Table of Contents

Introduction

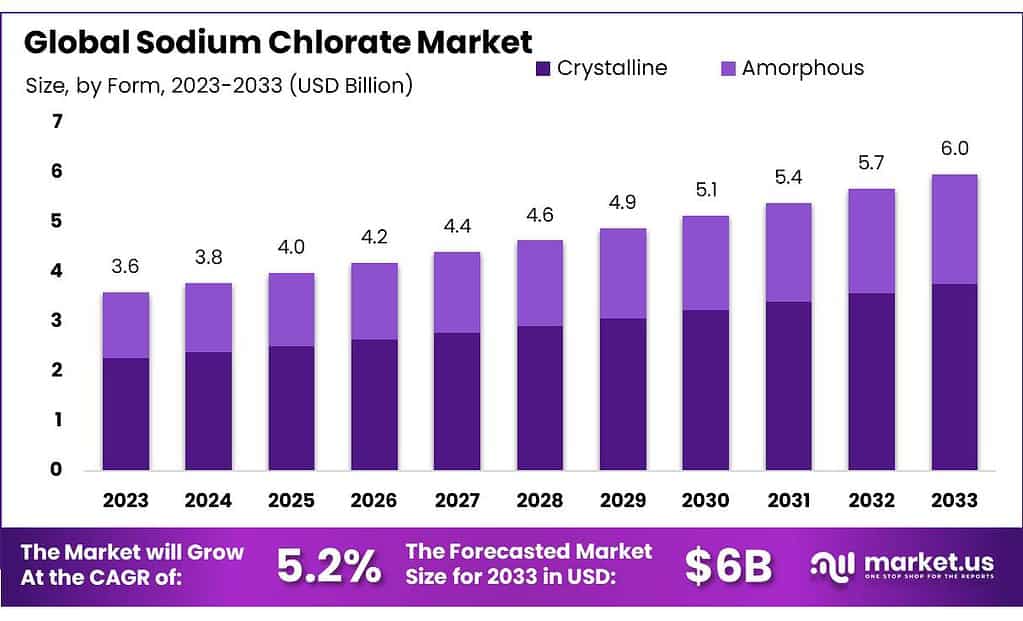

The global sodium chlorate market, valued at USD 3.6 billion in 2023, is anticipated to grow robustly, reaching approximately USD 6.0 billion by 2033. This growth, at a compound annual growth rate (CAGR) of 5.2%, is driven by its extensive use in the paper and pulp industry, particularly for chlorine dioxide production, crucial in the bleaching process. Increased demand for eco-friendly packaging and high-quality paper products is further propelling this growth. Sodium chlorate’s applications extend to water treatment, where it acts as a disinfectant, and in the agricultural sector as an effective herbicide, broadening its market scope.

However, the market faces challenges, including volatility in raw material prices and stringent environmental regulations, which scrutinize the chemical’s production and usage. The push towards more sustainable and eco-friendly alternatives could restrain market expansion. Additionally, geopolitical tensions and supply chain disruptions also pose significant risks, potentially impacting global supply dynamics.

Recent developments in the industry include strategic expansions and technological innovations by key market players. For instance, companies are increasingly focusing on enhancing production capacities and forming strategic alliances to bolster their market position. There’s also a notable shift towards the development of bio-based alternatives, aiming to mitigate the environmental impact associated with traditional sodium chlorate production processes.

Arkema, for instance, has focused on expanding its portfolio through targeted acquisitions, notably in high-performance materials and specialty chemicals sectors. This approach has helped Arkema to strengthen its global presence and technology base, contributing significantly to its revenue growth, which reached nearly €11.5 billion in 2022, marking a substantial year-over-year increase.

Chemtrade, another significant player, has been actively managing its portfolio of chemical products, including sodium chlorate, to better align with market demands and environmental standards. This includes optimizing their production processes and exploring sustainable practices within their operations. ERCO, a specialist in the manufacture and supply of sodium chlorate, continues to invest in production efficiency and capacity expansion, aiming to meet the increasing demand in the pulp and paper industry, where sodium chlorate is predominantly used as a bleaching agent.

Key Takeaways

- Market Size and Growth: The global Sodium Chlorate Market is projected to grow from USD 3.6 billion in 2023 to approximately USD 6.0 billion by 2033, at a CAGR of 5.2% during the forecast period.

- The crystalline form of sodium chlorate held a dominant market position, capturing more than a 63.4% share.

- Bleaching Agents: Dominates with over 60.3% market share in 2023, crucial for producing high-quality paper products by removing lignin.

- Paper & Pulp Industry: Leads with a market share of 73.3% in 2023, driven by sodium chlorate’s role in paper bleaching processes.

- Indirect Sales: Predominant with a market share of 63.4% in 2023, facilitated by distributors reaching diverse industries globally.

