Table of Contents

- Introduction

- Editor’s Choice

- History and Evolution of Smart Locks

- Smart Lock Market Overview

- Market Smart Door Lock Overview

- Smart Home Security Market Overview

- Statistics of Smart Doorbell

- Smart Lock Brands Statistics

- Smart Door Lock Sales Statistics

- Identification Methods of Smart Door Lock Statistics

- Production of Smart Lock Statistics

- Digital Door Locks Statistics

- Importance of Smart Lock Features Statistics

- Key Spending and Investments

- Key Safety Concerns and Challenges

- Consumer Perspectives of Data Privacy Regulations to Build Trust

- Organizational Perspective of Building Trust Among Customers

- Innovations and Developments in Smart Lock Statistics

- Regulations for Smart Locks

- Recent Developments

- Conclusion

- FAQs

Introduction

Smart Lock Statistics: A smart lock is an advanced electronic locking system that allows keyless entry and remote control via smartphone apps, keypads, biometric recognition, or proximity sensors.

These locks offer enhanced security through features like encryption, access logs, and customizable temporary access codes.

Many models integrate with smart home systems, providing additional automation and voice control. While offering convenience and improved security, smart locks do require regular battery maintenance and can pose privacy risks if not properly secured.

They are available in various types, including deadbolts, lever handle locks, and padlocks. Making them suitable for both residential and commercial use.

Editor’s Choice

- Today’s smart locks became prominent in the security landscape around the 1970s with the introduction of push-button electronic locks. Offer features such as remote access, real-time alerts, and user-specific access codes.

- The global smart lock market revenue is projected to reach USD 10.8 billion by 2029

- AI Smart Lock Market generated USD 3.45 billion in 2024 and is predicted to register growth from USD 4.26 billion in 2025 to about USD 28.48 billion by 2034, recording a CAGR of 23.5%

- In 2024, the global smart lock market is projected to generate significant revenue across various countries, with the United States leading at USD 1,723 million.

- The global smart door lock market revenue reached USD 10.9 billion in 2033.

- In 2022, the global smart door lock market was dominated by biometric door locks. Which accounted for the largest market share at 35%.

- In 2023, Xiaomi dominated the smart lock market in China, holding a significant market share of 23.6%.

- In 2019, fingerprint recognition dominated the smart door lock market in China, accounting for 92% of identification methods used.

History and Evolution of Smart Locks

- The evolution of smart locks over the years highlights a significant transformation in the security industry. Moving from mechanical to digital solutions that enhance both convenience and security.

- The journey began with simple mechanical locks that required physical keys and evolved through increased sophistication during the medieval period when locks became more complex to counteract picking threats.

- With the advent of the Industrial Revolution, mass production and new technologies allowed for more advanced designs. Such as the pin tumbler lock, which still influences modern security systems.

- The digital age ushered in electronic and digital locks, leveraging technologies like Bluetooth, Wi-Fi, and biometrics. Thereby eliminating the need for traditional keys and allowing locks to be more integrated with smart home systems.

- Today’s smart locks became prominent in the security landscape around the 1970s with the introduction of push-button electronic locks. Offer features such as remote access, real-time alerts, and user-specific access codes.

- These locks not only provide enhanced security by allowing owners to track access but also integrate seamlessly with other smart home devices. Making them a central component of modern home security systems

- As we look to the future, the potential for further innovation in smart lock technology is vast. With possibilities including blockchain-based and AI-powered locks that promise even greater security and convenience.

(Sources: Itechfy, Lockorunlock)

Smart Lock Market Overview

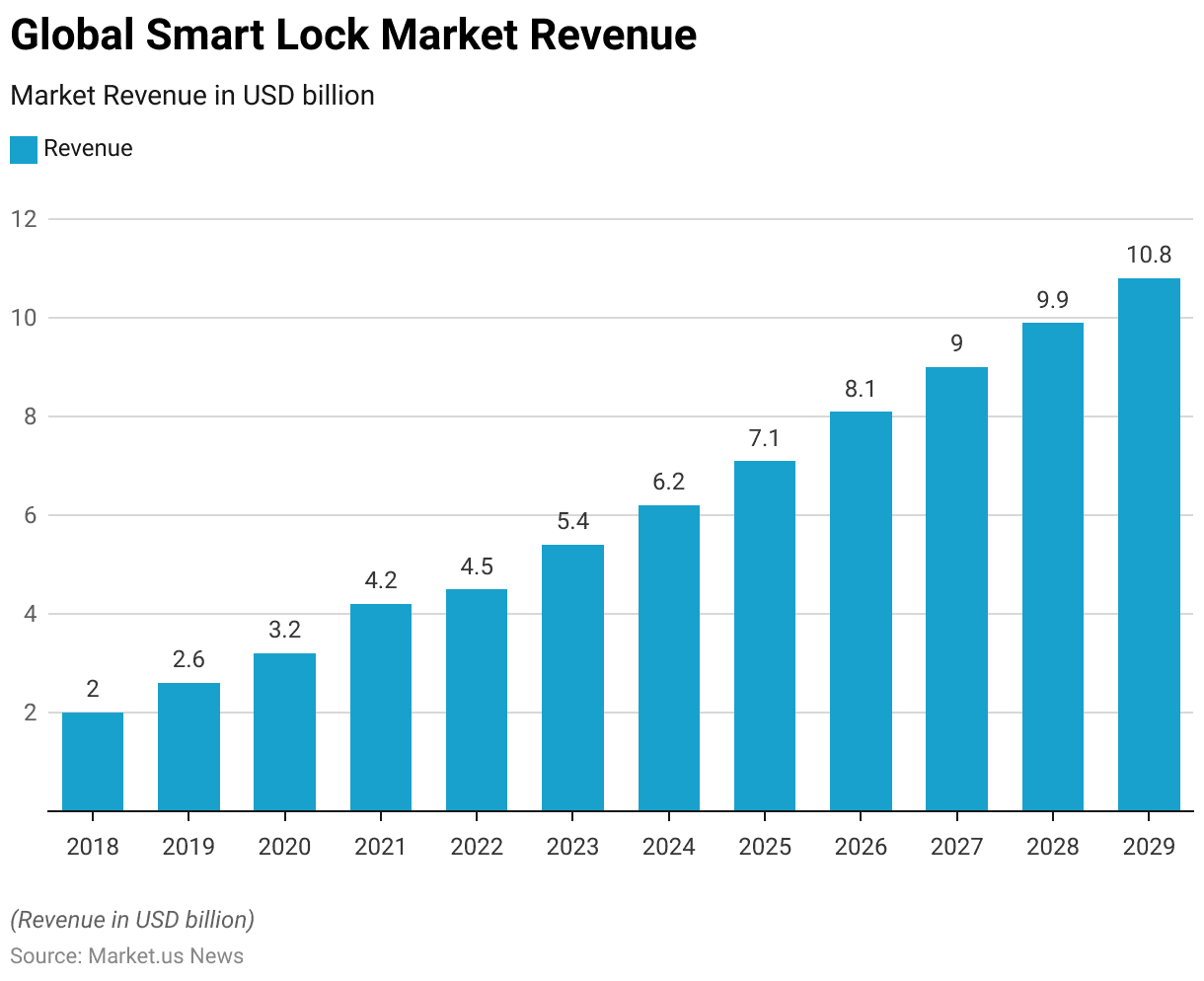

Global Smart Lock Market Revenue Statistics

- The global smart lock market has demonstrated significant growth over the past years and is poised for continued expansion at a CAGR of 11.69%.

- In 2018, the market revenue was valued at USD 2.0 billion. Increasing to USD 2.6 billion in 2019 and USD 3.2 billion in 2020.

- This upward trend persisted, with revenues reaching USD 4.2 billion in 2021 and USD 4.5 billion in 2022.

- The market continued its growth trajectory, with a valuation of USD 5.4 billion in 2023.

- Projections indicate further expansion, with the market expected to reach USD 6.2 billion in 2024, USD 7.1 billion in 2025, and USD 8.1 billion in 2026.

- By 2027, the market is forecasted to grow to USD 9.0 billion. Followed by USD 9.9 billion in 2028, culminating in a revenue of USD 10.8 billion by 2029.

- This sustained growth underscores the increasing demand for smart lock technologies. Driven by advancements in security systems and the rising adoption of IoT-enabled devices.

(Source: Statista)

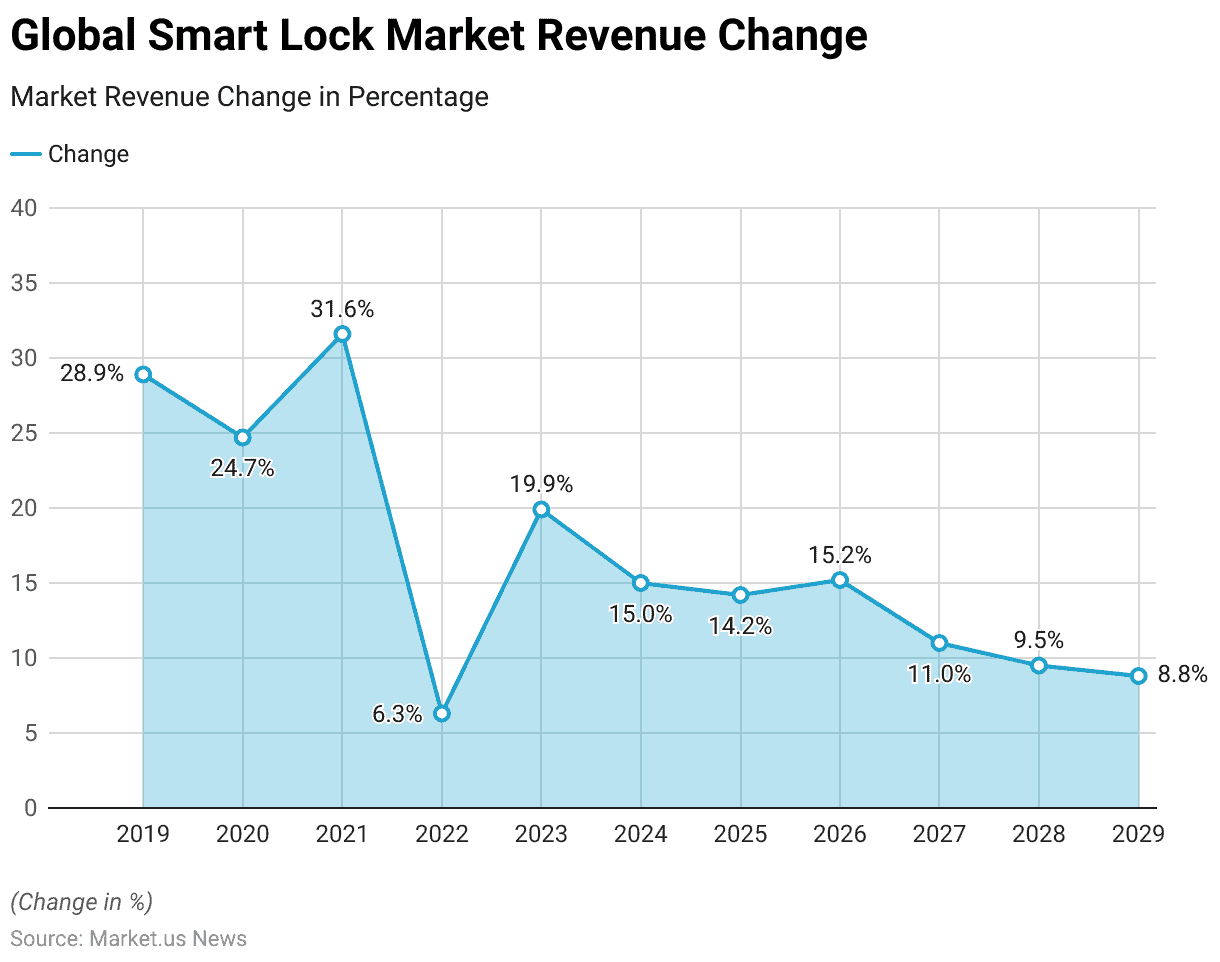

Global Smart Lock Market Revenue Change Statistics

- The global smart lock market has experienced varying growth rates over the years, highlighting its dynamic nature.

- In 2019, the market saw a significant increase of 28.9%, followed by a growth of 24.7% in 2020.

- The highest growth rate during this period was recorded in 2021, at 31.6%.

- However, growth slowed considerably in 2022, with a modest increase of 6.3%.

- In 2023, the market regained momentum, expanding by 19.9%.

- The growth rates for the subsequent years are projected to stabilize, with increases of 15.0% in 2024, 14.2% in 2025, and 15.2% in 2026.

- From 2027 onwards, a gradual deceleration in growth is anticipated, with rates of 11.0% in 2027, 9.5% in 2028, and 8.8% in 2029.

- These trends reflect the market’s maturation and the sustained yet moderated demand for smart lock technologies.

(Source: Statista)

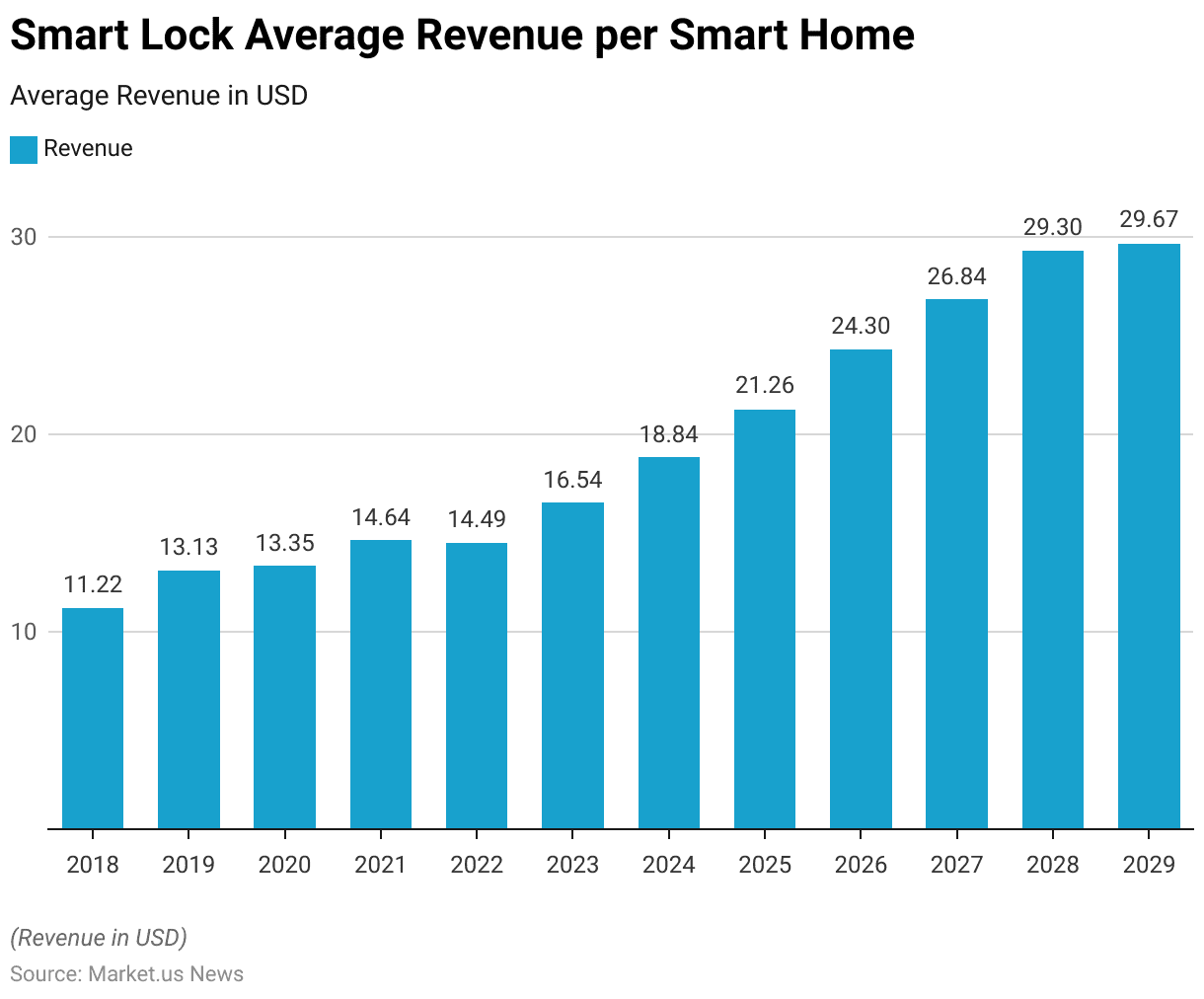

Smart Lock Average Revenue per Smart Home Statistics

- The average revenue generated per smart home from smart locks has shown a steady upward trend over the years.

- In 2018, the average revenue per smart home was USD 11.22. Which increased to USD 13.13 in 2019 and USD 13.35 in 2020.

- By 2021, this figure rose to USD 14.64, though a slight decrease to USD 14.49 was observed in 2022.

- The growth regained pace in 2023, with an average revenue of USD 16.54 per smart home.

- Projections indicate a continued increase, with revenues reaching USD 18.84 in 2024, USD 21.26 in 2025, and USD 24.30 in 2026.

- This growth trajectory is expected to persist, with average revenues per smart home projected to rise to USD 26.84 in 2027, USD 29.30 in 2028, and USD 29.67 in 2029.

