Table of Contents

Introduction

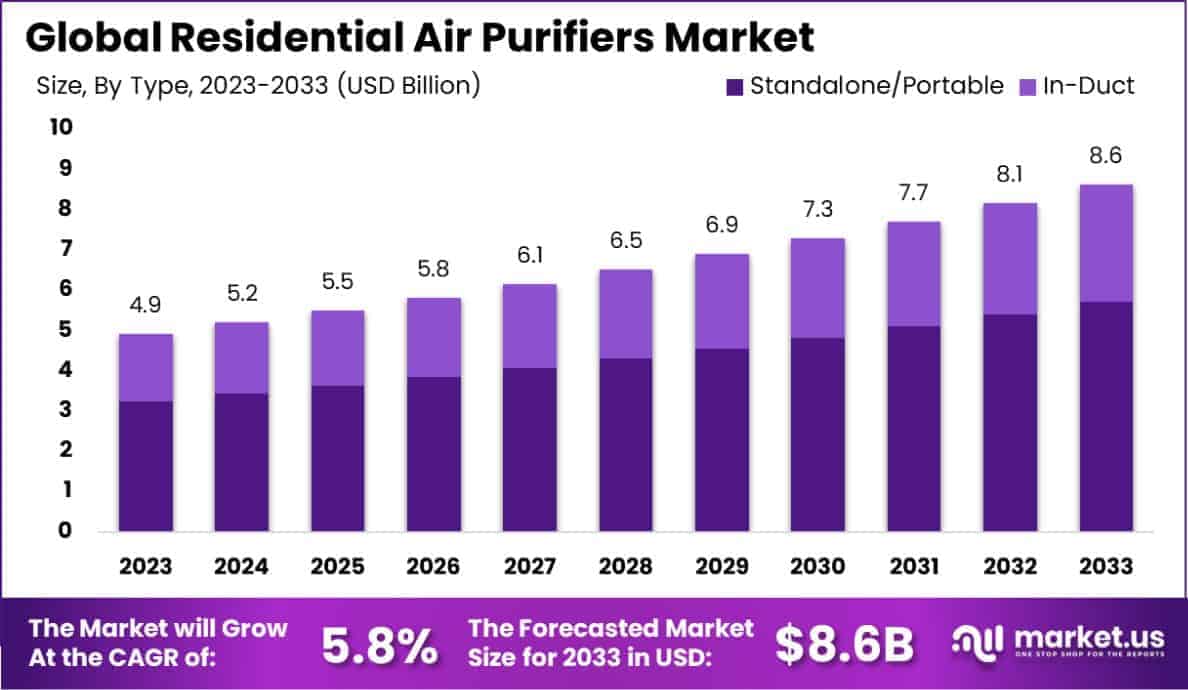

The Global Residential Air Purifiers Market is projected to grow from USD 4.9 billion in 2023 to an estimated USD 8.6 billion by 2033, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period from 2024 to 2033.

Residential air purifiers are devices designed to improve indoor air quality by removing pollutants, allergens, and contaminants such as dust, smoke, pet dander, mold spores, and harmful airborne particles. These devices often utilize filtration systems, including HEPA filters, activated carbon filters, or advanced technologies such as ionizers and UV sterilization, to ensure cleaner air. Residential air purifiers are increasingly viewed as essential household appliances, contributing to health and wellness by minimizing respiratory issues and providing a cleaner living environment.

The residential air purifiers market encompasses the production, distribution, and sales of air purification devices specifically designed for household use. This market is characterized by a diverse range of products tailored to different consumer needs, including portable units, whole-house systems, and smart purifiers with IoT capabilities. The market caters to rising consumer awareness regarding indoor air quality, driven by health concerns and environmental factors. It involves a complex value chain, spanning manufacturers, suppliers, distributors, and retailers, both online and offline.

Several factors are driving growth in the residential air purifiers market. Increasing urbanization and industrialization have escalated air pollution levels globally, prompting consumers to seek solutions for better indoor air quality. Additionally, heightened awareness of respiratory diseases such as asthma and allergies, often aggravated by poor air quality, has bolstered demand. Technological advancements in air purification systems, including smart connectivity features and energy-efficient designs, further enhance the appeal of these products. Regulatory initiatives encouraging cleaner indoor air standards also act as a catalyst for market expansion.

