Table of Contents

Introduction

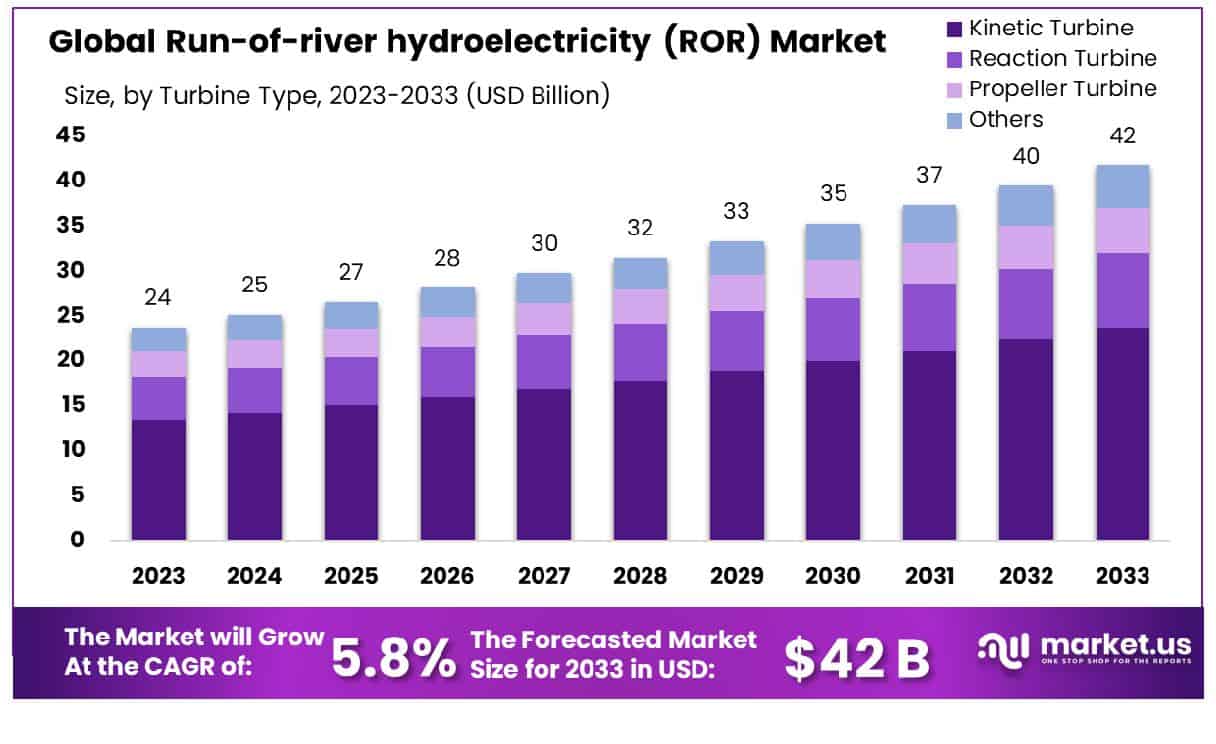

The Global Run-of-river (ROR) hydroelectricity market, valued at USD 24 billion in 2023, is anticipated to achieve a robust growth trajectory, reaching approximately USD 42 billion by 2033. This expansion reflects a compound annual growth rate (CAGR) of 5.8% over the forecast period from 2024 to 2033. Growth in the ROR market is primarily driven by increasing global demand for sustainable and renewable energy sources, as governments and industries shift away from fossil fuels to combat climate change and reduce greenhouse gas emissions.

However, the market faces challenges, including environmental concerns related to water use and biodiversity, as well as the high initial capital costs associated with setting up new installations. Despite these obstacles, recent advancements in turbine and generator technologies have enhanced the efficiency and feasibility of ROR projects, contributing to the market’s overall positive outlook. These developments suggest a dynamic future for the ROR hydroelectricity sector, underpinned by technological innovations and a global push towards renewable energy.

