Table of Contents

Introduction

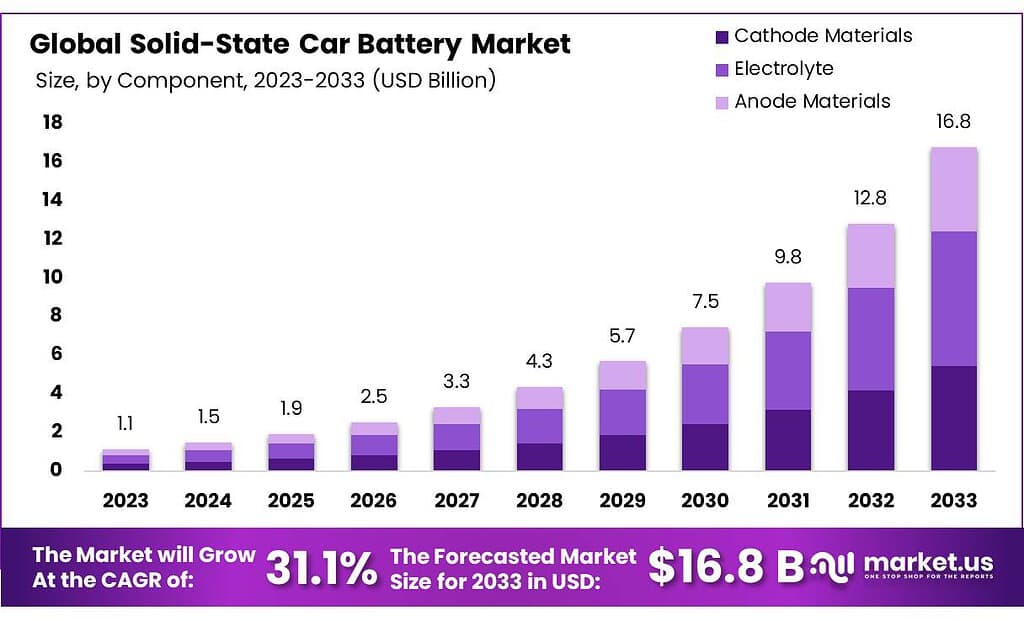

The global solid-state car battery market is projected to witness significant growth in the coming years. From a market size of USD 1.1 billion in 2023, it is expected to expand rapidly, reaching USD 16.8 billion by 2033, with a compound annual growth rate (CAGR) of 31.1% over the forecast period from 2023 to 2033. This growth is driven by the rising demand for electric vehicles (EVs), coupled with advancements in battery technology that offer higher energy density, improved safety, and longer lifespans compared to conventional lithium-ion batteries.

Solid-state batteries use solid electrodes and electrolytes, which provide several benefits over traditional liquid-based lithium-ion batteries. Key advantages include enhanced safety, faster charging times, and a higher energy density. These features make solid-state batteries particularly appealing for electric vehicle manufacturers seeking to enhance vehicle range and efficiency. Moreover, the ability of these batteries to operate across a wider temperature range without performance degradation further supports their application in various climate conditions.

Recent technological developments have also contributed to the growth of the market. For instance, advancements in ceramic and polymer electrolytes are allowing for the development of batteries that are more efficient and reliable. Major automakers like Toyota, BMW, and Volkswagen have invested heavily in research and development (R&D) to bring solid-state batteries to commercial production. These companies are leading efforts to overcome manufacturing challenges, such as scaling up production and reducing costs, which have historically hindered widespread adoption.

However, the market still faces challenges, particularly in terms of the high cost of production and the technical complexity of manufacturing at scale. The development of solid-state batteries requires the use of expensive materials, and ensuring consistent performance across large-scale manufacturing remains a challenge. Additionally, the integration of these batteries into electric vehicles requires further optimization, particularly regarding their durability and performance in real-world conditions.

Regionally, Asia Pacific is expected to dominate the market due to the presence of leading battery manufacturers and the rapid adoption of electric vehicles, particularly in countries like China, Japan, and South Korea. North America and Europe are also poised for strong growth, driven by government regulations promoting clean energy and increasing consumer demand for EVs.