- This consistent growth underscores the increasing integration of smart lock technology within smart home ecosystems. Driven by advancements in technology and rising consumer adoption.

(Source: Statista)

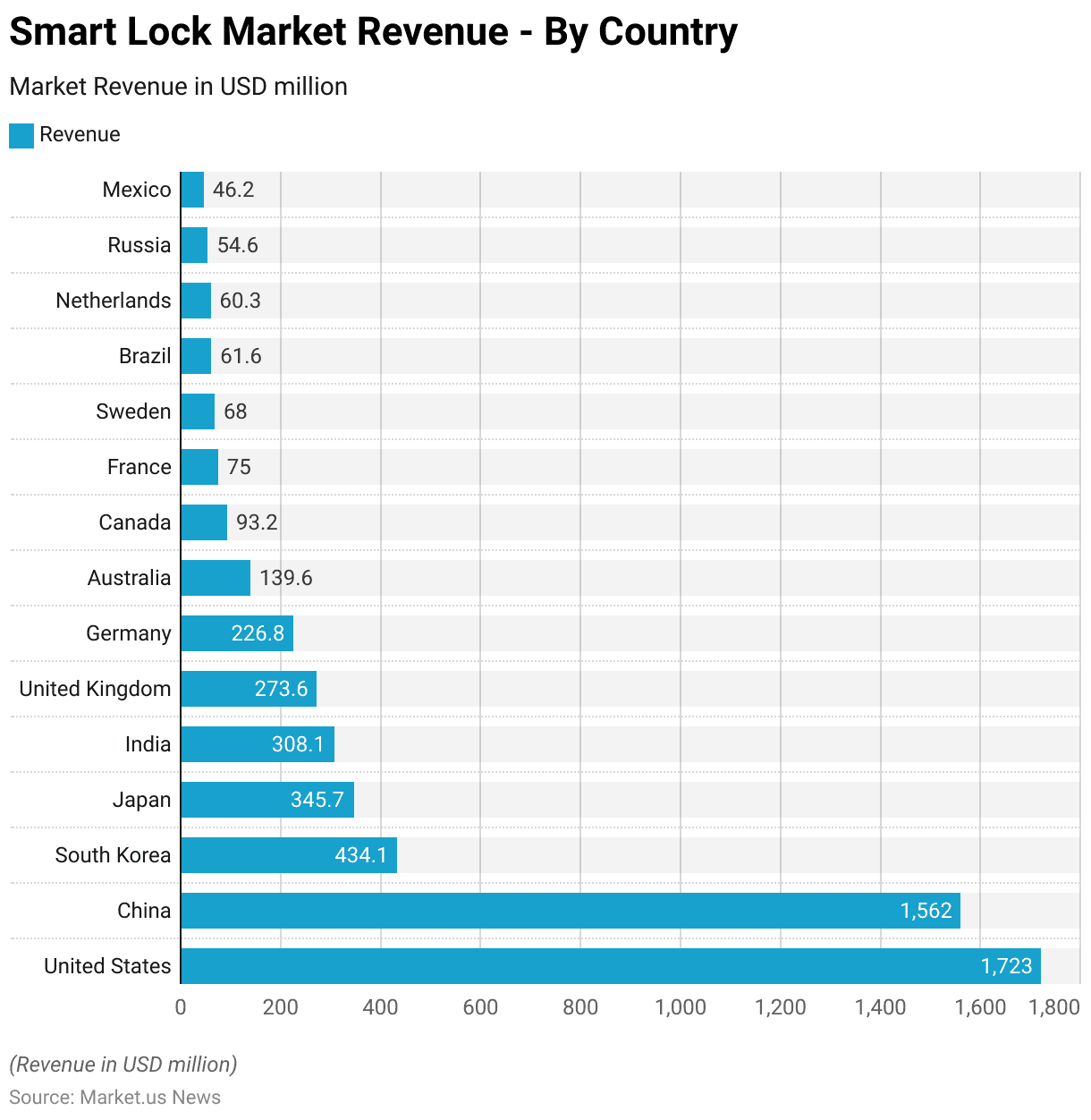

Smart Lock Market Revenue – By Country Statistics

- In 2024, the global smart lock market is projected to generate significant revenue across various countries, with the United States leading at USD 1,723 million, followed by China at USD 1,562 million.

- South Korea is expected to rank third, contributing USD 434.1 million. While Japan and India follow with revenues of USD 345.7 million and USD 308.1 million, respectively.

- The United Kingdom and Germany are also notable contributors, with revenues of USD 273.6 million and USD 226.8 million, respectively.

- Other key markets include Australia (USD 139.6 million), Canada (USD 93.2 million), and France (USD 75.0 million).

- Sweden (USD 68.0 million), Brazil (USD 61.6 million), the Netherlands (USD 60.3 million), Russia (USD 54.6 million), and Mexico (USD 46.2 million) also demonstrate steady market performance.

- These figures reflect the widespread adoption of smart lock technologies across both developed and emerging markets.

(Source: Statista)

Market Smart Door Lock Overview

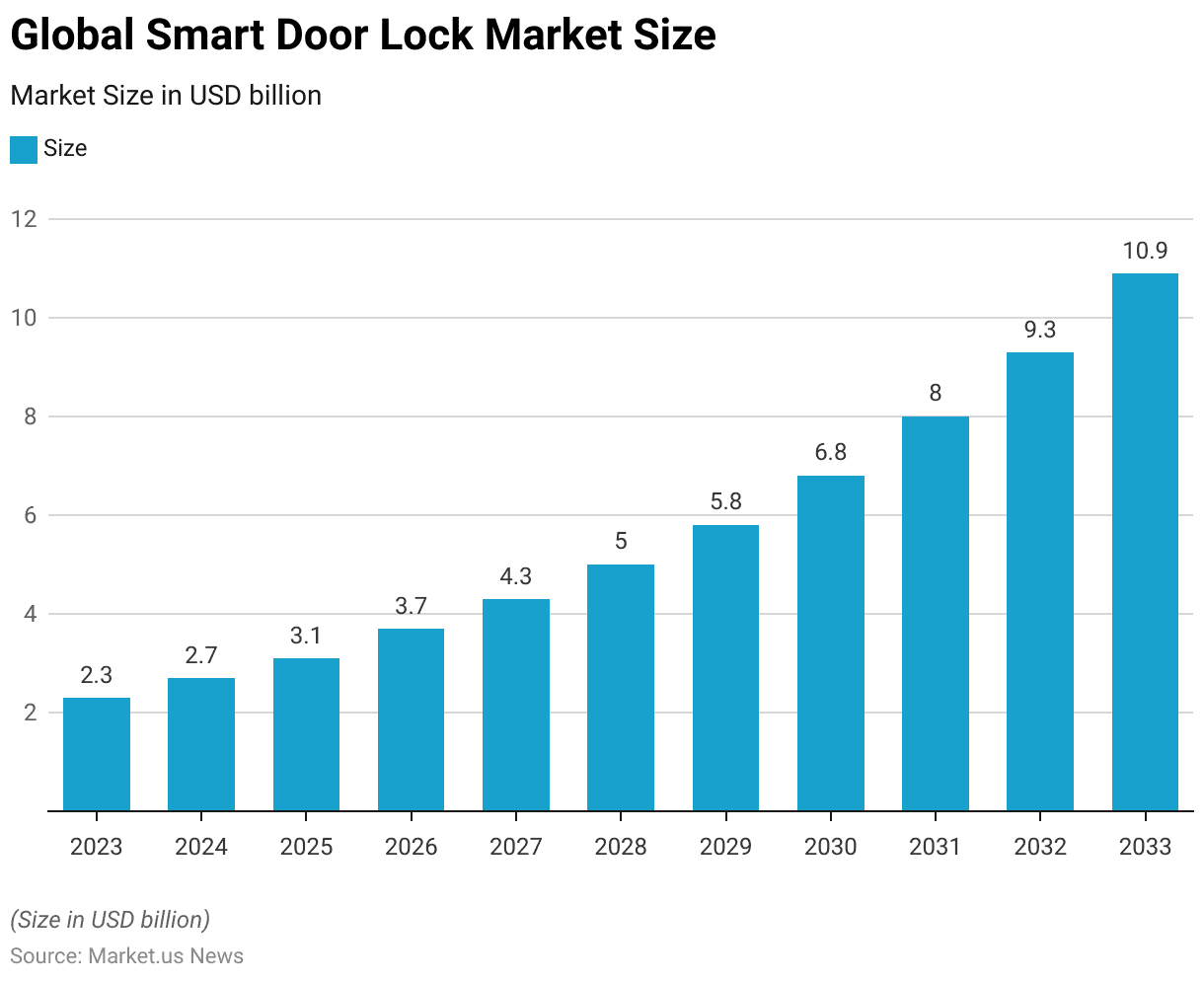

Global Smart Door Lock Market Size Statistics

- The global smart door lock market is expected to exhibit consistent growth over the next decade at a CAGR of 16.8%.

- In 2023, the market size was estimated at USD 2.3 billion, with projections indicating an increase to USD 2.7 billion in 2024 and USD 3.1 billion in 2025.

- By 2026, the market is anticipated to reach USD 3.7 billion, followed by USD 4.3 billion in 2027 and USD 5.0 billion in 2028.

- The upward trend is expected to continue, with the market size projected to grow to USD 5.8 billion in 2029, USD 6.8 billion in 2030, and USD 8.0 billion in 2031.

- Further growth is forecasted, with the market reaching USD 9.3 billion in 2032 and USD 10.9 billion in 2033.

- This sustained expansion underscores the increasing adoption of smart door lock technology. Driven by advancements in home automation and heightened security concerns.

(Source: market.us)

Smart Door Lock Market Size – By Type Statistics

- The global smart door lock market is segmented by lock type, with steady growth anticipated across all categories through 2033.

- In 2023, the market was valued at USD 2.3 billion, with deadbolts accounting for USD 0.62 billion. Lever handles for USD 0.51 billion, and padlocks for USD 0.35 billion.

- Server locks & latches, knob locks, and other types contributed USD 0.25 billion, USD 0.18 billion, and USD 0.39 billion, respectively.

- By 2024, the total market is projected to rise to USD 2.7 billion, with similar growth across categories.

- Deadbolts are expected to lead, reaching USD 2.94 billion by 2033. Followed by lever handles at USD 2.40 billion and padlocks at USD 1.64 billion.

- Other segments, including server locks & latches (USD 1.20 billion), knob locks (USD 0.87 billion), and miscellaneous types (USD 1.85 billion), are also set to expand significantly.

- This growth reflects rising demand for diverse smart lock solutions driven by technological advancements and heightened security needs.

(Source: market.us)

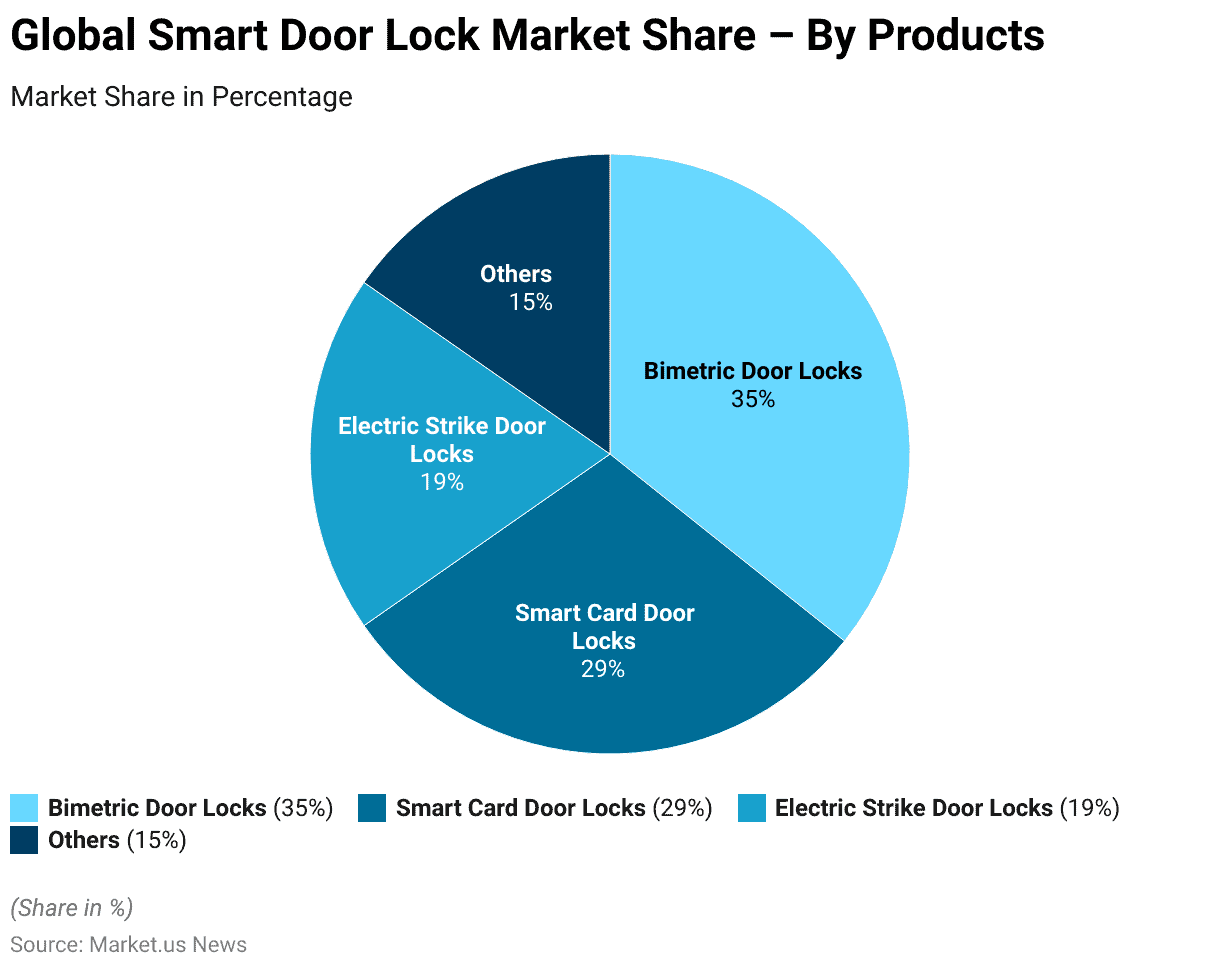

Global Smart Door Lock Market Share – By Product

- In 2022, the global smart door lock market was dominated by biometric door locks. Which accounted for the largest market share at 35%.

- Smart card door locks followed closely, capturing 29% of the market. Highlighting their widespread adoption due to convenience and security features.

- Electric strike door locks held a 19% share, reflecting their continued use in specific applications requiring secure and controlled access.

- The remaining 15% of the market was attributed to other types of smart door locks, including keypads and hybrid systems. Underscoring the diversity of solutions available to meet varying consumer and business needs.

- This distribution showcases the increasing preference for advanced, technology-driven security solutions in both residential and commercial sectors.

(Source: market.us)

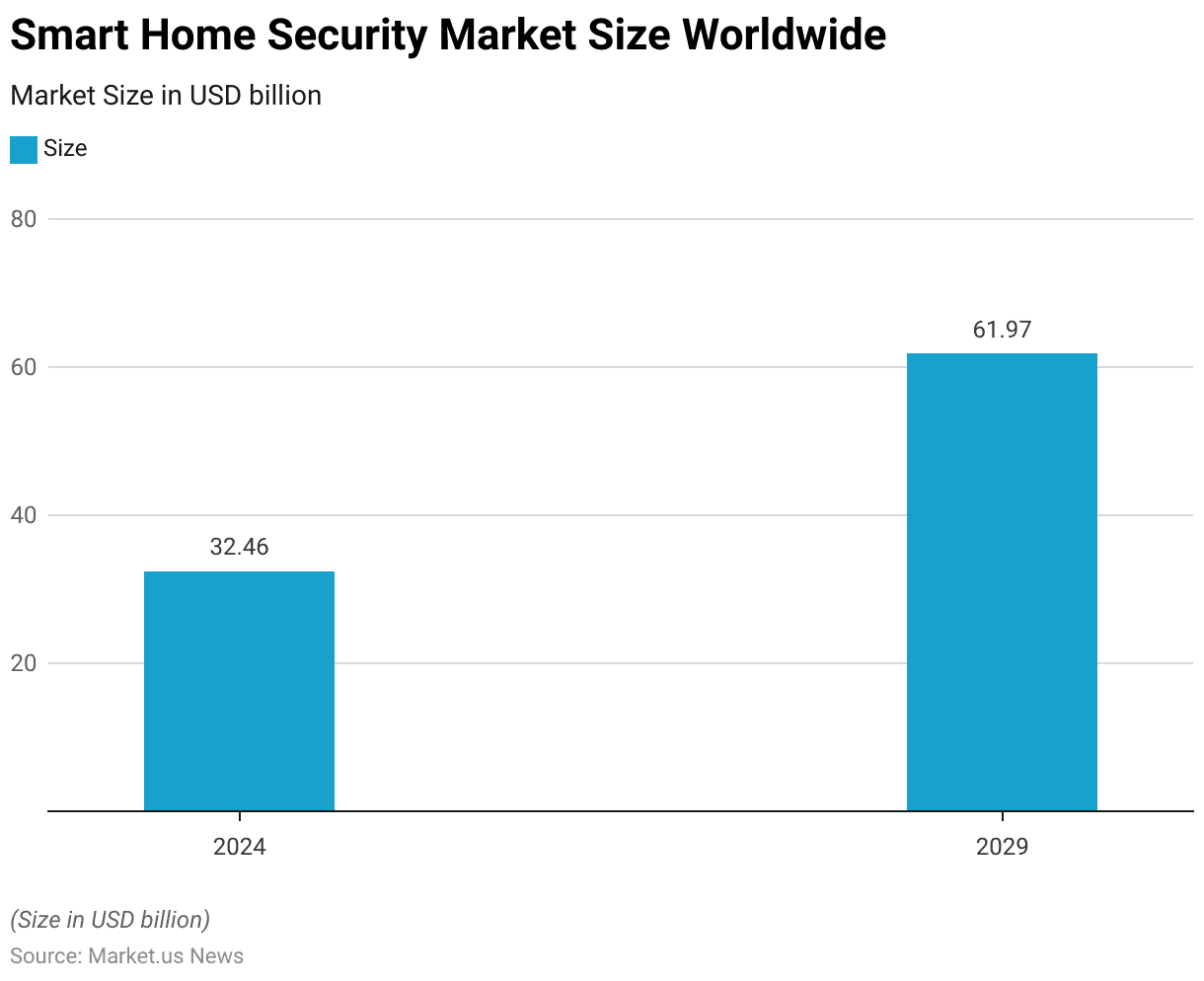

Smart Home Security Market Overview

Worldwide Smart Home Security Market Size

- The global smart home security market is projected to experience substantial growth between 2024 and 2029.

