Table of Contents

Introduction

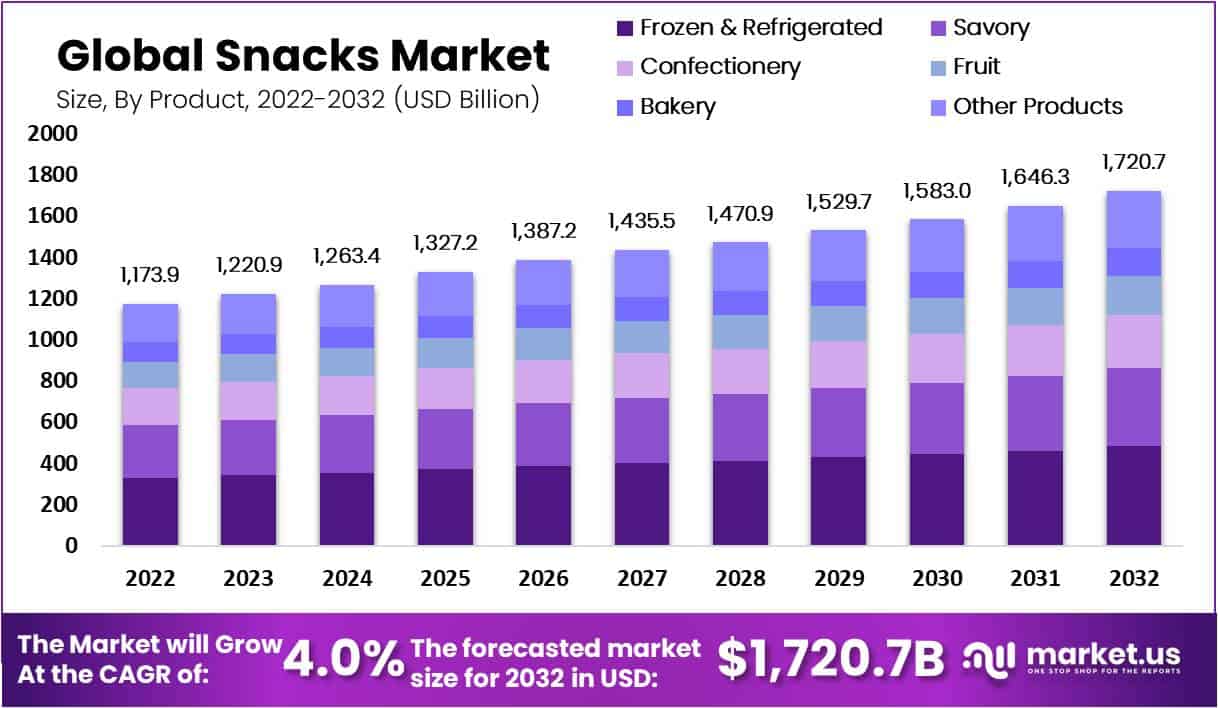

The global snacks market is on a trajectory to expand from USD 1,220.9 billion in 2023 to USD 1,720 billion by 2032, reflecting a steady compound annual growth rate (CAGR) of 4.0%. This growth is driven by several factors, including the rising demand for convenient, ready-to-eat snack options that cater to busy lifestyles and the increasing health consciousness among consumers who prefer snacks with organic and natural ingredients.

However, the market faces challenges such as health concerns associated with snack consumption and the competition within the food industry to offer healthier, more sustainable options. Companies are navigating these challenges by innovating their product lines to include snacks that not only meet the taste preferences of a broad demographic but also align with the growing consumer demand for health-centric foods.

Recent developments in the market highlight the introduction of advanced freezing technologies that help preserve the freshness and nutritional value of snacks, particularly in the frozen segment, which is seeing significant growth. Additionally, there’s a visible trend towards more sustainable packaging solutions to appeal to environmentally conscious consumers.

General Mills Inc. recently expanded its portfolio by acquiring TNT Crust, a producer of frozen pizza crusts, which highlights the company’s strategy to diversify and strengthen its offerings in the frozen foods segment. PepsiCo Inc. launched “Doritos After Dark” in partnership with PepsiCo Foodservice Digital Lab and Popchew. This product targets consumers’ preferences for nighttime snacking, illustrating PepsiCo’s focus on catering to specific consumer behaviors and expanding its product range to fit different occasions.

The Kraft Heinz Company is focusing on a transformation strategy, emphasizing innovation and global scale growth. This includes introducing new products and improving their global supply chain efficiency to better serve emerging and existing markets. Nestlé S.A continues to innovate in the health and wellness space, reflected in their recent launch of Vegan KitKat in 15 European countries. This product launch aligns with the growing consumer trend towards plant-based diets and veganism.

Snacks Facts And Statistics

- Obesity rates have reached alarming levels globally, with the World Obesity Atlas 2023 estimating that 2.6 billion people suffer from overweight and obesity in 2020

- Among those employees who have food-based perks, 48% consume office-provided snacks or beverages up to four times per week, 29% do so once a day or more.