In 2023, ABB Ltd emphasized its commitment to sustainability and efficiency in the energy sector. The company’s efforts included reducing its greenhouse gas emissions significantly, achieving a 76% reduction in scope 1 and scope 2 emissions since 2019. Furthermore, ABB’s products sold in 2023 are expected to avoid 74 megatons of emissions over their lifetime, demonstrating a strong alignment with global sustainability goals.

Alstom has been active in pioneering green mobility solutions beyond traditional hydroelectric projects. In 2023, Alstom’s Coradia iLint, the world’s first hydrogen-powered passenger train, began operations in Quebec, Canada. This project not only demonstrates Alstom’s leadership in sustainable transport solutions but also represents a significant step towards green hydrogen utilization in public transport.

Andritz Hydro is renowned for its comprehensive range of services in hydraulic power generation. Specializing in both traditional and innovative hydroelectric technologies, Andritz provides solutions that include the design, installation, and maintenance of hydropower equipment. The company focuses on maximizing the efficiency and sustainability of water-to-wire solutions, which are essential for RoR hydroelectric plants.

As a key player in the RoR sector, China Hydroelectric Corporation operates numerous small to medium-sized hydroelectric projects. Their focus is on utilizing the natural river flow to generate electricity without the extensive environmental impact associated with traditional hydroelectric dams. The company’s strategic management of these assets underlines its commitment to enhancing renewable energy generation while adhering to environmental standards.

China Three Gorges Corporation is a global leader in clean energy production, with significant investments in RoR hydroelectric projects. The corporation not only operates one of the world’s largest hydroelectric dams but also invests in smaller, less intrusive RoR projects that align with global sustainability goals. Their operations demonstrate a balance between large-scale infrastructure projects and environmentally considerate practices.

Key Takeaways

- Market Growth: The Global Run-of-river hydroelectricity (ROR) Market size is expected to be worth around USD 42 Billion by 2033, From USD 24 Billion by 2023, growing at a CAGR of 5.8% during the forecast period from 2024 to 2033.

- Regional Dominance: The European Run-of-river hydroelectricity market holds a 39.1% share, valued at USD 9.3 billion.

- By Turbine Type: Kinetic Turbine type dominates with a 56.35% market share.

- By Capacity: Small-capacity turbines hold a 46% share in the market.

- By End-use: Industrial end-use leads significantly, capturing 67.1% market.

Run-of-River Hydroelectricity and Global Impact

- At a flow rate of 500 m³/s, this means that around 500 tonnes of water per second flow through the seven new Kaplan turbines, which together have a capacity of 43.4 MW and produce an average of 310 GWh of electricity per year. This is enough to supply almost 70,000 households with an average electricity consumption of 4500 kWh.

- As a general rule, the effective annual production of all hydroelectric power plants fluctuates plus/minus 20% depending on precipitation, runoff, and (storage) management.

- A total of 4132 MW of capacity is available in run-of-river power plants in Switzerland to produce around 17,800 GWh of electricity annually.

- According to the US Energy and Information Administration, 7.3% of utility-scale electricity in the United States is produced from hydropower.

- Globally, hydropower accounts for 60% of all renewable sources and 16% of total electricity generation, significantly high in countries like Albania, Congo, Ethiopia, Nepal, Norway, and Paraguay.

- In ISONE, renewables (predominantly wind and solar resources) account for 9%, while hydropower accounts for an additional 7% of the electric energy generation.

Technical Potential and Efficiency

- The 75% flow dependability was used to assess and evaluate the available potentials in intermediate flow conditions. The analysis under the 30% flow dependability assumes that the design discharge is available only during the first two or three months of the rainy season.

- The study revealed that considering constraints, the annual energy that can be produced from technical potential sites ranges from 7.06 PWh/yr to 49.05 PWh/yr, for 95% to 30% flow dependability, respectively.

