Table of Contents

Introduction

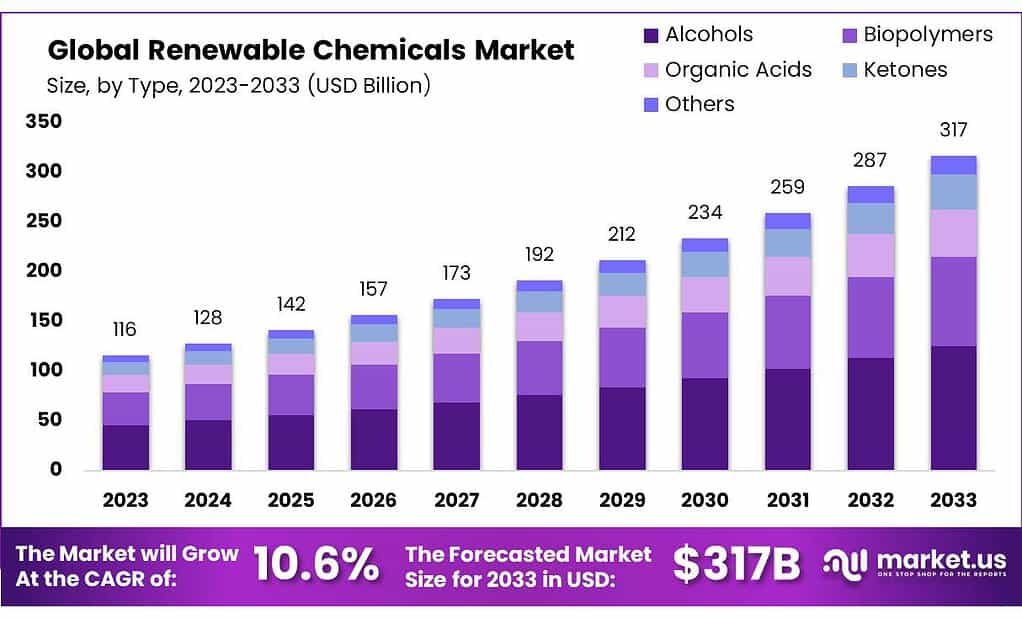

The Global Renewable Chemicals Market is projected to experience significant growth, expanding from USD 116 billion in 2023 to around USD 317 billion by 2033, with a Compound Annual Growth Rate (CAGR) of 10.6%. This growth is being driven by several factors including robust government support, technological advancements in production processes, and increasing industrialization in regions like Asia-Pacific, which alone held a significant market share in 2023.

Key growth factors in the market include a rising demand for sustainable and eco-friendly products across various sectors such as automotive, packaging, and construction. Technological innovations, particularly in bio-refining technologies, are enabling more efficient and cost-effective production of renewable chemicals from diverse feedstocks like corn, sugarcane, and biomass. Additionally, environmental regulations and government incentives across the globe are promoting the shift from traditional petrochemicals to renewable sources.

However, the market faces challenges such as high production costs and complex manufacturing processes compared to traditional chemical production. The volatility of raw material prices and stringent regulations also pose significant hurdles. Yet, companies are increasingly overcoming these challenges through R&D investments and by leveraging economies of scale.

Recent developments in the industry highlight the dynamic nature of the market. Key players are focusing on expanding their product portfolios and enhancing their sustainable practices. For example, major advancements have been noted in the production of bio-alcohols and biopolymers, which are being increasingly utilized in industries ranging from pharmaceuticals to automotive, underscoring their growing importance.

3M has reported that approximately 25% of its sales in 2023 were generated from sustainable solutions, indicating a significant shift towards products that support a lower environmental impact. This marks a strong commitment to integrating sustainability into their business model.

Amyris Inc. has also made strides with reported revenues of approximately USD 175 million in 2023, driven largely by the demand for its bio-based products in personal care and cosmetics industries. This reflects the growing consumer preference for sustainable and eco-friendly products.

Key Takeaways

- The renewable chemicals market is projected to grow from USD 116 billion in 2023 to USD 317 billion by 2033, at a 10.6% CAGR.

- In 2023, Alcohols (bioethanol, biobutanol) held 39.6% of the market share, dominating due to their role as biofuels and industrial solvents.

