Table of Contents

Introduction

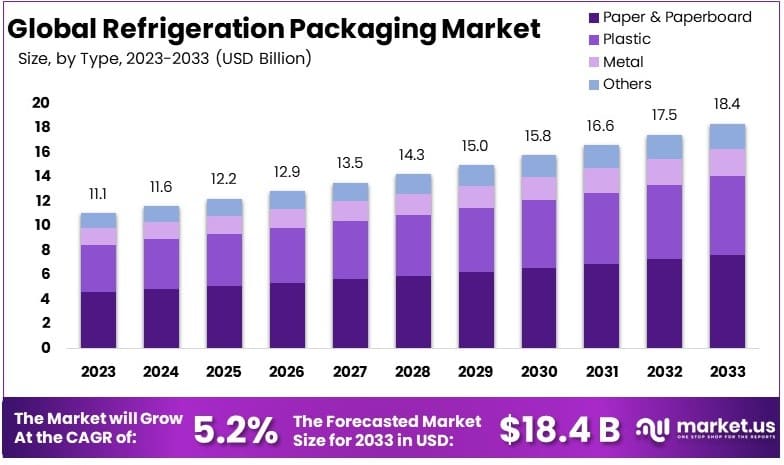

The Global Refrigeration Packaging Market is projected to expand from USD 11.1 Billion in 2023 to approximately USD 18.4 Billion by 2033, demonstrating a Compound Annual Growth Rate (CAGR) of 5.2% during the forecast period from 2024 to 2033. This market’s growth can be attributed to several factors including increasing demands for packaged foods and pharmaceutical products, which require stringent standards for preservation and longevity.

However, the industry faces challenges such as the need for sustainable and environmentally friendly packaging solutions, which poses difficulties in balancing cost-effectiveness with ecological concerns. Recent developments in this sector highlight advancements in biodegradable and recyclable materials, aiming to reduce the environmental footprint while maintaining the efficacy of refrigeration packaging. This evolution is supported by technological innovations and regulatory frameworks that encourage the adoption of sustainable practices within the industry.

Amcor Limited, a key player in the refrigeration packaging market, has been actively advancing its sustainability and technology fronts. Recent strides include the launch of PowerPost technology, which enhances the recyclability of PET bottles and significantly reduces their weight and carbon footprint. This innovation supports environmental goals by improving operational efficiencies and reducing material use in the packaging process.

Ball Corporation, another significant entity in this market, has focused on expanding its production capabilities and improving its sustainable packaging solutions. Recent developments include investments in aluminum cup manufacturing to cater to growing demand for recyclable beverage packaging options.

Bemis Company, Inc., now part of Amcor following a strategic merger, has integrated its operations to leverage combined technologies and resources, enhancing its product offerings in the flexible packaging sector . This merger has enabled Bemis to extend its reach and innovation capabilities across various packaging applications.

Crown Holdings Incorporated has been actively involved in developing innovative packaging solutions tailored to the needs of the refrigeration sector. Recent efforts include the introduction of new can designs that improve recycling rates and reduce the environmental impact of packaging.

These companies are instrumental in driving forward the innovations and sustainability initiatives within the refrigeration packaging industry, meeting both consumer demands and environmental standards.

Key Takeaways

- Market Value: The Refrigeration Packaging Market was valued at USD 11.1 billion in 2023, and is expected to reach USD 18.4 billion by 2033, with a CAGR of 5.2%.

- By Type Analysis: Paper & Paperboard dominated with 43.9%, preferred for its recyclability and sustainability features.

- By Application Analysis: Residential applications accounted for 62.9%, reflecting increasing consumer demand for refrigerated home delivery services.

- Dominant Region: Asia Pacific led the market with 42.5%, propelled by growing urbanization and rising consumer expenditure on packaged goods.

- Analyst Viewpoint: The market is experiencing strong growth, driven by innovations in sustainable packaging solutions.

