Table of Contents

Introduction

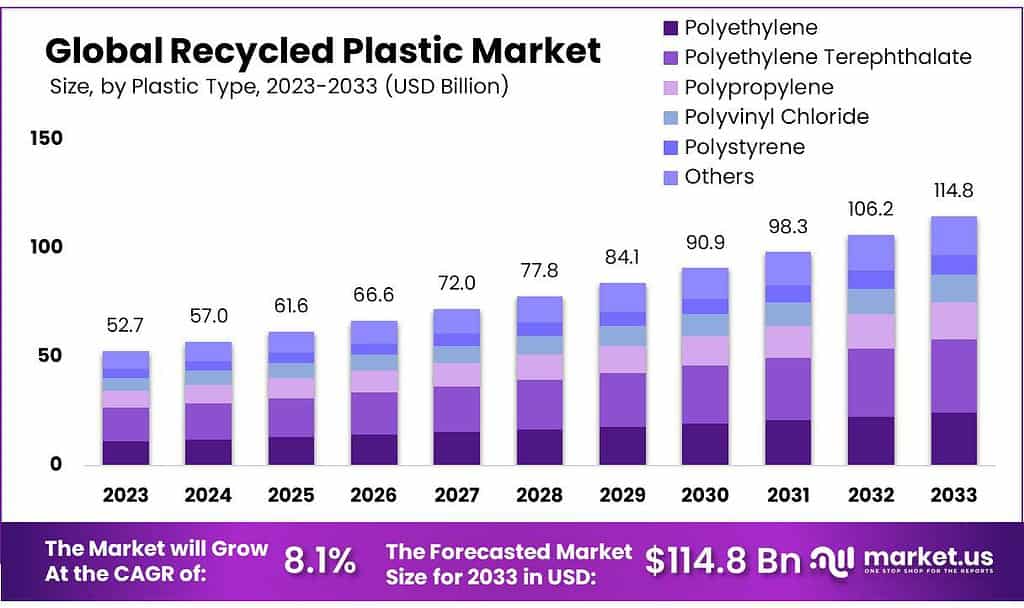

The Global Recycled Plastics Market is forecasted to expand significantly, from USD 52.7 billion in 2023 to an anticipated USD 114.8 billion by 2033, reflecting a robust compound annual growth rate (CAGR) of 8.1%. This growth is fueled by increasing demand across various industries, particularly packaging, driven by a surge in the use of recycled polyethylene terephthalate (PET) for food and beverage containers. Furthermore, technological advancements and rising environmental awareness have encouraged the adoption of recycled plastics.

However, the market faces challenges, primarily from the cost competitiveness of virgin plastics. Lower crude oil prices have reduced the cost of virgin plastics, making them more appealing to industries that prioritize specific chemical properties and quality. Additionally, a general lack of awareness about the benefits of recycled products also restrains market growth.

Regionally, Asia Pacific dominates the market due to high waste production and strong governmental support for recycling initiatives. Recent developments in this region, such as innovative recycling technologies and significant investments in recycling infrastructure, bolster market growth. For instance, in 2024, an innovative 100% recycled PET bottle was introduced by CARBIOS, L’OCCITANE en Provence, and Pinard Beauty Pack, highlighting significant progress in recycling technologies.

Plastipak Holdings has continued to innovate in the recycling arena, committing to the production of high-quality recycled PET materials, which are increasingly being used in packaging solutions across various industries. This commitment is part of a broader industry trend towards sustainable production practices. SUEZ SA, another significant entity, has also been active in expanding through acquisitions, such as the purchase of the recycling and recovery divisions of Veolia, aiming to bolster its services in waste management and recycled plastics.

Ultra Poly Corporation is notable for its efforts in processing post-consumer and post-industrial plastics, emphasizing the importance of advanced recycling technologies to improve the quality and efficiency of recycled products. Fresh Pak Corporation and B&B Plastics Recycling Inc. are also key contributors to the market, with efforts centered on enhancing recycling processes and developing new applications for recycled plastics. These companies are particularly focused on integrating recycled plastics into higher-value products, which is crucial for driving the market’s growth and sustainability.

Recycled Plastics Facts And Statistics

- Globally, only 9% of plastic waste is recycled while 22% is mismanaged. The majority of plastic waste ends up in landfills, oceans, and the natural environment.

- Every year, over 380 million tonnes of plastic is produced globally. This number is expected to quadruple by 2050.

- Plastic packaging is the most common type of plastic waste generated. It makes up over 40% of the total plastic waste generated.

- Recycling rates for plastic are alarmingly low. Only 14% of plastic packaging is collected for recycling.

- Single-use plastics, such as straws and disposable cutlery, make up a significant portion of plastic waste. In the United States alone, 500 million straws are used and discarded every day.

