Table of Contents

Introduction

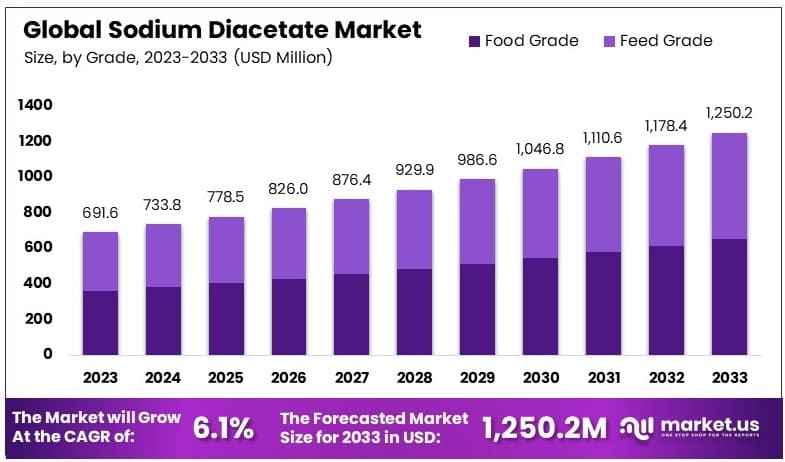

The Global Sodium Diacetate Market is projected to expand from USD 691.6 Million in 2023 to approximately USD 1,250.2 Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 6.1% during the forecast period from 2024 to 2033. This growth can be attributed to the increasing demand for sodium diacetate in food preservation and as a flavor enhancer across various industries. Moreover, its application in mold inhibitors and its utility in extending the shelf life of food products also drive market expansion.

However, challenges such as stringent regulatory requirements and the potential health risks associated with overconsumption may impede market growth. Recently, advancements in food safety standards have bolstered the use of sodium diacetate, reflecting a growing endorsement by food safety agencies. Furthermore, the market has experienced a significant shift due to the adoption of environmentally friendly production techniques, which promise to mitigate regulatory and health-related challenges in the coming years.

Recent developments in the sodium diacetate market indicate a robust engagement in strategic initiatives by key players, with a particular focus on expansions, new product launches, and mergers and acquisitions. These activities are aimed at enhancing market reach and improving production capabilities, driven by the rising demand for sodium diacetate across various industries.

For instance, companies like Mitsubishi Chemical Corporation and Macco Organiques Inc. are actively increasing their production capacities and improving supply chain efficiencies. These efforts are particularly directed towards meeting the growing needs in the food and pharmaceutical sectors, where sodium diacetate is extensively used as a preservative and flavor enhancer.

Henan Honghui Biotechnology Co., Ltd., another significant player, has been focusing on technological advancements to streamline their production processes and reduce environmental impact. This aligns with the global shift towards sustainable manufacturing practices.

ULRICH GmbH, recognized for its stringent quality standards, continues to expand its product offerings to cater to niche markets, including organic and natural food producers, indicating a strategic pivot to address evolving consumer preferences.

The sodium diacetate market is witnessing a dynamic transformation, with companies adopting aggressive growth strategies to secure their positions in a competitive landscape. These developments not only enhance the companies’ operational capabilities but also broaden their global footprint, ensuring they remain competitive in a fast-evolving industry landscape.

Key Takeaways

- Market Value: The Sodium Diacetate Market was valued at USD 691.6 million in 2023, and is expected to reach USD 1,250.2 million by 2033, with a CAGR of 6.1%.

- Grade Analysis: Food Grade dominated with 52.5%; vital for its widespread use in food preservation.

- Application Analysis: Food and Beverages led with 46%; critical for its preservative properties enhancing shelf life.

- Distribution Channel Analysis: Offline channels dominated with 75.4%; important for direct sales to food manufacturers.

- Dominant Region: Asia Pacific held 41.8%; significant due to high demand in the food industry.

- Analyst Viewpoint: The sodium diacetate market is highly competitive with significant potential for growth in food preservation. Future trends indicate increased adoption in various food applications.

Sodium Diacetate Chemical and Physical Properties

- Sodium diacetate is a compound with the formula NaH(C2H3O2)2, a salt of acetic acid.

- The chemical formula of sodium diacetate is C4H7NaO4.

- Its molar mass is 142.086 g·mol−1.

- Solubility: 1 g/mL in water, slightly soluble in alcohol, and insoluble in ether.

