Table of Contents

Introduction

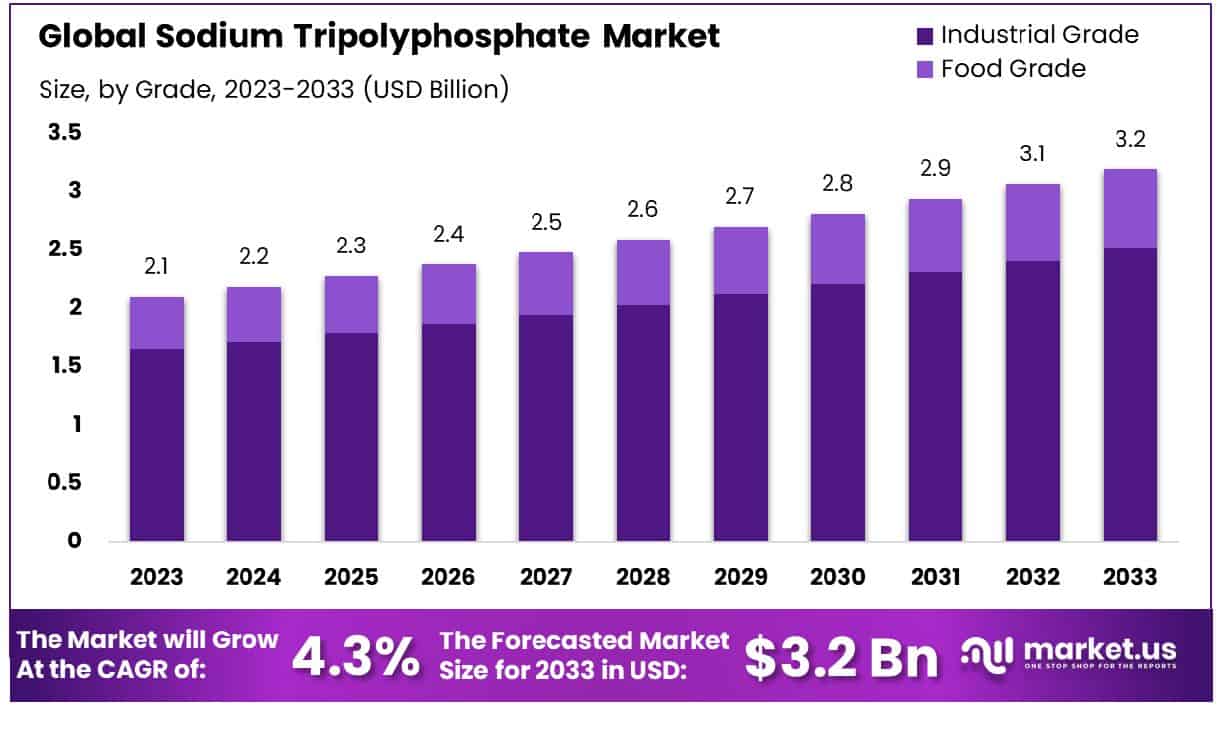

The Global Sodium Tripolyphosphate Market is poised for significant growth over the next decade, anticipated to expand from USD 2.1 billion in 2023 to around USD 3.2 billion by 2033, marking a compound annual growth rate (CAGR) of 4.3%. This growth trajectory is driven primarily by the increasing demand for this chemical in various applications, including detergents, water treatment, and food preservatives, which require substantial quantities to enhance product efficiency and stability.

However, the market faces challenges such as stringent environmental regulations and volatility in raw material prices, which could hinder progress. Recent developments in the industry, including advancements in sustainable production techniques, aim to address these challenges by reducing the environmental impact associated with the chemical’s production and use. These innovations are crucial for maintaining the market’s expansion and addressing regulatory and supply chain complexities.

The Haifa Group has recently expanded its production capabilities to meet growing global demand, particularly in agricultural and industrial applications. This strategic expansion is expected to increase their production output by significant margins, although specific figures are yet to be disclosed.