Hitachi has been focusing on developing next-generation solid-state batteries through its subsidiary Hitachi Zosen. They have created a proprietary method to produce solid-state batteries using a machining technique that enhances safety and energy density. This development is aimed at integrating solid-state batteries into electric vehicles (EVs) to achieve better performance and longer range, although commercialization timelines have not been fully disclosed yet.

Enevate has made significant strides with its high-silicon anode battery technology, which allows ultra-fast charging (up to 5 minutes) and higher energy density. In December 2023, Enevate announced a production licensing agreement with CustomCells, a German battery manufacturer, to commercialize this technology. The partnership is set to scale up Enevate’s battery technology globally, with a focus on the European market. This technology is designed to meet the increasing demand for fast-charging EV batteries.

BMW has invested heavily in solid-state battery innovation. In a notable move, BMW increased its investment in Solid Power, a U.S.-based solid-state battery developer, aiming to bring a prototype vehicle with solid-state batteries to the market before 2025. BMW is also working on its “Neue Klasse” vehicles, which will feature this advanced technology by the end of the decade, aiming to significantly enhance energy density and reduce production costs.

Key Takeaways

- Market Growth: The Solid-State Car Battery Market is set to reach USD 16.8 billion by 2033, exhibiting a remarkable 31.1% CAGR from its 2023 value of USD 1.1 billion.

- Component Significance: Electrolyte commands a substantial market share of 41.6% in 2023, underscoring its critical role in facilitating ion movement and boosting solid-state battery efficiency.

- Material Type Dominance: Battery Electric Vehicles (BEVs) hold a significant market share of 64.8%, reflecting a strong consumer preference for fully electric vehicles.

- Vehicle Type Preference: Passenger Electric Vehicles capture a major market position with a share of 43.2%, signaling an increasing consumer inclination towards personal electric transportation.

- Regional Leadership: Asia-Pacific leads the global market with a dominant 37% share, driven by robust developments in China, India, and other countries.

Solid-State Car Battery Statistics

- With conventional lithium-ion processes, multi-layer solid-state batteries already run with 20-ampere hours (Ah) capacity from a roll-to-roll production line.

- Electric vehicles (EVs) are gaining traction worldwide and for good reasons. They produce less pollution, are cheaper to maintain, offer great speed and power, and now come in all sizes, from the pint-sized Nissan Leaf to the F-150 pick-up and three-row SUVs. Even the most common concern of range anxiety has abated, as EVs today have a range of between 300 and 500 miles.

- Lithium-ion batteries, the most common in EVs, are much heavier than comparable gas tanks. For instance, while a 15-gallon tank of gasoline weighs about 90lbs and provides about 300 miles of range for a mid-size sedan

- A traditional Lithium-ion (Li-ion) battery pack has to weigh well over 1,000 lbs to provide a similar range.

- The gas version has twice the range (460 miles) than its electric version does (230 miles) on a 150-pound gas storage system, while the EV battery is over ten times as heavy.

- Months-long testing performed by Volkswagen’s subsidiary battery company Powerco showed QuantumScape’s prototype cells could complete 1,000 charging cycles while maintaining 95% of their nominal energy storage capacity, equivalent to driving 500,000 km without any perceived reduction in electric vehicle (EV) range.

- QuantumScape’s commercial energy density target of 800–1,000 Wh/L for its solid-state batteries, batteries could extend EV ranges by over 40% when compared with the 700 Wh/L energy density of today’s best-performing lithium-ion cells.

- QuantumScape’s battery exceeded both testing targets, completing 1,000 charging cycles with only marginal aging, maintaining 95% of its nominal rated energy storage capacity.

- In practical terms, this result indicates that a typical EV using the new batteries could be driven up to 500,000 km without any significant loss in range between charges.

- Tests conducted on a prototype solid-state battery built by United States-based company QuantumScape retained 95 percent of its capacity after driving after completing 1000 charging cycles.

- For an electric car with a range of 500-600 kilometers, this corresponds to a total mileage of more than half a million kilometers.