- First registered in 1968 as a food preservative.

Sodium Diacetate Uses and Applications

- Approved as a food additive with the E number E262, imparting a salt and vinegar flavor.

- Fungicide and bactericide registered to control molds and bacteria in stored grains.

- Post-harvest feed uses are exempt from tolerance requirements since 1981.

- Approved at a level up to 0.25% for antimicrobial use in meat and poultry products.

- Inhibits the growth of Listeria monocytogenes in meat and poultry products.

Sodium Diacetate Antifungal Effects

- Antifungal effect on inhibiting the growth of bread spoiling molds examined in culture media and flat bread “in situ.”

- Concentrations of sodium diacetate (0, 1000, 2000, 3000, 4000, and 5000 ppm) tested against Aspergillus sp., Aspergillus niger, Rhizopus sp., and Penicillium sp.

- At 5000 ppm, mold growth was inhibited up to the fifth day.

- In “in situ” tests, 3000 ppm inhibited mold growth and prevented bread staling without harmful effects on texture and flavor, extending shelf life by up to four days.

- 3000 ppm is recommended for increasing bread shelf life.

Sodium Diacetate Market Dynamics

- According to Volza’s Global Export data, sodium diacetate export shipments stood at 2.2K, exported by 362 world exporters to 391 buyers.

- The top three supplier countries for sodium diacetate are China, Belgium, and the United States.

- China is the leading exporter with 1,040 shipments, followed by South Korea with 272 shipments, and Belgium at the third spot with 246 shipments.

- The top three buyer countries for sodium diacetate are the United States, Ukraine, and India.

- World exports most of its sodium diacetate to the United States, India, and Vietnam.

Emerging Trends

- Increased Demand in Food Preservation: There is a growing demand for sodium diacetate as a food preservative due to its effectiveness in inhibiting mold and bacteria growth. This trend is driven by the increasing consumer preference for longer shelf life and reduced food waste.

- Rise in Clean Label Products: Consumers are increasingly seeking clean label products, which list ingredients that are familiar and natural. Sodium diacetate, being a relatively safe food additive, is gaining popularity in clean label formulations, particularly in baked goods and snacks.

- Expansion in Pet Food Applications: Sodium diacetate is emerging as a popular choice in pet food preservation, thanks to its antimicrobial properties. This trend is supported by the rising expenditure on pet food products that are safe and have an extended shelf life.

- Technological Advancements in Production: Technological advancements are enabling more efficient production of sodium diacetate, reducing costs and environmental impact. This trend is crucial for maintaining competitiveness in the global market.

- Regulatory Scrutiny and Compliance: There is an increased focus on regulatory scrutiny and compliance, which is prompting manufacturers to invest in proper certification and labeling to meet global standards, thus affecting market dynamics significantly.

- Development of Synthetic Routes: Research in synthetic routes for sodium diacetate is gaining momentum. These methods aim to enhance the purity and yield of sodium diacetate, making the production process more cost-effective and scalable.

- Increased Use in Pharmaceutical Applications: Sodium diacetate is finding new applications in the pharmaceutical industry as an excipient and a pH control agent. This trend is driven by the pharmaceutical industry’s need for reliable and safe ingredients to enhance medication efficacy and stability.

Use Cases

- Food Preservation: Sodium diacetate is commonly used as a preservative in packaged and processed foods to extend shelf life by preventing the growth of mold and bacteria. It is especially prevalent in bread, cakes, and other bakery products where freshness is crucial.

- Flavor Enhancer: In the food industry, sodium diacetate serves as a flavor enhancer, imparting a vinegar-like taste to snacks such as potato chips and crackers without the need for liquid vinegar, thus simplifying the manufacturing process.

- Antimicrobial Agent in Pet Foods: It is used in pet food to prevent spoilage and to ensure products remain safe and palatable for pets over extended periods. This application takes advantage of its antimicrobial properties.

- pH Regulator in Pharmaceuticals: In pharmaceuticals, sodium diacetate is employed to adjust and stabilize pH levels in various medications, ensuring they maintain their efficacy and stability throughout their shelf life.

- Meat Industry Applications: Sodium diacetate is applied in the meat packing industry as a mold inhibitor and to control the growth of Listeria monocytogenes in ready-to-eat meat products, thereby enhancing safety and quality.

- Industrial Applications: Beyond its uses in food and pharmaceuticals, sodium diacetate is also used in industrial settings as a buffering agent, helping control the acidity or alkalinity in industrial processes.

