Table of Contents

Introduction

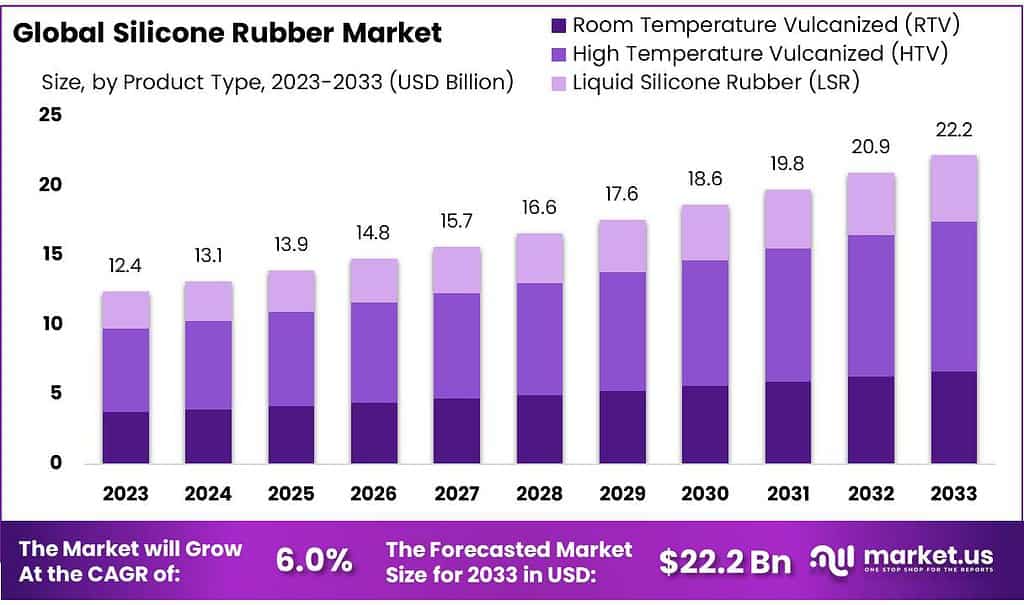

The global Silicone Rubber Market is poised for significant growth, expected to expand from USD 12.4 billion in 2023 to USD 22.2 billion by 2033, demonstrating a robust CAGR of 6.0% during this period. This upward trajectory is largely driven by increased applications across diverse industries such as automotive and medical sectors, which collectively account for more than 50% of the market demand. Specifically, the automotive sector is anticipated to maintain its lead due to ongoing global population growth and technological advancements in vehicle manufacturing.

Challenges in the market include stringent regulatory standards and the high cost of manufacturing, which compel companies to innovate and optimize their production processes. Key players like Momentive and Wacker Chemie AG are actively expanding their production capacities and enhancing product offerings to meet the rising demand, particularly in advanced applications such as electric vehicles and healthcare devices.

Recent developments have seen significant investments in research and development by major companies to innovate and improve silicone rubber products. For instance, new formulations have been introduced that enhance the performance and processing capabilities of silicone rubbers, particularly in high-temperature environments. This is crucial for applications in sectors such as electronics, where thermal management is essential.

Wacker Chemie AG has been active in expanding its footprint and product offerings. In October 2021, Wacker Chemie acquired a 60% stake in SICO Performance Material Co., Ltd., a specialty silane manufacturer in China. This move is part of Wacker’s strategy to increase its portfolio of high-margin specialty products in the global silicone business.

Dow has made significant investments to cater to emerging market demands, particularly in mobility and transportation. For instance, in March 2022, Dow funded the development of moldable optical silicone technologies at its Jincheon site in South Korea, enhancing its capabilities in automotive and industrial lighting applications. Additionally, in October 2023, Dow announced a $1 billion investment to expand its specialty silicone production capacity in China, targeting sectors like electronics and healthcare.

Key Takeaways

- Market Growth: Silicone Rubber Market is projected to reach USD 22.2 billion by 2033, growing at a robust CAGR of 6.0% from 2023.

- HTV Dominance: In 2023, High-Temperature Vulcanized (HTV) secured over 48.5% market share, valued for high-temperature resistance in automotive and industrial applications.

- Application Leadership: Automotive & Transportation led applications in 2023, capturing a significant 36.7% market share due to silicone rubber’s resilience.

