Table of Contents

Introduction

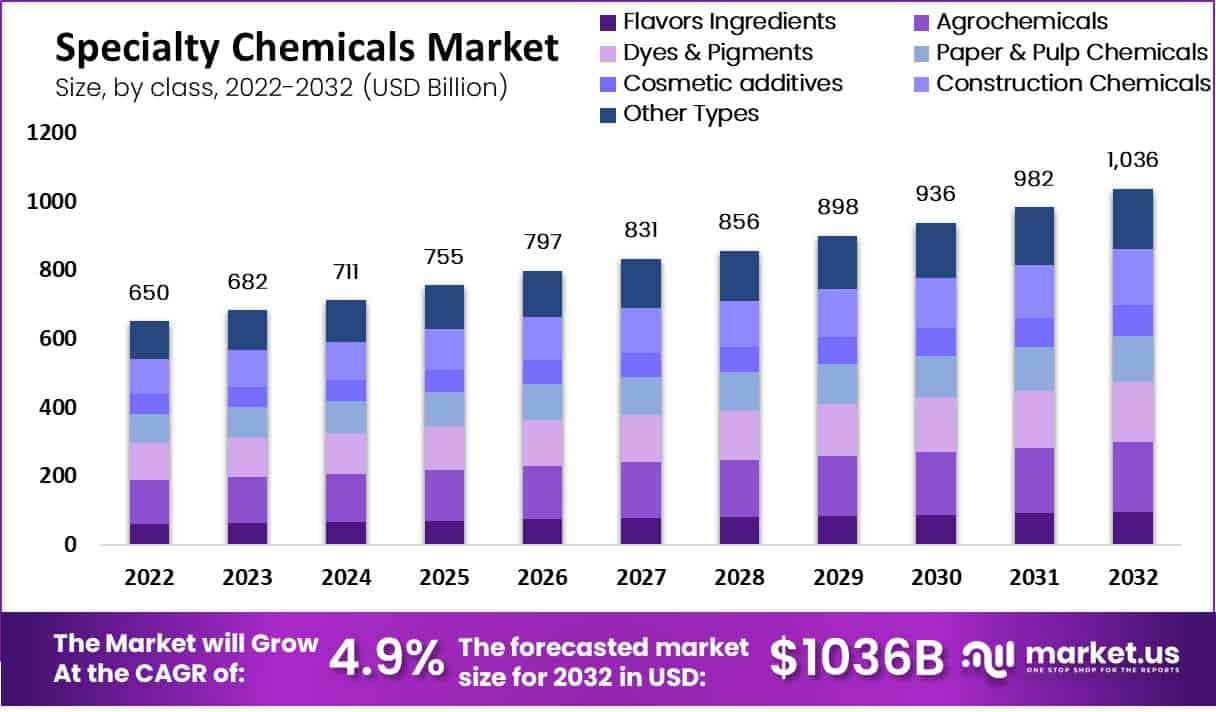

The global specialty chemicals market, valued at approximately USD 650 billion in 2022, is projected to reach USD 1,036 billion by 2032, growing at a compound annual growth rate (CAGR) of 4.9% during the forecast period. This robust growth is driven by increasing demand across several key industries, including construction, water treatment, electronics, pharmaceuticals, and food processing.

One of the primary growth factors is the rising demand for advanced construction materials and chemicals, particularly in emerging markets like Asia-Pacific, where rapid urbanization and infrastructure development are prominent. The region is expected to dominate the market due to its significant chemical production base, especially in China and India. Additionally, the growing need for water treatment solutions, spurred by global concerns over water scarcity and pollution, is contributing significantly to the market’s expansion.

In the pharmaceutical and healthcare sectors, the heightened awareness of health and hygiene, especially post-pandemic, has increased the demand for sanitizers, disinfectants, and other specialty chemicals, further boosting market growth. The electronics industry also plays a crucial role, with the rising production of semiconductors and other electronic components driving the demand for electronic chemicals.

However, the market faces challenges such as stringent environmental regulations and fluctuating raw material prices, which could impact profitability. Despite these challenges, the industry is witnessing continuous innovation and product development, particularly in bio-based chemicals and sustainable solutions, driven by regulatory mandates and shifting consumer preferences.

Recent developments in the market include the introduction of new products like biostimulants in the agricultural sector and advanced materials for the electronics and automotive industries. These innovations highlight the market’s adaptability and focus on sustainability, positioning specialty chemicals as essential components in various industrial applications.