- Studies have shown that solid electrolytes can adapt to higher-than-ambient temperatures (60-120°C), which may make them more suitable for Indian conditions.

- The average electric car on the road today has the same greenhouse-gas emissions as a car getting 88 miles per gallon — which is far greater than the average new gasoline-powered car (31 mpg) or truck (21 mpg), according to analysis by the Union of Concerned Scientists.

- QuantumScape claims that you will be able to buy an Audi or Volkswagen with its batteries as soon as 2024, a vehicle that can go nearly 400 miles on a single charge, and then recharge in 15 minutes.

- Leading lithium-ion batteries boast an energy density of about 600 watt-hours per liter, but QuantumScape expects its ASSB to achieve an average energy density of 1,000 watt-hours per liter.

- QuantumScape says its EV battery will take 15 minutes to go from 10 to 80 percent.

- Toyota announced a $13.6 billion investment in an in-house battery development and production program, one that includes solid-state batteries, in 2021.

- the shipment volume of lithium batteries in China was 328GWh, a year-on-year increase of 135%, setting a new historical high.

Emerging Trends

- Higher Energy Density: Solid-state batteries are gaining attention due to their potential for higher energy density compared to traditional lithium-ion batteries. By replacing the liquid electrolyte with a solid material, these batteries can store more energy in the same space, offering longer driving ranges for electric vehicles. For instance, solid-state batteries are expected to have an energy density of over 500 Wh/kg, significantly higher than current lithium-ion batteries, which typically offer around 250-300 Wh/kg.

- Enhanced Safety Features: One of the most significant trends in the solid-state battery market is the focus on safety. Traditional lithium-ion batteries can pose risks of overheating and catching fire, especially under stress or damage. Solid-state batteries eliminate the flammable liquid electrolyte, making them inherently safer. This is a crucial factor driving the adoption of solid-state batteries in electric vehicles, as safety is a top priority for manufacturers and consumers alike.

- Faster Charging Times: A key challenge with EV adoption has been the slow charging time of current battery technologies. Solid-state batteries offer the potential for much faster charging. Companies like Enevate have developed technologies that allow solid-state batteries to charge up to 10 times faster than conventional lithium-ion batteries, reducing charging time to as little as five minutesThis capability can make EVs more convenient and competitive with traditional gasoline vehicles.

- Extended Lifespan: Solid-state batteries also have a longer lifespan compared to lithium-ion batteries. They are less prone to degradation over time, meaning they can endure more charge and discharge cycles before their performance starts to decline. This longevity makes solid-state batteries more cost-effective over the lifetime of an EV, reducing the need for battery replacements.

- Commercialization and Strategic Partnerships: The race to commercialize solid-state batteries is intensifying. Companies like BMW and Toyota are investing heavily in solid-state battery R&D, with plans to integrate these batteries into their vehicles by the mid-2020s. Strategic partnerships, such as those between Enevate and CustomCells, are also playing a vital role in scaling up production and bringing these batteries to market.

- Sustainability and Lower Carbon Footprint: Sustainability is a growing trend in the solid-state battery market. These batteries are expected to reduce the environmental impact associated with battery production and disposal. They require fewer raw materials like cobalt and nickel, which are often mined under environmentally harmful conditions. Additionally, solid-state batteries can be made more recyclable, further lowering their carbon footprint.

Use Cases

- Electric Vehicles (EVs): The primary use case for solid-state batteries is in electric vehicles. With solid-state batteries offering energy densities of over 500 Wh/kg, they significantly improve the driving range of EVs compared to traditional lithium-ion batteries, which typically provide 250-300 Wh/kg.

- Additionally, the enhanced safety features—such as reduced risk of fire or overheating—are highly desirable for automakers like BMW and Toyota, who plan to introduce solid-state battery-powered vehicles by 2025. These batteries will enable faster charging, potentially as quick as 10 minutes, a significant improvement over the current 30-60 minute fast charging for conventional EVs.