- Agricultural Uses: It is utilized in agricultural products as a bactericide and fungicide, helping protect crops from various diseases and enhancing the overall yield and quality of agricultural products.

Key Players Analysis

Henan Honghui Biotechnology Co., Ltd. is a prominent supplier in the sodium diacetate market, focusing on food safety and natural solutions. The company produces sodium diacetate as part of their Acetate & Diacetate series, which includes a blend with sodium lactate, used mainly as a preservative in meat and poultry products to inhibit pathogen growth and extend shelf life. Recently, the company has enhanced its offerings in this segment, emphasizing eco-friendly and health-conscious products.

Mitsubishi Chemical Corporation engages in the production of sodium diacetate, primarily used as a sour agent and pH regulator in various food products. Their sodium diacetate consists of 58% sodium acetate and 42% glacial acetic acid. The company is also involved in sustainability initiatives, collaborating with other firms to achieve carbon neutrality by 2050. In 2024, Mitsubishi Chemical reported a significant profit increase and ongoing efforts to expand their product portfolio in the chemical sector.

ULRICH GmbH operates in the sodium diacetate sector, supplying this compound primarily for food preservation and flavor enhancement. Their sodium diacetate is widely used in the food industry due to its antimicrobial properties that help extend the shelf life of various food products. Recently, ULRICH GmbH has focused on expanding its product offerings and market presence in Europe. The company continues to innovate in this space to meet the growing demand for effective food preservatives.

Macco Organiques Inc. is a key player in the sodium diacetate market, providing high-quality sodium diacetate for food preservation and pH regulation. Their products are used extensively in the food and beverage industry. Recently, Macco Organiques has reported steady revenue growth, driven by increasing demand for processed foods and the need for effective preservatives. The company continues to expand its production capabilities and distribution network to meet the rising global demand.

Niacet, a leader in preservation technologies, specializes in cost-effective low-sodium solutions for meat and plant-based foods. Acquired by Kerry Group in 2021, Niacet enhances Kerry’s food protection portfolio with its proprietary drying and granulation process technologies. Recently, Niacet invested $50 million to expand its facility in Niagara Falls, focusing on high-purity chemicals for the semiconductor industry. This strategic move aims to bolster its presence in the growing New York semiconductor supply chain.

Kerry Company, known for its innovative taste and nutrition solutions, acquired Niacet to solidify its leadership in food protection and preservation. The acquisition brings together complementary technologies, enhancing Kerry’s capabilities in creating sustainable nutrition solutions. Kerry’s recent development includes Tastesense Salt, designed to reduce sodium while retaining flavor in snacks, addressing global health initiatives to lower sodium intake.

Corbion, a key player in the sodium diacetate market, offers high-quality preservation solutions for food safety and shelf-life extension. The company focuses on sustainable ingredient solutions and recently expanded its product portfolio to meet the rising demand for clean-label preservatives. Corbion’s expertise in biotechnology and fermentation processes positions it as a leader in providing natural preservation solutions that cater to both conventional and clean-label markets.

Vinipul Inorganics Pvt Ltd, established in 1984, is a prominent manufacturer and exporter of a wide range of inorganic and industrial chemicals, including sodium diacetate. The company is recognized for its quality products and competitive pricing. Vinipul Inorganics caters to various industries such as pharmaceuticals, chemicals, and food processing. With a modern production line and a strong focus on R&D, the company is expanding its market reach, particularly in Europe and the United States.

Fooding Group Limited is a major supplier of food additives, including sodium diacetate, which is used for its preservative and flavor-enhancing properties. The company is known for its high-quality standards and extensive product range that meets diverse customer needs in the food industry. Fooding Group’s recent initiatives focus on expanding their market presence globally by enhancing product offerings and ensuring compliance with international food safety standards.

Conclusion

In conclusion, sodium diacetate is a versatile additive that plays a crucial role across various industries, from food preservation and flavor enhancement to pharmaceutical applications. Its ability to inhibit microbial growth and regulate pH levels makes it an invaluable component in maintaining the quality and safety of numerous products.

As market trends continue to evolve, the demand for sodium diacetate is expected to grow, driven by its effectiveness and the ongoing development of applications that meet both regulatory standards and consumer expectations. Companies in the sector are likely to see continued opportunities for innovation and expansion, leveraging sodium diacetate’s properties to meet the changing needs of a dynamic market.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)