Table of Contents

- Introduction

- Editor’s Choice

- Consumer Electronics Market Overview

- Consumer Electronics Production Statistics

- Price of Various Consumer Electronics

- Consumer Electronics Consumption and Sales Statistics

- Top Electronics Exporters – By Country

- Top Electronics Importers by Country

- Consumer Preferences

- Impact of COVID-19 on the Consumer Electronics Sector

Introduction

According to Consumers Electronic Statistics, Consumer electronics encompass a diverse range of everyday electronic devices. Including smartphones, computers, televisions, audio equipment, cameras, gaming consoles, wearables, home appliances, e-readers, and accessories.

These products serve various purposes, such as communication, entertainment, productivity, and utility, catering to the needs and preferences of consumers worldwide.

From compact smartphones to immersive gaming consoles and smart home devices, consumer electronics continue to evolve with advancements in technology, offering enhanced features, connectivity, and convenience.

Editor’s Choice

- The global consumer electronics market revenue is projected to reach USD 1,176.8 billion by 2028.

- In the computing segment, the market size increased from USD 286.9 billion in 2018 to a projected USD 348.5 billion in 2028.

- The global consumer electronics market is dominated by a few major companies, with Apple leading the market with a 21% share.

- China leads the global consumer electronics market with a revenue of USD 218.6 billion.

- The total consumer electronics production volume increased from 7,749.2 million pieces in 2018 to a projected 9,014.2 million pieces in 2028.

- The United States leads the consumption, contributing 20-25% of the market share.

- In 2018, American adults spent an average of 90 minutes online daily, which increased to 2.5 hours per day in 2019. Due to the COVID-19 pandemic, this figure surged to 8 hours per day, significantly boosting the demand for electronic devices.

Consumer Electronics Market Overview

Global Consumer Electronics Market Size

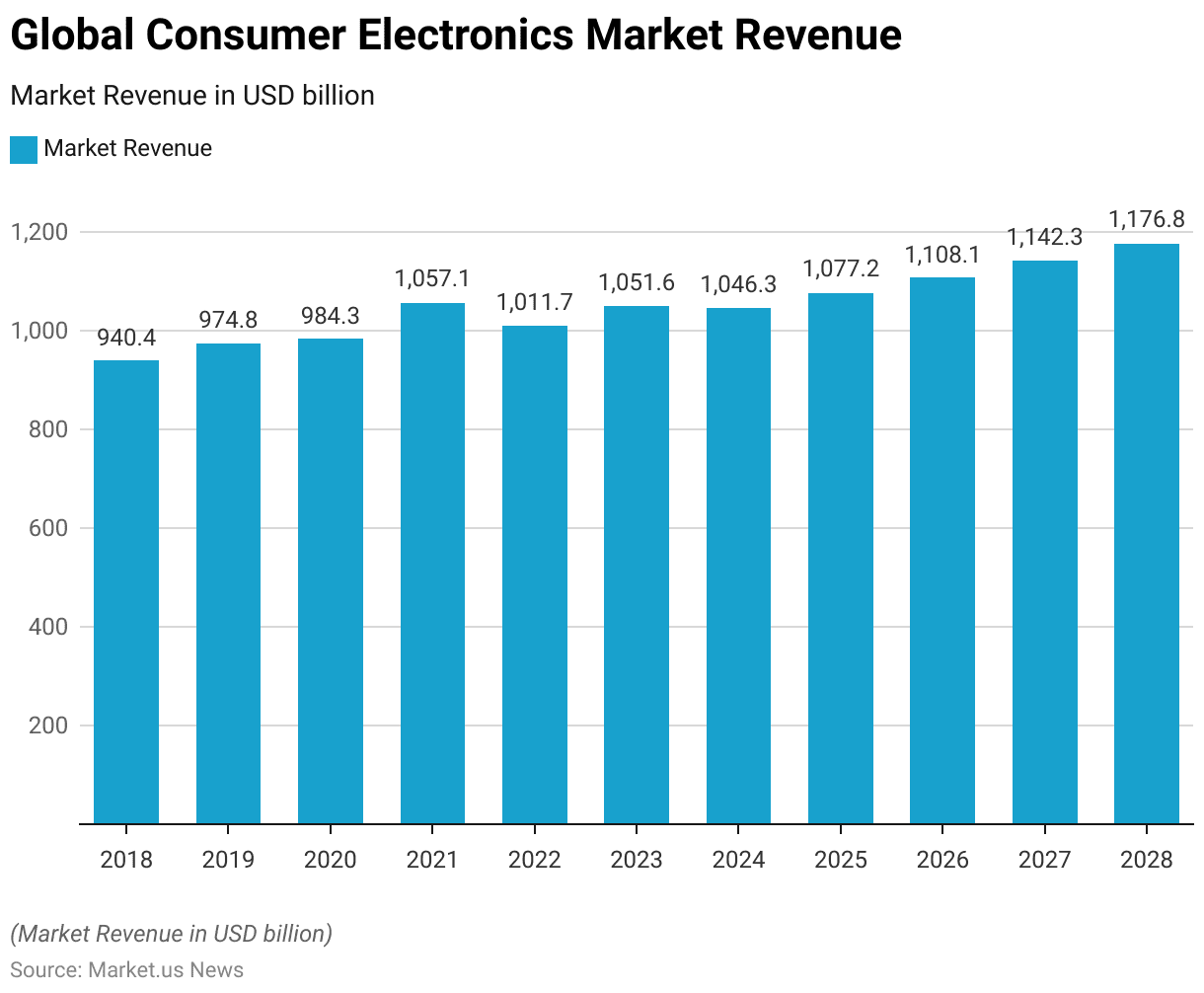

- The global consumer electronics market has experienced significant growth over the past decade at a CAGR of 2.99%, with notable fluctuations in annual revenue.

- In 2018, the market revenue was recorded at USD 940.4 billion, which increased to USD 974.8 billion in 2019 and further to USD 984.3 billion in 2020.

- Projections for the future indicate a steady upward trend, with expected revenues of USD 1,046.3 billion in 2024, USD 1,077.2 billion in 2025, USD 1,108.1 billion in 2026, USD 1,142.3 billion in 2027, and USD 1,176.8 billion in 2028.

Global Consumer Electronics Market Size – By Type

- The global consumer electronics market size, segmented by type, has exhibited notable trends and growth patterns from 2018 to 2028.

- In the computing segment, the market size increased from USD 286.9 billion in 2018 to a projected USD 348.5 billion in 2028.

- The drones segment, although smaller in size, showed growth from USD 2.9 billion in 2018 to USD 4.7 billion in 2028.

- Gaming equipment experienced significant growth, rising from USD 18.1 billion in 2018 to USD 37.7 billion in 2028.

- The telephony segment remained a major contributor, starting at USD 446.1 billion in 2018, with a projected increase to USD 560.1 billion by 2028.

- TV, radio, and multimedia also showed consistent growth, from USD 178.7 billion in 2018 to USD 209.9 billion in 2028.

- Lastly, TV peripheral devices saw an increase from USD 7.7 billion in 2018 to USD 15.9 billion in 2028.