- In 2024, the market size is expected to reach USD 32.46 billion. Driven by increasing consumer demand for integrated security solutions and advancements in IoT technology.

- By 2029, the market is forecasted to nearly double, reaching USD 61.97 billion.

- This significant growth reflects the rising adoption of smart home security systems, including surveillance cameras, smart locks, and motion detectors. Consumers prioritize safety and convenience in their homes.

(Source: Statista)

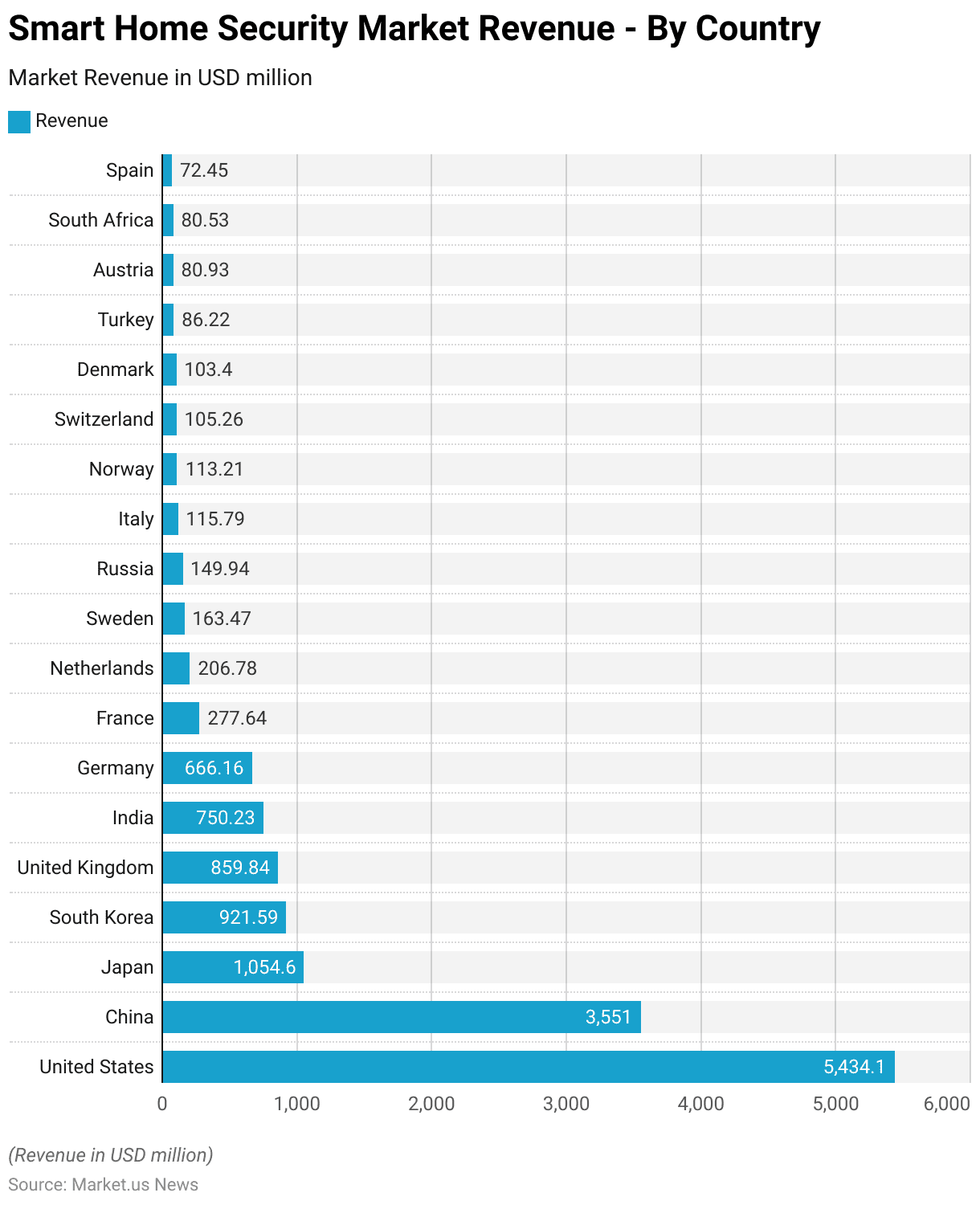

Smart Home Security Market Revenue – By Country

- In 2022, the global smart home security market generated significant revenue across various countries, with the United States leading at USD 5,434.1 million.

- China followed with USD 3,551 million, while Japan ranked third with USD 1,054.6 million.

- South Korea and the United Kingdom contributed USD 921.59 million and USD 859.84 million, respectively.

- India also emerged as a key market with USD 750.23 million in revenue, followed by Germany at USD 666.16 million.

- Other notable contributors included France (USD 277.64 million), the Netherlands (USD 206.78 million), Sweden (USD 163.47 million), and Russia (USD 149.94 million).

- Italy, Norway, Switzerland, and Denmark generated USD 115.79 million, USD 113.21 million, USD 105.26 million, and USD 103.4 million, respectively.

- Additionally, Turkey (USD 86.22 million), Austria (USD 80.93 million), South Africa (USD 80.53 million), and Spain (USD 72.45 million) demonstrated steady market performance.

- This data highlights the widespread adoption of smart home security solutions globally. Driven by advancements in technology and increasing consumer demand for enhanced home security.

(Source: Statista)

Statistics of Smart Doorbell

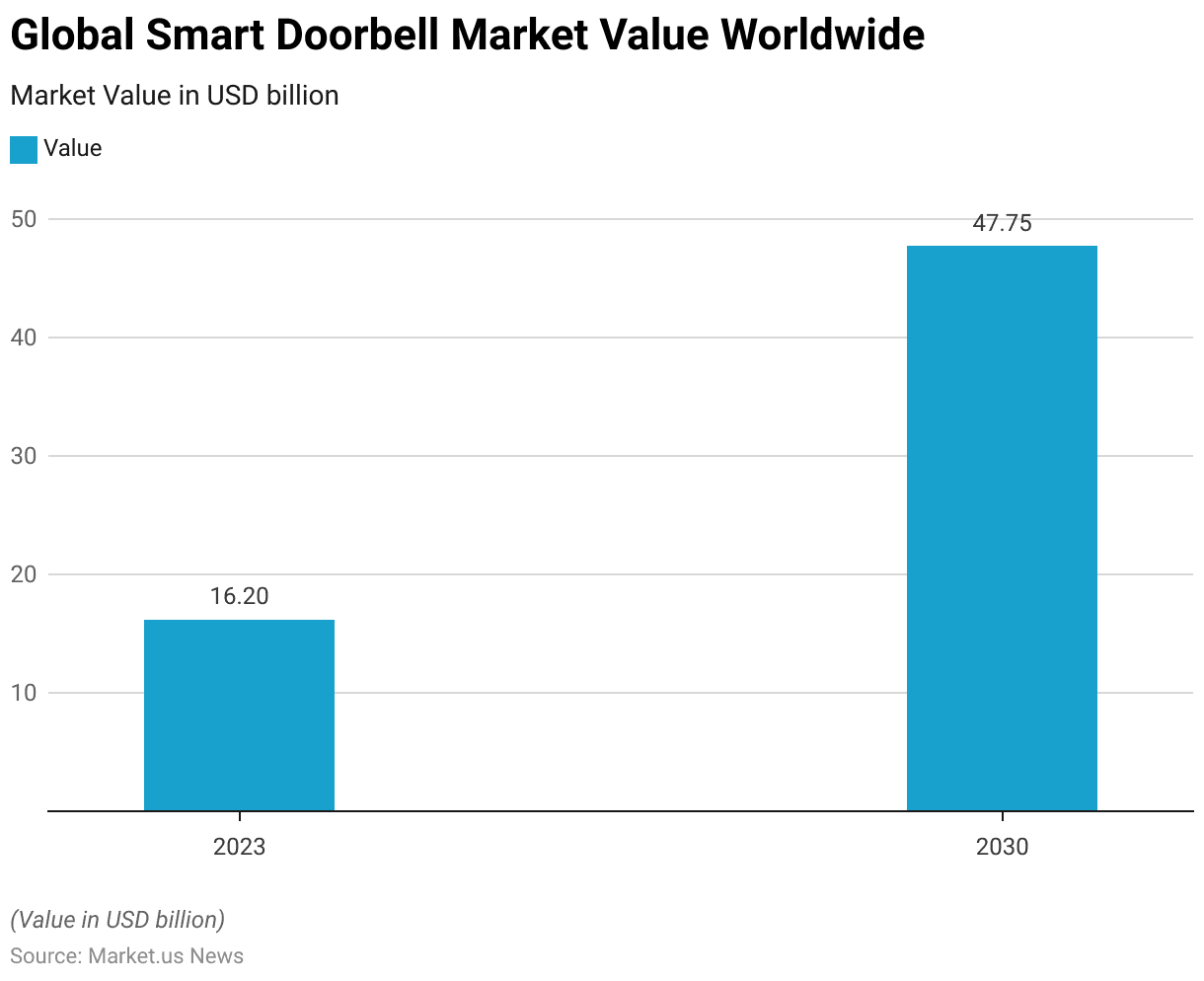

Global Smart Doorbell Market Value Worldwide

- The global smart doorbell market is projected to witness substantial growth from 2023 to 2030.

- In 2023, the market value is estimated at USD 16.2 billion, reflecting the increasing adoption of smart home technologies and the growing demand for enhanced home security solutions.

- By 2030, the market is forecasted to reach USD 47.75 billion, nearly tripling in size.

- This growth underscores the rising consumer preference for connected devices that offer convenience, real-time monitoring, and advanced security features.

- The market expansion is expected to be driven by technological advancements, increased internet penetration, and a growing awareness of smart home benefits.

(Source: Statista)

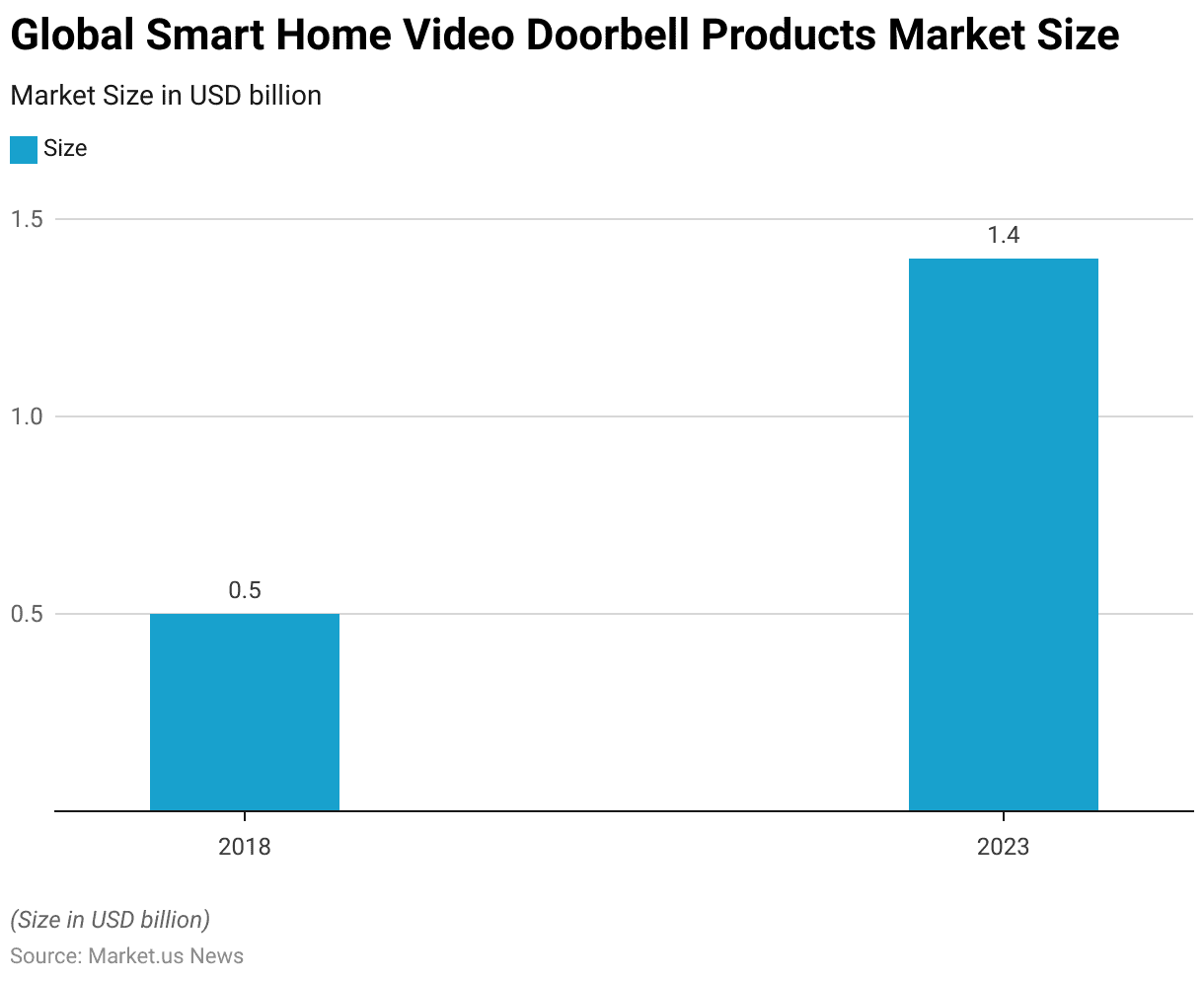

Smart Home Video Doorbell Products Market Size

- The global market for smart home video doorbell products has experienced significant growth from 2018 to 2023.

- In 2018, the market was valued at USD 0.5 billion, reflecting the early stages of adoption as consumers began integrating smart technologies into their homes.

- By 2023, the market size is projected to reach USD 1.4 billion, nearly tripling over five years.

- This growth highlights the increasing demand for enhanced home security solutions and the rising popularity of smart home ecosystems, driven by technological advancements and greater consumer awareness of connected devices’ benefits.

(Source: Statista)

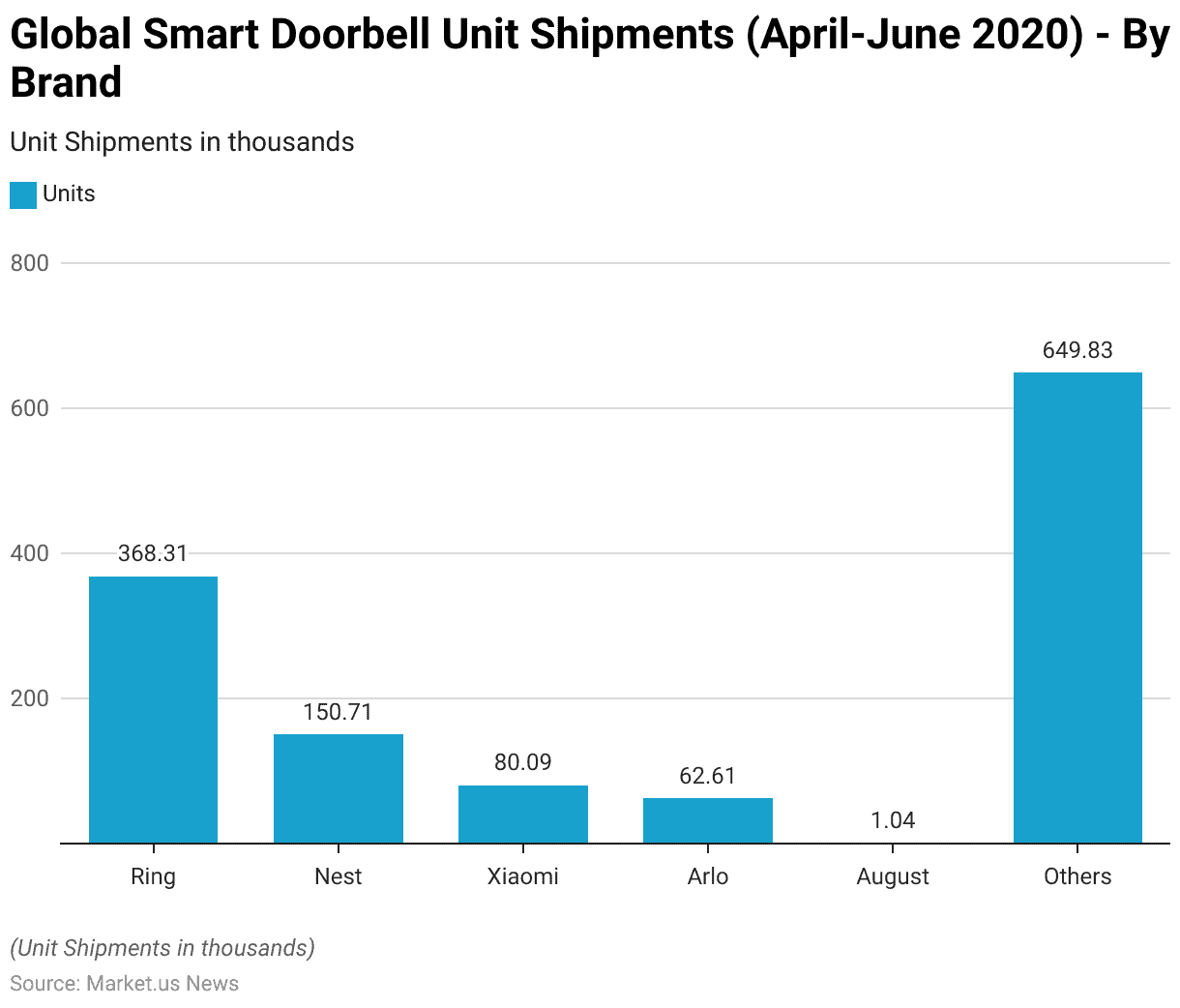

Global Smart Doorbell Shipments – By Brand

- From April to June 2020, the global smart doorbell market saw significant unit shipments across various brands.