- Companies that provide free snacks are on the rise (32%) and most companies already offer free coffee (81%)

- 66% of millennials said if they were offered a job at a company with better perks like snacks, they would take it

- 48% of respondents would weight company perks if they were looking for a new job

- 67% of employers say that food is part of their employee retention strategy

- Free food increases employee retention, 41% say they would not accept a job offer from a company without food perks if their current employer provides them.

- 88% of employees consider it important for their employer to provide snacks

- 56% of employees say that without an afternoon snack, they hit a no-energy slump.

- Healthy snacks are considered a “huge perk” by 83% of respondents.

- Access to free food in the office increased employee happiness by 11%.

- Millennials are three times more likely to value free snacks than those 45 and over.

- 61% of employees said that free snacks saved them money throughout the workweek.

- 2.4 billion hours were lost in productivity due to employees going out to buy coffee and snacks.

- 88% of employers say that office food saves their employees time by not having to go out and get it themselves.

- A study done by Staples found that 2.4 billion hours were lost in US worker productivity each year because employees would leave their offices for coffee and snack runs.

- As many as 57% of office workers reported leaving the office to buy coffee or snacks daily, resulting in the shocking number mentioned above.

- The Center for Disease Control (CDC) estimates that companies spend a whopping $225 billion a year on employee health care.

- Americans have a few interesting snacking habits. 17% of people admit to eating party snacks in the bathroom – either on the toilet or in the shower – and almost 50% of people double-dip at parties.

- 70% of people admit to eating an entire bag of snack food in one sitting.

Emerging Trends

- Health and Wellness: Consumers increasingly prefer snacks that not only satisfy their cravings but also contribute to their health. This includes snacks with added functional benefits like protein, and fiber, and reduced negative ingredients such as sugar and fat. The demand for better-for-you (BFY) snacks is rising as more people look for options that help maintain a balanced diet while being mindful of ingredients.

- Flavor Innovation: There’s a growing consumer interest in unique and diverse flavors, which drives snack innovation. Consumers are willing to experiment with new and exotic flavors, and snack manufacturers are responding by exploring a wide range of tastes from savory to sweet, often incorporating global culinary influences. The trend towards bold and distinctive flavors is particularly noticeable among younger demographics who value both variety and novelty.

- Convenience and Portability: Snacks that offer convenience, such as ready-to-eat options and single-serving packaging, continue to be popular, especially among consumers with busy lifestyles. The demand for snacks that can be consumed on the go or as meal replacements reflects the fast-paced nature of modern living, where convenience often dictates food choices.

- Sustainable and Ethical Snacking: There is an increasing awareness of the environmental and ethical impact of food production. Consumers are looking for snacks that are not only healthy but also produced sustainably and ethically. This includes preferences for snacks made from ethically sourced ingredients and those offering transparent labeling about their production and sourcing practices.

- Technological Innovations in Packaging: Advances in packaging technology that enhance the freshness and extend the shelf life of snack products are also notable. Innovative packaging solutions that improve the sustainability credentials of products, such as biodegradable or recyclable materials, are increasingly in demand as consumers become more environmentally conscious.

Use Cases

Snacks play a versatile role across various industries, not just in food service but extending to areas like event hosting, personal care, and beyond. They are increasingly incorporated into different business models and consumer offerings, demonstrating broad utility.

In the hospitality and event sectors, snacks are crucial for enhancing guest experiences, often served in lounges and during conferences as a convenience and hospitality gesture. The trend of offering gourmet and premium snacks at such venues underscores the importance of snacks in promoting a high-quality customer service experience.

Retail sectors, particularly those focusing on health and convenience, leverage snacks to cater to busy consumers seeking quick and nutritious food options. This includes supermarkets and health food stores where pre-packaged snacks like nuts, bars, and fruit snacks are popular. These outlets often emphasize the health benefits of their offerings to attract health-conscious consumers.

The packaging industry also significantly benefits from snacks. Innovations in packaging solutions, such as stand-up pouches, are prominently used for various snack items. These packaging formats are popular due to their convenience, freshness preservation, and the ability to include attractive branding. Snacks packaged in such modern solutions are found in sectors ranging from grocery to personal care, where even cosmetic products might use snack-format sachets for single-use applications.

Key Players Analysis

General Mills Inc. is a major player in the snacks sector, known for its strong portfolio of brands like Nature Valley and Betty Crocker. The company has strategically expanded its snack offerings to include healthier and more convenient options to meet evolving consumer preferences. General Mills continues to innovate within its product lines, focusing on taste and nutritional value, which helps it maintain a competitive edge in the rapidly growing snacks market.

PepsiCo Inc. dominates the snacks industry with its Frito-Lay division, offering popular brands like Lay’s, Doritos, and Cheetos. PepsiCo has been at the forefront of responding to consumer demands for healthier and more diverse snack options, incorporating bold flavors and nutritious ingredients. Their commitment to innovation and market adaptation ensures a strong market presence and consumer loyalty, making them a leading name in the global snacks market.