Demand for residential air purifiers is on a consistent upward trajectory due to a combination of factors, including rising health consciousness and the prevalence of air quality concerns. Seasonal fluctuations, such as increased pollution levels during winter months in certain regions, lead to temporary spikes in demand. The post-COVID-19 era has also witnessed heightened interest in maintaining hygiene and health at home, further driving consumer investment in air purifiers. Premium and smart air purifiers are particularly gaining traction among tech-savvy and high-income segments, while entry-level models cater to price-sensitive customers.

The residential air purifiers market presents numerous opportunities for growth and innovation. Emerging markets in Asia-Pacific, Africa, and Latin America, where urbanization is accelerating and air quality concerns are mounting, represent untapped potential. The integration of smart home technologies, such as IoT-enabled purifiers with air quality monitoring systems, provides avenues for differentiation and value addition. Furthermore, rising consumer preference for eco-friendly and energy-efficient products opens opportunities for manufacturers to develop sustainable and cost-effective solutions. Strategic partnerships and investments in R&D to introduce advanced filtration technologies also offer pathways to capture market share and drive long-term growth.

Key Takeaways

- The global residential air purifiers market is expected to grow from USD 4.9 billion in 2023 to USD 8.6 billion by 2033, registering a CAGR of 5.8% during the forecast period from 2024 to 2033.

- In 2023, standalone/portable air purifiers dominated the market by type, accounting for a significant 66.3% share.

- HEPA (High-Efficiency Particulate Air) filters were the leading technology in 2023, holding a 41.5% market share.

- The Asia Pacific region was the largest market for residential air purifiers in 2023, with a 43.2% market share and generating USD 2.11 billion in revenue.

Residential Air Purifiers Statistics

- HEPA filters were the leading residential air purifier technology, holding a 41.5% market share in 2023.

- These filters effectively remove 99.97% of particulate matter larger than 0.3 microns, with some standards defining efficiency as 99.95% for MPPS.

- HEPA filters typically last between 6 months to 3 years, but maintenance checks are recommended every 6 to 12 months.

- Residential air purifier prices range from USD 100 to USD 800, influenced by features and technologies.

- The World Health Organization links air pollution to 7 million deaths annually, with 4.2 million from outdoor pollution and 3.8 million from indoor pollution.

- Around 30% of urban households own air purifiers due to rising awareness of indoor air quality.

- Air purifiers significantly reduce indoor PM 2.5 levels, with improvements ranging from −3.7 to −26.5 µg/m3 and PM2.5 percentages by −10.4% to −56.4%.

- Roughly 70% of consumers report health improvements after consistent air purifier use.

- By 2030, over 50% of new homes are expected to have integrated air purification systems as a standard feature.

- About 80% of consumers show interest in smart home devices with integrated air purification functions.

- Government incentives for energy-efficient appliances could drive a 15-20% increase in air purifier sales over five years.

- Globally, 25 million households use air purification technologies as awareness of indoor air pollution grows.

- Developing countries saw a 30% rise in residential air purifier adoption post-pandemic due to heightened health awareness.

- Consumers are willing to pay 9.7% more for sustainably produced or sourced products.

- Approximately 90% of consumers believe air purifiers enhance life quality by improving health through cleaner indoor air.

- Smart air purifiers represented 35% of total air purifier sales in 2023.

- Over 60% of air purifier users report better sleep quality with regular usage.

- About 82% of new air purifier models in 2023 featured auto mode functionality.

Emerging Trends

- Integration of Smart Technologies: Modern air purifiers are increasingly incorporating smart features, such as Wi-Fi connectivity and real-time air quality monitoring. These advancements enable users to control and monitor air quality remotely, enhancing convenience and efficiency. For instance, devices like Dyson’s Pure Cool Air series offer inbuilt LCD screens that provide real-time air quality readings, along with temperature and humidity sensors.

- Adoption of High-Efficiency Particulate Air (HEPA) Filters: HEPA filters have become the preferred choice in residential air purifiers due to their effectiveness in removing particulate matter, including dust, pollen, and smoke. Their ability to capture particles as small as 0.3 micrometers with high efficiency has made them a standard in the industry.

