Table of Contents

Introduction

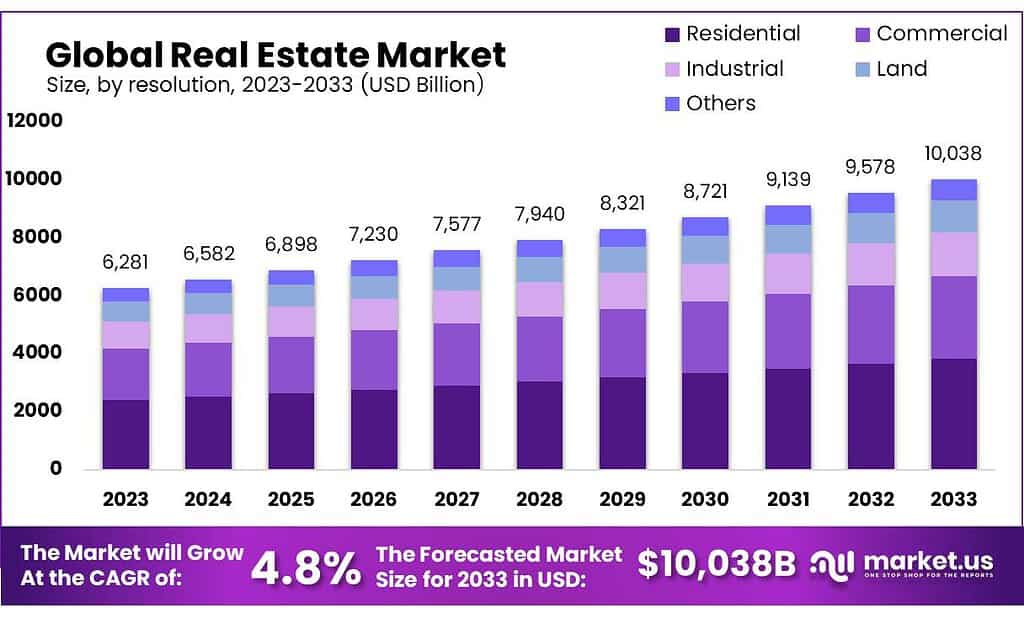

The global real estate market is projected to grow significantly, with its size expected to increase from USD 6,281 billion in 2023 to around USD 10,038 billion by 2033, reflecting a compound annual growth rate (CAGR) of 4.8% during the forecast period. This growth is driven by several factors, including increased urbanization, rising disposable incomes, and substantial investments in infrastructure. Technological advancements, such as the use of virtual tours and online platforms for property transactions, are also enhancing market dynamics by improving accessibility and efficiency.

Challenges in the market include economic uncertainties and potential recessions, which can dampen investment and slow down market growth. Additionally, regulatory constraints and high interest rates can restrict development activities and reduce demand for new properties.

Recent developments highlight the growing integration of technology in real estate, with innovations like AI-driven tools and augmented reality (AR) enhancing property viewing and transaction processes. The trend towards smart cities and sustainable developments is also notable, with governments and developers focusing on eco-friendly urban planning and energy-efficient buildings to attract global investments

Brookfield Asset Management Inc: Brookfield has forged a strategic partnership with CBRE Group, Inc., transferring the management of its U.S. office properties to CBRE. This move allows Brookfield to focus on long-term financial planning and investment strategies while leveraging CBRE’s expertise in property management. Additionally, Brookfield has reported robust financial performance, with distributable earnings of $4.8 billion for 2023, and plans to deploy $122 billion in new investments. CBRE Global Investors: Now operating as CBRE Investment Management, this division continues to lead global real estate investment sales, holding a 24% market share across major property types in 2023. CBRE has also expanded its public sector capabilities by acquiring J&J Worldwide Services, enhancing its service offerings to military and government facilities.

Key Takeaways

- Market Size: Real Estate Market is projected to reach USD 10038 billion by 2033, growing at 4.8% CAGR from USD 6281 billion in 2023.

- Segment Dominance: The residential segment captured over 38.3% market share in 2024, indicating strong demand for housing properties.

- Property Preferences: Fully furnished properties held 41.6% market share in 2024, followed by semi-furnished and unfurnished options.

- Business Segment Significance: Rental properties accounted for over 54.5% market share in 2024, reflecting demand for flexible accommodation.

- Mode Analysis: Offline transactions dominated with 76.3% market share in 2024, although online transactions are expected to grow rapidly.

