Table of Contents

Introduction

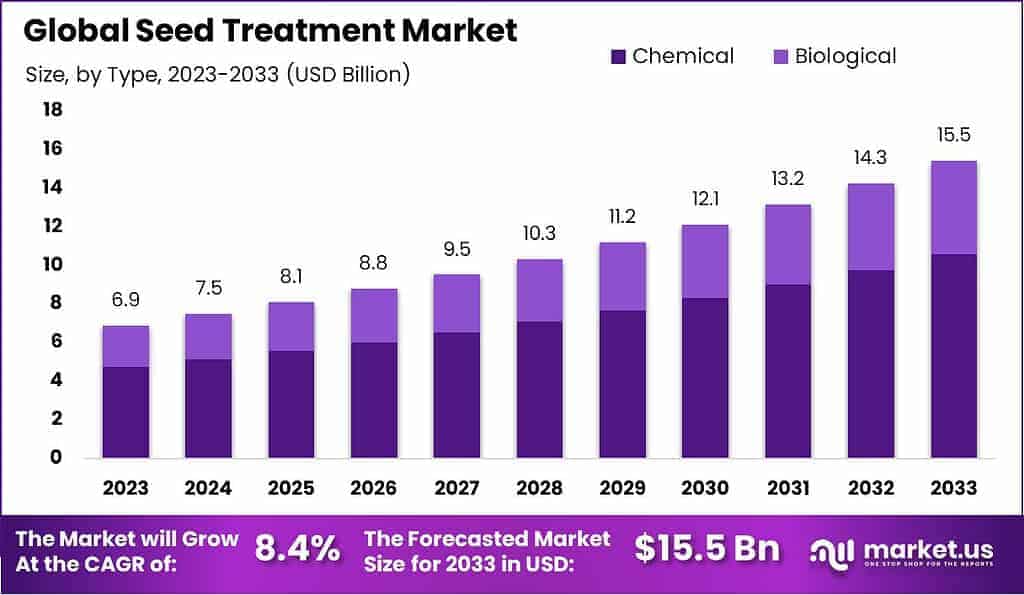

The global Seed Treatment Market is forecasted to reach approximately USD 15.5 billion by 2033, a significant increase from USD 6.9 billion in 2023, exhibiting a robust compound annual growth rate (CAGR) of 8.4% during the period from 2024 to 2033. This growth is underpinned by a rising demand for high-quality seeds, propelled by increasing global food requirements and advancements in agricultural practices.

A key growth driver for the market is the enhancement of seed performance through advanced treatment solutions, which improve germination rates and stress tolerance, contributing to higher agricultural yields.

The burgeoning emphasis on sustainable agriculture also fuels the adoption of bio-based and non-chemical seed treatments, which are gaining traction due to their environmental benefits and alignment with global shifts towards organic farming.

However, the market faces challenges such as stringent regulatory frameworks that vary by region, complicating compliance for manufacturers, and the commercialization of new products. Additionally, the high cost of development and the need for multiple approvals impede faster market entry for new treatments.

Recent developments in the market include the introduction of novel biological treatments and innovations in seed coating technologies, which enhance the effectiveness of seed treatments while minimizing environmental impact.

Syngenta International AG has demonstrated strategic growth through key acquisitions, most notably the purchase of Valagro, an Italy-based company known for its biostimulants and specialty nutrients. This acquisition enhances Syngenta’s product line, reinforcing its market position in sustainable agricultural solutions.

Syngenta’s commitment to research and development is evident in its increased focus on delivering agricultural innovations that respond to grower needs. The company aims to accelerate the development of active ingredients and introduce two new AIs per year, up from an average of 1.3

Key Takeaways

- The Global Seed Treatment Market size is expected to be worth around USD 15.5 Billion by 2033, from USD 6.9 Billion in 2023, growing at a CAGR of 8.4% during the forecast period from 2024 to 2033.

- The Chemical segment dominated the Seed Treatment Market with a 68.6% share.

- Cereals & Grains dominated the Seed Treatment Market with a 41.3% share.

- Seed Protection dominated the Seed Treatment Market with a 38.7% share.

- Coating dominated the seed treatment market with over 39% share, enhancing crop yield and sustainability.

- North America dominates the seed treatment market with a 34.6% share, valued at USD 2.4 billion.

Seed Treatment Statistics

Impact and Investment in Seed Treatment

- Biological seed treatment is a 100% natural approach that involves the application of active ingredients such as beneficial fungi and bacteria.