BASF SE acquired Isobionics, a biotech company specializing in natural flavors and fragrances, and Scentium, a leading flavor and fragrance company. This acquisition aims to strengthen BASF’s position in the specialty chemicals sector, particularly in the growing market for natural ingredients. BASF launched a new range of bio-based surfactants under the brand name Dehyton®. These products are aimed at reducing the carbon footprint and meeting the increasing demand for sustainable solutions in the personal care industry. BASF announced an investment of USD 500 million in its R&D facilities to accelerate innovation in specialty chemicals, focusing on sustainable and digital solutions.

Dow Inc. entered into a strategic partnership with Mura Technology to advance the development of advanced recycling technologies for plastics. This partnership aligns with Dow’s commitment to sustainability and circular economy initiatives. Dow announced a USD 200 million expansion of its silicone manufacturing facility in Michigan, USA, to meet the growing demand for specialty silicones used in electronics, healthcare, and personal care applications. Dow introduced the SILASTIC SA 994X Liquid Silicone Rubber series, designed for the automotive and transportation sectors, offering enhanced performance and sustainability features.

SABIC launched a new range of certified renewable polymers, produced using bio-based feedstock. This development is part of SABIC’s broader strategy to offer sustainable solutions across its product portfolio.

Specialty Chemicals Statistics

- India accounts for ~16% of the world’s production of dyestuffs and dye intermediates.

- The chemical sector accounts for 2.1 percent of the country’s overall FDI equity inflows.

- In India, specialty chemicals account for 22% of the entire chemicals and petrochemicals market.

- The Indian chemical industry is expected to further grow with a CAGR of 11-12% by 2027, increasing India’s share in the global specialty chemicals market to 4% from 3%.

- A shift in the global supply chain brought on by the China+1 strategy and a resurgence in domestic end-user demand was expected to fuel significant revenue growth of 18–20% in 2022 and 14–15% in 2023.

- Asia promises to drive 75% of the specialty chemicals demand till FY25, primarily owing to disproportionate growth in China. This continent’s share in this sector is expected to grow from 47% in 2018 to 50% in 2025.

- Agro-chemicals, slated to touch US$ 3.7 billion by 2022 in India alone, constitute all the products used in agriculture, like different fertilizers and pesticides

- We expect U.S. GDP to rise 2.4% in 2024, before slowing to a 1.7% gain in 2025.

- Business investment, motivated, in part, by recent legislation (e.g., Inflation Reduction Act, CHIPS Act), rose 4.5% in 2023. With higher borrowing costs and tighter credit conditions, growth is business investment is expected to slow to 3.1% in 2024 and 2.7% in 2025.

- The global chemical industry was valued at $4.1 trillion in 2019.

- The Asia-Pacific region dominates the global chemical industry market, accounting for over 60% of revenue.

- China is the largest producer of chemicals globally, accounting for over 30% of total production.

- The chemical industry accounts for about 2.1% of India’s GDP and 3.4% of the global chemical industry.

- The sector (including fertilizers and pharmaceuticals) is expected to be worth $304 billion in 2024-25 and will grow at a rate of 9.3% in the coming years.

- The total market size of specialty chemicals is around $32 billion in 2023 and is expected to reach $64 billion by 2025.

Emerging Trends

Sustainability and Green Chemistry: The specialty chemicals industry is increasingly focusing on sustainability and the development of eco-friendly products. Companies are investing in green chemistry, which emphasizes the design of products and processes that reduce or eliminate the use and generation of hazardous substances. For instance, there is growing interest in bio-based chemicals derived from renewable resources, such as plant-based surfactants and biodegradable polymers. This trend is driven by both regulatory pressures and consumer demand for environmentally responsible products.

Digitalization and Smart Manufacturing: Integrating digital technologies into manufacturing processes is revolutionizing the specialty chemicals industry. Companies are adopting Industry 4.0 technologies such as the Internet of Things (IoT), artificial intelligence (AI), and machine learning to optimize production, reduce waste, and enhance product quality. These technologies enable real-time monitoring and predictive maintenance, leading to increased efficiency and reduced operational costs.

Growth in Specialty Polymers: The demand for specialty polymers is on the rise, particularly in high-performance applications such as electronics, automotive, and healthcare. These materials offer unique properties such as high durability, resistance to extreme temperatures, and biocompatibility, making them essential for advanced manufacturing sectors. The ongoing development of lightweight and high-strength materials for automotive and aerospace applications is a key driver of this trend.

