Table of Contents

Introduction

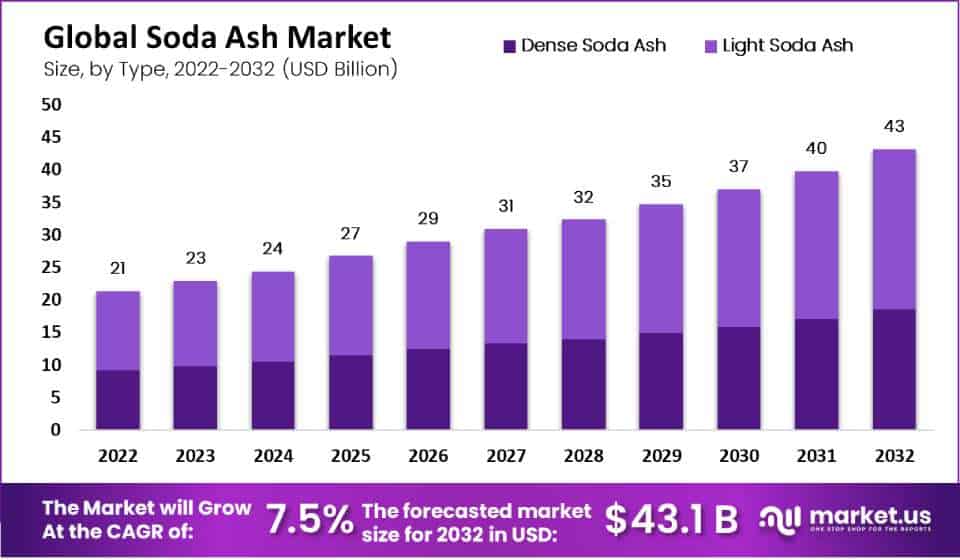

The global Soda Ash Market is poised for significant growth, projected to increase from USD 21.3 billion in 2022 to USD 43.1 billion by 2032, with a compound annual growth rate (CAGR) of 7.5%. Several key factors drive this growth, including rising demand from the glass manufacturing sector and the expanding use of soda ash in detergents and water treatment processes.

Challenges such as the volatility in the prices of raw materials, including coal and natural gas, pose considerable risks to the market’s stability. These fluctuations can impact production costs and profitability, affecting overall market growth. Moreover, stringent environmental regulations and the competition from alternative products further intensify the market challenges.

Recent developments have seen significant investments in sustainable production technologies and expansions of production capacities by key players. Strategic collaborations also enhance market presence, reflecting the industry’s dynamic response to evolving market conditions. These initiatives are crucial as they not only address immediate market needs but also set a foundation for long-term sustainability and competitiveness in the global marketplace.

CIECH SA faced challenges in 2019 when they had to temporarily halt production at their Romanian soda ash factory due to external conditions. This indicates their sensitivity to operational disruptions, which can affect supply dynamics within the market. Ciner Group Resources Corporation has been actively expanding its capacity in natural soda ash production. In 2019, they entered into an equal production partnership with Şişecam Group for natural soda production in the United States. This partnership aims to leverage the strengths of both entities to bolster production efficiency and market reach.

Key Takeaways

- Market Growth: The global soda ash market achieved a value of USD 21.3 billion in 2022 and is anticipated to escalate to approximately USD 43.1 billion by 2032, showcasing an impressive CAGR of 7.5% during the period from 2023 to 2032.

- Soda Ash Source: The natural soda ash segment holds prominence in the market due to its extensive application in various industries. However, synthetic soda ash is also expected to witness substantial growth.

- Product Types: Light soda ash stands as a dominant product type, capturing a significant market share, largely owing to its diverse applications in the glass and chemicals industry.

- Applications: Glass manufacturing consumes over 40% of the globally produced soda ash, making it the primary contributor to the soda ash market’s overall share.

- Regional Dominance: The soda ash market in North America is expected to be the most profitable globally, holding the largest market share at 40% throughout the forecast period.

Soda Ash Statistics

- Domestic Production (2020): 9.7 million tons, worth $1.5 billion, decreased by 17% compared to the previous year.

- Capacity: The combined annual nameplate capacity of Wyoming plants is 13.9 million tons.

- Soda Ash, also known as Sodium Carbonate, is the 10th most consumed inorganic compound globally, used for over 5,000 years.

- Synthetic Soda Ash is produced through chemical processes like the Solvay or Hou method, accounting for about 70% of global production.

- In January 2024, soda ash production reached 996,000 metric tons, up by 5% from the previous month and 13% compared to January 2023.

- Ending stocks in January were 292,000 metric tons, a 17% increase from the preceding month.

- Wyoming trona production in January 2024 was 1.63 million metric tons, slightly down from December 2023 but 32% higher than January 2023.

- Exports of soda ash decreased by 8% in January 2024 to 573,000 metric tons compared to December 2023.

- Imports of soda ash in January 2024 were 746 metric tons, up from 421 metric tons in December 2023.