- “A yield reduction of 1 percent per acre results in a total crop loss of about 25 million to 35 million dollars,” the council’s website states. “Annual crop losses in North America from flea beetles potentially exceed 300 million dollars.”

- To maximize the efficacy of insecticide and fungicide seed treatments and promote rapid emergence, it is recommended to plant canola 1.25 to 2.5 centimeters (0.5 to 1 inches) deep into a warm moist seedbed using a seeding rate that targets 50 to 80 plants/m2 (5-8 plants/ft2).

- Lucent Bio, an innovative agricultural technology company, has announced over $3.6 Million will be provided by PacifiCan through the Business Scale-up and Productivity program, earmarked to expedite the development of Nutreos, their innovative seed treatment technology.

- Elevate invests in high-potential, cross-sector innovative companies with a minimum $500 million total addressable market at the pre-seed, seed, and Series A stages.

Economic Loss and Advances in Seed Treatment

- The global agriculture system occupies approximately 40% of the earth’s surface and has the main objective of producing food for an ever-increasing population (7.5 billion people today, and nearly 10 billion by 2050).

- Between 20-40% of agriculture production is lost to pests and diseases each year, totaling roughly $220 billion in economic value.

- Massachusetts-based Clean Crop Technologies has launched a commercial cold plasma seed treatment facility, signed $3.4 million in purchase orders, and has a sales and pilot pipeline worth $47 million in annual recurring revenue from companies that represent 39%.

- Polish Oxla, a platform offering database creation solutions, secured a $11M (€10.12M) seed funding round.

- Waypoint Bio secures USD 14.5Mln seed funding to turbocharge drug discovery.

Emerging Trends

- Growth in Biological Ingredients: The industry is witnessing a robust increase in the adoption of biopesticides and biostimulants. These natural alternatives are projected to grow annually by 9.3% and 7.8% over the next five years, favored for their eco-friendly nature and ability to boost seed performance.

- Shift Due to Regulatory Standards: In response to environmental concerns, the EU has banned specific neonicotinoid compounds, steering the market towards safer seed treatment options that are non-toxic to pollinators.

- Innovations in Application Technology: New technologies are enhancing the precision and efficiency of seed treatments, allowing for improved coverage and protection while using fewer chemicals.

- Integrated Pest Management Emphasis: There is an increasing integration of seed treatments within comprehensive pest management frameworks, enhancing crop resilience and aiding in the management of pest resistance.

- Development of Comprehensive Solutions: The market is moving towards multifunctional seed treatments that deliver a combination of disease and pest resistance, growth enhancement, and stress tolerance, offering greater value to farmers.

Use Cases

- Enhancing Seed Germination: Seed treatments can improve seed germination rates, helping seeds to start growing more quickly and uniformly, which is crucial for optimal crop establishment.

- Disease Protection: Treating seeds with fungicides or bactericides can protect young plants from diseases that could otherwise destroy seedlings or severely hamper crop development.

- Pest Control: Insecticide treatments help shield seeds from pests during the critical early stages of growth, reducing damage and potential yield loss.

- Nutrient Provision: Some seed treatments include micronutrients or growth-promoting substances that enhance seedling health and vigor, supporting stronger growth right from the start.

- Environmental Stress Resistance: Treatments can help seeds withstand adverse conditions such as drought or excessive moisture, improving plant resilience and survival rates in challenging climates.

Major Challenges

- Limited Application Space: Seeds can only absorb a limited amount of chemical treatment before their growth and development are negatively affected. This limitation poses a challenge in effectively treating seeds without harming their viability.

- Environmental Concerns: The chemicals used in some seed treatments can lead to environmental contamination if not properly managed. There’s growing concern about the impact of these chemicals on non-target species and the broader ecosystem.

- Resistance Development: Similar to antibiotics in medicine, pests and diseases can develop resistance to the chemicals used in seed treatments. This resistance necessitates the development of new treatment formulas, which can be both costly and time-consuming.

- Regulatory Challenges: Seed treatment chemicals are subject to strict regulations to ensure they are safe for the environment and human health. Navigating these regulatory frameworks can be a complex and costly process for companies developing new seed treatments.

- Cost: The development and application of seed treatments can be expensive, and the cost is often passed down to farmers. This can make treated seeds less accessible, especially for small-scale and subsistence farmers.

Market Growth Opportunities

- Adoption of Biological Ingredients: The use of biologicals like biopesticides and biostimulants in seed treatments is increasing. These options are favored for their low environmental impact and their ability to boost crop growth effectively. The demand for such sustainable solutions is anticipated to surge in the upcoming years.