Grasim Industries Ltd., a major player in the chemical sector, has launched a new line of environmentally friendly STPP products. These developments are not only aimed at reducing environmental impact but also at capturing a niche market segment that favors sustainable and green chemicals. This move is anticipated to boost their market share and appeal to a broader consumer base concerned with environmental sustainability.

Hubei Xingfa Chemicals Group Co. Ltd. has been involved in strategic partnerships to leverage synergies in technology and distribution. These collaborations are geared towards improving the efficiency of their supply chain and enhancing product accessibility in underserved regions, which is crucial for maintaining competitive advantage.

Innophos Holdings Inc. has invested in advanced R&D to develop novel STPP formulations that offer superior performance for applications in detergents and cleaning agents. This focus on high-performance products is likely to position them favorably in markets with stringent regulatory standards on environmental safety and product efficiency.

Israel Chemicals Ltd. has been proactive in acquiring smaller competitors to consolidate its market position and expand its product portfolio. These acquisitions have not only increased their market coverage but also enhanced their capability to meet diverse customer needs across different regions.

Key Takeaways

- Market Growth: The Global Sodium Tripolyphosphate Market size is expected to be worth around USD 3.2 Billion by 2033, From USD 2.1 Billion by 2023, growing at a CAGR of 4.3% during the forecast period from 2024 to 2033.

- In the Asia-Pacific, the sodium tripolyphosphate market commands 45.6%, valued at USD 0.9 billion.

- By Type: Industrial-grade products dominate the market, accounting for 78.6%.

- By Form: Powder form holds a significant share, comprising 68.4% of products.

- By Application: Detergents & cleaners lead in the application, capturing 36.7% market share.

Sodium Tripolyphosphate Industrial Uses

- The thin layer containing 1% w/w STPP showed favorable flux and relatively good rejection for the Cu2+ ions. However, the best rejection was obtained for 5% w/w STPP.

- Grinding tests showed that STPP significantly improved the mass fraction of -0.074 mm in grinding products by 6.8 percentage points.

- The hydrolysis of sodium tripolyphosphate was investigated in a sterile aqueous solution between pH 3 and 7 and at temperatures between 40 and 70°C.

- As an auxiliary agent of synthetic detergent, sodium tripolyphosphate can keep the PH value of detergents around 8.4 and promote the removal of acidic dirt.

- The aqueous solution of STPP is weakly alkaline. It forms a suspension liquid in water with a PH value ranging from 4.3 to 14.

Sodium Tripolyphosphate Market Trends

- Sodium Triphosphate (Sodium Tripolyphosphate), Other than Food Grade data was reported at 0.003 USD mn in Apr 2024. This records a decrease from the previous number of 0.034 USD mn for Dec 2023.

- The price of Sodium Tripolyphosphate (United States) decreased during April 2019 to 1,310 USD per metric ton, which represents a slight decline of 2% compared to the previous month’s value. On a year-over-year basis, the prices of Sodium Tripolyphosphate (United States) decreased by 5%.

- Meanwhile, the average price of Sodium Tripolyphosphate (China) amounted to 870 USD per metric ton, from 866 USD per metric ton one year earlier. On a month-over-month basis, the price of Sodium Tripolyphosphate (China) is 0.5% lower than the price one month before.

- The prices of Sodium Tripolyphosphate (South America) were flat and decreased by 3% every year.

- In 2022, Sodium triphosphate was the world’s 2540th most traded product, with a total trade of $725M. Between 2021 and 2022 the exports of Sodium triphosphate grew by 31.7%, from $551M to $725M. Trade in Sodium triphosphate represents 0.0031% of total world trade.

Sodium Tripolyphosphate in Food Processing

- Ground turkey meat, cooked and uncooked, was prepared with and without 0.5% sodium tripolyphosphate (STPP) and stored at 5°C for different periods.

- A two-level factorial design with three independent variables (fat (10 and 30%), sodium chloride (NaCl) (0.8 and 2.4%), and sodium tripolyphosphate (STPP) (0.5 and 1.5%)) was used to randomly produce eight formulations of Jamnapari goat meat emulsion.