- Ring led the market with 368.31 thousand units shipped, followed by Nest with 150.71 thousand units.

- Xiaomi shipped 80.09 thousand units, while Arlo recorded 62.61 thousand units.

- August had a smaller presence, with 1.04 thousand units shipped.

- Collectively, other brands accounted for a substantial share, shipping 649.83 thousand units.

- These figures highlight the competitive landscape and the broad consumer adoption of smart doorbell technologies during this period.

(Source: Statista)

Smart Lock Brands Statistics

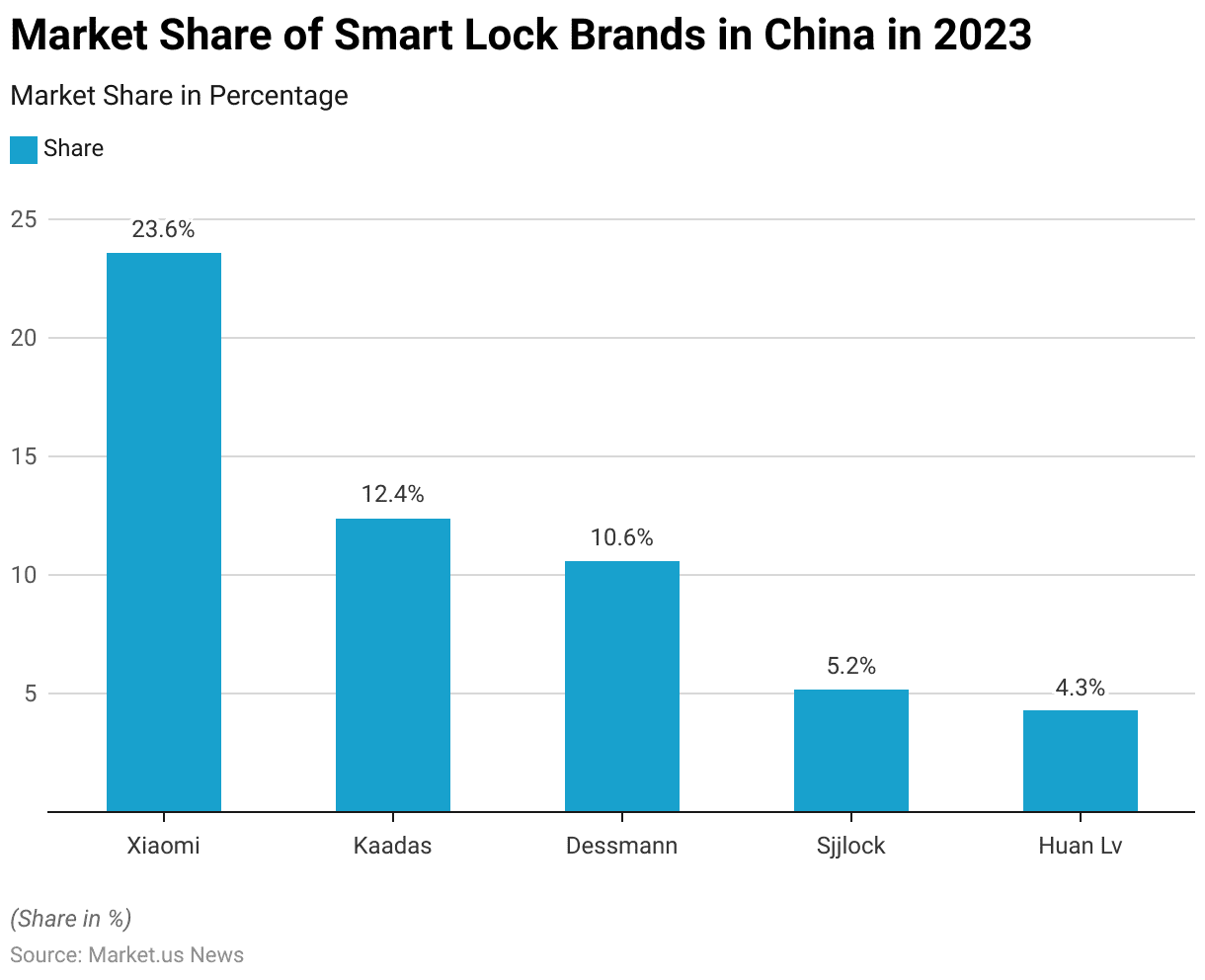

Market Share of Smart Lock Brands Statistics

- In 2023, Xiaomi dominated the smart lock market in China, holding a significant market share of 23.6%.

- Kaadas ranked second with a 12.4% share, followed by Dessmann, which accounted for 10.6% of the market.

- Sjjlock and Huan Lv held smaller shares at 5.2% and 4.3%, respectively.

- These figures underscore the competitive nature of the smart lock industry in China, with Xiaomi maintaining a strong lead due to its broad product portfolio and technological innovations.

(Source: Statista)

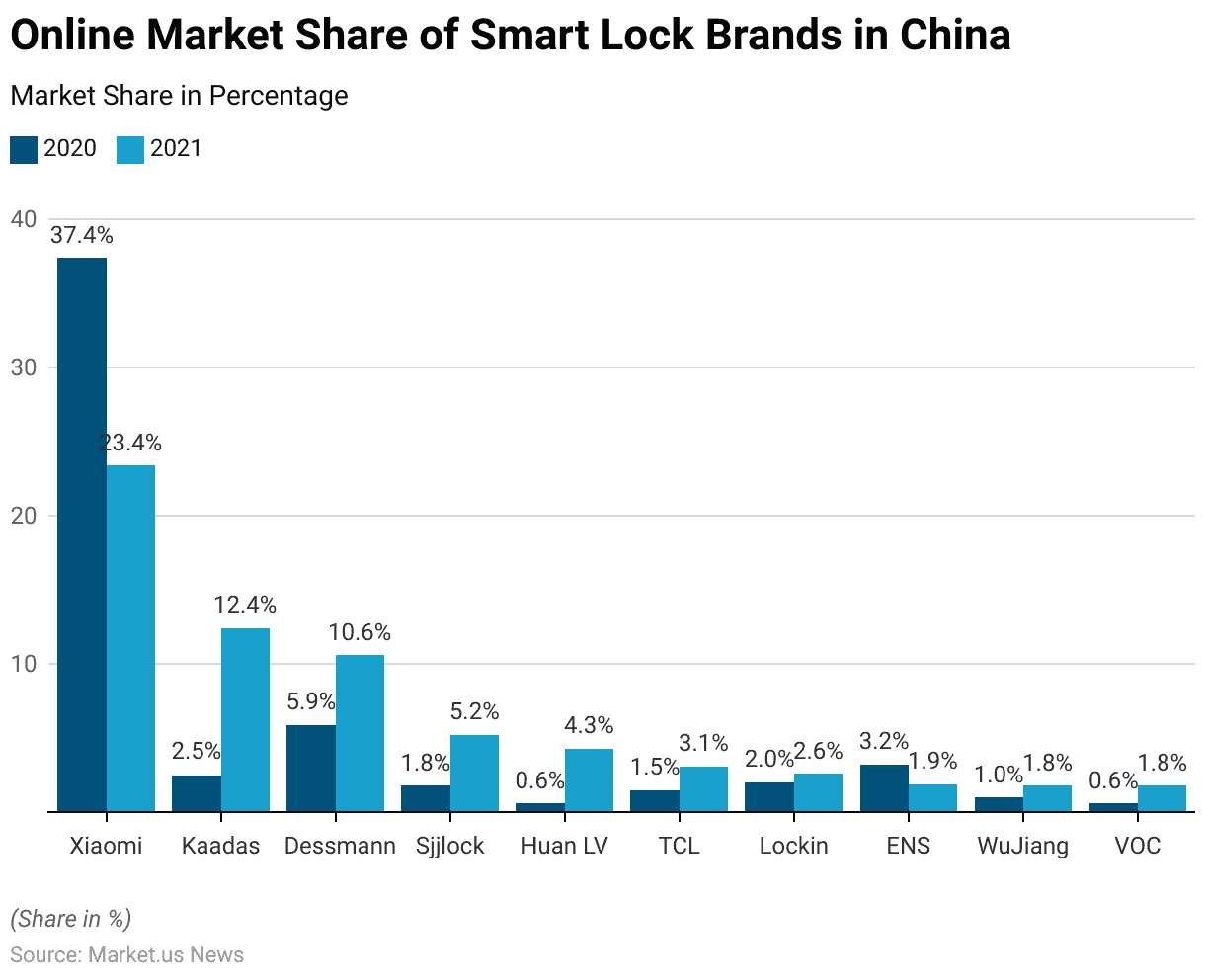

Online Market Share of Smart Lock Brands Statistics

- Between 2020 and 2021, the online market share of smart lock brands in China experienced notable shifts.

- Xiaomi maintained its leadership position but saw its market share drop significantly from 37.4% in 2020 to 23.4% in 2021.

- Meanwhile, Kaadas showed remarkable growth, increasing its share from 2.5% to 12.4%.

- Dessmann also expanded its presence, growing from 5.9% to 10.6%.

- Sjjlock’s share rose from 1.8% to 5.2%, while Huan LV increased from 0.6% to 4.3%.

- TCL saw moderate growth, moving from 1.5% to 3.1%.

- Lockin’s share grew slightly from 2% to 2.6%, while ENS experienced a decline from 3.2% to 1.9%.

- WuJiang and VOC both increased their shares from 1% and 0.6% in 2020 to 1.8% in 2021.

- These changes reflect a competitive and evolving market, with emerging brands gaining traction and established players adjusting to market dynamics.

(Source: Statista)

Smart Door Lock Sales Statistics

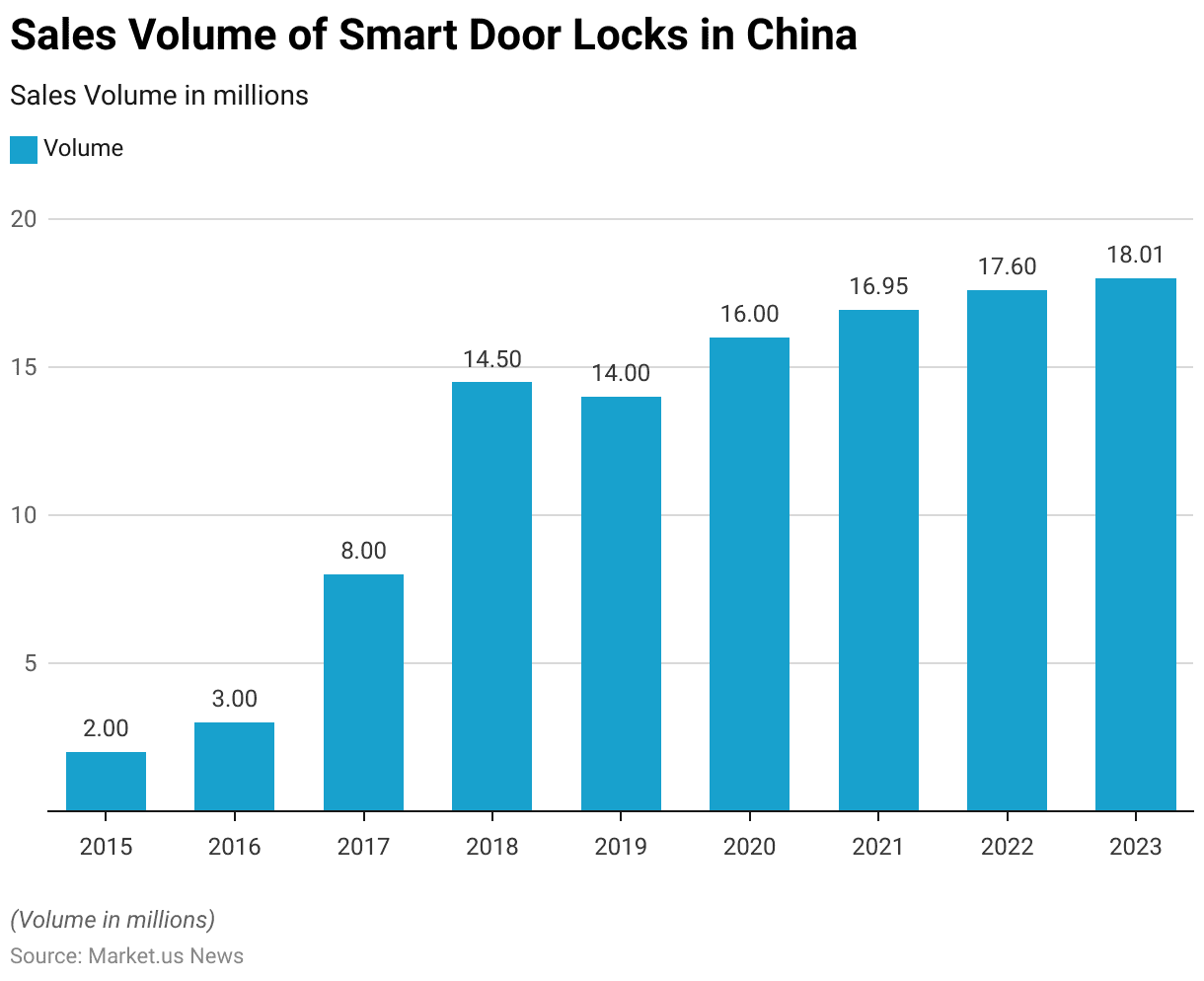

Sales Volume of Smart Door Locks in China

- The sales volume of smart door locks in China has demonstrated significant growth from 2015 to 2023.

- In 2015, sales were relatively modest at 2 million units, increasing to 3 million in 2016.

- By 2017, sales had more than doubled, reaching 8 million units.

- This growth accelerated in 2018, with sales surging to 14.5 million units.

- In 2019, the market slightly stabilized with 14 million units sold, followed by a further increase to 16 million units in 2020.

- The upward trend continued, with sales reaching 16.95 million units in 2021, 17.6 million in 2022, and an estimated 18.01 million units in 2023.

- These figures reflect the rising adoption of smart door lock technology in China, driven by advancements in smart home integration and increasing consumer demand for enhanced security solutions.