Refrigeration Packaging Statistics

Market Overview

- According to IIR estimates, 12% of food produced globally in 2017 was lost due to an insufficient cold chain.

- An improved global cold chain would allow a reduction of almost 50% of the CO2 emissions of the current cold chain.

- This improved cold chain would also avoid 55% of the food losses attributable to the current cold chain.

- Over 13% of all food is lost due to a lack of refrigeration.

- An improved cold chain could feed 950 million inhabitants per year.

Cold Chain Infrastructure and Technology

- Only 25-30 countries in the world have the infrastructure required for the ultracold cold chain.

- The spot rate for refrigerated trucks in July was $2.44 a mile compared with $2.07 a mile for dry vans, an 18% increase.

Temperature Requirements and Energy Consumption

- Common cold chain temperature range is 36 to 46 °F (2 to 8 °C).

- Frozen chain temperature requirement is -4° F (-20° C).

- Ultralow or ultracold chain temperature requirement is -94° F (-70 °C).

- Polyethylene (PE) shrink film can withstand freezing temperatures as low as -40 degrees.

- IQF (individually quick frozen) polyethylene-wrapped food undergoes rapid freezing in a blast freezer at temperatures around -40 degrees Fahrenheit.

- Lowering refrigerator temperatures from 7 °C to 4 °C can extend storage lives and reduce food waste.

- The increased energy consumption from operating refrigerators at lower temperatures is estimated to cost £80.9 million and result in 367,411 tonnes of CO2e.

- The estimated annual UK-wide impact of lowering refrigerator temperatures from 7 °C to 4 °C includes saving £283.8 million in waste, associated with 578,383 tonnes of CO2e.

- Surveys of air temperatures in household fridges found average temperatures closer to 7 °C, with some operating at 9 °C or above.

- Only 29% of domestic fridges were found to operate at mean air temperatures of 5 °C or less in the most recent UK study.

Food Waste and Packaging Statistics

- According to statistics, 80% of fruit and vegetable loss occurs in the transportation link.

- In 2021, 38% of the US food supply went unsold or uneaten, resulting in a cost of $444 billion, with $310 billion attributable to food waste.

- One-third of all food grown for human consumption in the US never makes it to someone’s stomach, equating to 4 trillion tons of wasted water.

- The EPA reports that packaging waste accounts for approximately 30% of all waste generated in the U.S.

- The recycling rate in the U.S. has increased from 7% in 1960 to 32% today.

- Of the 82 million tons of packaging waste discarded in 2018, 53.9% was recycled.

- Additionally, 9% of packaging waste was combusted to reduce waste volume, while 37% (over 30,000 tons) was sent to landfills.

- It costs approximately $147 to recycle one ton of garbage.

- Americans use 100 billion plastic grocery bags per year.

- Plastic is typically a cheaper packaging alternative, potentially being up to 3.8 times less expensive than other materials.

Market Dynamics and Industry Trends

- The global packaging industry has a turnover of more than $500 billion, with food packaging being a significant segment.

- In 2021, 960 chicken eggs were packed in cardboard or plastic boxes and stored for 28 days under different temperature conditions (room and refrigeration) to study the quality changes.

- Putting food in the refrigerator within 2 hours of cooking can prevent or slow the growth of bacteria.

- Approximately 4.4 million tonnes of avoidable household food and drink waste are thrown away each year in the UK, with products requiring refrigeration contributing significantly to this waste.

- Around 2.5 million tonnes of this waste result from food not being eaten before ‘use by’ or ‘best before’ dates or being judged as spoiled.

Emerging Trends

- Sustainable Materials: The shift towards sustainable materials is increasingly prominent in refrigeration packaging. Companies are adopting biodegradable, recyclable, and reusable materials to meet regulatory demands and consumer preferences for environmentally friendly products. Innovations include the use of plant-based bioplastics and improved designs that minimize material use without compromising the integrity of the packaging.