- Latest Trends: Global urbanization and technological integration drive market growth, particularly in the Asia Pacific region, which captured 53% market share in 2024.

- Home prices are expected to rise by around 5.4% in 2023, according to Fannie Mae’s housing forecast.

- The median rent in the United States was $1,717 in February 2023, an increase of 6.7%.

Real Estate Statistics

- RBI maintaining interest rates at 4% boosts investor confidence.

- Low home loan interest rates are expected to increase housing demand by 35-40%.

- SEBI’s approval of the REIT platform opens up a Rs. 1.25 trillion investment opportunity.

- National Association of Realtors predicts 4.71 million existing home sales in 2024.

- US homeownership in 2024 stands at 65.8%, higher than pre-COVID levels.

- The average home price in the US was $495,100 in 2023, per the Census Bureau.

- Midwest boasts the highest homeownership rate at 70%.

- US median home price was $412,000 in September 2023, up 2% from last year.

- First-time home buyer’s average down payment is 6%.

- The median age of first-time home buyers is 35.

- The average time to save for a down payment is 8.7 years.

- 98% of final sale prices match the original asking price.

- 73% of sellers would reuse the same real estate agent.

- The median days on the market before offer acceptance is 40.

- Rental prices are now 29.4% higher than pre-pandemic levels.

- The commercial real estate market size in the US reached $1.2 trillion.

- Retail sector vacancy rate flatlined at 10.3% in Q1 2023.

- Commercial real estate revenue dropped by 0.4% in 2023.

Emerging Trends

- Higher Interest Rates and Economic Adjustments: The real estate sector is adapting to a “higher for longer” interest rate environment, driven by ongoing Federal Reserve policies. This shift is leading to a more cautious investment climate, with investors becoming increasingly selective and focusing on high-quality assets.

- Sustainability and ESG Focus: There is a growing emphasis on Environmental, Social, and Governance (ESG) criteria, with real estate firms integrating sustainable practices to meet regulatory requirements and consumer demand. This trend is also driven by increasing climate-related risks, prompting property owners to enhance energy efficiency and reduce carbon footprints.

- Technological Advancements: The adoption of Artificial Intelligence (AI) and Augmented Reality (AR) is transforming real estate operations, from virtual property tours to predictive analytics for market trends. These technologies are enhancing marketing, property management, and customer engagement.

- Hybrid Work Models: The persistence of hybrid and remote work models is significantly impacting the office real estate sector. There is a bifurcation in the market, with premium, amenity-rich office spaces in high demand, while older, less adaptable buildings face declining interest.

- Increased Housing Construction: Construction activity, particularly for multi-family units, is nearing record levels, helping to address the ongoing housing inventory crisis. This increase in supply is expected to alleviate some pressure on housing affordability.

- Urban Revitalization: Cities are focusing on revitalizing downtown areas and repurposing vacant office spaces into residential units to adapt to changing urban dynamics. This trend aims to enhance urban livability and address the surplus of unused commercial properties.

Use Cases

- Predictive Analytics and Preventive Maintenance: IoT Integration By leveraging Internet of Things (IoT) technology, real estate managers can monitor critical building systems like HVAC, elevators, and plumbing. Predictive analytics enable the early detection of potential issues, reducing maintenance costs and extending equipment lifespan. For instance, sensors can detect leaks or malfunctions and send alerts for immediate action, thereby preventing costly repairs.

- AI-Driven Lead Generation: Enhanced Targeting AI algorithms analyze vast amounts of data from online interactions to identify high-potential leads. Platforms like Zillow utilize AI to evaluate visitor behavior and preferences, streamlining the identification of serious buyers and tailoring property suggestions to meet their needs. This technology significantly improves the efficiency of real estate marketing and sales efforts.

- Virtual Tours and Augmented Reality (AR): Improved Property Viewing The integration of AR and virtual reality (VR) technologies offers potential buyers immersive property tours without physical visits. This technology enhances the home-buying experience, allowing detailed exploration of properties through 360-degree virtual tours and AR overlays that highlight property features.

- Automated Property Management: Efficiency Gains AI-powered tools streamline property management tasks such as lease agreement generation, maintenance scheduling, and tenant communication. Automated systems can handle routine queries and manage rental transactions, improving operational efficiency and tenant satisfaction.