(Source: Statista)

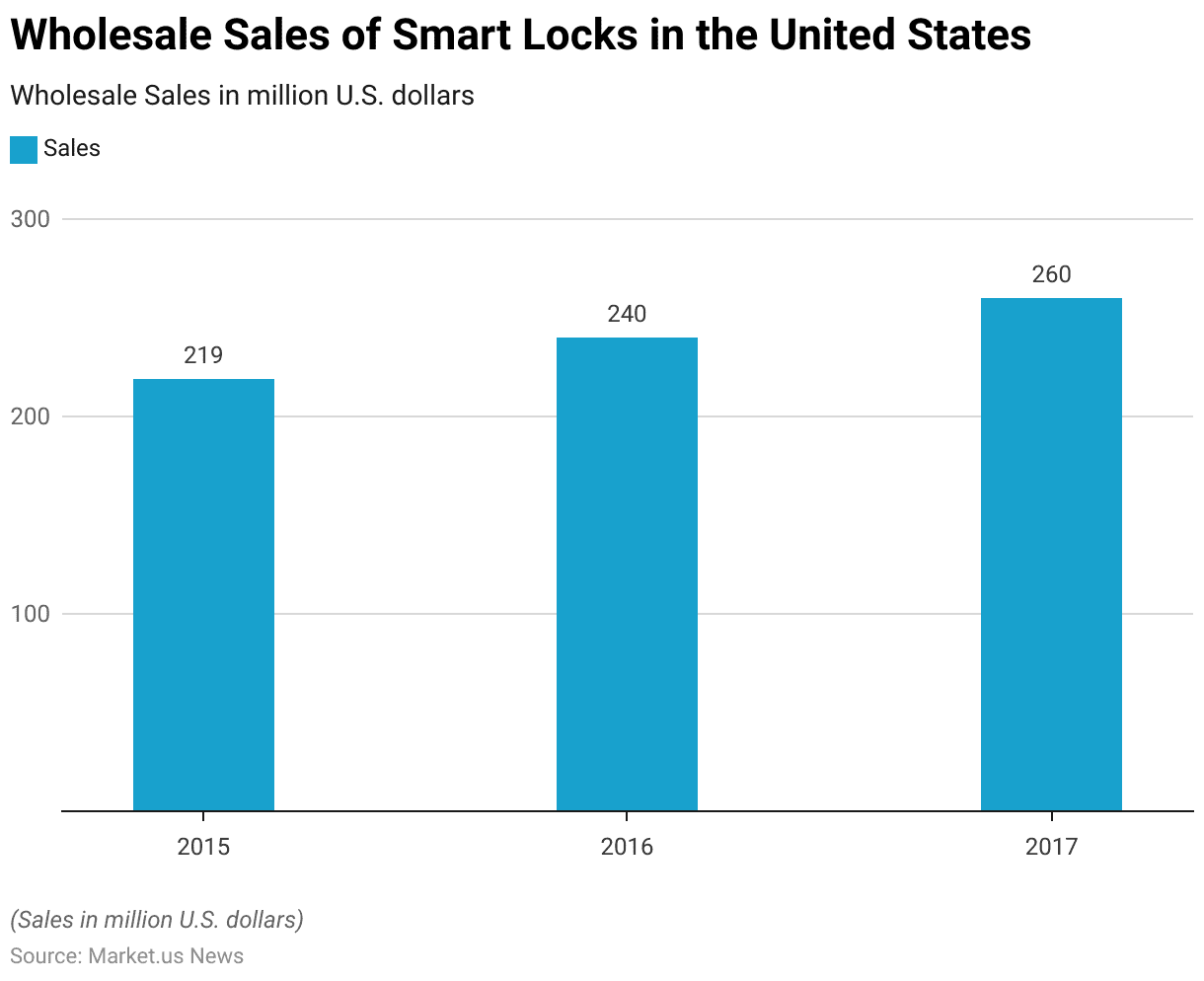

Wholesale Sales of Smart Lock in the United States Statistics

- From 2015 to 2017, wholesale sales of smart locks in the United States experienced steady growth.

- In 2015, sales were valued at USD 219 million, increasing to USD 240 million in 2016.

- By 2017, wholesale sales had reached USD 260 million, reflecting a consistent rise in demand for smart lock technology.

- This growth highlights the increasing adoption of smart security solutions in both residential and commercial markets during this period.

(Source: Statista)

Identification Methods of Smart Door Lock Statistics

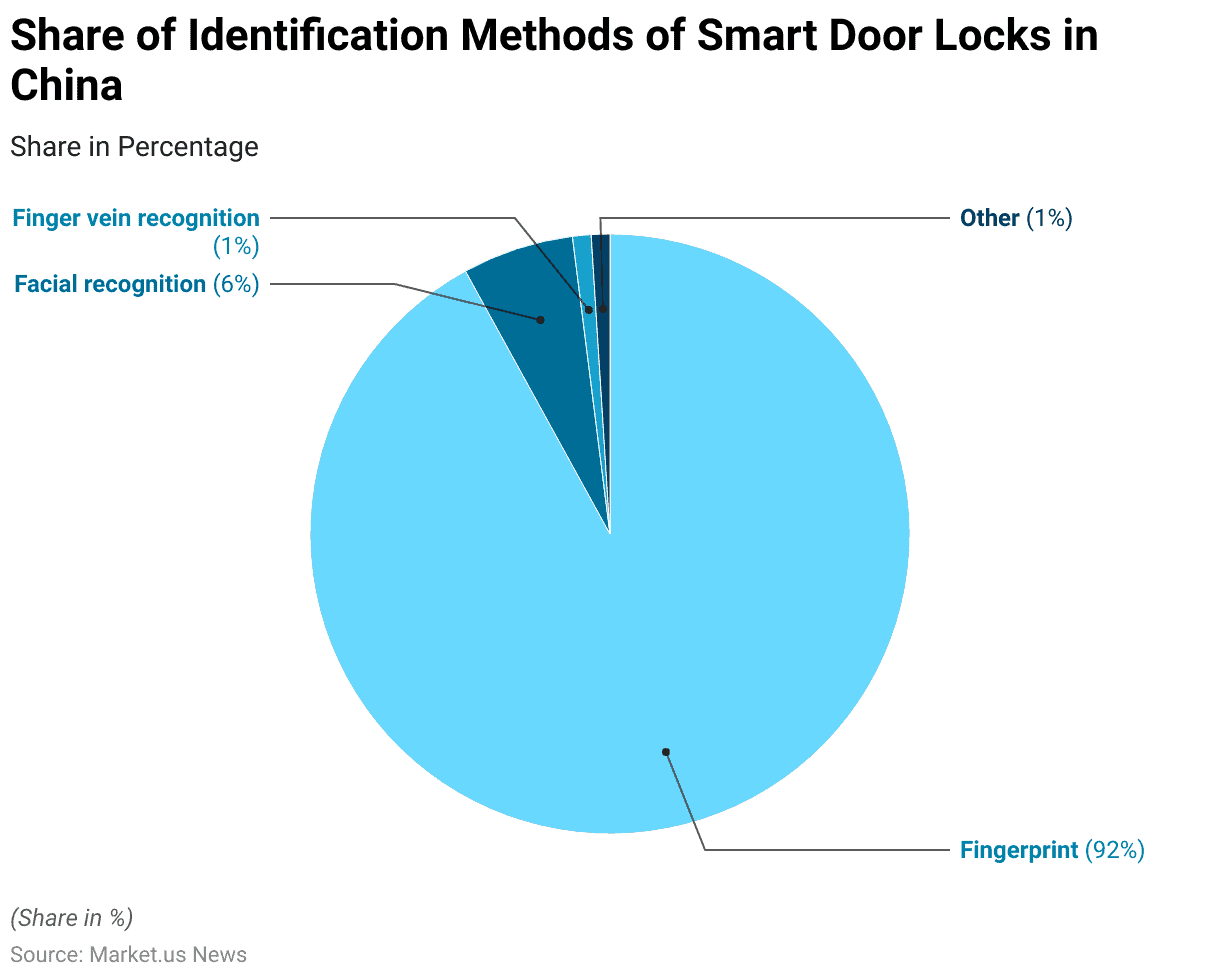

- In 2019, fingerprint recognition dominated the smart door lock market in China, accounting for 92% of identification methods used.

- Facial recognition technology held a much smaller share at 6%, while finger vein recognition and other methods each accounted for just 1%.

- This distribution highlights the widespread adoption and reliability of fingerprint recognition as the preferred authentication method in smart door locks, with other technologies still in their early stages of market penetration.

(Source: Statista)

Production of Smart Lock Statistics

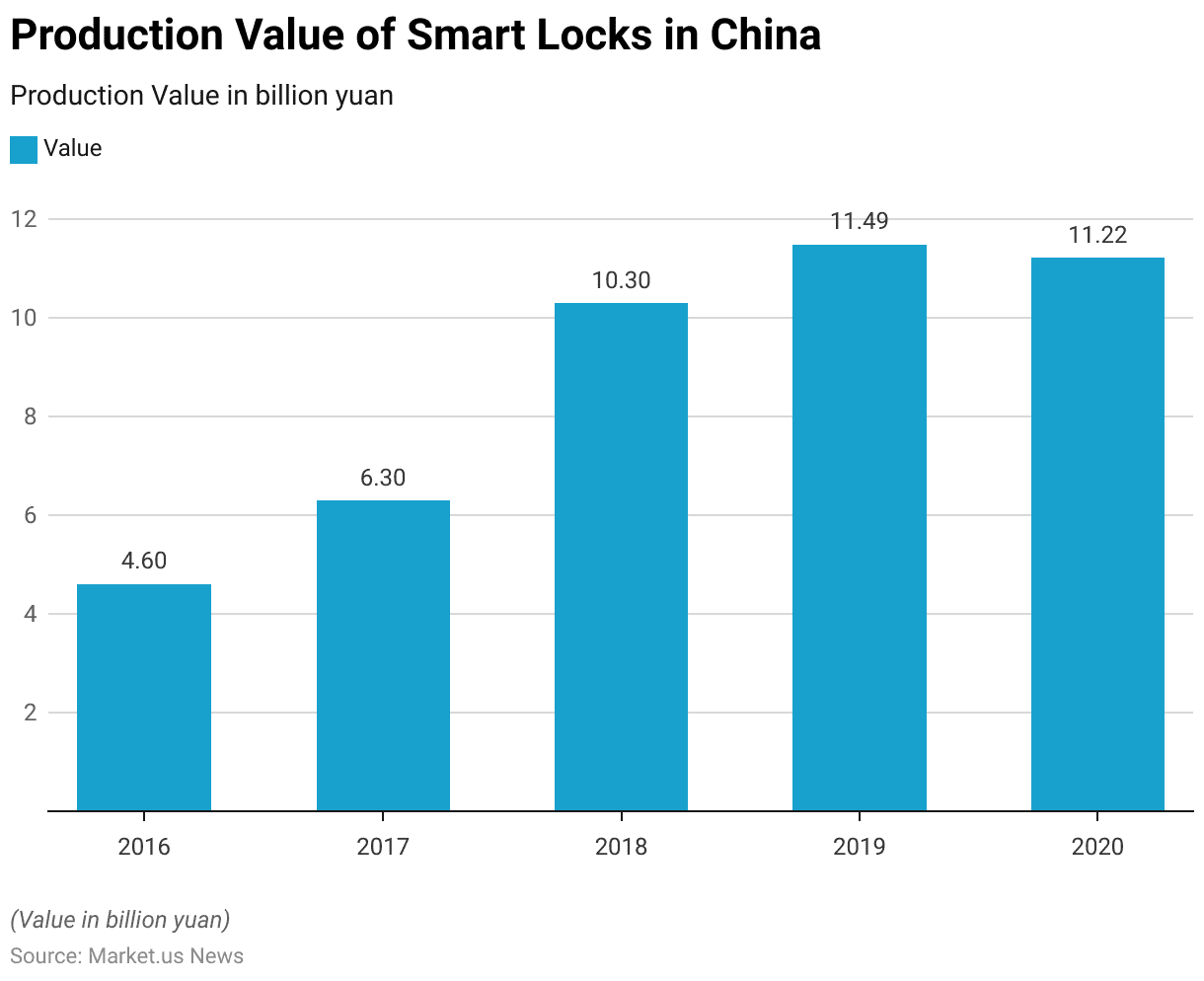

- From 2016 to 2020, the production value of smart locks in China experienced significant growth, reflecting the increasing demand for advanced security solutions.

- In 2016, the output value stood at 4.6 billion yuan, rising to 6.3 billion yuan in 2017.

- This upward trend continued, with production value reaching 10.3 billion yuan in 2018 and further increasing to 11.49 billion yuan in 2019.

- However, in 2020, the market saw a slight decline, with the output value decreasing marginally to 11.22 billion yuan.

- Despite this dip, the overall growth during this period underscores the expanding adoption of smart lock technologies in the Chinese market.

(Source: Statista)

Digital Door Locks Statistics

Production of Digital Door Locks

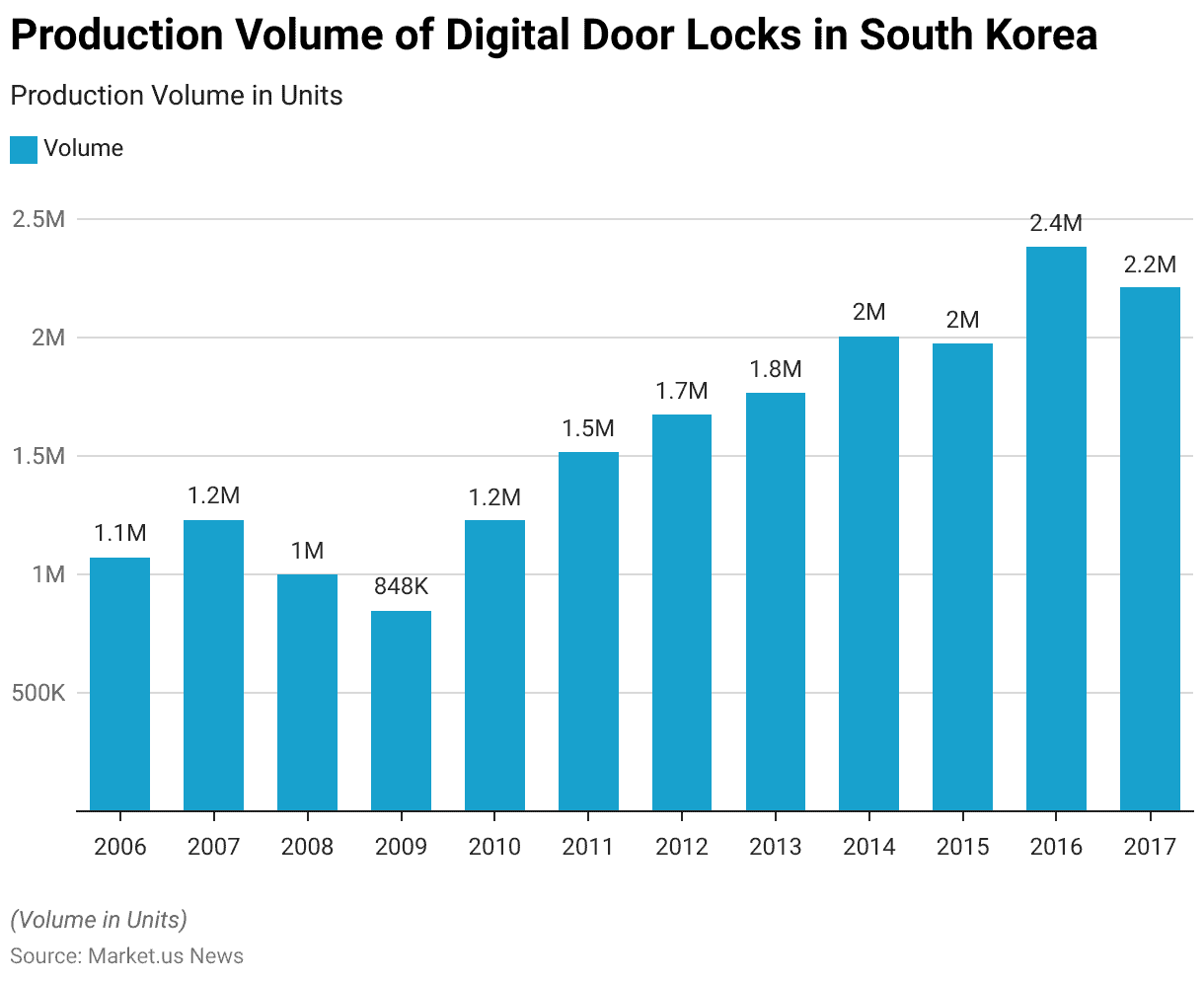

- The production volume of digital door locks in South Korea showed a fluctuating yet generally upward trend between 2006 and 2017.

- In 2006, production stood at 1,074,303 units, increasing to 1,232,406 units in 2007.

- However, production dipped to 1,001,262 units in 2008 and further declined to 848,015 units in 2009.

- A rebound occurred in 2010, with production reaching 1,229,029 units.

- This upward momentum continued, with 1,519,619 units in 2011 and 1,675,215 units in 2012.

- By 2013, production had risen to 1,769,532 units, and in 2014, it surpassed the 2-million mark at 2,006,892 units.

- Production peaked in 2016 at 2,383,597 units before slightly declining to 2,213,269 units in 2017.

- This data reflects the increasing demand for digital door locks in South Korea, driven by advancements in security technology and growing consumer adoption.