- The average moisture content of the slurry entering the tower is about 40%, and the average moisture content of the powder product from the tower is about 7%. About 33% of the water is evaporated, and the energy consumption required accounts for about 13% of the total energy consumption of production.

- The main forms of Sodium Triphosphate are anhydrous (85% minimum purity, 56-59% P2O5 content) and hexahydrate (65% minimum purity, 43-45% P2O5 content). The anhydrous form may be more specified, with a technical grade (94% minimum purity) or food grade (94-97% minimum purity, metals content).

- For safe and accurate dosing of Sodium Tripolyphosphate (Na5P3O10). From precise dosing applications (10 ml/hour) to large applications up to as much as 1,000 liters per hour.

Emerging Trends

- Increased Demand in Detergent Industry: STPP is a key component in many household cleaning products. Its ability to soften water and enhance detergent performance is driving its demand. As global hygiene awareness rises, especially in developing regions, the need for effective cleaning products is expected to boost the STPP market.

- Food Industry Applications: STPP is employed as a preservative and texture enhancer in processed foods such as seafood, meats, and poultry. With the growth in processed food consumption globally, the demand for STPP in this sector is anticipated to rise. However, health concerns over additives in food could affect its usage rates.

- Environmental Regulations: STPP has been scrutinized for its environmental impact, particularly its role in water eutrophication, where it contributes to excessive growth of algae and deterioration of water quality. This has led to stricter regulations and a shift towards eco-friendly alternatives in some regions. The market is adapting by developing less harmful formulations or finding new, sustainable compounds that can replace STPP.

- Technological Innovations: Advancements in chemical processing and biotechnology are leading to the development of alternative materials that offer similar benefits as STPP but with reduced environmental impact. The adoption of such innovations could reshape the market, decreasing reliance on traditional STPP.

- Market Expansion in Emerging Economies: Economic growth in Asia-Pacific and Latin America is expected to be a major driver for the STPP market. Increasing urbanization and a growing middle class in these regions could escalate the consumption of products containing STPP, such as detergents and processed foods.

- Supply Chain Optimization: Companies are focusing on optimizing their supply chains to reduce costs and improve the efficiency of STPP production and distribution. This involves enhancing logistical operations and investing in closer proximity to key markets to minimize transportation costs and response times.

Use Cases

- Detergent Industry: STPP is predominantly used in the production of laundry detergents and dishwashing agents. It acts as a water softener in these formulations, enhancing the effectiveness of detergents by binding calcium and magnesium ions. As of recent market data, approximately 60% of the global STPP production is utilized in the detergent sector. The demand in this segment is driven by the rising household consumption of cleaning products, particularly in emerging economies.

- Food Industry: In the food industry, STPP is utilized as a preservative and to maintain moisture and texture in seafood, meats, and poultry. It helps prevent spoilage and retain water content, making frozen products, including shrimp and fillets, more palatable after thawing. The food-grade STPP market accounts for about 15% of its total usage, with a growing trend influenced by increasing global seafood consumption, estimated to rise by 4% annually.

- Ceramic Tiles Industry: STPP is employed in the manufacture of ceramic tiles as a dispersing agent to reduce viscosity and improve the handling properties of ceramic slurry. The ceramics sector consumes roughly 10% of the global supply of STPP. The market for ceramic tiles is projected to expand at a compound annual growth rate (CAGR) of approximately 6.8% over the next five years, potentially increasing the demand for STPP.

- Water Treatment: STPP is used in water treatment facilities to prevent the formation of scale deposits and corrosion in water pipes. It forms complexes with ions that would otherwise precipitate and cause scaling. The use of STPP in this application is critical for ensuring the longevity and efficiency of water-handling infrastructure.

- Paper Production: In paper manufacturing, STPP serves as a dispersant to prevent clumping and to improve the quality of paper. It facilitates the even distribution of ingredients in pulp, thereby enhancing the smoothness and quality of the final product.