- Electric Trucks and Buses: Commercial electric vehicles like trucks and buses are another key application. Solid-state batteries’ high energy density and extended lifespan make them particularly suitable for heavy-duty electric vehicles, which require substantial power to operate over long distances. For example, electric buses powered by solid-state batteries would be able to operate longer routes without the need for frequent recharging. These batteries’ durability also means that fleet operators would save on maintenance and battery replacement costs over time.

- Aerospace and Aviation: In the aerospace industry, solid-state batteries are being considered for their lightweight nature and ability to operate in extreme conditions. This makes them ideal for electric aircraft and drones, where weight is a critical factor. The longer lifecycle of solid-state batteries, combined with their safety advantages, makes them an attractive choice for electric vertical takeoff and landing (VTOL) aircraft, which could transform urban air mobility.

- Autonomous Vehicles: Another growing use case is in autonomous electric vehicles. Autonomous systems require consistent and reliable energy sources to power advanced sensors, computing platforms, and control systems. Solid-state batteries’ ability to deliver high power with safety and longevity aligns with the needs of autonomous vehicles, ensuring they can operate effectively over extended periods.

- Energy Storage Systems: Solid-state batteries are also being explored for use in stationary energy storage systems. These systems, critical for integrating renewable energy sources like solar and wind into the grid, benefit from the safety and long lifespan of solid-state batteries. The ability to store large amounts of energy and release it steadily over time is essential for balancing supply and demand in power grids.

- Consumer Electronics: While still emerging, another potential use case is in high-performance consumer electronics. The improved energy density and safety of solid-state batteries can extend the battery life of smartphones, laptops, and wearables. In this application, fast charging is a particularly appealing feature, allowing users to recharge devices in minutes instead of hours.

Major Challenges

- Manufacturing Complexity and Cost: One of the major hurdles is the complexity involved in manufacturing solid-state batteries. These batteries require precise engineering, especially in creating the solid electrolyte and ensuring it maintains stability across the battery’s life cycle. Current production methods are expensive, largely due to the materials and technology required. For instance, the use of lithium metal anodes, which enhance energy density, also increases manufacturing costs. Scaling up production to meet the demand for mass-market electric vehicles is expected to be a key obstacle.

- Material Availability and Durability: Solid-state batteries rely on rare materials such as lithium and cobalt. While solid-state batteries are expected to use fewer rare materials than traditional lithium-ion batteries, securing a stable supply chain for these materials remains a challenge. Moreover, ensuring the durability of these batteries, especially under real-world conditions like high temperatures and repeated charging cycles, has proven difficult. Dendrite formation—the growth of needle-like lithium structures—can degrade the battery’s performance and lifespan.

- Technological Maturity: Solid-state batteries are still in the research and development phase, with only a few companies, like BMW and Toyota, aiming for commercialization by the mid-2020s. However, achieving the necessary technological maturity to produce these batteries at a large scale while ensuring safety, efficiency, and cost-effectiveness remains a challenge.

Market Growth Opportunities

- Rising Demand for Electric Vehicles (EVs): The growing global market for electric vehicles is one of the primary drivers of solid-state battery demand. As governments worldwide enforce stricter emissions regulations, EV sales are expected to rise significantly. Solid-state batteries, with their higher energy density and longer range, offer a competitive advantage over traditional lithium-ion batteries. By 2030, electric vehicle sales are projected to make up nearly 30% of all global vehicle sales, creating a substantial market for solid-state batteries.

- Increased Focus on Safety and Performance: Safety concerns around lithium-ion batteries, such as overheating and fire hazards, are pushing automakers toward solid-state solutions. Solid-state batteries reduce these risks by eliminating flammable liquid electrolytes, making them a safer option for high-performance applications. This factor makes them highly appealing for both commercial and passenger EVs, offering automakers an opportunity to differentiate their vehicles in terms of safety and efficiency.

- Government Incentives and Investment: Governments across Europe, North America, and Asia are investing heavily in battery technology as part of their green energy initiatives. These include subsidies for research and development (R&D) in battery technology and EV infrastructure, which create favorable conditions for solid-state battery innovation and commercialization. For instance, in 2022, the European Union committed over €3 billion in funding for battery R&D, part of which is expected to accelerate the development of solid-state batteries.