(Source: Statista)

Import of Digital Door Locks

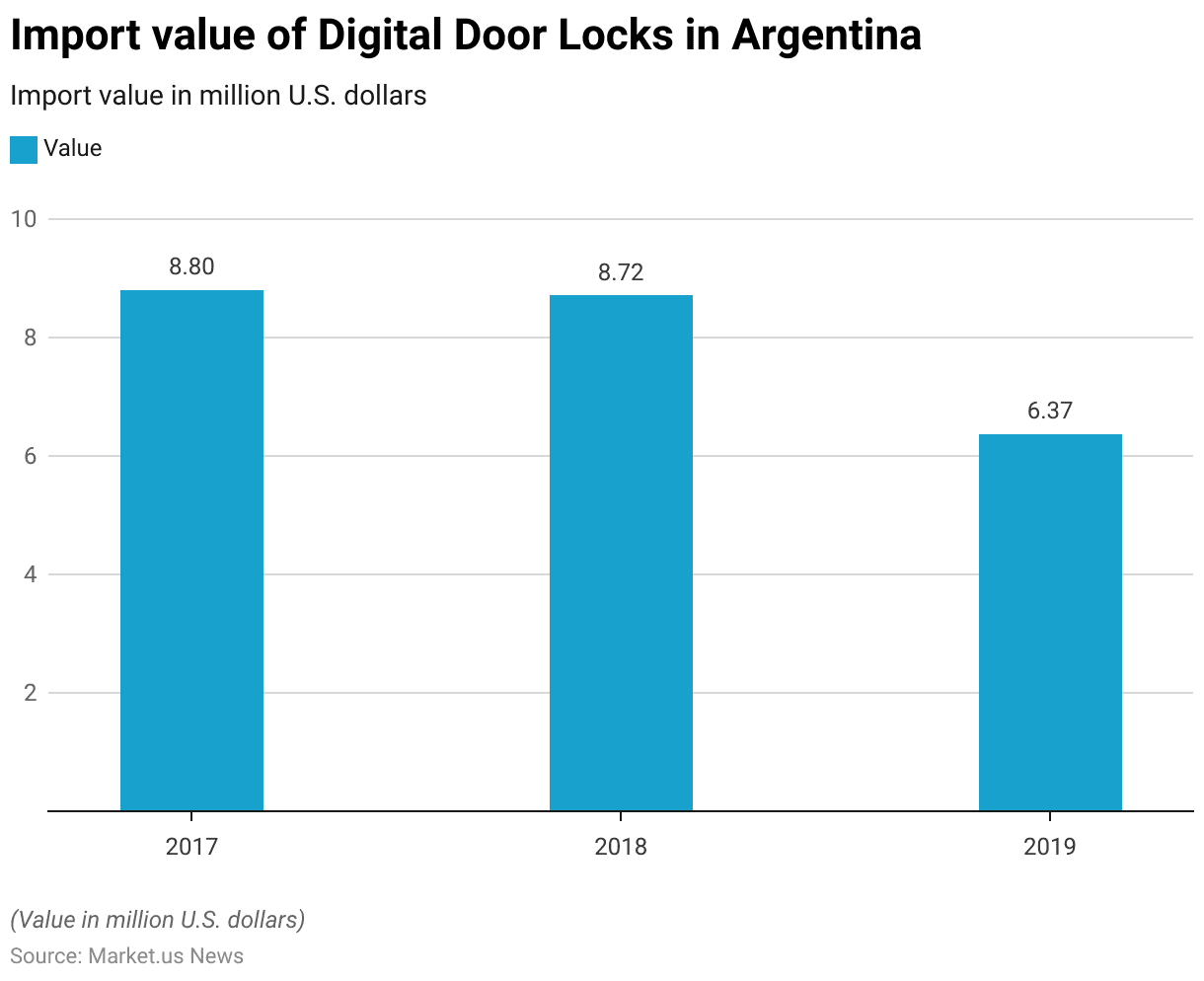

- Between 2017 and 2019, the import value of digital door locks in Argentina experienced a decline.

- In 2017, imports were valued at USD 8.8 million, slightly decreasing to USD 8.72 million in 2018.

- By 2019, the import value had dropped more significantly to USD 6.37 million.

- This downward trend may reflect shifts in local demand, increased domestic production, or broader economic factors affecting import levels.

(Source: Statista)

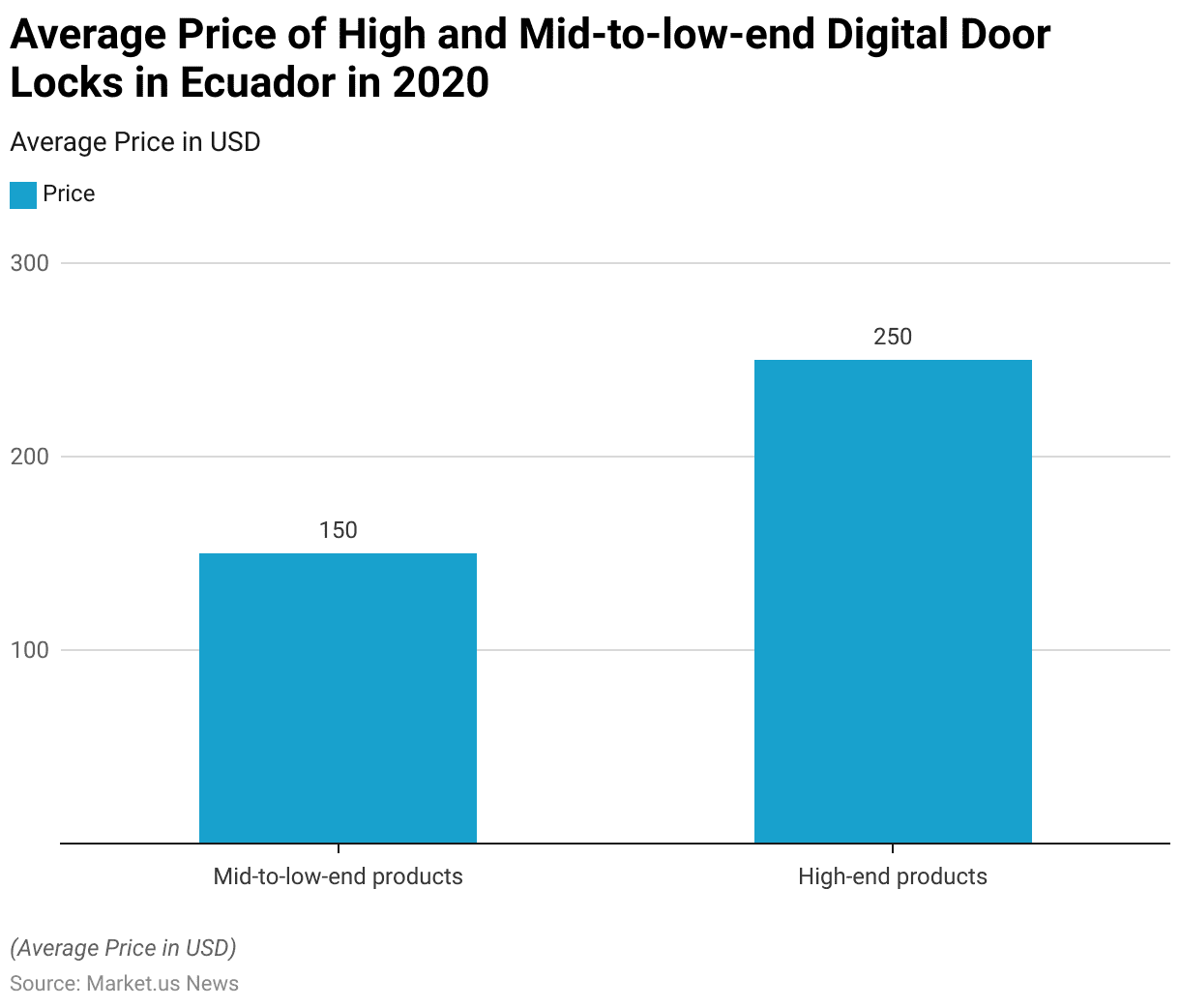

Price of High and Mid-to-low-end Digital Door Locks

- In 2020, the average price of digital door locks in Ecuador varied significantly between mid-to-low-end and high-end products.

- Mid-to-low-end digital door locks were priced at an average of USD 150, catering to cost-conscious consumers seeking basic security features.

- In contrast, high-end digital door locks, which offer advanced functionalities and premium designs, commanded a higher average price of USD 250.

- This pricing structure highlights the diverse market segments and the range of options available to meet varying consumer preferences and budgets.

(Source: Statista)

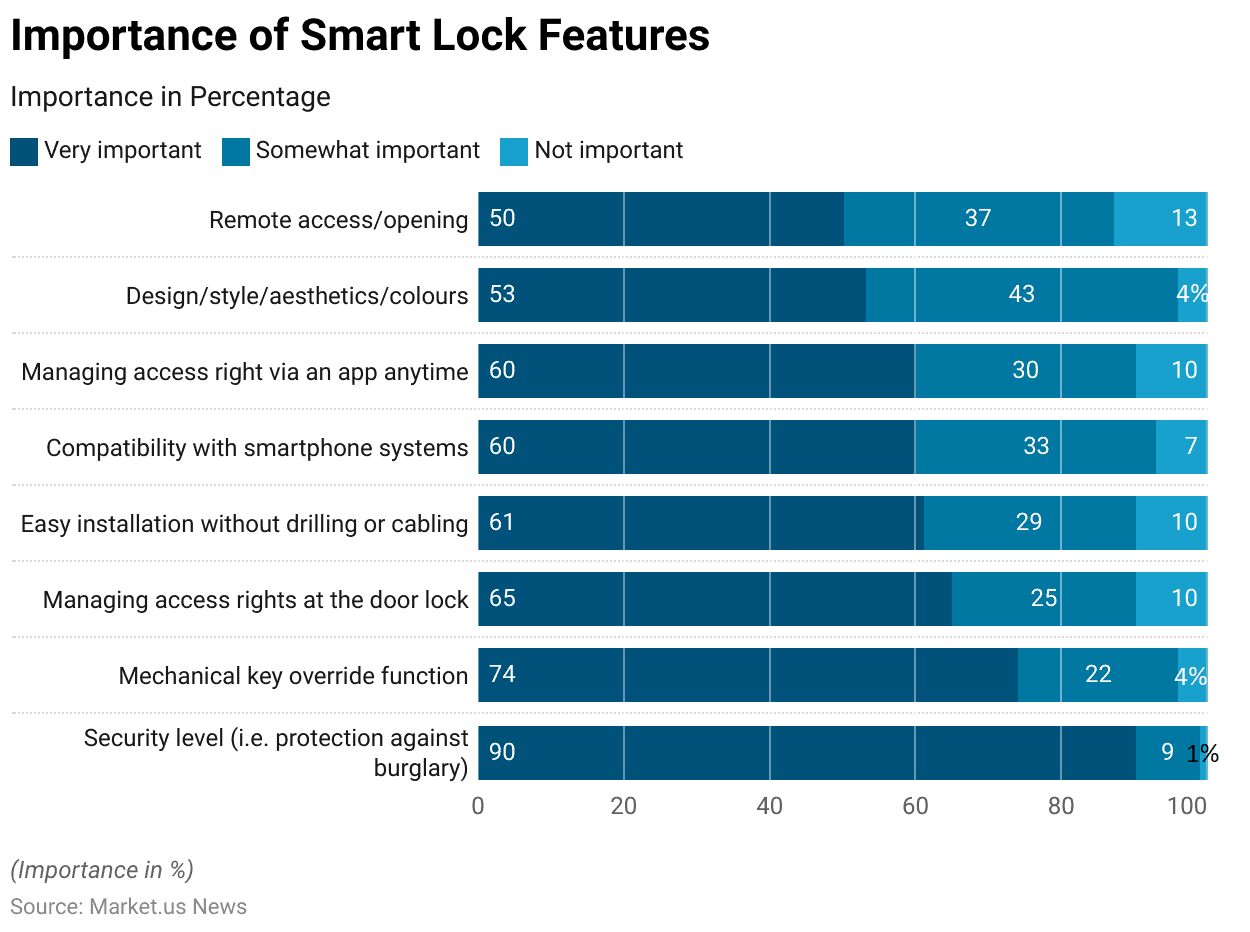

Importance of Smart Lock Features Statistics

- In evaluating the importance of features in smart locks, consumers prioritized certain aspects over others.

- Security level, particularly protection against burglary, was deemed very important by 90% of respondents, with only 9% considering it somewhat important and 1% viewing it as unimportant.

- The mechanical key override function was rated very important by 74% of respondents, with 22% finding it somewhat important and 4% deeming it unimportant.

- Managing access rights at the door lock was a priority for 65%, while 25% considered it somewhat important.

- Easy installation without drilling or cabling was very important for 61% of users, and compatibility with smartphone systems held similar importance, with 60% rating it as very important.

- Managing access rights via an app was also valued by 60%, and 53% prioritized the design, style, and color of the smart lock.

- Remote access and opening functionality were rated very important by 50%, somewhat important by 37%, and unimportant by 13%.

- These preferences reflect a strong emphasis on security, ease of use, and aesthetic considerations in smart lock features.

(Source: Oaklins)

Key Spending and Investments

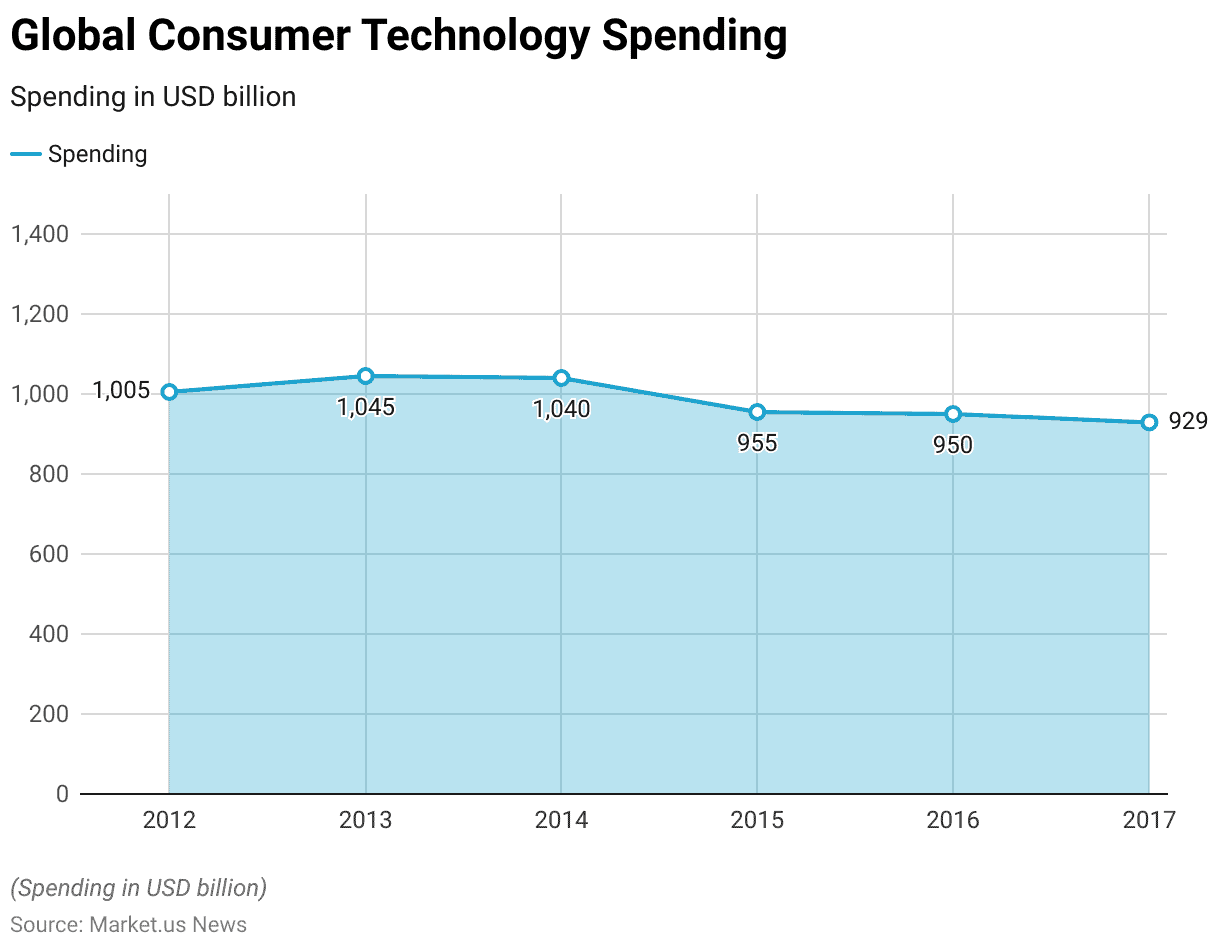

Global Consumer Technology Spending

- Global consumer technology spending experienced a gradual decline from 2012 to 2017.

- In 2012, spending was recorded at USD 1,005 billion, increasing slightly to USD 1,045 billion in 2013.

- In 2014, spending remained relatively stable at USD 1,040 billion.

- However, from 2015 onward, a downward trend became evident, with spending decreasing to USD 955 billion in 2015 and further to USD 950 billion in 2016.

- By 2017, global consumer technology spending had declined to USD 929 billion.

- This reduction may reflect market saturation in certain technology segments and shifting consumer priorities over the years.

