Table of Contents

Introduction

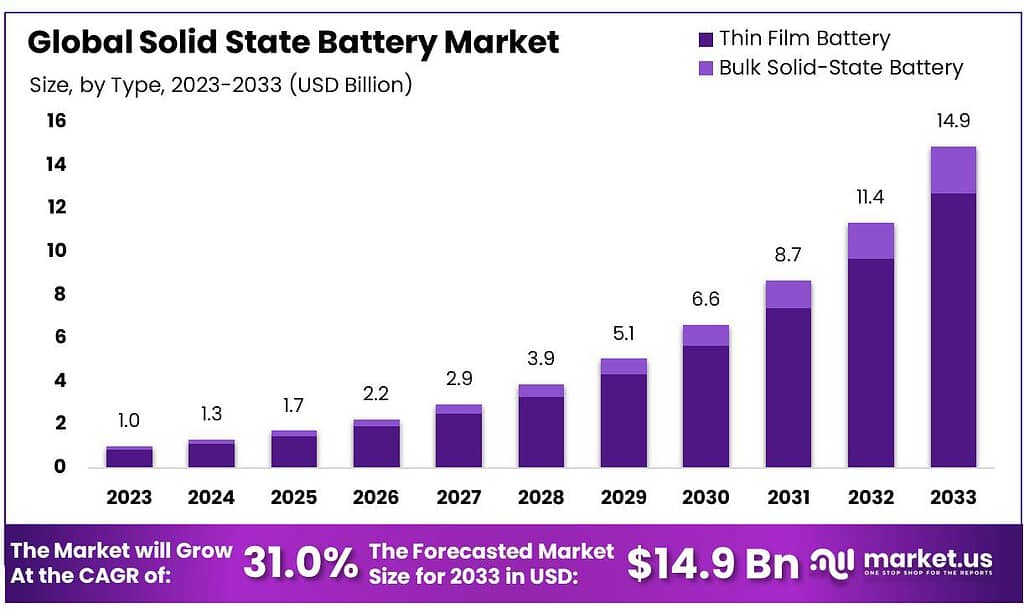

The global solid-state battery market is anticipated to experience remarkable growth, expanding from USD 1 billion in 2023 to USD 14.9 billion by 2033, reflecting a robust compound annual growth rate (CAGR) of 31.0% from 2024 to 2033. This surge is driven by several key factors, notably the increasing demand for electric vehicles (EVs) and advancements in consumer electronics.

Solid-state batteries offer significant advantages over traditional lithium-ion batteries, including higher energy density, faster charging times, and enhanced safety, which are crucial for the performance and reliability of EVs and portable electronic devices. Recent developments in this market include substantial investments in research and development by major companies such as Samsung SDI, Toyota Industries, and QuantumScape, aimed at overcoming technical challenges and improving battery efficiency and lifespan.

One of the primary growth drivers is the automotive industry’s shift towards electric mobility, with solid-state batteries playing a critical role due to their potential to provide longer driving ranges and quicker charging capabilities. For instance, Toyota has announced plans to introduce solid-state batteries in their EVs by 2027, which are expected to significantly enhance vehicle performance and safety. Additionally, the consumer electronics sector is increasingly adopting solid-state batteries for devices such as smartphones, laptops, and wearable technology, benefiting from their compact size and longer lifespan.

Despite these advancements, the market faces challenges such as high production costs and scalability issues, which companies are actively addressing through innovative manufacturing techniques and strategic collaborations. For example, ProLogium Technology is expanding its production capabilities with new facilities in Taiwan and France, leveraging advanced manufacturing processes to enhance output efficiency and reduce costs. Furthermore, the development of new solid electrolytes and battery architectures is accelerating, with companies exploring AI-enhanced material development to optimize performance.

Samsung SDI Co., Ltd. is making notable progress by unveiling a mass-production roadmap for its all-solid-state batteries (ASB), featuring an industry-leading energy density of 900 Wh/L. Samsung SDI’s recent advancements include ultra-fast charging technology that achieves 80% charge in just 9 minutes and batteries with a lifespan exceeding 20 years.

The company aims to begin mass production of these batteries by 2027, highlighting its commitment to leading the next generation of battery technology. Toyota Industries Corporation continues to pioneer in the solid-state battery space with plans to commercialize solid-state batteries for electric vehicles. In 2023, Toyota announced the development of a solid-state battery prototype capable of providing a range of over 500 miles on a single charge and a full recharge in just 10 minutes. This positions Toyota as a frontrunner in creating safer and more efficient batteries for the automotive industry.