- Tailored Seed Treatment Solutions: There is a growing trend toward creating seed treatment solutions that are specifically designed to meet the unique conditions of different regions, such as local soil compositions and climate variances. This customization helps in combating plant diseases more effectively and enhancing crop development.

- Innovative Seed Coating Technologies: Developments in seed coating technologies, including the adoption of microplastic-free options, are enhancing the environmental sustainability of seed treatments while also improving the application process and the growth performance of plants. This sector is ripe for further innovations and market growth.

- Expansion into New Markets: The seed treatment industry sees significant potential in expanding into developing regions like Asia, Africa, and South America. These areas are experiencing growth in agricultural activities and have an acute need for technologies that can increase crop yields.

- Integration with Digital Agriculture: The future of seed treatments lies in their integration with digital technologies, such as precision agriculture tools and data analytics. This combination promises to optimize the application of seed treatments and enhance overall crop management, paving the way for advanced agricultural practices.

Key Players Analysis

- Syngenta International AG is at the forefront of the seed treatment sector, utilizing advanced biotechnology to enhance crop protection and sustainability. Their work includes developing innovative seed treatment solutions that safeguard crops from diseases and pests, thus ensuring strong early growth and better yield sustainability.

- Bayer Crop Science AG is at the forefront of the seed treatment sector with their Acceleron® Seed Applied Solutions. This product line includes a range of bio-enhancers, fungicides, insecticides, and nematicides, all developed through extensive research to provide robust protection against a variety of plant stresses and pests, thereby enhancing overall plant health and yield.

- BASF SE actively enhances the seed treatment sector by developing products that improve seed success and overall crop health. Their efforts are focused on delivering innovative solutions that safeguard the future of food security and farm operations globally, tailoring treatments to meet the diverse needs of growers, and enhancing plant potential through advanced research and development.

- Corteva Agriscience is actively advancing its seed treatment solutions to enhance crop yields and protect against diseases and pests. They focus on innovation in their LumiGEN® seed treatment portfolio, including new fungicide and insecticide treatments designed to improve early-season disease control and overall crop health.

- Croda International PLC is expanding its presence in the seed treatment sector, focusing on seed enhancement to gain market share. This includes increasing sales by 9% in this area and showcasing their commitment to advancing agricultural solutions that optimize seed performance and sustainability.

- KWS has been advancing in the seed treatment sector by focusing on the development of biologicals. They’ve innovated a new stabilization process that allows beneficial microorganisms to be preserved and applied to seeds. This breakthrough offers sustainable agricultural benefits and is tailored to support the seeds from the early stages of development, enhancing growth and yield under various stress conditions.

- Ecologic Technologies is innovating in the seed treatment sector by developing advanced encapsulation techniques for microbial products. Their BioShield® technology effectively stabilizes beneficial microbes, enhancing their viability and shelf life. This allows for the seamless integration of these biological treatments into seeds, improving crop resilience and growth.

- Borregaard is actively involved in the seed treatment sector through its development of microplastic-free and biodegradable seed coatings. These coatings apply antimicrobial and fungicidal agents to seeds, promoting healthier crop growth from the earliest stages and improving the nutritional value of crops.

- Amulix is actively working in the seed treatment sector to offer environmentally friendly solutions. They produce biodegradable seed coatings designed to improve seed performance and reduce environmental impact by using bio-based materials. These coatings are particularly notable for their low carbon footprint and compliance with strict EU microplastics regulations, making them an attractive option for sustainable agriculture.

- ADAMA Ltd. is actively involved in the seed treatment sector, developing and providing solutions that control pests in various crops. Their focus is on creating effective treatments that help ensure healthier crops and improved yield, utilizing their broad portfolio of crop protection technologies.

- BioWorks Inc. is contributing to the biological seed treatment market, which is expected to grow significantly by 2030. They offer a range of biopesticides that enhance plant health and crop productivity by protecting against diseases and insects. BioWorks focuses on sustainable crop protection solutions, emphasizing their role in reducing reliance on synthetic pesticides.

- Certis Europe, now part of Certis Belchim after a merger, has launched a groundbreaking bio-fungicide for cereal seed treatment called TOLTEK. This bio-fungicide is specifically developed to combat Take-All disease in cereals, marking a significant advancement in biological crop protection.

Conclusion

Seed treatments are crucial for fostering sustainable and safe crop growth. While there are concerns about microplastics in the agricultural environment, the industry is dedicated to developing innovative, environmentally friendly alternatives to address these issues.

This proactive approach demonstrates a strong commitment to responsible agricultural practices and ensuring the availability of sustainable options for the future.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)