Increased Focus on Water Treatment Chemicals: With growing concerns over water scarcity and pollution, the market for water treatment chemicals is expanding rapidly. Specialty chemicals used in water treatment, such as coagulants, flocculants, and biocides, are critical for ensuring a safe and clean water supply. This trend is particularly strong in regions facing water shortages and stringent environmental regulations.

Rising Demand for Specialty Coatings: Specialty coatings, including anti-corrosion, fire-resistant, and antimicrobial coatings, are seeing increased demand across various industries. These coatings offer enhanced performance and protection in extreme conditions, making them essential for industries such as construction, automotive, and electronics. The trend towards environmentally friendly and low-VOC (volatile organic compounds) coatings is also gaining momentum as companies strive to meet regulatory requirements and consumer expectations.

Personal Care and Cosmetic Ingredients: The personal care industry is a significant consumer of specialty chemicals, particularly for ingredients used in skincare, haircare, and cosmetics. The trend towards natural and organic products is driving innovation in this sector, with companies developing new active ingredients that are both effective and environmentally sustainable. Additionally, the demand for multifunctional ingredients that offer multiple benefits, such as anti-aging and moisturizing properties, is on the rise.

Expansion in the Asia-Pacific Region: The Asia-Pacific region is emerging as a major hub for specialty chemicals, driven by rapid industrialization, urbanization, and a growing middle-class population. Countries like China, India, and Japan are seeing significant investments in chemical manufacturing infrastructure. The region’s dominance in electronics, automotive, and construction sectors further fuels the demand for specialty chemicals.

Use Cases

Water Treatment: Specialty chemicals play a crucial role in water treatment processes. Chemicals such as coagulants, flocculants, biocides, and corrosion inhibitors are used to purify water, making it safe for drinking, industrial processes, and wastewater management. For example, flocculants help in aggregating suspended particles in water, aiding in their removal. The demand for these chemicals is increasing, especially in regions facing water scarcity and strict environmental regulations. It’s estimated that the global market for water treatment chemicals is worth over USD 30 billion and is growing rapidly due to the rising need for clean water.

Agriculture: In agriculture, specialty chemicals are used as agrochemicals, including pesticides, herbicides, and fungicides, which help in protecting crops from pests and diseases. These chemicals are also involved in enhancing crop yields through fertilizers and growth regulators. With the global population projected to reach 9.7 billion by 2050, the need for higher agricultural productivity is driving the use of specialty chemicals in this sector. The agrochemicals market is substantial, with global sales exceeding USD 50 billion annually.

Construction: The construction industry relies on specialty chemicals for various purposes, including concrete admixtures, waterproofing agents, and protective coatings. These chemicals enhance the durability, strength, and aesthetics of buildings and infrastructure. For example, concrete admixtures are used to improve the workability and setting time of concrete, making construction processes more efficient. The growing demand for infrastructure development in emerging markets like Asia-Pacific is driving the use of specialty chemicals in construction, with the sector expected to see significant growth in the coming years.

Automotive: In the automotive industry, specialty chemicals are essential for manufacturing and maintaining vehicles. These include lubricants, adhesives, coatings, and polymers that improve the performance, safety, and longevity of vehicles. For instance, specialty coatings are used to protect car exteriors from corrosion and enhance their appearance. The increasing production of electric vehicles (EVs) is further boosting the demand for specialty chemicals, particularly in battery production and lightweight materials. The automotive specialty chemicals market is projected to grow as the global automotive industry continues to expand.

Electronics: Specialty chemicals are critical in the electronics industry for the production of semiconductors, printed circuit boards (PCBs), and other electronic components. Chemicals like photoresists, etchants, and solvents are used in the manufacturing process to ensure precision and functionality. As the demand for electronics, including smartphones, laptops, and wearables, continues to rise, the use of specialty chemicals in this sector is also increasing. The global electronics chemicals market is valued at over USD 25 billion and is expected to grow alongside advancements in technology.

Personal Care and Cosmetics: The personal care and cosmetics industry uses specialty chemicals in the formulation of products such as skincare creams, shampoos, deodorants, and makeup. These chemicals include emulsifiers, preservatives, and active ingredients that enhance product stability, efficacy, and sensory appeal. With growing consumer demand for natural and sustainable personal care products, companies are increasingly using bio-based specialty chemicals. The global market for personal care chemicals is robust, with significant growth driven by the rising popularity of premium and organic cosmetics.