- Smart Packaging: Integration of technology into refrigeration packaging is on the rise, with smart labels and IoT-enabled containers that monitor and report real-time data on temperature and freshness. These technologies help in maintaining the quality of perishable goods, reducing waste, and providing transparency in the supply chain, enhancing consumer trust.

- Active Packaging Systems: Active packaging systems that actively work to extend the shelf life of the products they contain are becoming more common. These systems might include moisture control, ethylene scavenging, and antimicrobial agents that are incorporated directly into the packaging material, ensuring products remain fresh longer.

- Customization and Personalization: There is a growing trend toward customization and personalization in packaging. This is driven by consumer demand for convenience and functionality, as well as brand differentiation strategies. Refrigeration packaging is seeing variations in size, shape, and design that cater to specific demographics, regional preferences, or even individual customer needs.

- Advanced Barrier Protection: New materials and technologies that offer improved barrier protection against moisture, oxygen, and other environmental factors are being developed. These advancements help in preserving the freshness, flavor, and nutritional quality of refrigerated products for longer periods, thus reducing food spoilage and waste.

- Lightweighting: Reducing the weight of packaging materials not only cuts down on transportation costs but also helps in reducing the carbon footprint of packaging. Innovations in material science and design are enabling the production of lighter, yet more durable refrigeration packaging solutions that perform as well as their heavier predecessors.

- Regulatory Compliance: As governments worldwide tighten regulations on packaging waste and sustainability, companies are innovating to comply with these new laws. This includes developing packaging solutions that meet specific recycling standards, contain a certain percentage of recycled material, or are completely free from certain types of plastics and other non-sustainable materials.

Use Cases

- Pharmaceuticals: Refrigeration packaging is crucial for transporting and storing pharmaceuticals, particularly vaccines and biologic drugs that require strict temperature control to remain effective. For example, mRNA-based vaccines need storage temperatures as low as -70°C. Advanced refrigeration packaging solutions utilize insulated containers and gel packs to maintain these critical temperatures during transit.

- Fresh Produce: Ensuring the freshness and extending the shelf life of fruits and vegetables during transport is another key use case. Refrigeration packaging for produce often incorporates moisture control systems that prevent spoilage and maintain nutritional quality, helping reduce the estimated 45% of fruits and vegetables that are lost or wasted globally each year.

- Dairy Products: Dairy products like milk, cheese, and yogurt need consistent refrigeration to prevent spoilage and maintain safety. Packaging solutions for these products often include high barrier materials that protect against oxygen and moisture, crucial for preserving taste and preventing contamination.

- Meat and Seafood: Refrigeration packaging for meat and seafood products focuses on preventing bacterial growth and spoilage. Vacuum sealing and modified atmosphere packaging are common techniques that extend shelf life by replacing the air inside a package with a gas formula that slows down decay.

- Prepared Meals: The rise of ready-to-eat meals has increased demand for refrigeration packaging that can extend shelf life and withstand reheating. Packaging in this segment often incorporates dual-ovenable materials, allowing consumers to heat meals directly in their containers, which supports the growing market for convenience foods.

- Frozen Foods: Packaging for frozen foods not only needs to maintain low temperatures but also prevent freezer burn. This is often achieved using multi-layer films that provide excellent barrier properties against vapor and odors, helping frozen products like ice cream and frozen dinners stay fresher longer.

- Clinical Trials: In clinical trials, maintaining the integrity of trial materials is paramount. Refrigeration packaging in this context often uses advanced data loggers and sensors to track temperature and humidity in real-time, ensuring that trial drugs remain within specified conditions throughout their transport and storage.

Major Challenges

- Cost and Material Efficiency: Balancing cost with environmental sustainability poses a significant challenge. High-performance insulation materials and advanced technologies that offer better thermal protection tend to be more expensive. Companies must navigate these costs while trying to keep the end products affordable for consumers.