Silicone Rubber Statistics

- Silicone rubber is generally non-reactive, stable, and resistant to extreme environments and temperatures from −55 to 300 °C (−70 to 570 °F) while still maintaining its useful properties.

- This is done by heating large volumes of quartz sand to extremely high temperatures, often up to 1800 °C. From here, there are several processes where silicon is combined with methyl chloride and heated.

- Heat Stabilised grades of silicone contain an additive enabling them to operate at temperatures up to 260°C. These are available from 30° Shore A to 80° Shore A.

- High tear strength grades of silicone are FDA approved and are available from 50° Shore A to 70° Shore A. Naturally, these polymers are translucent, however, they can be pigmented to any colour you may require.

- It has incredible heat resistance that also helps it to have brilliant low-temperature flexibility to around -50°c. LSRs also have very low compression sets in the range of around 15%-20%.

- VFR(2) is a flame retardant grade of silicone developed for rail applications. It is available in 68° Shore A, pigmentation is limited to shades of grey. This material meets the following rail spec

- This flame-retardant grade of material is specified for use in aerospace applications and is available from 20° shore A to 80° shore.

- These filings allow for easy detection if material breaks away from the seal. Metal detectable grades are available from 45° Shore A to 75° Shore A in blue.

- This is a high-quality compound that has been developed specifically to resist high-pressure steam applications. It has an operating temperature from -60°C to +260°C and is available at 60° shore A.

- Temperature – The temperature range of silicone rubber can go as low as -70°c and as high as 300°c. However, exposing the material to temperatures outside of this range can cause the material to degrade significantly.

Emerging Trends

- Sustainability and Bio-Based Innovations: The industry is moving towards more sustainable practices, including the development of bio-based silicones. This shift is driven by growing environmental concerns and regulatory pressures, aiming to reduce the carbon footprint of silicone production.

- High-Performance Applications: Silicone rubber is being increasingly used in demanding applications that require materials to withstand extreme conditions. This includes high-temperature resistance for automotive under-the-hood parts, as well as in medical devices where durability and biocompatibility are critical.

- Thermal Management in Electronics: With the rise of electric vehicles (EVs) and portable electronics, there is a growing demand for silicone rubber materials that can manage heat effectively. Silicone is ideal for these applications due to its excellent thermal stability and insulation properties.

- Expansion in Healthcare Applications: Medical-grade silicones are seeing expanded use, particularly in prosthetics, implants, and other medical devices, thanks to their biocompatibility and robustness. The sector is also innovating with silicone hydrogels and other silicone-based materials for various medical applications.

- Technological Advancements in Production: Leading manufacturers are investing in new technologies to improve the properties of silicone rubber. This includes enhancing the material’s conductivity, elasticity, and resistance to environmental factors, which broadens its applicability across various industries.

Use Cases

- Medical Industry: Silicone rubber is extensively used for medical applications owing to its biocompatibility and stability. It is used in manufacturing implants, tubing, and seals that come into contact with body tissues and fluids without causing adverse reactions.

- Automotive Industry: In the automotive sector, silicone rubber is crucial for manufacturing parts that must withstand high temperatures and harsh conditions, such as gaskets, hoses, and engine seals. Its resistance to extreme temperatures and degradation helps extend the lifespan of automotive components.

- Electronics: Due to its excellent insulative properties, silicone rubber is ideal for protective covers, insulation materials, and various components within electronic devices. It ensures safety and functionality by preventing electrical failures and providing thermal management.

- Food and Beverage: Silicone rubber is safe for food contact applications. It is used in products like baking molds, food storage containers, and utensils due to its non-toxic nature and ability to withstand various temperatures without degrading.

- Consumer Goods: In consumer goods, silicone rubber is used in a variety of products ranging from household items to personal care products. It offers durability and resistance to moisture and chemicals, making it suitable for daily use items.

Major Challenges

- High Production Costs: One of the primary challenges for the silicone rubber market is the high cost of production. This is due to the expensive raw materials and the energy-intensive manufacturing processes required to produce high-quality silicone rubber. These high costs can limit the profitability of manufacturers and increase the final product prices for consumers.