Consumer Electronics Market Revenue Change – By Type

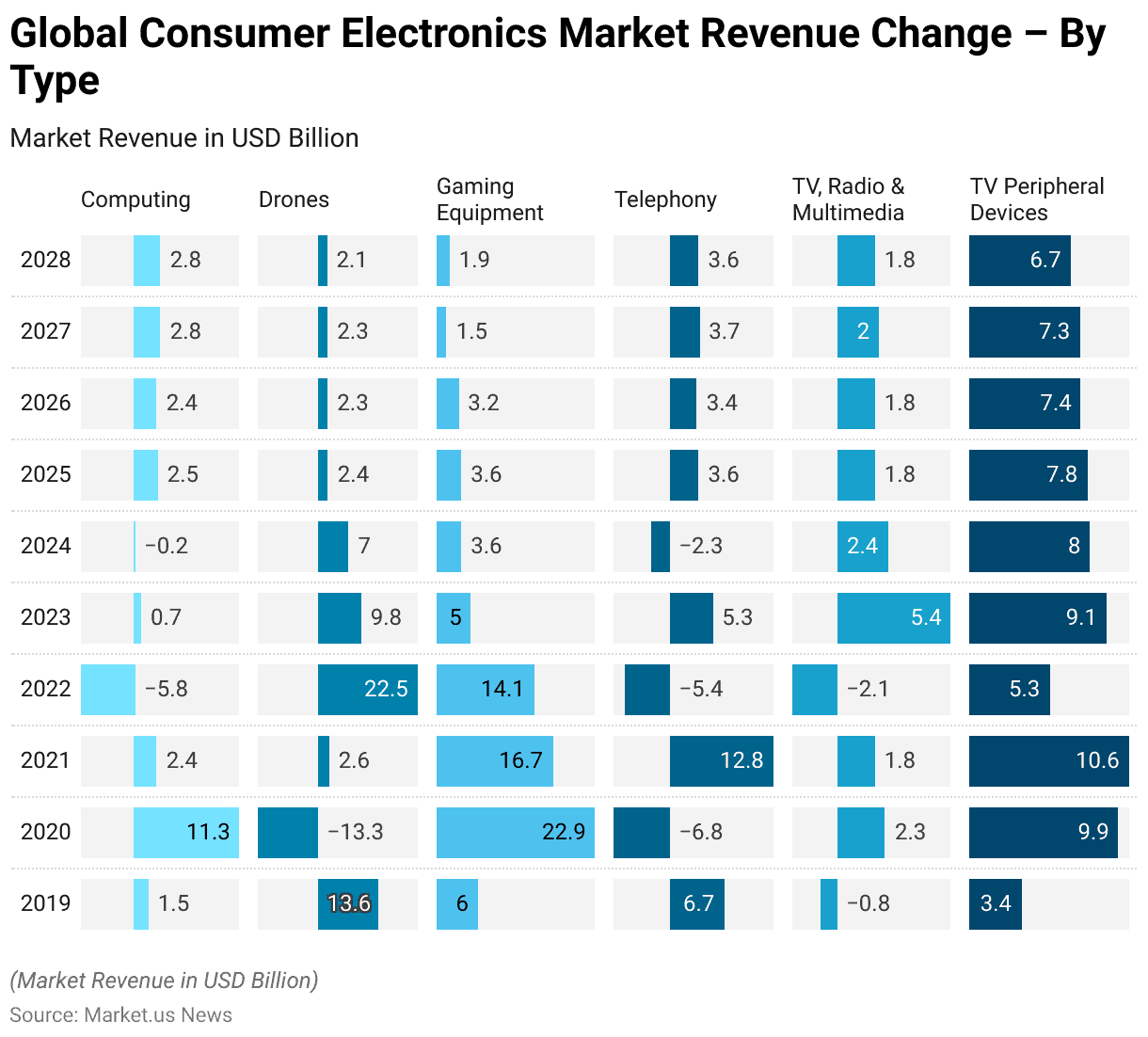

- The global consumer electronics market revenue change, segmented by type, has demonstrated diverse trends from 2019 to 2028.

- In the computing segment, revenue increased by 1.5% in 2019 and saw a significant jump of 11.3% in 2020. However, a decline of 5.8% was observed in 2022, followed by modest growth in subsequent years, with an average increase of around 2.5% annually from 2025 to 2028.

- The drones segment experienced notable fluctuations, with a 13.6% increase in 2019, a sharp decline of 13.3% in 2020, and a substantial recovery with a 22.5% increase in 2022. From 2023 onwards, the growth rate stabilized to a steady 2-9.8% range.

- Gaming equipment showed robust growth, particularly in 2020, with a 22.9% increase, followed by 16.7% in 2021 and consistent positive growth, averaging around 3.6% annually from 2024 to 2028.

- The telephony segment experienced a 6.7% increase in 2019, a decline of 6.8% in 2020, and a notable recovery with a 12.8% increase in 2021. Despite a drop of 5.4% in 2022, the segment maintained a steady growth rate of approximately 3.6% from 2025 to 2028.

Global Consumer Electronics Market Share – By Distribution Channel

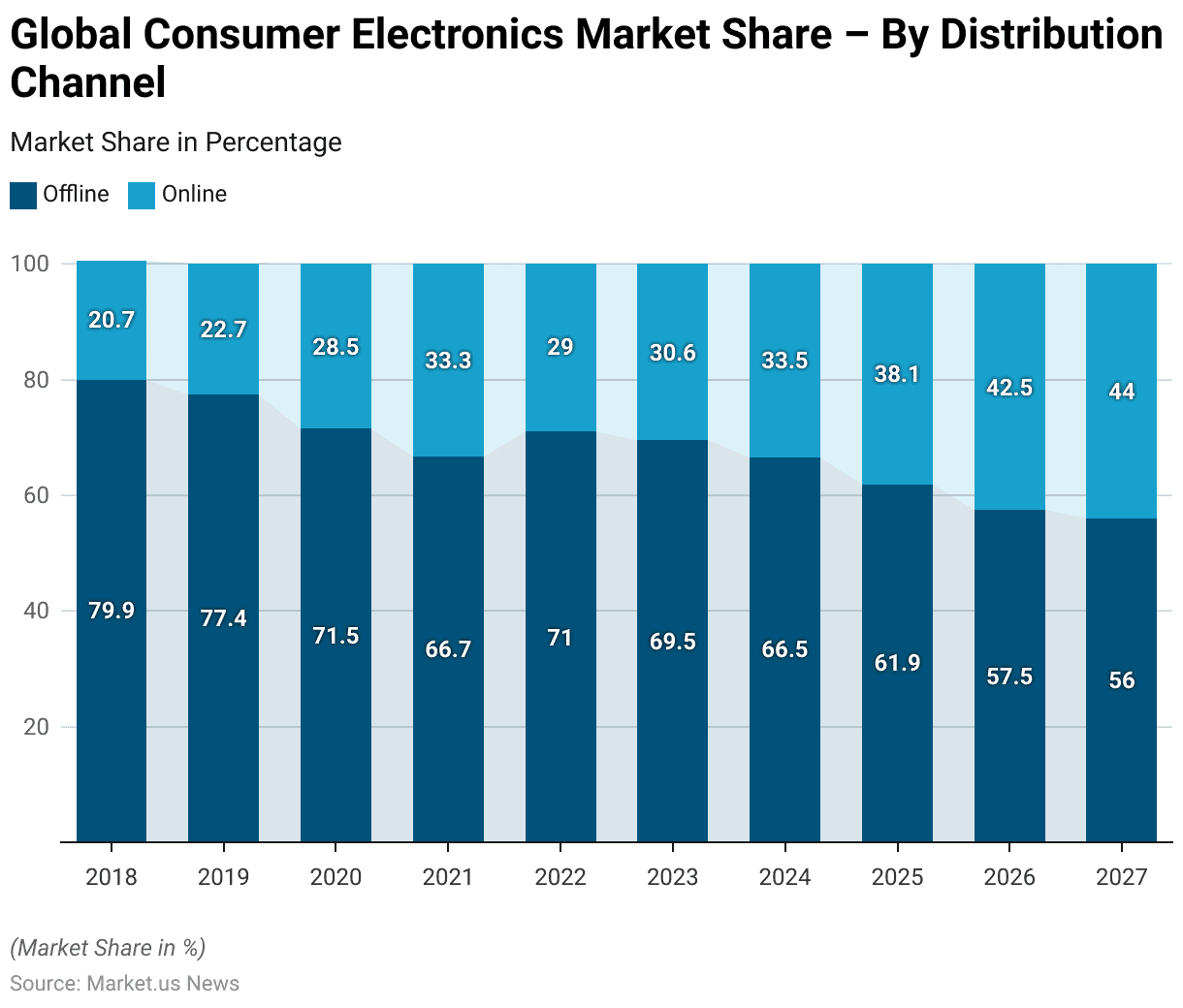

- The global consumer electronics market share, analyzed by distribution channel, has shown a significant shift from offline to online sales between 2018 and 2027.

- In 2018, offline sales dominated the market with a share of 79.9%, while online sales accounted for only 20.7%.

- Projections indicate that by 2024, online sales will account for 33.5%, with offline sales at 66.5%.

- This trend is expected to persist, with online sales anticipated to grow to 38.1% in 2025, 42.5% in 2026, and 44% in 2027, while offline sales decline correspondingly.