- Asia is the highest contributor in the world, having more exploitable hydropower potential than anywhere else, with an average contribution of 46.53%.

- About 38.47% of exploitable global potential is available in the North and South American continents.

- Africa accounts for an average of 11.4% contribution, of which a significant amount is still undeveloped.

- Worldwide, about 20% of all electricity is generated by hydropower.

Economic Impact and Sustainability

- In Wisconsin, hydropower accounts for 4.1% of the electric generating capacity and 4.4% of the total electricity generated.

- Hydropower is clean. It prevents the burning of 22 billion gallons of oil or 120 million tons of coal each year.

- Hydropower is the most efficient way to generate electricity, with modern hydro turbines converting as much as 90% of the available energy into electricity.

- In the U.S., hydropower is produced for an average of 0.85 cents per kilowatt-hour (kwh), significantly cheaper than other energy sources.

- Only 2,400 of the nation’s 80,000 existing dams are used to generate power, indicating significant untapped potential.

- Hydropower reservoirs contribute to local economies, with one study in Wisconsin showing recreational value exceeding $6.5 million annually.

Emerging Trends

- Technological Advancements: New technologies are making RoR hydroelectric systems more efficient and environmentally friendly. Innovations such as advanced turbine designs and modular systems are prominent. These advancements allow for better adaptation to variable water flows and reduce ecological disruptions, especially in fish migration paths.

- Decentralized Energy Systems: There’s a growing trend towards small-scale, decentralized RoR systems, particularly useful in remote and rural areas. These systems do not require large infrastructure like dams and are thus quicker to deploy and less disruptive to local ecosystems. They provide a viable solution for communities looking to harness sustainable energy sources independently of national grids.

- Integration with Other Renewable Technologies: RoR projects are increasingly being integrated with other renewable energy sources, such as solar and wind. For example, hybrid systems that combine solar panels with RoR installations leverage the complementary nature of these energy sources, improving efficiency and reliability.

- Increased Focus on Sustainability: Environmental impact mitigation is a key focus area, with projects increasingly incorporating designs that minimize impacts on water flow and aquatic life. There is a stronger emphasis on developing RoR projects that are not only energy-efficient but also align with broader environmental conservation goals.

- Smart Grid and IoT Integration: The integration of smart technologies and the Internet of Things (IoT) in RoR hydroelectric systems is on the rise. These technologies provide real-time data that can be used to optimize power generation, enhance operational efficiency, and predict maintenance needs, thereby reducing downtime and extending the lifespan of equipment.

- Regulatory and Policy Support: Governments worldwide are recognizing the benefits of RoR hydroelectricity and are supporting its development through favorable policies and incentives. This regulatory support is crucial in facilitating investments and the adoption of innovative technologies in the hydroelectric sector.

Use Cases

- Remote Area Electrification: RoR systems are particularly effective in providing electricity to remote and rural communities that lack access to national power grids. For instance, small-scale RoR projects with capacities ranging from just a few kilowatts up to several megawatts can empower local communities, reduce energy poverty, and enhance the quality of life. An example includes projects in Nepal, where small RoR installations contribute significantly to the country’s aim to achieve universal electricity access by 2030.

- Environmental Impact Studies: The minimal environmental footprint of RoR projects makes them ideal for locations sensitive to ecological disturbances. In regions where environmental conservation is paramount, such as near protected areas or in ecologically vulnerable landscapes, RoR projects can generate power without the extensive habitat disruption that larger dams cause. For example, the implementation of fish-friendly turbine designs helps maintain biodiversity in river ecosystems.

- Supplementing Existing Grids: In developed regions with established power infrastructure, RoR can complement existing renewable energy sources by providing additional power during periods of low wind or solar generation. This is due to their ability to generate electricity continuously as long as there is river flow, thus providing a stable and reliable power supply. For instance, in the German part of the Rhine, several RoR stations add to the grid’s stability by contributing to the renewable energy mix, which primarily includes wind and solar power.