- Supply Chain Disruptions: The industry has faced challenges related to supply chain disruptions, which affect the availability of raw materials. This has been exacerbated by geopolitical factors and trade policies that influence the global movement of these materials. Disruptions in the supply chain can lead to delays in production and increased costs.

- Environmental Regulations: Increasingly stringent environmental regulations are also posing challenges to the silicone rubber industry. These regulations often require significant investment in cleaner technologies and can impact the ways in which silicone rubber is produced and disposed of. Compliance with these regulations is essential but can be costly.

- Market Saturation and Competitive Intensity: The market for silicone rubber is highly competitive with a high intensity of rivalry among existing players. Companies compete on aspects such as price, quality, and innovation, striving to differentiate themselves and capture greater market share. This competition, while driving innovation, can also pressure profit margins and lead to market saturation.

- Evolving Market Needs: As technology advances, so do the requirements for silicone rubber in various applications. Keeping up with these evolving demands, particularly in high-tech industries like electronics and automotive, requires continuous research and development. This need for constant innovation can be a significant hurdle for companies that lack the resources to invest heavily in R&D.

Market Growth Opportunities

- Geographic Expansion: The Asia-Pacific region is expected to experience the fastest growth in the silicone rubber market due to increasing automotive production and industrial activities in countries like China and India. This region’s market is not only the largest but also the fastest-growing, providing substantial opportunities for market players to expand their presence.

- Automotive and Medical Applications: The automotive and medical industries are major drivers of demand for silicone rubber, accounting for more than 50% of the market. The growth in these sectors is attributed to the increasing global population and advancements in medical technologies. Silicone rubber’s properties such as durability, flexibility, and resistance to extreme temperatures make it ideal for applications in these industries.

- Innovation and Product Development: There is a continuous need for innovation in product offerings to meet evolving market demands. Major players in the industry are investing in research and development to enhance their product lines, which is crucial for staying competitive. This includes the development of new silicone rubber formulations with improved performance characteristics for use in high-tech applications like electric vehicles and medical devices.

- Sustainability Practices: As global awareness of environmental issues grows, there is an increasing demand for sustainable manufacturing practices and materials. Silicone rubber offers significant advantages in this area due to its long service life and potential for recycling, aligning with the global shift towards sustainability. Companies that invest in environmentally friendly production techniques are likely to see growth opportunities from eco-conscious consumers and regulatory bodies.

- Expansion in Consumer Goods: Silicone rubber is widely used in the consumer goods sector due to its biocompatibility, chemical resistance, and excellent thermal and electrical insulation properties. The versatility of silicone rubber makes it suitable for a broad range of products from household goods to personal care items. The growing consumer goods sector, driven by rising disposable incomes and lifestyle changes, particularly in emerging markets, offers significant potential for the expansion of silicone rubber applications.

Key Players Analysis

In 2023, Wacker Chemie AG focused on enhancing its global production capacities for silicone rubber to meet the increasing market demand. The company invested over €100 million in expanding both liquid silicone rubber (LSR) and high consistency rubber (HCR) capacities. Notably, new production facilities were launched in Adrian, Michigan, and Burghausen, Germany, aimed at improving supply efficiencies, particularly in North and Central America.

Dow Shin-Etsu Chemical Co. Ltd does not have specific 2023 updates available in the provided data. However, the company is known for its significant role in the silicone rubber sector, contributing to various applications and innovations in the industry. For the latest details on their activities, it would be best to check their official resources or latest financial disclosures.

In 2023, Elkem ASA focused on enhancing its position in the silicone rubber sector by expanding its production capabilities to meet the growing demands, particularly in the healthcare market. They launched a new high-purity medical silicone production facility in York, South Carolina, which highlights their commitment to providing specialized silicone solutions for medical applications, showcasing their continuous growth in this segment.

Momentive has been actively expanding its global presence and capacity in the silicone rubber industry. In early 2023, they inaugurated a new Global Innovation Center in Pearl River, NY, aimed at driving innovation across various sectors including agriculture, paint, and beauty. Moreover, Momentive started construction of a new specialty silicones facility in Rayong, Thailand, to enhance their manufacturing capabilities and better serve the Southeast Asian market, particularly in industries like automotive, energy, healthcare, and agriculture. This expansion aligns with their strategic vision to provide innovative and sustainable silicone solutions globally.