Competitive Landscape of the Global Consumer Electronics Market

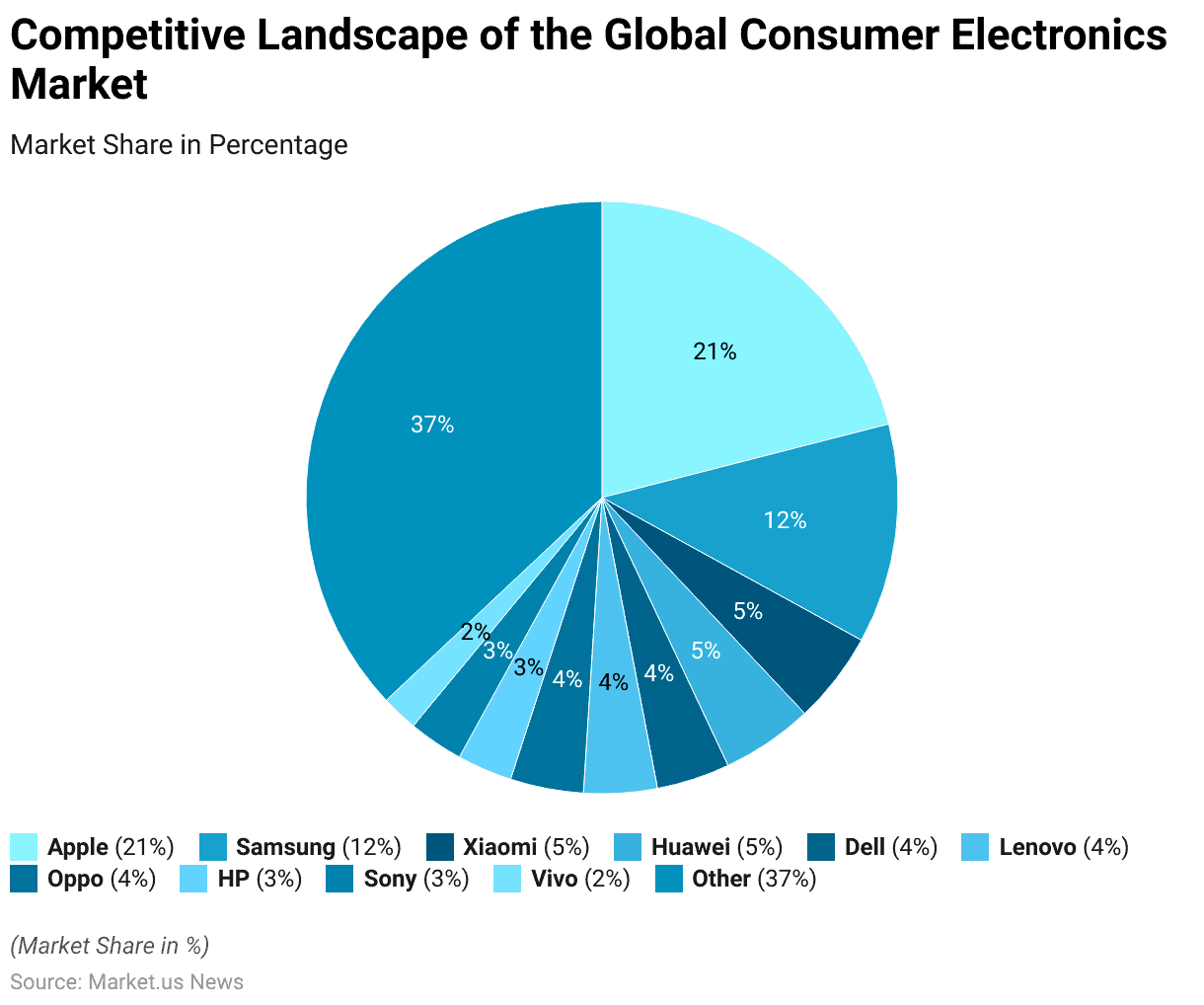

- The global consumer electronics market is dominated by a few major companies, with Apple leading the market with a 21% share.

- Samsung holds the second position with a 12% market share, followed by Xiaomi and Huawei, each with a 5% share.

- Dell, Lenovo, and Oppo each capture 4% of the market.

- HP and Sony both hold a 3% share, while Vivo has a 2% share.

- Collectively, these leading companies account for 63% of the market.

- The remaining 37% is comprised of various other companies, reflecting a diverse and competitive landscape within the consumer electronics industry.

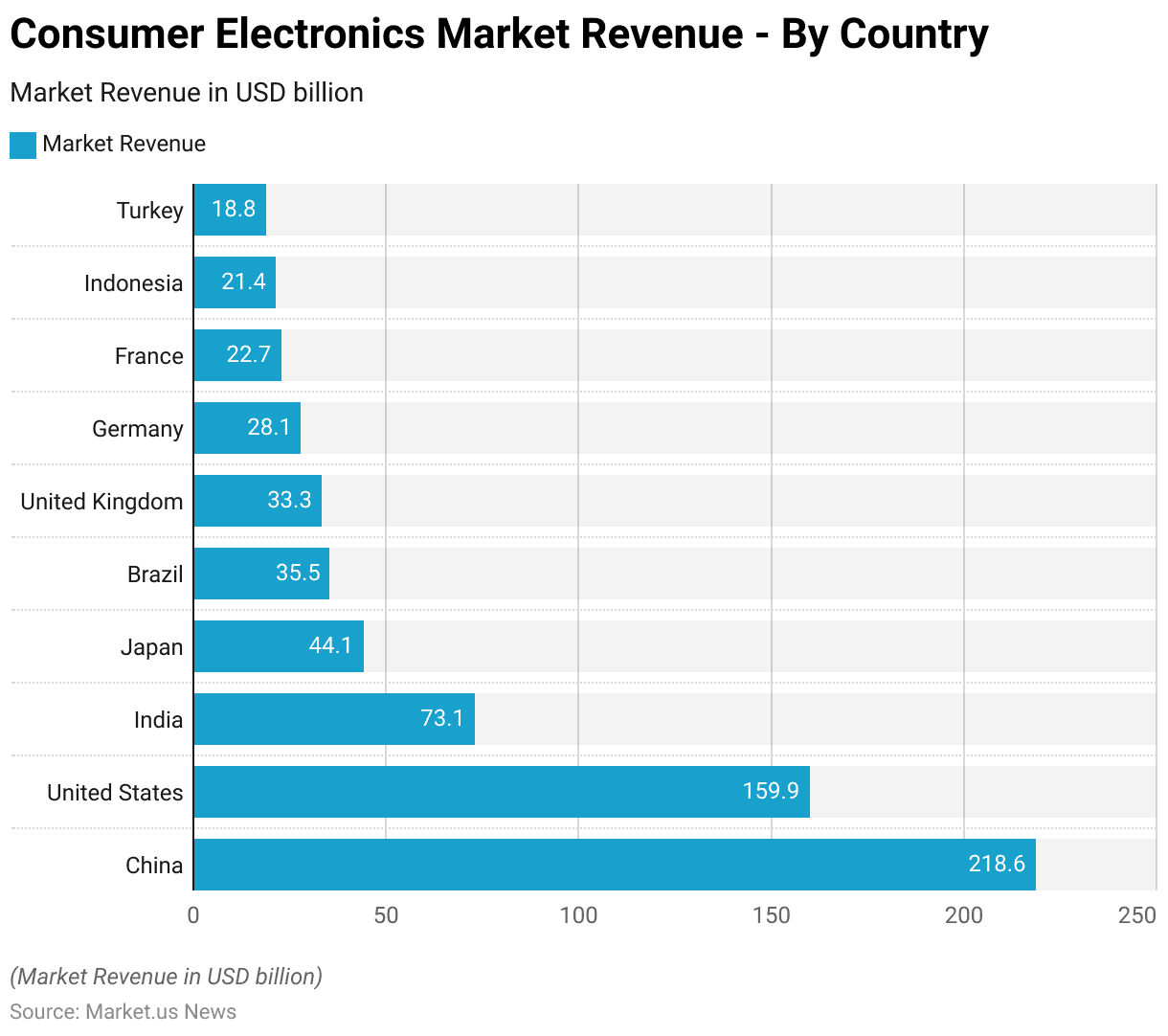

Global Consumer Electronics Market Revenue – By Country

- The global consumer electronics market revenue is significantly concentrated in a few key countries.

- China leads the market with a revenue of USD 218.6 billion, followed by the United States with USD 159.9 billion.

- India ranks third with a market revenue of USD 73.1 billion.

- Japan and Brazil follow with revenues of USD 44.1 billion and USD 35.5 billion, respectively.

- The United Kingdom contributes USD 33.3 billion, while Germany’s market revenue stands at USD 28.1 billion.

- France and Indonesia have market revenues of USD 22.7 billion and USD 21.4 billion, respectively.

- Turkey rounds out the list with a market revenue of USD 18.8 billion.

