Table of Contents

Introduction

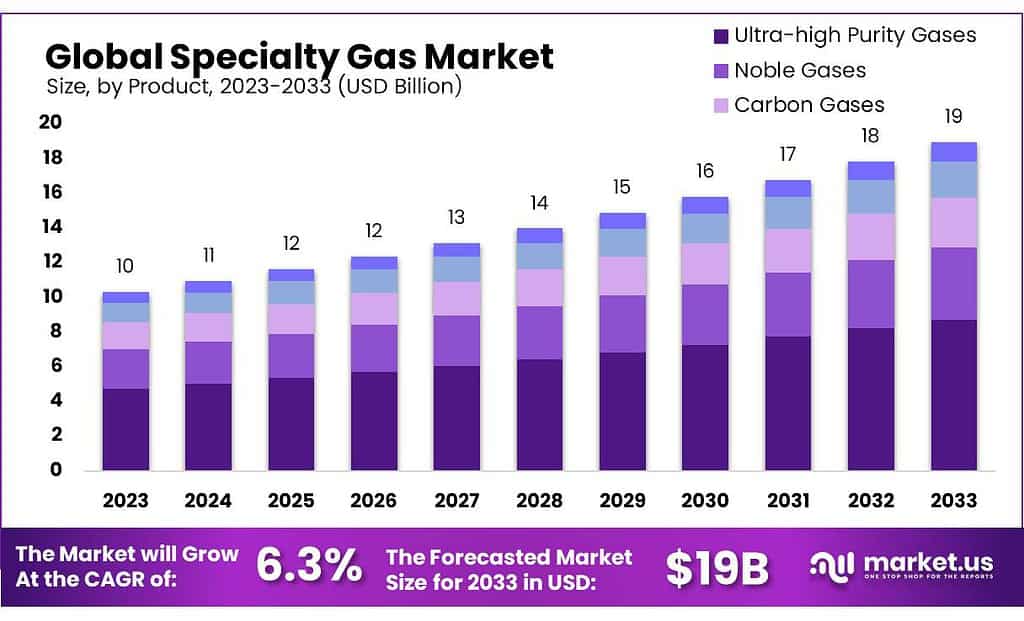

The global specialty gas market, valued at approximately USD 10 billion in 2023, is projected to grow to around USD 19 billion by 2033, achieving a compound annual growth rate (CAGR) of 6.3% over the forecast period. This expansion is driven by a variety of factors including the increased demand for ultra-high purity gases in the semiconductor, healthcare, and electronics sectors. Ultra-high purity gases are essential for applications such as insulation, lighting, cooling, and particularly in the manufacturing of semiconductors due to their contamination-free properties.

The market’s growth is also spurred by the robust development in the healthcare industry, where specialty gases are used for a wide range of medical applications, from patient care to diagnostic functions. Furthermore, the electronics sector, leveraging gases for the production of semiconductors and other components, stands out as a significant growth area, especially with the rise in demand for consumer electronics and advancements in technology such as 5G and AI components.

However, the market faces challenges, primarily due to stringent environmental regulations that govern the production and usage of specialty gases. These regulations aim to mitigate the environmental impact associated with the production of gases, particularly those used in the semiconductor and electronics industries. High production costs associated with ensuring compliance can also pose significant obstacles.

Recent developments within the market include strategic expansions and acquisitions by major players aimed at enhancing production capacities and market reach. For instance, companies like Linde and Air Liquide have been actively involved in expanding their production facilities in key markets to cater to the growing demand. These strategic moves not only enhance their service offerings but also position them advantageously within the global market.

Air Products and Chemicals, Inc. has continued to invest in capacity expansions and technological advancements to support its market position. This includes the development of a large-scale green hydrogen production facility in Texas, which represents a significant step toward supporting the growing demand for zero-carbon-intensity fuels. This facility is part of a broader initiative to develop sustainable gas solutions and leverage technological innovations to meet the stringent requirements of the semiconductor and other high-tech industries.

Key Takeaways

- The global specialty gas market is expected to expand from USD 10 billion in 2023 to USD 19 billion by 2033, growing at a CAGR of 6.3%.

- In 2023, ultra-high purity gases captured 46.4% of the market, crucial for sectors like semiconductors and pharmaceuticals due to their contamination-free properties.

- The electronics and semiconductor sector accounted for 38.5% of the market in 2023, driven by high demand for precision gases in manufacturing processes like etching and deposition.

- Asia-Pacific (APAC) led the market in 2023, holding 39% of the global share, with significant growth driven by China, Japan, and South Korea’s industrial sectors.

