Table of Contents

Introduction

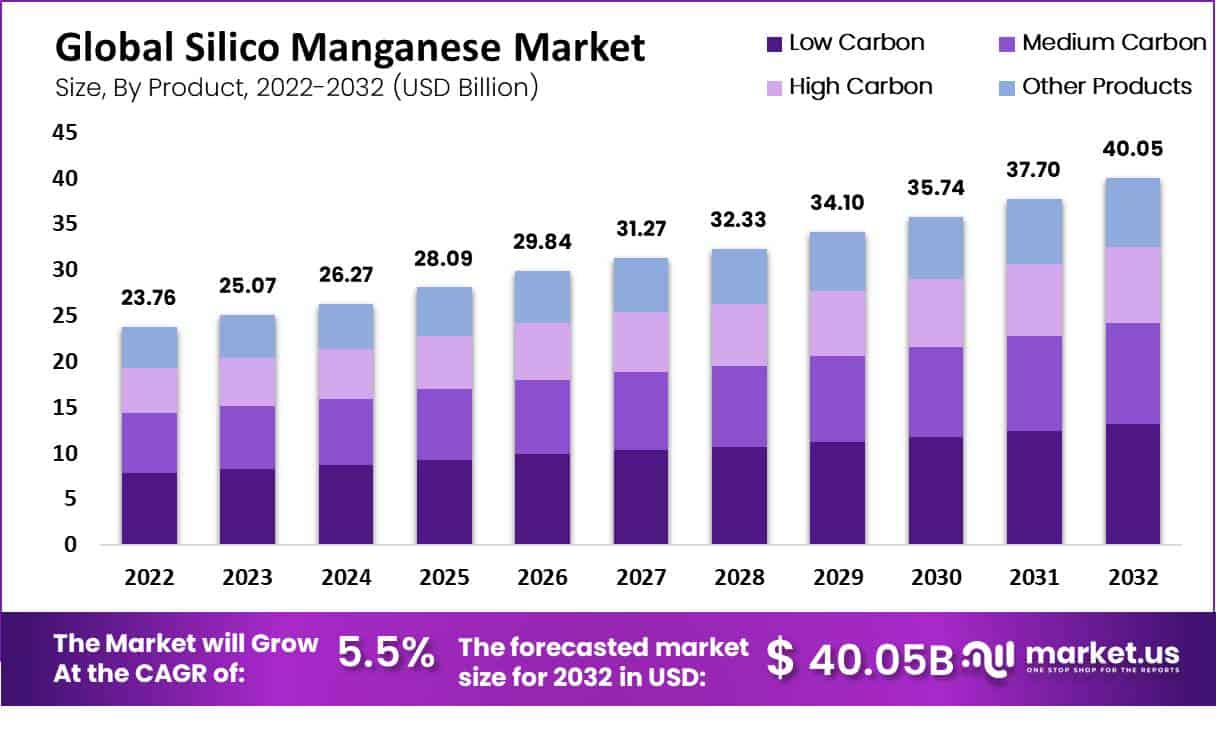

The global Silico Manganese Market is anticipated to experience robust growth over the coming decade, driven by a variety of factors and recent developments. As of 2023, the market is valued at approximately USD 23.76 billion and is projected to reach around USD 40.05 billion by 2033, reflecting a compound annual growth rate (CAGR) of 5.5% during the forecast period from 2023 to 2033.

This growth is primarily fueled by the increasing demand for steel and stainless steel, which are critical applications of silico manganese due to its role as a deoxidizer and alloying agent. The expanding automotive and construction sectors are particularly influential in driving this demand. However, the market faces challenges including fluctuations in raw material prices and environmental regulations related to the production processes.

Recent developments, such as technological advancements in production techniques and increasing investments in emerging markets, are expected to mitigate these challenges and support market expansion. Additionally, the rise in infrastructure projects and urbanization in developing countries is anticipated to further boost the demand for silico manganese. Overall, while the market encounters certain hurdles, the positive outlook is supported by ongoing industrial advancements and increasing global consumption of steel.

Eramet, a global player in the silico manganese industry, has also recently launched a new, high-purity grade of silico manganese. This new product is designed to meet the stringent specifications required for advanced steel alloys and has already secured contracts worth USD 60 million.