- Environmental Impact: The environmental impact of refrigeration packaging is a major concern. Traditional materials like certain plastics and foams are not biodegradable and contribute significantly to landfill waste. Finding materials that provide necessary insulation properties while being environmentally friendly remains a tough challenge.

- Regulatory Compliance: Navigating the complex landscape of global regulations regarding packaging materials can be difficult. Different countries have varying standards for recyclability and the use of certain materials, making it challenging for companies to design universally compliant packaging solutions.

- Supply Chain Complexity: Refrigeration packaging often requires a complex supply chain that can maintain the integrity of products through controlled temperatures. Disruptions in the supply chain, such as transportation delays or failures in cooling systems, can compromise product quality and safety.

- Technological Integration: Incorporating advanced technologies like IoT sensors and smart labels into packaging without significantly increasing costs or impacting the recyclability of the package is a challenge. These technologies offer great potential for quality control and supply chain tracking but must be implemented in a way that is cost-effective and environmentally conscious.

Growth Opportunities

- Expansion into Emerging Markets: There’s significant growth potential in expanding refrigeration packaging solutions into emerging markets. These regions are experiencing rapid urbanization and increased access to refrigeration, driving demand for packaged refrigerated and frozen foods. Companies that can navigate these markets effectively stand to gain a substantial new customer base.

- Innovations in Material Science: Developing new, sustainable materials that provide excellent thermal insulation without environmental downsides is a promising opportunity. Innovations like biodegradable insulating foams or improvements in recyclable plastics could meet consumer and regulatory demands for sustainability while maintaining or enhancing packaging performance.

- Adoption of Smart Packaging Technologies: Integrating smart technologies such as temperature monitors and freshness indicators into packaging offers a growth avenue. These technologies can reduce waste by providing more accurate tracking and management of perishable goods throughout the supply chain, appealing to both businesses and environmentally conscious consumers.

- Tailored Solutions for Niche Markets: Creating customized packaging solutions for niche markets such as gourmet foods, specialty pharmaceuticals, or biotechnology products presents opportunities for growth. These sectors often require specialized packaging that meets strict regulatory standards and can benefit from high-value, innovative refrigeration packaging solutions.

- Partnerships with Food Delivery Services: As food delivery services continue to grow, partnering with these companies to develop optimized refrigeration packaging could provide a lucrative opportunity. Effective packaging solutions that maintain food safety, quality, and temperature during transit can enhance the customer experience and build brand loyalty.

Key Players Analysis

Amcor Limited operates in the refrigeration packaging sector, focusing on innovative and sustainable packaging solutions. In 2023, the company’s annual revenue reached $14.69 billion, experiencing a modest growth of 1.03% from the previous year. Recently, Amcor launched a new European Innovation Center, emphasizing advancements in material science and packaging design to enhance its market offerings. This initiative aligns with the company’s strategy to maintain its leading position in the packaging industry, despite facing a 7.72% year-over-year decline in revenue as of March 2024.

Ball Corporation, a key player in refrigeration packaging, primarily supplies sustainable aluminum packaging solutions. In 2023, the company reported a revenue of $14.03 billion, reflecting an 8.6% decline from the previous year due to market challenges. Ball recently sold its aerospace business, using the proceeds to retire $2.8 billion in debt and initiate a multi-year share repurchase program. This strategic move aims to strengthen its financial position and enhance shareholder value, ensuring continued investment in sustainable packaging innovations.

Bemis Company, Inc., now part of Amcor following its acquisition in 2019, continues to influence the refrigeration packaging sector through its advanced packaging technologies. The integration has expanded Amcor’s product offerings and market reach, leveraging Bemis’ expertise in flexible packaging solutions. Although specific recent financial details for Bemis are integrated into Amcor’s overall performance, the acquisition has significantly contributed to Amcor’s ability to deliver innovative packaging solutions across various industries.