- Households are responsible for a significant amount of plastic waste. The average household generates over 30 pounds of plastic waste per month.

- India alone produces 40,000 Tonnes of Plastic everyday of which only 60% gets recycled.

- In India, 70% of plastic waste is recycled at Registered Offices, 20% by the Unorganized Sector and 10% is reused at Home.

- 50% of the Plastic is single use or use and throw plastic.

- When not recycled, almost 0.6 Million Tons of India’s Plastic Waste is disposed off in the oceans. This puts India among the Top 20 countries that dump maximum plastic in the oceans.

- 1 Ton of Recycled Plastic saves equivalent to 5774 KWh of Electricity.

- It consumes 66% less energy to produce new plastic from recycled materials instead of raw materials.

- An additional 9.3 million tons were imported. However, only 12.06 million tons were processed—the remaining amount was exported.

- According to the German Environment Agency (Umweltbundesamt, UBA) around 5.88 million tons of plastic waste were reutilised in 2015. In 1994 the figure amounted to 1.4 million tons.

- A staggering 99% of the plastic waste in Germany generated through the consumption of plastic products and not through the manufacturing of another product is being reutilised.

- Mainly plastics used for packaging are being recycled (79%), for example via the German dual recycling system or by recycling PET bottles.

- North Carolinians throw away more than $41,411,600 in plastic each year.

- In reality, only 9% of all plastic in use worldwide is recycled, and the majority of this recycled plastic is of inferior quality.

- During the formation of this alliance, these companies agreed to invest 1 billion dollars in combatting plastic pollution.

- What these companies fail to mention is that plastic production will grow by 40% in the next ten years and that they want to profit from this development.

Emerging Trends

Emerging trends in the recycled plastics market reflect an increasing focus on sustainability, advanced recycling technologies, and the expansion of applications across various industries. There’s a growing adoption of green and sustainable solutions as more industries are urged to reduce their environmental footprint by shifting to the use of recycled plastics. This shift is facilitated by advancements in recycling technologies that allow for more eco-friendly and biodegradable products.

One significant trend is the development of chemical recycling methods like pyrolysis, which is becoming increasingly viable economically. Pyrolysis transforms mixed polymer streams into usable feedstocks for plastics production, offering an alternative even when oil prices are low. This method is particularly promising for treating polymers that are difficult to recycle mechanically and could significantly reduce the reliance on virgin plastics.

Additionally, the market is seeing a rise in strategic initiatives among key players, including investments in new technologies and collaborations aimed at enhancing recycling infrastructure and expanding the scope of recyclable materials. Companies are also focusing on developing closed-loop recycling processes, where waste materials are continuously cycled back into production without degradation in quality.

Use Cases

- Packaging: The packaging industry heavily employs recycled plastics to produce containers, bags, and films. Innovations in this sector focus on enhancing recyclability through technologies like glue dots and laser etching, contributing to a more sustainable lifecycle for packaging products.

- Manufacturing: Recycled plastics are integrated into manufacturing processes to replace virgin materials. This includes applications in 3D printing and injection molding, which not only reduce waste but also cut down on the energy and resources needed compared to producing new plastics.

- Infrastructure: In the infrastructure domain, recycled plastics are being explored for use in constructing durable and environmentally friendly roads, bridges, and other structural components. This application aims to reduce overall plastic waste by integrating it into long-lasting infrastructure projects.

- Medical Devices: The medical sector is also advancing the use of recycled plastics, particularly in non-invasive medical devices and packaging, where the risk of contamination is low. This shift is driven by the need to reduce medical waste and promote sustainability within healthcare operations.

- Food & Beverage: In this industry, recycled plastics are commonly used to make food-safe packaging materials such as bottles, trays, and containers. This not only supports recycling initiatives but also meets consumer demand for sustainable practices.

- Energy: Recycling technologies like pyrolysis convert plastic waste into valuable resources such as synthetic fuels or new plastics, offering a sustainable solution to energy production while tackling plastic waste issues.

Key Players Analysis

Veolia is actively engaged in the recycled plastics sector, focusing on enhancing its recycling capabilities to support sustainability goals. The company’s significant initiatives include advanced recycling technologies that promote the circular economy. Veolia aims to innovate in the recycling processes to improve the quality and efficiency of recycled plastics, thereby supporting global sustainability efforts and contributing to the reduction of plastic waste.

