s saw a 12.6% increase in U.S. comparable sales, attributed to effective marketing campaigns and menu price adjustments. February maintained momentum with global sales growing by 9%, while in March, consolidated revenues reached $5.9 billion, marking a 4% year-over-year increase. April’s results continued this positive trend with an 8% rise in global comparable sales, led by a 4.3% increase in the U.S. and 4.4% in international markets.

In 2023 and early 2024, Starbucks Corporation demonstrated robust performance in the quick-service restaurant sector through strategic initiatives and market expansions. In January 2023, Starbucks saw a revenue increase of 12.6% in the U.S. and similar growth in its international markets. By February, Starbucks executed a $2 billion bond issuance for general corporate purposes and launched a loyalty partnership with Bank of America, enhancing rewards for members. March witnessed the virtual hosting of its 32nd Annual Meeting of Shareholders, where Starbucks announced leadership changes and the certification of over 6,000 Greener Stores globally.

In 2023, Chick-fil-A, Inc. continued to exhibit robust performance within the quick-service restaurant sector, achieving significant growth milestones. Monthly data for 2023 shows that Chick-fil-A generated nearly $21.6 billion in sales, marking a 14.7% increase from the previous year. This growth was driven by strategic initiatives, including expanding their footprint by nearly 6% to almost 3,000 locations by the end of the year. Notably, Chick-fil-A’s average unit volumes (AUVs) reached a record $9.3 million, an 8.1% increase over 2022.

In January 2023, Chick-fil-A announced plans to open its first-ever mobile pickup restaurant in New York City, designed to streamline the digital ordering process for on-the-go customers. This innovative approach reflects Chick-fil-A’s commitment to enhancing customer convenience while maintaining its signature hospitality. Throughout the year, the company also focused on community engagement, as seen in its various local support initiatives and the Chick-fil-A Shared Table program, which redirects surplus food to those in need.

In 2023, Taco Bell Corp. demonstrated strong performance in the quick-service restaurant sector, driven by significant innovations and strategic expansions. The brand’s U.S. system sales grew by 11%, reaching $13.85 billion, supported by an 8% increase in same-store sales and a 5% growth in unit count. Taco Bell’s digital sales saw a remarkable surge, with a 60% year-over-year growth in the first three months of 2023, largely due to enhancements in its mobile app and the addition of delivery services.

Throughout the year, Taco Bell continued to innovate with the introduction of its “Go Mobile” restaurant design, focusing on digital orders and efficiency. This new model features smaller footprints, walk-up windows, dedicated mobile order parking, and grab-and-go shelves, optimizing the customer experience for the digital age. By the end of 2023, Taco Bell had expanded its footprint to 8,218 total units globally, including 7,198 in the U.S.

Conclusion

The Quick Service Restaurants (QSR) industry is experiencing significant transformation, driven by technological advancements, changing consumer preferences, and economic adjustments. As of 2024, the industry is leveraging digital technologies such as AI, automation, and mobile ordering systems to enhance operational efficiency and customer experience. These innovations are crucial in addressing persistent challenges like labor shortages and rising operational costs.

Discuss Your Needs With Our Analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)