- Tourism and Recreation: Some RoR projects are integrated into recreational areas, offering additional amenities such as hiking trails, fishing, and boating without impacting the scenic value or accessibility of a river. This dual use maximizes the value of the installation site and promotes local tourism, an example being the Rhône River in Switzerland where RoR facilities coexist with areas designated for recreational activities.

- Research and Development: Academic institutions and research centers use RoR setups as practical sites for studying hydroelectric technology, environmental impacts, and fish migration solutions. These facilities often serve as test beds for new technologies before they are rolled out on a larger scale. Notably, various universities across Canada and the U.S. are engaged in ongoing research projects aimed at improving the efficiency and environmental compatibility of RoR systems.

- Industrial Applications: RoR hydroelectricity can provide dedicated power solutions for industries located near rivers, reducing their reliance on fossil fuels and lowering operational costs. Industries such as manufacturing, mining, and data centers, which require constant power supply, can benefit significantly from the stable energy output of RoR systems.

Major Challenges

- Regulatory and Permitting Issues: The complexity and variability of regulatory frameworks across different regions can be a significant barrier. Obtaining the necessary permits for water use and ensuring compliance with environmental standards can be a lengthy and uncertain process. This often delays project timelines and increases costs, affecting the overall feasibility of RoR projects.

- Economic Constraints: The initial capital outlay for RoR hydroelectric systems can be high, particularly due to the civil engineering work required to integrate them into natural river systems without causing damage. The financial return on these investments can also be uncertain, given the variability in power generation linked to changing hydrological conditions. Moreover, smaller RoR projects often struggle to achieve economies of scale, resulting in higher per megawatt costs compared to larger hydroelectric facilities.

- Social and Community Impact: RoR projects can face opposition from local communities, especially if they impact traditional uses of water resources, such as fishing, agriculture, or recreational activities. Ensuring community buy-in through transparent communication and demonstrating tangible benefits is crucial but can be challenging.

- Maintenance and Durability Challenges: The operational longevity of RoR plants can be compromised by issues like sediment buildup, wear and tear on equipment, and the need for frequent maintenance. For instance, sediment management is a critical concern since sediment accumulation can reduce the efficiency of turbines and increase operational costs.

- Grid Integration and Stability Issues: Integrating RoR power into national grids can be challenging due to its variable nature. This variability can cause grid stability issues unless supplemented with storage solutions or other forms of backup power, which can further escalate costs and technical complexities.

Market Growth Opportunities

- Technological Innovations: Investing in technologies that enhance efficiency and reduce the ecological footprint of ROR projects presents a significant opportunity. Innovations in turbine and generator design can lead to higher energy outputs and lower operational costs.

- Emerging Markets: Developing countries with abundant river resources represent untapped potential for ROR deployments. These regions often have rising energy needs and governmental support for renewable energy developments, which can facilitate market entry and expansion.

- Regulatory Incentives: Many governments are offering incentives for renewable energy projects, including tax rebates, grants, and higher purchase tariffs for green energy. These incentives can improve the profitability of ROR projects and attract more investments.

- Hybrid Systems Integration: Combining ROR systems with other renewable energy sources, such as solar or wind, can lead to increased reliability and power output. This integration can cater to a broader range of energy demands and market needs.

- Community-based Projects: There is a growing trend towards small-scale, community-owned ROR projects. These initiatives often receive strong local support and can benefit from specific funding schemes aimed at boosting rural development and sustainability.

Key Players Analysis

ABB Ltd has effectively incorporated its technology into the run-of-river hydroelectricity sector, providing high-efficiency permanent magnet generators that are particularly suited for this application due to their compact size and high power density. These generators optimize energy yield in hydroelectric projects like the Carrapatelo dam in Portugal, enhancing both performance and maintainability.