Plastipak Holdings, Inc. is a leader in the recycled plastics market, particularly known for its efforts in sustainable packaging solutions. The company produces food-grade post-consumer recycled resin, which is used in new packaging. Plastipak is committed to sustainability, implementing science-based targets for reducing emissions and increasing the use of renewable energy sources like solar energy and biogas in its operations. Their innovative approach includes producing PET resin from captured carbon emissions, highlighting their proactive stance on reducing environmental impact

SUEZ SA is deeply entrenched in the recycled plastics sector, focusing on both mechanical and chemical recycling solutions to enhance environmental and economic performance for their industrial customers. They have been actively processing significant amounts of plastics in Europe, emphasizing the synergy between different recycling technologies to expand their offerings and improve sustainability practices. Their initiatives are aimed at transforming waste into valuable resources, thus supporting a circular economy.

Ultra Poly Corporation specializes in recycling post-industrial and post-consumer plastics, converting these materials into high-quality resins for various applications. They emphasize sustainable practices and have established a reputation for processing a wide range of plastic types, which contributes to significant environmental benefits by diverting waste from landfills and reducing the reliance on virgin materials.

Fresh Pak Corporation is prominently engaged in the recycled plastics sector, specializing in sustainable packaging solutions that leverage up to 100% post-consumer recycled (PCR) resins. Operating with over four decades of industry experience, Fresh Pak produces environmentally-friendly plastic packaging products and material handling solutions, such as their patented Eco-Sheet Plastic Slip Sheets. Their commitment to innovation and sustainability is evident in their strategic use of recycled plastics to manufacture cost-effective and environmentally responsible products, contributing significantly to the circular economy by enhancing recycling and reuse capabilities across various industries.

B&B Plastics Recycling Inc. is another key player in the recycled plastics market, known for processing a wide range of post-industrial and post-consumer plastic waste into high-quality recycled resins. Their focus lies in providing sustainable material solutions that help reduce landfill waste and promote the use of recycled materials across different sectors. B&B Plastics is committed to improving environmental outcomes by enhancing the efficiency and scope of plastic recycling, making a significant impact on reducing the ecological footprint of plastic waste.

Alpek S.A.B. de C.V., a leading petrochemical company in the Americas, plays a significant role in the recycled plastics sector. The company operates extensive recycling facilities, notably in the United States and Argentina, and specializes in producing high-quality recycled polyethylene terephthalate (rPET). Their operations include converting post-consumer bottles into rPET, which is primarily supplied back to bottlers, demonstrating a strong commitment to circular economy practices.

Indorama Ventures is a global giant in the recycled plastics market, known for its significant contributions to sustainability through its extensive recycling operations. The company is heavily invested in enhancing PET recycling capabilities across various global locations, aiming to produce high-quality recycled materials that support the industry’s shift towards sustainable practices.

Far Eastern New Century Corporation (FENC) is a leader in the global recycled polyester industry, boasting the largest production capacity for food-grade recycled polyester. FENC’s integrated system spans from recycled feedstock to finished product applications, recycling over 22 billion post-consumer PET bottles annually into various products, ranging from packaging to automotive textiles. The company’s commitment to the circular economy is demonstrated by its extensive recycling operations across multiple continents and collaborations with major brands, ensuring sustainable production practices and innovation in the recycling sector.

Envision Plastics Industries is recognized for its pioneering work in the recycled plastics field, focusing on creating high-quality recycled resins. The company specializes in transforming difficult-to-recycle plastic waste into reusable high-grade resins through advanced processing techniques. Envision Plastics’ products are used in a variety of applications, emphasizing their commitment to reducing plastic waste and enhancing sustainability across industries.

Custom Polymers, Inc. stands out as a global leader in the recycling of both post-industrial and post-consumer plastic scraps, offering customized recycling solutions tailored to the specific needs of their clients. Founded in 1996 and headquartered in Charlotte, NC, the company processes a wide variety of plastic materials, delivering quality recycled products used daily across diverse industries. With operations expanding over 50 countries, Custom Polymers is celebrated for its innovative approach to sustainability, comprehensive service, and significant contributions to reducing the environmental impact of plastic waste.

Berry Global Inc. is a major player in the recycled plastics market, focusing on the production of recycled packaging and engineered products. The company emphasizes sustainability through its operations, actively engaging in the recycling of plastics to produce environmentally friendly products. Berry Global’s commitment to innovation in the recycling process showcases its leadership in promoting circular economy practices within the industry.

Conclusion

In conclusion, the recycled plastics market is poised for substantial growth, driven by increasing environmental awareness, advancements in recycling technologies, and stringent regulatory pressures for sustainable practices across various industries. From packaging to infrastructure and energy solutions, recycled plastics are becoming integral to creating a more sustainable future. These materials not only help reduce the environmental footprint by minimizing waste and conserving resources but also offer economic benefits through cost savings and new opportunities for innovation. As the industry continues to evolve, the adoption of recycled plastics is expected to expand, reflecting a significant shift towards circular economic models and sustainability across global markets.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)