- Corn accounted for 33.4% of the feedstock market in 2023, mainly used for bioethanol production, a critical biofuel in renewable energy.

- The petrochemical sector used renewable chemicals in plastics and resins, holding a 35.3% market share in 2023, indicating its shift towards sustainability.

- Asia-Pacific led the renewable chemicals market in 2023, holding a 45.4% share, driven by industrialization and government incentives.

Renewable Chemicals Statistics

- The workshop Side Effects of Power-to-X and a Hydrogen Economy followed the training in October 2021, with about 50 experts from different countries.

- The white paper gives an overview of the situation in Uruguay. During the first stage of its energy transition, Uruguay achieved almost 98% of renewable energy and is now seeking to de-fossilise various sectors during the second stage of the transition towards green hydrogen.

- Although CF Industries does boast the world’s largest grey ammonia capacity at over 10,000 ktpa currently.

- The Dutch chemical giant division’s 100% biobased B-MB PA 6 comprises the majority of a Bugaboo strollers’ plastic parts.

- Synthesis, corresponding to 57% of global methanol feedstocks,8 and has a feedstock demand of 33.9 GJCH4,LHV/tMeOH.

- The composition of the feedstock has a significant effect on the shares of products produced, and ethylene and propylene yields from various feedstocks and operating conditions can range from 24 to 55% and 1.5 to 18%, respectively.

- Chemical flows, roughly 61% of downstream chemicals considered in this study are used for plastic production, and comprise roughly 24% of all global chemical flows.

- In 2023, global production capacity for these two resins alone is in excess of 15,000 kilotons. Eliminating fossil-based ammonia production from their value chain would significantly reduce the carbon footprint.

- The conventional methane reforming of natural gas route to ammonia underpins the majority of its output. It is estimated that each ton of ammonia produced emits 2.7 tons of CO2.

- Netherlands-based specialist chemical supplier Anqore developed a green acrylonitrile – designated Econtrile. Anqore was a fully Royal DSM-owned enterprise until 2015 but the Dutch chemicals giant is now a 35% stakeholder beside global advisory firm CVC Capital Partners.

- The group of participants consisted to 75% of local university professors in the field of renewable energy, engineering and chemistry and to 25% of the professional trainers from the local educational organisations.

Emerging Trends

- Adoption of Sustainable Feedstocks: There is a significant shift towards using sustainable feedstocks like plant biomass and CO2 conversion technologies (CO2-to-X), which convert atmospheric CO2 into valuable chemicals like methanol and ethanol. These practices not only help in reducing carbon footprints but also align with global climate goals by utilizing carbon from the atmosphere instead of fossil-based sources.

- Electrification of Chemical Processes: Innovations in electrifying chemical processes, particularly through electrocatalysis, are emerging. This includes the synthesis of renewable fuels and chemicals from renewable energy sources, reducing dependence on fossil fuels and enhancing the sustainability of production processes.

- Biodegradable and Renewable Solutions: The specialty chemicals industry is increasingly adopting biodegradable and renewable materials. With the depletion of fossil fuel reserves and climate change concerns, there’s a growing interest in using biomass, algae, and agricultural waste as alternative raw materials. This shift not only addresses environmental impacts but also opens up new avenues for innovation in the production of biofuels, bioplastics, and biochemicals.

- Bio-Based Product Demand: There is a rising demand for bio-based products due to their lower carbon emissions and improved biodegradability. These products are designed to minimize long-term environmental pollution and maintain ecological balance, which is particularly important in sectors like packaging, where sustainable practices are becoming a necessity.

Use Cases

- Alcohols as Feedstock: Alcohols, derived from renewable resources like biomass, play a crucial role in the production of environmentally friendly compounds. They are extensively used as solvents and intermediates in chemical synthesis, significantly driving the market for renewable chemicals. Alcohols are anticipated to hold the highest market share among types of renewable chemicals due to their widespread applications and the push for sustainable development by governments globally.

- Packaging Industry: The packaging sector extensively utilizes renewable chemicals to meet the growing consumer demand for eco-friendly packaging solutions. This trend is driven by increasing environmental awareness among consumers and the desire for sustainable lifestyles, leading to innovations in sustainable packaging materials. The packaging industry’s preference for renewable chemicals is bolstered by the need to reduce packaging waste and enhance the environmental friendliness of packaging materials.