- Growing Demand in Asia-Pacific: The Asia-Pacific region is witnessing a surge in demand for residential air purifiers, driven by increasing urbanization and awareness of air pollution’s health impacts. Countries like China and India are experiencing rapid market growth, with consumers seeking solutions to improve indoor air quality.

- Focus on Energy Efficiency and Sustainability: Consumers are prioritizing energy-efficient and environmentally friendly air purifiers. Manufacturers are responding by developing products that consume less energy and utilize sustainable materials, aligning with the global emphasis on reducing carbon footprints.

- Expansion of Product Portfolios by Key Players: Leading companies in the market are broadening their product lines to cater to diverse consumer needs. This includes introducing models with advanced filtration technologies, varying capacities, and additional features like air quality indicators and multi-stage purification systems.

Top Use Cases

- Allergen Reduction: Air purifiers equipped with High-Efficiency Particulate Air (HEPA) filters can capture up to 99.97% of airborne particles as small as 0.3 microns, effectively reducing allergens such as pollen, dust mites, and pet dander. This is particularly beneficial for the 10-30% of the global population affected by allergic rhinitis.

- Smoke and Odor Elimination: Activated carbon filters in air purifiers adsorb volatile organic compounds (VOCs) and odors, including those from cooking and tobacco smoke. For instance, the Clorox Air Purifier has been noted for its effectiveness in removing smoke, making it suitable for households aiming to maintain a fresh indoor environment.

- Pet Hair and Dander Management: Households with pets can benefit from air purifiers designed to capture pet hair and dander. Models like the Rabbit Air A3 are tailored for pet owners, featuring comprehensive filtration systems that address pet-related pollutants.

- Mold Spore Reduction: In regions with high humidity, mold growth is a common issue. Air purifiers with HEPA filters can trap mold spores, reducing their presence in the air and mitigating potential health risks. The Germ Guardian air purifier, for example, is recognized for its efficacy in addressing mold concerns.

- Improvement of Overall Indoor Air Quality: Beyond specific pollutants, air purifiers contribute to the general enhancement of indoor air quality by removing a broad spectrum of contaminants. This is crucial considering that indoor air can be 2-5 times more polluted than outdoor air, according to the U.S. Environmental Protection Agency. Devices like the Coway AP-1512HH are noted for their ability to improve air quality in medium to large rooms.

Major Challenges

- High Initial Investment and Maintenance Costs: Quality air purifiers often require a substantial upfront investment, with prices ranging from $100 to over $1,000, depending on features and brand. Additionally, ongoing maintenance, such as regular filter replacements—typically every 6 to 12 months—adds to the total cost of ownership, potentially deterring budget-conscious consumers.

- Limited Effectiveness in Real-World Conditions: While laboratory tests demonstrate high efficiency, real-world performance can be less impressive. Factors such as room size, layout, and ventilation affect an air purifier’s ability to clean air effectively. For instance, a study found that the actual effectiveness of air purifiers is significantly lower in real conditions than the values declared by manufacturers.

- Ozone Emission Concerns: Certain air purifiers, especially those utilizing ionization or ozone generation technologies, can emit ozone as a byproduct. Elevated indoor ozone levels pose health risks, including respiratory issues. The U.S. Environmental Protection Agency advises caution, noting that some air purifiers can produce ozone concentrations that exceed health standards.

- Consumer Awareness and Misleading Claims: A lack of consumer understanding regarding different air purification technologies leads to confusion and skepticism. Some manufacturers have faced scrutiny for overstated claims about their products’ capabilities. For example, the Better Business Bureau recommended that Molekule discontinue certain advertising claims about its air purifiers’ effectiveness.

- Energy Consumption and Environmental Impact: Continuous operation of air purifiers can lead to increased energy consumption, raising concerns about environmental sustainability and higher utility bills. Consumers are increasingly seeking energy-efficient models, but not all available products meet these expectations. The Energy Star program certifies air purifiers that meet specific energy efficiency criteria, yet not all models qualify.

Top Opportunities

- Rising Awareness of Indoor Air Quality: Increasing public consciousness about the health impacts of indoor air pollution is leading to higher demand for air purification solutions. Studies indicate that indoor air can be more polluted than outdoor air, prompting consumers to seek effective purification methods.