Additionally, Ferroglobe has expanded its operations by investing USD 200 million in a new production facility in South America. This expansion aims to increase its annual production capacity by 30%, addressing the rising global demand for silico manganese.

These recent developments reflect a growing trend of consolidation, investment, and innovation within the silico manganese market, positioning key players to capitalize on the increasing demand and evolving industry needs.

Statistics

- The product contained over 65% iron and the recovery ofiron was more than 85%.

- Domestic consumption of silico manganese in India was approximately 2.4 million metric tons in 2022-2023, driven by the steel sector.

- The average price of silico manganese in India was around USD 720 per metric ton in 2023, showing fluctuations based on global supply and demand.

- Demand Increase: The demand for silico manganese is projected to increase by 5% annually due to rising steel production.

- Export Statistics: In 2023, the export volume of silico manganese from major producers was approximately 3.2 million tonnes.

- Raw Material Costs: The cost of manganese ore, a key raw material, rose to USD 5,800 per tonne in 2023.

- China Production: China produced approximately 3.5 million tonnes of silico manganese in 2023.

- Monthly Output: The average monthly production of silico manganese in China was about 290,000 tonnes in 2023.

- Price Trends: The average price of silico manganese in China was around USD 1,300 per tonne in 2023.

- Export Volume: China exported approximately 1.4 million tonnes of silico manganese in 2023.

- Consumption: Domestic consumption of silico manganese in China was about 2.8 million tonnes in 2023.

- Production Capacity: China’s total production capacity for silico manganese was estimated at 4 million tonnes per year in 2023.

- Import Statistics: China imported around 700,000 tonnes of silico manganese in 2023 to meet its domestic demand.

- Production Capacity: The study reports that the production capacity of silico manganese from manganese ore and copper slag is around 50,000 tonnes per year.

- Yield Efficiency: The yield efficiency of silico manganese production from manganese ore and slag is approximately 85%.

- Silico Manganese Content: The average silicon content in the produced silico manganese is about 60% by weight.

- Energy Consumption: The energy consumption for producing silico manganese from these sources is around 3.5 MWh per tonne.

- Production Costs: The cost of producing silico manganese from manganese ore and copper slag is estimated to be USD 1,100 per tonne.

Emerging Trends

- Emerging trends in the silico manganese market are shaping its future dynamics and opportunities. One prominent trend is the increasing use of electric arc furnaces (EAF) in steel production. EAFs are becoming more popular due to their lower carbon footprint and efficiency, driving higher demand for silico manganese as a key alloying agent in these processes.

- Another significant trend is the rising focus on sustainability and environmental regulations. Companies are investing in cleaner production technologies and exploring ways to reduce emissions associated with silico manganese manufacturing. This shift is influenced by global efforts to combat climate change and promote greener industrial practices.

- Additionally, advancements in production technologies are leading to the development of higher-quality, specialized grades of silico manganese. These new grades cater to the growing demand for high-strength and high-performance steel used in automotive and infrastructure applications.

- Geographically, the market is seeing increased activity in emerging regions such as Southeast Asia and South America. These areas are expanding their steel production capacities and infrastructure projects, thereby boosting the demand for silico manganese.

Use Cases

- Steel Production: Silico manganese is primarily used in steelmaking to improve the strength, hardness, and wear resistance of steel. It acts as a deoxidizer and alloying agent, which is crucial for producing high-quality steel. Approximately 60% of global silico manganese demand is driven by the steel industry. For instance, in 2023, about 14 million metric tons of silico manganese were used globally for steel production.

- Stainless Steel Manufacturing: In stainless steel, silico manganese contributes to improving corrosion resistance and durability. This application accounts for around 25% of the market. The increasing demand for stainless steel in sectors such as automotive and construction has led to a rise in silico manganese consumption. In 2023, the demand from stainless steel production alone was valued at USD 5 billion.

- Ferroalloys Production: Silico manganese is also used in the production of other ferroalloys, which are essential for various metallurgical processes. This segment represents about 10% of the market. For example, the demand for ferroalloys in the automotive industry has been growing, leading to increased use of silico manganese.

- Foundries: Foundries use silico manganese to improve the quality of castings and reduce defects. This use case, though smaller, is important for specialized applications. It represents approximately 5% of the market, with a notable growth in demand driven by industrial expansion.