- Biopolymers: Renewable chemicals are integral to the production of biopolymers, which are used in various applications including agricultural films, biodegradable shopping bags, and disposable items such as cutlery and plates. Biopolymers are favored for their reduced carbon footprint and biodegradability compared to conventional plastics.

- Biofuels and Energy: Renewable chemicals contribute to the production of biofuels such as bioethanol and biodiesel, which are used as alternatives to traditional fossil fuels. This not only helps in reducing the reliance on non-renewable resources but also decreases greenhouse gas emissions from vehicles and industrial processes.

- Agricultural Chemicals: Renewable chemicals are used to produce bio-based fertilizers and pesticides, offering a sustainable alternative to conventional agrochemicals. These products are derived from natural sources and are less harmful to the environment, promoting healthier soil and reducing pollution.

Major Challenges

- High Production Costs: Relative to traditional chemical polymers, renewable chemicals generally involve higher production costs. These costs stem from the complex manufacturing processes required to produce renewable chemicals from biomass and other bio-based feedstocks. The intricacy of these processes can often slow down technological advancements and scale-up efforts, posing a barrier to widespread adoption and market expansion.

- Technological Maturity: Many of the technologies essential for producing renewable chemicals, such as advanced bio-refineries and conversion processes, are still under development. The immaturity of these technologies can lead to inefficiencies and higher operational costs, which are challenging for industry players attempting to compete with established, fossil-based chemical processes.

- Supply Chain and Market Volatility: The industry is also subject to significant supply chain disruptions and market volatility, which can affect everything from raw material availability to end-product pricing. Factors such as geopolitical tensions, economic downturns, and energy price fluctuations can further complicate operations and strategic planning for companies in this sector.

- Regulatory and Compliance Issues: Navigating the regulatory landscape poses another hurdle. Companies must comply with stringent environmental regulations, which can vary significantly by region and often require substantial investment in compliance and reporting mechanisms. Balancing regulatory requirements with commercial objectives requires a nuanced understanding of both the regulatory environment and market dynamics.

- Cultural and Organizational Adaptation: Achieving sustainability goals also demands profound organizational and cultural shifts within companies. This includes integrating environmental, social, and governance (ESG) considerations into core business practices, which can be challenging to implement consistently across all levels of an organization.

Market Growth Opportunities

- Biopolymers and Bioplastics: As industries and consumers increasingly prioritize sustainability, the demand for biopolymers and bioplastics is expected to rise. These materials, derived from renewable sources, are key in reducing reliance on fossil-based plastics and decreasing environmental footprints.

- Expansion in Developing Regions: The Asia-Pacific region, in particular, shows significant potential due to its rapid industrialization and heightened environmental concerns. This region is expected to dominate the global renewable chemicals market, driven by governmental support for green products and the availability of abundant biomass and agricultural residues.

- Alcohol-based Chemicals: Alcohols such as ethanol and methanol, derived from renewable resources, are forecast to maintain a dominant share in the market. Their versatility makes them essential for a variety of applications, including solvents and biofuels, and they are pivotal in transitioning to sustainable manufacturing practices.

- Innovative Applications in Key Industries: There are significant growth opportunities in applications across various industries such as packaging, agriculture, and transportation. For instance, in the packaging industry, there is a growing demand for renewable chemicals due to consumer preference for sustainable packaging solutions. Similarly, in transportation, renewable chemicals are increasingly used as alternatives to conventional fuels.

- Technological Innovations and R&D: Advancements in biotechnology and process engineering are enhancing the efficiency and cost-effectiveness of producing renewable chemicals. This innovation is crucial for meeting the rising demand for eco-friendly products and overcoming existing production challenges.

Key Players Analysis

In 2023, 3M has made notable progress in the renewable chemicals sector by achieving significant sustainability milestones. The company increased its use of renewable electricity to 56.2% across its global operations and reduced its greenhouse gas emissions by 43.2% compared to 2019. Additionally, 3M decreased its virgin fossil-based plastic usage by 69.8 million pounds and enhanced water efficiency by 19.1%. These efforts are part of 3M’s broader commitment to environmental, social, and governance (ESG) goals, underpinned by substantial investments in community and environmental initiatives.

