Table of Contents

Introduction

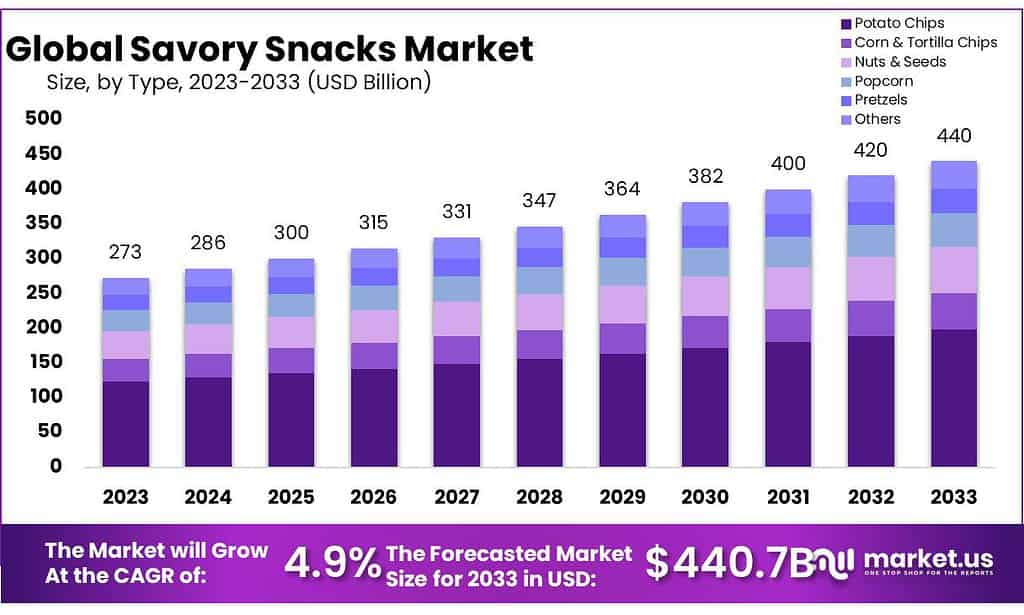

The global savory snacks market is on a robust growth trajectory, expected to reach approximately USD 440 billion by 2033, up from USD 273 billion in 2023, representing a compound annual growth rate (CAGR) of 4.9% during the forecast period. This growth can be attributed to increasing consumer demand for convenient and flavorful snack options, driven by busy lifestyles and changing eating habits. Health-conscious trends are also influencing the market, with consumers seeking snacks that offer nutritional benefits, such as protein-rich and low-calorie alternatives.

However, the industry faces challenges, including rising raw material costs and heightened competition among brands. Additionally, fluctuating consumer preferences, influenced by trends toward healthier eating, require companies to innovate continuously to remain relevant. Recent developments highlight a surge in plant-based and organic savory snacks, reflecting the industry’s response to health trends and sustainability concerns. For instance, several major brands have expanded their product lines to include gluten-free and non-GMO options, catering to diverse dietary needs.

Furthermore, strategic partnerships and mergers are shaping the landscape, with companies seeking to enhance their market presence through acquisitions and collaborations. This dynamic environment indicates that while the savory snacks market faces certain challenges, it also presents significant opportunities for growth and innovation, positioning it as a vibrant sector within the broader food industry.

PepsiCo continues to innovate with product launches and acquisitions. In 2023, the company introduced several new snack options, including plant-based and healthier versions of popular brands like Doritos and Lay’s. Additionally, PepsiCo acquired a smaller startup focused on nutritious snacks, enhancing its portfolio and aligning with the growing consumer preference for healthier alternatives.

The Kellogg Company has also been active, launching new flavors and expanding its snack offerings under brands such as Pringles and Cheez-It. In 2023, Kellogg announced a merger with a snack company to diversify its product range and improve market presence, positioning itself to better compete in the rapidly evolving snack landscape.

Kraft Heinz Company has prioritized product innovation, introducing new savory snack lines that emphasize bold flavors and healthier ingredients. In response to consumer trends, Kraft Heinz has expanded its portfolio to include organic and gluten-free options, targeting health-conscious consumers. The company reported a 10% increase in sales within its snack segment in the last quarter, reflecting successful new product strategies.

Key Takeaways

- Market Growth Projection: By 2033, the market is expected to reach USD 440 billion, growing at a CAGR of 4.9% from USD 273 billion in 2023.