- Asia Pacific: Leads with a market share of 43.5%, expected to reach USD 1.6 billion by the forecast period end, driven by robust adoption in key sectors like pulp and paper.

Sodium Chlorate Statistics

- CAS Number: Sodium chlorate’s CAS number is 7775-09-9, essential for product identification and regulatory purposes.

- Molecular Weight: It has a molecular weight of 106.44, crucial for calculating dosages and chemical reactions.

- EC Number: Identified by EC number 231-887-4, aiding in regulatory compliance and safety assessments.

- Product Categories: Categorized under salts, with 3 specific product listings available from Sigma-Aldrich and Supelco.

- Available Brands: Sigma-Aldrich offers 2 variants, while Supelco provides 1, ensuring options for different purity requirements.

- Purity Grades: Available as ACS reagent (≥99.0%) and ReagentPlus® (≥99%), suitable for various analytical and industrial applications.

- Specific Products: Includes items like 403016 (ACS reagent) and 244147 (ReagentPlus®), meeting specific purity and application needs.

- In its crystal form, sodium chlorate is stable at temperatures up to 250°C.

- Chemical Formula: NaClO3

- I concluded that you would need to run your cell at somewhere below 50C to do this. I don’t know how low below 50C.

- The cells I ran were at 65C (this one was pH controlled) and a non-pH-controlled one at about 50C.

- At room temperature and pressure, stresses of 2.4 and 5 MPa, and grain sizes in the range of 75–500 μm, NaClO3 aggregates compact by a diffusion-controlled PS mechanism

- Melting-point: Decomposes at 180–200°C

- Solubility: Soluble in water (g/l): 390 at 17° C, 550 at 60° C

- Molecular weight: 90.44

Emerging Trends

Emerging trends in the Sodium Chlorate market indicate a dynamic landscape shaped by several influential factors, primarily driven by its application across diverse industries. One notable trend is the increasing demand for elemental chlorine-free (ECF) paper products, reflecting growing environmental concerns. This shift is influencing the pulp and bleaching industry significantly, as sodium chlorate is a primary agent in the ECF bleaching process. As sustainability becomes more critical, this trend is expected to continue driving demand within the sector.

Another trend is the adoption of sodium chlorate as a non-selective herbicide, especially for controlling vegetation on non-crop areas such as roadsides and fenceways. This application highlights its versatility and expands its utility beyond traditional sectors.

The market is also seeing a rise in the use of sodium chlorate in water treatment processes. As a powerful oxidizing agent, it is used to purify water, making it safer for consumption. This application is gaining traction, driven by the global push for improved water quality standards and infrastructure.

Additionally, advancements in production technologies are emerging as a trend. Companies are increasingly focusing on enhancing the efficiency and environmental footprint of their production processes. This includes improvements in manufacturing processes to reduce waste and emissions, which is not only a response to regulatory pressures but also aligns with the broader industry shift towards sustainability.

Moreover, the sodium chlorate market is experiencing strategic expansions, including mergers and acquisitions, which are shaping the competitive landscape. Companies are consolidating to leverage synergies, expand their market presence, and enhance their technological capabilities to meet the evolving demands of the market.

Use Cases

- Pulp and Bleaching Industry: Sodium chlorate is extensively used as a bleaching agent in the production of high-quality, elemental chlorine-free (ECF) paper. The chemical’s oxidizing nature helps in the efficient bleaching of wood pulp, which is crucial for producing bright, white paper.

- Water Treatment: It acts as a disinfectant and sanitizer in water treatment processes, contributing to the purification of drinking water and wastewater treatment. The demand for sodium chlorate in this application is driven by the rising awareness and regulatory standards concerning water quality.

- Chemical Production: Sodium chlorate is used as a precursor in the synthesis of various chemicals, including chlorine dioxide, which is pivotal for different chemical processes. Its role in manufacturing high-quality dyes and other chemical intermediates underscores its importance in the chemical industry.

- Herbicides and Pesticides: Due to their strong oxidizing properties, sodium chlorate is also popular in agriculture as a non-selective herbicide for vegetation control, particularly along roadsides and non-crop areas.

- Mining and Metal Treatment: In the mining industry, sodium chlorate is used in processes like uranium mining for ore processing. Moreover, it serves in the surface treatment of metals, which is essential in industries such as automotive and aerospace for improving the durability and performance of metal parts.

Key Players Analysis

Arkema is actively involved in the sodium chlorate market, primarily through its Alpure® sodium chlorate product line. This product is a white crystalline solid used significantly in the pulp and paper industry as a key bleaching agent for high-quality chemical pulps. Arkema’s sodium chlorate helps produce chlorine dioxide, which is essential for the bleaching process, aiming to enhance the quality and sustainability of paper products. Additionally, Arkema has implemented price increases for its sodium chlorate products in Europe and overseas markets to offset rising raw material and transportation costs, reflecting its strategic adjustments in response to market conditions.