Overall, the solid-state battery market is set to revolutionize the energy storage landscape, driven by technological innovations and increasing applications in various sectors, paving the way for a more sustainable and efficient energy future.

Key Takeaways

- Market Growth: Expected to reach USD 14.9 billion by 2033, growing at 31.0% CAGR from USD 1 billion in 2023.

- Dominant Type: Thin Film Batteries secured over 85.4% market share in 2023 due to their adaptability.

- Capacity Preference: 20mAh-500mAh segment captured 68.4% market share in 2023, showcasing versatility.

- Application Dynamics: Wearables led with a 62.5% market share in 2023, driven by solid-state battery adoption.

- Regional Dynamics: Asia Pacific dominates with a 50.1% market share, driven by electronics and EV demand.

Solid-state Battery Statistics

- The cost per kWh for Li-ion batteries was $137 in 2020.

- Electric vehicles are projected to constitute 10–12% of total automotive sales by 2030.

- Over 100 players are involved in solid-state battery technology development.

- Theoretical specific energy of silicon anodes: 4200 mAh/g.

- Specific energy of lithium-ion batteries with graphite anodes: 372 mAh/g.

- Initial voltage plateau of a carbon anode: 2.5 V.

- Initial voltage plateau of a silicon anode: 3.5 V.

- Volume expansion of silicon during lithiation: Over 300%.

- Self-discharge rate of solid-state batteries: Less than 1% per year.

- Energy improvement with solid-state batteries: Up to 50% better.

- Potential global market size for Li-ion batteries by 2025: 600 GWh per year.

- Expected timeline for commercial availability of solid-state batteries: 3 to 4 years for early adopters, 4 to 5 years for high-volume consumer markets, and

- 8 to 10 years for mature technology.

- Life Cycle Testing: QuantumScape’s batteries have undergone rigorous testing, with some cells experiencing almost 1,000 discharge and charge cycles.

- Solid-state batteries promise:

- Energy density increase of up to 2 to 8 times.

- Range of 500-800 km.

- 1 liter per kWh versus 4 liters per kWh in current Tesla Model 3.

- Current cost comparison:

- Solid-state batteries: $800 per kWh.

- Lithium-ion batteries: $100 per kWh.

Emerging Trends

- Higher Energy Density and Faster Charging: Solid-state batteries (SSBs) offer a significant improvement in energy density, capable of storing more energy than traditional lithium-ion batteries of the same size and weight. This results in electric vehicles (EVs) having longer ranges. Additionally, SSBs charge faster due to the lower resistance of their solid electrolytes, making them more efficient for applications requiring quick turnaround times.

- Improved Safety and Longevity: One of the key advantages of SSBs is their enhanced safety profile. Unlike conventional lithium-ion batteries, SSBs use solid electrolytes that are less likely to leak or catch fire, reducing the risk of thermal runaway. Moreover, these batteries have a longer lifespan, as their solid electrolytes are more resistant to degradation over time, making them ideal for applications requiring durable energy storage solutions.

- Technological Innovations: The industry is witnessing breakthroughs in electrolyte composition and battery architecture, with advancements like AI-enhanced material development accelerating innovation. These developments are crucial for enhancing the performance and commercial viability of SSBs, paving the way for their integration into EVs, consumer electronics, and renewable energy systems.

- Global Strategic Initiatives: Countries like China, Japan, and South Korea are leading the global push for SSB development, emphasizing the strategic importance of this technology for the EV industry and beyond. This international focus is driving significant investments and collaborative efforts to advance SSB technology and establish a robust supply chain.

- Challenges in Commercialization: Despite their advantages, SSBs face challenges such as high manufacturing costs and complexities in mass production. Developing cost-effective, highly efficient electrodes and stable solid electrolytes remains a critical hurdle. The industry is also working on establishing dedicated production lines to accommodate the unique requirements of SSB technology.

- Industry Collaborations and Investments: There is a growing trend of collaborations between major companies and startups to advance SSB technology. For instance, companies like Toyota and QuantumScape are investing heavily in R&D to bring solid-state batteries to commercial viability by the late 2020s.

Use Cases

- Electric Vehicles (EVs): Solid-state batteries are highly sought after in the EV industry for their higher energy density, which can potentially double the range of electric vehicles. Companies like Toyota and QuantumScape are at the forefront of developing these batteries, which are expected to significantly reduce charging times and enhance vehicle safety. Recent advancements have demonstrated solid-state batteries achieving energy densities of up to 720 Wh/kg, enabling EVs to potentially cover over 1,300 miles on a single charge.