- Technological Advancements: Innovations such as smart air purifiers with real-time monitoring and integration with home automation systems are attracting tech-savvy consumers. Features like app control, air quality sensors, and voice assistant compatibility enhance user experience and drive market adoption.

- Urbanization and Air Pollution: Rapid urbanization has led to increased air pollution levels in cities, elevating the need for residential air purifiers. Urban dwellers are more exposed to pollutants, making air purifiers a necessary appliance for maintaining indoor air quality.

- Health and Wellness Trends: A growing focus on health and wellness is encouraging consumers to invest in products that improve living environments. Air purifiers that effectively remove allergens, bacteria, and viruses align with this trend, appealing to health-conscious individuals.

- Regulatory Support and Standards: Government initiatives aimed at improving air quality and establishing standards for indoor environments are fostering market growth. Policies promoting cleaner indoor air encourage the adoption of residential air purifiers as a preventive health measure.

Key Player Analysis

- Daikin Industries, Ltd.: Headquartered in Osaka, Japan, Daikin Industries is a global leader in air conditioning and air purification solutions. The company offers a range of residential air purifiers featuring advanced filtration technologies, including HEPA filters and electrostatic dust collection. In fiscal year 2023, Daikin reported net sales of approximately ¥3.2 trillion (USD 29.5 billion), with a significant portion attributed to its air conditioning and air purification segments.

- Sharp Corporation: Based in Sakai, Japan, Sharp Corporation is renowned for its consumer electronics and home appliances. The company’s Plasmacluster air purifiers utilize ion technology to reduce airborne particles and odors. In fiscal year 2023, Sharp’s net sales were approximately ¥2.4 trillion (USD 22.1 billion), with the Health and Environment division, including air purifiers, contributing notably to this figure.

- Honeywell International Inc.: An American multinational conglomerate headquartered in Charlotte, North Carolina, Honeywell offers a diverse portfolio of consumer products, including air purifiers. The company’s air purifiers are equipped with HEPA filters and are designed to capture up to 99.97% of airborne particles. In 2023, Honeywell’s Home and Building Technologies segment, which encompasses air purifiers, generated revenues of approximately USD 10.7 billion.

- Panasonic Corporation: Headquartered in Kadoma, Japan, Panasonic is a leading multinational electronics company. Its residential air purifiers feature Nanoe technology, which inhibits bacteria and viruses. In fiscal year 2023, Panasonic reported net sales of approximately ¥7.4 trillion (USD 68.2 billion), with the Appliances segment, including air purifiers, contributing significantly.

- LG Electronics: Based in Seoul, South Korea, LG Electronics is a global leader in consumer electronics and home appliances. The company’s PuriCare line of air purifiers offers features such as 360-degree purification and smart connectivity. In 2023, LG’s Home Appliance & Air Solution division reported revenues of approximately KRW 23.5 trillion (USD 20.8 billion), reflecting strong performance in the air purifier market.

Recent Developments

- In 2024, Bosch announced the acquisition of the residential and light commercial HVAC business from Johnson Controls, including a full takeover of the Johnson Controls-Hitachi Air Conditioning joint venture. The $8 billion transaction will enhance Bosch’s Energy and Building Technology division, pending regulatory approval within 12 months.

- In June 2024, Resideo Technologies finalized the acquisition of Snap One, a leader in smart-living products and software. Snap One will join Resideo’s ADI Global Distribution segment, broadening its offerings for professional integrators with an expanded range of products and digital tools.

- In 2024, Air Liquide expanded its Home Healthcare presence with the acquisition of businesses in Belgium and the Netherlands. This strategic move supports Air Liquide’s goal of serving more patients with chronic conditions and advancing its Home Healthcare priorities globally.

Conclusion

The residential air purifiers market is poised for significant growth, driven by increasing awareness of indoor air quality and its impact on health. Advancements in filtration technologies, such as HEPA filters, and the integration of smart features are enhancing product appeal and functionality. The Asia-Pacific region, experiencing rapid urbanization and rising pollution levels, presents substantial opportunities for market expansion. However, challenges persist, including the need for consumer education on product efficacy and the importance of energy-efficient designs to address environmental concerns. Manufacturers focusing on innovation, affordability, and sustainability are well-positioned to capitalize on the growing demand for cleaner indoor air solutions.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)