- Product Dominance: Potato Chips hold over 68.2% of the market share, followed by Corn and Tortilla Chips, Nuts and Seeds, Popcorn, and Pretzels.

- FlavorPreferences: Barbeque flavors lead with over 35% market share, followed by Spice, Salty, and Plain/Unflavored options.

- Distribution Channels: Hypermarkets and supermarkets capture more than 62% of the market share, followed by Convenience Stores, Online, and other retail outlets.

- Asia Pacific holds the largest market share (48%), led by countries like India, Japan, and China. Europe, driven by Spain and the UK, also shows strong demand.

Savory Snacks Statistics

- In 2020, the snack food market was valued at USD 427 billion, and it is estimated to grow with an annual growth rate of 3.4%.

- The sales total represents a 29% increase from Super Bowl Week 2022.

- The data reveals that Americans consumed 118 million pounds of savory snacks during the latest Super Bowl Week.

- Corn Chips sold 7 million pounds for $53 million (+37% from 2022).

- Tortilla Chips sold 36 million pounds for $195 million (+20.2% from 2022).

- Potato Chips sold 32 million pounds for $216 million (+17.2% from 2022).

- Pretzels sold 1.3 million pounds for $45 million (+16.8% from 2022).

- Snack Category Records 11.4% Dollar Sales Growth During First 3 Quarters Of 2022

- More people are looking for sales specials (49 percent), IRI reports.

- In-person trips remain prevalent, at 85 percent, with the remainder equally divided between click-and-collect and delivery.

- Salty snacks rang up $26.6 billion in the first nine months of 2022, which represents 59.3 percent of total sales across all snack sectors.

- Total snack unit sales were down 2.2 percent year-on-year and slightly down from the loss of 1.4 percent during the first half of the year.

- The fastest growth was recorded by pretzels, which were up 17.6 percent, with growth boosted by inflation as well as robust demand, with pound sales up 3.8 percent year-on-year.

- However, volume was down 3.2 percent and it is one of the few sectors that fell behind 2019 levels.

- The dollar gains in crackers were inflation-driven, with volume down 2.9 percent. The highest growth within the sector was achieved by graham crackers, with sales up 15.5 percent.

- As mentioned in the first part of this series, in 2020 the Global snack foods market category was valued at USD 215.9 billion, growing at a CAGR of 2.7%.

- Savory snacks dominate global snacking with a retail value of around USD 175 billion in 2020, showing that not everyone has a sweet tooth.

- Eva Bold is a brand new, UK-based company that produces high-protein, keto-friendly crackers from 100% natural ingredients.

Emerging Trends

- Healthier Snack Options: There is a growing consumer preference for healthier snacks. Products that are low in calories, high in protein, and free from artificial ingredients are gaining popularity. Many brands are introducing baked, air-fried, or reduced-fat versions of traditional snacks to cater to health-conscious consumers.

- Plant-Based Snacks: The demand for plant-based and vegetarian snacks is on the rise. Consumers are increasingly looking for snacks made from legumes, nuts, and seeds. This trend reflects a broader shift toward plant-based diets, with companies launching innovative products that appeal to this market segment.

- Ethnic and Gourmet Flavors: Consumers are exploring diverse flavors and culinary experiences. Savory snacks featuring bold and exotic flavors inspired by global cuisines are becoming popular. This trend is driving brands to experiment with unique seasonings and ingredients, offering consumers more gourmet options.

- Sustainability: There is a heightened focus on sustainability in the snack industry. Brands are adopting eco-friendly packaging and sourcing ingredients responsibly. Consumers are more likely to choose products from companies that demonstrate environmental stewardship.

- Convenience: As lifestyles become busier, the demand for convenient snacks continues to grow. Portable, ready-to-eat snack options are increasingly favored by consumers looking for on-the-go solutions. Brands are innovating with packaging that enhances convenience without compromising product quality.

Use Cases

- On-the-Go Snacking: Savory snacks are increasingly popular as convenient, portable options for busy consumers. Products like single-serving packs of chips or nut mixes cater to individuals looking for quick snacks during commutes or outdoor activities. The on-the-go snack segment has grown significantly, projected to reach approximately USD 40 billion by 2025.

- Health-Conscious Choices: Many consumers are opting for healthier savory snacks as part of their dietary choices. Snacks such as baked veggie chips or protein-rich snack bars are tailored to those seeking nutritious options without sacrificing flavor. The health-oriented segment is expected to grow at a CAGR of over 5% in the coming years, reflecting this shift.