- Smart Decision-Making Tools: Data-Driven Insights IoT-enabled applications provide real-time analytics and insights on property usage, helping owners and managers optimize space utilization and energy efficiency. These tools assist in making informed decisions about property improvements and investments, enhancing overall asset management.

- Content Marketing and Customer Support: Chatbots and AI Assistance Real estate companies are deploying AI chatbots to handle customer inquiries, provide property information, and assist with document preparation. These chatbots offer 24/7 support, improving customer engagement and satisfaction.

Key Players Analysis

Brookfield Asset Management Inc. is a global leader in real estate, managing a vast portfolio that includes 424 properties totaling 179 million square feet of commercial space. The company specializes in developing and managing high-quality office, retail, and mixed-use properties in key gateway cities worldwide. Notably, Brookfield’s acquisition of Forest City Realty Trust for $11.4 billion significantly expanded its portfolio, adding 6.3 million square feet of office space, 2.3 million square feet of life sciences assets, and 18,500 multifamily units.

CBRE Global Investors, now known as CBRE Investment Management, is a prominent player in real estate investment, managing a diverse portfolio valued at over $146 billion. The firm focuses on delivering sustainable investment solutions across various property types, including office, retail, industrial, and residential sectors. CBRE’s strategic acquisitions and innovative investment strategies have positioned it as a leader in global real estate, with a significant market share in investment management.

Colliers International Group Inc. is a prominent global real estate services and investment management company, operating in 66 countries with a workforce of over 19,000 professionals. The company reported strong financial performance in 2023, with a focus on Outsourcing & Advisory and Investment Management services, which together generated significant growth. Colliers recently raised $3 billion in new capital for its investment management division and continues to expand its service offerings through strategic acquisitions, enhancing its global footprint and service capabilities.

Cushman & Wakefield is a leading global real estate services firm, managing approximately 4.1 billion square feet of commercial space. The company offers a wide range of services including property management, transaction services, and consulting. In 2023, Cushman & Wakefield strengthened its market research and analytics capabilities, focusing on providing strategic insights and tailored solutions to clients amid evolving market conditions. The firm’s emphasis on technology and data analytics is enhancing its ability to serve clients effectively in the dynamic real estate landscape.

Digital Realty Trust, Inc. is a prominent real estate investment trust specializing in data centers. The company owns and operates a global network of over 284 data centers across 23 countries, providing essential infrastructure for cloud services and digital businesses. Its PlatformDIGITAL® facilitates seamless interconnection of data centers and cloud services, enhancing data flow management. Recently, Digital Realty expanded its AI-ready data center capacity in Tokyo through a joint venture with Mitsubishi Corporation, further strengthening its position in the market.

Equity Residential is a leading real estate investment trust focused on high-quality apartment properties in urban and high-density suburban areas. The company owns and manages a diverse portfolio of over 300 properties with more than 80,000 apartment units across the United States. Equity Residential emphasizes sustainability and tenant satisfaction, incorporating energy-efficient features and community amenities in its properties. Recent developments include strategic acquisitions in growth markets and continuous investment in property upgrades to enhance tenant experience.

Hines is a leading global real estate investment, development, and management firm, managing a portfolio valued at $94.6 billion. The company operates in 30 countries, focusing on diverse sectors including residential, logistics, retail, office, and mixed-use properties. Recently, Hines secured a $220 million loan to develop a mixed-use project in Fort Lauderdale’s FAT Village, which will include 601 apartments, 180,000 square feet of office space, and 70,000 square feet of retail. This project exemplifies Hines’ commitment to innovative and sustainable urban developments.

Host Hotels & Resorts, Inc. is a premier lodging real estate investment trust, owning a portfolio of upscale and luxury hotels primarily in urban and resort markets. The company focuses on enhancing property value through strategic renovations and acquisitions. Host Hotels & Resorts recently reported a strong performance, with significant investments in property upgrades to enhance guest experiences and drive long-term growth. Their strategic focus includes sustainability initiatives and leveraging technology to optimize operations across their hotel properties.

Jones Lang LaSalle (JLL) is a leading global real estate services firm, providing a wide array of services including property and investment management. With a strong focus on technology integration, JLL leverages AI and data analytics to enhance client outcomes in areas such as office leasing, property management, and investment advisory. The company operates in over 80 countries and has a significant presence in commercial real estate, offering innovative solutions to optimize real estate assets and improve operational efficiency.