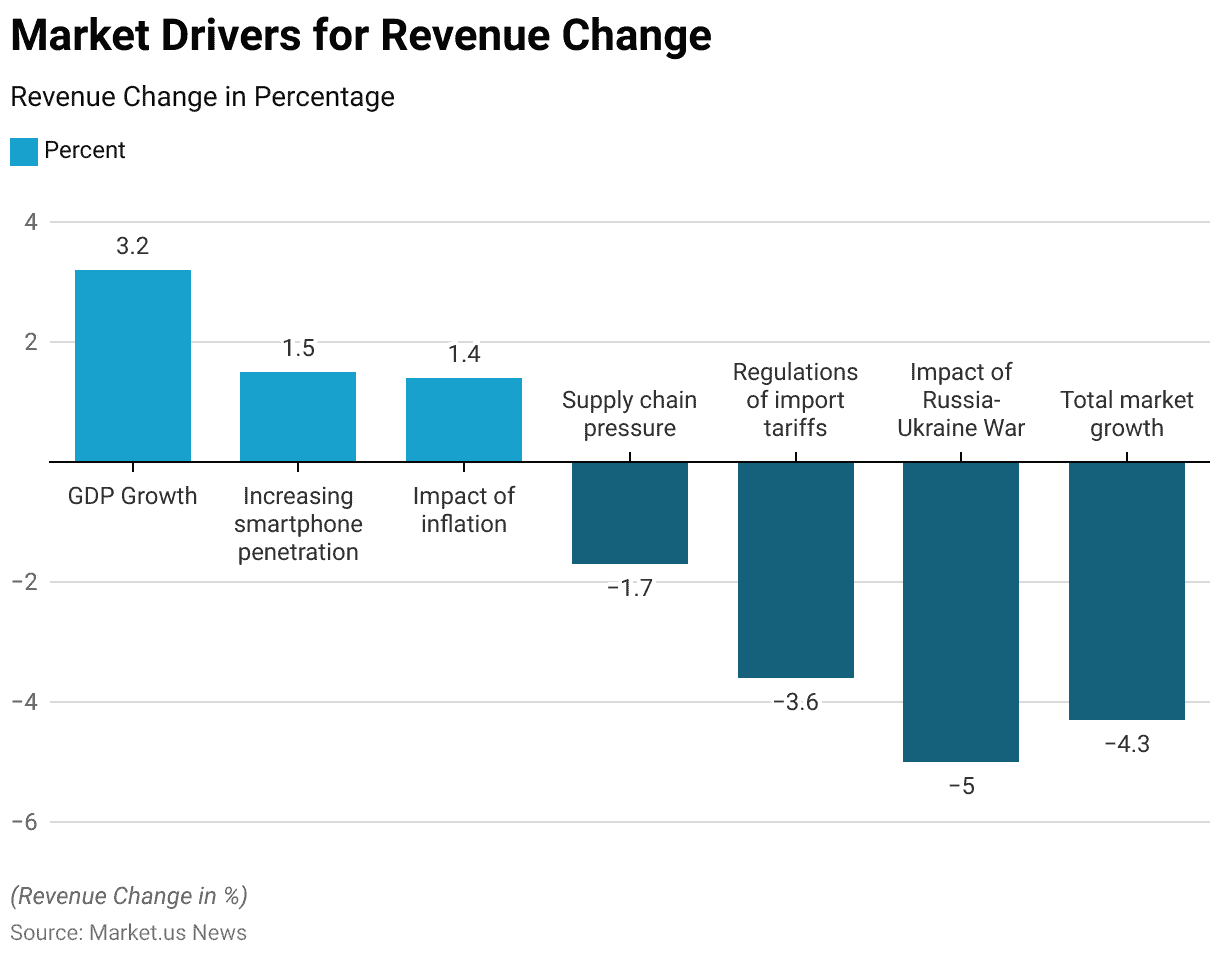

Market Drivers for Revenue Change

- Various drivers and factors influence the global consumer electronics market.

- Positive contributors include GDP growth, which adds 3.2%, and increasing smartphone penetration, contributing 1.5%.

- Additionally, inflation has a minor positive effect of 1.4%.

- However, several negative factors offset these gains. Supply chain pressure results in a 1.7% decline, while regulations of import tariffs contribute to a 3.6% reduction.

- The ongoing Russia-Ukraine war has a significant negative impact, reducing market growth by 5.0%.

- Overall, these factors collectively result in a total market growth decline of 4.3%.

Consumer Electronics Production Statistics

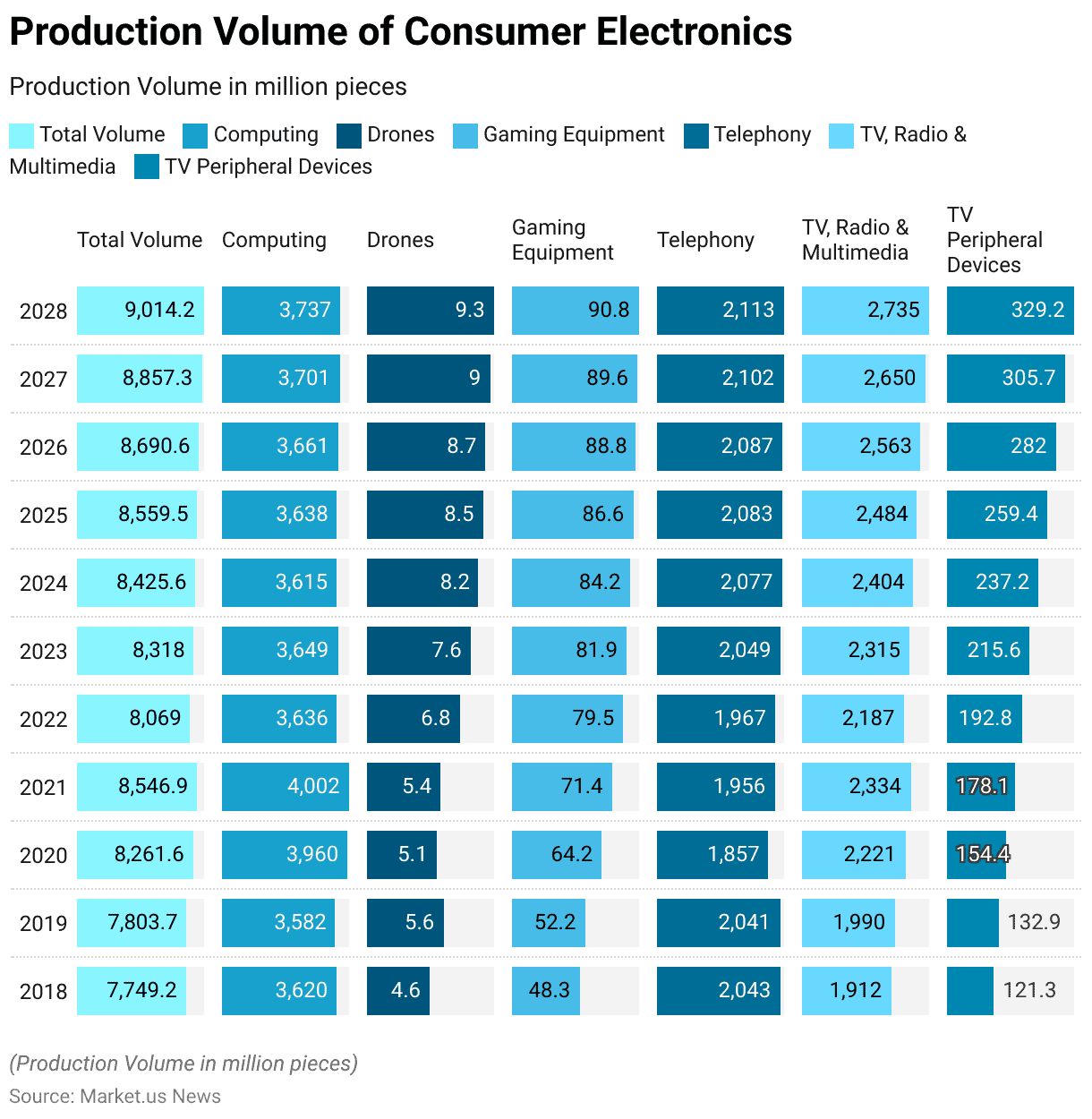

Production Volume

- The production volume of consumer electronics, measured in million pieces, has demonstrated substantial growth across various segments from 2018 to 2028.

- The total production volume increased from 7,749.2 million pieces in 2018 to a projected 9,014.2 million pieces in 2028.

- Within this total, the computing segment grew from 3,620.0 million pieces in 2018 to 3,737.0 million pieces in 2028.