- Social Snacking: Savory snacks play a vital role in social gatherings and events, such as parties and movie nights. Brands are capitalizing on this by offering shareable snack packs, including gourmet popcorn and snack platters. The social snacking market is projected to see increased demand, particularly for products that enhance the experience of socializing.

- Meal Replacement: As lifestyles become busier, some consumers are using savory snacks as meal replacements. High-protein and low-carb options, like savory protein bars or nut-based snacks, appeal to those looking for quick, filling solutions. This segment is seeing rapid growth, with an expected market increase of about 15% over the next few years.

- Culinary Exploration: With consumers becoming more adventurous, snacks that offer unique flavors and textures are gaining traction. Products inspired by global cuisines, such as spicy Indian snacks or Middle Eastern dips, cater to those looking to explore new culinary experiences. This trend is reflected in a growing segment of the market that emphasizes gourmet and ethnic flavors.

Major Challenges

- Health Trends and Regulations: Increasing consumer awareness regarding health issues is pushing brands to reformulate products. Snacks that are high in salt, sugar, and unhealthy fats are facing scrutiny. As a result, companies must invest in research and development to create healthier alternatives, which can increase production costs. Approximately 30% of consumers are now prioritizing health over taste, impacting traditional snack sales.

- Intense Competition: The market is highly competitive, with numerous brands vying for consumer attention. This saturation can lead to price wars, which erode profit margins. New entrants and innovative startups often disrupt established brands, requiring constant innovation and marketing efforts. The top players must spend around 20% of their revenue on marketing to maintain market share in this environment.

- Supply Chain Disruptions: Recent global events, such as the COVID-19 pandemic and geopolitical tensions, have highlighted vulnerabilities in supply chains. Fluctuating prices for raw materials, such as grains and oils, can significantly impact production costs. In 2022, prices for key ingredients rose by nearly 15%, forcing brands to adjust their pricing strategies.

- Changing Consumer Preferences: Consumer tastes are rapidly evolving, with increasing demand for plant-based and organic snacks. Brands that fail to adapt to these trends risk losing market share. Research indicates that the plant-based snack segment is growing at a CAGR of over 8%, necessitating immediate action from traditional savory snack manufacturers.

- Sustainability Concerns: There is a growing demand for sustainable packaging and ethical sourcing of ingredients. Brands that do not address these concerns may face backlash from environmentally conscious consumers. Approximately 70% of consumers prefer products with sustainable packaging, highlighting the need for brands to innovate in this area.

Market Growth Opportunities

- Sustainability Initiatives: With increasing consumer awareness regarding environmental issues, there is a significant opportunity for companies to develop eco-friendly textile chemicals. The market for sustainable textiles is expected to grow from USD 105 billion in 2020 to USD 150 billion by 2025, indicating strong consumer demand for greener alternatives.

- Technological Advancements: Innovations in smart textiles, which incorporate functionalities like moisture-wicking and temperature regulation, are on the rise. The smart textiles market is projected to expand from USD 1.8 billion in 2020 to USD 5.4 billion by 2025. Companies can capitalize on this growth by investing in research and development to create advanced chemical solutions.

- Emerging Markets: The growth of the textile industry in regions such as Asia-Pacific, particularly in countries like India and Bangladesh, offers substantial expansion opportunities. The Asia-Pacific textile chemicals market is expected to witness significant growth due to rising disposable incomes and increasing demand for clothing.

- Healthcare Textiles: The demand for antimicrobial and biocompatible textiles in the healthcare sector is increasing, especially in the wake of the COVID-19 pandemic. The global market for healthcare textiles is anticipated to reach USD 30 billion by 2026, presenting a lucrative opportunity for manufacturers of specialized textile chemicals.

- Circular Economy Practices: The shift towards a circular economy, which emphasizes recycling and reuse, offers companies the chance to develop recyclable textile chemicals. This approach not only addresses sustainability concerns but also meets regulatory requirements, potentially increasing market appeal.

Key Players Analysis

PepsiCo has solidified its lead in the global savory snacks market, leveraging a diverse brand portfolio including Lay’s, Doritos, and Cheetos. The company’s strategic positioning, underscored by extensive market share and aggressive product innovation, caters to evolving consumer preferences for on-the-go and health-oriented snack options. In 2023, PepsiCo commanded a substantial portion of the market by leveraging effective distribution channels and adapting packaging to meet consumer demands, thereby reinforcing its market dominance.