Amyris Inc., on the other hand, continues to excel in the renewable chemicals market by developing and commercializing biosynthetic production platforms. These platforms are crucial for converting plant sugars into valuable molecules, including squalane and hemisqualane, which are used in cosmetics and personal care products. Amyris’ technology not only supports sustainable product development but also drives down manufacturing costs, making green chemistry more accessible and commercially viable.

In 2023, Archer-Daniels-Midland Company (ADM) enhanced its renewable chemicals portfolio by successfully launching a biobased propylene glycol facility in Decatur. This facility produces industrial-grade, biobased propylene glycol, setting a precedent as it meets stringent US Pharmacopeia (USP) and USDA Certified Biobased Product Label standards. This initiative underscores ADM’s commitment to sustainable production practices and innovation in the renewable chemicals sector.

In 2023, BASF SE made significant strides in the renewable chemicals sector, particularly in the production of low-carbon hydrogen. The company received funding approval for a 54-megawatt water electrolysis plant, expected to begin operation in 2025. This project, a part of BASF’s broader strategy, aims to reduce carbon emissions significantly by switching to renewable energy sources and enhancing energy efficiency across its operations. BASF’s commitment to sustainability is also evident in its ambitious target to achieve net-zero CO2 emissions by 2050, supported by increased use of renewable energies and the development of new technologies at its Ludwigshafen site.

In 2023, Cargill Inc. has made significant progress in the renewable chemicals sector by focusing on sustainability and reducing environmental impacts. The company invested $78 million in efficiency and sustainability projects within its operations and advanced its regenerative agriculture practices across 880,000 acres in North America. This is part of Cargill’s broader goal to improve its renewable energy use and decrease greenhouse gas emissions, with plans to expand these efforts in 2024.

Cobalt Technology, LLC., For firms like Cobalt Technology that are involved in renewable chemicals, typical activities may include developing new bio-based products or technologies to replace traditional materials and reduce environmental impacts. More detailed and current information might be available directly from company reports or specialized industry databases.

In 2023, DSM, having merged with Firmenich, emphasized sustainability as a core element of its operations, focusing on reducing greenhouse gas emissions across all scopes, including a direct focus on Scopes 1 and 2 emissions. They have implemented a rigorous science-based targets framework to help guide these efforts. DSM-Firmenich is actively engaged in enhancing the sustainability of its operations and products, which includes substantial progress in various environmental and social initiatives. The merger has facilitated a unified approach to these goals, leveraging combined technologies and expertise to further their impact in the renewable chemicals sector.

DuPont, continues its work in the renewable chemicals sector by focusing on sustainable innovations and material science solutions that cater to a broad range of industries including electronics, automotive, and construction. DuPont’s strategies involve developing bio-based alternatives that significantly reduce environmental footprints while maintaining or enhancing product performance compared to traditional materials.

Elevance has been involved in renewable chemicals, utilizing its metathesis technology to create a range of bio-based products. This technology allows Elevance to produce high-performance chemicals from natural oils, which are used across various applications, including personal care, detergents, and lubricants. The company has focused on expanding its portfolio of renewable solutions to meet growing market demand for sustainable products.

Evonik Industries AG has made significant strides in the renewable chemicals sector through various innovative strategies aimed at enhancing sustainability. In 2024, Evonik continued to expand its green transformation efforts with projects like the new plant for sustainable emollients at its Steinau site in Germany. This facility uses enzymatic processes to produce cosmetic emollients, reducing the climate footprint by more than 60%. Additionally, Evonik has been investing in electrodialysis technology to improve efficiency and sustainability in chemical manufacturing, highlighting its commitment to the green transformation of the industry.

Genomatica Inc. has been actively expanding its renewable chemicals initiatives, emphasizing partnerships and scaling its technology for bio-based product development. A notable collaboration with Unilever focuses on creating sustainable palm oil alternatives, aiming to significantly reduce carbon footprints in home and personal care products. Similarly, L’Oréal has partnered with Genomatica to incorporate bio-based ingredients into their beauty products, aligning with L’Oréal’s sustainability goals for 2030. Additionally, Hyosung has collaborated with Genomatica to establish a facility for bio-based butanediol (BDO), essential for producing sustainable spandex, highlighting Genomatica’s influential role in transforming the materials sector toward greener alternatives.