Food and Beverage: In the food and beverage industry, specialty chemicals are used as additives, preservatives, flavor enhancers, and colorants. These chemicals ensure food safety, extend shelf life and improve the taste and appearance of food products. For example, emulsifiers are used to stabilize processed foods, while preservatives prevent spoilage. The increasing demand for processed and convenience foods is driving the use of specialty chemicals in this sector. The global market for food additives is estimated to be worth over USD 45 billion and continues to grow as consumer preferences evolve.

Major Challenges

Regulatory Compliance: One of the primary challenges in the specialty chemicals market is the increasing stringency of environmental regulations. Governments worldwide are imposing stricter rules on the production, use, and disposal of chemicals to minimize environmental and health impacts. Compliance with regulations such as REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) in the European Union and similar frameworks in other regions requires substantial investment in research, development, and process modifications. Non-compliance can lead to heavy fines, production halts, and damage to a company’s reputation.

Raw Material Price Volatility: The specialty chemicals industry is highly dependent on raw materials, many of which are derived from petroleum. Fluctuations in crude oil prices directly affect the cost of raw materials, leading to increased production costs and squeezed profit margins. The industry also faces challenges in sourcing sustainable raw materials as there is growing pressure to reduce reliance on non-renewable resources.

Technological Advancements: Technological innovation is crucial for staying competitive but also presents challenges. The rapid pace of technological change requires continuous investment in research and development to keep up with advancements. Companies must adopt new technologies to improve efficiency, reduce costs, and meet evolving customer demands. However, the high cost of these investments can be a barrier, particularly for smaller players in the market.

Supply Chain Disruptions: Global supply chain disruptions, exacerbated by events such as the COVID-19 pandemic and geopolitical tensions, have posed significant challenges for the specialty chemicals industry. Disruptions can lead to delays in raw material supply, increased transportation costs, and uncertainty in production timelines, impacting the ability to meet customer demands consistently.

Market Growth Opportunities

Sustainability and Green Chemistry: As global awareness of environmental issues grows, there is a significant opportunity for companies to develop and market sustainable specialty chemicals. Green chemistry, which focuses on reducing or eliminating hazardous substances in the production process, is becoming increasingly important. Companies that innovate in bio-based chemicals, biodegradable products, and environmentally friendly alternatives to traditional chemicals are well-positioned to capitalize on this trend. For example, the demand for bio-based surfactants and polymers is expected to rise as industries seek to reduce their carbon footprint.

Expansion in Emerging Markets: Emerging markets, particularly in Asia-Pacific, offer substantial growth opportunities for specialty chemicals. Rapid industrialization, urbanization, and a growing middle class in countries like China, India, and Southeast Asia are driving demand for specialty chemicals in construction, automotive, electronics, and consumer goods. The region’s large population and increasing purchasing power make it a key target for expansion.

Innovation in High-Performance Materials: Developing high-performance materials for industries such as electronics, automotive, and aerospace represents another significant growth area. Specialty chemicals that enhance the durability, efficiency, and sustainability of these materials are in high demand. For instance, the growing electric vehicle (EV) market requires advanced batteries, lightweight materials, and specialty coatings, creating new opportunities for chemical manufacturers.

Digitalization and Industry 4.0: The integration of digital technologies in manufacturing processes, often referred to as Industry 4.0, offers growth opportunities by improving efficiency, reducing waste, and enabling the production of more complex and customized specialty chemicals. Companies that invest in digitalization can enhance their competitive edge by offering innovative solutions and improving operational efficiency.

Key Players Analysis

BASF SE is a global leader in the specialty chemicals sector, focusing on sustainable solutions across various industries, including automotive, construction, agriculture, and personal care. The company is known for its innovations in performance materials, such as high-performance polymers, biodegradable plastics, and advanced coatings. BASF’s specialty chemicals are designed to improve efficiency, reduce environmental impact, and enhance product performance, making them integral to modern manufacturing processes. The company also emphasizes green chemistry and bio-based products to meet increasing regulatory and consumer demands.