- The drone segment, though smaller in scale, expanded from 4.6 million pieces in 2018 to 9.3 million pieces in 2028.

- Gaming equipment production saw significant growth, rising from 48.3 million pieces in 2018 to 90.8 million pieces in 2028.

- Telephony, a major contributor to the total volume, experienced fluctuations but ultimately increased from 2,043.0 million pieces in 2018 to 2,113.0 million pieces in 2028.

- The TV, radio, and multimedia segment showed a steady increase from 1,912.0 million pieces in 2018 to 2,735.0 million pieces in 2028.

- Lastly, the TV peripheral devices segment exhibited the most dramatic growth, from 121.3 million pieces in 2018 to 329.2 million pieces in 2028.

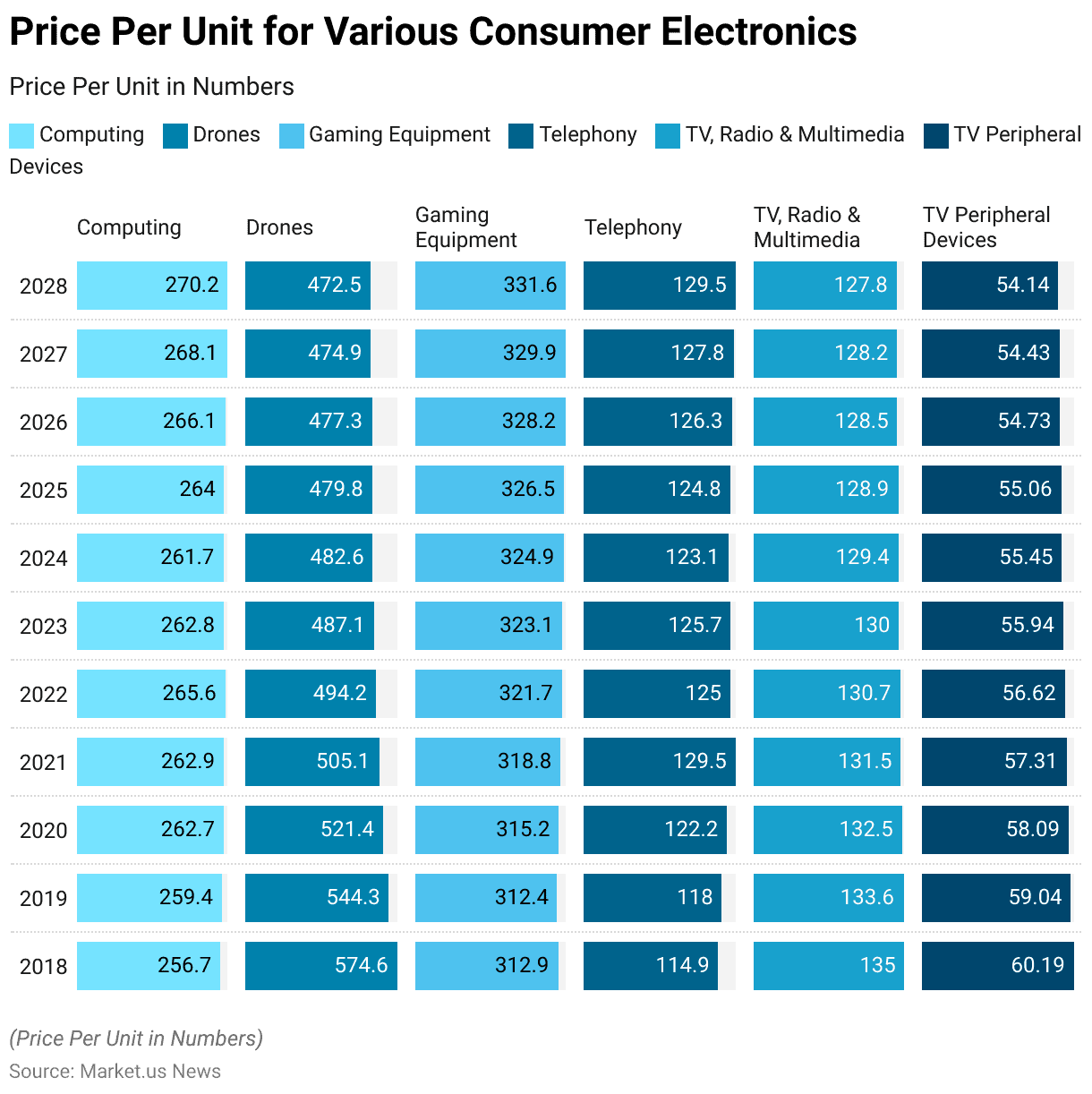

Price of Various Consumer Electronics

- The price per unit for various consumer electronics segments has shown a mix of stability and slight fluctuations from 2018 to 2028.

- In the computing segment, the price per unit started at USD 256.7 in 2018 and is projected to rise to USD 270.2 by 2028.

- The drones segment saw a decrease from USD 574.6 in 2018 to USD 472.5 in 2028, indicating a gradual reduction in unit prices over the years.

- Gaming equipment prices remained relatively stable, starting at USD 312.9 in 2018 and reaching USD 331.6 in 2028.

- The telephony segment experienced a slight increase in unit prices, from USD 114.9 in 2018 to USD 129.5 in 2028.

- Similarly, the TV, radio, and multimedia segment saw a minor decline from USD 135 in 2018 to USD 127.8 in 2028.

- The TV peripheral devices segment exhibited a gradual decrease in unit prices, starting at USD 60.19 in 2018 and dropping to USD 54.14 by 2028.

Consumer Electronics Consumption and Sales Statistics

Top 10 Consumer Electronics Consumption Countries

- The top 10 countries that consume electronics account for a significant portion of the global market share.

- The United States leads the consumption, contributing 20-25% of the market share, followed closely by China with 18-20%.

- Japan holds a substantial share of 12-14%, while Germany accounts for 8-10%.

- South Korea contributes 7-8% to the market, and the United Kingdom follows with 6-8%.

- France has a market share of 5-6%, and India accounts for 4-5%.

- Both Brazil and Russia each hold a market share of 3-4%.