In 2023, BRB International showcased its innovative silicone products and applications at various industry events. They presented a technical paper on ‘Optimizing Addition Cure TIM’ at the Silicone Elastomers World Summit in November, highlighting advances in silicone elastomers used in high-performance electronics. Additionally, BRB highlighted its BRB SF 1802, a low viscosity amino alkyl functional polydimethylsiloxane, at SEPAWA 2023, designed for use in car care and home care applications, demonstrating its versatility and enhanced storage stability.

CHT Group has been actively involved in the development and production of specialty chemicals, including silicone rubbers, tailored for various industrial applications. However, specific updates for 2023 or 2024 regarding CHT Group’s activities in the silicone rubber sector were not detailed in the data obtained from the search. For the latest and detailed insights, it would be best to consult direct updates from CHT Group’s resources or industry publications.

In 2023, DyStar Singapore Pte Ltd, notable for its contributions to the textile industry, did not specifically highlight new developments within the silicone rubber sector. As a company primarily focused on dyes and chemical solutions for textiles, their involvement in silicone rubber might not be prominent this year. For the most accurate and detailed information, it’s advisable to consult directly with DyStar Singapore or relevant industry publications.

Evonik Industries AG has been active in the silicone rubber market. In 2023, Evonik launched a new line of UV LED curable release coatings made from recycled materials, targeting the label industry. This innovation, known as TEGO® RC 2000 LCF, is designed to help label producers reduce their carbon footprint and energy consumption, emphasizing sustainability in production processes.

In 2023, Hoshine Silicon Industry Co. Ltd focused on expanding its presence in the silicone rubber sector by advancing its production technologies and enhancing its product range, which includes high-consistency and room-temperature vulcanizing silicone rubbers. The company continues to emphasize the importance of industrial and technological expansion in its core business areas, leveraging its position as a leading manufacturer of silicon-based materials.

Jiangsu Mingzhu Silicone Rubber Material Co. Ltd, while not having specific updates available in the provided data for 2023 or 2024, remains a notable player in the silicone rubber industry in China. The company specializes in the production of various silicone rubbers, catering to a broad range of applications across different industries. For the most current and detailed insights into their activities, it is advisable to refer directly to the company’s updates or industry reports.

In 2023, Kaneka Corporation focused on expanding its business in the silicone rubber sector. The company emphasized developing modified silicone polymers, improving profitability after overcoming previous market challenges. Significant efforts were made to increase production capacity in Belgium to meet rising global demand, driven by expanding sales to new regions and applications.

Mitsubishi Chemical Holdings Corporation also played a significant role in the silicone market, contributing to its growth alongside other major players. The company is involved in producing various silicone products used across multiple industries, highlighting its strategic importance in the sector. Both companies are integral to the silicone rubber industry’s dynamics, focusing on innovation and market expansion to meet diverse global demands.

In 2023, Momentive continued to innovate in the silicone rubber sector by expanding its product offerings and enhancing its manufacturing capabilities. The company focused on developing new formulations that improve the performance and processing capabilities of silicone rubbers, especially for high-temperature applications which are essential in industries like electronics. This innovation is part of Momentive’s broader strategy to meet increasing demand in high-growth areas such as electric vehicles and healthcare devices.

Shin-Etsu Chemical Co., Ltd. has also been proactive in the silicone rubber market, particularly in developing products tailored for the automotive industry. In 2023, they introduced a new silicone rubber, KE-5641-U, optimized as an insulation covering material for high-voltage cables in electric and hybrid vehicles. This product enhances the cable’s flexibility and reduces its weight, which is crucial for the efficient assembly and operation of modern electric vehicles. The company’s efforts are part of a broader commitment to enhancing the functionality and environmental sustainability of its products.

In 2023, Wynca Group continued to advance its position in the silicone rubber sector, showcasing a range of both solid and liquid silicone rubber products designed for various applications. The company emphasizes the production of high-quality silicone rubber that meets stringent international standards such as ISO 9001:2015 and ISO 14001:2015. Wynca’s silicone rubbers are used in diverse applications including baby products, food-grade items, and general industrial uses, demonstrating their capability in providing tailored solutions across different market segments.

Conclusion

In conclusion, while the silicone rubber market confronts various challenges, its diverse applications and ongoing innovations provide a strong foundation for continued growth and expansion across global markets.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)