Key Player Analysis

In 2023, Hitachi Ltd. made significant progress in the solid-state car battery sector through its subsidiary Hitachi Zosen. By February 2023, the company had developed an innovative all-solid-state lithium-ion battery (AS-LiB) and received its first commercial order for these batteries from a semiconductor manufacturer.

Throughout 2023, Hitachi focused on improving battery safety and performance, leveraging their expertise in X-ray foreign material analysis to enhance the manufacturing process. This technology is crucial for identifying contaminants during production, ensuring higher battery quality and safety.

In 2023, Enevate Corporation made notable progress in the solid-state car battery sector, particularly focusing on its breakthrough silicon-dominant anode technology. In September 2023, Enevate entered a strategic partnership with NantG Power to commercialize and scale its XFC-Energy® battery technology. This collaboration aims to deliver next-generation batteries with ultra-fast charging capabilities, allowing electric vehicle batteries to charge in as little as five minutes while providing high energy density and improved performance in cold climates.

In 2023, BMW Group made significant advancements in its solid-state battery technology. In January, the company, in partnership with Solid Power, began testing solid-state battery cells and is planning to integrate this technology into their upcoming vehicles. BMW is setting up a prototype production line at its Cell Manufacturing Competence Center in Parsdorf, near Munich. This collaboration with Solid Power aims to accelerate the commercialization of all-solid-state batteries (ASSBs). BMW received its first A-samples of solid-state cells from Solid Power in late 2023, marking the start of formal automotive qualification processes. The company plans to introduce its first demonstration vehicle featuring this cutting-edge technology by 2025.

In 2023, Ionic Materials made notable strides in the development of solid-state batteries, focusing on polymer-based electrolytes that enhance safety and performance in electric vehicles (EVs). They are committed to mass-producing solid-state batteries that are safer, cost-effective, and capable of high performance. A significant part of their innovation lies in their advanced polymer materials which are crucial for solving existing challenges in EV battery chemistries. Their approach not only emphasizes safety and cost but also aims at enabling the batteries to perform reliably under a variety of environmental conditions. Looking ahead, Ionic Materials is poised to continue its efforts in scaling its technology to meet the growing demands of the EV market, ensuring its position as a key player in the evolution of battery technology.

In 2024, LG Chem made significant progress in the solid-state battery sector through a strategic partnership with Factorial Energy, aiming to lead in the development of new battery materials for solid-state batteries. This collaboration focuses on accelerating the commercialization of these technologies, combining LG Chem’s advanced material technology with Factorial’s expertise in solid-state battery development. The partnership formalized through a memorandum of understanding, is geared toward optimizing and enhancing the performance and safety of solid-state batteries, which are crucial for the future of electric vehicles. This alliance highlights LG Chem’s commitment to evolving beyond its established base in traditional battery materials and moving towards next-generation battery technologies.

In 2023, NGK Spark Plug expanded its expertise in ceramics into the solid-state battery sector, showcasing its innovation in challenging environments. A notable achievement includes the successful verification test of their solid-state battery technology aboard the HAKUTO-R Lunar Lander, demonstrating the battery’s adaptability and safety in harsh conditions. This milestone underlines NGK’s potential to provide reliable and safe battery solutions in future societal applications.

In 2023, Johnson Energy Storage, part of Johnson Research, introduced a groundbreaking solid-state battery featuring an ultra-thin 5-micron glass separator. This development marked a significant advancement, optimizing battery performance, especially in lower temperatures, while enhancing safety by using solid rather than flammable liquid electrolytes. Johnson Energy Storage’s innovative approach, including the use of glass-based electrolytes and lithium metal anodes, aims to substantially improve energy density and safety in battery technology, signaling a shift towards more efficient and reliable energy storage solutions.

Conclusion

The solid-state car battery market is poised for substantial growth, driven by significant technological advancements and a rising demand for electric vehicles (EVs). These batteries are crucial for the next generation of EVs due to their higher energy density, faster charging capabilities, and enhanced safety compared to traditional lithium-ion batteries. Asia-Pacific currently leads this market, indicative of robust developments particularly in China, Japan, and South Korea.