The Kellogg Company, a key player in the savory snacks sector, continues to enhance its market presence through a robust portfolio featuring brands like Pringles and Cheez-It. The company’s focus on nutritional advancements and flavor innovation has been pivotal in maintaining consumer interest and expanding its market reach. Through strategic marketing and an adaptive supply chain, Kellogg effectively meets the dynamic demands of the global snack food market, ensuring sustained growth and consumer engagement in this competitive sector.

Kraft Heinz, a prominent player in the savory snacks market, is making significant investments to expand its portfolio, focusing on innovative, clean-label products to meet evolving consumer preferences for healthier snacks. The company’s partnership with APC Microbiome to research fermented ingredients reflects a strategic move to develop novel flavors and formulations that resonate with experimental consumers. This strategy helps Kraft Heinz adapt to the growing demand for better-for-you products and strengthens its competitive position in the global market.

Conagra Brands Inc. maintains a robust presence in the savory snacks sector with a portfolio that includes popular brands like Slim Jim and David Seeds. The company is focused on catering to consumer preferences for convenience and flavor variety, which has helped solidify its market position. Through continuous product innovation and effective marketing strategies, Conagra Brands effectively responds to the dynamic demands of today’s snack food consumers, ensuring sustained relevance and growth in a competitive market.

ITC Limited is a significant contender in India’s savory snacks sector, particularly known for its popular Bingo! brand which includes a variety of chips and other snack items. The company has capitalized on the widespread preference for ethnic and traditional snacks, which are the leading segment in the market. ITC’s strategic use of widespread distribution channels, particularly convenience stores, and its focus on flexible packaging have helped it maintain a strong market presence. The sector is expected to see continued growth, with ITC well-positioned to benefit from expanding consumer demand for processed snacks.

ConAgra Foods, known for brands like Slim Jim and David Seeds, plays a substantial role in the savory snacks sector, emphasizing product innovation and marketing to adapt to changing consumer tastes. The company’s offerings meet the growing demand for convenient and flavorful snacks, which has been particularly significant among busy, health-conscious consumers. With strategic product launches and a focus on healthier snack options, ConAgra is positioned to meet both current and emerging consumer trends in the savory snacks market.

Kellogg Co. has maintained a strong position in the savory snacks market with significant activities in key regions like the US and UK, supported by its diverse product range including the globally recognized Pringles brand. The company focuses on innovation and strategic expansions to increase its market share, which includes adapting its offerings to meet evolving consumer preferences for snacking options that align with modern, on-the-go lifestyles.

General Mills Inc., another significant player in the savory snacks sector, capitalizes on its well-established brands like Nature Valley and Bugles. The company strategically enhances its product lines to align with the consumer shift towards healthier and more convenient snack options. By integrating consumer insights into product development and marketing strategies, General Mills successfully caters to the dynamic demands of global snack food consumers, thus sustaining its competitiveness and growth in the market.

Hain Celestial is intensifying its focus on the savory snacks sector, emphasizing its product lines. The company’s strategic efforts are geared towards stabilizing and expanding its core snack brands such as Garden Veggie™ Snacks and Terra® chips, aiming for significant growth within the snack category. This focus is part of a broader strategic overhaul under the “Hain Reimagined” initiative, which targets enhanced operational efficiencies and a streamlined product range to boost market competitiveness and shareholder returns.

Blue Diamond Growers, renowned for their almond-based products, continues to play a significant role in the savory snacks sector. Their offerings, particularly in nut-based snacks, cater to a growing consumer demand for healthier snacking options. The company leverages its extensive experience in almond cultivation and product innovation to maintain a strong presence in the market, appealing to both health-conscious consumers and those seeking tasty, convenient snack options.

Conclusion

In conclusion, the textile chemicals market is positioned for substantial growth, driven by increasing demand for innovative and sustainable solutions. With a projected market size reaching approximately USD 41.7 billion by 2033, companies are focusing on eco-friendly products and advanced technologies to meet regulatory requirements and consumer preferences. The rise of smart textiles and sustainable practices further underscores the need for continuous innovation in this sector. As manufacturers adapt to these trends, the textile chemicals industry is likely to play a crucial role in shaping the future of textile production and sustainability.