Alstom Hydro, known for its significant contributions to the run-of-river hydroelectricity sector, specializes in supplying integrated solutions and equipment that enhance the efficiency and sustainability of these projects. The company’s extensive experience and technological expertise enable the development of reliable and environmentally friendly hydroelectric facilities.

Andritz Hydro plays a vital role in the run-of-river hydroelectricity sector, supplying bespoke, high-efficiency Kaplan turbines and offering comprehensive solutions for the installation and modernization of hydroelectric projects. The company is recognized for its technological expertise in enhancing the environmental sustainability of power plants, demonstrated through projects like the rehabilitation of the Ryburg-Schwörstadt hydropower plant in Switzerland.

China Hydroelectric Corporation plays a pivotal role in China’s run-of-river hydroelectric sector, capitalizing on the country’s vast natural resources to generate clean, renewable energy. This approach aligns with China’s broader environmental and energy conservation strategies, crucial for the sustainable development of the nation’s vast hydroelectric capabilities.

China Three Gorges Corporation (CTG) has significantly contributed to the run-of-river hydroelectricity sector, particularly through its involvement in the Yangtze River’s extensive hydroelectric projects. As a leader in China’s clean energy initiatives, CTG operates six major hydropower stations along the Yangtze River, forming the world’s largest clean energy corridor. This corridor significantly reduces coal consumption and carbon emissions while enhancing the country’s hydroelectric capacity and environmental sustainability.

CPFL Energia S.A., a major player in Brazil’s energy sector, has a significant presence in the run-of-river hydroelectricity market. The company’s operations span generating, transmitting, and distributing electricity through a diverse mix of renewable energy sources, including hydroelectric power. CPFL Energia’s commitment to sustainability is evident in its 2030 ESG Plan, which emphasizes renewable energy generation and sustainable operations, aiming to enhance the societal and environmental impact of its activities.

GE Energy has a robust presence in the run-of-river hydroelectricity sector, with extensive experience across a spectrum of hydropower plants including run-of-river systems. Their portfolio emphasizes maximizing plant performance and reliability through advanced technological solutions and comprehensive service offerings, catering to both medium and large-scale hydro projects. This holistic approach ensures optimal coordination and efficiency from the planning phase through to operation and maintenance.

Gerdau S.A., primarily known for its global steel production operations, has made a strategic move in the energy sector by divesting its two hydroelectric power plants in Goias to Kinross Gold. This decision is aimed at reinforcing Gerdau’s core focus on its steel operations. The transaction underlines Gerdau’s strategic shift to streamline its business and focus on its primary industrial activities.

IHI Corporation has diversified its business to include contributions in the resources, energy, and environmental sectors, although specific details on their involvement in run-of-river hydroelectricity were not directly found. The company’s broad engagement in the energy and environment sectors suggests a commitment to sustainable practices and technologies.

Sinohydro Corporation is actively engaged in the run-of-river hydroelectricity sector, developing significant projects across various global locations. Notable projects include the Tamakoshi V in Nepal, a 100-megawatt plant that leverages the natural river flow without needing its own dam, and the Coca Codo Sinclair in Ecuador, a 1,500MW project that is currently active and was constructed in phases starting in 2010. Additionally, Sinohydro has made substantial contributions to Africa’s energy infrastructure, such as the recently commissioned Kafue Gorge Lower Hydropower Station in Zambia, which underscores its role in bolstering the region’s power supply.

Conclusion

The run-of-river hydroelectricity (ROR) market presents significant growth opportunities, fueled by an increasing global focus on sustainable and renewable energy sources. Technological advancements and supportive governmental policies are key drivers that make ROR an attractive option for investors and energy companies.

Despite challenges such as environmental concerns and the variability of water flows, strategic investments in this sector can yield substantial benefits. By focusing on innovative technologies and sustainable practices, stakeholders can effectively harness the potential of ROR projects to meet rising energy demands while contributing to environmental conservation.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)