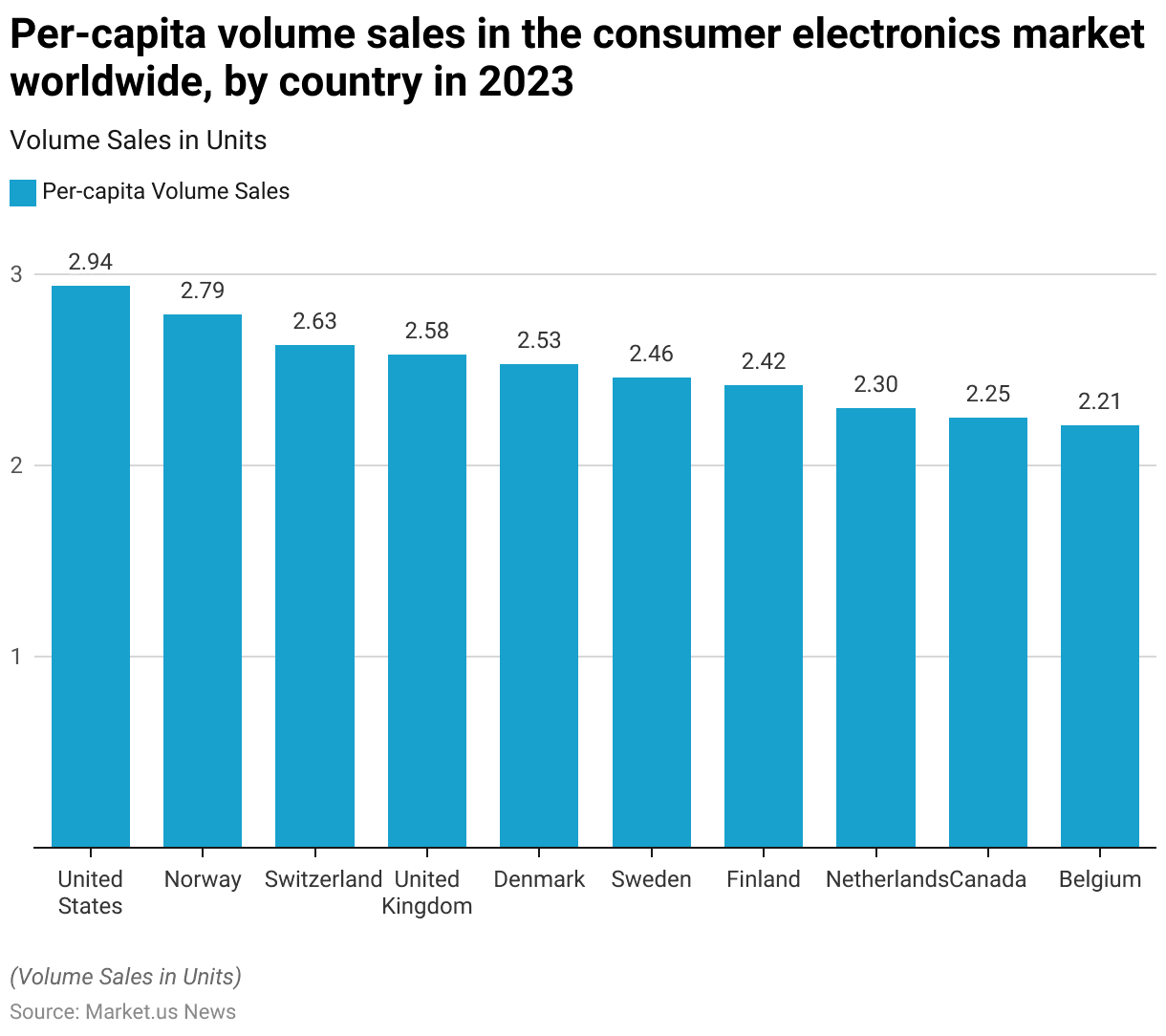

Per-capita Volume Sales in The Consumer Electronics Market Worldwide – By Country

- In 2023, per-capita volume sales in the global consumer electronics market revealed significant consumption patterns across various countries.

- The United States led with 2.94 units per capita, followed by Norway with 2.79 units.

- Switzerland reported 2.63 units per capita, while the United Kingdom had 2.58 units.

- Denmark and Sweden showed high consumption rates of 2.53 and 2.46 units per capita, respectively.

- Finland recorded 2.42 units, and the Netherlands had 2.3 units per capita.

- Canada and Belgium also demonstrated notable per-capita sales, with 2.25 and 2.21 units, respectively.

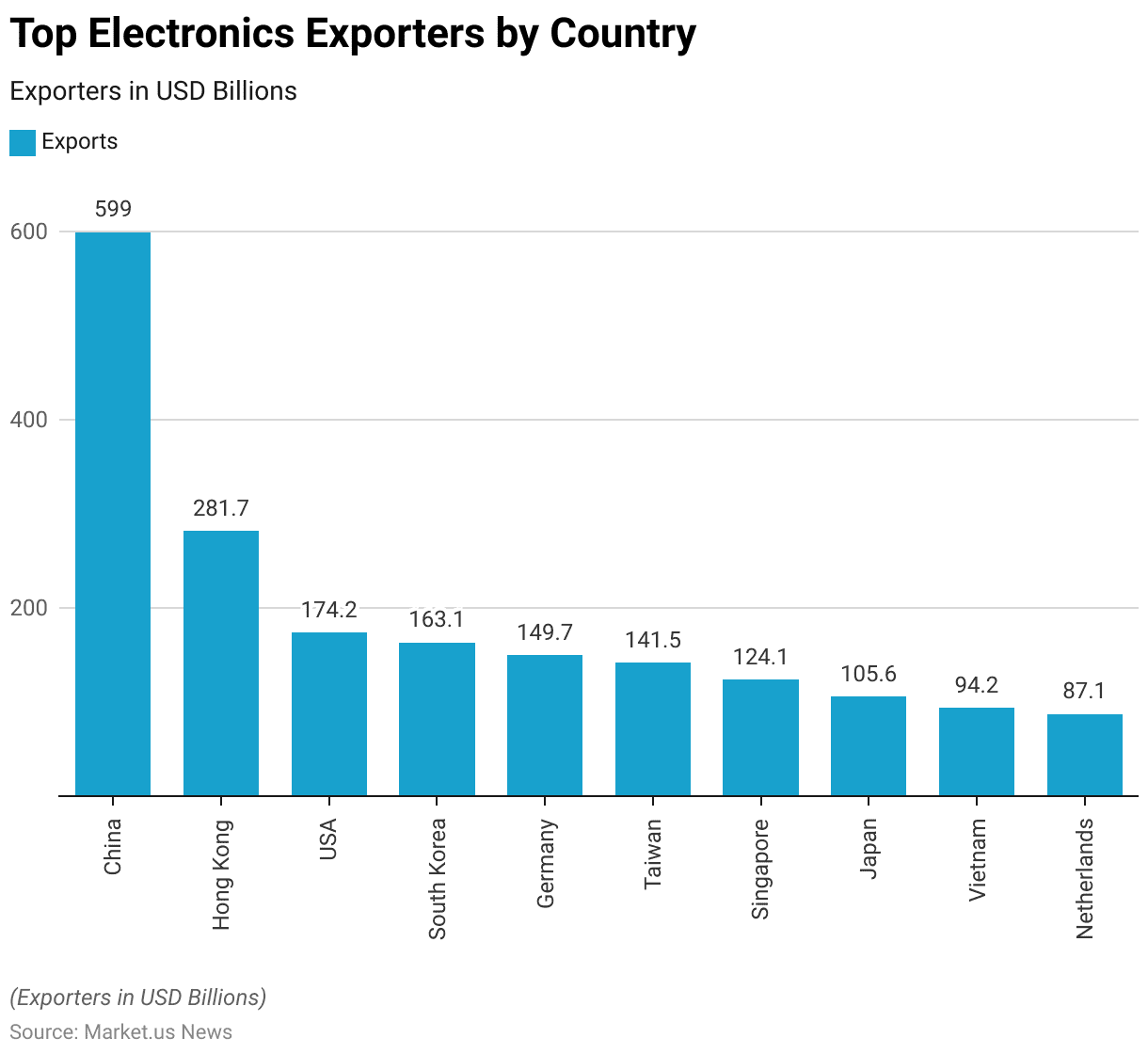

Top Electronics Exporters – By Country

- The top electronics exporters by country in terms of export value highlight the global leaders in the electronics industry.

- China stands at the forefront, with exports valued at USD 599 billion.

- Hong Kong follows with USD 281.7 billion, while the United States ranks third with USD 174.2 billion.

- South Korea and Germany also play significant roles, with exports of USD 163.1 billion and USD 149.7 billion, respectively.

- Taiwan contributes USD 141.5 billion, and Singapore exports USD 124.1 billion worth of electronics.

- Japan’s electronics exports total USD 105.6 billion, while Vietnam and the Netherlands export USD 94.2 billion and USD 87.1 billion, respectively.