Dow Inc. plays a pivotal role in the specialty chemicals market with its focus on innovative materials science solutions. The company’s portfolio includes advanced materials, industrial intermediates, and plastics, which are utilized across critical industries such as construction, consumer care, electronics, and automotive. Dow’s emphasis on sustainability is evident through its development of solutions that reduce environmental impact, such as energy-efficient materials and technologies aimed at reducing emissions. With a global presence and a commitment to addressing complex material science challenges, Dow Inc. continues to be a major contributor to the specialty chemicals sector, driving advancements and delivering value to a wide array of industries.

Saudi Basic Industries Corporation (SABIC) is a major player in the global specialty chemicals industry, operating in over 50 countries. SABIC manufactures a diverse range of products, including high-performance plastics, agri-nutrients, metals, and specialty chemicals such as engineering thermoplastic resins and compounds. The company’s specialty chemicals are particularly prominent in the pipe and utilities market as well as the global water management industry, underscoring its significant role in essential industrial sectors.

DuPont de Nemours Inc., commonly known as DuPont, is deeply integrated into the specialty chemicals sector, focusing on innovative material solutions across various markets, including electronics, transportation, and construction. The company’s specialty products include advanced resins and films for electronics, bio-based materials, and safety-enhanced materials for various industrial applications. DuPont’s strategy involves leveraging cutting-edge science and engineering to meet the complex demands of its global customers, driving forward its leadership in the specialty chemicals industry.

LyondellBasell Industries is a prominent player in the specialty chemicals sector, renowned for its production of plastics and chemicals. The company has a diverse portfolio that includes high-performance polymers and advanced polyolefin process technologies, catering to industries like food packaging, automotive components, and construction. LyondellBasell’s focus on innovation is evident in its significant investments in sustainable solutions and circular economy initiatives. With headquarters in Rotterdam, the company operates globally, consistently adapting to meet the dynamic demands of the specialty chemicals market.

Mitsubishi Chemical Group Corporation is deeply involved in the specialty chemicals industry, where it harnesses its wide-ranging capabilities in materials science to produce a variety of products. These include performance polymers, industrial gases, and electronic materials. Mitsubishi Chemical is noted for its commitment to sustainability, aiming to address global environmental issues through its products and processes. The company’s strategic focus includes expanding its footprint in high-value-added markets, which is central to its growth strategy in the global chemicals industry.

Koninklijke DSM N.V., also known as Royal DSM, is deeply embedded in the specialty chemicals sector, with a strong focus on health, nutrition, and sustainable living. DSM leverages advanced bioscience to provide solutions that nourish, protect, and improve performance across various industries including food, dietary supplements, personal care, feed, medical devices, and automotive. Their commitment to sustainability is evident in their efforts to reduce environmental impact and foster socially responsible practices.

3M Co. plays a significant role in the specialty chemicals market with its vast array of innovative products and solutions tailored for a diverse range of industries, from healthcare to electronics and automotive. The company is renowned for its research and development capabilities, which have led to a wide range of patented technologies. 3M’s products often feature unique adhesive, abrasive, and laminate properties, enhancing the functionality and durability of end products in various applications.

Bayer AG is a key player in the specialty chemicals sector, especially known for its innovations in high-performance materials and crop science chemicals. The company focuses on developing products that contribute to improving human, animal, and plant health. Bayer’s portfolio includes advanced materials that are essential for a variety of applications across industries like healthcare, agriculture, and high-tech materials, highlighting its commitment to science for a better life.

INEOS Group Limited is a powerhouse in the specialty chemicals industry, producing a broad range of products including petrochemicals, specialty chemicals, and oil products. The company operates across multiple segments, providing essential chemicals that serve as building blocks for numerous modern conveniences. INEOS is noted for its significant contributions to the automotive, construction, and pharmaceutical industries, among others. With a robust focus on innovation and sustainability, INEOS continues to expand its influence in the global chemicals market by enhancing its production capabilities and entering new markets.

Conclusion

The specialty chemicals industry stands at a pivotal juncture, driven by technological advancements, evolving market demands, and the increasing emphasis on sustainable practices. This sector is essential in various industries, ranging from agriculture and pharmaceuticals to construction and automotive, underscoring its role in modern economies. Companies like BASF, Dow, and INEOS are at the forefront, innovating within their product lines and processes to address both environmental challenges and consumer needs. This dynamic landscape presents numerous opportunities for growth, innovation, and leadership in the specialty chemicals market, promising a future where the industry contributes even more significantly to a sustainable and technologically advanced world.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)