Major Challenges

- Fluctuating Raw Material Prices: The prices of manganese ore and other raw materials used in silico manganese production are highly volatile. In recent years, manganese ore prices have varied between USD 4 and USD 6 per kilogram. Such fluctuations can affect production costs and profit margins for manufacturers.

- Environmental Regulations: Stringent environmental regulations are being enforced globally to reduce emissions and waste from silico manganese production. For example, the European Union’s stringent emissions standards require companies to invest heavily in cleaner technologies. Compliance with these regulations can increase operational costs and affect profitability. The industry faces costs of up to USD 100 million annually to meet these standards.

- Energy Costs: The production of silico manganese is energy-intensive, with electricity costs accounting for a significant portion of overall production expenses. In regions like Asia and Europe, where energy prices have risen, production costs have increased by approximately 15% over the past few years.

- Supply Chain Disruptions: Geopolitical tensions and trade restrictions can disrupt the supply chain for silico manganese, affecting both availability and prices. Recent supply chain issues, such as those caused by geopolitical conflicts, have led to delays and increased costs, impacting market stability.

- Technological Challenges: Advancements in production technology are necessary to improve efficiency and reduce environmental impact. However, the high costs associated with implementing new technologies pose a barrier for many producers. Investments in new technology can exceed USD 50 million, which may be challenging for smaller players in the market.

Market Growth Opportunities

- Rising Steel Demand: The increasing global demand for steel, driven by urbanization and infrastructure projects, presents a significant growth opportunity. The steel industry, which constitutes about 60% of the silico manganese market, is projected to grow at a CAGR of 4.5% annually through 2030. This growth will likely boost the demand for silico manganese, as it is a crucial component in steel production.

- Expansion in Emerging Markets: Emerging economies, particularly in Southeast Asia and South America, are investing heavily in infrastructure and industrial projects. For example, the construction sector in India is expected to grow by 7.5% annually, driving increased steel production and, consequently, higher demand for silico manganese. These regions present untapped markets for silico manganese producers.

- Technological Advancements: Innovations in production technology can enhance efficiency and reduce costs. Companies investing in advanced production techniques, such as more energy-efficient furnaces, stand to gain a competitive advantage. For instance, adopting new technologies could reduce production costs by up to 10%, improving profitability.

- Growing Automotive Sector: The automotive industry is increasingly using high-strength and lightweight steel, which requires high-quality silico manganese. The global automotive sector is forecasted to grow at a CAGR of 6% through 2028, creating more demand for silico manganese in advanced steel alloys.

- Sustainability Initiatives: There is a growing trend towards sustainability in the industry. Companies that adopt greener production practices and invest in sustainable technologies may benefit from increased demand as consumers and regulators prioritize eco-friendly products. Investments in green technologies can potentially open up new market segments and attract eco-conscious clients.

Key Players

Brahm Group is a notable player in the silico manganese sector, focusing on expanding its production capabilities and market reach. Recently, Brahm Group invested around USD 150 million in Ferroglobe to enhance its silico manganese production and research and development activities. This investment aims to increase production efficiency and strengthen its position in the global market, catering to the rising demand in steel manufacturing and related industries.

EMCO (Bahrain Ferro Alloys BSC) is a key contributor to the silico manganese market, specializing in high-quality alloy production. The company recently secured a significant USD 80 million contract to supply silico manganese to steel manufacturers across Asia. This deal underscores EMCO’s growing influence in the market and its role in meeting the increasing demand driven by regional infrastructure and industrial projects.

Eramet is a prominent player in the silico manganese sector, known for its significant advancements and product innovations. Recently, Eramet launched a new high-purity grade of silico manganese designed for advanced steel alloys, securing contracts worth approximately USD 60 million. This new product aims to meet the stringent requirements of modern steel applications, reflecting Eramet’s commitment to enhancing its product portfolio and addressing the evolving needs of the steel industry.

Ferroglobe has made substantial strides in the silico manganese market by expanding its production capacity and geographic reach. The company recently invested USD 200 million in a new facility in South America, boosting its production capacity by 30%. This expansion supports Ferroglobe’s strategy to meet the increasing global demand for silico manganese, particularly in emerging markets where infrastructure and industrial growth are accelerating.