- Consumer Electronics: SSBs are ideal for portable devices such as smartphones, laptops, and tablets due to their compact size and extended lifespan. The improved energy density and fast charging capabilities make them suitable for next-generation consumer electronics that require long battery life and quick recharging.

- Energy Storage Systems: SSBs are becoming crucial in renewable energy storage solutions, providing efficient and safe storage options for solar and wind energy. Their ability to handle more charge cycles without significant degradation makes them ideal for both grid-connected and off-grid energy storage systems, supporting the transition to sustainable energy sources.

- Medical Devices: In the medical field, SSBs are used in devices like pacemakers and hearing aids, where reliability and longevity are critical. Their stable chemical properties and long life cycles ensure consistent performance, which is vital for medical applications.

- Aerospace and Defense: SSBs are being explored for use in drones, satellites, and other aerospace applications due to their lightweight and high energy density, which are essential for maximizing the efficiency and range of these devices.

- Wearable Technology: The lightweight and flexible nature of SSBs makes them suitable for wearable devices, including fitness trackers and smartwatches, providing longer battery life and enhanced safety for users.

Key Players Analysis

Samsung SDI Co., Ltd. is advancing significantly in the solid-state battery sector, focusing on mass production readiness by 2027. The company is developing all-solid-state batteries (ASB) with an impressive energy density of 900 Wh/L, aiming to enhance the performance and safety of electric vehicles (EVs) and consumer electronics. Samsung SDI’s roadmap includes ultra-fast charging technology, achieving 80% charge in just 9 minutes, and a 20-year battery lifespan, positioning the company as a leader in next-generation battery technology.

Toyota Industries Corporation is at the forefront of solid-state battery development, aiming to commercialize these batteries for electric vehicles by 2027. Toyota’s solid-state batteries promise a range of over 500 miles on a single charge and the ability to fully recharge in just 10 minutes, significantly enhancing EV performance and safety. This development underscores Toyota’s commitment to leading the market with innovative, high-performance energy solutions.

ProLogium Technology Co., Ltd. has made significant advancements in the solid-state battery market, notably with the inauguration of the Taoke factory in Taiwan, which is the world’s first large-scale solid-state lithium ceramic battery production facility. This factory has a capacity of 2 GWh, sufficient to power up to 26,000 electric vehicles annually. ProLogium is also investing €5.2 billion in a new gigafactory in Dunkirk, France, set to begin production in 2026, further enhancing its global footprint and supporting the transition to electric mobility with high-capacity solid-state batteries.

QuantumScape Corporation is at the forefront of solid-state battery innovation, focusing on developing batteries with higher energy density and faster charging capabilities. The company has demonstrated significant progress with its lithium-metal solid-state battery technology, achieving milestones such as a 15-minute charge to 80% capacity and extended battery life. QuantumScape is also scaling up production with a pilot plant aimed at producing thousands of multi-layer cells, positioning itself as a key player in revolutionizing the electric vehicle battery market.

LG Chem is making significant strides in the solid-state battery sector through its collaboration with Factorial Energy. This partnership focuses on developing advanced solid-state battery materials, combining LG Chem’s expertise in battery materials with Factorial’s innovative FEST® solid-state technology. The collaboration aims to enhance battery performance, increase energy density, and improve safety, targeting the electric vehicle (EV) market. This initiative underscores LG Chem’s commitment to leading the next generation of battery technologies and supporting the global transition to electric mobility.

Solid Power is advancing its solid-state battery technology by leveraging its proprietary sulfide-based solid electrolytes, which offer high ionic conductivity and stability. The company is actively collaborating with major automotive manufacturers, including BMW and Ford, to integrate its solid-state batteries into electric vehicles. Solid Power’s focus is on scaling up production capabilities and enhancing battery performance to deliver safer, more efficient, and longer-lasting energy storage solutions, positioning itself as a key player in the future of electric mobility.

Conclusion

The solid-state battery market is poised for robust growth, driven by technological advancements and increasing applications across various industries. Projected to grow from USD 1 billion in 2023 to USD 14.9 billion by 2033 at a CAGR of 31.0%, the market is primarily fueled by the demand for electric vehicles (EVs) and enhanced consumer electronics.

Key developments include significant investments in new battery technologies by major players such as Samsung SDI, Toyota Industries, and QuantumScape, focusing on improving energy density, safety, and charging speeds. However, challenges like high production costs and scalability issues remain, with ongoing efforts to develop cost-effective manufacturing solutions. These trends indicate a promising future for solid-state batteries, transforming energy storage and electric mobility sectors.