Specialty Gas Statistics

- Offering over 100 specialty gases and mixtures, we are the first and global choice for electronic special gases.

- The requirement for analysis and quantification is ever-changing, so BOC has invested in a $18M special gases production facility with state-of-the art information systems.

- GAS/SPEC SS is less corrosive and less prone to degradation than MEA, DEA, or DIPA and it can be used at up to 50 weight % amine strength, which reduces amine circulation rate and energy usage.

- An advanced regional specialty gases cylinder filling operation and the associated QC laboratory may have more than 20 gas analyzers.

- Modular gas analyzer series where up to 4 analyzer modules can be integrated and connected to a common controller, measuring up to 6 gas components simultaneously

- The specialist for Zone 1 and Zone 2 hazardous areas with Ex-d protection and operation through-the-glass

- As with all gas mixing operations, the composition of the gas mixture must be analysed to ensure that it meets the 50 / 50 specification within the acceptable tolerances and the use on an online direct read analyzer such as the Magnos28 for oxygen measurement can support operational excellence.

- An advanced regional specialty gases cylinder filling operation and the associated QC laboratory may have more than 20 gas analyzers.

- Synthetic air is produced by mixing pure oxygen (20 %) and pure nitrogen (80 %). This eliminates all kind of impurities present in normal ambient air.

- Specialty gas companies initiate NTRM mixture production with NIST concurrence and analyze 100% of the cylinders; NIST analyzes 10% of the cylinder lot and issues a Certificate of Traceability.

- NIST analyzes the data and if the data passes our initial screening, selects 10% of the cylinders for NIST audit.

- Oil consumption in the country has grown at a CAGR of 3.69 per cent from 2000 to 2022.

- Gas consumption and production have grown at a CAGR of 3.84 per cent and 0.73 per cent respectively from 2000 to 2022. Gas production peaked at 47.4 bcm in 2010.

- India has been increasingly relying on LNG imports to meet the huge demand-supply gap.

- LNG imports currently stand at 49 per cent of the total consumption against 9 per cent in 2004.

- McKinsey predicts that the semiconductor industry will grow at an annual growth rate of 6–8 % over the next 10 years, reaching $1 trillion in 2030. Advancements in autonomous driving, artificial intelligence, the Internet of Things, 5 G, and wirelessly connected devices are creating a significant demand worldwide.

Emerging Trends

- High-Purity Gases in Semiconductor Manufacturing: The demand for ultra-high purity gases is skyrocketing, especially in the semiconductor industry, due to the need for precision in the production of integrated circuits and other electronic components. This trend is fueled by the ongoing miniaturization of electronic devices and the expanding electronics industry.

- Healthcare Applications: There is a growing demand for medical specialty gases in healthcare for a range of applications, from anesthesia to respiratory therapies. This is driven by the aging global population and the expansion of healthcare infrastructure, necessitating a steady supply of these gases.

- Renewable Energy and Electric Vehicles: Specialty gases are crucial in the manufacturing of components for renewable energy systems, such as solar panels, and for electric vehicles, particularly in battery production. The shift towards greener technologies is significantly influencing the demand for specialty gases.

- Technological Innovations and Environmental Regulations: Advances in manufacturing and purification processes for gases are enhancing their efficiency and reliability, making them more suitable for high-tech applications. Furthermore, stringent environmental regulations are promoting the use of low-emission specialty gases, pushing industries towards sustainable solutions.

- Biotechnology and Chemical Industry Expansion: The biotechnology sector’s reliance on specialty gases for various research and production processes is growing. Similarly, the chemical industry’s need for these gases is expanding as their manufacturing processes require increasing precision and purity.

Use Cases

- Semiconductor Manufacturing: Ultra-high purity gases are essential in the semiconductor industry for processes such as chemical vapor deposition and etching. These gases help ensure the production of high-quality microchips, which are vital for modern electronics. The demand in this sector is driven by the ongoing miniaturization of electronic devices and advancements in technology.

- Healthcare: In the medical field, specialty gases are used for various purposes including anesthesia, respiratory therapy, and diagnostic procedures. The purity and control provided by these gases are vital for patient safety and effective treatment. The growing global healthcare expenditure and advancements in medical technologies are significant drivers for the increased use of medical gases like oxygen, nitrous oxide, and others.

- Renewable Energy: Specialty gases are also integral to the renewable energy sector, particularly in the production of photovoltaic solar panels. They are used to create the pure environments needed for the manufacture of highly efficient solar cells.

- Environmental Monitoring and Protection: There is a growing use of specialty gases in environmental applications, where they help monitor and control atmospheric contaminants. The stringent global environmental regulations are pushing for lower emissions, thereby increasing the demand for specialty gases that can help in achieving compliance with these standards.