(Source: Statista)

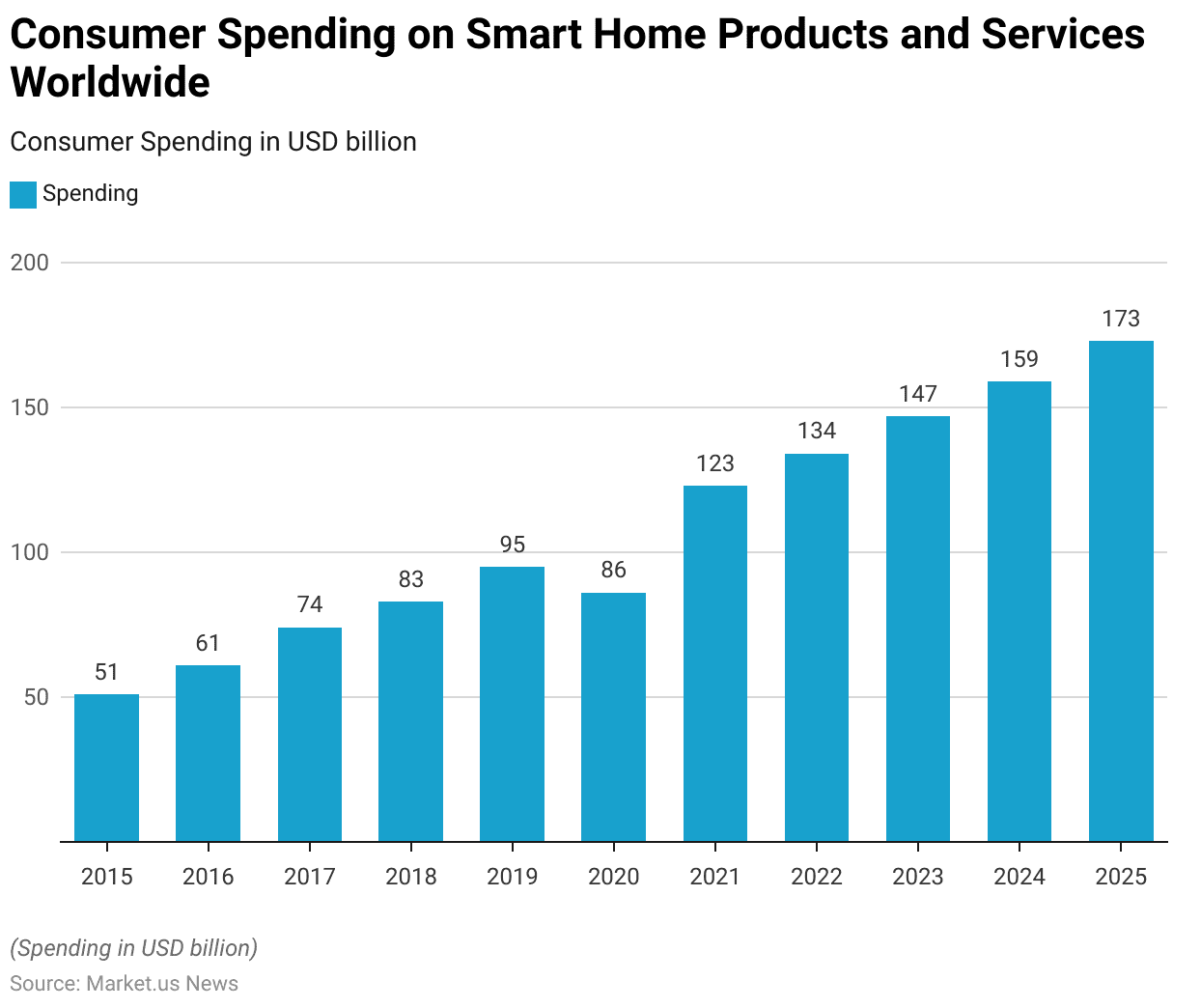

Consumer Spending on Smart Home Products and Services Worldwide

- Global consumer spending on smart home products and services has shown substantial growth from 2015 to 2025.

- In 2015, spending was recorded at USD 51 billion, increasing to USD 61 billion in 2016 and USD 74 billion in 2017.

- This trend continued, with expenditures reaching USD 83 billion in 2018 and USD 95 billion in 2019.

- Despite a slight decline to USD 86 billion in 2020, spending rebounded strongly in 2021, climbing to USD 123 billion.

- The upward trajectory persisted, with spending reaching USD 134 billion in 2022 and USD 147 billion in 2023, and it is projected to grow to USD 159 billion in 2024.

- By 2025, consumer spending is expected to hit USD 173 billion, driven by increasing adoption of smart home technologies and advancements in IoT.

(Source: Statista)

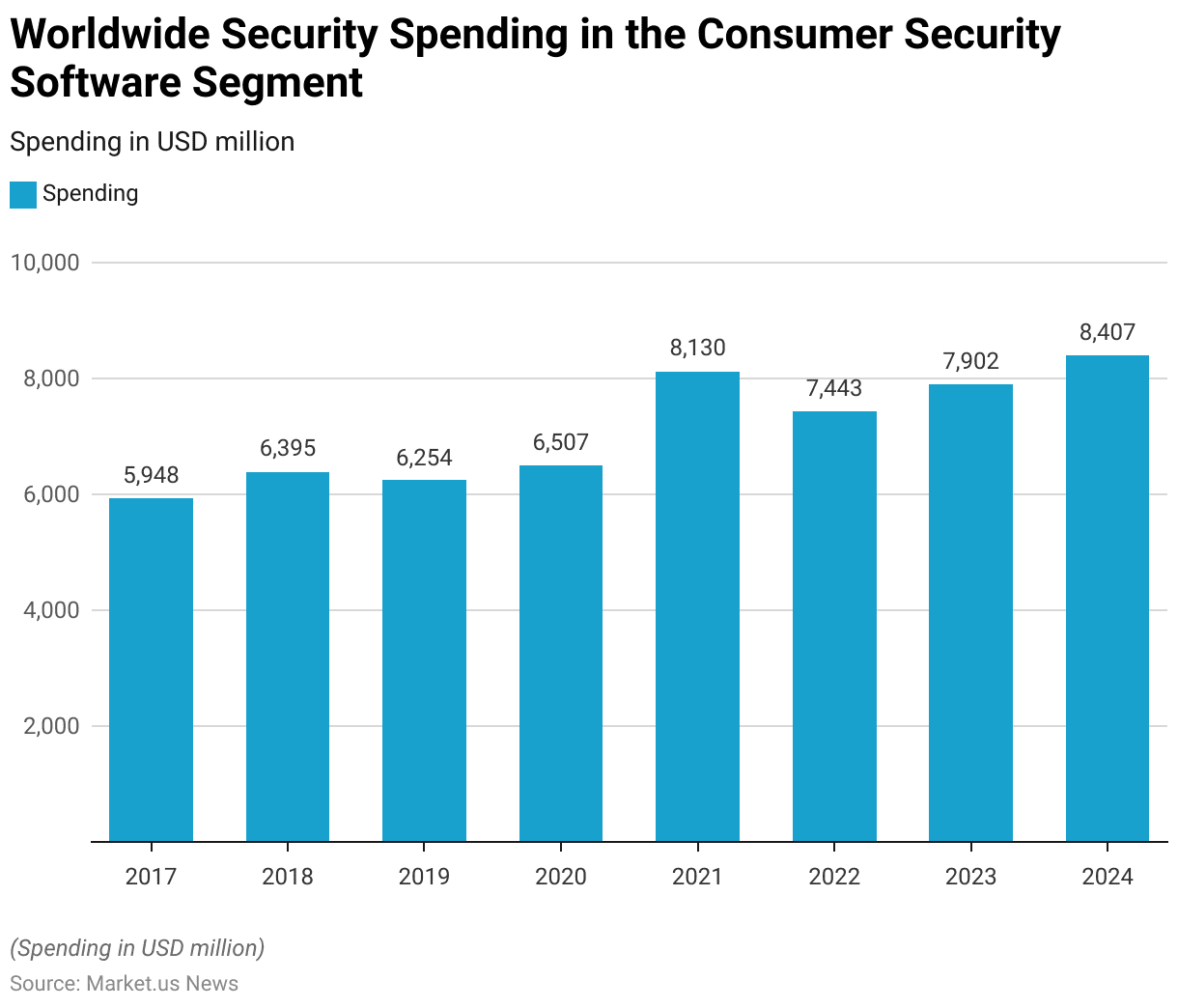

Worldwide Security Spending in the Consumer Security Software Segment

- Global spending on consumer security software has demonstrated a fluctuating but generally upward trend from 2017 to 2024.

- In 2017, spending amounted to USD 5,948 million, increasing to USD 6,395 million in 2018.

- In 2019, spending slightly declined to USD 6,254 million but rebounded in 2020 to USD 6,507 million.

- A significant surge occurred in 2021, with spending reaching USD 8,130 million, reflecting heightened consumer demand for security solutions.

- Although spending decreased to USD 7,443 million in 2022, it rose again in 2023 to USD 7,902 million.

- By 2024, global spending is projected to reach USD 8,407 million, underscoring the continued importance of robust security software in an increasingly digital world.

(Source: Statista)

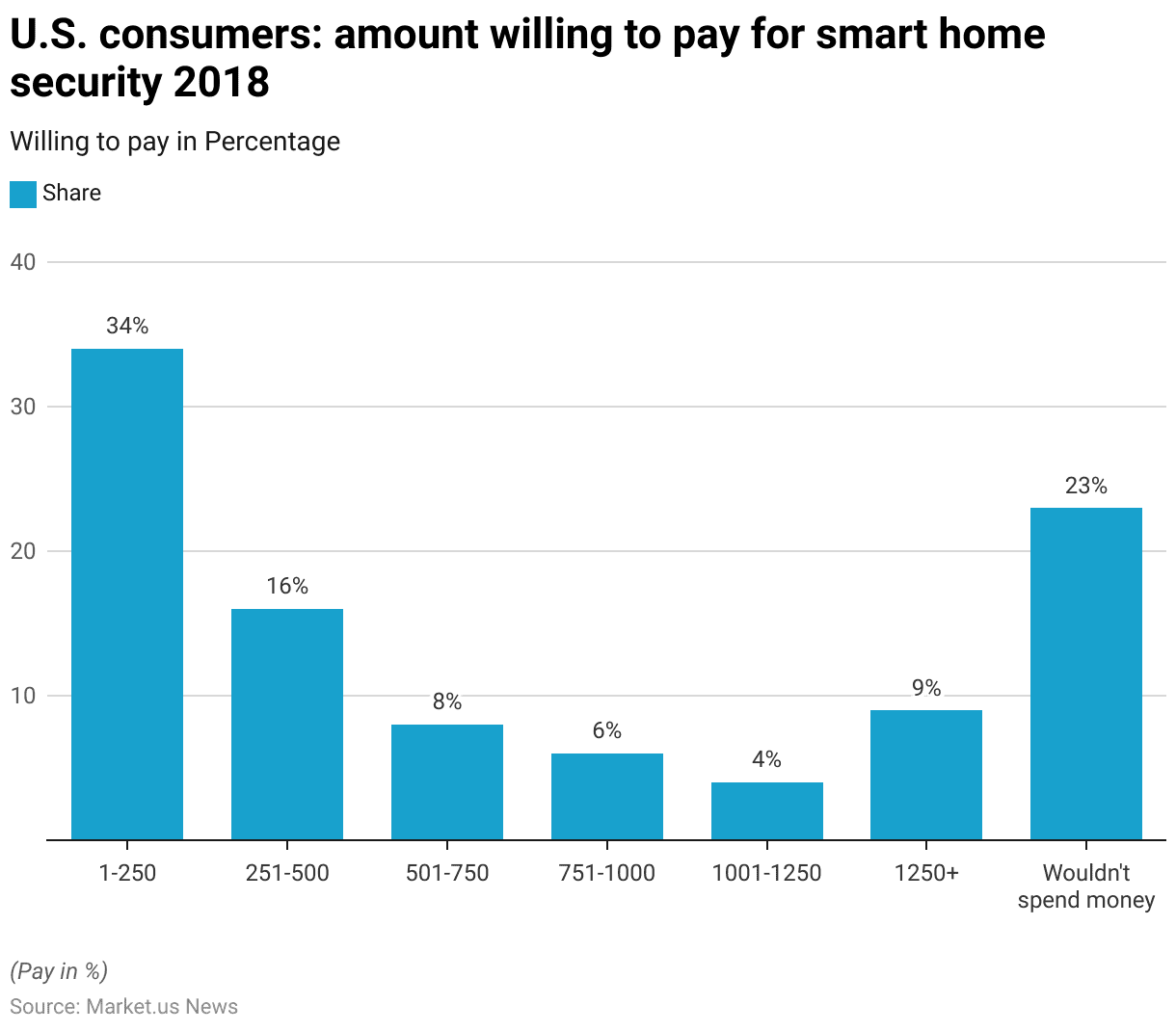

Amount Consumers Are Willing to Pay for Smart Home Security

- As of 2018, consumer willingness to pay for smart home security products in the United States varied significantly.

- The largest proportion of respondents (34%) were willing to spend between USD 1 and 250, while 16% were prepared to pay between USD 251 and 500.

- A smaller segment, 8%, indicated willingness to spend between USD 501 and 750, followed by 6% for the USD 751 to 1000 range.

- Only 4% of consumers were willing to pay between USD 1001 and 1250, while 9% were open to spending more than USD 1250 on these products.

- Notably, 23% of respondents stated they would not spend money on smart home security products, reflecting a significant market segment that remains reluctant to invest in such technology.

(Source: Statista)

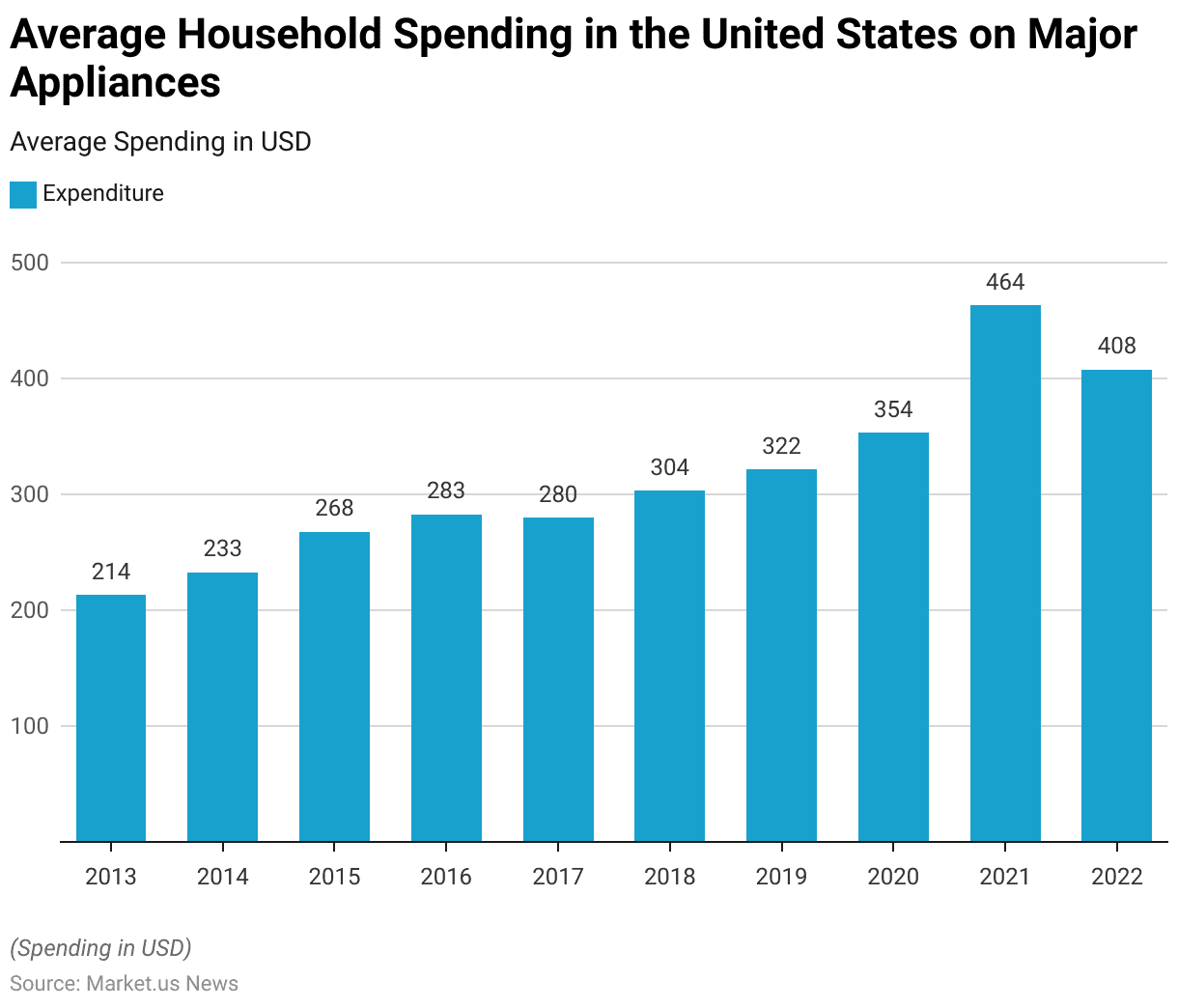

Household Spending On Major Appliances

- Between 2013 and 2022, average household spending in the United States on major appliances showed a steady increase, reflecting evolving consumer demand and possibly rising prices for durable goods.

- In 2013, households spent an average of USD 214 on major appliances, which gradually rose to USD 233 in 2014 and USD 268 in 2015.

- This upward trend continued, with average spending reaching USD 283 in 2016 and USD 280 in 2017.

- In 2018, spending increased further to USD 304, followed by USD 322 in 2019.

- A noticeable jump occurred in 2020, with households spending USD 354 on average, likely influenced by increased home upgrades during the pandemic.

- In 2021, average spending peaked at USD 464 before slightly decreasing to USD 408 in 2022.

- This trajectory highlights a growing investment in home appliances over the decade.