Crown Holdings Incorporated operates in the refrigeration packaging sector, providing innovative and sustainable packaging solutions. In 2023, the company generated $12.01 billion in revenue, although this marked a 7.21% decline from the previous year. Recently, Crown completed the acquisition of Helvetia Packaging AG, expanding its European beverage can platform with an added capacity of one billion units annually. The company’s net income for the first half of 2024 was $241 million, slightly down from $259 million in the same period in 2023.

Graphic Packaging International, Inc. focuses on producing sustainable, fiber-based packaging solutions. In recent developments, the company has been enhancing its market position through strategic acquisitions and innovations in packaging technology. As of the latest financial reports, Graphic Packaging continues to show strong revenue growth, driven by increased demand for its eco-friendly products. The company remains committed to expanding its operations and meeting the rising consumer demand for sustainable packaging solutions.

International Paper Company, a global leader in the paper and packaging industry, has been making significant strides in the refrigeration packaging sector. The company’s recent financial performance reflects steady growth, with a focus on sustainability and innovation. International Paper’s latest initiatives include expanding its product offerings and improving operational efficiencies. The company continues to invest in new technologies and processes to meet the evolving needs of its customers and maintain its competitive edge in the market.

Pactiv LLC, operating under Pactiv Evergreen Inc., focuses on manufacturing and distributing fresh foodservice and food merchandising products, including refrigeration packaging. In the first quarter of 2024, Pactiv Evergreen reported revenues of $1.25 billion, reflecting a year-over-year decline of 12.51% due to higher manufacturing costs and lower sales volumes. Recently, Pactiv Evergreen announced a definitive agreement to sell two of its US industrial facilities to Suzano SA, aiming to streamline operations and optimize its asset portfolio.

Sealed Air Corporation, known for its Cryovac brand, is a leader in providing packaging solutions for the refrigeration sector. The company focuses on extending the shelf life of perishable goods through innovative packaging technologies. In 2023, Sealed Air reported a revenue of $5.64 billion, up from the previous year, driven by strong demand in the food packaging segment. Recently, Sealed Air acquired Foxpak Flexibles Ltd., an Irish packaging firm, to enhance its capabilities in sustainable packaging solutions and expand its market presence.

Sonoco Products Company, a prominent player in the packaging industry, reported a revenue of $1.6 billion in the first quarter of 2024, marking a 5% decrease due to lower pricing and changes in recycling operations. Recently, Sonoco announced its acquisition of Eviosys, Europe’s leading manufacturer of metal food cans, in a deal worth $3.9 billion. This acquisition aims to enhance Sonoco’s metal packaging business and expand its market presence. Additionally, Sonoco integrated its flexible and thermoformed packaging businesses to streamline operations and drive growth.

WestRock Company, a leader in paper and packaging solutions, focuses on providing sustainable and innovative packaging. In 2023, WestRock reported a revenue of approximately $21 billion, driven by strong demand in its packaging segments. Recently, WestRock completed the acquisition of Grupo Gondi, a major packaging company in Mexico, for $970 million. This acquisition strengthens WestRock’s footprint in Latin America and enhances its capabilities in producing corrugated packaging. WestRock continues to invest in sustainability initiatives and operational efficiencies to maintain its competitive edge in the market.

Conclusion

In conclusion, the refrigeration packaging market is poised for robust growth, driven by rising demand across multiple sectors including pharmaceuticals, fresh produce, and ready-to-eat meals. Challenges such as the need for sustainable materials and compliance with diverse global regulations remain significant. However, these hurdles also present substantial opportunities for innovation in material science and technology integration.

As companies continue to develop environmentally friendly and technologically advanced packaging solutions, they can expect to not only meet the evolving needs of consumers but also drive significant advancements in the industry’s overall sustainability and efficiency. This dynamic sector stands at the forefront of both technological innovation and environmental responsibility, making it a critical area for ongoing investment and development.