CHG is recognized as a key player in the global sodium chlorate market. The company has been actively involved in the production and sales of sodium chlorate, primarily catering to applications in the pulp & paper industry, water treatment, and chemical raw materials sectors. CHG’s performance and business strategies in the sodium chlorate sector focus on maintaining a robust market presence and optimizing their product offerings to meet diverse industry demands.

China First Chemical Holdings is also prominently featured in the sodium chlorate market, offering products that serve a variety of applications, including the pulp & paper sector. The company is known for its commitment to enhancing its production capabilities and expanding its market reach. This strategic focus is aimed at leveraging the growing demand for sodium chlorate, particularly in high-volume industries like paper manufacturing and chemical processing, ensuring that China First Chemical Holdings remains a significant player in the market.

ERCO is a notable entity in the sodium chlorate market, primarily recognized for its significant role in the supply of this chemical to various industrial sectors. ERCO’s operations are heavily centered on producing sodium chlorate for pulp and paper bleaching, reflecting its crucial role in the industry. The company’s focus on maintaining robust production facilities highlights its commitment to meeting the growing industrial demand for sodium chlorate, which is essential for producing high-quality, environmentally friendly bleached paper products.

Ercros, another key player, is distinguished by its substantial market presence in Spain, where it leads in sodium chlorate production. The company’s strategic initiatives, including expanding its production capabilities and enhancing its product offerings, underscore its commitment to sustainability and technological advancement. Ercros has been particularly focused on increasing its production capacity to meet both domestic and international demand, ensuring it remains a significant competitor in the global sodium chlorate market.

Hunan Hengguang Chemical is a recognized participant in the global sodium chlorate market, noted for its production and sale of sodium chlorate among other chemical products. This company, based in China, focuses on harnessing the properties of sodium chlorate mainly for applications such as pulp bleaching in the paper industry and other industrial uses. Their operations contribute to meeting both domestic and international market demands.

Inner Mongolia Lantai Industrial is another key player in the sodium chlorate sector, leveraging its production capabilities to serve diverse industrial needs. Located in China, Lantai Industrial is involved in manufacturing sodium chlorate, which is essential for industries like paper and pulp for bleaching processes, and for other applications including water treatment and herbicide production. The company’s strategic position in the market is reinforced by its ability to meet significant domestic and global chemical demands.

Kemira has significantly invested in enhancing its sodium chlorate production capabilities, most notably with a new production line in Joutseno, Finland. This facility is pivotal for Kemira’s strategy to boost supply to the global pulp and paper industry, where sodium chlorate is essential for the environmentally preferred ECF bleaching processes. Kemira’s commitment to this sector is reinforced by its comprehensive portfolio of bleaching chemicals and deep expertise in fiber processing, aimed at producing high-quality, clean pulp.

Lianyungang Xingang Chemical is recognized in the sodium chlorate market primarily for its contributions to various industrial applications. The company is involved in the production of sodium chlorate, which is used across several sectors including paper and pulp for bleaching, water treatment, and as a component in certain chemical manufacturing processes. This positions Lianyungang Xingang Chemical as a significant player in catering to both domestic and international markets, leveraging its production capabilities to meet diverse industrial needs.

Nouryon is a global leader in the production of sodium chlorate, renowned for its extensive use in the pulp and paper industry where it is a key component for elemental chlorine-free (ECF) pulp bleaching. Nouryon’s expertise ensures a reliable and sustainable supply of sodium chlorate, produced through environmentally conscious methods. The company’s focus on innovation and sustainability is evident in its commitment to reducing the carbon footprint of its production processes, which includes utilizing renewable energy sources and advanced technology to enhance efficiency and minimize environmental impact.

Sanxiang Electrochemical, while not as prominently featured in the sources as Nouryon, appears to be involved in the broader sodium chlorate market, potentially engaging in similar applications such as pulp bleaching or other chemical processes. Details specific to Sanxiang Electrochemical’s operations in the sodium chlorate sector were not as readily available, suggesting a smaller or more niche role compared to global leaders like Nouryon. For specific operations and market involvement, more targeted or detailed industry sources would be required to gather comprehensive insights into Sanxiang Electrochemical’s activities in this sector.

Conclusion

In terms of applications, the market is significantly supported by its demand in the pulp and paper industry where it is utilized as a bleaching agent. The shift towards environmentally friendly paper products and the growing need for high-quality, elemental chlorine-free (ECF) papers continue to push the demand for sodium chlorate. Additionally, its uses in water treatment as a disinfectant and in the chemical industry as a precursor for various compounds underline its critical role across different sectors.

However, the market also faces challenges, including the volatility of raw material prices and stringent environmental regulations that scrutinize the production and use of sodium chlorate. These factors might restrain market growth to some extent. Moreover, the availability of alternatives like hydrogen peroxide and ozone for bleaching processes could also impact the market dynamics.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)