Major Challenges

- Regulatory Restrictions: Regulatory limitations represent one of the most significant challenges for the STPP market. Many countries, particularly within the European Union, have imposed stringent regulations on phosphate usage in detergents due to environmental concerns. Phosphates, including STPP, can contribute to water pollution, leading to eutrophication, which depletes oxygen in water bodies and harms aquatic life. For instance, the EU Regulation (EC) No 648/2004 has significantly limited the phosphate content in consumer laundry and dishwasher detergents. These regulations encourage the shift toward phosphate-free products, reducing the demand for STPP in these regions.

- Competition from Alternatives: The development and adoption of alternative materials that can replace STPP in its various applications pose another challenge. For instance, zeolites, citrates, and other biodegradable compounds are being used as replacements in detergent formulations. These alternatives are often marketed as more environmentally friendly options, aligning with both regulatory trends and consumer preferences. The growing effectiveness and cost-competitiveness of these alternatives could erode STPP’s market share.

- Volatility in Raw Material Prices: STPP production is dependent on the availability and prices of raw materials such as phosphoric acid and sodium carbonate. Fluctuations in the prices of these commodities can significantly affect the production costs of STPP. For example, any disruption in the supply chain, such as geopolitical issues or trade restrictions, can lead to increased raw material costs, impacting the profitability of STPP manufacturers.

- Market Saturation in Developed Countries: The market for STPP in developed countries is nearing saturation, particularly in applications like detergents where the use of phosphates has been a standard for decades. With the mature markets facing stringent regulations and high consumer awareness, growth opportunities in these regions are limited, pushing companies to focus more on emerging markets where regulatory frameworks are less stringent.

Market Growth Opportunities

- Developments in Personal Care Products: The use of STPP in personal care products like toothpaste and shampoos for their emulsifying properties is on the rise. With the personal care market expanding by approximately 4.8% per year globally, this is a lucrative avenue for growth.

- Agricultural Uses: As a nutrient in livestock and aquaculture feed, STPP can enhance animal growth and bone development. Given the steady growth in these industries, estimated at 3.5% annually, targeting this segment could provide steady revenue streams.

- Pharmaceutical Applications: STPP’s use in pharmaceuticals as a dispersing agent can be further explored. With healthcare spending expected to increase by 5% globally, tapping into this sector could yield considerable benefits.

- Construction Industry: In construction, STPP is used to improve the quality of concrete and ceramics. With the global construction market projected to grow at 4% annually, focusing on construction-related applications could open up additional markets.

- Geographic Expansion: Exploring untapped markets in Africa and Latin America, where industrial growth rates are predicted to be higher than the global average, can lead to substantial growth in STPP demand. Tailoring products to meet local needs and regulations will be key.

Key Players Analysis

Haifa Group operates in the Sodium Tripolyphosphate sector by providing high-grade, food-quality sodium tripolyphosphate primarily used as an emulsifier, texturizer, buffer, sequestrant, and stabilizer. The company’s products are utilized extensively in meat and seafood processing, affirming its role as a significant player in the industry.

Grasim Industries Ltd., a flagship company of the Aditya Birla Group, is engaged in the production of a wide range of chemicals and materials, including Sodium Tripolyphosphate (STPP), which is used predominantly in detergents. The company has seen significant growth in this sector, leveraging its expansive industrial capabilities to meet global demand.

Hubei Xingfa Chemicals Group Co., Ltd. is a leading producer of phosphorus chemical products, including sodium tripolyphosphate, primarily used in detergents and cleaners. The company, recognized as a national high-tech enterprise in China, operates advanced facilities for developing and manufacturing a wide range of phosphorus-based products, enhancing its market position in the global chemicals industry.

Innophos Holdings Inc., a prominent player in the sodium tripolyphosphate sector, specializes in the production and supply of specialty ingredients. The company focuses on delivering high-quality products tailored for applications in food processing, water treatment, and detergents. Innophos’s strategic approach includes enhancing product efficiency and supporting customer needs in various industries.