- Apparent consumption in January 2024 was 382,000 metric tons, 4% less than December 2023 but 4% more than January 2023.

Emerging Trends

- Increased Demand from Various Industries: The demand for soda ash is growing across multiple sectors, particularly in the glass, chemicals, and detergents industries. This is driven by the ongoing industrialization and urbanization in emerging economies, which boosts consumption in the construction and manufacturing sectors.

- Shift Towards Synthetic Production: There’s a notable shift towards the synthetic production of soda ash, primarily due to its cost-effectiveness and scalability. The synthetic route, mainly through the Solvay process, allows for large-scale production which is essential to meet the bulk requirements of industries like glass and chemicals.

- Sustainability and Eco-Friendly Practices: As environmental concerns continue to grow, there is an increasing focus on sustainable and eco-friendly manufacturing practices. This includes the development of production methods that minimize environmental impact and are more energy-efficient.

- Technological Advancements: The industry is also seeing significant technological advancements aimed at improving efficiency and reducing costs. This includes automation and the use of advanced analytics to optimize production processes.

- Regional Growth Dynamics: Asia Pacific, particularly China, is leading in terms of production and consumption due to its massive industrial base. The region is expected to continue dominating the market, driven by rapid industrialization and the expansion of end-use industries.

Use Cases

- Glass Manufacturing: Soda ash is extensively used in the glass industry as a fluxing agent. By reducing the melting point of silica, soda ash helps in the energy-efficient production of glass. It is essential for manufacturing flat glass for buildings and automobiles, as well as container glass for beverages and foods. Approximately 50% of global soda ash production is utilized in this sector.

- Detergents and Soaps: In the production of detergents and soaps, soda ash acts as a buffering agent to maintain pH levels and enhances cleaning performance by activating surfactants. Its strong alkaline properties are crucial for effective cleaning in laundry and household cleaning products.

- Metallurgy: Soda ash is used in metallurgical processes for the purification of metals. By adjusting pH levels, it helps in the removal of impurities from raw metals which is essential for producing high-quality end products.

- Chemicals: In the chemical industry, soda ash is used for producing various chemicals like dyes, coloring agents, and synthetic detergents. It serves as a raw material for the production of sodium silicate and sodium bicarbonate, which are used in a wide array of chemical processes.

- Water Treatment: Soda ash is utilized to adjust pH levels in water treatment processes. It neutralizes acidic water, making it safer and more effective for various uses, including municipal water supplies and industrial applications.

Key Players Analysis

CIECH SA is a key player in the European soda ash market, particularly known for its substantial market share in Central and Eastern Europe. The company’s operations span across Poland and Germany, where it is one of the largest producers of both light and heavy soda ash as well as sodium bicarbonate. CIECH SA caters to a broad range of industries, including glass manufacturing and the FMCG sector, offering products essential for the production of flat and packaging glass among others. The company has effectively managed to secure its supply chain and pricing strategies, even amidst fluctuating raw material costs and market demands, thereby ensuring delivery reliability to its customers globally.

Ciner Group Resources Corporation, on the other hand, specializes in natural soda ash production with operations primarily based in the United States. The company is a significant player in the global soda ash market, leveraging the trona mineral resource, which is a primary source of natural soda ash. This focus on natural soda ash aligns with market trends that favor environmentally friendly and sustainable production processes. Ciner Group’s strategic positioning allows it to meet the robust demands of the glass and chemicals industries, maintaining a strong foothold in international markets.

Genesis Energy LP is a prominent figure in the natural soda ash industry, with significant operations in the Green River Basin, Wyoming. The company is renowned for its sustainable practices in extracting and processing trona ore to produce soda ash, which is a key ingredient in various industries including glass and detergents. Genesis Energy’s commitment to environmental sustainability is reflected in its operations, which are designed to have a lower carbon footprint compared to synthetic soda ash production. They have also undertaken ambitious expansions, notably investing $350 million to enhance their soda ash output, demonstrating their dedication to meeting global demand efficiently.

GHCL Limited is another key player in the soda ash sector, recognized for its production of both light and dense soda ash. GHCL caters to a diverse array of industries, including glass, detergents, and chemicals, emphasizing its role in the domestic and international markets. The company is noted for its strategic initiatives to enhance production capabilities and its focus on sustainability within its operations. This approach ensures GHCL remains competitive in the dynamic market environment of soda ash.

Lianyungang Soda Ash Co. Ltd is a prominent state-owned enterprise in China, well-known for its large-scale production of both light and heavy soda ash since its inception in 1989. It serves a crucial role in various industries, particularly in glass manufacturing, contributing significantly to China’s position as a major player in the global soda ash market.

NIRMA LIMITED, established in 1969, is a significant Indian manufacturer of soda ash and other chemicals. It is renowned for its focus on quality and customer satisfaction, playing a key role in supplying soda ash to various sectors including soaps, detergents, and glass industries. This commitment positions NIRMA as a pivotal company within the Asia-Pacific region’s chemical sector.