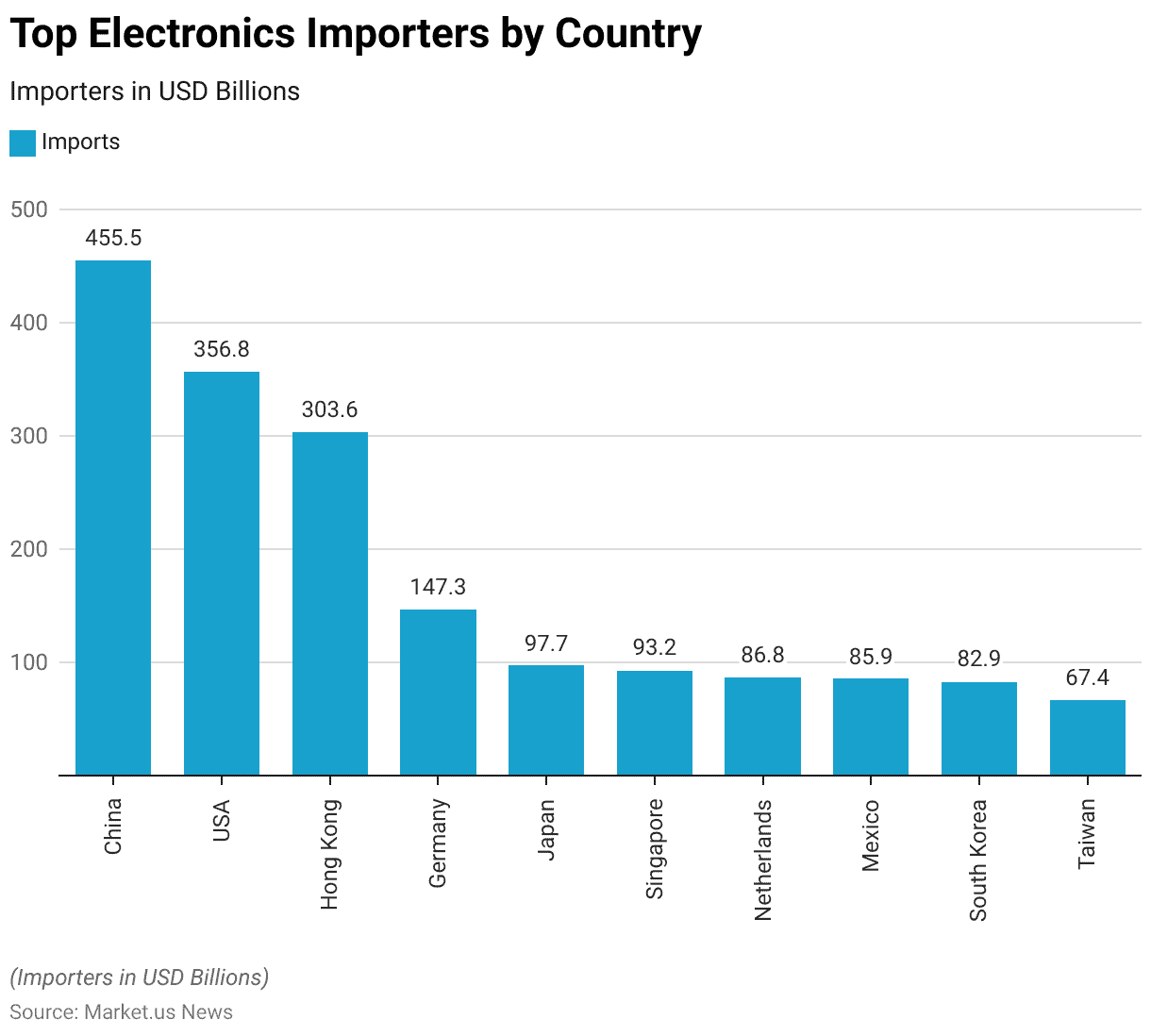

Top Electronics Importers by Country

- The top electronics importers by country, measured in USD billions, reveal the major global markets for electronics products.

- China is the largest importer, with imports valued at USD 455.5 billion.

- The United States follows closely with USD 356.8 billion in imports.

- Hong Kong ranks third, importing electronics worth USD 303.6 billion.

- Germany and Japan are also significant importers, with values of USD 147.3 billion and USD 97.7 billion, respectively.

- Singapore imports electronics worth USD 93.2 billion, while the Netherlands and Mexico account for USD 86.8 billion and USD 85.9 billion, respectively.

- South Korea imports USD 82.9 billion worth of electronics, and Taiwan rounds out the top ten with USD 67.4 billion.

Consumer Preferences

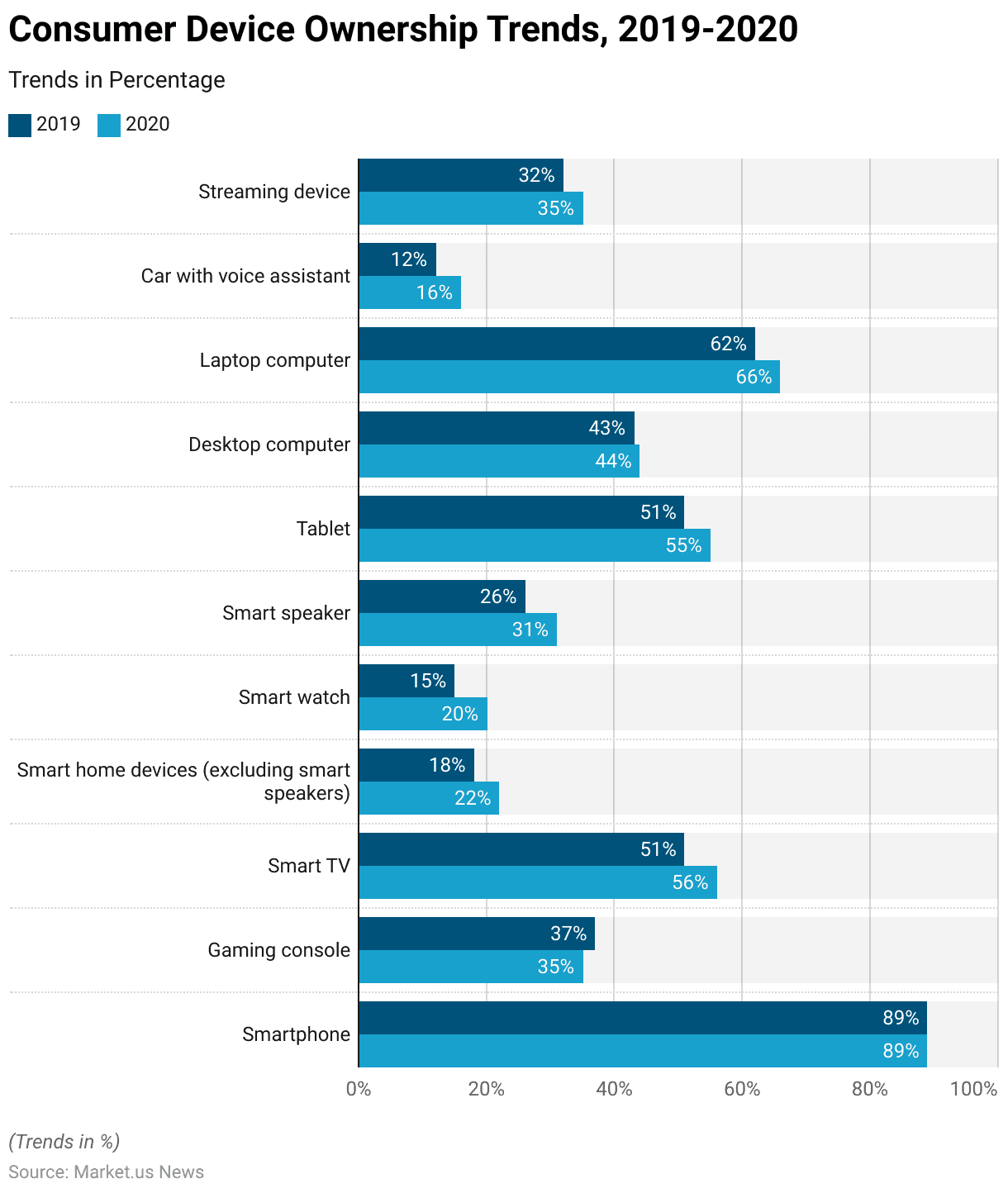

Consumer Device Ownership Trends

- A survey on device ownership among consumers in 2019 and 2020 revealed notable trends in the adoption of various electronic devices.

- The ownership of smartphones remained steady at 89% for both years.

- Gaming consoles saw a slight decline from 37% in 2019 to 35% in 2020.

- Smart TV ownership increased from 51% to 56%, and smart home devices (excluding smart speakers) rose from 18% to 22%.

- The adoption of smartwatches grew from 15% to 20%, and smart speakers increased from 26% to 31%.

- Tablet ownership rose from 51% to 55%, and desktop computers saw a slight increase from 43% to 44%.

- Laptop ownership also climbed from 62% in 2019 to 66% in 2020.

- Additionally, cars with voice assistants increased from 12% to 16%, and streaming devices grew from 32% to 35%.