Israel Chemicals Ltd. plays a significant role in the sodium tripolyphosphate market, specializing in the production of this compound which is crucial in various industrial applications including detergents and cleaning products. The company’s focus on this sector helps meet the growing demand for effective water-softening solutions, which are essential in enhancing the efficiency of cleaning processes.

Merck KGaA is also a key player in the sodium tripolyphosphate market. This company provides high-quality STPP, which is utilized in numerous applications ranging from detergents to food preservation. Their strategic production and supply capabilities support a wide array of industries, underscoring their critical role in the global supply chain of sodium tripolyphosphate.

PhosAgro is a key producer of sodium tripolyphosphate (STPP), which is extensively utilized in the manufacturing of synthetic detergents, water treatment products, and various industrial applications like ceramics and paints. Their production capabilities are enhanced by their strategic location near St. Petersburg, facilitating efficient global distribution. PhosAgro’s focus on high-quality feedstock ensures the production of superior STPP grades.

Sumitomo Chemicals Co. Ltd. is a key player in the Sodium Tripolyphosphate (STPP) market, participating alongside other major companies in a fragmented and competitive sector. The company is known for its involvement in various chemical markets, including the production and distribution of STPP, which is primarily used in manufacturing detergents. Sumitomo Chemicals leverages its innovative capabilities to enhance its market position and meet the growing demand in industries like processed food and detergents.

Tata Chemicals Ltd. has a rich history in the production of Sodium Tripolyphosphate (STPP), originally starting at its Haldia plant to meet the needs of detergent manufacturers. Over the years, the company’s focus shifted towards more complex fertilizers, but it continues to be a significant player in the market for chemicals used in detergents and other applications.

Thermo Fisher Scientific Inc. participates in the sodium tripolyphosphate market by offering it for various applications, including water softening, fabric washing, and as a preservative in food and feed products. The company markets this chemical under its Thermo Scientific Chemicals brand, highlighting its utility in heavy-duty washing and as an emulsifier and stabilizer in diverse formulations.

The Mosaic Company is engaged in a significant venture within the Sodium Tripolyphosphate (STPP) sector as part of a large-scale integrated phosphate production facility in partnership with Ma’aden and SABIC. This complex is set to enhance their phosphate production capabilities, including the production of STPP, which is commonly used in detergents. This initiative underlines Mosaic’s role in advancing industrial growth and sustainability in phosphate production.

HBCChem, Inc. is listed as a supplier of Sodium Tripolyphosphate (STPP), a chemical primarily used in detergents and cleaning agents due to its properties as a water softener and sequestrant. The company provides this product to various industries, showcasing its role in the chemical supply chain for products requiring water treatment capabilities and enhanced cleaning performance.

Yuntianhua Group is a prominent entity in the Sodium Tripolyphosphate (STPP) sector, noted for its significant role in the production and market presence within this industry. The company’s involvement spans from the manufacturing to the commercial distribution of STPP, which is used extensively as a detergent builder and water softener. Yuntianhua’s operations highlight its capacity to meet substantial market demands, positioning it as a key player in the global STPP market landscape.

Shifang Sundia, based in Shifang City, Sichuan, plays a significant role in the Sodium Tripolyphosphate (STPP) market, leveraging its strategic location in one of China’s major phosphate bases. The company focuses on the production and distribution of STPP, which is utilized across various industries for applications such as water softening and as a cleaning agent. Their products, compliant with international quality standards, are both sold domestically and exported globally, reflecting a robust operational and market reach.

Conclusion

The market for Sodium Tripolyphosphate (STPP) is anticipated to witness steady growth over the coming years. This growth is primarily driven by its extensive use in various industries such as detergents, water treatment, and ceramics. The detergent sector, in particular, remains the largest consumer of STPP, owing to its effectiveness in water softening and stain removal. Moreover, emerging applications in the food processing industry are likely to open new avenues for market expansion.

However, environmental concerns and stringent regulations regarding phosphate usage could pose challenges to the market. Overall, while the market faces potential regulatory hurdles, the ongoing demand across multiple industries underscores a cautiously optimistic outlook for the future of the Sodium Tripolyphosphate market.