Şişecam Group: As a significant player in the soda ash industry, Şişecam Group, headquartered in Istanbul, Turkey, continues to make its mark globally. Founded in 1935, the company has diversified its operations beyond glass to include chemicals and other sectors, maintaining a strong presence in international markets. Şişecam is known for its commitment to sustainable practices and innovation within the soda ash sector, contributing to the industry with a strong focus on quality and environmental sustainability.

Solvay S.A: Solvay S.A, based in Brussels, Belgium, stands as a global leader in the production of soda ash, employing both the traditional Solvay process and natural trona refining. With significant investments in the e.Solvay process, the company aims to halve CO2 emissions and eliminate limestone waste, enhancing efficiency and sustainability. Solvay’s expansion plans include increasing natural soda ash production capacity at its Green River plant in the US and developing a state-of-the-art export terminal in Vancouver, Washington, aimed at boosting its export capabilities.

Shandong Haihua Group Co., Ltd. is a key player in China’s chemical industry, heavily involved in the production of soda ash alongside other chemical products like bromine and calcium chloride. The company leverages its position as a state-owned enterprise to expand its production capabilities. Recently, Shandong Haihua has been active in financial markets, issuing bonds to fund the construction of new soda ash production facilities, underscoring its commitment to growing its production capacity and maintaining a significant presence in the global soda ash market.

Tata Chemicals Limited, part of the larger Tata Group, is a major force in the soda ash industry not just in India but globally. The company produces both light and dense soda ash used in a variety of applications including glass manufacturing and detergents. Tata Chemicals is recognized for its sustainable practices and has been expanding its reach and capacity to meet both domestic and international demand effectively, emphasizing its role in environmental stewardship within the industry.

FMC Corporation previously had significant operations in the soda ash sector, focusing on the production of natural soda ash from trona ore. Historically, FMC was one of the major producers in the United States, leveraging its mining operations in Wyoming. However, it’s important to note that FMC Corporation sold its soda ash business around 2015 to focus more on its core chemical businesses and agricultural solutions.

Novacap Group is a prominent player in the soda ash industry, particularly strong in Europe but also expanding globally. Novacap not only produces soda ash but also manufactures sodium bicarbonate and other chemical products. The company has been enhancing its production capabilities, notably with a significant expansion in Singapore where they have established a state-of-the-art sodium bicarbonate plant designed to serve the growing Asian markets. This facility underscores Novacap’s commitment to high-quality production and sustainable practices.

DCW Limited is a prominent Indian chemical manufacturer, notably involved in the soda ash sector. The company, which started in 1939, operates India’s first soda ash factory. DCW has evolved into a diversified chemical company, offering products that serve a variety of industrial applications such as detergents, cleaning products, and water treatment. Recently, DCW restored its soda ash production to 75% capacity following a mechanical issue, demonstrating its resilience and capability to maintain essential supply chains.

OCI COMPANY Ltd., a major global chemical company based in South Korea, is a significant player in the soda ash industry. OCI focuses on the production of natural soda ash and has undertaken various expansion projects to increase its production capacity. This strategic expansion is aimed at meeting the growing global demand for soda ash, used widely in glass manufacturing and chemicals.

Tronox Limited is a significant player in the global soda ash market, renowned for its mining and marketing of inorganic minerals and chemicals. The company has been strategically increasing the prices of soda ash, reflecting its strong market position and response to economic factors in the industry. Tronox operates two main business segments: Titanium Dioxide and Alkali, with the latter focusing on soda ash. Notably, the company enhanced its capabilities in the soda ash sector by acquiring FMC Corporation’s Alkali Chemicals division. This acquisition has allowed Tronox to expand its production and market reach, particularly in cost-advantaged natural soda ash, which is crucial for various industrial applications including glass and chemicals production.

SEQENS Group, a global leader in pharmaceutical solutions and specialty ingredients, has a diversified presence in the soda ash sector through its Mineral Specialties division. The company produces and sells sodium carbonate, commonly known as soda ash, along with other mineral specialties. Notably, SEQENS has made significant investments in its production facilities, including a state-of-the-art plant in Singapore, enhancing its international footprint and capabilities in serving high-demand markets such as pharmaceuticals and personal care. The integration of green technologies and practices in their operations underlines SEQENS’s commitment to sustainability and high-quality production.

Conclusion

In conclusion, the Soda Ash market is poised for continuous growth, driven by its indispensable uses across various industries, particularly in glass manufacturing, chemicals, and detergents. The market is forecasted to expand significantly, with a projected increase in market size due to the rising demand from these key sectors. Technological innovations and strategic market expansions are likely to enhance production capacities and efficiency, thereby supporting the global demand for Soda Ash.

The focus on sustainable and eco-friendly manufacturing processes is becoming increasingly important, and companies are investing in new technologies to minimize environmental impact while maintaining production efficiency. The market’s growth is also facilitated by strategic mergers and acquisitions, allowing companies to leverage their resources better and expand their market presence globally.

As Soda Ash continues to be a critical component in various applications, its market is expected to remain robust, offering numerous opportunities for growth and innovation in the coming years.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)