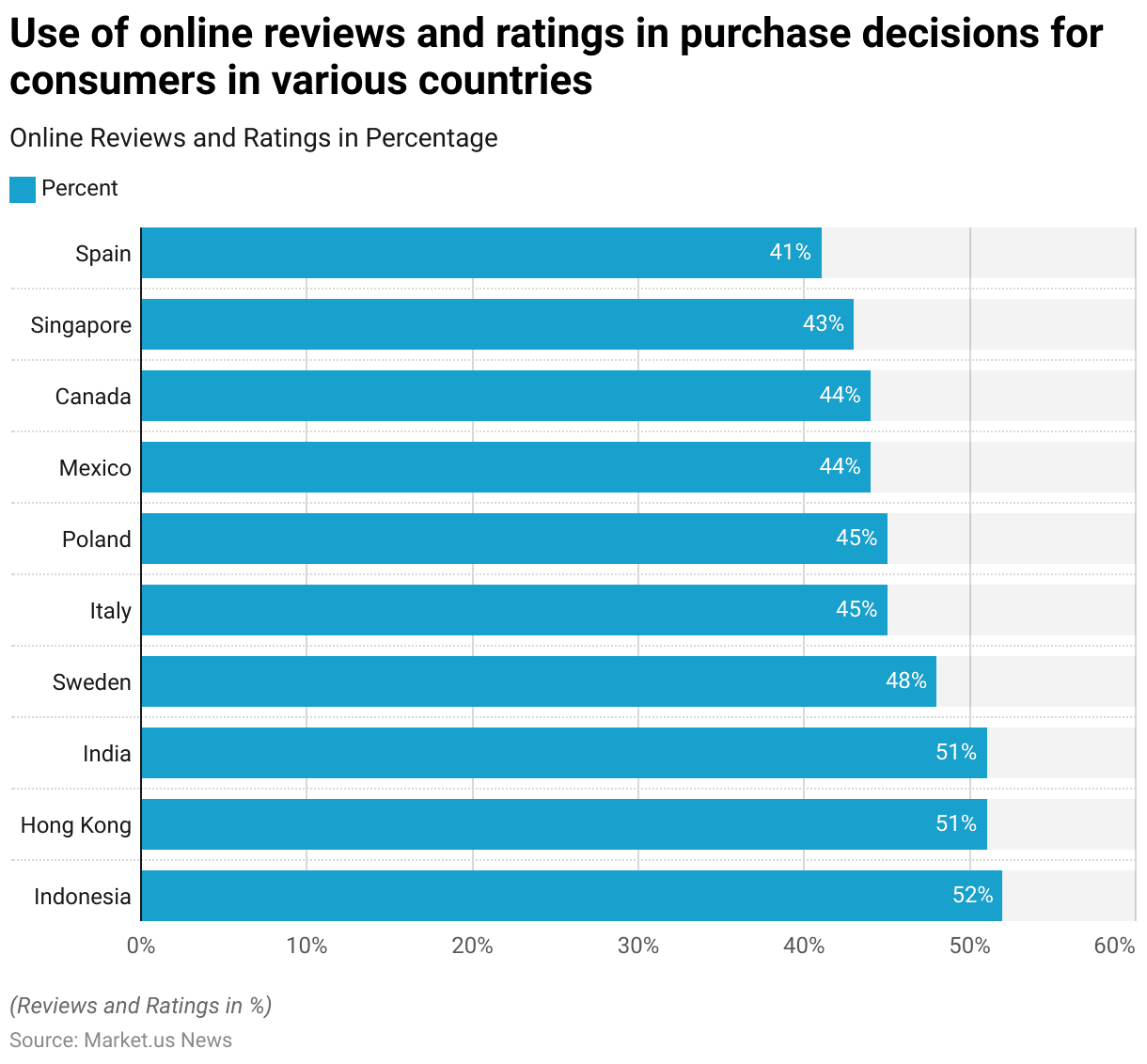

Use of Online Reviews and Ratings

- In Indonesia, 52% of respondents regularly use online reviews and ratings provided by other consumers to aid their purchase decisions.

- Hong Kong and India follow closely, with 51% of respondents relying on such feedback.

- In Sweden, 48% of consumers turn to online reviews, while in Italy and Poland, the percentage stands at 45%.

- Mexico and Canada each have 44% of respondents utilizing online reviews, and in Singapore, 43% of consumers do the same.

- Spain rounds out the list, with 41% of respondents considering online reviews when making their purchasing decisions.

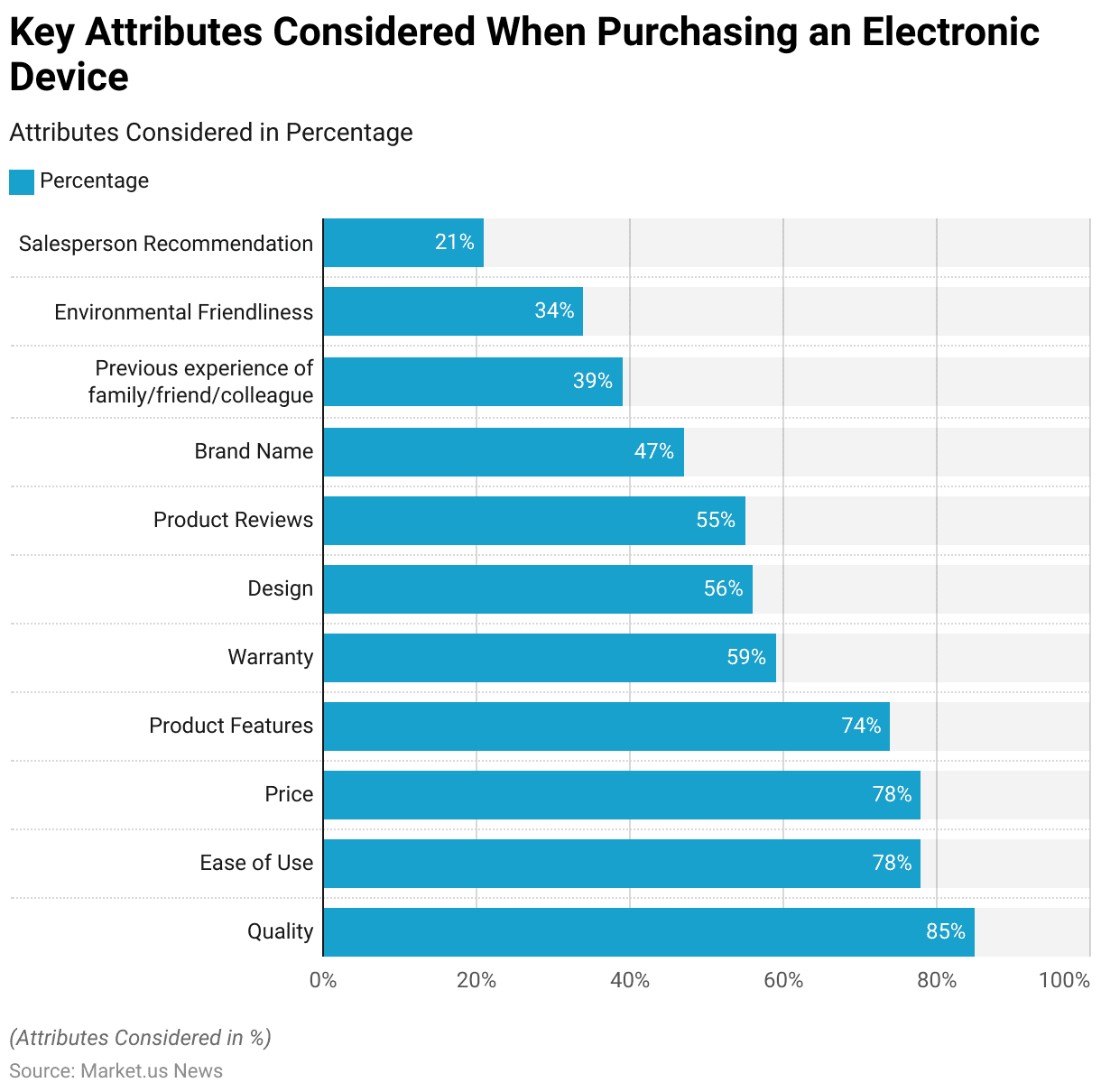

Key Attributes Considered When Purchasing an Electronic Device

- When purchasing an electronic device, consumers consider several key attributes.

- Quality is the most important factor, with 85% of respondents prioritizing it in their decision-making process.

- Ease of use and price are equally important to 78% of consumers.

- Product features are a critical consideration for 74% of respondents, while 59% look for a good warranty.

- Design is important to 56% of consumers, and 55% rely on product reviews.

- Brand name influences the decisions of 47% of respondents, and 39% consider the previous experience of family, friends, or colleagues.

- Environmental friendliness is a factor for 34% of consumers, and 21% take salesperson recommendations into account.

Impact of COVID-19 on the Consumer Electronics Sector

- During the first ten weeks of the pandemic (mid-March to the end of May), the consumer electronics sector experienced significant growth compared to early January. However, it was not as robust as the overall e-commerce growth.

- The 10-week average growth rate for consumer electronics was 33%, while overall e-commerce saw a 53% increase.

- However, due to the heightened focus on electronics during holiday sales, consumer electronics retailers surpassed the overall growth in the early part of the season, with a five-week average growth rate of 176% compared to 135% for overall e-commerce.

- In 2018, American adults spent an average of 90 minutes online daily, which increased to 2.5 hours per day in 2019. Due to the COVID-19 pandemic, this figure surged to 8 hours per day, significantly boosting the demand for electronic devices.

- Best Buy, a US-based electronics retailer, saw its US sales triple in the third quarter of 2020 as a result of the pandemic.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)