- Food and Beverage Industry: Specialty gases are used in the food sector for packaging and preserving freshness. Carbon dioxide, for example, is used to create modified atmosphere packaging that extends the shelf life of food products.

- Chemical Industry: In chemical manufacturing, specialty gases are employed for their reactive properties and to create controlled atmospheres during the synthesis of various chemicals, further underscoring their importance across multiple chemical processes

Major Challenges

- Supply Chain Vulnerabilities: The industry has experienced disruptions in supply chains due to various factors, including geopolitical tensions, natural disasters, and pandemics. These disruptions can hinder production capabilities and affect the global distribution of specialty gases.

- Environmental Regulations: Stricter environmental regulations pose a challenge to the specialty gas industry. Producers must adapt to increasingly rigorous standards that govern the production and quality control of gases, especially those used in sensitive applications like healthcare and electronics. Compliance with these regulations often requires significant investment in technology and processes.

- Technological and Market Changes: The specialty gases industry must continually adapt to technological advancements and shifts in market demand. For example, the semiconductor industry, a major consumer of specialty gases, is evolving rapidly with increasing demands for miniaturization and enhanced performance, which requires high-purity gases. Keeping pace with such technological demands requires ongoing research and development investment.

- Geopolitical Tensions and Economic Policies: Trade tensions, such as those between the USA and China, can lead to tariffs and other trade barriers that affect the specialty gases market. Additionally, policies and subsidies aimed at reshoring manufacturing operations to specific countries can alter market dynamics and create inefficiencies in what has traditionally been a globally integrated market.

Market Growth Opportunities

- Semiconductor Industry Expansion: The rapid growth of the semiconductor industry is a major driver for the specialty gas market, particularly for ultra-high purity gases used in chip manufacturing processes. The demand for electronics that use semiconductors, such as smartphones and tablets, continues to drive substantial market growth.

- Healthcare Applications: Specialty gases are critical in healthcare for applications ranging from anesthesia and respiratory therapy to medical imaging and clinical diagnostics. The expansion of healthcare services globally is expected to boost the demand for medical gases.

- Investments in Production Capacity: Companies like Merck are investing significantly in expanding their production capacities. For example, Merck’s investment of over $300 million in building the world’s largest integrated specialty gas facility is set to strengthen its global market position.

- Geographical Expansion: The Asia Pacific region dominates the specialty gas market due to its extensive manufacturing base for semiconductors and chemicals. Countries like China, India, and Singapore are attracting investments, which is anticipated to maintain high growth in this region. Meanwhile, North America remains a significant market due to its robust semiconductor and healthcare industries

- Emerging Markets and Applications: There is increasing use of specialty gases in sectors such as automotive for manufacturing and in the food and beverage industry for packaging and preservation. These applications are expected to open new avenues for market growth

Key Players Analysis

In 2023, Air Liquide made substantial progress in the specialty gas sector, focusing on innovative technologies and sustainable development. The company invested significantly, including over €50 million in a new nitrogen production unit in Singapore and upgrading facilities in the U.S. for better energy efficiency. Their commitment to the energy transition is evident from their investment in biomethane production in the U.S. and various green projects funded by a €500 million green bond issue. Air Liquide also launched several joint ventures, including TEAL Mobility with TotalEnergies to develop hydrogen refueling stations across Europe.

Air Products and Chemicals, Inc., another major player, continues to expand its specialty gas operations, especially in ultra-high purity gases crucial for various industries, including electronics and manufacturing. The company is well-known for its commitment to technological advancement and strategic investments to meet global demand for specialty gases.

In 2023 and 2024, Coregas has continued to advance its specialty gas offerings, emphasizing sustainable and high-precision solutions. Recent developments include the launch of Australia’s first hydrogen refueling station for heavy vehicles, highlighting Coregas’ commitment to clean mobility. The company also celebrated 20 years of precision in the industry, reflecting on their growth and expertise in providing specialty gases across various sectors.

ILMO Products Company, although not as prominently covered in recent updates as Coregas, operates in a similar market, providing specialty gases with a focus on quality and tailored solutions for diverse industries. Both companies are actively expanding their technological capabilities and market reach to meet the evolving demands of industries ranging from healthcare to advanced manufacturing and energy solutions.

In 2023, Iwatani Corporation of America, a leader in the specialty gases industry, reinforced its market presence by acquiring Advanced Specialty Gases, expanding its offerings to include a diverse range of specialty and rare gases. This move is part of Iwatani’s strategy to support industries such as semiconductors and electronics, which are crucial for technologies like 5G and automation. This acquisition highlights Iwatani’s commitment to supporting high-tech industries by providing essential gases that are critical for the development and manufacturing of advanced technologies.