(Source: Statista)

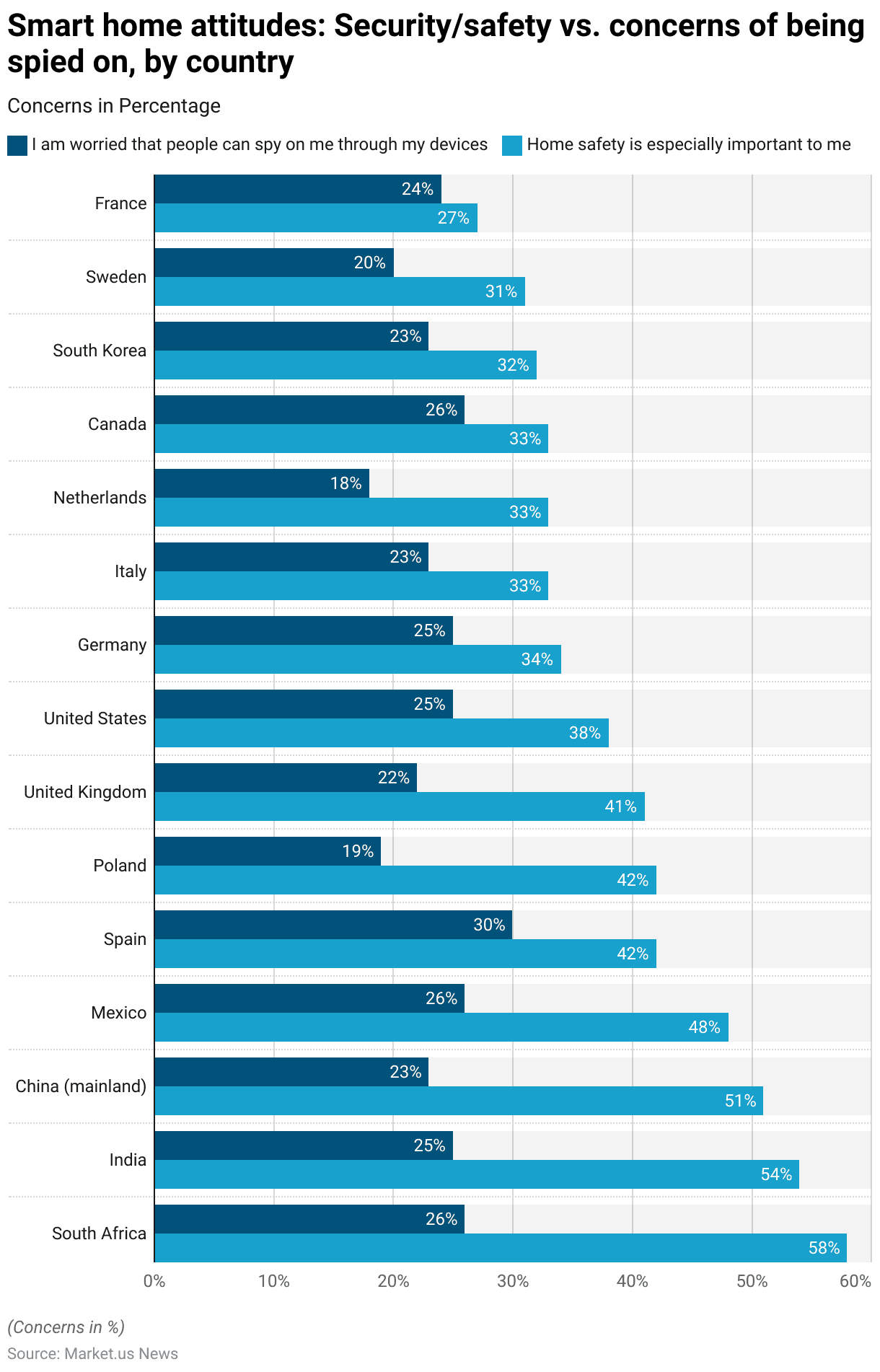

Key Safety Concerns and Challenges

- In 2023, concerns about smart home security and privacy, as well as the importance of home safety, varied across countries.

- In South Africa, 26% of respondents expressed worry about being spied on through their devices, while 58% prioritized home safety.

- India showed similar sentiments, with 25% concerned about spying and 54% valuing home safety.

- In China, 23% were worried about privacy, with 51% emphasizing home safety.

- In Mexico, 26% had privacy concerns, and 48% valued safety, whereas in Spain, 30% were worried about spying, and 42% saw safety as important.

- Poland had 19% expressing privacy concerns and 42% prioritizing safety, while the United Kingdom showed 22% and 41%, respectively.

- In the United States, 25% were worried about privacy, with 38% emphasizing safety.

- Germany and Italy had similar patterns, with 25% and 23% expressing privacy concerns and 34% and 33% valuing safety.

- The Netherlands, Canada, and South Korea showed lower levels of concern, with 18%, 26%, and 23% worried about privacy and 33%, 33%, and 32% emphasizing safety, respectively.

- In Sweden, 20% had privacy concerns, and 31% prioritized safety, while in France, 24% worried about privacy, but only 27% emphasized home safety.

- This data reflects varying degrees of privacy concerns and the importance of home safety across different countries about smart home technologies.

(Source: Statista)

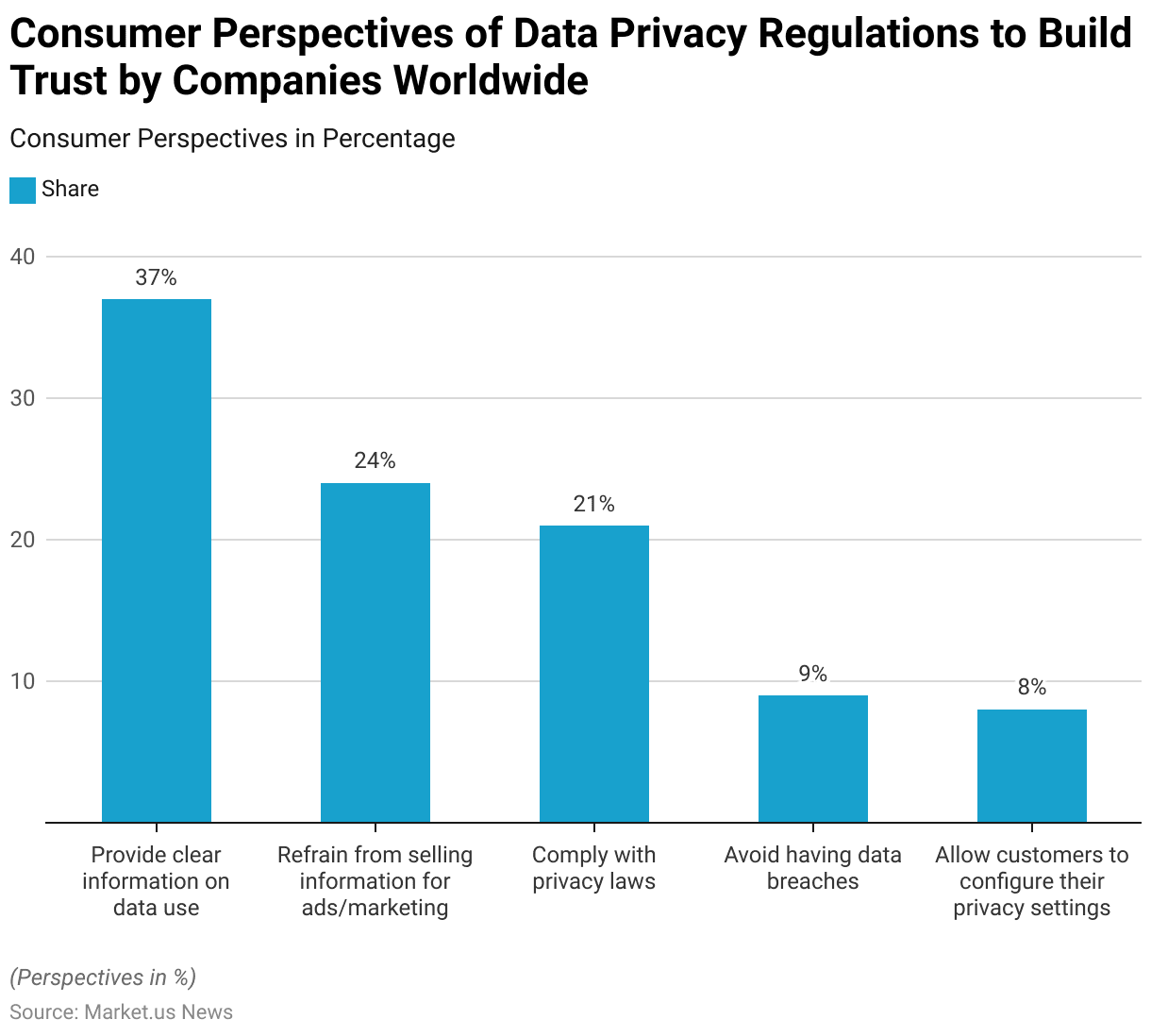

Consumer Perspectives of Data Privacy Regulations to Build Trust

- As of 2023, consumers globally expressed various preferences for how companies can build trust regarding data privacy.

- The most popular response, with 37% of respondents, was for companies to provide clear information on how their data is used.

- 24% of respondents felt that companies should refrain from selling personal information for advertising or marketing purposes.

- Compliance with privacy laws was important to 21% of respondents, while 9% emphasized the importance of avoiding data breaches.

- Lastly, 8% of consumers valued having the option to configure their privacy settings themselves.

- These perspectives underscore the growing demand for transparency, security, and control in data privacy practices by companies worldwide.

(Source: Statista)

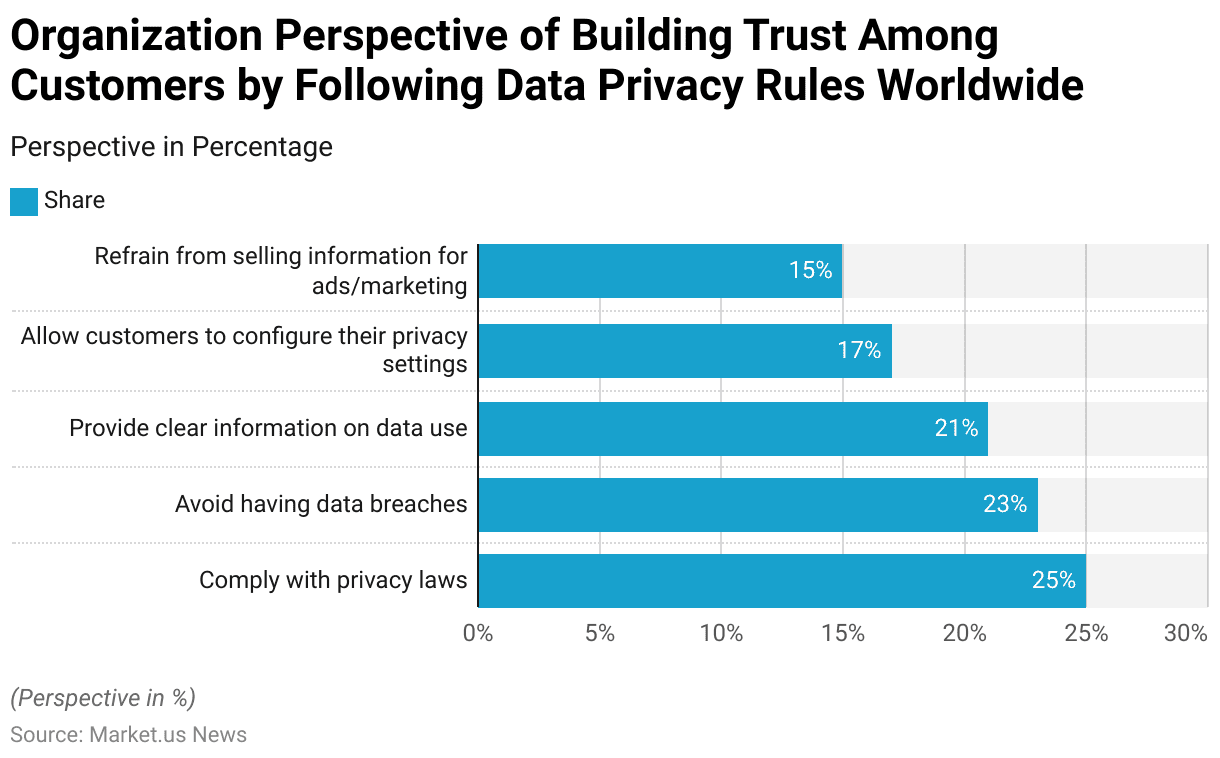

Organizational Perspective of Building Trust Among Customers

- In 2023, organizations worldwide identified various strategies for building customer trust in data privacy.

- The top priority for 25% of respondents was to comply with privacy laws, highlighting the importance of legal adherence in fostering trust.

- Close behind, 23% emphasized the need to avoid data breaches, reflecting the critical role of security in protecting consumer information.

- Providing clear information on data usage was prioritized by 21% of respondents, underscoring transparency as a key trust factor.

- Additionally, 17% felt that allowing customers to configure their privacy settings would strengthen trust, while 15% suggested refraining from selling information for advertising or marketing purposes.

- These approaches indicate that organizations view compliance, security, transparency, and consumer control as essential to building trust in data privacy practices.

(Source: Statista)

Innovations and Developments in Smart Lock Statistics

- The smart lock industry has experienced significant innovations and developments in recent years, driven by advancements in IoT, AI, and wireless communication technologies.

- These locks, which offer enhanced security and convenience compared to traditional mechanical locks, are becoming increasingly popular in residential, commercial, and automotive applications.

- Key innovations include the integration of biometric authentication (such as fingerprint and facial recognition), mobile app control, and voice activation, allowing users to unlock doors remotely via smartphones or voice assistants like Amazon Alexa and Google Assistant.

- Additionally, the development of encrypted, Bluetooth-based technology has enhanced security, reducing vulnerabilities to hacking.

- One notable example is the August Smart Lock, which allows users to retrofit existing deadbolts with smart capabilities.

- Schlage Encode has developed Wi-Fi-enabled locks that eliminate the need for a hub or additional device.

- Furthermore, advancements in battery life and energy-efficient designs have contributed to the widespread adoption of smart locks.

- As smart homes continue to gain traction, the market is expected to grow, with companies focusing on integrating advanced features like remote monitoring, activity logs, and temporary access codes for visitors.

- The ongoing shift towards security automation and seamless integration into smart home ecosystems is expected to continue shaping the future of smart locks.

(Source: August, Schlage)

Regulations for Smart Locks

- Smart locks, as part of the broader Internet of Things (IoT) market, are increasingly regulated across various jurisdictions to address concerns related to cybersecurity, data privacy, and consumer safety.

- Regulations vary significantly by country, with the European Union, for example, enforcing strict data protection laws under the General Data Protection Regulation (GDPR), which impacts how data collected by smart locks is handled.

- In the U.S., the National Institute of Standards and Technology (NIST) provides cybersecurity frameworks for IoT devices, including smart locks, to ensure that they meet minimum security standards.

- Additionally, the California Consumer Privacy Act (CCPA) impacts companies collecting personal data via these devices.

- In Australia, the Australian Communications and Media Authority (ACMA) sets standards for device connectivity and cybersecurity.

- These regulations are designed to mitigate risks such as hacking, unauthorized access, and data breaches, ensuring that smart locks meet privacy and security benchmarks.

- Furthermore, countries like Japan have stringent rules regarding product safety, while the UK mandates compliance with the Cybersecurity Act, which requires manufacturers to meet specific security requirements for connected devices.

- As the smart lock market grows, compliance with these diverse regulations is becoming a critical factor for manufacturers aiming to enter or expand in these markets.

(Sources: Gdpr, Nist, Ccpa, Acma)

Recent Developments

Acquisitions and Mergers:

- Assa Abloy’s Acquisition of Level Home: In September 2024, Assa Abloy, a global leader in access control, acquired Level Home, a smart lock startup known for integrating digital control within traditional lock designs. This strategic move aims to enhance Assa Abloy’s portfolio in digital door security solutions.

Product Launches:

- Nuki’s Smart Lock Ultra: In November 2024, Nuki announced the Smart Lock Ultra, its fifth-generation smart lock. This model features a compact design, being a third the size of the original, and incorporates a brushless motor that unlocks doors in under 1.5 seconds. Priced at €349, it is set to be available in December 2024.

- Level Home’s Level Lock+ (Matter): In November 2024, Level Home introduced the Level Lock+ (Matter), priced at $329. Touted as the world’s smallest and most advanced smart lock, it integrates with major smart home systems and supports Bluetooth and Matter-over-Thread protocols.

Conclusion

Smart Lock Statistics – The smart lock market is rapidly growing due to advancements in technology, increasing demand for home security, and IoT integration.

Consumers prioritize features like high security, smartphone compatibility, remote access, and easy installation, though privacy concerns about data use persist.

Leading brands are expanding globally, and the industry’s future is promising as smart home adoption rises.

Focusing on security, transparency, and user-friendly design will be crucial for manufacturers to capture market share.

At the same time, innovations in biometrics and access control will enhance smart locks’ appeal in modern security solutions.

FAQs

A smart lock is an electronic lock that allows you to lock and unlock your door remotely via a smartphone, keypad, or key fob. Most smart locks connect to Wi-Fi or Bluetooth, enabling control and access management through a mobile app.

Smart locks are designed with advanced security features, often including encryption, tamper alerts, and activity logs. However, security depends on the lock’s design and settings. High-quality smart locks provide reliable security, especially when paired with strong access codes and regular firmware updates.

Many smart locks are designed for easy DIY installation without drilling or special tools. However, some complex models may require professional installation.

Smart locks tend to be more expensive than traditional locks due to added features and connectivity. However, they offer increased convenience, flexibility, and control, which many users find valuable.

Most smart locks are compatible with popular smartphone operating systems (iOS and Android) and integrate with home automation systems like Alexa, Google Assistant, and Apple HomeKit.