Knight Frank LLP is a renowned global real estate consultancy, specializing in commercial and residential property services. The firm operates in over 50 countries, offering services including property sales, leasing, valuation, and advisory. Knight Frank is known for its market-leading research and insight into global property trends, helping clients navigate complex real estate landscapes. Recent initiatives focus on sustainability and digital transformation to enhance client services and support long-term investment strategies.

Lendlease Corporation Limited is a global leader in real estate development and investment, focusing on creating sustainable urban environments. The company operates across Australia, Asia, Europe, and the Americas, with notable projects such as The Exchange TRX in Kuala Lumpur, Malaysia. This development is Lendlease’s largest integrated project in Asia, featuring commercial, residential, retail, and leisure spaces. Lendlease is recognized for its commitment to placemaking and sustainability, aiming to set new standards in urban rejuvenation and community development.

Mitsui Fudosan Co., Ltd. is a major Japanese real estate developer, known for its innovative projects in commercial, residential, and mixed-use developments. The company is actively involved in international expansion, with significant investments in the United States and Europe. Mitsui Fudosan focuses on creating smart cities and sustainable communities, integrating advanced technologies and eco-friendly designs. Their recent projects include large-scale urban developments that enhance connectivity and livability, aligning with global trends toward sustainable urbanization.

Newmark Group, Inc. is a leading commercial real estate advisory firm that offers a comprehensive suite of services including capital markets, corporate services, leasing, valuation, and property management. The company operates globally with a strong presence in major markets, providing tailored solutions for institutional investors, corporations, and property owners. Recently, Newmark has expanded its international footprint by opening a new office in Paris and enhancing its retail capital markets team, further solidifying its position in the global real estate market.

Savills plc is a global real estate services provider, operating over 700 offices across the Americas, Europe, Asia Pacific, Africa, and the Middle East. The company is heavily focused on sustainability, integrating environmentally friendly practices across its projects. In 2024, Savills emphasized decarbonization, smart technologies, and green building certifications like LEED and BREEAM. These initiatives align with global goals set at COP28, aiming to enhance energy efficiency and reduce carbon footprints in real estate developments.

Simon Property Group, Inc. is a leading real estate investment trust (REIT) specializing in retail real estate. The company owns and operates premier shopping, dining, entertainment, and mixed-use destinations. Simon Property Group focuses on enhancing its properties through strategic investments and developments to drive traffic and sales. Recent initiatives include the expansion of their experiential offerings and the integration of digital and physical retail channels to improve customer engagement and shopping experiences.

The Blackstone Group Inc. is the world’s largest alternative asset manager with over $1 trillion in assets under management. Blackstone’s real estate division holds a diverse portfolio that includes logistics, rental housing, data centers, and hospitality assets. Recently, Blackstone raised $30.4 billion for its latest global real estate fund, BREP X, which focuses on acquiring high-quality assets poised for growth. The firm continues to leverage its scale and capital to invest in sectors with strong fundamentals, aiming to maximize returns for its investors.

Unibail-Rodamco-Westfield SE is a prominent European commercial real estate company specializing in owning and managing flagship shopping destinations. The company operates a portfolio valued at over €55 billion, focusing on prime retail and office properties in major cities across Europe and the United States. Recent initiatives include enhancing digital integration and sustainability efforts, such as energy-efficient upgrades and renewable energy projects, to attract high-profile tenants and improve customer experiences.

Vornado Realty Trust is a leading real estate investment trust (REIT) focused on high-quality office and retail properties, primarily in New York City, Chicago, and San Francisco. The company owns and manages over 20 million square feet of office space and 2.5 million square feet of retail space. Vornado emphasizes redevelopment and value-added projects, with recent efforts including the modernization of Penn District in New York City to create a premier commercial hub.

Conclusion

The real estate market in 2024 is poised for a year of stability and growth, transitioning from the rapid fluctuations experienced in recent years. The market is expected to grow from USD 6,281 billion in 2023 to around USD 10,038 billion by 2033, with a compound annual growth rate (CAGR) of 4.8%. Key factors driving this growth include technological advancements, such as virtual reality (VR) and artificial intelligence (AI), which are enhancing the efficiency of property transactions and market analysis.

Moreover, sustainability continues to gain traction, with increasing demand for energy-efficient and eco-friendly homes. This trend is not only environmentally beneficial but also aligns with cost-saving initiatives for homeowners. The shift towards suburban and rural living remains strong, driven by a desire for more space and natural surroundings, particularly among millennials.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)