The Kraft Heinz Company is a significant contributor to the snacks sector, focusing on expanding its snack portfolio alongside its staple condiments and sauces. The company is dedicated to innovation, often revitalizing its snack lineup with new flavors and healthier options in response to consumer trends. Kraft Heinz’s strategic approach to merging traditional snack favorites with new, on-trend offerings helps it maintain a strong presence in a competitive market.

Nestlé S.A is a powerhouse in the global snacks market, known for its wide range of popular snack brands like KitKat and Smarties. Nestlé continuously adapts its snack offerings to align with global health trends, including reducing sugar and introducing organic ingredients. This adaptability, combined with a strong commitment to sustainability and ethical sourcing, strengthens its market position and appeals to a broad consumer base looking for both indulgence and healthier snack options.

The Kellogg Company, now transforming into Kellanova, is sharpening its focus in the snacks sector by emphasizing innovation, strategic marketing, and product diversity. The company is actively pursuing growth by enhancing its global brand presence, introducing more conveniently packaged products, and capitalizing on the shift towards more health-conscious snacks. Kellanova is particularly focusing on small and multi-pack options, which aim to increase market penetration in both developed and developing regions. Additionally, it continues to invest in new production capabilities to better meet consumer demands.

Unilever maintains a robust position in the global snacks market, leveraging its vast portfolio of brands to cater to a diverse consumer base. Unilever’s approach in the snack segment focuses on health and sustainability, aligning with the global trend towards nutritious and environmentally friendly products. The company’s strategy includes innovating product lines and packaging solutions to meet the evolving preferences of health-conscious consumers, thus ensuring strong market retention and growth.

Calbee has demonstrated resilience and strategic foresight in the snacks sector, particularly in adapting to supply chain disruptions. Facing significant challenges such as droughts in Japan and shipping issues from the U.S., Calbee worked to enhance its domestic production capabilities and diversified its import strategies to stabilize its supply chain. This adaptability is supported by a strong commitment to quality and consumer preferences, particularly through its popular Harvest Snaps brand, which emphasizes healthful, plant-based ingredients. Moreover, Calbee’s strategic investment of $1 billion over three years aims to bolster efficiency and facilitate expansion into promising markets like China and North America, reflecting a proactive approach to counteracting market challenges in Japan and leveraging global growth opportunities.

Intersnack Group GmbH & Co. KG remains a powerhouse in the European snack food industry with a broad portfolio of brands and products that span various snack categories. The company has grown through strategic acquisitions that have expanded its reach and capabilities, making it one of the leading snack producers in Europe. Intersnack emphasizes innovation in product development and packaging to cater to a diverse consumer base, focusing on trends such as health, convenience, and sustainability. This approach not only strengthens its market position but also aligns with changing consumer preferences toward healthier snack options and more sustainable consumption practices.

Conagra Brands Inc. is a major player in the North American snacks sector, known for its innovative approach and diverse product range. The company continuously evolves its snack offerings to meet changing consumer tastes and preferences, focusing on both traditional favorites and healthier options. Conagra has recently launched over fifty new meals and snacks, tapping into current consumer trends for frozen and convenience foods with a fresh and flavorful twist. These developments reflect Conagra’s strong commitment to combining culinary creativity with consumer convenience, ensuring its products remain relevant and appealing in a competitive market.

ITC Limited has made significant strides in the snacks sector, particularly in the Indian market, where it is known for its diverse array of snack products under brands like Bingo! and Sunfeast. ITC’s approach combines innovation in flavor with strategic marketing to cater to the diverse palate of Indian consumers. The company’s focus on quality and customer satisfaction, coupled with its robust distribution network, has helped it secure a strong presence in the competitive snacks market in India. ITC continues to expand its product offerings by incorporating regional flavors and aligning with health trends to meet the evolving demands of consumers.

Grupo Bimbo has effectively positioned itself in the global snacks sector through strategic acquisitions and a focus on health-oriented products. The company’s global footprint is vast, with a strong presence in North America, Europe, Asia, and Latin America, making it the world’s largest bakery company. Grupo Bimbo’s commitment to sustainability is evident in its operations, with significant investments in eco-friendly packaging and energy-efficient technologies, positioning the company as a leader in environmental responsibility within the snacks industry.

Danone is enhancing its snacks division by expanding the usage of yogurt beyond traditional breakfast time through innovative offerings like the Remix platform. This initiative targets younger consumers by introducing yogurt with mix-ins, which combine the nutritional benefits of yogurt with the indulgence of dessert-like toppings, creating a healthier snack option. Danone’s strategic approach aims to increase yogurt consumption throughout the day and capture a larger share of the snacking market by appealing to health-conscious consumers looking for tasty yet nutritious snack options.

Conclusion

The global snacks market is set to experience sustained growth, driven by evolving consumer preferences for convenient, healthier, and innovative snack options, the industry is responding with advancements in product offerings, such as plant-based and high-protein snacks, that cater to a health-conscious audience. Additionally, the integration of advanced packaging technologies is enhancing product appeal through sustainability and improved shelf life. These factors collectively underline a dynamic sector poised for expansion, reflecting broad consumer trends toward convenience and wellness.