Mitsubishi Chemical Holdings Corporation has also made significant advancements in renewable chemicals, focusing on integrating sustainability into its operations. Their approach includes developing bio-based materials and improving recycling processes to support a circular economy. Mitsubishi’s initiatives are part of a broader strategy to reduce environmental impact and enhance material sustainability, showcasing their commitment to addressing global ecological challenges through innovative chemical solutions.

In 2023, Mitsui Chemicals Inc. has been actively working towards a sustainable chemical industry by focusing on carbon neutrality and recycling initiatives. The company introduced the use of pyrolysis oil from plastic waste as a feedstock for its chemical crackers at its Osaka Works, marking a significant step towards establishing Japan’s first bio and circular cracker system. This initiative is part of a broader effort to achieve carbon neutrality, with the Osaka Works serving as a model site for deploying these innovative technologies by 2030. The use of bio-based and recycled feedstocks is central to Mitsui Chemicals’ strategy to reduce its carbon footprint and enhance sustainability in its operations.

NatureWorks LLC continues to be a leader in the production of Ingeo™ biopolymers derived from renewable resources such as corn. Over the years, NatureWorks has been at the forefront of the bioplastics market, providing materials that are used in a variety of applications, including packaging, fibers, and 3D printing. The company’s products represent a sustainable alternative to petroleum-based plastics, focusing on the global need for environmentally friendly solutions. NatureWorks’ commitment to sustainability is evident in its ongoing investments in new technologies and production capacities to meet growing global demand for biopolymers.

In 2023 and 2024, Novamont S.p.A. has been actively leading in the renewable chemicals sector, particularly emphasizing its commitment to biobased solutions in packaging. Through its coordination of the TERRIFIC project, which launched in June 2024, Novamont is spearheading the development of innovative, circular, and biobased packaging solutions. This initiative is part of a broader collaboration involving 19 European partners and aims to enhance performance, circularity, and efficient resource use in the packaging sector. The project has secured significant financial backing and seeks to leverage agro-industrial byproducts to produce compostable and highly renewable biopolyesters and other biomaterials.

Novozymes has not been covered in the recent searches for specific activities or developments in the renewable chemicals sector for 2023 or 2024. Typically, Novozymes is known for its bioinnovation, particularly through the production of enzymes and microbes that support a wide range of industries, including bioenergy, agriculture, and food production. More detailed and specific recent activities or developments might be available through industry-specific reports or direct company updates.

In 2023 and 2024, OCI N.V. has continued to strengthen its position in the renewable chemicals sector, particularly focusing on low carbon ammonia and green methanol production. In 2023, OCI N.V. supplied Röhm with bio-ammonia for the production of methyl methacrylate, a key component in acrylic glass, and announced a doubling of its green methanol production capacity. This effort was part of OCI’s broader strategy to capitalize on the growing demand for renewable chemicals in industrial processes and other applications.

Solvay, meanwhile, has been actively pursuing sustainability through its various business segments, though specific year-wise updates for 2023 or 2024 were not detailed in the latest searches. Generally, Solvay is known for its commitment to advancing renewable chemistry, including the development of bio-based polymers and the integration of renewable energy sources into its production processes, as part of its goal to reduce its carbon footprint and enhance product sustainability. For more precise and current information, checking industry-specific reports or Solvay’s direct communications would be beneficial.

Conclusion

In conclusion, the renewable chemicals market is poised for significant growth, driven by global shifts toward sustainability and green practices. With the market projected to expand robustly, key opportunities lie in biopolymers, bioplastics, and alcohol-based chemicals, which are increasingly favored for their eco-friendly properties and versatility.

The Asia-Pacific region, in particular, is emerging as a pivotal market due to strong governmental support and abundant biomass resources. However, the industry faces challenges such as high production costs and technological maturity, which require ongoing innovation and investment. As the market continues to evolve, the integration of renewable chemicals across various industries promises not only environmental benefits but also substantial economic opportunities, making it a critical component of a sustainable future.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)