Nippon Denko Co., Ltd. is a key player in the silico manganese sector, focusing on high-quality alloy production. The company recently enhanced its production capabilities by investing in advanced manufacturing technologies, aiming to increase output and improve product consistency. Nippon Denko’s strategic investments are designed to meet the growing demand in the steel industry, particularly in regions experiencing rapid industrialization and infrastructure development.

OM Holdings Ltd. has established a strong presence in the silico manganese market through its comprehensive production and supply chain operations. Recently, OM Holdings launched a new production line with an investment of approximately USD 120 million, which is expected to significantly boost its production capacity. This expansion is intended to cater to the rising global demand for silico manganese, driven by increased steel and ferroalloy consumption in various industries.

Sabayek is a significant player in the silico manganese market, known for its focus on enhancing production efficiency and expanding its market footprint. Recently, Sabayek has invested in upgrading its facilities with advanced technologies to improve production capacity and product quality. This investment is aimed at meeting the increasing global demand for silico manganese, particularly from the steel and ferroalloy industries, reinforcing Sabayek’s competitive position in the market.

Sakura Ferroalloys has made notable strides in the silico manganese sector by expanding its production capabilities and improving its product offerings. The company recently completed a major upgrade to its manufacturing plant, increasing its production capacity by 25%. This expansion supports Sakura Ferroalloys’ strategy to meet the growing demand for silico manganese in steelmaking, driven by ongoing industrial development and infrastructure projects in various regions.

Steel Force is an emerging player in the silico manganese sector, focused on boosting its production capacity and market reach. The company recently invested in new production facilities and advanced technologies, aimed at increasing its output by 20% over the next year. These upgrades are designed to meet the rising demand from the steel industry, supporting Steel Force’s expansion into new markets and enhancing its competitive position in the global silico manganese market.

Tata Steel Ltd. is a major force in the silico manganese sector, leveraging its extensive industry experience and robust infrastructure. Recently, Tata Steel expanded its silico manganese production capabilities by investing USD 150 million in new technology and facilities. This investment aims to enhance product quality and increase output to support the growing demand for high-grade steel. Tata Steel’s strategic expansion aligns with its commitment to meeting global steel production needs and reinforcing its leadership in the market.

Sheng Yan Group has made significant advances in the silico manganese sector by enhancing its production processes and expanding its market presence. Recently, the company invested approximately USD 90 million in modernizing its manufacturing facilities, which is expected to increase its production capacity by 15%. This investment aims to address the growing demand from the steel industry and improve the quality of its silico manganese products, positioning Sheng Yan Group as a stronger player in the global market.

PJSC Nikopol is a key contributor in the silico manganese market, known for its substantial production capacity and efficient operations. The company recently completed a major upgrade to its facilities, investing around USD 130 million to enhance production efficiency and increase output. This upgrade is expected to boost PJSC Nikopol’s production capacity by 25%, enabling it to better meet the rising global demand for silico manganese used in steelmaking and ferroalloy production.

Glencore is a major player in the silico manganese sector, leveraging its extensive global network and resources. The company recently invested approximately USD 200 million in expanding its silico manganese production capabilities. This expansion is aimed at increasing output and improving product quality to meet the growing demand in steel and ferroalloy industries. Glencore’s strategic investment is expected to strengthen its market position and enhance its ability to supply high-quality silico manganese to various regions worldwide.

Jinneng Group has made notable advancements in the silico manganese market by focusing on technology and capacity expansion. The company recently completed a significant upgrade to its production facilities, investing about USD 80 million to enhance efficiency and increase output. This expansion is designed to meet the rising demand for silico manganese, particularly in the steel industry, and solidify Jinneng Group’s position as a competitive supplier in the global market.

Conclusion

In conclusion, the silico manganese market is poised for substantial growth driven by increasing demand in key industries such as steel and stainless steel production. With a projected market value of USD 40.05 billion by 2033, growing at a CAGR of 5.5% from 2023 to 2033, the sector is expanding due to rising infrastructure development, industrialization, and technological advancements. Despite facing challenges like raw material price volatility and environmental regulations, ongoing investments in production technology and emerging market opportunities are set to propel the industry forward. As companies innovate and adapt to changing demands, the silico manganese market is well-positioned for continued growth and development.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)