Linde plc continues to be a dominant player in the specialty gas market, leveraging its extensive infrastructure and technological expertise to serve a broad spectrum of industries globally. With a strategic focus on innovation and sustainability, Linde supports critical applications across various sectors, including healthcare, manufacturing, and environmental technology. This approach not only enhances their service capabilities but also strengthens their global leadership in the specialty gases sector.

In 2023 and 2024, MESA Specialty Gases & Equipment has reinforced its commitment to delivering high-quality calibration and specialty gases across various industries, including laboratories, energy, and petrochemical sectors. The company specializes in providing a broad array of instrument applications with precision custom specialty gases and calibration tools, meeting stringent standards and specific client needs. MESA is known for its rigorous quality assurance processes and the provision of detailed Certificates of Analysis with each product, ensuring optimal performance and reliability for their clients’ critical applications.

Messer Group GmbH continues to be a leader in the specialty gases market, leveraging its extensive production capabilities and innovative technology to supply gases for industries ranging from healthcare to manufacturing. The company focuses on developing gas applications that improve operational efficiencies and meet high environmental standards, positioning Messer as a key player in the global market for specialty gases.

In 2023 and 2024, Mitsui Chemicals, Inc. focused on enhancing its specialty gas operations within various sectors, with a notable emphasis on improving product applications in life and healthcare, mobility, and information and communications technology (ICT). Despite some challenges in demand within these sectors, the company has leveraged improvements in trading conditions and strategic investments in innovation to maintain steady growth in these critical areas. Mitsui Chemicals continues to integrate sustainability into its operations, aiming to align with global environmental standards while addressing the complex needs of the specialty gas market.

Norco Inc., known for its robust supply of industrial, medical, and specialty gases, continues to strengthen its market position by providing comprehensive gas solutions that support a wide range of industries, including healthcare, manufacturing, and technology. The company’s commitment to high-quality products and customer service ensures it remains a key player in the specialty gases sector, particularly in the U.S. where it has a strong distribution network. Norco’s ongoing investments in technology and infrastructure reflect its dedication to meeting the evolving needs of its diverse customer base.

In 2023 and 2024, SHOWA DENKO K.K. has continued to develop and enhance its specialty gases sector, focusing on environmental sustainability and advanced material solutions. Their efforts are aligned with global trends towards cleaner technologies and more efficient manufacturing processes, which are pivotal in the semiconductor and electronics industries.

Taiyo Nippon Sanso Corporation has been active in expanding its technological contributions to the specialty gas market, particularly within the semiconductor research sector. In 2024, the company provided advanced reactor platforms to Ohio State University, significantly enhancing the university’s semiconductor research capabilities. This collaboration underscores Taiyo Nippon Sanso’s commitment to supporting cutting-edge research and development in materials science, contributing to innovations in power electronics and optoelectronics. Additionally, Taiyo Nippon Sanso has been involved in sustainable initiatives, such as supporting Toyota’s hydrogen utilization projects in Thailand, aiming for carbon neutrality by providing crucial hydrogen supply technologies.

In 2023, Weldstar has focused on enhancing its specialty gases services by managing and expanding its operations in the supply of bulk and specialty gases like oxygen, nitrogen, argon, hydrogen, and carbon dioxide. They specialize in the installation and maintenance of gas supply systems and have invested in training technicians for handling cryogenic and specialty gas equipment, reinforcing their commitment to safety and customer service. This aligns with their broader strategy to meet the diverse needs of industries in Illinois, Indiana, and Wisconsin, where they operate.

Yueyang Kaimeite Electronic and Specialty Rare Gases Co. has not been prominently featured in recent updates or specific year-wise data for 2023 or 2024. General information on their operations indicates they continue to focus on the production and supply of rare and specialty gases, serving various sectors including electronics and manufacturing. The company is known for providing high-quality products essential for a wide range of industrial applications, but specific details on recent developments or financial performance were not readily available from the sources accessed.

Conclusion

Investments in production capacity, like Merck’s $300 million development of the world’s largest specialty gas facility, exemplify the strategic initiatives companies are undertaking to capture market share and meet the rising demand. The Asia Pacific region remains a focal point of this expansion, supported by governmental incentives and a strong manufacturing base, particularly in semiconductors and chemicals. As the market continues to evolve, the integration of specialty gases in emerging technologies and green initiatives offers new avenues for growth, reinforcing the specialty gas market’s integral role in modern industry and healthcare solutions.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)